Global Protective Packaging Market Size, Share, Growth Analysis By Product Type (Flexible Protective Packaging, Rigid Protective Packaging, Foam Protective Packaging), By Material Type, By Functionality, By End-User Industry, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2024-2033

- Published date: Dec 2024

- Report ID: 32489

- Number of Pages: 258

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Protective Packaging Market Key Takeaways

- Protective Packaging Business Environment Analysis

- Type Analysis

- Material Type Analysis

- Functionality Analysis

- End-User Industry Analysis

- Key Market Segments

- Driving Factors

- Restraining Factors

- Growth Opportunities

- Emerging Trends

- Protective Packaging Market Regional Analysis

- Protective Packaging Market Competitive Landscape

- Latest News in Protective Packaging Market

- Report Scope

Report Overview

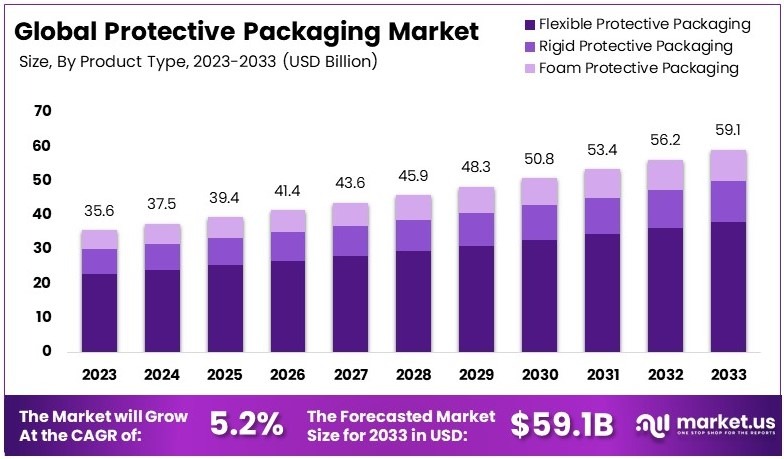

The Global Protective Packaging Market size is expected to be worth around USD 59.1 Billion by 2033, from USD 35.6 Billion in 2023, growing at a CAGR of 5.2% during the forecast period from 2024 to 2033.

Protective Packaging refers to materials and solutions used to safeguard products during transportation, handling, and storage. It includes packaging types like cushioning, wrapping, and containment systems designed to prevent damage, contamination, and ensure product integrity. Protective packaging is essential across various industries, including electronics, pharmaceuticals, and consumer goods.

The Protective Packaging Market comprises companies that produce and supply materials designed to protect products throughout the supply chain. This market includes packaging manufacturers, suppliers of cushioning materials, and innovative protective solutions.

Protective packaging is becoming essential as businesses prioritize product safety during transit. Return shipments during holiday seasons reached $32 billion, with 20%-30% related to damage, according to Supply Chain Beyond. Consequently, companies are investing in better packaging solutions to reduce losses. Additionally, the rise in e-commerce drives the need for reliable protective packaging.

The protective packaging market is expanding rapidly due to the surge in global e-commerce sales, which grew to $5.9 trillion in 2023 and are projected to exceed $8 trillion by 2027. Furthermore, increased online shopping leads to higher demand for packaging that ensures products arrive intact.

Growth factors include the need to minimize in-transit damage and comply with sustainability standards. For example, using 3 inches of packaging material for glass items helps prevent breakage. Moreover, opportunities arise from advancements in packaging technology and the increasing focus on zero waste packaging and eco-friendly materials.

Government regulations are increasingly shaping the protective packaging market. For instance, the European Union’s Packaging and Packaging Waste Regulation (PPWR) aims to reduce plastic packaging by 5% by 2030, 10% by 2035, and 15% by 2040. Similarly, in the United States, Extended Producer Responsibility (EPR) laws require producers to manage packaging waste costs by 2031. These regulations encourage sustainable practices and drive the market towards greener technology solutions.

Protective Packaging Market Key Takeaways

- The Protective Packaging Market was valued at USD 35.6 Billion in 2023 and is expected to reach USD 59.1 Billion by 2033, with a CAGR of 5.2%.

- In 2023, Flexible Protective Packaging dominated the type segment with 64.3%, driven by its versatility and lightweight properties.

- In 2023, Paper & Paperboard led the material type segment, supported by sustainability trends and increasing eco-friendly packaging demand.

- In 2023, Wrapping held the largest share in the functionality segment due to its widespread use across industries.

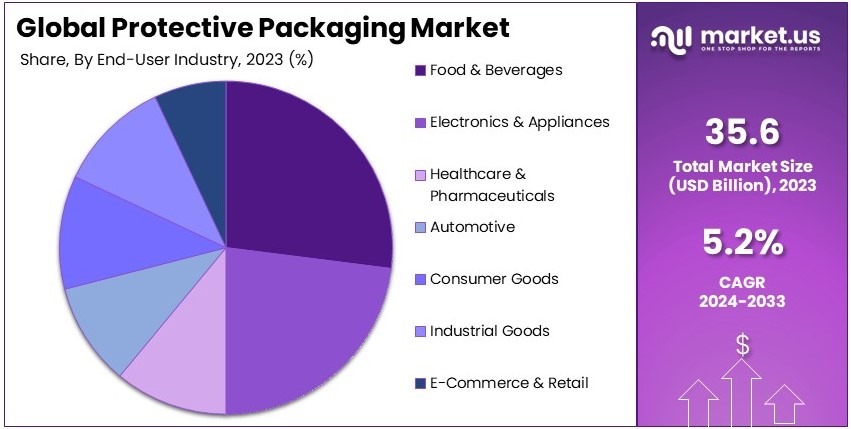

- In 2023, Food & Beverages dominated the end-user segment, reflecting strong demand for secure and insulated packaging.

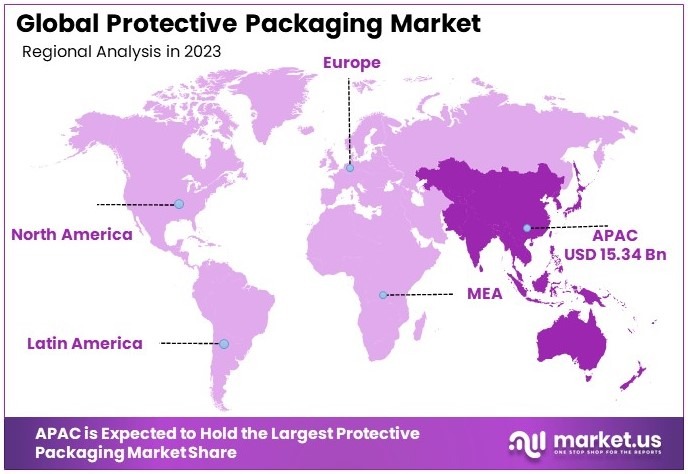

- In 2023, Asia Pacific led the market with 43.1% share, driven by rapid industrialization and e-commerce growth, valued at USD 15.34 Billion.

Protective Packaging Business Environment Analysis

Targeting primarily large enterprises, 50% of the market demand comes from businesses with extensive supply chains. Additionally, medium and small businesses contribute 30% and 20%, respectively. According to MarketWatch, this diverse demographic requires tailored packaging solutions to meet varying operational needs.

Product differentiation is essential as companies strive to stand out. For instance, UFlex introduced aluminum-free tube packaging in October 2024, enhancing recyclability. Moreover, Colgate and Watsons’ recycling scheme launched in Hong Kong emphasizes sustainable innovations, setting brands apart in a competitive market.

Analyzing the value chain, efficient integration of design, production, and distribution is crucial. According to Interior Daily, partnerships with suppliers and recyclers ensure high-quality standards. Furthermore, advancements in materials and processes streamline operations, reducing costs and improving product offerings.

Investment opportunities are expanding with the shift towards sustainable packaging. Diviana’s €50 million expansion and APT’s new ships highlight significant growth potential. Investors are increasingly drawn to eco-friendly innovations and companies committed to reducing environmental impact, driving market advancements.

Export and import dynamics play a pivotal role in market growth. According to OEC, global trade of paper containers reached $2.6 billion in 2022, up 8.56% from 2021. Additionally, WITS reports plastic packaging exports totaled $2.16 billion, led by China and the United States, facilitating global market expansion.

Type Analysis

Flexible Protective Packaging dominates with 64.3% due to its versatility and cost-effectiveness in various applications.

The protective packaging market is segmented primarily by the types of packaging solutions offered. Among these, Flexible Protective Packaging has emerged as the dominant sub-segment, accounting for 64.3% of the market. This dominance can be attributed to the adaptability and efficiency of flexible protective packaging solutions in safeguarding products during transit.

Materials such as bubble wraps, air pillows, stretch films, and paper fillers are extensively used across multiple industries, including electronics, automotive, and food and beverages, which require reliable packaging solutions that accommodate varied product shapes and sizes.

Bubble wraps are a critical component in flexible packaging, offering lightweight and reliable cushioning, which significantly reduces shipping costs while providing superior protection. Similarly, air pillows are valued for their ability to fill voids within boxes, ensuring that products remain stationary during shipping.

Stretch films are extensively utilized for their strength and durability, providing a tight hold on goods, which is essential for preventing movement and damage. Paper fillers, made from recycled paper, offer an eco-friendly option that adequately protects products without adding significant weight.

Material Type Analysis

Paper & Paperboard leads due to its sustainability and wide availability.

In the material type segment of the protective packaging market, Paper and Paperboard take precedence as the leading sub-segment. The rise of environmental concerns and the increasing regulations against plastic usage have propelled the adoption of paper-based solutions within the protective packaging industry.

Plastic, although versatile and durable, faces growing scrutiny due to environmental impact concerns, leading to a gradual decline in its use for protective packaging. Foam materials provide excellent cushioning properties and are often used for delicate or high-value items, but they are not as environmentally friendly as paper-based options.

Metal packaging, although highly durable and offering superior protection, is generally reserved for industrial goods due to its weight and cost. Biodegradable packaging materials are gaining traction as they offer a compromise between functionality and sustainability, though they are yet to reach the widespread adoption levels of paper and paperboard.

Functionality Analysis

Wrapping is predominant as it ensures product integrity and enhances shelf appeal.

Functional analysis of the protective packaging market highlights Wrapping as the most crucial function, primarily due to its direct impact on product integrity and aesthetic presentation. Wrapping materials, including papers and films, are essential for protecting products from surface damage, contamination, and preserving their marketable condition.

Cushioning remains a significant function, especially for shipping fragile electronic goods, pharmaceuticals, and other sensitive items. Blocking and bracing solutions are integral in preventing product movement within packages, thus avoiding abrasion and impact damage. Insulation is vital for temperature-sensitive goods, such as foods and certain pharmaceuticals, ensuring that they remain within safe thermal thresholds during transit.

End-User Industry Analysis

The Food and Beverages sector leads due to stringent safety standards and consumer demand for fresh products.

In the end-user industry segment, the Food and Beverages industry stands out as the largest consumer of protective packaging. This is driven by the critical need to maintain food safety, extend product freshness, and meet consumer demands for pristine and untainted products. The growing global trade in perishable goods has further underscored the necessity for robust protective packaging solutions in this sector.

Electronics and appliances also form a significant portion of the market, as these products require precise protection against mechanical shocks and environmental factors. The healthcare and pharmaceuticals industry relies heavily on protective packaging to ensure the safety and integrity of medical products.

The automotive industry uses rigid and foam protective packaging extensively to protect parts during shipping. Consumer goods, including household items, require durable packaging solutions to withstand the rigors of long-distance transportation.

Lastly, the increasing online shopping trend has made E-Commerce and Retail sectors major users of protective packaging to ensure that consumer products are delivered in optimal condition.

Key Market Segments

By Product Type

- Flexible Protective Packaging

- Bubble Wraps

- Air Pillows

- Stretch Film

- Paper Fillers

- Rigid Protective Packaging

- Foam Inserts

- Molded Pulp

- Corrugated Boxes

- Foam Protective Packaging

- Polyurethane Foam

- Expanded Polystyrene (EPS)

- Polyethylene Foam

By Material Type

- Paper and Paperboard

- Plastic

- Foam

- Metal

- Biodegradable Materials

By Functionality

- Cushioning

- Blocking and Bracing

- Insulation

- Wrapping

By End-User Industry

- Electronics and Appliances

- Food and Beverages

- Healthcare and Pharmaceuticals

- Automotive

- Consumer Goods

- Industrial Goods

- E-Commerce and Retail

Driving Factors

E-commerce Growth Drives Market Growth

The growth of the Protective Packaging Market is significantly influenced by the rapid expansion of the e-commerce sector. As online shopping becomes increasingly popular, the demand for reliable packaging solutions that ensure products reach consumers in perfect condition rises.

Additionally, the surge in consumer electronics demand contributes to the need for specialized protective packaging to safeguard high-value items during transit. Increased focus on product safety further drives the market, as businesses prioritize packaging that can prevent damage and enhance customer satisfaction.

Advancements in packaging materials also play a crucial role, enabling the development of more efficient and durable protective solutions. Innovations such as shock-absorbing materials and eco-friendly options meet the evolving needs of both businesses and consumers.

Restraining Factors

High Costs and Environmental Concerns Restraint Market Growth

The Protective Packaging Market faces several restraining factors that hinder its growth. High costs of advanced materials present a significant barrier, as premium packaging solutions often require expensive inputs that can increase overall production costs. This makes it challenging for businesses to maintain profitability while meeting high safety standards.

Environmental concerns also pose a major restraint, as there is growing scrutiny over the sustainability of packaging materials. Consumers and regulators are increasingly demanding eco-friendly packaging, which can limit the use of traditional protective materials that are not environmentally sustainable.

Regulatory compliance challenges further complicate market expansion, as businesses must navigate a complex landscape of laws and standards related to packaging safety and environmental impact. Additionally, supply chain disruptions, whether due to geopolitical tensions or natural disasters, can impede the timely production and distribution of protective packaging materials.

Growth Opportunities

Sustainable Solutions Provide Opportunities

The Protective Packaging Market is poised to capitalize on several growth opportunities that can drive its expansion. One significant opportunity lies in the development and adoption of sustainable packaging solutions. As environmental awareness increases, there is a growing demand for eco-friendly protective packaging made from recyclable or biodegradable materials.

Customization and personalization present another avenue for growth, as businesses seek tailored packaging solutions that enhance brand identity and customer experience. Offering bespoke packaging options allows companies to differentiate themselves in a competitive market.

Expansion in emerging markets also provides substantial opportunities, as rising industrialization and increasing consumer spending in regions like Asia-Pacific and Africa drive demand for protective packaging. Additionally, the integration of smart packaging technologies offers innovative solutions that enhance functionality, such as real-time tracking and product monitoring.

Emerging Trends

Biodegradable Packaging Is Latest Trending Factor

Current trends are significantly shaping the Protective Packaging Market, driving its evolution and appeal. Biodegradable packaging is at the forefront, as consumers and businesses seek environmentally responsible solutions that reduce waste and carbon footprints. This trend aligns with global sustainability goals and enhances brand reputation for companies adopting eco-friendly practices.

Minimalist packaging designs are also gaining traction, emphasizing simplicity and functionality while reducing material usage. These designs appeal to consumers who prefer clean and efficient packaging that minimizes environmental impact.

The use of recycled materials is another key trend, as it supports the circular economy and meets the increasing demand for sustainable packaging options. By incorporating recycled content, companies can offer protective packaging that is both effective and environmentally friendly.

Additionally, smart and interactive packaging is becoming popular, integrating technologies such as QR codes and NFC tags that provide additional functionality like product tracking and consumer engagement. These smart features add value to protective packaging, making it more versatile and appealing to tech-savvy consumers.

Protective Packaging Market Regional Analysis

Asia Pacific Dominates with 43.1% Market Share

Asia Pacific leads the Protective Packaging Market with a 43.1% share with USD 15.34 Bn valuation, influenced by its extensive manufacturing base and booming e-commerce sector. This dominance is driven by the high volume of goods produced and shipped within the region, necessitating robust protective packaging solutions to ensure product safety during transit.

The region’s rapid industrialization and urbanization have significantly impacted the demand for protective packaging. Asia Pacific’s strategic role as a global manufacturing hub also amplifies its need for advanced packaging technologies that can withstand the rigors of long-distance shipping, further solidifying its leadership in the market.

The future impact of Asia Pacific on the global Protective Packaging Market is expected to be substantial. Continued economic growth and expansion of the manufacturing sector are likely to increase the demand for protective packaging. Additionally, innovations in sustainable packaging solutions could see Asia Pacific leading in eco-friendly packaging trends, potentially increasing its market share even further.

Regional Mentions:

- North America: North America is a major player in the Protective Packaging Market, supported by advanced logistics and a strong retail sector. The region focuses on innovative packaging solutions that offer sustainability and high efficiency, catering to a variety of industries.

- Europe: Europe maintains a strong position in the Protective Packaging Market, with a focus on sustainability and high-quality standards. The region’s commitment to environmental regulations drives the adoption of recyclable and reusable packaging materials.

- Middle East & Africa: The Middle East and Africa are witnessing growth in protective packaging due to expanding trade activities and infrastructure development. The market is driven by increasing industrialization and the need for durable packaging solutions.

- Latin America: Latin America shows growth potential in the Protective Packaging Market, with advancements in manufacturing and export services. The region is adapting to new packaging technologies to meet international standards and boost its trade capabilities.

Key Regions and Countries Covered in the Report

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Protective Packaging Market Competitive Landscape

In the Protective Packaging Market, several leading companies significantly shape industry dynamics through innovation, sustainability, and market reach. Among them, Sealed Air Corporation, Sonoco Products Company, Pregis LLC, and Smurfit Kappa Group are key players, each contributing uniquely to the market’s growth and evolution.

Sealed Air Corporation is renowned for its innovative packaging solutions that prioritize sustainability and efficiency. Best known for its Bubble Wrap and Cryovac brands, Sealed Air’s products are essential in protecting goods during transportation, particularly in the food and consumer goods sectors. The company’s commitment to reducing waste and enhancing protective packaging effectiveness makes it a leader in the market.

Sonoco Products Company offers a diverse range of packaging materials, including highly customized protective solutions for various market sectors such as automotive, electronics, and pharmaceuticals. Sonoco’s strength lies in its integrated approach, combining materials science with industry-specific expertise to meet complex packaging requirements.

Pregis LLC is focused on providing environmentally responsible protective packaging solutions that meet the needs of dynamic market sectors. With a robust product line that includes air pillows, foam packaging, and hybrid cushioning systems, Pregis is dedicated to innovation that supports the protection of goods while minimizing environmental impact.

Smurfit Kappa Group, a global leader in paper-based packaging, leverages its expertise to offer sustainable protective packaging solutions. The company’s approach emphasizes the use of renewable resources and the development of recyclable products, catering to a growing demand for sustainable packaging practices in the global market.

These top companies are pivotal in driving technological advancements and sustainable practices in the Protective Packaging Market. Their efforts not only address current consumer and industrial needs but also set trends for future market developments, ensuring ongoing improvements in protective packaging efficiency and environmental stewardship.

Major Companies in the Market

- Sealed Air Corporation

- Sonoco Products Company

- Pregis LLC

- Smurfit Kappa Group

- Storopack Hans Reichenecker GmbH

- Amcor Limited

- WestRock Company

- DuPont de Nemours, Inc.

- International Paper Company

- Ranpak Holdings Corp.

- Schütz GmbH & Co. KGaA

- d3o Limited

Latest News in Protective Packaging Market

- Amcor and Berry Global: On November 19, 2024, Amcor announced its agreement to acquire Berry Global Group in an all-stock transaction valued at $8.4 billion. The merger is expected to create a leading entity in consumer and healthcare packaging, with combined revenues projected at $24 billion.

- Novolex and Pactiv Evergreen: On December 9, 2024, Novolex announced its intention to acquire Pactiv Evergreen in a deal valued at $6.7 billion. Pactiv Evergreen, a prominent manufacturer of food packaging and foodservice products, reported revenues of $5.437 billion in 2021.

- Earthodic: In November 2024, Brisbane-based start-up Earthodic secured $6 million in funding to advance its fully recyclable protective coating for paper and cardboard packaging. The innovative coating, made using lignin, a byproduct of the pulp and paper industry, aims to replace non-recyclable coatings commonly used in e-commerce packaging.

Report Scope

Report Features Description Market Value (2023) USD 35.6 Billion Forecast Revenue (2033) USD 59.1 Billion CAGR (2024-2033) 5.2% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Flexible Protective Packaging: Bubble Wraps, Air Pillows, Stretch Film, Paper Fillers; Rigid Protective Packaging: Foam Inserts, Molded Pulp, Corrugated Boxes; Foam Protective Packaging: Polyurethane Foam, Expanded Polystyrene (EPS), Polyethylene Foam), By Material Type (Paper and Paperboard, Plastic, Foam, Metal, Biodegradable Materials), By Functionality (Cushioning, Blocking and Bracing, Insulation, Wrapping), By End-User Industry (Electronics and Appliances, Food and Beverages, Healthcare and Pharmaceuticals, Automotive, Consumer Goods, Industrial Goods, E-Commerce and Retail) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Sealed Air Corporation, Sonoco Products Company, Pregis LLC, Smurfit Kappa Group, Storopack Hans Reichenecker GmbH, Amcor Limited, WestRock Company, DuPont de Nemours, Inc., International Paper Company, Ranpak Holdings Corp., Schütz GmbH & Co. KGaA, d3o Limited Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Protective Packaging MarketPublished date: Dec 2024add_shopping_cartBuy Now get_appDownload Sample

Protective Packaging MarketPublished date: Dec 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- International Paper Co

- Smurfit KAPPA Group

- West Rock

- Ball Corporation

- Oji Holdings

- Berry Global

- Crown Holdings

- Stora Enso

- Graphic Packaging Holding Company

- Owens Corning

- Packaging Corporation of America

- Pregis Corp

- Pro-Pac Packaging Ltd

- Intertape Polymer Group Inc (IPG)

- Sealed Air Corporation