Global Waste Management Market by Waste Type (Municipal Waste, Medical Waste, Industrial Waste, and E-Waste), By Service Type (Collection, Transportation, and Disposal), By End-User, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: Oct 2023

- Report ID: 40293

- Number of Pages: 209

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

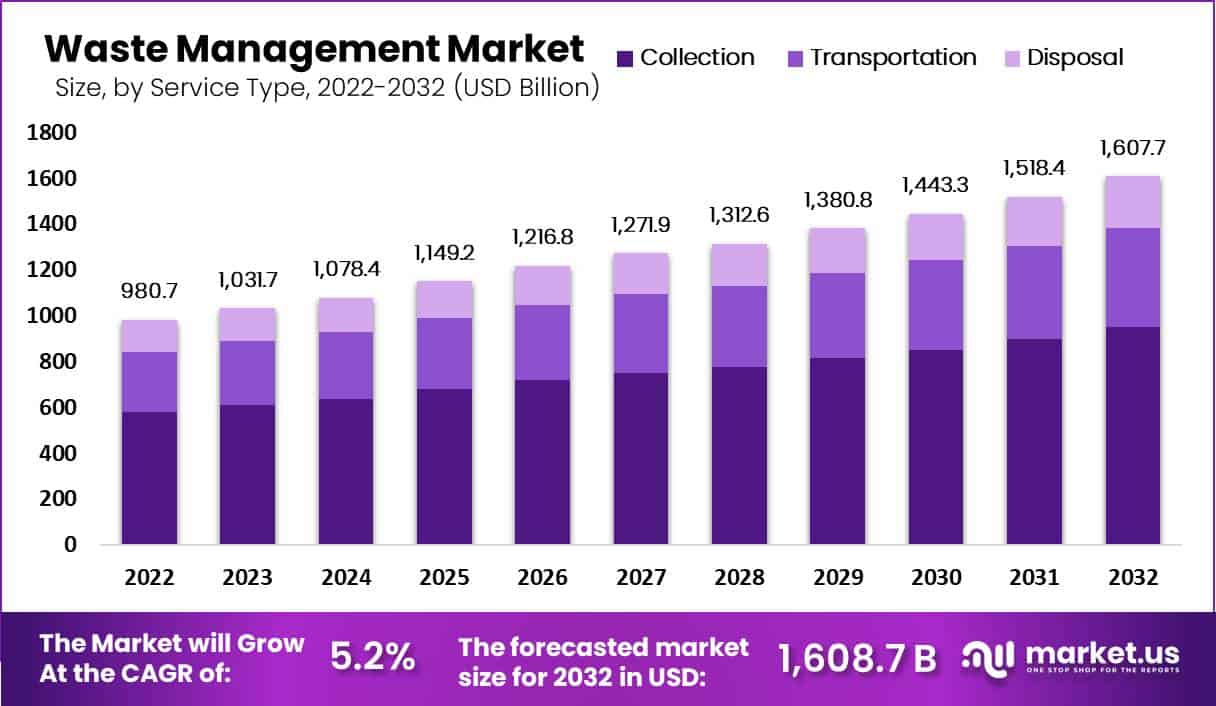

In 2022, the global waste management market size accounted for USD 980.7 billion and will reach USD 1607.6 billion by 2032. Between 2023 and 2032, this market is estimated to register a CAGR of 5.2%

The government’s strict regulations, such as the Recovery Act and Resource Conservation and Waste Shipment Regulation, are expected to drive this market. Due to the COVID-19 pandemic lockdown, waste products from the commercial and industry sectors decreased as factories and offices were shut down or partially. On the other hand, the urban waste from residential areas increased.

The reopening of production facilities in 2021 and the rising vaccination rates led to the re-initiation of the waste recycling industry. The growing awareness of proper waste disposal for animal and human health globally has led to the emergence and development of different disposal methods and techniques. Waste management companies must dispose of or recycle wastes on time due to the presence of large quantities of dangerous compounds such as metals and sodium in waste.

The market is dominated mainly by a few large players, such as Veolia, Covanta, Valrico, and Waste Management Inc. These companies have a large customer base and goodwill and thus limit new entrants. Due to the advanced processing technologies, new market entrants will face high capital costs. This will reduce the threat of new market entrants and limit the competition in the market.

Key Takeaways

- Market Growth: The global waste management market witnessed substantial expansion between 2023-2032, reaching USD 980.7 billion at an impressive compound annual growth rate of 5.2% annually from 2023-2032. Projections indicate a remarkable surge to approximately USD 1607.6 billion during that same time span – according to projections for 2032 alone.

- According to Waste Type Analysis: Market participants have three main waste streams to consider for analysis in regards to industrial waste management market, medical, and electronic. Of the three waste categories analyzed here, industrial garbage has proven itself most prominent due to rapid industrialization as well as urbanization processes that fuel this segment’s rise.

- Analysis by Service Types: Waste collection remains the top service market segment with 59% waste management market share, followed by transportation (31% market share), collection, and disposal. Waste collection represents 59% market share overall.

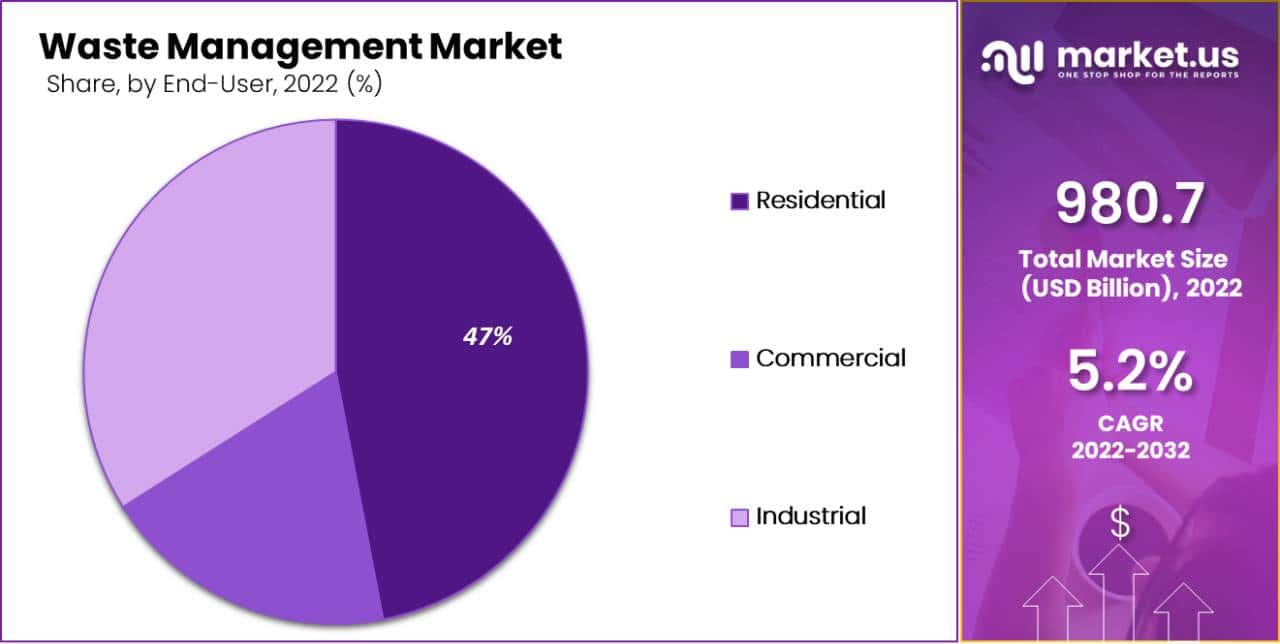

- Based on End User Analysis: With regard to end-user analysis, the residential segment is by far the dominant in this market capturing 47%.

- Drives: Population growth and urbanization are major forces driving waste management market expansion. Concern for environmental matters as well as stricter regulations surrounding proper waste disposal also play a part.

- Restraints: Waste management market challenges stem from rising operational costs, limited landfill capacity, and public awareness; managing hazardous materials also poses unique obstacles.

- Opportunities in This Market: Opportunities exist within this market for developing innovative waste-to-energy technologies, expanding recycling programs, and creating environmentally responsible disposal methods; public-private partnerships also present growth potential.

- Trends: Key trends in waste management today include adopting circular economy principles to promote resource recovery and recycling. Furthermore, single-use plastic usage and sustainability packaging practices have become prominent concerns.

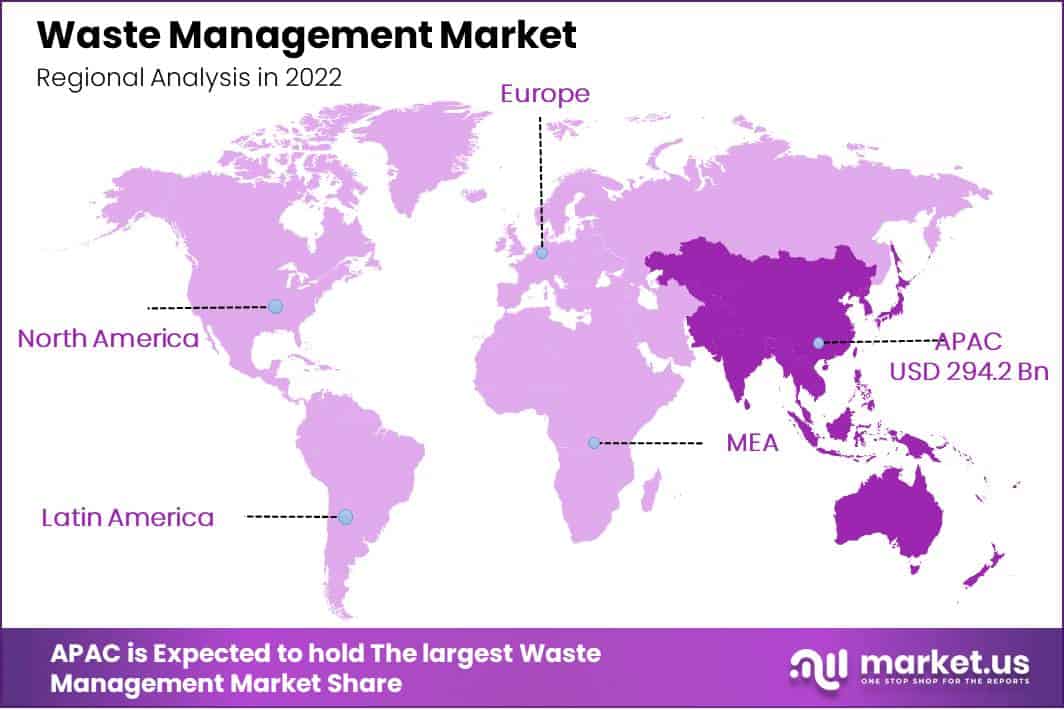

- Regional Dominance: Asia-Pacific was the region with the highest revenue share in 2022 for Waste Management Market revenue at 30% market share.

- Major Players in the Waste Management Market: Suez, Valicor Environmental Services, Veolia, and Waste Connections are key companies involved in shaping the market’s development and sustainability efforts. These key players play an essential part in shaping growth strategies within this space.

Driving Factors

The world population is growing and so is the amount of waste. Effective waste management strategies are needed to deal with waste produced by an increasing population. As cities grow, so does waste production. The limited space in urban areas makes it difficult to manage waste. Waste management is essential for sustainable economic growth.

Waste Management can reduce pollution and the impact of Climate Change. Governments around the world have implemented regulations to regulate waste management practices. This regulation can help ensure waste is properly managed and also promote innovative waste management technology. Technological advances have led to the development of new waste management methods which are more efficient than traditional methods. This has improved waste disposal and reduced the negative environmental impact of waste.

Restraining Factors

Many people are unaware of the impact that waste has on the environment and human health. This can lead people to be less motivated to reduce waste or engage in proper waste management. Building and maintaining waste infrastructure is expensive in developing nations, where resources are scarce. Lack of funding can lead to inadequate waste management equipment and personnel.

Some countries or regions may not have adequate policies or regulations that enforce proper waste disposal. Illegal dumping, littering, and other harmful waste management practices can result. Limited access to innovation and technology. Limited access to technology and innovation. Lacking cooperation can hinder efforts to reduce waste and improve waste management practices.

By Waste Type Analysis

The industrial waste segment dominates the market with a 79% market share.

By waste type, the market is divided into municipal waste, medical waste management market, industrial waste, and e-waste. The industrial waste management market size segment dominates the market due to Industrialization and rapid urbanization are the main factors that contribute to the increase in industrial waste. Managing industrial waste can cause lakes and groundwater pollution and damage to wildlife and plants.

According to “Our World In Data”, by 2050, around 7 billion people are expected to live in urban areas. This will increase the generation of urban waste shortly. In 2020, during the COVID-19 Pandemic, the governments of several countries, including the U.S.A., India, and China, imposed a lockdown to control the virus’ spread. This resulted in people working at home, which increased the amount of urban waste in 2020. Over the forecast period, the e-waste sector is expected to grow at the fastest CAGR (7.4%)

Rapid technological advancements have led to the creation of new electronic products and upgraded versions of existing products. This has resulted in a reduction in their shelf life and increased the generation of e-waste. Hospitals, clinics, and diagnostic centers must use proper waste management techniques to prevent the spread of diseases and infections such as whooping cough and diarrhea. The generation of biomedical waste increased between 2020-2021 due to the increase in diagnostic activities and treatment for COVID-19 patients.

By Service Type Analysis

The collection segment dominates the market with a 59% market share.

By service type, the market is divided into collection, transportation, and disposal. The collection segment dominates the market waste collection includes, segregation, loading, and unloading, selecting an area suitable for waste storage, setting up this area at a distance of a minimum from where the waste was generated, and maintaining the waste.

Companies involved in waste collection must consider regular cleaning and maintaining these storage areas. Transporting waste properly is essential to prevent spillage and leakage. Liquid waste must be protected and leak-proof while being transported. Hazardous waste from industrial and commercial premises must be transported in vehicles that provide a certain level of protection. Non-hazardous materials can be taken directly to the recycling facility.

Over the forecast period, the disposal segment is expected to grow at the highest CAGR (5.9%). There are many methods of disposal including recycling, incineration, and composting. Landfills and open dumping are also options. Proper waste disposal is necessary to prevent environmental degradation and infections such as HIV or hepatitis in the population.

By End-User Analysis

According to the end-user analysis, the residential segment dominates the market with 47% market share.

End-User divides the market into Residential, Commercial, and Industrial. The residential segment dominates the market because this category includes waste generated by multi-family and single-family homes. Consumer durables (CD), fast-moving consumer goods (FMCG), and e-waste make up the majority of household waste. Other packaging materials are also included.

Plastic waste in the residential sector is also increasing due to the increase in disposable incomes and consumers’ preference for online shopping. Industrial waste is another leading segment. Construction, oil and gas industries, chemical, nuclear, and agricultural industries produce and collect industrial waste. This waste includes solids, liquids, and gases. This waste contains both hazardous materials and non-hazardous ones.

The chemical, oil and gas, and nuclear industries produce the majority of hazardous industrial waste. The increasing global demand for chemicals, energy, and other materials will increase waste production from these industries. This will benefit service providers who collect hazardous industrial waste, treat it, and then dispose of it.

Key Market Segments

Based on Waste Type

- Municipal Waste

- Medical Waste

- Industrial Waste

- E-waste

Based on Service Type

- Collection

- Transportation

- Disposal

Based on End-User

- Residential

- Commercial

- Industrial

Growth Opportunity

The waste management sector can benefit from technological advances, such as automation, robotics, and artificial intelligence, to improve waste sorting, recycling, and other processes. Growth opportunities are also available with the development of new waste-to-energy technologies and improved landfill gases capture systems. The shift to a circular economy where waste is viewed as a resource presents a significant opportunity for growth in the waste management industry.

The industry can capitalize on this trend through new recycling and upcycling methods that turn waste into valuable materials. Consumers are becoming more interested in sustainable waste disposal practices. This presents a growth opportunity for companies that emphasize environmental sustainability. This can include providing waste reduction and recycling services and implementing green procurement practices. As developing countries experience rapid urbanization and waste generation increases, the waste management industry has growth opportunities.

Companies can take advantage of this trend by offering services for waste management and infrastructure development in emerging markets. Collaboration between stakeholders in the waste industry, including government agencies, waste companies, and technology suppliers, can lead to new business opportunities and innovative solutions for waste management. Waste management has a lot of potential for growth thanks to innovation, sustainability, new markets, and collaboration.

Latest Trends

The waste management sector can benefit from technological advances, such as automation, robotics, and artificial intelligence, to improve waste sorting, recycling, and other processes. Growth opportunities are also available with the development of new waste-to-energy technologies and improved landfill gases capture systems. The shift to a circular economy where waste is viewed as a resource presents a significant opportunity for growth in the waste management industry.

The industry can capitalize on this trend through new recycling and upcycling methods that turn waste into valuable materials. Consumers are becoming more interested in sustainable waste disposal practices. This presents a growth opportunity for companies that place an emphasis on environmental sustainability. This can include providing waste reduction and recycling services and implementing green procurement practices.

As developing countries experience rapid urbanization and waste generation increases, the waste management industry has growth opportunities. Companies can take advantage of this trend by offering services for waste management and infrastructure development in emerging markets.

Collaboration between stakeholders in the waste industry, including government agencies, waste companies, and technology suppliers, can lead to new business opportunities and innovative solutions for waste management. Waste management has a lot of potential for growth thanks to innovation, sustainability, new markets, and collaboration.

Regional Analysis

Asia-Pacific Accounted for the Largest Revenue Share in the Waste Management Market in 2022 with a 30% market share.

The Asia Pacific waste management market was studied in China, India, Japan, South Korea, and other countries along the Pacific Rim. This region is expected to register the highest growth over the forecast period due to its dense population, with India and China as the most populated nations.

The construction market is growing, which is a result of increased drilling activities and rapid urbanization. Key players are also focusing on developing cost-effective and sustainable management solutions that are technologically advanced.

In December 2017, Keppel Corporation (China) won a contract to design, construct, and operate the first integrated waste management facility in Hong Kong. Waste management services are expected to be in high demand due to an improvement in infrastructure, a rise in garbage management reforms, and an increase in urban populations in emerging markets such as India and China.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The generic strategies adopted by companies include mergers and acquisitions, expansion of distribution networks, and expansion of product portfolios. In February 2020, Valrico acquired Affiliated Water Environmental Services in order to expand its network and strengthen its position in the U.S. Vertical integration is a key feature of major players in the industry.

They provide services such as waste collection, transportation, and disposal. This allows the companies to optimize their operational costs and increase profit margins. Some of the leading players in the global market for waste management include:

Market Key Players

- Suez

- Valicor environmental services

- Veolia

- Waste Connections

- Republic Services, Inc.

- Biffa

- Clean Harbors, Inc.

- Covanta Holding Corporation, Ltd.

- Hitachi Zosen Co.

- Remondis Se & Co. Kg

- Urbaser S.A.U

- FCC Recycling (UK) Limited,

- Biomedical Waste Solutions

- Other Key Players

Recent Developments

- February 2021: Biffa Group announced that it would acquire Company Shop Group, the UK’s largest and most prominent redistributor, and retailer of surplus household and food products.

- October 2020: Waste Management acquired all outstanding shares in Advanced Disposal by October 2020, after receiving the required regulatory approvals. The previously announced USD 30.30 purchase price per share in cash represents an enterprise value of USD 4, 6 billion, including USD 1.8 billion net debt of Advanced Disposal.

Report Scope

Report Features Description Market Value (2022) USD 980.7 Bn Forecast Revenue (2032) USD 1607.7 Bn CAGR (2023-2032) 5.2% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered Waste Type (Municipal Waste, Medical Waste, Industrial Waste, and E-Waste) By Service Type (Collection, Transportation, and Disposal)

By End-User (Residential, Commercial, and Industrial)

Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Waste Management, Suez, Veolia, Valicor, Waste Connections, Republic Services, Biffa, Clean Harbors, Covanta Holding, Daiseki, Hitachi Zosen, Remondis Se & Co. Kg, Urbaser, Fcc Environment, Biomedical Waste Solutions, and Stericycle Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

How big is the global waste management market?The global waste management market accounted for USD 980.7 billion in 2022. The market is expected to reach USD 1607.6 billion by 2032.

What are the driving factors for the growth of the waste management market?Factors driving the market growth include the increasing world population and waste generation, government regulations promoting proper waste management, and technological advancements in waste management methods.

Which waste type dominates the waste management market?Industrial waste is the dominant segment in the market, accounting for a 79% market share, followed by municipal waste, medical waste, and e-waste.

What are the growth opportunities in the waste management market?Growth opportunities include technological advancements like automation and artificial intelligence, circular economy practices, expansion in developing markets, and collaboration between stakeholders in the industry.

Which region accounted for the largest revenue share in the waste management market?Asia-Pacific accounted for the largest revenue share in the waste management market in 2022, with a 30% market share.

What are some leading players in the global waste management market?Key players in the waste management market include Suez, Valicor Environmental Services, Veolia, Waste Connections, Republic Services Inc., Biffa, Clean Harbors Inc., Covanta Holding Corporation, Daiseki Co. Ltd., Hitachi Zosen Co., Remondis Se & Co. Kg, Urbaser S.A.U, FCC Recycling (UK) Limited, and Biomedical Waste Solutions.

What are the primary waste types considered in the waste management market analysis?The waste management market analysis includes municipal waste, medical waste, industrial waste, and e-waste. These waste types represent different sources and require specific management approaches.

-

-

- Suez

- Valicor environmental services

- Veolia

- Waste Connections

- Republic Services, Inc.

- Biffa

- Clean Harbors, Inc.

- Covanta Holding Corporation, Ltd.

- Hitachi Zosen Co.

- Remondis Se & Co. Kg

- Urbaser S.A.U

- FCC Recycling (UK) Limited,

- Biomedical Waste Solutions