Global Polypropylene Market Type(Homopolymer, Copolymer, Random Copolymer, Impact Copolymer), Application(Injection Moulding, Blow Moulding, Fibres and Filaments, Films and Sheets, Others, End-Use Industry, Packaging, Automotive, Consumer Goods, Electrical and Electronics, Agriculture, Building and Construction, Others) , By Region, and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: May 2024

- Report ID: 120704

- Number of Pages: 327

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

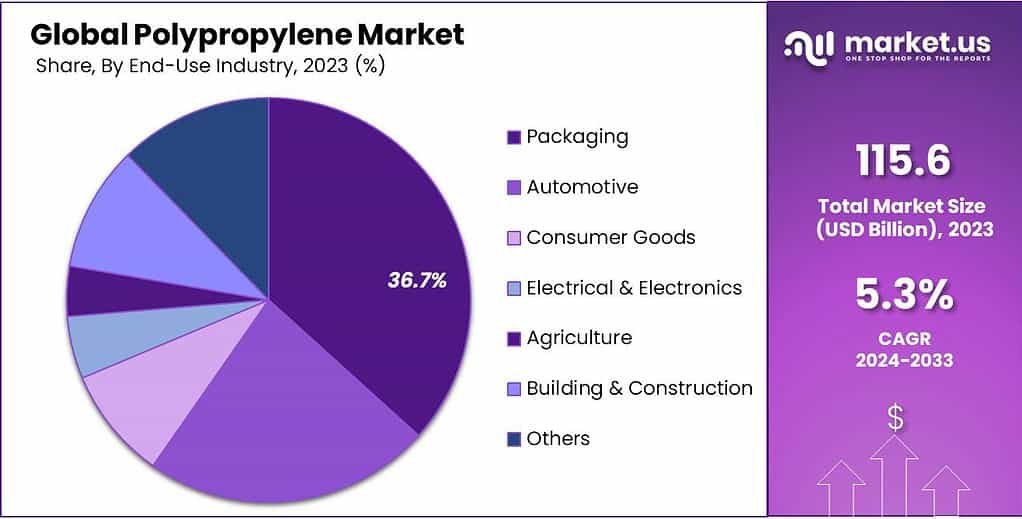

The global Polypropylene Market size is expected to be worth around USD 193.7 billion by 2033, from USD 115.6 billion in 2023, growing at a CAGR of 5.3% during the forecast period from 2023 to 2033.

The polypropylene market refers to the industry segment focused on the production, distribution, and consumption of polypropylene, a thermoplastic polymer that is widely used in various applications due to its versatility, durability, and cost-effectiveness.

Polypropylene, often known as PP, is a major plastic material that is categorized under the group of polyolefins. It is typically produced through the polymerization of propylene monomer, a byproduct of oil refining and natural gas processing.

Polypropylene is known for its resistance to various chemical solvents, bases, and acids, as well as its toughness and fatigue resistance. This makes it a popular choice in consumer goods, automotive components, textiles, packaging, and many industrial applications. The polypropylene market is characterized by its applications in these diverse sectors:

Packaging: Used in both consumer and industrial packaging, polypropylene is valued for its clarity, excellent chemical resistance, and recyclability. It is often found in food containers, wrappers, and as a material for retail packaging.

Automotive: In the automotive industry, polypropylene is utilized for the manufacturing of bumpers, dashboards, lining, and other interior or exterior parts due to its low cost and high resistance to wear and environmental conditions.

Consumer Goods: Everyday items such as plastic furniture, toys, luggage, and household appliances incorporate polypropylene due to its durability and aesthetic flexibility.

Textiles: Polypropylene is used in the production of fibers and fabrics for carpets, wall coverings, and upholstery. It is chosen for its ability to be engineered into various textures and its color retention properties.

The market dynamics of polypropylene are influenced by global economic factors, crude oil prices, and the regulatory landscape regarding plastic use and sustainability. Innovations in polypropylene recycling and bio-based alternatives are also gaining traction as part of sustainability efforts within the industry.

Market analysis often focuses on production capacities, demand cycles, and emerging market trends, such as the increasing use of post-consumer recycled polypropylene in various industries.

Key Takeaways

- Market Size: Expected to reach USD 193.7 billion by 2033, growing at a 5.3% CAGR from USD 115.6 billion in 2023.

- Application Dominance: Injection Moulding holds a 41.5% market share in 2023, favored for producing precise shapes essential for automotive parts.

- Type Analysis: Homopolymers dominated with over 68.5% share in 2023, prized for strength and high-temperature resistance.

- End-Use Industry Insights: Packaging holds a 36.7% market share in 2023, benefiting from polypropylene’s moisture barrier properties.

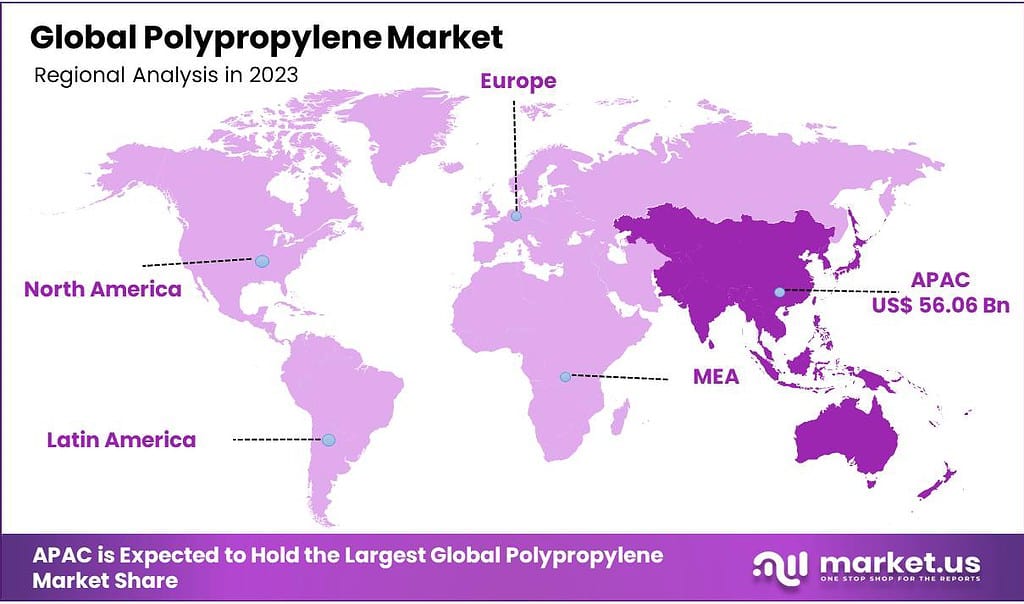

- Asia Pacific region emerges as a dominant force in the polypropylene market, boasting a substantial market share of 48.5%.

By Type

In 2023, Homopolymers held a dominant market position, capturing more than a 68.5% share of the polypropylene market. Homopolymers are highly favored due to their strength and high-temperature resistance, making them ideal for a broad range of applications such as packaging, textiles, and various household goods. The high share of homopolymers is also driven by their ease of production and cost-effectiveness, which appeal to manufacturers looking for reliable and economical materials.

Moving to the copolymer segment, which includes both block copolymers and random copolymers, these materials offer enhanced impact resistance and toughness compared to homopolymers. Copolymers are particularly valued in the automotive and consumer goods sectors where durability under varying conditions is crucial. They provide the flexibility needed for complex parts and products that require a balance of rigidity and impact resistance.

Random copolymers, a sub-type of copolymers, are specifically designed to have improved clarity and impact strength at lower temperatures. This makes them suitable for food packaging and medical applications where clarity and sterilization are important. Random copolymers are gaining popularity as the demand for high-quality, safe packaging materials increases.

Lastly, impact copolymers are recognized for their exceptional toughness and are primarily used in products that must withstand harsh use. These include automotive parts, industrial containers, and outdoor furniture. Impact copolymers are engineered to perform well in environments where other materials might fail, ensuring longevity and durability.

By Application

In 2023, Injection Moulding held a dominant market position, capturing more than a 41.5% share of the polypropylene market. This method is highly favored for producing complex shapes with excellent precision, which is essential in automotive parts, household goods, and consumer electronics. The popularity of injection moulding stems from its efficiency and the high quality of the products it produces, making it a core technique in manufacturing.

Blow Moulding is another significant application segment, utilized primarily for making hollow objects such as bottles, containers, and other packaging solutions. This technique is valued for its ability to produce lightweight, durable products quickly and economically, which is crucial in the beverage and pharmaceutical sectors.

The Fibres & Filaments segment leverages polypropylene’s resistance to chemicals, water, and wear, making it ideal for textiles, carpets, and industrial fabrics. Its use in this segment is driven by the demand for materials that combine durability with lightness and flexibility, important for both consumer and industrial applications.

Films & Sheets represent a vital application area, especially in food packaging, where polypropylene’s barrier properties against moisture and contaminants are crucial. This segment also sees significant use in agricultural films, retail packaging, and disposable consumer goods, where its strength and clarity are highly valued.

By End-Use Industry

In 2023, Packaging held a dominant market position, capturing more than a 36.7% share of the polypropylene market. This segment benefits from polypropylene’s excellent moisture barrier properties, making it ideal for food and beverage packaging that requires long shelf life and protection against contaminants. The demand in this segment is driven by the need for durable, lightweight, and recyclable packaging solutions.

The Automotive sector also makes extensive use of polypropylene, primarily due to its resistance to chemical corrosion, low cost, and flexibility. It is used in a variety of applications including bumpers, dashboards, and door panels. Polypropylene helps in reducing vehicle weight, which enhances fuel efficiency and reduces emissions, aligning with the global push for greener automotive solutions.

Consumer Goods is another key end-use industry, where polypropylene is used in products ranging from household containers to children’s toys. Its ease of processing and ability to be colored or made transparent makes it highly versatile for a wide array of consumer products.

In the Electrical & Electronics sector, polypropylene is valued for its insulative properties in electrical components, batteries, and appliances. This segment relies on polypropylene to provide safety, durability, and resistance to high temperatures.

Agriculture utilizes polypropylene in a variety of applications such as irrigation systems, mulch films, and twines. Its resistance to water and chemicals makes it suitable for the harsh environments often encountered in agricultural settings.

Building & Construction uses polypropylene for pipes, membranes, and flooring. Its toughness and resistance to degradation are essential for materials that need to withstand environmental stress and wear over long periods.

Key Market Segments

Type

- Homopolymer

- Copolymer

- Random Copolymer

- Impact Copolymer

Application

- Injection Moulding

- Blow Moulding

- Fibres & Filaments

- Films & Sheets

- Others

End-Use Industry

- Packaging

- Automotive

- Consumer Goods

- Electrical & Electronics

- Agriculture

- Building & Construction

- Others

Drivers

Increasing Demand in Packaging and Automotive Industries

A significant driver of the polypropylene market is the escalating demand within the packaging and automotive industries, which has been spurred by both sectors’ ongoing expansion and innovation. Polypropylene’s unique properties, including its strength, flexibility, chemical resistance, and recyclability, make it an ideal choice for a wide range of applications in these industries.

In the packaging sector, polypropylene is extensively used due to its ability to preserve the integrity and extend the shelf life of products. Its barrier properties against moisture and contaminants are crucial for food and medical packaging, helping to maintain product safety and quality. The lightweight nature of polypropylene also reduces shipping costs and enhances the environmental sustainability of packaging solutions, aligning with global trends towards more eco-friendly materials. The growing consumer awareness and regulatory push for sustainable packaging solutions have led manufacturers to favor polypropylene over other plastics that are less recyclable or have a higher environmental impact.

Moreover, the COVID-19 pandemic has resulted in increased hygiene awareness, further boosting the demand for packaged goods and consequently for polypropylene. The surge in e-commerce has also played a crucial role, as products shipped over long distances require robust and reliable packaging that can withstand various handling and environmental conditions. Polypropylene’s versatility allows it to be manufactured in various forms such as films, sheets, and fibers, making it adaptable to a broad array of packaging designs and needs.

In the automotive industry, the drive towards lighter vehicles for better fuel efficiency and reduced emissions has made polypropylene a material of choice. Polypropylene is used in various automotive components such as bumpers, dashboards, door panels, and linings.

Its low density makes it an excellent option for reducing vehicle weight without compromising the durability or performance of parts. Additionally, as the automotive industry moves towards more sustainable practices, the recyclability of polypropylene becomes a significant advantage, aligning with the industry’s goals to reduce the environmental impact of its products and processes.

The versatility of polypropylene also allows for innovations in material composites and blends, which can be engineered to meet specific performance requirements, further enhancing its applications in high-performance automotive parts. These advancements not only fulfill the technical requirements but also offer cost-effective solutions, which is crucial in the competitive automotive market.

Global economic growth, particularly in emerging markets, has led to increased consumer spending and industrial activity, which in turn fuels further demand for packaging and automotive products. As economies grow and urbanize, the need for durable and efficient materials like polypropylene in these sectors will continue to rise.

Restraints

Environmental Concerns and Regulatory Pressure

A significant restraint facing the polypropylene market is the growing environmental concerns and regulatory pressures related to plastic use and disposal. As global awareness of environmental issues such as plastic pollution and climate change increases, polypropylene, like other plastics, faces scrutiny over its environmental impact, particularly regarding waste management and the sustainability of its production processes.

Polypropylene is not biodegradable, which means it can persist in the environment for hundreds of years, contributing to the growing problem of plastic pollution in the world’s oceans, waterways, and landscapes. The widespread use of polypropylene in single-use products exacerbates this issue, leading to large quantities of waste that are often not properly managed or recycled. Although polypropylene is recyclable, the current recycling rates are relatively low due to a lack of recycling infrastructure, technological limitations in sorting and processing, and economic factors that sometimes make recycling less viable than producing new plastic.

Regulatory bodies around the world are increasingly implementing stricter regulations aimed at reducing plastic waste and promoting sustainability. These regulations may include bans on certain single-use plastics, mandates for increased use of recycled materials in new products, and requirements for more sustainable manufacturing practices. For instance, the European Union’s strategy on plastics in a circular economy seeks to transform the way plastic products are designed, produced, used, and recycled in the EU. Similar initiatives in other regions put pressure on manufacturers to adapt their practices to comply with new regulations.

Moreover, the push for a circular economy and the drive towards more sustainable materials have led to the development and adoption of alternative materials that are biodegradable or derived from renewable resources. These materials are increasingly viewed as direct competitors to polypropylene, especially in applications where environmental impact is a critical concern, such as in packaging and consumer goods.

The impact of these environmental and regulatory pressures is particularly pronounced for companies operating in global markets, where they must navigate a complex and often varying regulatory landscape. This not only increases the cost of compliance but also forces companies to invest in research and development to find more sustainable alternatives or improve the recyclability and overall environmental footprint of their polypropylene products.

Consumer preferences are also shifting towards more sustainable products, which influences purchasing decisions. As consumers become more environmentally conscious, they demand products that are not only effective but also have a minimal environmental impact. This shift in consumer behavior can affect market demand for polypropylene, particularly in sectors such as packaging, where public scrutiny of plastic use is highest.

Opportunity

Advancements in Recycling Technologies

A significant opportunity within the polypropylene market is the advancement in recycling technologies. As environmental concerns and regulatory pressures increase, the demand for sustainable practices and materials also grows. Polypropylene, being one of the most widely used plastics globally, presents a substantial opportunity for recycling innovations that can transform waste management practices and create a more sustainable lifecycle for plastic products.

Currently, one of the major challenges with polypropylene recycling is the complexity involved in sorting and processing the material from mixed waste streams. However, recent technological advancements are set to change this dynamic. New sorting technologies, such as enhanced near-infrared (NIR) spectroscopy and other automated systems, have improved the efficiency and accuracy of polypropylene identification during the recycling process. These technologies make it feasible to separate polypropylene from other plastics and contaminants more effectively, increasing the yield and quality of recycled polypropylene.

Furthermore, the development of advanced chemical recycling methods is a game-changer for the polypropylene industry. Unlike traditional mechanical recycling, chemical recycling breaks down polypropylene into its molecular components, which can then be polymerized into new polypropylene with properties comparable to virgin material.

This process significantly extends the lifecycle of polypropylene by allowing it to be recycled multiple times without degradation of quality. Such advancements not only enhance the recyclability of polypropylene but also open up new applications for recycled resins in high-value and demanding products.

The push for a circular economy and the increasing emphasis on sustainable material flows in industries such as automotive, packaging, and consumer goods drive the demand for high-quality recycled materials. Companies that invest in advanced recycling technologies can tap into new market segments and gain competitive advantages by offering sustainably produced polypropylene. This is not only appealing from an environmental standpoint but also meets the growing consumer and regulatory demand for sustainable products.

Additionally, these recycling advancements contribute to corporate social responsibility (CSR) goals and align with global sustainability targets, potentially attracting investments and partnerships from stakeholders interested in environmental conservation. Companies that lead in this area can also benefit from enhanced brand reputation and customer loyalty, which are increasingly influenced by environmental performance.

Economically, the improvement in recycling technologies can reduce dependency on virgin materials, which are subject to price volatility due to fluctuations in crude oil prices. By securing a steady supply of recycled polypropylene, companies can achieve more stable production costs and improve their supply chain sustainability.

Trends

Shift Towards Bio-based Polypropylene

A major trend shaping the polypropylene market is the shift towards bio-based alternatives, driven by increasing environmental concerns and the global push for sustainable manufacturing practices. As industries and consumers alike seek more environmentally friendly materials, bio-based polypropylene offers a promising solution by reducing reliance on fossil fuel-derived plastics and minimizing the carbon footprint associated with plastic production.

Bio-based polypropylene is made from renewable raw materials such as vegetable oils, sugarcane, or corn starch, unlike traditional polypropylene which is derived from petroleum. The production of bio-based polypropylene involves using these biological sources to create monomers that can be polymerized into polypropylene. This process not only utilizes renewable resources but typically results in lower greenhouse gas emissions compared to its petroleum-based counterpart.

The trend towards bio-based polypropylene is gaining momentum due to its potential to align with circular economy goals and regulatory requirements aimed at reducing plastic waste and environmental impact. This is particularly relevant in industries such as packaging, automotive, and consumer goods, where sustainability is increasingly becoming a competitive advantage.

For instance, in the packaging industry, companies are adopting bio-based polypropylene to appeal to eco-conscious consumers and comply with regulations that favor sustainable materials over single-use plastics.

Moreover, technological advancements in the processing and refining of bio-based polymers have improved their properties and cost-effectiveness, making them more comparable to conventional polypropylene in terms of functionality and performance. This enhances their applicability across a broad range of products, ensuring that switching to bio-based alternatives does not compromise the quality or durability of the final product.

Another factor contributing to this trend is the strategic partnerships between biotechnology companies and polypropylene manufacturers. These collaborations are crucial for accelerating the development and commercialization of bio-based polypropylene. They combine expertise in bioprocessing, material science, and large-scale manufacturing to enhance the economic viability and market acceptance of bio-based polypropylene.

Additionally, government initiatives and subsidies supporting the production and use of bio-based materials further encourage the adoption of bio-based polypropylene. These policies are designed to stimulate the growth of sustainable industries and reduce the environmental impact of plastic production and consumption.

Regional Analysis

The Asia Pacific region emerges as a dominant force in the polypropylene market, boasting a substantial market share of 48.5%. Projections indicate that the market is poised to achieve a valuation of USD 56.06 billion by the end of the forecast period, buoyed by robust adoption across critical sectors such as packaging, automotive manufacturing, consumer goods production, and construction.

This growth trajectory is chiefly propelled by powerhouse economies like China, India, Japan, and South Korea, where a notable uptick in polypropylene production and utilization is observed. These countries are actively responding to the escalating demand for versatile plastic materials, underscoring the region’s steadfast commitment to pioneering manufacturing and export practices in the polypropylene market.

In North America, the polypropylene market is witnessing steady expansion. This upward trend is underpinned by growing demand from industries that leverage polypropylene for packaging materials, automotive components, consumer goods, electrical appliances, and construction applications. The region’s diverse industrial landscape and advancements in polymer technologies play pivotal roles in fostering the adoption of polypropylene products.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In the dynamic landscape of the polypropylene market, several key players stand out, each contributing to the industry’s growth and innovation. Leading the charge is Exxon Mobil Corporation, renowned for its extensive portfolio of polypropylene products tailored to diverse applications across industries.

Leveraging advanced research and development capabilities, Exxon Mobil continues to introduce cutting-edge solutions that meet evolving market demands while maintaining a competitive edge.

Market Key Players

- BASF SE

- Borealis AG

- Braskem

- Chevron Phillips Chemical Company DuPont

- Westlake Chemical Corp.

- Eastman Chemical Company

- ExxonMobil

- Reliance Industries Limited

- Sinopec

- LyondellBasell Industries

- SABIC

- Bayer Material Science

- Fulton Pacific

- INEOS

- TotalEnergies SE

- Washington Penn Plastic Company Inc.

- PetroChina Company Limited

- Qatar Petrochemical Company

- Japan Polypropylene Corporation

- Others

Recent Developments

In 2023, BASF SE demonstrated resilience and strategic prowess, with January witnessing a surge in polypropylene production capacity expansions, aligning with growing market demands.

In 2023, Borealis AG demonstrated strategic agility and market acumen, with January witnessing a notable uptick in polypropylene sales volumes, driven by increased demand from key end-use sectors.

Report Scope

Report Features Description Market Value (2023) US$ 115.6 Bn Forecast Revenue (2033) US$ 193.7 Bn CAGR (2024-2033) 5.3% Base Year for Estimation 2023 Historic Period 2020-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered Type(Homopolymer, Copolymer, Random Copolymer, Impact Copolymer), Application(Injection Moulding, Blow Moulding, Fibres and Filaments, Films and Sheets, Others, End-Use Industry, Packaging, Automotive, Consumer Goods, Electrical and Electronics, Agriculture, Building and Construction, Others) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape BASF SE, Borealis AG, Braskem, Chevron Phillips Chemical Company DuPont, Westlake Chemical Corp., Eastman Chemical Company, ExxonMobil, Reliance Industries Limited, Sinopec, LyondellBasell Industries, SABIC, Bayer Material Science, Fulton Pacific, INEOS, TotalEnergies SE, Washington Penn Plastic Company Inc., PetroChina Company Limited, Qatar Petrochemical Company, Japan Polypropylene Corporation, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- BASF SE

- Borealis AG

- Braskem

- Chevron Phillips Chemical Company DuPont

- Westlake Chemical Corp.

- Eastman Chemical Company

- ExxonMobil

- Reliance Industries Limited

- Sinopec

- LyondellBasell Industries

- SABIC

- Bayer Material Science

- Fulton Pacific

- INEOS

- TotalEnergies SE

- Washington Penn Plastic Company Inc.

- PetroChina Company Limited

- Qatar Petrochemical Company

- Japan Polypropylene Corporation

- Others