Global Zero Waste Packaging Market By Material (Paper and Cardboard, Biopolymer, Glass Packaging, Metal Packaging), By Type (Reusable and Recyclable Packaging, Compostable Packaging, Edible Packaging), By Distribution Channel(Offline, Online), By Application(Food and Beverages, Healthcare, Cosmetics and Personal Care, Electrical and Electronics, E-commerce, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec 2024

- Report ID: 135050

- Number of Pages: 279

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

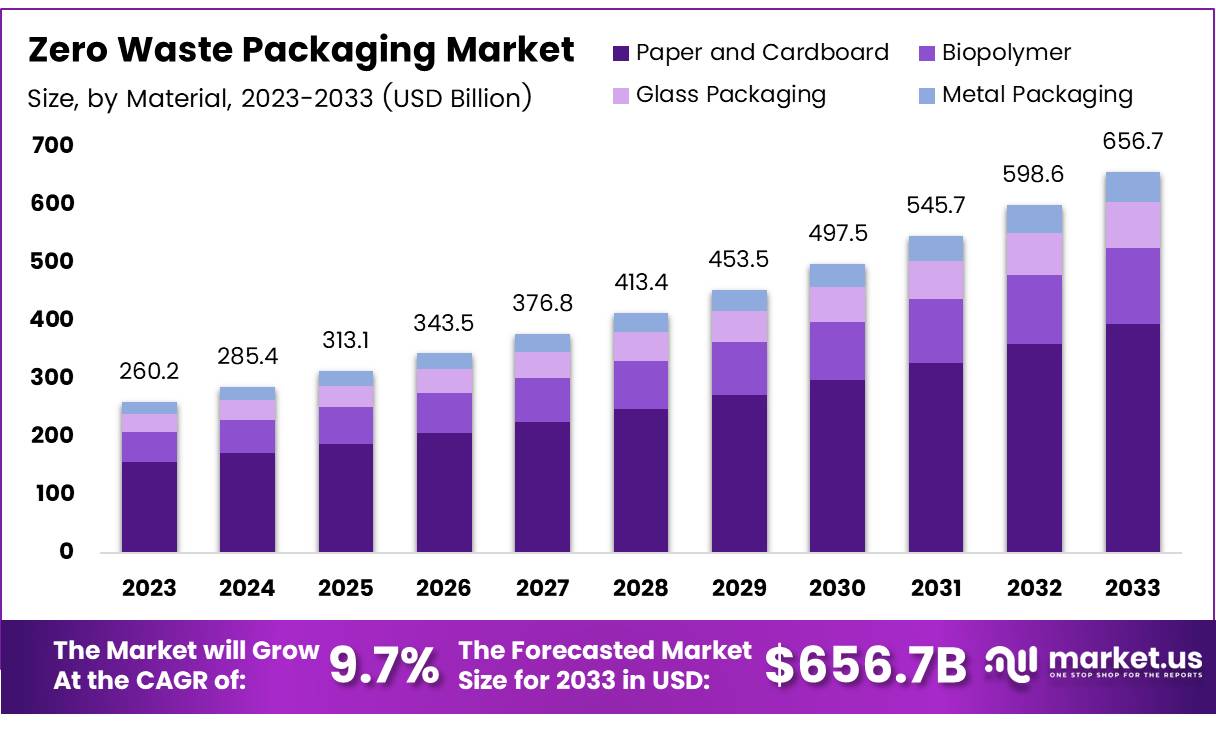

The Global Zero Waste Packaging Market size is expected to be worth around USD 656.7 Billion by 2033, from USD 260.2 Billion in 2023, growing at a CAGR of 9.7% during the forecast period from 2024 to 2033.

Zero Waste Packaging is an innovative approach aimed at redesigning product and packaging systems to prevent waste at the source. The primary objective is to ensure that products are designed, manufactured, used, and managed in ways that encourage the highest value of reuse and recycling.

This Packaging encompasses a spectrum of practices, from using biodegradable and compostable materials to implementing refill systems and encouraging consumer habits that align with circular economy principles.

The Zero Waste Packaging Market is a dynamic sector driven by increasing consumer awareness and regulatory pressures regarding environmental sustainability. This market includes the production, distribution, and use of packaging solutions that leave minimal or no waste.

It ranges from paper-based products, which are highly favored for their recyclability, to innovative compostable and reusable packaging solutions. The demand for such packaging is growing, particularly in industries like food and beverages, personal care, and pharmaceuticals, reflecting a broader shift towards sustainability.

The growth of the Zero Waste Packaging Market is propelled by robust consumer demand for sustainable options. According to greenmatch, 76% of consumers across the UK, Europe, and the United States show a clear preference for paper-based over plastic packaging due to environmental concerns. This sentiment is increasingly influencing buying habits, prompting companies to innovate in their packaging designs to cater to this demand.

Moreover, there is a notable economic opportunity within this sector. UK insights suggest that the global zero waste potential market for plastics is at a substantial 72 million metric tons. Adopting zero waste strategies could lead to significant savings, potentially reducing 5-7% of the global Gross Domestic Product, underscoring the economic viability of zero waste initiatives.

Government roles are pivotal in shaping the trajectory of the Zero Waste Packaging Market through investments and regulations. Stringent regulations are being implemented worldwide to reduce waste and encourage recycling.

For example, using recycled paper, as noted by unsustainable magazine, can lead to a 74% decrease in greenhouse gas emissions compared to using unrecycled materials. Such data underscores the environmental and regulatory benefits of shifting towards zero waste solutions.

Investments in recycling infrastructure and incentives for companies adopting zero waste packaging are also crucial. These efforts are supported by statistics from businesswaste, which highlight that about 69% of paper and cardboard packaging is currently recycled, indicating a solid foundation for expanding zero waste practices.

The long-term sustainability of the Zero Waste Packaging Market is heavily influenced by consumer behavior and technological advancements. The increased adoption of reusable transport packaging, which consumes 39% less energy and produces 95% less waste compared to single-use alternatives (rpeurope), is a testament to the advancements in packaging technology that align with environmental goals.

Consumer willingness to support sustainable packaging is also rising. Emerald reports that 82% of respondents in a recent survey across Europe and the Americas would pay more for sustainable packaging, an increase from previous years. This trend is significant, as it not only reflects growing consumer consciousness but also bolsters market growth by increasing demand for innovative zero waste solutions.

Key Takeaways

- The Global Zero Waste Packaging Market is projected to reach USD 656.7 billion by 2033, growing at a CAGR of 9.7% from 2024 to 2033.

- Paper and Cardboard dominated the Material Analysis segment in 2023, holding a 75.5% market share due to biodegradability and recyclability.

- Reusable/Recyclable Packaging led the Type Analysis segment in 2023 with an 80% market share, driven by consumer awareness and regulatory standards.

- Offline distribution channels held the largest market position in 2023, catering to consumer preferences for hands-on product evaluation.

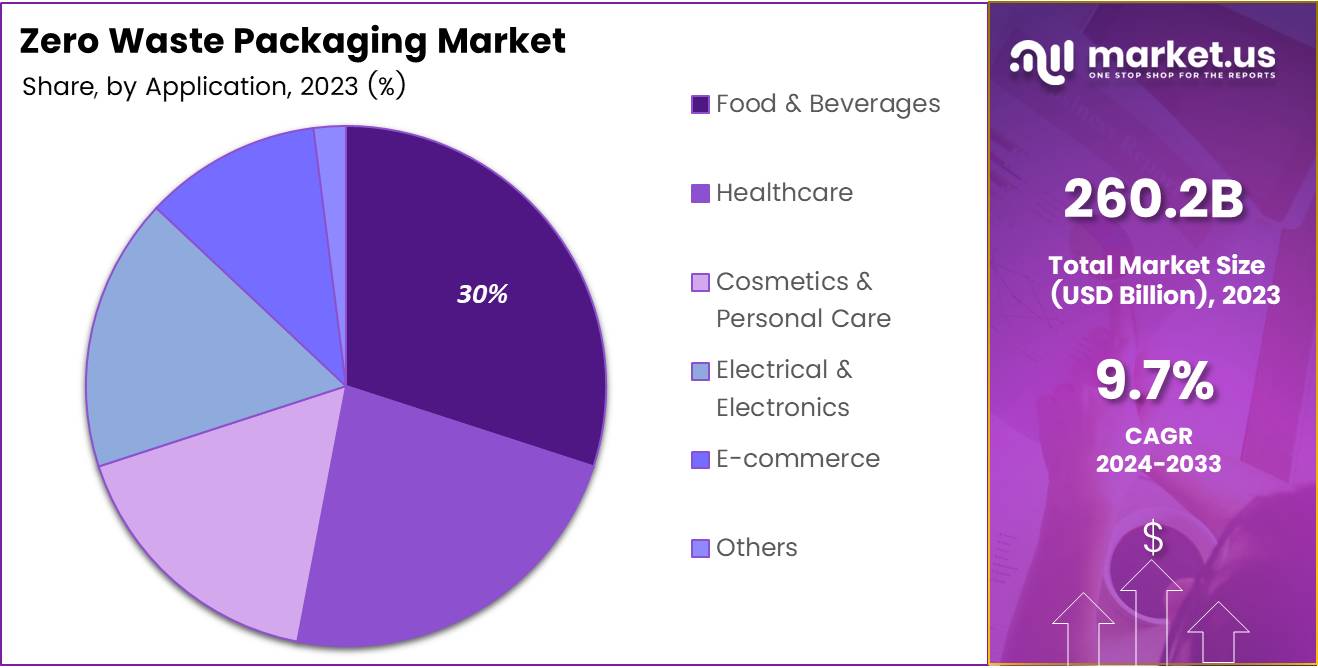

- The Food & Beverages sector accounted for 30% of the market in 2023, driven by demand for eco-friendly packaging and regulatory compliance.

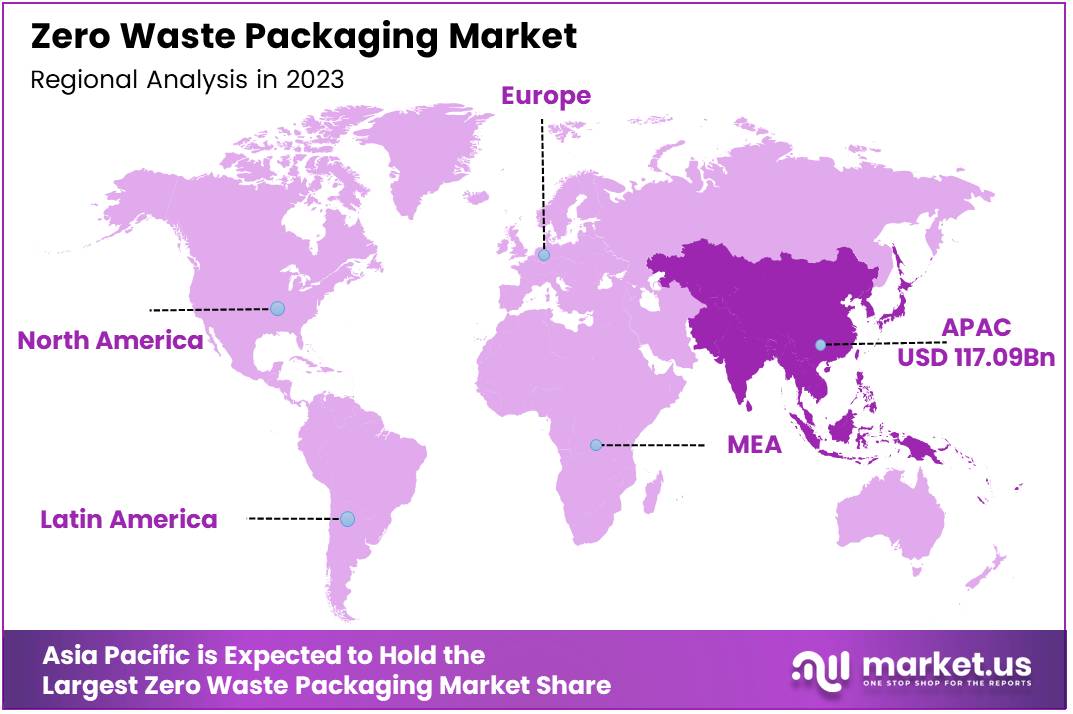

- Asia Pacific led the regional market in 2023 with a 45.6% share, fueled by strong manufacturing and adoption of sustainable practices in major economies.

Material Analysis

Paper and Cardboard Dominate Zero Waste Packaging Market with 75.5% Share Due to Sustainability Efforts

In 2023, Paper and Cardboard held a dominant market position in the By Material Analysis segment of the Zero Waste Packaging Market, with a commanding 75.5% share. This prevalence underscores a significant shift towards sustainable packaging solutions, driven by increasing environmental awareness and stringent regulatory standards.

The Paper and Cardboard segment benefits from its inherent biodegradability, recyclability, and widespread availability, which collectively enhance its attractiveness to industries aiming to minimize their environmental footprint.

Adjacent to this, the Biopolymer segment is emerging as a notable player, offering innovative solutions that promise further reductions in waste through compostable and bio-based materials. Though smaller in market share, this segment is growing at a brisk pace, spurred by advancements in material science and an expanding range of applications.

Glass Packaging, valued for its purity and recyclability, continues to maintain a steady presence in the market. It remains a preferred choice for food and beverage industries due to its non-reactive nature, which ensures product integrity and longevity.

Metal Packaging also holds a significant position, distinguished by its durability and the high recyclability rate of materials like aluminum and steel. The sector is poised for growth, particularly in markets where long-term sustainability and product protection are paramount.

These materials collectively propel the Zero Waste Packaging Market forward, as industries increasingly prioritize sustainability in their packaging choices.

Type Analysis

Reusable/Recyclable Packaging Leads Zero Waste Market with 80% Share Due to Growing Environmental Awareness

In 2023, Reusable/Recyclable Packaging held a dominant market position in the By Type Analysis segment of the Zero Waste Packaging Market, with an 80% share. This segment’s significant market share underscores its pivotal role in driving sustainable packaging solutions.

The preference for reusable and recyclable materials is primarily attributed to heightened consumer awareness and stringent regulatory standards aimed at reducing environmental impact.

Compostable Packaging, though smaller in market share, is experiencing gradual growth, facilitated by advancements in biodegradable materials and increasing adoption in the food and beverage sector. This type of packaging is designed to decompose under specific conditions, offering an eco-friendly alternative that aligns with global sustainability goals.

Edible Packaging remains a niche but innovative segment. It introduces an intriguing prospect for waste reduction by integrating food-grade materials that consumers can eat, thereby eliminating packaging waste entirely. While still in its developmental phase, edible packaging is gaining traction, particularly in the snack and pharmaceutical industries, where it offers a novel approach to zero waste.

Distribution Channel Analysis

Offline Continues to Lead in Zero Waste Packaging Distribution

In 2023, Offline held a dominant market position in the By Distribution Channel Analysis segment of the Zero Waste Packaging Market. This channel’s predominance is driven by consumer preference for tangible product evaluation and immediate purchase gratification.

Retail stores and direct seller outlets, by facilitating hands-on interaction with zero waste products, cater effectively to consumers seeking to assess product quality and sustainability credentials firsthand.

On the other hand, the Online distribution channel is rapidly growing, fueled by the digitalization of shopping and increased consumer reliance on e-commerce platforms. This growth is augmented by convenience, wider reach, and often lower prices.

Online platforms also offer the potential for direct-to-consumer sales models, which are increasingly favored by zero waste brands aiming to reduce packaging and distribution footprints.

Despite the rising trend of online shopping, offline channels continue to capture a significant share of the market due to strong consumer habits and the inherent appeal of physically inspecting a product before purchase. The balance between these channels will be crucial as both strive to align with the sustainability goals inherent to zero waste principles.

Application Analysis

Zero Waste Packaging Leads with Food & Beverages Taking a 30% Share Driven by Consumer Demand for Sustainability

In 2023, Food & Beverages held a dominant market position in the By Application Analysis segment of the Zero Waste Packaging Market, commanding a 30% share. This sector’s robust performance can be attributed to escalating consumer demand for sustainable packaging solutions, driven by growing environmental awareness and regulatory pressures regarding waste reduction.

The transition towards eco-friendly materials has been further accelerated by innovations in biodegradable and compostable packaging options, aligning with global sustainability goals.

The Healthcare sector also demonstrated significant engagement with zero waste packaging, focusing on reducing the environmental footprint of medical supplies and pharmaceuticals. The adoption of reusable and recyclable materials in this segment is enhanced by stringent regulations ensuring safety and hygiene.

In Cosmetics & Personal Care, a shift towards sustainable practices has been crucial. Brands are increasingly committing to zero waste initiatives, reflecting consumer preferences for environmentally responsible products. The Electrical & Electronics sector is progressing towards sustainability by integrating recycled materials in product packaging, although challenges remain in balancing protection with waste reduction.

E-commerce, a rapidly expanding sector, is adopting innovative packaging solutions that minimize waste, a crucial factor given the high volume of packaging materials used in shipping and handling. The Others category, which includes various industries, continues to explore and implement zero waste strategies, albeit at a more gradual pace.

Key Market Segments

By Material

- Paper and Cardboard

- Biopolymer

- Glass Packaging

- Metal Packaging

By Type

- Reusable/Recyclable Packaging

- Compostable Packaging

- Edible Packaging

By Distribution Channel

- Offline

- Online

By Application

- Food & Beverages

- Healthcare

- Cosmetics & Personal Care

- Electrical & Electronics

- E-commerce

- Others

Drivers

Boost in Environmental Awareness Fuels Zero Waste Packaging Adoption

The zero waste packaging market is experiencing significant growth, primarily driven by heightened global awareness of environmental challenges. This awareness is motivating both consumers and businesses to seek out sustainable packaging options that align with eco-friendly practices.

Additionally, governmental policies are playing a crucial role in this shift by enforcing stricter waste management and plastic reduction regulations, compelling industries to adopt zero waste packaging solutions. The consumer base is also shifting, with a growing preference for products that support sustainability, further propelling the demand for zero waste packaging.

Moreover, many corporations are actively setting and pursuing aggressive sustainability goals, including commitments to achieve zero waste, which naturally enhances the deployment of eco-friendly packaging solutions. These factors collectively foster a robust environment for the expansion of the zero waste packaging market, as stakeholders across the spectrum embrace more sustainable practices.

Restraints

Material Shortages Hinder Zero Waste Packaging

The growth of the zero waste packaging market faces significant challenges, primarily due to the limited availability of sustainable materials. This restraint is crucial as the production of zero waste packaging relies heavily on materials that are both sustainable and suitable for recycling or composting. The shortage of such materials can limit the capacity to meet growing market demand and potentially increase costs.

Furthermore, consumer resistance also poses a notable barrier. Many consumers continue to prefer traditional packaging options due to their convenience and familiarity. This resistance to adopting new, environmentally friendly packaging solutions can slow market penetration and acceptance, making it challenging for the zero waste packaging sector to expand its footprint. Such factors must be carefully considered by stakeholders looking to invest or participate in this market.

Growth Factors

Embracing Partnerships for Sustainable Growth

In the zero waste packaging market, collaborations and partnerships stand out as pivotal catalysts for growth. By forging strategic alliances, packaging companies and brands can introduce innovative, sustainable packaging solutions that resonate with eco-conscious consumers. This collaborative approach not only enhances the adoption of zero waste practices but also supports the development of cutting-edge materials and technologies.

As e-commerce continues to expand, tailored zero waste packaging solutions become increasingly vital, presenting a significant opportunity to reduce the sector’s environmental footprint.

Furthermore, the promotion and implementation of reusable packaging models offer a lucrative avenue for companies aiming to capitalize on consumer trends towards sustainability. These initiatives collectively represent a robust framework for driving the zero waste packaging market forward, underscoring the importance of integrated efforts in achieving environmental and business objectives.

Emerging Trends

Trending Factors in the Zero Waste Packaging Market

The zero-waste packaging market is seeing significant growth due to innovative solutions that address both sustainability and functionality. Smart packaging is emerging as a key trend, where technologies like QR codes and RFID tags are integrated into packaging to streamline recycling and composting processes. This ensures that consumers can easily understand how to dispose of the packaging responsibly.

Another major trend is the rise of biodegradable and compostable solutions, with companies focusing on developing materials that naturally break down in the environment without leaving harmful residues. These solutions align with consumer demand for eco-friendly alternatives and regulatory pushes for sustainable practices.

Additionally, multi-use packaging is gaining popularity, encouraging customers to reuse packaging multiple times before recycling or disposal. This approach not only minimizes waste but also extends the lifecycle of packaging materials, reducing environmental impact.

Together, these factors underline a growing emphasis on innovation and environmental responsibility, driven by changing consumer preferences and stringent regulatory requirements.

Regional Analysis

Asia Pacific leads the Zero Waste Packaging Market with 45.6% share valued at USD 117.09 billion

The Zero Waste Packaging Market is experiencing significant growth across all regions, driven by increasing environmental awareness and government initiatives promoting sustainable practices.

Asia Pacific, the dominating region with a market share of 45.6%, accounted for a valuation of approximately USD 117.09 billion in 2023. This dominance is attributed to the region’s robust manufacturing base, coupled with rising adoption of eco-friendly packaging solutions in major economies like China, India, and Japan.

Regional Mentions:

In North America, the market is buoyed by stringent regulations against single-use plastics and a highly informed consumer base. Countries like the United States and Canada are leading the adoption of biodegradable and reusable packaging, driven by rising corporate responsibility efforts. The region’s established infrastructure for waste management and high investments in sustainable technologies further enhance market growth.

Europe emerges as another prominent region, underpinned by the European Union’s regulatory frameworks such as the Green Deal and Circular Economy Action Plan. Key markets like Germany, France, and the United Kingdom are spearheading efforts in zero-waste packaging, particularly in sectors like food and beverage and personal care. This is supported by increasing demand for recyclable materials and significant R&D activities in packaging innovation.

The Middle East & Africa region is steadily adopting zero-waste packaging practices, driven by increased awareness and policy shifts in countries like the UAE and South Africa. While the market is nascent, growing foreign investments and regional commitments to sustainability goals signal promising growth potential.

Latin America, with markets such as Brazil and Mexico, is witnessing growth fueled by heightened environmental concerns and government initiatives promoting circular economies. However, infrastructural challenges in waste management may pose hurdles to rapid adoption in this region.

Key Regions and Countries covered іn thе rероrt

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The global zero waste packaging market in 2023 is characterized by the innovative contributions of key players striving to meet the rising demand for sustainable and eco-friendly solutions.

Ecovative LLC and Loliware Inc. are leading the shift toward biodegradable and compostable materials, leveraging advancements in biomaterials to address environmental concerns effectively. Ecovative LLC has particularly gained attention with its mushroom-based packaging, which offers a scalable and sustainable alternative to traditional plastics.

Sulapac Oy and TIPA are at the forefront of developing bio-based polymers that maintain functionality while being environmentally friendly. Their products cater to diverse sectors, including food, cosmetics, and consumer goods, driving significant adoption in industries with high plastic dependency.

DS Smith plc and World Centric focus on paper-based and fiber-based solutions, offering recyclable alternatives aligned with circular economy principles. Their established global presence enhances their ability to influence market trends.

Notpla Limited and Avani Eco are gaining traction with innovations like seaweed-based packaging and compostable alternatives, respectively, highlighting the entrepreneurial dynamism in the market. Meanwhile, Biome Bioplastics Limited and BIOPLA are investing heavily in R&D to refine bioplastic technologies and expand their applications.

Overall, the market is shaped by strategic partnerships, R&D investments, and regional expansion initiatives by these companies. Their collective efforts are expected to bolster the zero waste packaging industry, addressing environmental challenges while meeting regulatory and consumer expectations.

Top Key Players in the Market

- Ecovative LLC

- Loliware Inc.

- Evoware

- Hero Packaging

- DS Smith plc

- Sulapac Oy

- TIPA

- Regeno

- World Centric

- Notpla Limited

- Avani Eco

- Biome Bioplastics Limited

- BIOPLA

Recent Developments

- In November 2023, sustainable packaging startup Fibmold raised $10 million in funding from venture capital firms Omnivore and Accel. The funding is expected to accelerate the development and commercialization of Fibmold’s innovative eco-friendly packaging solutions.

- In October 2024, pharmaceutical packaging startup Sorich secured $1 million in funding to enhance its packaging technology for the healthcare sector. The investment aims to support the company’s expansion and innovation efforts in sustainable pharmaceutical packaging.

- In November 2024, Ukhi raised $1.2 million to scale its sustainable biomaterial solutions for the packaging industry. The funding will be used to expand production capacity and explore new markets for its eco-friendly products.

- In May 2024, Kelpi secured £4.3 million in funding to advance its seaweed-based packaging to the market. This investment will support Kelpi’s goal of replacing traditional plastics with biodegradable alternatives derived from marine resources.

- In October 2024, Notpla raised £20 million to further its development of sustainable packaging materials made from seaweed and plants. The funding is intended to enhance product innovation and increase the company’s market reach globally.

Report Scope

Report Features Description Market Value (2023) USD 260.2 Billion Forecast Revenue (2033) USD 656.7 Billion CAGR (2024-2033) 9.7% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Material (Paper and Cardboard, Biopolymer, Glass Packaging, Metal Packaging), By Type (Reusable and Recyclable Packaging, Compostable Packaging, Edible Packaging), By Distribution Channel(Offline, Online), By Application(Food and Beverages, Healthcare, Cosmetics and Personal Care, Electrical and Electronics, E-commerce, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Ecovative LLC, Loliware Inc., Evoware, Hero Packaging, DS Smith plc, Sulapac Oy, TIPA, Regeno, World Centric, Notpla Limited, Avani Eco, Biome Bioplastics Limited, BIOPLA Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Zero Waste Packaging MarketPublished date: Dec 2024add_shopping_cartBuy Now get_appDownload Sample

Zero Waste Packaging MarketPublished date: Dec 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Ecovative LLC

- Loliware Inc.

- Evoware

- Hero Packaging

- DS Smith plc

- Sulapac Oy

- TIPA

- Regeno

- World Centric

- Notpla Limited

- Avani Eco

- Biome Bioplastics Limited

- BIOPLA