Global Polyvinyl Chloride Market By Type(Rigid, Flexible), Stabilizer Type(Calcium-based Stabilizers, Tin-based Stabilizers, Barium Based Stabilizers, Lead-based, Stabilizers, Others), Product Category(Bio-Based, Synthetic), By Application(Pipes and Fittings, Wire and Cables, Profiles, Film and Sheet, Hoses and Tubing, Others), End-Use Industries(Building and Construction, Automotive, Footwear, Electrical and Electronics, Healthcare, Other End-user Industries), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: March 2024

- Report ID: 116101

- Number of Pages: 231

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

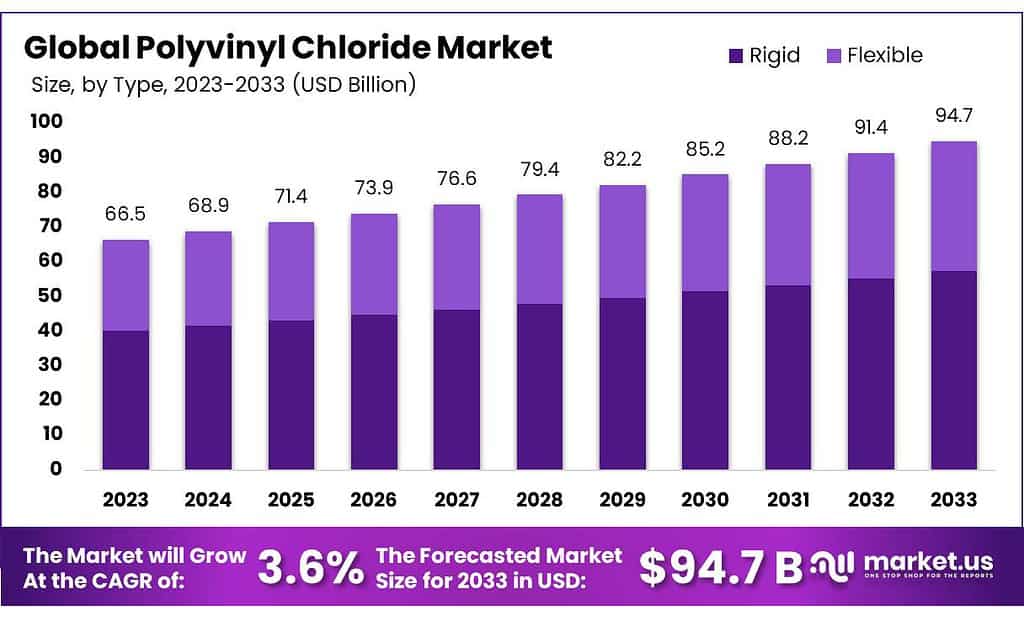

The global Polyvinyl Chloride Market size is expected to be worth around USD 94.7 billion by 2033, from USD 65.5 billion in 2023, growing at a CAGR of 3.6% during the forecast period from 2023 to 2033.

Polyvinyl Chloride (PVC) is an extremely useful thermoplastic material derived by polymerizing vinyl chloride monomers into filaments, yielding PVC as the end product. PVC’s many uses span across numerous industries due to its durability, flexibility, and cost-efficiency; rigid and flexible forms of PVC exist simultaneously making this versatile thermoplastic ideal for various products.

PVC plastic is widely utilized in construction materials, pipes, cable insulation, clothing, inflatable structures, signage, and bags – as well as numerous other applications – worldwide. Due to its chemical resistance, fire resistance, low maintenance needs, and global adoption. PVC remains one of the world’s top-produced and used plastics globally.

Key Takeaways

- The PVC market is poised to reach USD 94.7 billion by 2033, with a 3.6% CAGR, driven by the construction and automotive sectors.

- Versatile PVC is utilized in construction, clothing, signage, and packaging for its durability and cost-effectiveness.

- Calcium-based stabilizers dominate PVC production, ensuring strong and reliable materials.

- Synthetic PVC holds over 66.5% market share due to cost-effectiveness and versatile properties.

- PVC applications span pipes, wires, profiles, films, and hoses, with building and construction leading at 54.6% market share.

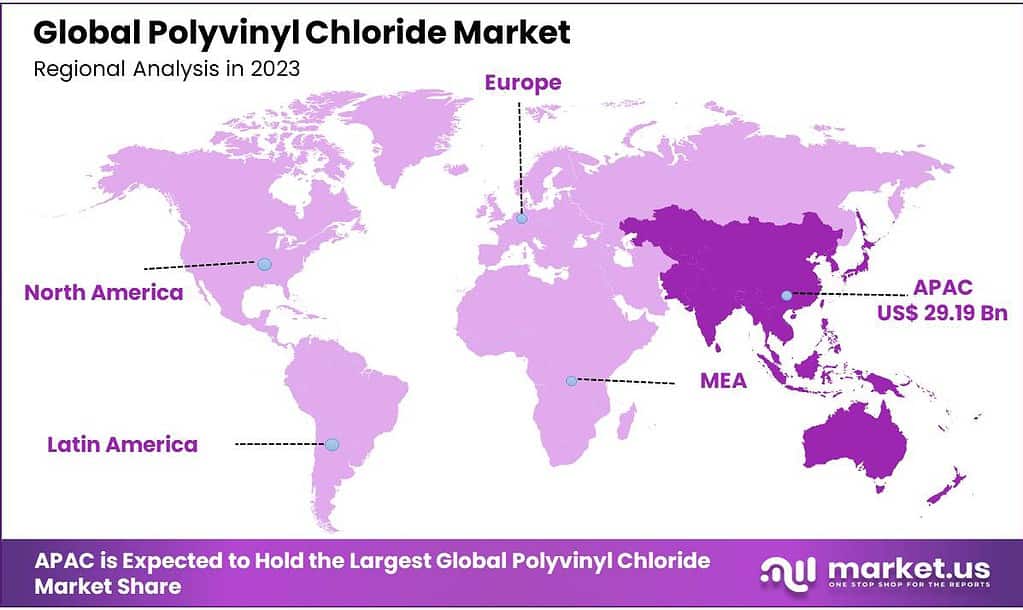

- Asia Pacific commands 44.5% of the PVC market, driven by the construction and automotive industries.

By Type

Rigid PVC held an overwhelming market position, accounting for 60.5% of Polyvinyl Chloride (PVC) market sales in 2023. Rigid PVC stands out among its family as it provides strength and stability when applied in construction materials and pipes; builders tend to favor it when durability or maintaining an exact shape is crucial to their projects.

On the flip side, flexible PVC plays an essential role in our society despite not dominating market shares as strongly. Being highly flexible, flexible PVC makes an excellent solution for applications that demand versatility such as flexible hoses or packaging materials that need to bend easily and be bent more frequently than rigid forms can.

Rigid and Flexible PVC covers an expansive variety of uses, making PVC an indispensable material in many different industries. Both forms provide firm reliability or flexible adaptability – two properties that contribute significantly to PVC’s wide use in everyday life.

Stabilizer Type

Calcium-based stabilizers secured the top position in the Polyvinyl Chloride (PVC) market stabilizer segment by holding over 39.8% share in 2023. Calcium-based stabilizers serve to ensure strong and reliable PVC materials without creating environmental concerns with other stabilizer types.

Tin-based stabilizers play an integral part in stabilizing PVC for applications where clarity and color retention is vital, contributing to its resilience against heat and light exposure – making them suitable for many industries.

Barium-based Stabilizers, although holding a smaller share, offer unique advantages in certain PVC formulations. They provide excellent heat stability and are preferred in specific applications where stringent performance requirements are essential.

Lead-based stabilizers remain widely used despite environmental considerations; their presence remains due to their proven efficacy; but ongoing efforts aim at moving away from these toxic solutions in favor of eco-friendlier ones.

Product Category

In 2023, Synthetic secured the leading position in the Polyvinyl Chloride (PVC) market’s product categories, commanding a dominant share of over 66.5%. Synthetic PVC, derived from chemical processes, dominated the market due to its widespread use in various applications, benefiting from its cost-effectiveness, durability, and versatile properties.

Bio-based PVC continues to make advances within its niche within the PVC market and garner greater market share each year, drawing interest for its eco-friendly attributes derived from renewable sources. Even though its market share may remain smaller, its growing prominence demonstrates rising interest in sustainable alternatives within this segment of PVC production.

The prevalence of Synthetic PVC, with its established market presence and versatile applications, continues to shape the PVC industry. However, the emerging Bio-Based segment indicates a shifting trend toward more environmentally conscious choices, highlighting the industry’s responsiveness to sustainability concerns.

Application

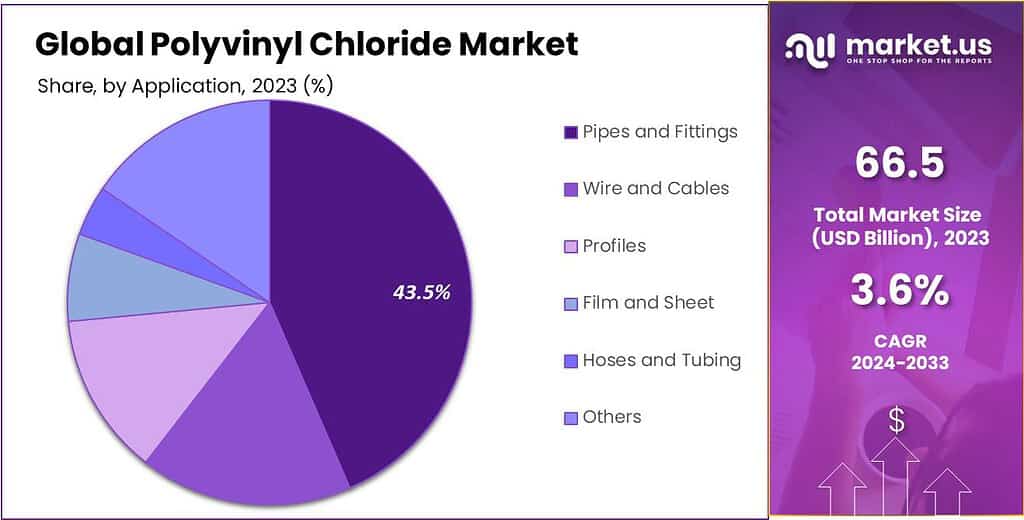

Pipes and Fittings took the top position among Polyvinyl Chloride (PVC) market applications in 2023, holding over 43.55% market share. Pipes and fittings serve as essential infrastructure components in plumbing and construction; their durability makes PVC the go-to material in these instances, guaranteeing reliable water and gas transportation systems.

Wire and Cables demonstrate how PVC plays an essential part of modern electrical infrastructure. PVC-coated wires and cables offer insulation and protection while simultaneously facilitating safe electricity flow – taking full advantage of its insulating properties as well as fire-resistant properties. This application benefits greatly from PVC’s ability to resist thermal stress as a material component of its application.

Profiles come in all sorts of shapes and forms, making them indispensable components in numerous industries such as windows, doors, and automotive applications. PVC’s versatility enables it to produce custom profiles with different functionalities for greater adoption in general.

Film and Sheet Applications demonstrate PVC’s versatility as both packaging and construction material. PVC films and sheets are widely utilized for packaging various products as well as providing protective layers in construction projects, providing both strength and flexibility in equal measures.

PVC Hoses and Tubing demonstrate its flexibility and adaptability, making it the go-to material for fluid transportation in multiple industries. From medical tubing to industrial hoses, PVC’s resilience guarantees safe liquid flow for effective transportation purposes.

By End-Use

Building and Construction was the clear winner among end-use industries for Polyvinyl Chloride (PVC) market end-use industries in 2023, taking home 54.6% market share for end-use industries using PVC products. PVC plays a pivotal role in construction as pipes, profiles, and various applications depend on it for strength, versatility, and cost-efficiency; making PVC an indispensable material worldwide in building projects.

Automotive manufacturing uses PVC extensively for interior trims, wiring insulation, and insulation applications. Due to its ability to withstand tough environmental conditions and its contribution towards lightweight vehicle components, PVC makes for an invaluable material in automotive production.

Footwear manufacturers increasingly appreciate PVC material for its flexibility and weatherproof properties, often employing PVC soles in footwear for durability and long-term comfort.

Electrical and electronics applications of PVC’s insulating properties benefit greatly, aiding both the safety and efficiency of wires, cables, and electronic components. PVC also features fire retardancy properties which makes it a highly sought-after material in this sector.

Healthcare relies heavily on PVC material for various uses, from medical tubing and packaging materials to its sterilization properties and suitability for healthcare settings. PVC’s nonporous surface provides ideal hygiene. It has become one of the key materials in healthcare settings today.

Market Key Segments

By Type

- Rigid

- Flexible

Stabilizer Type

- Calcium-based Stabilizers

- Tin-based Stabilizers

- Barium Based Stabilizers

- Lead-based

- Stabilizers

- Others

Product Category

- Bio-Based

- Synthetic

By Application

- Pipes and Fittings

- Wire and Cables

- Profiles

- Film and Sheet

- Hoses and Tubing

- Others

End-Use Industries

- Building and Construction

- Automotive

- Footwear

- Electrical and Electronics

- Healthcare

- Other End-user Industries

Drivers

Polyvinyl Chloride (PVC) Market Growth Fueled by Construction Boom

PVC market growth is experiencing robust expansion globally. Construction activity worldwide continues to drive PVC demand from applications like pipes, profiles, and fittings for buildings; urbanization in emerging economies demonstrates this need for cost-effective durable building materials like PVC as the urban sprawl continues.

PVC’s versatility as an essential building component has contributed significantly to its widespread usage. Pipes for water supply, electrical wiring, and window profiles use show its widespread adoption within construction industries – driving sustained demand that projects an upward path for PVC markets worldwide.

PVC continues to gain increased use within the automotive sector for interior components and wiring harnesses, further driving market expansion. PVC’s properties – durability, flame resistance, and cost-effectiveness – align well with automotive sector demands and serve as key driving forces of its market growth.

Restraints

Volatility in Raw Material Prices Stifling PVC Market Growth

PVC market volatility stemming from raw material prices can be considered one of the main obstacles, with VCM (vinyl chloride monomer), one of the primary precursors, directly impacting production costs and total manufacturing expenses for PVC production.

Fluctuations in oil and gas prices, primary feedstocks for VCM production, contribute to its unpredictable nature and create challenges for PVC manufacturers in terms of production planning, cost control management, and overall market competitiveness. Companies operating within this sector need to navigate such uncertainties strategically to maintain stable operations and pricing structures.

Dependency on chlorine from chlor-alkali production further highlights this vulnerability to price changes, while VCM prices’ correlation to raw material costs emphasizes the necessity of employing effective risk mitigation strategies within the PVC market.

Opportunity

Rising Demand for PVC in Healthcare Sector Provides Growth Opportunities

The Polyvinyl Chloride (PVC) market presents an emerging opportunity with its increasing adoption within healthcare. PVC stands out with its combination of properties – flexibility, durability, and chemical resistance making it ideal for medical uses.

PVC has long been used in medical devices like IV tubing, blood bags, and packaging due to its biocompatibility and compatibility with sterilization processes. As healthcare awareness and advancement increase worldwide, so too will demand for PVC used for these medical uses increase exponentially.

Research and development efforts are also focused on increasing the safety and sustainability of PVC used in healthcare settings, specifically plasticizer-free formulations to address concerns regarding environmental impact. Market players have an opportunity to capitalize on this growing healthcare segment.

Trends

Sustainable Practices Shaping the PVC Market

An increasingly evident trend defining the Polyvinyl Chloride (PVC) market is an increasing focus on sustainability. As environmental concerns take center stage, manufacturers are shifting toward bio-based PVC production as part of an initiative towards eco-friendly practices in manufacturing PVC goods. They may even explore alternatives derived from renewable resources to mitigate any environmental effects caused by traditional production techniques of this plastic substance.

Bio-based PVC produced from plant sources is part of an increasingly global push toward greener materials, meeting consumer desires for eco-consciousness while fulfilling regulatory pressures and corporate sustainability goals. Companies investing in research and development for this form of material could gain a competitive advantage while capitalizing on changing market preferences.

Notable trends include PVC formulation innovations to increase its recyclability. Initiatives designed to increase end-of-life recycling capabilities and lower its environmental impact are gathering steam; such initiatives should reshape the PVC market landscape over time with eco-friendly alternatives taking hold.

Regional Analysis

The Asia Pacific region commands the largest market size in the global Polyvinyl Chloride (PVC) market, securing a dominant share of 44.5%. Projections Value of 29.19 Bn during the forecast period. The thriving market in this region is a result of heightened PVC consumption across vital end-use sectors, including construction, automotive, conductive polymers, and packaging.

The substantial increase in PVC production in key countries such as China, India, and Southeast Asian nations like Korea, Thailand, Malaysia, and Vietnam is expected to be the primary driving force behind market growth in this geographical area throughout the forecast period.

North America is experiencing robust economic growth, particularly in expanding sectors such as automotive, polymer, and manufacturing industries. This surge in economic activities is likely to propel significant demand for PVC products in this region. Simultaneously, Europe is anticipated to witness substantial growth in the PVC market due to strong demand in the textile industries.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In the Polyvinyl Chloride (PVC) market, key players play pivotal roles in shaping industry dynamics. Vinnolit GmbH & Co. KG stands out for its extensive PVC product portfolio and global reach, emphasizing innovation and sustainability. Shin-Etsu Chemical Co., Ltd. is recognized for its high-quality vinyl chloride resins and commitment to continuous research and development.

Market Key Players

- Shin-Etsu Chemical Co., Ltd.

- Formosa Plastics Corporation

- Oxy Chemical Corp.

- Ineos Group Limited

- Kem One SaS

- Orbia

- SABIC

- LG Chem Ltd.

- Inner Mongolia Junzheng Energy & Chemical Group

- Westlake Chemical

- Tianye Group

- The Axiall Corporation

- Others

Recent Developments

- Formosa Plastics Corporation 2023: Maintained its leading position in global PVC production capacity.

- Oxy Chemical Corp: Limited publicly available information found regarding specific PVC market developments during the timeframe.

Report Scope

Report Features Description Market Value (2022) US$ 65.5 Bn Forecast Revenue (2032) US$ 94.7 Bn CAGR (2023-2032) 3.6% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type(Rigid, Flexible), Stabilizer Type(Calcium-based Stabilizers, Tin-based Stabilizers, Barium Based Stabilizers, Lead-based, Stabilizers, Others), Product Category(Bio-Based, Synthetic), By Application(Pipes and Fittings, Wire and Cables, Profiles, Film and Sheet, Hoses and Tubing, Others), End-Use Industries(Building and Construction, Automotive, Footwear, Electrical and Electronics, Healthcare, Other End-user Industries) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Shin-Etsu Chemical Co., Ltd., Formosa Plastics Corporation, Oxy Chemical Corp., Ineos Group Limited, Kem One SaS, Orbia, SABIC, LG Chem Ltd., Inner Mongolia Junzheng Energy & Chemical Group, Westlake Chemical, Tianye Group, The Axiall Corporation, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of Polyvinyl Chloride Market?Polyvinyl Chloride Market size is expected to be worth around USD 94.7 billion by 2033, from USD 65.5 billion in 2023

What is the CAGR for the Polyvinyl Chloride Market?The Polyvinyl Chloride Market expected to grow at a CAGR of 3.6% during 2023-2032.

Who are the key players in the Polyvinyl Chloride Market?Shin-Etsu Chemical Co., Ltd., Formosa Plastics Corporation, Oxy Chemical Corp., Ineos Group Limited, Kem One SaS, Orbia, SABIC, LG Chem Ltd., Inner Mongolia Junzheng Energy & Chemical Group, Westlake Chemical, Tianye Group, The Axiall Corporation, Others

Polyvinyl Chloride MarketPublished date: March 2024add_shopping_cartBuy Now get_appDownload Sample

Polyvinyl Chloride MarketPublished date: March 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Shin-Etsu Chemical Co., Ltd.

- Formosa Plastics Corporation

- Oxy Chemical Corp.

- Ineos Group Limited

- Kem One SaS

- Orbia

- SABIC

- LG Chem Ltd.

- Inner Mongolia Junzheng Energy & Chemical Group

- Westlake Chemical

- Tianye Group

- The Axiall Corporation

- Others