Global Plastic Waste Management Market By Service (Collection, Recycling, Landfills , Incineration), By Material (Polypropylene , Low-density Polyethylene (LDPE), High-density Polyethylene (HDPE), Polyvinyl Chloride (PVC), Polyurethane (PUR), Other Materials), By Source (Commercial, Industrial, Residential), By End-user (Packaging, Transportation, Building & Construction, Electrical & Electronics, Textile, Other End-users), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: April 2025

- Report ID: 18173

- Number of Pages: 255

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

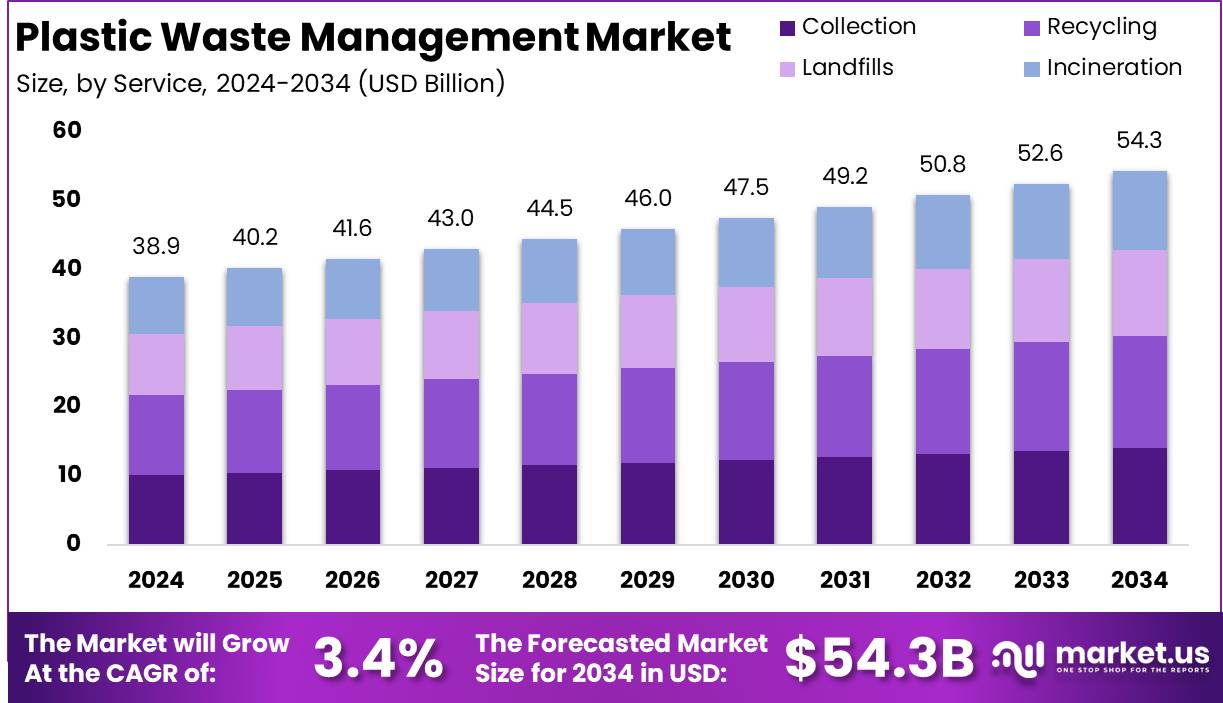

The Global Plastic Waste Management Market size is expected to be worth around USD 54.3 Billion by 2034 from USD 38.9 Billion in 2024, growing at a CAGR of 3.4% during the forecast period from 2025 to 2034.

Plastic waste management refers to the systematic approach employed to handle plastic waste through its collection, segregation, processing, recycling, or disposal, with the goal of minimizing its environmental footprint. The process encompasses various stages, including the reduction of plastic use at the source, adoption of sustainable alternatives, enhancement of recycling infrastructure, and the promotion of circular economy models.

In response to the mounting concerns over plastic pollution, governments, corporations, and environmental organizations have intensified their efforts toward more efficient waste management solutions. Key strategies include extended producer responsibility (EPR), material recovery facilities (MRFs), and advanced mechanical and chemical recycling methods.

The plastic waste management market encompasses the products, services, and technologies involved in the effective treatment and processing of plastic waste to mitigate environmental degradation. This market includes recycling facilities, plastic-to-fuel conversion technologies, waste sorting systems, biodegradable alternatives, and related consulting and regulatory services.

It is driven by environmental mandates, sustainability goals, and rising investments in circular economy practices. Stakeholders such as municipal bodies, waste management firms, packaging manufacturers, and environmental technology providers play a vital role in shaping market dynamics. As circular practices gain traction globally, the market has evolved from traditional landfill and incineration methods to more advanced and sustainable waste treatment solutions.

The growth of the plastic waste management market can be attributed to increasing environmental regulations and global sustainability initiatives aimed at reducing plastic pollution. Policy frameworks such as bans on single-use plastics, strict landfill directives, and EPR schemes are compelling industries to adopt more responsible plastic handling methods. Additionally, heightened public awareness and corporate social responsibility programs are further catalyzing investments in eco-friendly waste treatment technologies.

The demand for plastic waste management services is witnessing a steady upsurge due to the growing consumption of plastics across packaging, automotive, electronics, and healthcare industries. As the global production of plastic continues to rise, so does the urgency to manage post-consumer and industrial plastic waste responsibly. This surge in plastic usage necessitates an integrated waste management approach, creating substantial demand for efficient recycling, sorting, and disposal solutions.

Significant opportunities lie in the development and expansion of circular economy models that aim to retain the value of plastic materials within the supply chain through reuse and recycling. Startups and established firms are increasingly exploring business models focused on closed-loop recycling, plastic credit systems, and waste-to-energy technologies. These models not only offer environmental benefits but also unlock new revenue streams and cost-saving opportunities for businesses.

According to OH My Facts, the Plastic Waste Management Market is gaining traction amid growing environmental concerns, with the U.S. operating over 3,000 active landfills posing substantial ecological risks if inadequately managed. In contrast, Japan leads with a recycling rate exceeding 77%, reflecting systemic efficiency and societal participation. Energy efficiency is a key driver, as recycling aluminum conserves up to 95% of the energy compared to primary production.

These statistics underscore a critical momentum in the market, emphasizing both risk mitigation through landfill management and opportunity capture through high-efficiency recycling models. The market is poised for structured innovation and investment, driven by global sustainability mandates and rising regulatory pressure.

According to Energy Theory, the Plastic Waste Management Market is under significant pressure due to the alarming volume of global plastic pollution. The EU alone exports over 3 million kilograms of plastic waste daily, with Turkey (31%), Malaysia (16%), Indonesia (13%), and Vietnam (9%) as major recipients.

Globally, one million plastic bottles are purchased every minute, while up to 5 trillion plastic bags are consumed annually. More than 1,000 rivers are responsible for 80% of the 0.8 to 2.7 million tonnes of plastic flowing into oceans each year. Despite waste mitigation efforts, an estimated 75 to 199 million tonnes of plastic remain in marine environments.

In the UK, approximately 227,000 miles of Christmas wrapping paper equivalent to 108 million rolls or the distance from Earth to the Moon is discarded annually. Recycling such materials can reduce energy consumption by 70%, save 17 trees, 4,000 kilowatts of electricity, and preserve 18 square feet of landfill per ton. These statistics underline the urgent need for scalable and efficient waste management solutions, driving demand in the global Plastic Waste Management Market.

Key Takeaways

- The global Plastic Waste Management Market is projected to reach approximately USD 54.3 billion by 2034, rising from USD 38.9 billion in 2024, with a compound annual growth rate (CAGR) of 3.4% during the forecast period (2025–2034).

- Recycling remains the leading service category, capturing over 30.0% of the total market share, driven by increasing regulatory mandates and circular economy initiatives.

- Low-Density Polyethylene (LDPE) holds the largest share among material types, accounting for more than 24.3% of the market, owing to its extensive use in consumer packaging and flexible film applications.

- The residential sector dominates the market by source, contributing over 51.3% of total plastic waste, reflecting the growing volume of household plastic consumption and disposal.

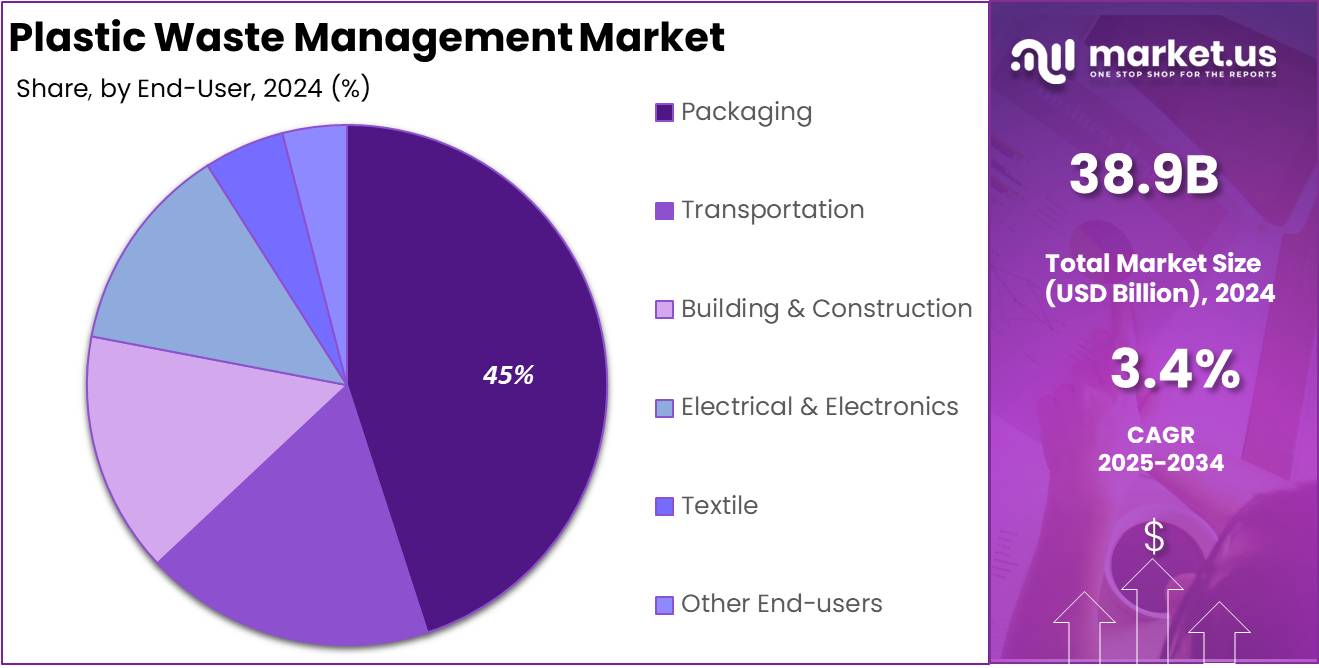

- The packaging industry is the largest end-use sector, representing over 45% of the total market, primarily fueled by rising demand for single-use and flexible packaging solutions.

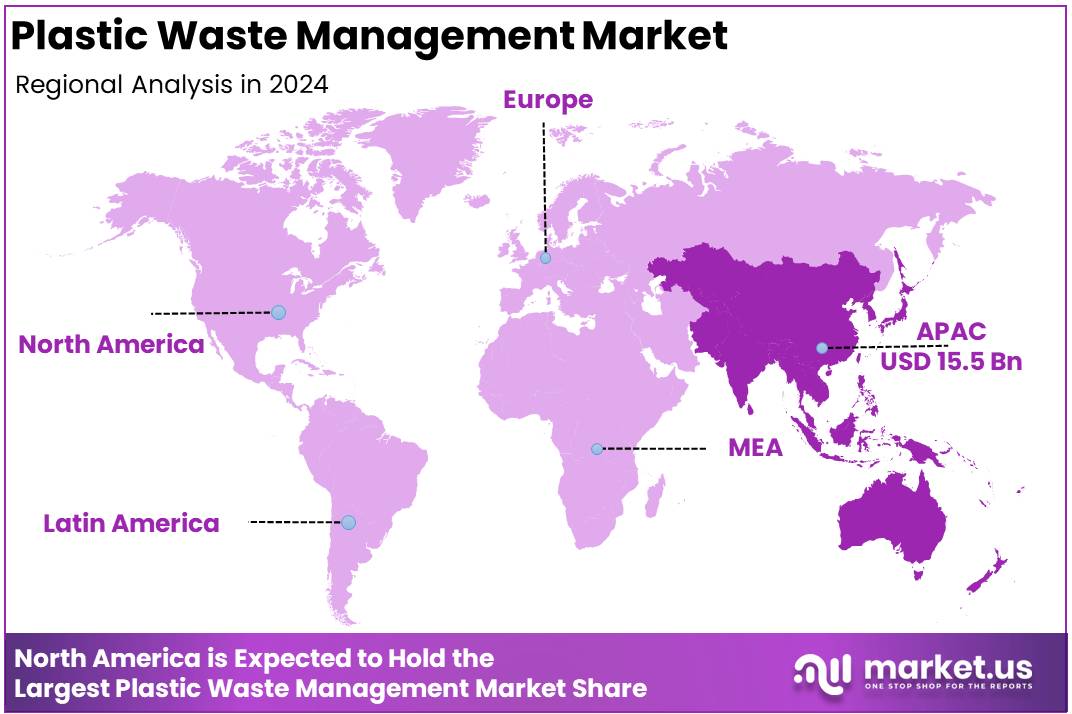

- Asia Pacific leads the global market, accounting for 40% of the total share in 2024, with a market valuation of approximately USD 15.5 billion, supported by rapid urbanization, high plastic consumption, and ongoing infrastructure development in waste management.

By Service Analysis

Recycling leads the Plastic Waste Management Market by Service with over 30.0% share.

In 2024, Recycling holds a dominant market position in the Plastic Waste Management Market by Service, capturing more than a 30.0% share. This significant market share can be attributed to rising regulatory pressure from governments and environmental agencies, encouraging sustainable waste treatment practices across both developed and developing economies. With increased public awareness and corporate responsibility towards reducing plastic pollution, the recycling segment has become a central focus of integrated waste management systems. Numerous industries are also shifting towards the use of recycled plastic in product manufacturing to reduce carbon emissions and enhance brand sustainability credentials.

The market has seen substantial investments in advanced recycling technologies, including chemical recycling and AI-driven sorting systems, which have improved the efficiency and scalability of recycling facilities. In 2024, Collection remains a significant contributor to the Plastic Waste Management Market by Service, forming the foundational step in the entire waste processing chain. The segment is critical for ensuring the effective flow of plastic materials into subsequent stages like sorting, recycling, and disposal.

Urbanization, increasing municipal waste volumes, and government-led waste collection initiatives have amplified the demand for structured and efficient plastic waste collection systems. In particular, developing regions are experiencing rapid improvements in waste collection infrastructure driven by international funding and environmental mandates.

In 2024, the Landfills segment holds a moderate share in the Plastic Waste Management Market by Service, as it continues to serve as a traditional disposal method, particularly in regions lacking advanced waste treatment infrastructure. Despite increasing regulations discouraging landfill use due to its environmental impact, it remains a prevalent option in low-income and rural areas where investment in recycling or incineration facilities is limited. The persistence of single-use plastics and non-recyclable materials further contributes to the reliance on landfill solutions.

In 2024, Incineration maintains a notable presence in the Plastic Waste Management Market by Service, especially in regions where land availability is constrained, and high-temperature waste disposal is prioritized. The segment is driven by the demand for volume reduction and energy recovery through waste-to-energy (WTE) technologies. Incineration facilities are particularly prevalent in densely populated and industrialized nations such as Japan and parts of Western Europe, where strict emission standards and modern incineration systems minimize environmental risks.

By Material Analysis

Low-density Polyethylene (LDPE) leads the Plastic Waste Management Market by Material with over 24.3% share.

Low-density Polyethylene (LDPE) leads the Plastic Waste Management Market by Material with over 24.3% share. This dominance is driven by its widespread use in products like plastic bags and containers. LDPE’s low cost and versatility contribute to its high presence in the waste stream. As environmental regulations tighten, its recycling has become crucial for meeting sustainability goals. Ongoing advancements in recycling technologies further enhance LDPE’s recyclability, providing growth opportunities in the segment.

Polypropylene (PP) holds a significant share in the Plastic Waste Management Market by Material in 2024. Its use in packaging and automotive parts, combined with its durability and recyclability, makes it a key material for plastic waste management. The ongoing push for recycling and eco-friendly solutions drives the growth of PP in the market.

High-density Polyethylene (HDPE) plays a key role in the Plastic Waste Management Market by Material, with a notable share. Its strength and recyclability make it a focus for plastic waste management. HDPE’s ability to be reused in various products, such as outdoor furniture, positions it for further growth as consumer awareness and regulations increase.

Polyvinyl Chloride (PVC) holds a moderate share in the Plastic Waste Management Market by Material. While its recycling is more challenging, ongoing advancements in recycling technologies are improving its waste management. The PVC segment is expected to grow modestly as sustainable waste management practices and circular economy solutions evolve.

Polyurethane (PUR) has an emerging presence in the Plastic Waste Management Market by Material. Historically difficult to recycle, PUR’s complex structure is now being addressed through advancements in chemical recycling. The growing demand for sustainable solutions, especially in construction and automotive sectors, is expected to expand PUR’s role in the market.

The Other Materials segment holds a smaller but growing share in the Plastic Waste Management Market by Material. This category includes materials like polystyrene and PET, which are gaining attention due to improved recycling technologies. As sustainability efforts intensify, the segment is expected to grow with increased focus on single-use plastics and packaging recycling.

By Source Analysis

Residential leads the Plastic Waste Management Market by Source with over 51.3% share.

In 2024, Residential holds a dominant market position in the Plastic Waste Management Market by Source, capturing more than a 51.3% share. This dominance is primarily driven by the significant volume of plastic waste generated from household items such as packaging, bottles, and food containers. As consumer behavior continues to shift toward higher plastic consumption, especially in single-use packaging, residential sources contribute the largest portion to the overall plastic waste stream.

This segment’s substantial share is further supported by the growing awareness and demand for waste management services in residential areas, as more households participate in recycling programs.

The residential sector’s contribution to plastic waste management is expected to remain significant due to ongoing initiatives to increase recycling rates at the household level. With more municipalities and organizations offering curbside recycling services and educating consumers about proper waste disposal, the residential segment is poised for continued growth.

In 2024, Commercial holds a significant share in the Plastic Waste Management Market by Source. This segment includes plastic waste generated from businesses, retail establishments, and foodservice operations. Commercial establishments are major contributors to the plastic waste stream, particularly through packaging, plastic utensils, and containers.

As environmental concerns intensify, businesses are increasingly adopting sustainable practices to minimize plastic waste, such as reducing packaging and transitioning to recyclable materials. This trend is driving demand for plastic waste management services across the commercial sector.

In 2024, the Industrial segment plays a key role in the Plastic Waste Management Market by Source, contributing a significant share. Industrial sources of plastic waste come from manufacturing, construction, and production processes, where plastic is used for packaging, components, and other applications.

The sheer scale of production in industries like automotive, electronics, and consumer goods generates substantial plastic waste, requiring effective management solutions. The growth of recycling technologies and waste sorting systems in industrial applications is helping to address the challenges of plastic disposal in this sector.

By End-user Analysis

Packaging leads the Plastic Waste Management Market by End-user with over 45% share.

In 2024, Packaging held a dominant market position in the Plastic Waste Management Market, capturing more than 45% share. The high consumption of single-use plastics in food packaging, consumer goods, and e-commerce parcels has significantly contributed to the volume of plastic waste generated from this segment. With growing environmental concerns and regulatory pressures, the need for effective plastic waste management within the packaging sector has gained priority across both developed and emerging economies.

Additionally, rising investments in sustainable packaging solutions, such as recyclable and biodegradable plastics, have further emphasized the importance of advanced waste management practices in this segment. The trend toward circular economy models, where packaging waste is reprocessed and reused in manufacturing, is expected to sustain the dominance of the packaging segment. Strong initiatives by FMCG brands and retailers toward post-consumer packaging collection and processing are also playing a crucial role in driving the demand for efficient plastic waste management in this category.

The Transportation segment has emerged as a significant contributor to the Plastic Waste Management Market. In automotive and logistics applications, plastics are valued for their lightweight properties, durability, and energy efficiency benefits. However, vehicle end-of-life management has become increasingly challenging due to the presence of composite plastic parts, such as bumpers, dashboards, and underbody panels, which are difficult to recycle using conventional techniques.

At the same time, the use of plastic films, stretch wraps, and containers in logistics and warehousing operations has led to considerable plastic waste accumulation. In response, industry stakeholders are implementing recycling solutions aligned with circular economy principles, targeting material recovery from both durable vehicle components and transient transport packaging. Collaborations between logistics firms and recycling service providers are expected to further enhance the waste management infrastructure in this segment.

The Building & Construction segment plays an increasingly important role in the Plastic Waste Management Market. The use of plastic materials in piping systems, window frames, insulation panels, and floor coverings has grown significantly in modern construction projects. As a result, large volumes of rigid and semi-rigid plastic waste are generated during construction, renovation, and demolition activities.

To address this challenge, construction companies and regulatory authorities are emphasizing sustainable waste practices, including on-site segregation and recycling of plastic debris. Technological advancements in sorting and reprocessing rigid plastics, such as PVC and HDPE, are enhancing recycling efficiencies within this segment. Furthermore, the integration of green building codes and sustainability certifications is expected to support long-term improvements in construction-related plastic waste management.

The Electrical & Electronics segment constitutes a critical area within the Plastic Waste Management Market, primarily due to the rising volumes of electronic waste. Plastics are extensively used in electronic products for insulation, structural housing, connectors, and printed circuit boards. The rapid turnover of consumer electronics has increased the pressure on waste systems to manage plastic-rich e-waste efficiently.

Emerging regulations are driving the adoption of extended producer responsibility (EPR) mechanisms, requiring manufacturers to take accountability for post-consumer electronic products. Additionally, technological innovations in automated sorting, polymer separation, and chemical recycling methods are opening new avenues for recovering plastics from complex e-waste compositions. These developments are expected to enhance the sustainability of the electronics sector and its contribution to circular waste practices.

The Textile segment is gaining prominence in the Plastic Waste Management Market due to the environmental impact of synthetic fiber waste. Materials such as polyester, nylon, and acrylics dominate fast fashion manufacturing and contribute significantly to non-biodegradable textile waste. This waste is generated both at the production level and through post-consumer garment disposal.

As sustainability becomes a core focus in the apparel industry, there is growing momentum toward textile-to-textile recycling technologies that recover plastic-based fibers for reuse in new garments. Industry stakeholders are also investing in closed-loop systems, reverse logistics, and consumer education to promote responsible garment disposal. These efforts are expected to strengthen plastic recovery mechanisms within the textile domain and support the development of a circular fashion economy.

The Other End-users segment in the Plastic Waste Management Market comprises various industries, including agriculture, healthcare, consumer goods, and institutional sectors. Each of these contributes to distinct plastic waste streams such as agricultural films, medical disposables, household plastic goods, and office supplies. The heterogeneity of waste types presents unique challenges in collection, sorting, and recycling.

Key Market Segments

By Service

- Collection

- Recycling

- Landfills

- Incineration

By Material

- Polypropylene

- Low-density Polyethylene (LDPE)

- High-density Polyethylene (HDPE)

- Polyvinyl Chloride (PVC)

- Polyurethane (PUR)

- Other Materials

By Source

- Commercial

- Industrial

- Residential

By End-User

- Packaging

- Transportation

- Building & Construction

- Electrical & Electronics

- Textile

- Other End-users

Driver

Rising Urbanization and Industrial Plastic Usage Intensifying Waste Management Needs

The growth of the global plastic waste management market in 2024 is strongly driven by the escalating rate of urbanization and industrialization, which has resulted in a significant surge in plastic consumption and subsequent waste generation. Rapid population growth, particularly in urban centers, has led to an increase in the demand for consumer goods, packaging, electronics, and construction materials sectors where plastic is heavily used due to its versatility and cost-effectiveness.

This heightened plastic dependency has directly contributed to the accumulation of plastic waste, placing immense pressure on municipal solid waste systems and reinforcing the demand for efficient plastic waste management solutions.

According to recent estimations, over 300 million tons of plastic waste is generated globally each year, with a substantial portion originating from urban and industrial sources. The increasing visibility of unmanaged plastic pollution in cities has accelerated government responses and driven public awareness initiatives, further supporting market expansion.

Moreover, the commercial and industrial sectors are increasingly adopting plastic waste segregation and recycling practices to comply with evolving environmental regulations and corporate sustainability goals. This transition is supported by stringent policies targeting industrial plastic disposal, which compel companies to partner with waste management service providers.

Additionally, the rise of Extended Producer Responsibility (EPR) frameworks is prompting manufacturers to take accountability for the end-of-life management of plastic products. Consequently, industries are actively investing in recycling infrastructure and circular economy models, creating long-term growth avenues for plastic waste management companies.

This industrial cooperation with waste management systems not only addresses the operational burden but also promotes sustainable resource utilization. Thus, the convergence of urban expansion, industrial waste generation, and regulatory enforcement is collectively reinforcing the demand for plastic waste collection, sorting, recycling, and energy recovery services, forming a core growth pillar of the global plastic waste management market in 2024.

Restraint

High Cost and Limited Accessibility of Advanced Recycling Technologies

Despite growing awareness and regulatory emphasis on plastic waste management, the global market is significantly constrained by the high cost and limited accessibility of advanced recycling technologies. Mechanical and chemical recycling processes, particularly those designed to handle mixed, contaminated, or multilayer plastics, often require substantial capital investment and operational expenditures. The installation of modern recycling infrastructure entails high costs for machinery, skilled labor, and ongoing maintenance.

In developing regions, where plastic waste generation is rising rapidly, the lack of financial and technical resources inhibits the deployment of these sophisticated recycling systems. As a result, a significant volume of plastic waste continues to be mismanaged, either through open dumping, incineration, or landfilling, which reduces the effectiveness of waste recovery efforts and limits market penetration.

Furthermore, the economic feasibility of recycling is closely linked to fluctuations in the prices of virgin plastics derived from fossil fuels. When crude oil prices fall, the production of new plastics becomes cheaper than recycling, undermining the commercial viability of secondary plastic materials.

This cost imbalance disincentivizes investment in recycling innovation and slows the pace of technological adoption. Additionally, the heterogeneous nature of plastic waste ranging in polymer type, color, and contamination level poses further technological challenges that are not easily addressed with existing infrastructure.

Inadequate sorting facilities and fragmented collection systems, especially in low- and middle-income countries, further exacerbate the problem by reducing feedstock quality and increasing processing complexity. These systemic limitations collectively hinder the scalability and cost-efficiency of plastic waste management solutions. Therefore, the high capital and operational costs associated with advanced recycling technologies, coupled with inconsistent economic incentives and infrastructure limitations, continue to restrain the broader development of the global plastic waste management market in 2024.

Opportunity

Integration of Circular Economy and Recycled Plastic Demand Surge

The global plastic waste management market in 2024 is positioned to capitalize significantly on the increasing integration of circular economy principles and the surging demand for recycled plastic materials across industries. Governments and private sectors are actively pursuing zero-waste targets and material recovery strategies that prioritize reuse, recycling, and resource efficiency. Circular economy models emphasize the transformation of plastic waste from an environmental liability into a valuable resource by enabling closed-loop recycling systems.

This approach supports not only environmental sustainability but also economic viability by reducing raw material costs and dependency on virgin plastic. Industries such as packaging, automotive, consumer electronics, and textiles are increasingly adopting recycled plastics to meet sustainability commitments and comply with regulatory mandates regarding the use of post-consumer resin (PCR).

The demand for recycled plastic has also seen a marked rise, especially in high-consumption sectors such as packaging, where brands are under pressure to shift towards environmentally responsible alternatives. As of 2024, recycled plastics are being integrated into product design at a higher rate, encouraged by green labeling initiatives and consumer preferences for eco-friendly products. This has created a robust market for high-quality recycled polymers like PET, HDPE, and LDPE.

Furthermore, financial incentives, tax benefits, and subsidies introduced by various governments to support recycling ventures are enhancing the profitability of plastic waste management operations. The alignment of sustainability goals with economic advantages is encouraging investments in plastic reprocessing infrastructure, especially in urban and industrial clusters.

These developments reflect a growing recognition of plastic waste as a strategic asset rather than a disposal burden. Therefore, the widespread adoption of circular economy frameworks and the escalating demand for recycled plastics offer a significant opportunity for the growth and diversification of the global plastic waste management market.

Trends

Technological Advancements in AI-Powered Sorting and Automation

A key trend shaping the growth of the global plastic waste management market in 2024 is the adoption of artificial intelligence (AI) and automation technologies in sorting, processing, and recycling operations. Traditional manual sorting techniques have long been plagued by inefficiencies, contamination risks, and high labor costs. However, the integration of AI-powered robotics, sensor-based recognition systems, and machine learning algorithms is revolutionizing waste classification processes by increasing precision and throughput.

These technologies enable the real-time identification of polymer types, colors, and contaminants, which improves the purity of recovered materials and enhances downstream recycling efficiency. As accuracy in sorting directly correlates with the quality of recyclates, the implementation of intelligent sorting solutions is becoming a critical competitive differentiator in the plastic waste management industry.

Moreover, automation is being widely adopted across various stages of the plastic waste management value chain, including collection logistics, baling, shredding, and reprocessing. Smart waste bins, GPS-enabled collection routing, and digital tracking of waste streams are enabling optimized resource allocation and operational transparency.

These innovations are not only reducing labor dependency but also lowering operational costs and enhancing regulatory compliance. Additionally, AI-driven data analytics tools are being utilized to forecast waste generation trends, monitor recycling rates, and support circular material flows.

The convergence of Industry 4.0 principles with environmental services is fostering the emergence of smart waste management ecosystems. This technological evolution is expected to significantly improve plastic recovery rates and contribute to the creation of scalable, efficient, and data-driven waste management systems. As a result, the rise of AI and automation is a defining trend that is transforming operational capabilities and propelling growth in the global plastic waste management market.

Regional Analysis

Asia Pacific Leads Plastic Waste Management Market with Largest Market Share of 40% in 2024

The global plastic waste management market exhibits significant regional disparities in terms of market size, growth potential, and waste generation practices. Among the key regions, Asia Pacific has emerged as the leading region, accounting for the largest market share of 40% in 2024, with a valuation of approximately USD 15.5 billion.

This dominance is largely attributed to the region’s high population density, rapid industrialization, and increasing urbanization across countries such as China, India, and Southeast Asian nations. The region’s rising plastic consumption and the growing environmental awareness among governments and consumers have driven demand for advanced plastic waste management solutions. Stringent regulations and growing adoption of recycling initiatives have further contributed to market growth in the region.

In North America, the plastic waste management market is witnessing steady development due to growing environmental consciousness and the presence of established waste processing infrastructure. Government policies promoting sustainable waste practices and an increasing emphasis on circular economy principles have fueled the demand for plastic recycling and reuse.

The region’s investment in technological innovations, especially in waste sorting and chemical recycling, is expected to support continued market growth. North America remains a mature market, characterized by well-organized collection systems and active participation from both public and private sectors.

Europe also holds a significant share in the global market, supported by stringent environmental regulations and an ambitious commitment to achieving plastic circularity. EU directives promoting zero landfill and recycling targets are encouraging the adoption of advanced waste management technologies. European nations are emphasizing plastic reduction at the source and supporting biodegradable alternatives. The region’s efforts are further reinforced by consumer demand for sustainable products and packaging, thereby creating favorable conditions for market expansion.

The Middle East & Africa region is gradually emerging as a market with growth potential, driven by increasing urban development, industrial activities, and the need for effective waste disposal solutions. While infrastructure remains underdeveloped in several areas, rising investments in waste-to-energy and recycling projects are expected to boost regional market prospects. Governments are also launching awareness campaigns and regulations to reduce environmental impact.

In Latin America, the plastic waste management market is witnessing gradual evolution, supported by government initiatives aimed at improving municipal waste systems and reducing environmental pollution. Countries in the region are exploring innovative models such as extended producer responsibility and informal sector integration to improve collection and recycling rates. Despite facing infrastructural and regulatory challenges, the region shows promising growth opportunities driven by a growing emphasis on environmental sustainability.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- United Arab Emirates

Key Players Analysis

In the Global Plastic Waste Management Market, 2024 has marked a phase of intensified competition and strategic realignments among major players, with a focus on capacity expansion, technological advancement, and circular economy integration. Veolia Environnement S.A., a dominant force, continues to strengthen its global footprint through its integrated waste management solutions and strategic partnerships.

The company’s emphasis on plastic circularity and chemical recycling technologies reinforces its leadership in sustainable plastic waste recovery. Waste Management Inc., one of North America’s largest waste service providers, is enhancing its recycling infrastructure and investing in advanced materials recovery facilities (MRFs) to process plastic waste more efficiently, aligning with rising U.S. regulations on plastic packaging and producer responsibility.

Suez Environnement Company remains a pivotal European player, expanding its plastic recycling capabilities through acquisitions and technological innovation, particularly in polymer sorting and reprocessing. Its alignment with EU green policies has positioned it well for regulatory-driven growth. Republic Services Inc. is focused on innovation in curbside recycling and has collaborated with industry stakeholders to develop scalable solutions for hard-to-recycle plastics, thereby strengthening its portfolio in municipal waste services.

Clean Harbors, Inc. leverages its expertise in hazardous waste to expand into complex plastic waste streams, offering integrated solutions for industrial clients seeking compliant and sustainable disposal routes. Stericycle maintains a niche in medical and pharmaceutical plastic waste, emphasizing safe and regulatory-aligned waste management practices. Biffa, a UK-based firm, is aggressively scaling its plastic recycling operations through acquisitions and investment in high-volume recycling plants.

Lastly, Remondis SE & Co. KG, a global waste management conglomerate, is advancing chemical recycling and secondary raw materials processing, supporting long-term circularity objectives. Collectively, these players are reshaping the market through innovation, capacity expansion, and a shared commitment to sustainability.

Top Key Players in the Market

- Veolia Environnement S.A.

- Waste Management Inc.,

- Suez Environnement Company

- Republic Services Inc.

- Clean Harbors, Inc.

- Stericycle

- Biffa

- Remondis SE & Co. KG

Recent Developments

- In 2024, WM, Republic Services, Waste Connections, GFL Environmental, and Casella Waste Systems spent around $4.2 billion on acquisitions. These companies carried out several deals across the year, though the total amount was below past records. The activity shows strong interest in expanding services and improving coverage in the waste and recycling industry.

- In 2023, Smurfit Kappa and WestRock signed a final agreement to merge and form Smurfit WestRock. This deal followed earlier announcements and brought together two global leaders in paper and packaging. The new company aims to lead in sustainable packaging across markets.

- In 2024, LyondellBasell completed the full acquisition of APK AG in Germany. APK will now operate as part of LyondellBasell, focusing on developing solvent-based recycling technology. The goal is to support the production of high-purity recycled plastics for packaging and personal care items.

- In 2025, Agilyx and Circular Resources launched Plastyx, a joint venture focused on securing plastic waste for recycling. The company aims to collect 200,000 tons of plastic by the end of 2025. Agilyx will focus on sourcing in Europe, while Carlos Monreal will lead the new venture as chairman.

- In 2024, Shell Chemicals and Braskem began working together to produce circular polypropylene. The material will be made using ISCC PLUS-certified feedstock and supports sustainability in sectors like automotive and packaging. This effort highlights both companies’ goals to expand circular material use.

- In 2025, ExxonMobil announced plans to increase its plastic recycling capacity to 1 billion pounds per year by 2027. The company is investing over $200 million to upgrade facilities in Texas. With this expansion, ExxonMobil aims to boost its role in advanced recycling and meet growing sustainability targets.

Report Scope

Report Features Description Market Value (2024) USD 38.9 Billion Forecast Revenue (2034) USD 54.3 Billion CAGR (2025-2034) 3.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Service (Collection, Recycling, Landfills , Incineration), By Material (Polypropylene , Low-density Polyethylene (LDPE), High-density Polyethylene (HDPE), Polyvinyl Chloride (PVC), Polyurethane (PUR), Other Materials), By Source (Commercial, Industrial, Residential), By End-user (Packaging, Transportation, Building & Construction, Electrical & Electronics, Textile, Other End-users) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Veolia Environnement S.A., Waste Management Inc.,, Suez Environnement Company, Republic Services Inc., Clean Harbors, Inc., Stericycle, Biffa, Remondis SE & Co. KG Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Plastic Waste Management MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample

Plastic Waste Management MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Veolia Environnement S.A.

- Waste Management, Inc.

- Suez Environnement Company

- Clean Harbors, Inc.

- Republic Services, Inc.

- Stericycle

- Biffa

- Remondis SE & Co. KG

- Other Key Players