Global Molded Pulp Packaging Market By Source (Wood Pulp, Non-wood Pulp), By Molded Type (Transfer, Processed, Thick Wall, Thermoformed), By Product (Trays, End Caps, Plates, Bowls and Cups, Clamshells, Others), By End-use (Food Packaging, Healthcare, Industrial, Food Service, Electronics, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec 2024

- Report ID: 134544

- Number of Pages: 262

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

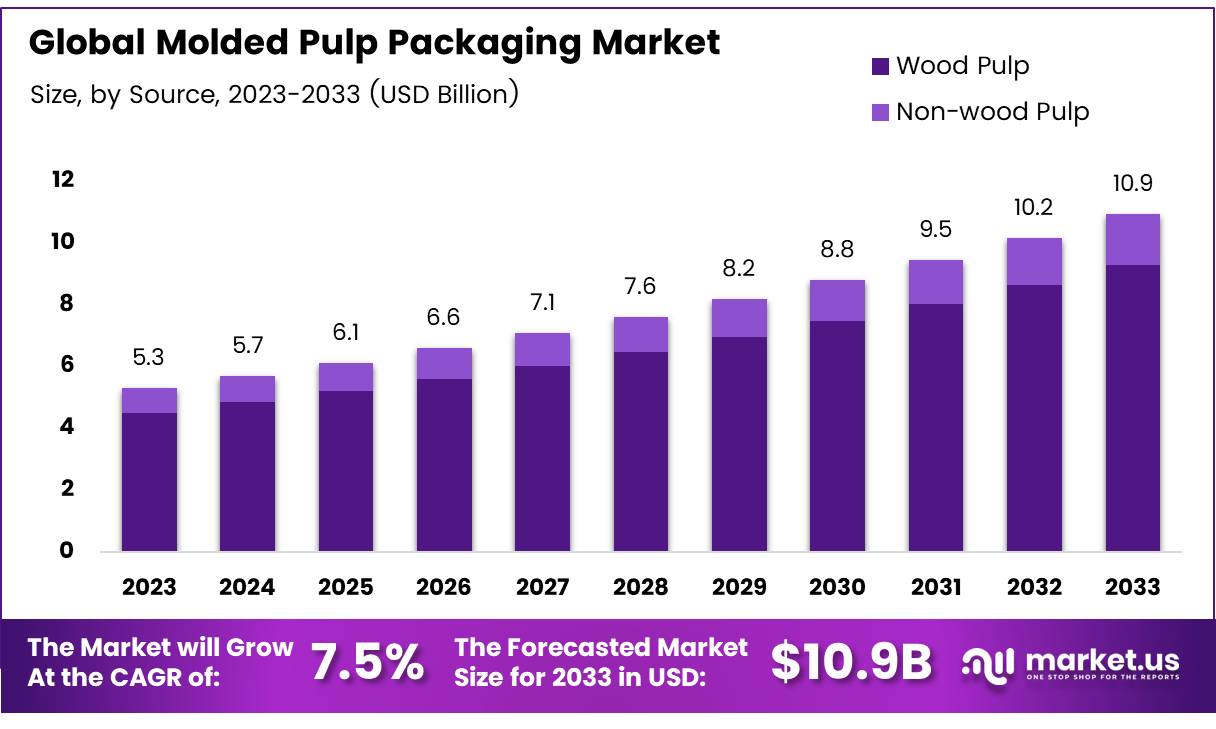

The Global Molded Pulp Packaging Market size is expected to be worth around USD 10.9 Billion by 2033, from USD 5.3 Billion in 2023, growing at a CAGR of 7.5% during the forecast period from 2024 to 2033.

Molded pulp packaging refers to a type of environmentally friendly packaging made primarily from recycled paperboard or newsprint fibers, combined with water. This material is shaped into a variety of forms through a molding process, offering a cost-effective and sustainable alternative to traditional plastic packaging. Molded pulp is often used for protective packaging, such as egg cartons, fruit trays, and custom-designed packaging for cosmetics or electronics.

The Molded Pulp Packaging Market is gaining traction due to several key factors. One of the primary drivers of growth is the increasing consumer demand for sustainable packaging solutions.

According to Forbes, around 70% of consumers are willing to pay a premium for packaging that is sustainable, including compostable and paper-based options. This growing preference is motivating manufacturers to shift towards eco-friendly materials such as molded pulp.

The molded pulp packaging market is expected to experience robust growth in the coming years, driven by increasing demand across multiple industries and geographic regions. This growth is also supported by the growing consumer shift toward environmentally friendly products and packaging.

Studies suggest that the Paper Pulp & Packaging industry could reduce its cost base by up to 15% through digital manufacturing solutions, which could further enhance the appeal of molded pulp packaging in terms of cost-effectiveness.

Governments across the globe are increasingly focusing on promoting sustainable packaging to mitigate environmental damage. Regulations surrounding plastic waste and carbon emissions are driving industries to explore alternative solutions, such as molded pulp. In many regions, policies have been introduced that incentivize the use of recyclable and biodegradable packaging materials, which further boosts the demand for molded pulp products.

Government investments in research and development of sustainable materials also foster innovation in this space. With sustainability now firmly on the agenda of both businesses and regulators, molded pulp packaging stands to benefit from an environment that encourages eco-friendly alternatives.

Molded pulp is a highly cost-effective material compared to other packaging alternatives, making it attractive for manufacturers. According to Lian Industrial, the cost of molded pulp products typically ranges from $0.10 to $2 per unit, depending on the type of packaging and design complexity.

For example, egg trays, which are among the most commonly produced molded pulp products, cost between $0.05 and $0.20 per unit. Fruit trays can range from $0.10 to $0.50, while custom cosmetic packaging can cost between $0.50 and $3.00 per item, based on the sophistication of the design. These prices make molded pulp an affordable solution for companies looking to reduce packaging costs while aligning with sustainability goals.

As the demand for sustainable packaging grows, molded pulp products are expected to become an increasingly attractive option for manufacturers. Not only does this material offer significant cost savings and environmental benefits, but it also helps companies meet the expectations of consumers who are increasingly looking for brands with sustainable practices.

Key Takeaways

- The Global Molded Pulp Packaging Market is projected to reach USD 10.9 billion by 2033, growing at a 7.5% CAGR.

- Wood Pulp dominated the market in 2023, with an 85.2% share in the By Source segment due to its quality and cost-effectiveness.

- Transfer molded pulp type led the market in 2023 with a 57.2% share, driven by demand for sustainable packaging solutions.

- Trays held a 41.2% share in the By Product segment, driven by their widespread use in food packaging and sustainability trends.

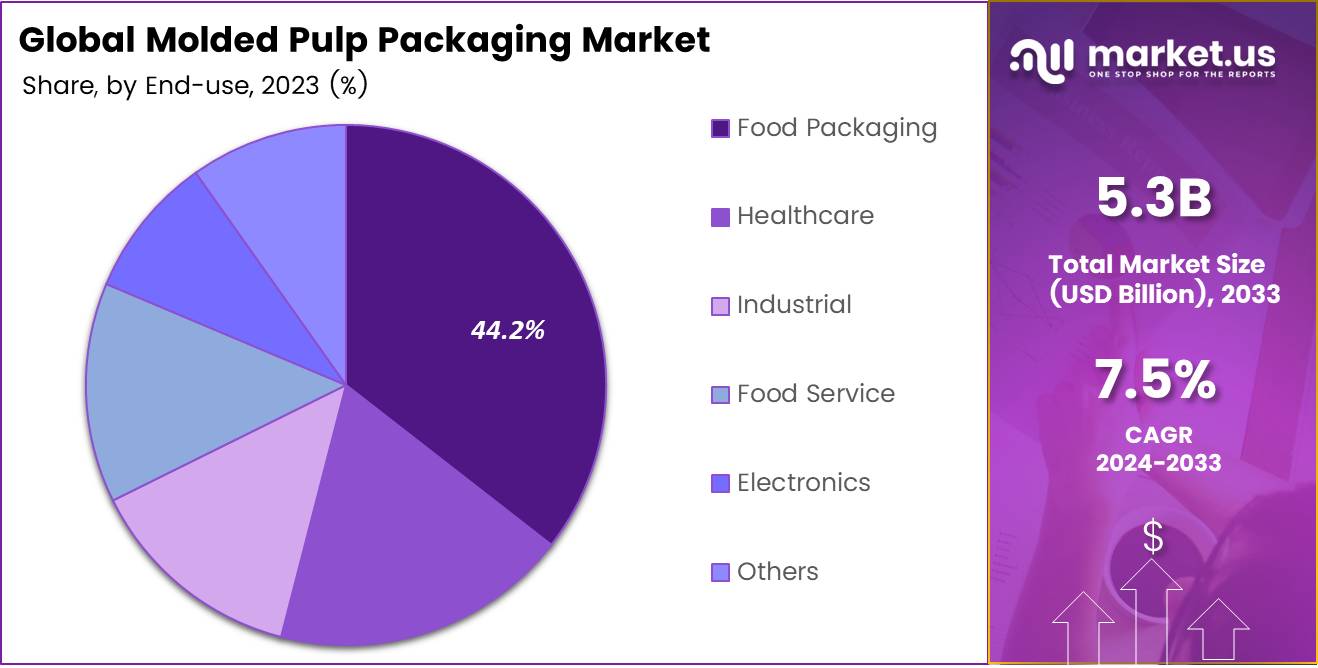

- Food Packaging dominated the market in 2023, with a 44.2% share, fueled by the rising demand for eco-friendly packaging.

- The Asia Pacific region held the largest market share in 2023, accounting for 41.5% of the global market.

Source Analysis

In 2023, Wood Pulp Dominated the Molded Pulp Packaging Market with an 85.2% Share

In 2023, Wood Pulp held a dominant market position in the By Source Analysis segment of the Molded Pulp Packaging Market, with an 85.2% share. The widespread preference for wood pulp can be attributed to its excellent fiber quality, cost-effectiveness, and availability.

Wood pulp is the primary raw material used in the production of molded pulp packaging due to its superior molding properties and high strength, making it ideal for packaging applications such as protective packaging, food containers, and consumer goods packaging.

Furthermore, the renewable nature of wood pulp aligns well with growing environmental concerns, as it is biodegradable and recyclable, contributing to its continued dominance in the market.

On the other hand, Non-wood Pulp, which includes materials like bagasse, straw, and bamboo, holds a relatively smaller share in the market. While non-wood pulp offers environmental benefits, such as lower carbon footprints, it faces challenges in terms of raw material availability and consistency in quality.

Despite these challenges, the demand for non-wood pulp is expected to grow gradually as companies shift toward sustainable alternatives, especially in regions where wood pulp is less abundant.

Molded Type Analysis

Transfer Dominates Molded Pulp Packaging Market’s Molded Type Segment with 57.2% Share in 2023

In 2023, Transfer held a dominant market position in the By Molded Type Analysis segment of the Molded Pulp Packaging Market, with a 57.2% share. This leadership can be attributed to Transfer’s widespread adoption across various industries, driven by the increasing demand for sustainable and eco-friendly packaging solutions.

The Transfer molded pulp type is widely used due to its cost-effectiveness and ability to be mass-produced without compromising on quality, especially for packaging fragile products.

The Processed molded pulp segment followed with significant market share, benefiting from its higher precision in molding and the ability to create more intricate designs. This makes it a preferred choice for premium packaging applications.

The Thick Wall molded pulp segment is also seeing growing adoption due to its strength and durability, especially in packaging products that require higher protection, such as electronics and industrial goods. It is projected to experience steady growth as companies continue to prioritize packaging that ensures product safety during transit.

The Thermoformed molded pulp segment is gaining traction due to its versatility and ability to form customized shapes. However, it currently holds a smaller share compared to the other molded types but is expected to grow as the demand for innovative packaging solutions increases.

Product Analysis Segment

Trays Held a 41.2% Share in the By Product Analysis Segment of the Molded Pulp Packaging Market in 2023

In 2023, Trays held a dominant market position in the By Product Analysis segment of the Molded Pulp Packaging Market, with a 41.2% share.

Trays are widely used in various industries, particularly in food packaging, due to their ability to securely hold items and provide easy stacking, making them a preferred choice for packaging fresh produce, meat, and other fragile goods. Their environmentally friendly attributes and the increasing shift towards sustainable packaging solutions have further fueled demand.

End Caps followed, accounting for a significant share of the market. These products are integral for protecting the ends of products during transportation, particularly in electronics and fragile items. Plates, Bowls & Cups, and Clamshells, while smaller in comparison, also maintained steady growth driven by the rise in eco-conscious consumer behavior, particularly in the foodservice industry.

Other product types, though collectively smaller, continue to see niche applications across various industries such as pharmaceuticals and cosmetics, where molded pulp packaging provides protective, biodegradable alternatives to plastic. The growing consumer preference for sustainable, recyclable packaging options is expected to further propel the growth of these product categories in the coming years.

End-use Analysis

Food Packaging Dominates Molded Pulp Packaging Market with 44.2% Share in 2023

In 2023, Food Packaging held a dominant market position in the By End-use Analysis segment of the Molded Pulp Packaging Market, with a 44.2% share.

The segment’s strong performance can be attributed to the growing consumer preference for sustainable and eco-friendly packaging solutions, which are becoming increasingly popular in the food industry. Molded pulp packaging provides an effective and environmentally friendly alternative to traditional plastic packaging, aligning with rising sustainability trends and regulations.

The Healthcare segment followed, driven by the rising demand for protective, biodegradable packaging for medical devices, pharmaceuticals, and diagnostic products. Industrial applications also experienced steady growth, benefiting from molded pulp’s ability to offer cost-effective and reliable packaging solutions for heavy-duty and bulk items.

Food Service and Electronics sectors exhibited moderate growth, driven by the increasing use of sustainable packaging in takeaway services and the need for safe, recyclable packaging in electronics.

The Others category includes miscellaneous uses, such as retail and personal care packaging, contributing to the overall growth. Across all sectors, the trend toward reducing environmental impact and enhancing supply chain sustainability is expected to continue driving the adoption of molded pulp packaging.

Key Market Segments

By Source

- Wood Pulp

- Non-wood Pulp

By Molded Type

- Transfer

- Processed

- Thick Wall

- Thermoformed

By Product

- Trays

- End Caps

- Plates

- Bowls & Cups

- Clamshells

- Others

By End-use

- Food Packaging

- Healthcare

- Industrial

- Food Service

- Electronics

- Others

Drivers

Drivers of Molded Pulp Packaging Market Growth

The molded pulp packaging market is being driven by several key factors, with environmental concerns being a major contributor. As the demand for eco-friendly and sustainable packaging continues to rise, molded pulp stands out because it is biodegradable and recyclable, offering a cleaner alternative to plastic.

Growing consumer awareness of the environmental impact of plastic packaging has accelerated this shift, as both individuals and businesses seek greener alternatives. This shift is further fueled by stringent government regulations and policies aimed at reducing plastic waste.

Governments worldwide are implementing stricter rules that promote the use of sustainable packaging materials, which has spurred industries to adopt molded pulp for product packaging. With the increasing need to comply with environmental standards, companies are turning to molded pulp not only to meet regulatory requirements but also to align with consumer expectations for sustainability.

The combination of heightened environmental concerns, growing consumer awareness, and supportive government policies has positioned molded pulp packaging as a viable, sustainable option that is expected to continue gaining market share in the coming years.

Restraints

Key Restraints in the Molded Pulp Packaging Market

Molded pulp packaging is gaining traction as an eco-friendly alternative to plastic, but there are notable constraints that could impact its widespread adoption. One of the primary concerns is its limited durability compared to other packaging materials.

While molded pulp is biodegradable and recyclable, it may not offer the same level of strength and protection as plastic or rigid cardboard, making it less suitable for heavy-duty or high-risk applications.

Additionally, moisture sensitivity is another significant limitation. Molded pulp packaging is prone to absorbing moisture, which can weaken its structural integrity, particularly in humid environments. This can lead to a decrease in its ability to protect products, especially when used for items that require consistent dryness or protection against water damage.

These factors can limit the scope of molded pulp’s use in certain industries, such as food or electronics, where moisture exposure and product protection are critical.

Furthermore, the production of molded pulp requires significant energy and raw materials, which can undermine its sustainability credentials if not managed properly. These constraints create challenges for manufacturers aiming to meet both environmental and performance expectations, posing a barrier to the widespread shift toward molded pulp packaging solutions.

Growth Factors

Growth Opportunities in the Molded Pulp Packaging Market

The molded pulp packaging market is set to benefit from several key growth opportunities in the coming years. Rapid urbanization and rising consumer awareness in emerging markets, such as Asia-Pacific and Latin America, are driving demand for eco-friendly packaging solutions. With a growing middle class and an increasing preference for sustainable products, the market for molded pulp packaging is expected to expand significantly in these regions.

Partnerships with e-commerce giants and food delivery companies are also providing an important growth avenue. As online shopping continues to surge, these platforms require protective and sustainable packaging to meet environmental goals, boosting demand for molded pulp.

Moreover, the increasing adoption of circular economy models presents another significant opportunity. Consumers and businesses alike are focusing on reducing waste, leading to a growing demand for packaging that is reusable, recyclable, or compostable.

Molded pulp packaging, with its biodegradable properties, aligns well with this trend, offering a more sustainable alternative to plastic. These trends are expected to fuel the growth of molded pulp packaging solutions, making it an attractive segment for investment and innovation in the coming years.

Emerging Trends

Trending Factors in the Molded Pulp Packaging Market

The molded pulp packaging market is experiencing significant growth, driven by several key trends. First, the shift toward biodegradable packaging is reshaping the industry. More consumers and businesses are opting for fully biodegradable and compostable packaging to reduce environmental impact. This change is in line with the global push for sustainability and eco-friendly alternatives to traditional plastic.

Additionally, collaborations between molded pulp producers and recycled paper suppliers are becoming more common, as companies work together to ensure sustainable sourcing and reduce waste. These partnerships are crucial for advancing circular economy practices within the packaging sector. Another notable trend is the integration of smart packaging solutions.

By incorporating technologies like QR codes and NFC, molded pulp packaging is becoming more interactive, offering brands an opportunity to engage with consumers in innovative ways. This integration not only improves customer experiences but also enhances supply chain visibility and traceability.

Lastly, there is a growing emphasis on creating lightweight molded pulp packaging. This innovation is helping businesses reduce transportation costs and improve the practicality of shipping, without compromising on the protection or functionality of the packaging. These trends highlight the molded pulp packaging market’s potential to address consumer demand for sustainability, cost-effectiveness, and enhanced user interaction.

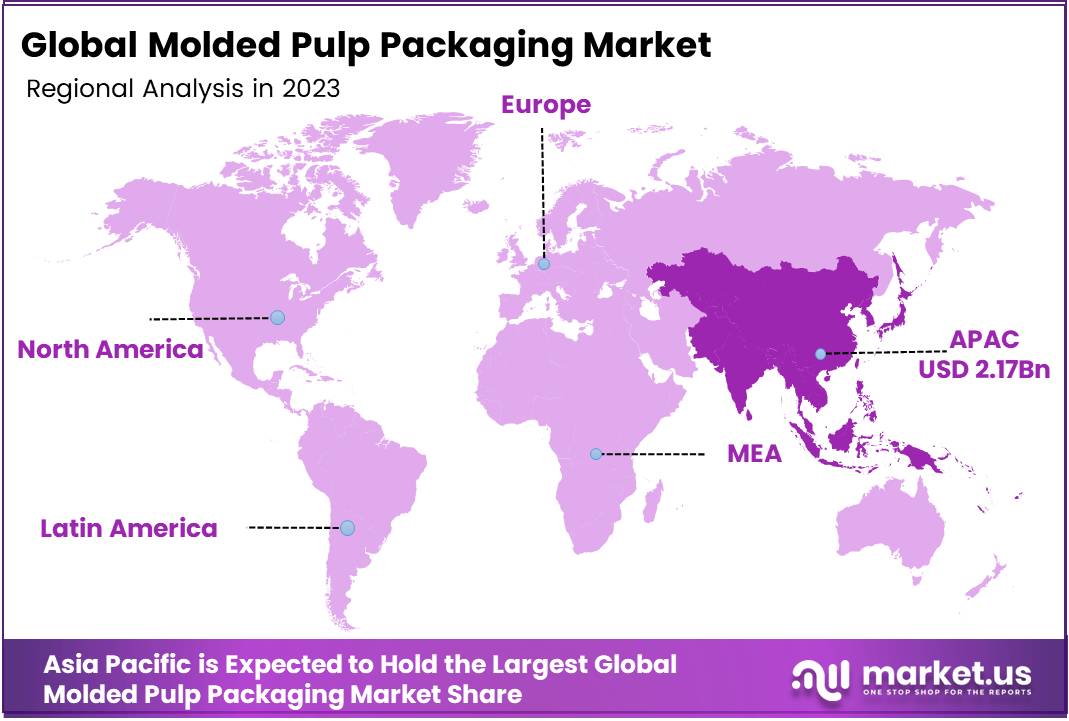

Regional Analysis

Asia Pacific Leading The Molded Pulp Packaging Market With 41.5% Market Share

The Molded Pulp Packaging Market is experiencing significant growth across various global regions, with the Asia Pacific region emerging as the dominant player. In 2023, Asia Pacific accounted for 41.5% of the global market share, valued at approximately USD 2.17 billion.

The demand for sustainable packaging solutions, driven by the growing awareness of environmental concerns, is particularly high in countries like China, India, and Japan, where there is a significant push toward reducing plastic usage.

Additionally, rapid industrialization and urbanization in this region have fostered the expansion of the e-commerce and food & beverage sectors, further driving the need for molded pulp packaging.

Regional Mentions:

North America, the second-largest market for molded pulp packaging, is expected to maintain steady growth due to increasing regulations around plastic waste and rising consumer preference for eco-friendly alternatives. The market in North America is primarily driven by the United States, which holds a major share of the market, owing to a robust packaging industry and high demand for sustainable products in sectors such as consumer electronics, healthcare, and food packaging.

Europe is another significant market, with countries like Germany, the UK, and France leading the adoption of molded pulp packaging. Stringent environmental regulations, such as the EU’s Circular Economy Action Plan, have fostered the use of biodegradable and recyclable materials in packaging. Europe is witnessing strong demand from industries like food & beverage, consumer goods, and electronics, where sustainable packaging solutions are increasingly prioritized.

In Latin America, there is a growing trend toward eco-conscious packaging solutions, with countries like Brazil and Mexico showing considerable demand. However, the market is relatively smaller compared to other regions. Middle East & Africa presents emerging opportunities, particularly in food packaging, though the market is still in its nascent stages due to economic challenges.

Key Regions and Countries covered іn thе rероrt

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The global molded pulp packaging market in 2023 continues to be shaped by the growth of sustainability-focused consumer demand and regulatory pressure for eco-friendly alternatives.

Among the prominent players in this market, companies such as Brodrene Hartmann A/S and Huhtamaki Oyj stand out due to their established market presence, extensive production capabilities, and focus on innovative, recyclable, and biodegradable solutions.

Brodrene Hartmann A/S, a leader in molded pulp production, has further solidified its position with strategic expansions and technological advancements in production efficiency, enabling it to cater to both food and non-food packaging sectors.

Huhtamaki Oyj, with its strong portfolio of sustainable packaging solutions, continues to drive the adoption of molded pulp in industries ranging from foodservice to consumer electronics.

Companies like Shandong Upmax Packaging Group Co., Ltd. and Pro-Pac Packaging Limited are increasing their market share through aggressive regional expansion and capacity enhancements. These firms leverage the growing demand from the Asia-Pacific and North American regions, respectively, which are witnessing heightened interest in eco-friendly packaging.

Key players such as Sabert Corporation and Genpak, LLC are tapping into niche markets by offering tailored molded pulp packaging for food products, particularly in the ready-to-eat and takeaway categories, where hygiene and sustainability are of paramount importance.

Additionally, emerging companies like MVI ECOPACK and Pton Molded Fiber Products Co., Ltd. are contributing to the competitive landscape with their focus on innovation and cost-effective production methods, further driving the market’s expansion.

These developments reflect an increasingly dynamic market where technological advancements, regional market demands, and sustainability trends will continue to influence competitive strategies in 2023 and beyond.

Top Key Players in the Market

- Brodrene Hartmann A/S

- Shandong Upmax Packaging Group Co., Ltd.

- Huain, Inc.

- Pro-Pac Packaging Limited

- Fabri-Kal

- Hentry Molded Products, Inc.

- Sabert Corporation

- HEFEI CRAFT TABLEWARE CO., LTD.

- Laizhou Guoliang Packing Products Co. Ltd

- Eco-Products, Inc.

- Pton Molded Fiber Products Co., Ltd

- Qingdao Xinya Molded Pulp Packaging Products Co., Ltd.

- MVI ECOPACK

- Huhtamako Oyj

- CKF Inc

- Thermoform Engineered Quality LLC

- Genpak, LLC

- Fuzhou Qiqi Paper Co., Ltd

Recent Developments

- In July 2023, Pulpex announced a significant investment to enable the creation of the world’s first commercial-scale production line for genuine paper bottles. These bottles are made of over 90% sustainably sourced fiber, representing a major step in sustainable packaging.

- In April 2024, Suzano Ventures invested up to US$5 million into Bioform Technologies to support the development of bio-based plastic alternatives. The partnership seeks to promote sustainable materials that can replace petroleum-based plastics.

- In October 2024, Mondi, a global leader in sustainable packaging and paper, completed a €95 million investment in its Świecie containerboard mill. This investment will enhance the mill’s capacity to produce environmentally friendly, recyclable packaging products.

- In October 2024, an expert panel at COP16 explored how USD 78 billion in investments can scale circular, next-generation supply chains for paper, packaging, and textiles. The discussion focused on creating sustainable systems that reduce waste and promote resource efficiency across industries.

- In November 2022, PulPac announced the closing of a €31 million private placement, led by Aliaxis, with additional participation from Stora Enso, Amcor Ventures, and Teseo Capital. This funding aims to accelerate PulPac’s development of sustainable packaging solutions and further enhance its manufacturing capabilities.

Report Scope

Report Features Description Market Value (2023) USD 5.3 Billion Forecast Revenue (2033) USD 10.9 Billion CAGR (2024-2033) 7.5% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Source (Wood Pulp, Non-wood Pulp), By Molded Type (Transfer, Processed, Thick Wall, Thermoformed), By Product (Trays, End Caps, Plates, Bowls and Cups, Clamshells, Others), By End-use (Food Packaging, Healthcare, Industrial, Food Service, Electronics, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Brodrene Hartmann A/S, Shandong Upmax Packaging Group Co., Ltd., Huain, Inc., Pro-Pac Packaging Limited, Fabri-Kal, Hentry Molded Products, Inc., Sabert Corporation, HEFEI CRAFT TABLEWARE CO., LTD., Laizhou Guoliang Packing Products Co. Ltd, Eco-Products, Inc., Pton Molded Fiber Products Co., Ltd, Qingdao Xinya Molded Pulp Packaging Products Co., Ltd., MVI ECOPACK, Huhtamako Oyj, CKF Inc, Thermoform Engineered Quality LLC, Genpak, LLC, Fuzhou Qiqi Paper Co., Ltd Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Molded Pulp Packaging MarketPublished date: Dec 2024add_shopping_cartBuy Now get_appDownload Sample

Molded Pulp Packaging MarketPublished date: Dec 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Brodrene Hartmann A/S

- Shandong Upmax Packaging Group Co., Ltd.

- Huain, Inc.

- Pro-Pac Packaging Limited

- Fabri-Kal

- Hentry Molded Products, Inc.

- Sabert Corporation

- HEFEI CRAFT TABLEWARE CO., LTD.

- Laizhou Guoliang Packing Products Co. Ltd

- Eco-Products, Inc.

- Pton Molded Fiber Products Co., Ltd

- Qingdao Xinya Molded Pulp Packaging Products Co., Ltd.

- MVI ECOPACK

- Huhtamako Oyj

- CKF Inc

- Thermoform Engineered Quality LLC

- Genpak, LLC

- Fuzhou Qiqi Paper Co., Ltd