Global Bamboo Packaging Market By Packaging Type (Cups and Straws, Bottles and Jars, Boxes and Cartons, Clamshell, Tubes, Mailers, Others), By Pulp Type (Recycled Pulp, Virgin Pulp), By End Use (Foods and Beverages, Pharmaceuticals, Cosmetics and Personal Care, Electrical and Electronics, E-Commerce, Automotive, Agriculture), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec 2024

- Report ID: 134284

- Number of Pages: 345

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

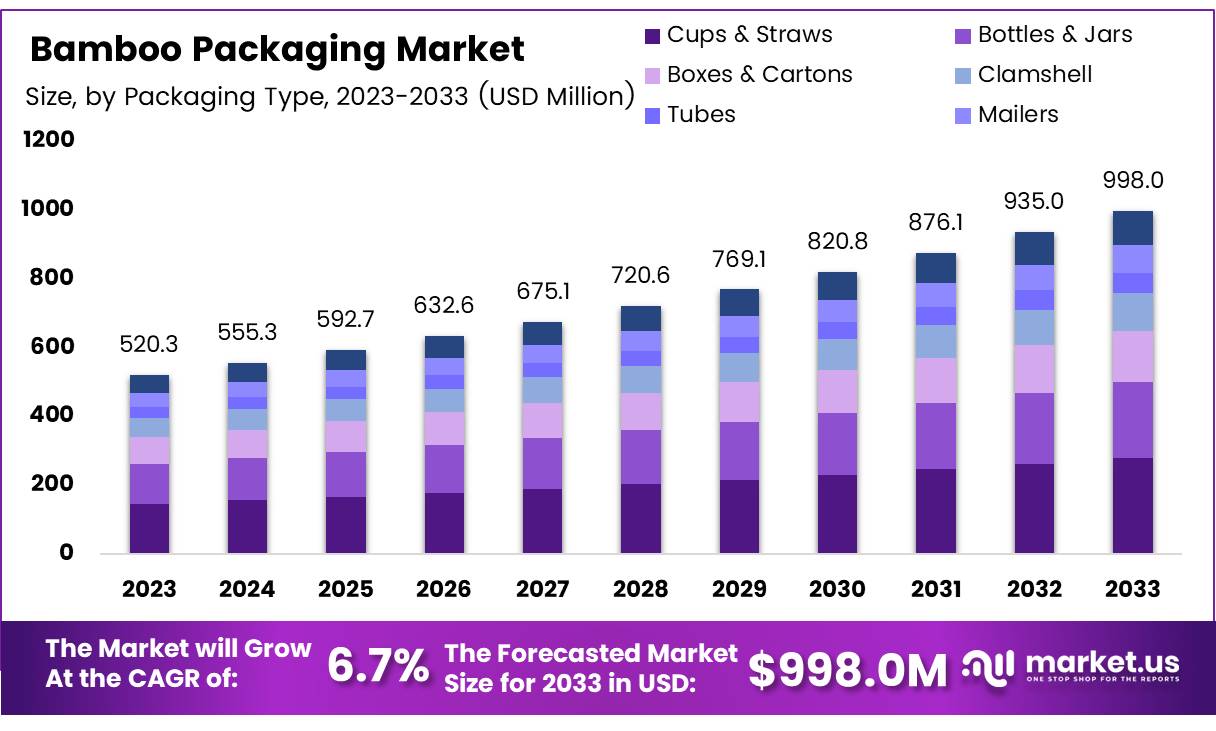

The Global Bamboo Packaging Market size is expected to be worth around USD 998.0 Million by 2033, from USD 520.3 Million in 2023, growing at a CAGR of 6.7% during the forecast period from 2024 to 2033.

Bamboo packaging refers to the use of bamboo as a sustainable material for producing packaging products. Unlike traditional packaging materials such as plastic or cardboard, bamboo is a rapidly renewable resource that offers a more eco-friendly alternative.

It is particularly valued for its strength, durability, and biodegradability, which makes it ideal for use in a variety of packaging applications, from food and beverage containers to shipping boxes and retail packaging.

The bamboo packaging market, a segment within the larger packaging industry, is experiencing rapid growth due to a shift in consumer behavior and heightened environmental concerns. As businesses face increasing pressure to reduce plastic waste and embrace more sustainable materials, bamboo has emerged as a popular alternative. The market encompasses a wide range of products, including single-use items, reusable containers, and innovative packaging solutions for e-commerce and retail.

The bamboo packaging market is witnessing significant growth, driven by several factors. Bamboo’s rapid growth rate up to 3 feet per day coupled with its ability to regenerate without the need for replanting, makes it an extremely attractive material for the packaging industry.

Bamboo forests are expanding at a rate of 3% annually, while the global rate of deforestation continues to decline. Bamboo’s ability to grow 20 times more timber per hectare than traditional trees, and its capacity to be harvested every 3-5 years, makes it a highly efficient and sustainable alternative for packaging solutions.

With the growing demand for sustainable packaging materials, bamboo is emerging as an attractive option for businesses in a variety of sectors, including food and beverage, cosmetics, and e-commerce. Manufacturers are increasingly looking for alternatives to single-use plastics, and bamboo provides a viable solution.

Furthermore, consumer preference for environmentally friendly products is driving the demand for bamboo packaging solutions. As the market for sustainable packaging grows, bamboo packaging is well-positioned to benefit from these shifts in consumer and business behavior.

Governments worldwide are increasingly investing in sustainable alternatives and introducing regulations that encourage the use of eco-friendly materials. Policies aimed at reducing plastic waste and promoting biodegradable packaging have created a favorable environment for bamboo packaging.

For instance, the European Union and several countries in Asia have implemented regulations that restrict the use of plastic packaging and encourage the use of renewable materials. These policies create a conducive market for bamboo packaging, making it more appealing to manufacturers and businesses seeking compliance with sustainability standards.

Furthermore, China, the world leader in bamboo production, plays a key role in the growth of the bamboo packaging market. With a 75% market share, China’s bamboo industry is worth approximately $78 million, and it continues to dominate both production and export.

As the largest producer and exporter of bamboo, China’s government has also supported the growth of the industry through investments in research and development and infrastructure, further boosting the availability and affordability of bamboo materials for packaging. This has led to a global increase in bamboo exports, making it easier for businesses around the world to access bamboo-based packaging solutions.

According to recent surveys, bamboo forests cover 22 million hectares globally, producing 15-20 million tons of timber annually. Southeast Asia, specifically China, is home to the largest bamboo forests, accounting for 80% of the world’s known bamboo species.

Bamboo’s rapid growth and high yield per hectare—20 times more timber than traditional trees—make it an efficient and sustainable resource for industries looking to reduce their environmental impact. As the bamboo industry continues to grow, its importance in global markets, including the bamboo packaging market, is expected to expand, offering new opportunities for companies focused on sustainability.

Key Takeaways

- The global bamboo packaging market is projected to reach USD 998.0 million by 2033, growing at a CAGR of 6.7% from 2024 to 2033.

- Recycled pulp dominated the pulp type segment in 2023, driven by sustainability and cost-effectiveness trends.

- Cups & straws led the packaging type segment in 2023, holding a 24.8% market share due to the demand for eco-friendly alternatives to plastic.

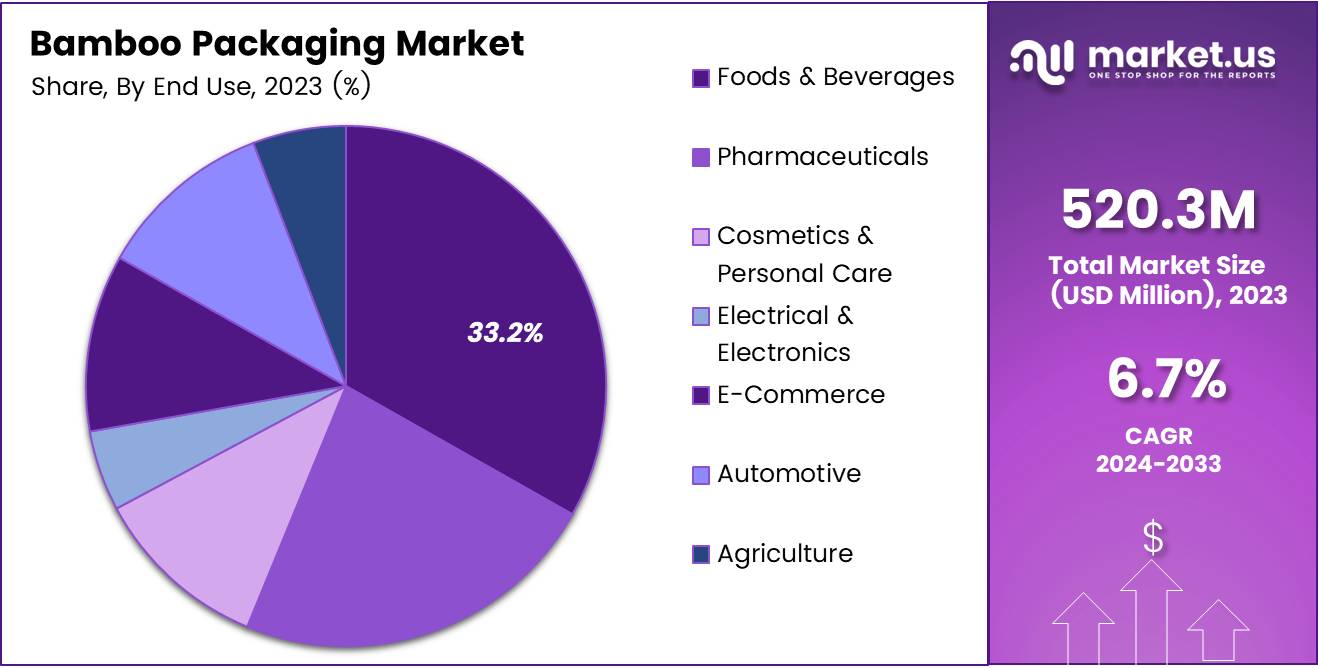

- The food and beverages sector held the largest share (33.2%) in the end-use segment in 2023, fueled by the rising demand for sustainable packaging.

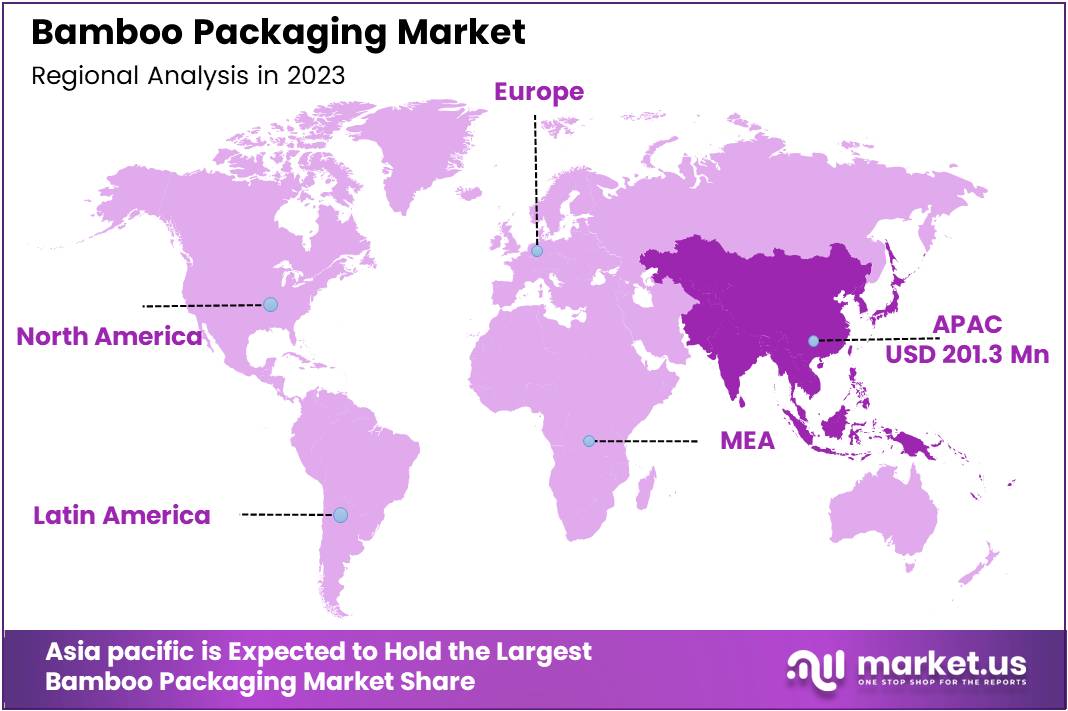

- Asia Pacific led the regional market with a 40% share, valued at USD 201.3 million, supported by abundant bamboo resources in China, India, and Indonesia.

Pulp Type Analysis

Recycled Pulp Dominates Bamboo Packaging Market’s Pulp Type Segment in 2023

In 2023, Recycled Pulp held a dominant market position in the By Pulp Type Analysis segment of the Bamboo Packaging Market, driven by its growing emphasis on sustainability and cost-effectiveness.

This pulp type, characterized by its use of post-consumer and post-industrial waste fibers, accounted for a significant share of the market due to increasing consumer demand for eco-friendly packaging solutions. Recycled pulp offers a more environmentally responsible alternative to virgin pulp, which aligns with global efforts to reduce deforestation and carbon footprints.

The preference for recycled pulp can also be attributed to its lower production cost compared to virgin pulp, making it an attractive option for manufacturers focused on operational efficiency. Additionally, recycled pulp supports the circular economy by reusing existing materials, thus reducing the need for new raw resources. As a result, recycled pulp is expected to continue to outperform virgin pulp in the near future, particularly as sustainability initiatives across industries intensify.

Virgin pulp, while still a key player in the market, is primarily utilized for higher-end packaging products where purity and strength are critical. However, its share in the bamboo packaging market is gradually declining as manufacturers shift toward more sustainable, recycled alternatives.

Packaging Type Analysis

Cups & Straws Leading with 24.8% Market Share in 2023

In 2023, Cups & Straws held a dominant market position in the By Packaging Type Analysis segment of the Bamboo Packaging Market, with a 24.8% share. This strong presence can be attributed to the growing consumer preference for eco-friendly alternatives to single-use plastic products. Bamboo, known for its sustainability, durability, and biodegradability, offers a viable solution for the foodservice industry, particularly in beverages and takeaway products.

Following Cups & Straws, Bottles & Jars emerged as a significant category, capturing a substantial portion of the market due to the increased demand for natural and sustainable packaging in the beverage and personal care sectors. Boxes & Cartons also contributed notably, driven by the rising trend of e-commerce and sustainable shipping practices.

Other packaging types, including Clamshell, Tubes, and Mailers, are steadily gaining traction, offering eco-friendly alternatives for food delivery, cosmetics, and shipping purposes. Additionally, Barrels, Crates, and Pallets cater to industrial applications, facilitating the movement of goods in a sustainable manner. The Others category, comprising items like bowls and plates, is also expanding, fueled by consumer demand for sustainable packaging in disposable foodservice products.

This diversified growth across packaging types reflects the increasing versatility of bamboo as a sustainable material in various industries.

End Use Analysis

Foods & Beverages Lead the Bamboo Packaging Market with a 33.2% Share in 2023

In 2023, the Foods & Beverages sector held a dominant market position in the By End Use Analysis segment of the Bamboo Packaging Market, commanding a 33.2% share. The growing demand for sustainable and eco-friendly packaging solutions in the food and beverage industry has significantly contributed to this trend.

As consumer preferences shift toward environmentally responsible products, bamboo packaging offers a renewable, biodegradable alternative to traditional plastic packaging. This shift is further driven by increasing regulations aimed at reducing plastic waste and the rising adoption of sustainability initiatives by leading food and beverage brands.

The Pharmaceuticals sector followed closely, with bamboo packaging gaining traction due to its antimicrobial properties and eco-friendly appeal. The Cosmetics & Personal Care segment also saw notable growth, as packaging sustainability becomes an essential factor in product differentiation.

Other sectors such as Electrical & Electronics, E-Commerce, Automotive, and Agriculture are gradually increasing their adoption of bamboo packaging, albeit at a slower pace. These industries are leveraging bamboo’s strength and versatility for protective packaging and lightweight solutions. However, the Foods & Beverages sector continues to lead, driven by heightened consumer awareness and an industry-wide push toward sustainable practices.

Key Market Segments

By Packaging Type

- Cups & Straws

- Bottles & Jars

- Boxes & Cartons

- Clamshell

- Tubes

- Mailers

- Others (Bowls, Plates, etc.)

By Pulp Type

- Recycled Pulp

- Virgin Pulp

By End Use

- Foods & Beverages

- Pharmaceuticals

- Cosmetics & Personal Care

- Electrical & Electronics

- E-Commerce

- Automotive

- Agriculture

Drivers

Key Drivers of Bamboo Packaging Market Growth

The bamboo packaging market has seen significant growth, primarily driven by the rising global awareness of sustainability. Consumers are increasingly seeking products that align with their environmental values, and as a result, demand for eco-friendly packaging solutions has surged.

Bamboo, being a renewable and biodegradable material, offers an attractive alternative to traditional plastic packaging. This shift toward sustainability is further supported by government regulations aimed at reducing plastic waste.

Several governments worldwide have introduced policies that restrict or ban plastic packaging, prompting manufacturers to seek viable alternatives like bamboo. In addition, concerns over the environmental impact of plastic pollution have heightened consumer preference for packaging materials that have a minimal ecological footprint.

Bamboo, with its rapid growth rate and minimal resource requirements, presents a sustainable solution that meets both consumer expectations and regulatory requirements. The rising demand for biodegradable packaging solutions, combined with these regulatory pressures and the increasing need for environmentally responsible products, has positioned bamboo packaging as a key player in the broader packaging industry.

This growing emphasis on reducing plastic use and adopting more sustainable materials is expected to continue driving the bamboo packaging market in the coming years, as businesses seek to improve their sustainability credentials and meet the preferences of environmentally conscious consumers.

Restraints

Key Restraints in the Bamboo Packaging Market

The bamboo packaging market faces several challenges that may hinder its widespread adoption. One of the main issues is the limited supply of bamboo in certain regions, which can restrict the material’s availability and scalability for packaging applications.

While bamboo grows rapidly in some areas, its cultivation and harvesting are still concentrated in specific geographies, making it difficult to meet global demand consistently. This limited supply may lead to fluctuations in pricing and availability, which could be a significant barrier for businesses relying on bamboo-based solutions.

Additionally, high production costs remain a concern. Although bamboo is considered a sustainable alternative to plastics and paper, the production and processing of bamboo into packaging material often require specialized equipment and labor, raising costs.

The initial setup costs for bamboo packaging production can be higher than for conventional materials like plastic or paper, which may make it less attractive for manufacturers, especially in regions where cost competitiveness is crucial. These factors could slow the adoption of bamboo packaging, particularly among companies that prioritize lower-cost options over sustainability.

Therefore, while bamboo presents a promising alternative to conventional packaging materials, the supply and cost challenges must be addressed for it to reach its full potential in the global market.

Growth Factors

Growth Opportunities in Bamboo Packaging Market

The bamboo packaging market is positioned for substantial growth due to various emerging opportunities. One of the most promising areas is the expansion into emerging markets, particularly in developing economies, where the shift toward sustainability is becoming more pronounced.

As environmental awareness rises, businesses in these regions are increasingly looking for eco-friendly alternatives to traditional plastic packaging, creating a demand for bamboo-based solutions.

Additionally, the food industry presents a significant opportunity for bamboo packaging, as it aligns with the growing consumer preference for sustainable and biodegradable materials. Bamboo packaging offers durability and versatility, making it ideal for food products while supporting eco-conscious brands.

Another potential area for growth is the adoption of bamboo packaging in luxury markets. Bamboo’s premium and natural appearance appeals to high-end brands seeking unique and sustainable packaging options for their products. This trend opens a new niche for bamboo packaging suppliers to cater to luxury goods.

Finally, partnerships with e-commerce platforms present a valuable opportunity. As e-commerce continues to thrive, online retailers are increasingly exploring eco-friendly packaging alternatives to meet the demands of environmentally aware consumers. Bamboo packaging suppliers are well-positioned to collaborate with these e-commerce giants, offering sustainable solutions that align with the platforms’ sustainability goals.

These growth areas, driven by both consumer demand and regulatory pressures, provide significant opportunities for players in the bamboo packaging market to expand their reach and capture new market segments.

Emerging Trends

Rising Popularity of Bamboo in Sustainable Packaging Solutions

The bamboo packaging market is experiencing significant growth, driven by several emerging trends. A prominent factor is the increasing demand for minimalist packaging designs, which align well with bamboo’s natural aesthetic. Companies are seeking eco-friendly alternatives that reflect simplicity and sustainability, making bamboo a favored choice.

Additionally, there is a global shift towards plastic-free packaging solutions, as businesses and consumers alike prioritize sustainability. Bamboo, being a biodegradable material, offers an attractive option for brands looking to eliminate plastic from their supply chains. This push is further supported by growing environmental awareness and regulatory pressure to reduce plastic waste.

Bamboo’s potential as a substitute for plastic bottles is also gaining traction, particularly in the beverage industry. Brands are replacing single-use plastic bottles with bamboo-based alternatives, which are not only environmentally friendly but also present a unique selling point for eco-conscious consumers.

Furthermore, the integration of smart packaging technologies with bamboo, such as QR codes or NFC (Near Field Communication) tags, is becoming increasingly popular. This trend allows companies to enhance customer engagement while maintaining sustainability in their packaging.

These factors collectively indicate that bamboo packaging is not only a passing trend but is becoming a key player in the global shift towards more sustainable, eco-friendly packaging solutions.

Regional Analysis

Asia Pacific Dominates Bamboo Packaging Market, Accounting for 40% Share Worth USD 201.3 Million

The bamboo packaging market exhibits diverse regional growth trends, with Asia Pacific emerging as the dominant region. Asia Pacific holds a commanding share of the market, accounting for 40%, valued at USD 201.3 Million. This dominance can be attributed to the region’s abundant bamboo resources, particularly in countries such as China, India, and Indonesia, where bamboo is cultivated extensively.

The growing demand for sustainable packaging solutions, coupled with favorable government policies and regulations promoting eco-friendly materials, contributes to the significant market share. Moreover, the strong presence of key manufacturers and industries like food and beverage, cosmetics, and consumer goods in the region further supports its growth.

Regional Mentions:

In North America, the demand for sustainable packaging has been steadily rising, driven by increasing consumer awareness and regulatory changes. Companies in the United States and Canada are adopting bamboo packaging as part of their commitment to reducing plastic waste, contributing to a positive market outlook.

Europe is experiencing robust growth, led by countries such as Germany, France, and the UK, where sustainability initiatives and bans on single-use plastics are fueling the demand for alternatives like bamboo packaging. The European market is further supported by government policies favoring eco-friendly materials.

The Middle East & Africa and Latin America represent emerging markets in the bamboo packaging sector. While the adoption of bamboo packaging is still in its nascent stages, growing awareness of environmental issues and increasing demand for sustainable alternatives provide substantial growth opportunities in these regions in the long term.

However, these markets are currently trailing behind North America, Europe, and Asia Pacific in terms of market share and adoption rates.

Key Regions and Countries covered іn thе rероrt

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The global bamboo packaging market in 2023 is characterized by the active participation of several key players who are driving innovation, sustainability, and growth within the industry. These companies leverage bamboo’s eco-friendly attributes, positioning themselves to capitalize on the rising demand for sustainable alternatives to traditional plastic packaging.

NCD Corporation and Meysher Industrial Group are prominent contributors to the bamboo packaging segment, known for their strong production capabilities and commitment to environmentally sustainable products. Their focus on offering both custom and standardized bamboo packaging solutions has enabled them to secure significant market shares in various regions.

Bloom Eco Packaging Co. Ltd., Golden Arrow, Inc., and OtaraPack represent other critical players who are setting trends in the development of biodegradable packaging alternatives. These companies emphasize innovation, with Golden Arrow specializing in sustainable bamboo-based materials for food and beverage packaging, while OtaraPack has been expanding its reach in e-commerce and consumer goods packaging segments.

Regional players such as APackaging Group, Kinghome, and RyPax are notable for their regional dominance, focusing on the production of high-quality bamboo containers for different industries, including cosmetics, food, and healthcare. Their strategy revolves around leveraging local supply chains and advancing the use of bamboo as a sustainable packaging option.

Ningbo Gidea Packaging Co., Ltd. and Lomei Cosmetics Ent. Co., Ltd. stand out with their focus on cosmetics packaging, an emerging trend driven by increased consumer demand for sustainable and natural products. Companies like Jarsking Group and Zhejiang Pando EP Technology Co., Ltd. are increasingly leveraging technology to enhance production efficiency and further push the adoption of bamboo-based solutions.

Top Key Players in the Market

- NCD Corporation

- Meysher Industrial Group

- Bloom Eco Packaging Co. Ltd.

- Golden Arrow, Inc.

- OtaraPack

- APackaging Group

- Oceans Republic Company Limited

- APC PACKAGING

- Kinghome

- RyPax

- Ningbo Gidea Packaging Co., Ltd.

- Lomei Cosmetics Ent. Co., Ltd.

- Jarsking Group

- Zhejiang Pando EP Technology Co., Ltd

- Three Bamboo

Recent Developments

- In November 2023, sustainable packaging manufacturer Fibmold secured $10 million in funding from investors Omnivore and Accel. This capital injection will support the company’s expansion of its eco-friendly packaging solutions, aimed at reducing the environmental impact of traditional packaging materials and advancing its position in the growing sustainable packaging market.

- In February 2023, Hive Energy acquired a 50% stake in BambooLogic, a company specializing in industrial-scale bamboo plantations. This strategic acquisition is expected to enhance Hive Energy’s renewable energy portfolio by leveraging bamboo’s potential as a sustainable raw material for bioenergy and carbon offset initiatives.

Report Scope

Report Features Description Market Value (2023) USD 520.3 Million Forecast Revenue (2033) USD 998.0 Million CAGR (2024-2033) 6.7% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Packaging Type (Cups and Straws, Bottles and Jars, Boxes and Cartons, Clamshell, Tubes, Mailers, Others), By Pulp Type (Recycled Pulp, Virgin Pulp), By End Use (Foods and Beverages, Pharmaceuticals, Cosmetics and Personal Care, Electrical and Electronics, E-Commerce, Automotive, Agriculture) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape NCD Corporation, Meysher Industrial Group, Bloom Eco Packaging Co. Ltd., Golden Arrow, Inc., OtaraPack, APackaging Group, Oceans Republic Company Limited, APC PACKAGING, Kinghome, RyPax, Ningbo Gidea Packaging Co., Ltd., Lomei Cosmetics Ent. Co., Ltd., Jarsking Group, Zhejiang Pando EP Technology Co., Ltd, Three Bamboo Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- NCD Corporation

- Meysher Industrial Group

- Bloom Eco Packaging Co. Ltd.

- Golden Arrow, Inc.

- OtaraPack

- APackaging Group

- Oceans Republic Company Limited

- APC PACKAGING

- Kinghome

- RyPax

- Ningbo Gidea Packaging Co., Ltd.

- Lomei Cosmetics Ent. Co., Ltd.

- Jarsking Group

- Zhejiang Pando EP Technology Co., Ltd

- Three Bamboo