Digital Health Market By Product Type (Software, Hardware, and Services), By Technology (Telehealthcare (Telehealth (Video Consultation and LTC Monitoring) and Telecare (Remote Medication Management and Activity Monitoring)), mHealth (Apps (Fitness Apps and Medical Apps), Wearables, Glucose Meter (BP Monitor, Pulse Oximeter, Neurological Monitors, Sleep Apnea Monitor, and Others), Digital Health Systems (E-prescribing Systems and Electronic Health Records), and Health Analytics), By Application (Obesity, Diabetes, Cardiovascular, and Others), By End-user (Patients, Providers, Payers, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Aug 2025

- Report ID: 64179

- Number of Pages: 227

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

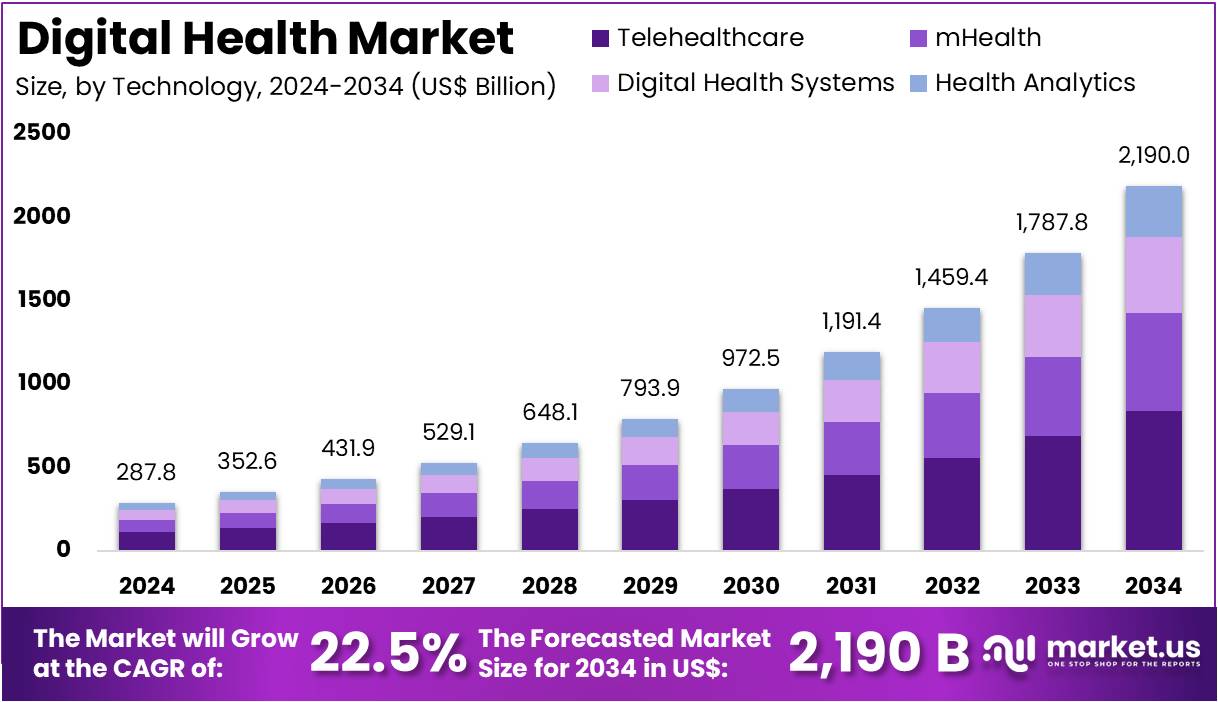

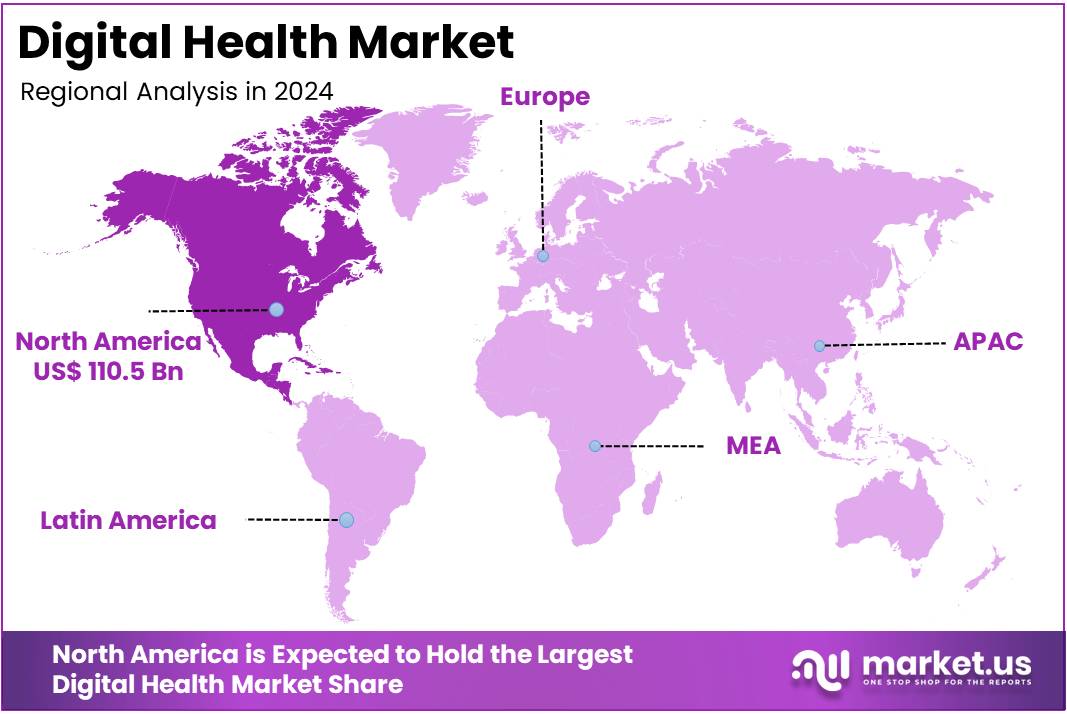

The Digital Health Market size is expected to be worth around US$ 2190.0 billion by 2034 from US$ 287.8 billion in 2024, growing at a CAGR of 22.5% during the forecast period 2025 to 2034. North America held a dominant market position, capturing more than a 38.4% share and holds US$ 110.5 Billion market value for the year.

The digital health market is expanding rapidly, driven by new technologies, government backing, and a growing public interest in managing personal health. The sector is supported by a strong network of local companies that offer services like telehealth, mobile health apps, wearable tech, and electronic prescription systems. Governments are encouraging this growth by creating policies that help integrate information technology into healthcare services.

Financial investment highlights the sector’s promise. In 2024, for instance, digital health startups in the US raised US$10.1 billion over 497 deals, showing strong investor confidence. This funding is crucial, as digital solutions can help tackle global health issues. The World Health Organization reports that noncommunicable diseases cause 74% of all deaths worldwide each year. Digital health is proving to be a transformative force, fundamentally reshaping the patient care experience. The tangible benefits are clear and multifaceted:

- Continuous Care and Early Intervention: Leveraging remote monitoring through wearables and connected sensors allows for the constant stream of vital health data. This provides clinicians with a more holistic view of a patient’s condition between appointments, enabling proactive management and timely interventions that can prevent complications before they become acute.

- Enhanced Treatment Adherence: Digital platforms, equipped with features like automated reminders, personalized coaching, and educational content, play a crucial role in helping patients stick to their prescribed treatment plans. This support is vital for improving health outcomes, particularly for those managing chronic conditions.

- Seamless Provider-Patient Engagement: Telehealth and secure messaging systems are breaking down geographical and logistical barriers, fostering a more connected and continuous dialogue between patients and their care teams. This facilitates prompt adjustments to care plans and addresses patient concerns efficiently, often eliminating the need for an in-person visit.

- Fostering Self-Management: By making health data and resources readily accessible, digital health solutions empower individuals to become active participants in their own health journeys. This increased sense of control and engagement motivates patients to make informed decisions and take a proactive role in maintaining their well-being.

Additionally, data from public organizations confirms the market’s positive direction. The CDC’s National Center for Health Statistics (NCHS) tracks the use of electronic health records (EHRs), which are a core part of digital health. The US Department of Health and Human Services (HHS) is also promoting data interoperability to ensure different healthcare systems can share information easily. The National Institutes of Health (NIH) is funding research to advance the scientific basis and clinical uses of these digital tools. These combined efforts from both the public and private sectors are paving the way for a more efficient, accessible, and patient-focused healthcare system.

Key Takeaways

- In 2024, the market for digital health generated a revenue of US$ 287.8 billion, with a CAGR of 22.5%, and is expected to reach US$ 2190.0 billion by the year 2034.

- The product type segment is divided into software, hardware, and services, with services taking the lead in 2024 with a market share of 48.9%.

- Considering technology, the market is divided into telehealthcare, mhealth, digital health systems, and health analytics. Among these, telehealthcare held a significant share of 38.4%.

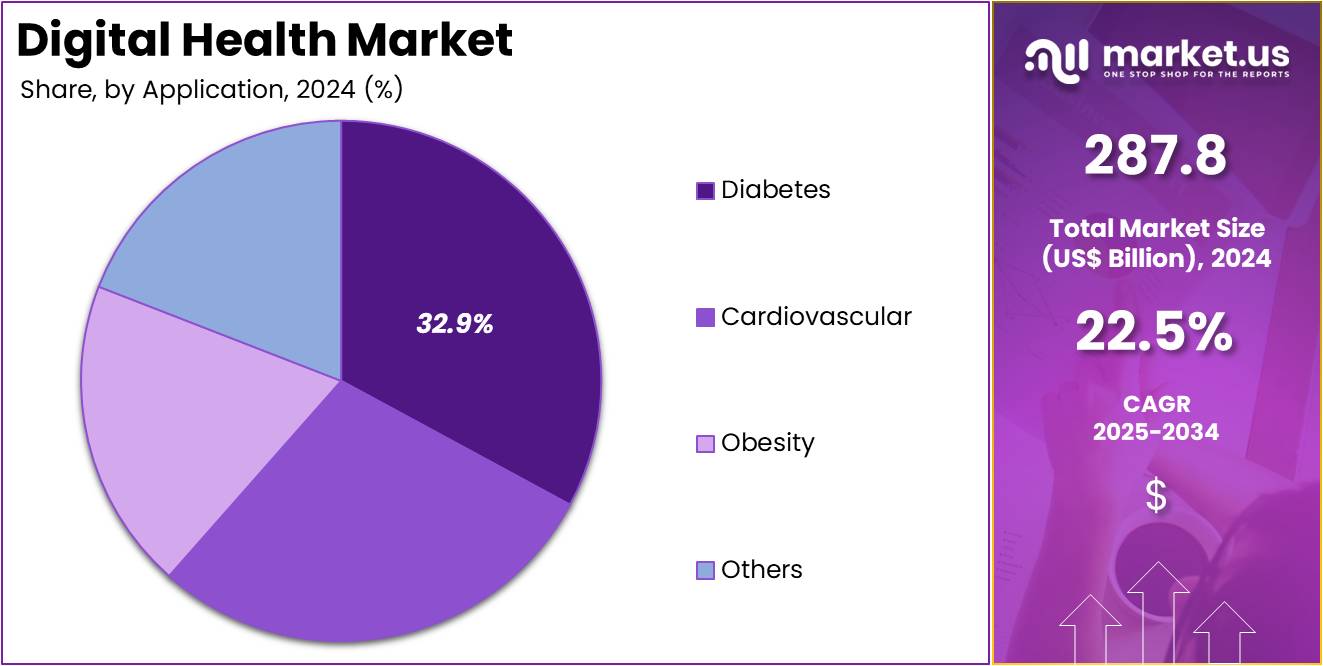

- Furthermore, concerning the application segment, the market is segregated into obesity, diabetes, cardiovascular, and others. The diabetes sector stands out as the dominant player, holding the largest revenue share of 32.9% in the digital health market.

- The end-user segment is segregated into patients, providers, payers, and others, with the patients segment leading the market, holding a revenue share of 47.2%.

- North America led the market by securing a market share of 38.4% in 2024.

Product Type Analysis

The services sector commands a substantial share of the digital health market, representing a significant 48.9%. This growth trajectory is poised for continued upward momentum as the demand for digitally delivered health services intensifies. Digital health services, encompassing telemedicine, remote monitoring, and virtual consultations, offer unparalleled convenience and expand healthcare access to both urban and rural populations.

As healthcare costs continue to climb and the need for more streamlined care delivery becomes a priority, digital services are positioned for rapid expansion. The COVID-19 pandemic acted as a key catalyst, particularly for telemedicine, a trend expected to persist as patients and providers embrace the efficiency of remote care. One notable statistic supporting this is that according to a recent report, telehealth claims grew from 0.1% in 2019 to approximately 5% by the end of 2021, illustrating a dramatic increase in adoption.

Technology Analysis

Within the technology segment, telehealthcare holds the dominant market position with a 38.4% share. The segment’s robust growth is fueled by the escalating demand for remote healthcare services, a need that became even more critical during the COVID-19 pandemic. As both patients and medical professionals grow more comfortable with virtual consultations, the demand for these platforms is expected to rise.

Telehealthcare platforms enable patients to consult with healthcare providers remotely, reducing the need for in-person visits and ensuring care can be delivered to individuals in geographically isolated or underserved areas. This is further fueled by the growing need for remote mental health services, chronic disease management, and post-surgical care. As technology continues to evolve, these platforms are becoming increasingly integrated with other digital solutions, such as remote patient monitoring devices and electronic health records, enhancing the quality and scope of care.

Application Analysis

In the application segment, diabetes management accounts for the largest share at 32.9%. This is a direct reflection of the rising global prevalence of diabetes, particularly type 2, driven by lifestyle factors such as increased rates of obesity and sedentary habits. The demand for digital solutions that aid in managing the condition, such as glucose monitoring apps, insulin management systems, and telehealth for diabetic care, is expected to see steady growth.

The increased adoption of continuous glucose monitoring (CGM) devices and wearable health technology for real-time tracking of glucose levels is a key driver. Digital health solutions for diabetes also facilitate early detection, personalized treatment plans, and remote monitoring, making management more accessible and efficient.

End-User Analysis

Patients represent the primary end-user segment in the digital health market, with a 47.2% share. This growth is anticipated to continue as more individuals turn to digital health tools to manage their conditions, gain remote access to healthcare, and track their personal health data. The increasing prevalence of chronic diseases like diabetes, cardiovascular disease, and obesity is driving the need for more personalized and accessible healthcare solutions, which digital platforms are uniquely positioned to provide.

Furthermore, the growing consumer focus on health and wellness, coupled with the widespread adoption of wearable devices and health apps, is projected to further increase demand among patients. The ease of access to healthcare services, the ability to track health metrics in real time, and the convenience of remote consultations are key factors that make these solutions highly appealing. The global digital health market is projected to reach over US$1 trillion by 2034, which highlights the immense potential for growth in a patient-centric healthcare future.

Key Market Segments

By Product Type

- Software

- Hardware

- Services

By Technology

- Telehealthcare

- Telehealth

- Video Consultation

- LTC Monitoring

- Telecare

- Remote Medication Management

- Activity Monitoring

- mHealth

- Apps

- Fitness Apps

- Medical Apps

- Wearables

- Glucose Meter

- BP Monitor

- Pulse Oximeter

- Neurological Monitors

- Sleep Apnea Monitor

- Others

- Digital Health Systems

- E-prescribing Systems

- Electronic Health Records

- Health Analytics

- Apps

- Telehealth

By Application

- Obesity

- Diabetes

- Cardiovascular

- Others

By End-user

- Patients

- Providers

- Payers

- Others

Drivers

The increasing prevalence of chronic diseases and the aging population are driving the market

The escalating burden of chronic diseases such as diabetes, cardiovascular conditions, and respiratory disorders, coupled with a rapidly aging global population, serves as a primary driver for the widespread adoption of digital health solutions. These conditions necessitate continuous monitoring and proactive management, which digital tools such as remote patient monitoring (RPM) and telehealth platforms can effectively provide. The Centers for Disease Control and Prevention (CDC) reported in 2024 that 6 in 10 adults in the US have a chronic disease, and 4 in 10 have two or more, creating a significant and persistent demand for ongoing care.

The aging demographic further amplifies this need for accessible and efficient care. The US Census Bureau projects that by 2030, one in five Americans will be 65 years or older, a population segment that is more susceptible to chronic illnesses and can significantly benefit from home-based, technology-enabled care. These solutions not only empower patients to take a more active role in their health but also lead to tangible benefits for the healthcare system, including reduced hospital readmissions, improved patient outcomes, and a lower overall cost of care delivery.

Restraints

Data privacy and security concerns are restraining the market

A significant restraint on the expansion of the digital health market is the widespread concern over data privacy and security. Digital health platforms collect and store vast amounts of sensitive personal health information, including medical history, biometric data, and personal identifiers, making them attractive targets for cyberattacks and data breaches. Patients and healthcare providers are justifiably hesitant to fully embrace these technologies without robust safeguards in place, fearing that their private and confidential data could be compromised.

Data from The HIPAA Journal in a 2024 report highlighted that the number of healthcare data breaches reported to the HHS Office for Civil Rights (OCR) had increased by 9.3% in the first half of 2024 compared to the same period in 2023. Furthermore, a 2023 survey from the US Department of Health and Human Services (HHS) revealed that 76% of healthcare consumers were concerned about the privacy of their health data when using digital platforms. These concerns can lead to a lack of trust, which directly impacts user adoption rates and the willingness of healthcare providers to integrate these systems into their critical clinical workflows.

Opportunities

The expansion of artificial intelligence (AI) and machine learning is creating growth opportunities

The integration of advanced artificial intelligence (AI) and machine learning (ML) capabilities into digital health solutions presents a major growth opportunity. AI-powered tools can analyze vast amounts of patient data from various sources to provide more accurate diagnostics, personalize treatment plans, and predict disease progression with unprecedented accuracy. This technology not only enhances clinical decision-making for healthcare professionals but also dramatically improves operational efficiency.

A new AI program called SMART (Simple Mobile AI Retina Tracker) has demonstrated remarkable accuracy in detecting diabetic retinopathy, achieving over 99% accuracy in preliminary studies. This highlights the potential of AI to revolutionize diagnostics. Furthermore, the use of generative AI is gaining significant traction within the industry.

In 2024, a major technology company launched an AI-powered medical assistant that automates the transcription of patient-clinician conversations directly into electronic health records, reducing the administrative burden on physicians by an estimated 40%. These innovations are transforming care delivery models and creating new avenues for value creation, from clinical support to administrative automation.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors are shaping the operating environment for manufacturers and suppliers in the digital health sector. Rising global inflation has increased the cost of raw materials, energy, and skilled labor. These pressures are driving up the price of hardware and software development. According to a 2025 global medical trends report, the average medical trend rate is projected to reach 10.0%. This marks a second year of double-digit growth. Such increases may compress company profit margins and strain healthcare provider budgets for new digital health technologies.

Geopolitical instability also poses risks to the digital health supply chain. Tensions between nations can disrupt the flow of critical components like semiconductor chips. Companies dependent on specific regions for essential materials face trade-related disruptions and transport issues. For example, the Digital Economy Report 2024 by UNCTAD noted that producing a two-kilogram computer requires 800 kilograms of raw materials. These materials often come from geopolitically sensitive regions, making the supply chain vulnerable. Such dependencies can halt production and delay the launch of key innovations in digital healthcare.

To overcome these challenges, digital health companies are adopting agile strategies. Emphasis is being placed on operational efficiency and diversified sourcing. Strategic procurement practices are being used to reduce risk and ensure continuity. Companies are also investing in technology that improves supply chain visibility and responsiveness. These actions help mitigate the impact of rising costs and global tensions. As a result, the sector continues to grow steadily, even in a complex macroeconomic and geopolitical climate.

In 2025, the United States imposed a 10% baseline tariff on many imported goods and a 25% tariff on specific medical devices. These new duties have increased the landed cost of essential components and finished products. As a result, the additional costs are being passed down the supply chain. Distributors face margin pressures, and healthcare providers are dealing with higher procurement costs. This price inflation is making it harder for institutions to adopt new digital health technologies, ultimately affecting patient access and innovation in healthcare delivery systems.

The increased tariffs are particularly challenging for healthcare providers relying on imported technologies. Organizations such as AdvaMed have formally requested exemptions for medical devices, warning of disruptions to critical care services. Despite these efforts, the higher import costs remain. This situation is negatively impacting the affordability and rollout of advanced solutions. End consumers may face higher medical expenses, and healthcare systems could experience slower integration of innovative technologies. These conditions could weaken long-term competitiveness for companies reliant on global supply chains.

However, the current tariff structure is offering an advantage to domestic manufacturers. Without import duties, U.S.-based companies are better positioned to offer more stable pricing and reliable supply. This shift is encouraging healthcare providers to prioritize local sourcing. As a result, firms are investing in domestic manufacturing capabilities to meet demand and bypass international tariffs. Supply chain resilience is improving as the industry adapts by diversifying vendors and streamlining logistics. These strategic adjustments are fostering a more self-reliant and competitive healthcare ecosystem in the U.S.

Trends

The growing focus on interoperability and integrated care is a recent trend

A notable trend observed in 2024 and 2025 is the increasing focus on achieving seamless interoperability and creating integrated care ecosystems. Historically, various digital health tools—such as remote patient monitoring devices, telehealth platforms, and electronic health records (EHRs)—operated in silos, leading to fragmented data and inefficient workflows.

The industry is now moving decisively toward solutions that can communicate and share data seamlessly across different platforms, providers, and care settings. This trend is driven by the demand for a holistic, 360-degree view of a patient’s health and the critical need to streamline care coordination. A 2024 report from the Office of the National Coordinator for Health Information Technology (ONC) highlighted that the proportion of hospitals using a certified EHR system with the ability to electronically find, send, receive, and integrate patient health information has increased to over 80%.

This push for interconnected systems is enabling more cohesive and patient-centric care models, where data from wearables, telehealth sessions, and EHRs are unified to create a comprehensive, actionable health profile for each patient.

Regional Analysis

North America is leading the Digital Health Market

The North American digital health market secured its position as the global leader in 2024, accounting for a 38.4% revenue share. This dominance stems from a confluence of factors, including rapid technological advancements, substantial investments in healthcare IT infrastructure, and supportive government policies. The US government, for example, is actively fostering digital health innovation through public-private partnerships, encouraging app developers and healthcare providers to create more effective digital solutions.

This has led to a significant increase in the adoption of telehealth and remote patient monitoring. The Centers for Medicare & Medicaid Services (CMS) reports that the number of Medicare beneficiaries using telehealth services increased dramatically between 2020 and 2024. Furthermore, the FDA’s Digital Health Center of Excellence, established to empower stakeholders and advance high-quality digital health innovation, has been a catalyst for the development of new technologies.

The United States, as the largest component of this regional market, is at the forefront of this digital transformation. Key industry players are aggressively developing advanced healthcare products, from secure electronic health record (EHR) platforms to robust network infrastructures for telemedicine.

According to a 2024 report by the CDC, the number of physicians using remote monitoring devices in the US grew to 30% in 2022, a significant increase from 12% in 2016. This trend is further supported by the high adoption rate of digital health solutions among the general population, with over 80% of all Americans reporting they have accessed care via telemedicine at some point in their lives, as per a 2022 survey.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

The Asia Pacific digital health market is expected to witness the fastest growth during the forecast period. This expansion is driven by rising healthcare spending and increased adoption of eHealth platforms across the region. A major contributor to this trend is the growing use of electronic medical records (EMR) and electronic health records (EHR). Countries like Singapore and Australia have implemented nationwide EHR systems. Singapore’s National Electronic Health Record (NEHR) allows clinicians access to comprehensive patient data, improving diagnosis, treatment coordination, and overall care delivery.

Australia’s digital health infrastructure is also well-developed. The My Health Record system is a central part of this framework. By December 2024, the system had accumulated more than 24 million individual records. It also hosted over 1.6 billion healthcare documents uploaded by both providers and consumers. This demonstrates a strong shift toward digital integration in healthcare services. Such systems support clinical decision-making, reduce redundancies, and improve patient safety. These developments highlight the region’s commitment to leveraging digital tools for enhanced medical outcomes and system efficiency.

In India, the digital health market is poised for significant growth. The rise in smartphone use, better internet access, and government-backed health programs are key enablers. The Ayushman Bharat Digital Mission (ABDM) aims to build a unified digital health ecosystem. By early 2025, over 730 million Ayushman Bharat Health Accounts (ABHA) had been created. In addition, over 500,000 health professionals were registered. The e-Sanjeevani platform, with millions of teleconsultations, further supports digital adoption. Together, these initiatives are accelerating the development of a robust digital health framework in India.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

To secure market growth, leading companies in the digital health sector employ a multifaceted strategy centered on innovation and expansion. They are actively developing advanced solutions that integrate artificial intelligence and data analytics to provide personalized, efficient care. Concurrently, these firms are forging strategic partnerships with healthcare providers, insurers, and large technology companies to broaden their distribution channels and accelerate market penetration. They also focus on mergers and acquisitions to quickly expand their service offerings and global reach. Their success hinges on creating a seamless user experience while demonstrating clear value through improved patient outcomes and reduced healthcare costs.

Teladoc Health, Inc., a key player, is a global virtual healthcare company based in the United States. Founded on the principle of accessible care from anywhere, it offers a wide range of services including telehealth, expert medical opinions, and chronic condition management. The company operates in more than 130 countries, connecting millions of people with healthcare professionals through its telephone and video conferencing platforms. Teladoc Health’s strategic acquisitions and product launches have allowed it to build a comprehensive, whole-person care model that addresses diverse healthcare needs for both individuals and organizations.

Top Key Players in the Digital Health Market

- Vocera Communications

- Softserve

- QSI Management, LLC

- Orange

- IBM Corporation

- Hims & Hers Health, Inc

- Google, Inc

- Epic Systems Corporation

- CISCO Systems

- BlueRock Therapeutics LP

- AT&T

- AirStrip Technologies

Recent Developments

- In January 2024: JD Health launched a dedicated elderly care channel on its platform, designed to offer a comprehensive suite of healthcare services tailored to the needs of China’s aging population.

- In April 2023: Microsoft partnered with Epic Systems Corporation to integrate artificial intelligence into electronic health records (EHR), enhancing healthcare professionals’ efficiency and improving patient communication through AI-powered solutions.

- In March 2023: BlueRock Therapeutics LP formed a strategic partnership with Emerald Innovations and Rune Labs, focusing on groundbreaking advancements in contactless, invisible wearable digital health technologies to enhance the monitoring of Parkinson’s disease.

Report Scope

Report Features Description Market Value (2024) US$ 287.8 billion Forecast Revenue (2034) US$ 2190.0 billion CAGR (2025-2034) 22.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Software, Hardware, and Services), By Technology (Telehealthcare (Telehealth (Video Consultation and LTC Monitoring) and Telecare (Remote Medication Management and Activity Monitoring)), mHealth (Apps (Fitness Apps and Medical Apps), Wearables, Glucose Meter (BP Monitor, Pulse Oximeter, Neurological Monitors, Sleep Apnea Monitor, and Others), Digital Health Systems (E-prescribing Systems and Electronic Health Records), and Health Analytics), By Application (Obesity, Diabetes, Cardiovascular, and Others), By End-user (Patients, Providers, Payers, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Vocera Communications, Softserve, QSI Management, LLC, Orange, IBM Corporation, Hims & Hers Health, Inc, Google, Inc, Epic Systems Corporation, CISCO Systems, BlueRock Therapeutics LP, AT&T, AirStrip Technologies. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Vocera Communications

- Softserve

- QSI Management, LLC

- Orange

- IBM Corporation

- Hims & Hers Health, Inc

- Google, Inc

- Epic Systems Corporation

- CISCO Systems

- BlueRock Therapeutics LP

- AT&T

- AirStrip Technologies