Outdoor Furniture Market By Product (Seating Sets, Loungers, Dining Sets, Chairs, Table, Others), By Material Type (Wood, Plastic, Metal, Textile, Others), By End Use (Commercial, Residential), By Distribution Channels (Home Centers, Flagship Stores, Specialty Stores, Online, Others), By Region, and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2025

- Report ID: 12173

- Number of Pages: 314

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

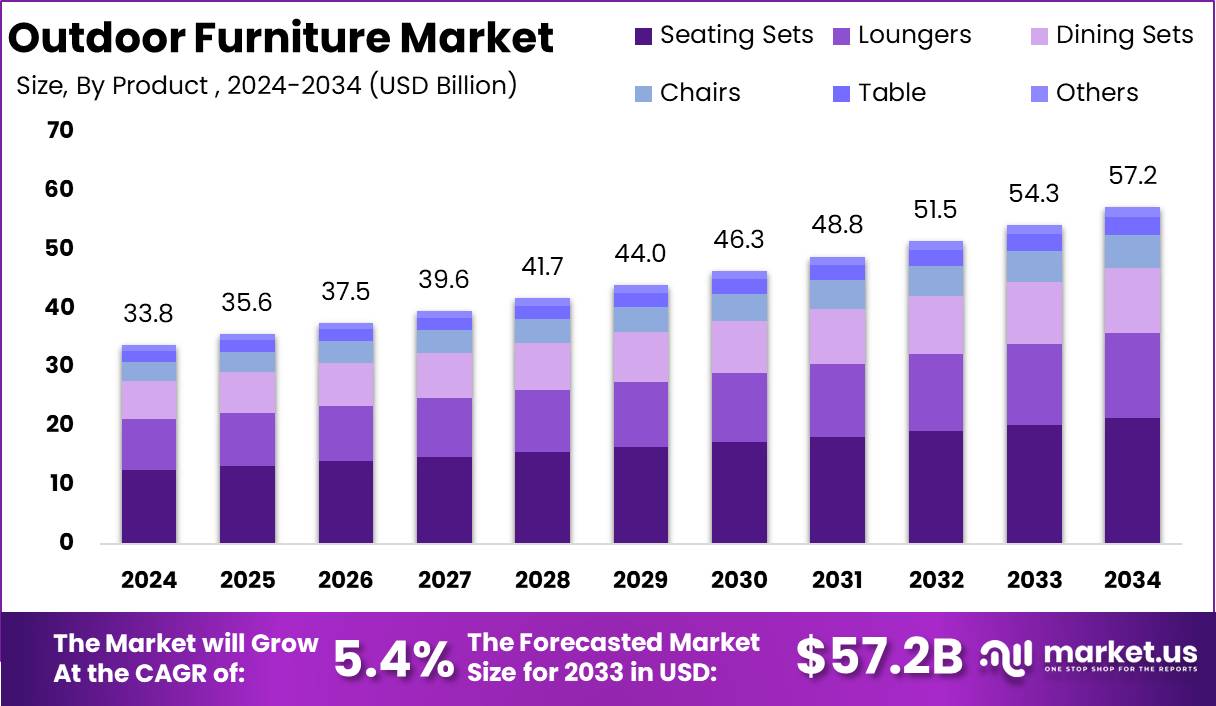

The Global Outdoor Furniture Market size is expected to be worth around USD 57.2 Billion by 2034, from USD 33.8 Billion in 2024, growing at a CAGR of 5.4% during the forecast period from 2025 to 2034.

Outdoor furniture refers to furniture designed specifically for outdoor use, including items such as patio chairs, tables, lounges, benches, and storage units. These products are made from durable materials like weather-resistant wood, metal, plastic, or wicker to withstand varying outdoor conditions like rain, sun, and humidity.

Outdoor furniture serves both functional and aesthetic purposes, providing comfortable and stylish solutions for spaces like gardens, balconies, patios, and poolside areas. The primary goal of outdoor furniture is to enhance the outdoor living experience, offering comfort, convenience, and style for relaxation or entertaining.

The outdoor furniture market encompasses the production, distribution, and retail of furniture specifically designed for use in exterior environments. This market includes a wide range of products, from seating solutions like armchairs and lounges to tables, storage options, and accessories such as cushions and umbrellas.

The market is segmented by product type, material (e.g., wood, metal, plastic), end-use (residential, commercial), and geographical regions. Over the years, the market has evolved with trends in design, functionality, and sustainability, driven by consumer demand for more personalized and durable outdoor solutions. It is also influenced by broader consumer lifestyle shifts toward outdoor living and sustainable practices.

The growth of the outdoor furniture market is primarily driven by increasing consumer interest in enhancing their outdoor living spaces. As urbanization and homeownership rise, more individuals are investing in their outdoor environments to create relaxing and social settings.

According to Civil, 53% of consumers primarily eat at the dining room or kitchen table, highlighting the importance of versatile, space-saving furniture solutions that cater to multifunctional home settings. Additionally, 30% of consumers opt to eat on the couch, while 17% prefer their beds, underscoring the growing demand for comfort-driven outdoor furniture.

Notably, 31% of buyers are willing to exceed their budget if they find the perfect item, with 84% preferring to purchase new furniture. Outdoor furniture’s appeal is further underscored by the 81% of consumers prioritizing quality when making their purchases. With 30% of consumers seeking new couches and 27% abandoning purchases due to high shipping costs, the market is evolving towards higher expectations of value and accessibility.

According to ComfyLiving, the outdoor furniture sector is experiencing significant expansion, supported by brands like IKEA, which offers a vast product range of 9,500 items. The company’s largest market, Germany, represents 15.6% of its retail sales, followed by the U.S. (12.2%), France (7.9%), the U.K. (6.2%), and China (4.8%). IKEA’s environmental initiatives, aiming for climate positivity within 10 years, are shaping consumer purchasing decisions in favor of sustainable options.

Key Takeaways

- The global outdoor furniture market is projected to grow from USD 33.8 billion in 2024 to over USD 57.2 billion by 2034, expanding at a CAGR of 5.4%.

- Seating Sets lead the market with a dominant share of 37.4% in 2024, driven by growing demand for comfortable, stylish outdoor living spaces.

- Wood remains the dominant material in the outdoor furniture market, capturing 42.3% of the market share in 2024 due to its timeless appeal and durability.

- Residential outdoor furniture holds the largest market share at 63.4% in 2024, fueled by increasing investments in home outdoor spaces.

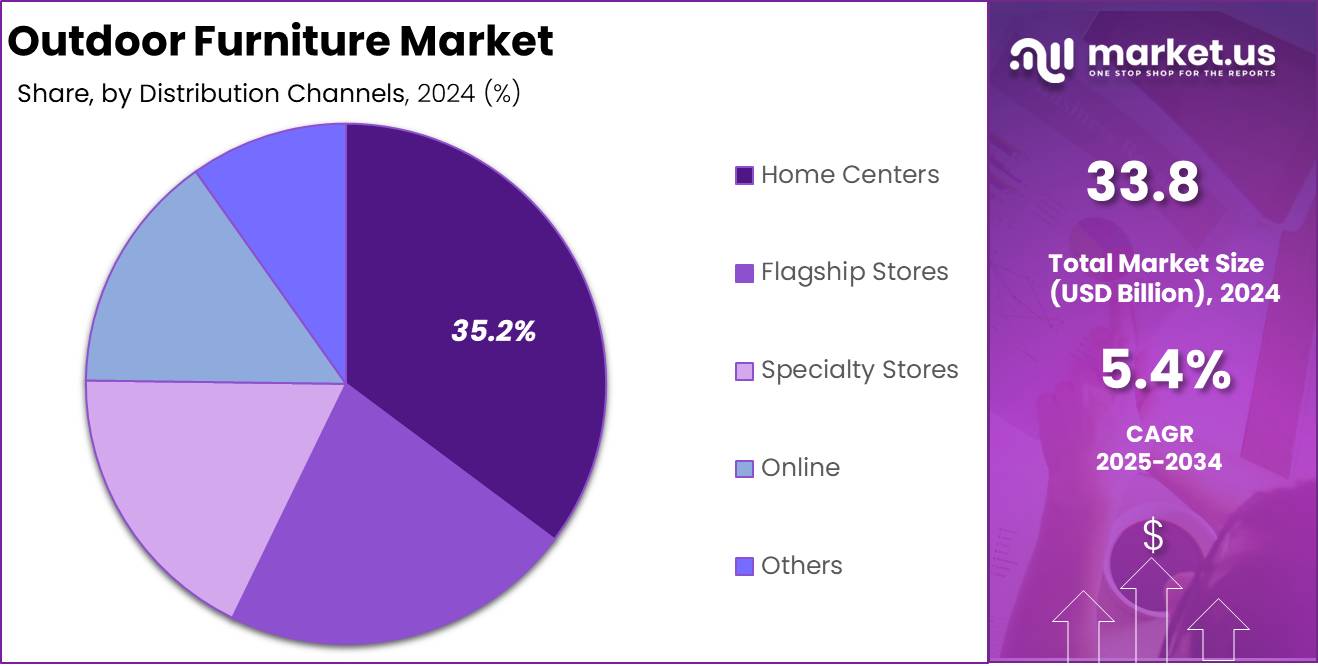

- Home Centers dominate distribution channels with a 35.2% market share in 2024, offering wide product availability and competitive pricing.

- Asia Pacific leads the outdoor furniture market with a substantial 43.6% share in 2024, driven by rapid urbanization and a growing middle class.

By Product Analysis

In 2024, Seating Sets dominate the Outdoor Furniture Market, capturing more than 37.4% market share.

Seating sets lead the outdoor furniture market, accounting for 37.4% of the total share in 2024. These sets, including sofas, sectionals, and modular units, are highly popular for their comfort and functionality. The growing trend of outdoor gatherings and the desire for stylish, comfortable outdoor spaces have driven their strong performance. As the demand for outdoor living continues to rise, seating sets are expected to maintain their dominant position.

Loungers follow closely, designed for relaxation and increasingly popular for use by pools, patios, and gardens. The rise in wellness trends and outdoor leisure activities has made loungers a key segment in the market, with steady growth expected.

Dining sets are essential for alfresco dining. As outdoor meals and gatherings become more common, dining sets comprising tables and chairs are in high demand. Their versatile designs continue to attract consumers seeking to enhance their outdoor spaces.

Chairs are another popular category. They are versatile, from lounge chairs to dining chairs, and offer essential seating for outdoor environments. While they have a smaller share compared to other segments, their demand remains steady.

Tables include coffee tables and dining tables. Though their share is smaller, they are a crucial complement to seating and dining arrangements. As outdoor spaces continue to evolve, the demand for tables remains consistent.

Other products, such as accessories, swings, and storage solutions, enhance outdoor living spaces and are gaining popularity as consumers seek unique and personalized outdoor solutions.

By Material Type Analysis

In 2024, Wood dominate the Outdoor Furniture Market, capturing more than 42.3% market share.

In 2024, Wood held a dominant market position in the Outdoor Furniture sector by material type, capturing 42.3% of the total market share. Its natural look, durability, and timeless appeal continue to make wood the preferred choice for outdoor furniture. Furthermore, the growing consumer preference for eco-friendly and sustainable products has fueled wood’s popularity, making it a key material in this space.

Plastic benefits from its lightweight, cost-effective, and low-maintenance properties. Plastic outdoor furniture is highly weather-resistant and available in a variety of designs and colors, which makes it a popular option for both residential and commercial outdoor spaces. The rise of recycled plastic options has also helped improve its environmental footprint.

Metal materials, such as aluminum and steel, are known for their durability, modern aesthetic, and resistance to rust. Although heavier than plastic, metal furniture’s longevity and sleek designs make it a staple in both high-end and casual outdoor settings.

Textile materials are primarily used in cushions, upholstery, and covers. With the demand for comfort and style in outdoor spaces rising, textiles like Sunbrella fabric, which are resistant to UV rays and mildew, are growing in popularity. This segment is particularly important for enhancing the aesthetic appeal and comfort of outdoor living areas.

The Others segment, which includes materials like rattan, wicker, and composite materials, caters to niche consumer preferences for unique, high-end, or artisanal outdoor furniture designs, adding diversity to the overall market.

By End Use Analysis

In 2024, Residential dominate the Outdoor Furniture Market, capturing more than 63.4% market share.

In 2024, Residential outdoor furniture held a dominant market position by end use, capturing more than 63.4% of the total market share. The strong demand for outdoor furniture in residential settings is driven by the increasing trend of creating functional and aesthetically pleasing outdoor living spaces. Homeowners are investing in patios, gardens, and balconies, seeking comfortable, durable, and stylish furniture to enhance their outdoor experiences. This growth is further supported by the popularity of outdoor entertaining and the desire for private, relaxing outdoor environments.

The Commercial outdoor furniture segment is seeing strong growth as businesses, hotels, restaurants, and other public spaces invest in quality outdoor furniture. With the rise of outdoor dining, leisure areas, and public events, commercial outdoor furniture is essential for creating inviting and functional spaces. Durability and low maintenance are key factors driving demand in the commercial sector, as businesses need furniture that can withstand high traffic and varying weather conditions.

By Distribution Channels Analysis

In 2024, Home Centers dominate the Outdoor Furniture Market, capturing more than 35.2% market share.

In 2024, Home Centers captured a dominant market position in the Outdoor Furniture market by distribution channel, holding more than 35.2% of the total market share. Home centers, such as large retailers and warehouse stores, continue to be the primary destination for consumers seeking outdoor furniture.

Their wide variety of products, competitive pricing, and convenience in terms of availability and location contribute to their strong market position. Customers often prefer home centers for one-stop shopping, where they can find everything from furniture to gardening tools and accessories.

Flagship Stores are gaining popularity as premium destinations for high-quality outdoor furniture. These stores, often owned by major brands, provide consumers with an exclusive shopping experience. Flagship stores typically offer a curated selection of outdoor furniture, allowing customers to explore high-end designs, customized options, and expert guidance.

Specialty Stores focus on specific product categories such as outdoor living, garden furniture, or home decor, offering specialized knowledge and products tailored to specific customer needs. They are particularly popular among consumers looking for unique designs, eco-friendly options, or niche products not typically found in mass-market retailers.

Online sales are expected to continue growing as consumers increasingly turn to e-commerce for their outdoor furniture needs. The convenience of shopping from home, the ability to compare prices, and access to a wide range of brands and products are key drivers behind the rise of online retail.

The Others category includes smaller distribution channels like direct-to-consumer sales, catalog sales, and independent retailers. While these channels represent a smaller share of the market, they provide unique sales models and personalized customer service that appeal to certain consumer segments.

Key Market Segments

By Product

- Seating Sets

- Loungers

- Dining Sets

- Chairs

- Table

- Others

By Material Type

- Wood

- Plastic

- Metal

- Textile

- Others

By End Use

- Commercial

- Residential

By Distribution Channels

- Home Centers

- Flagship Stores

- Specialty Stores

- Online

- Others

Driver

Growing Demand for Outdoor Living Spaces

The increasing popularity of outdoor living spaces has been a key driver in the growth of the global outdoor furniture market. As people seek to create more comfortable and functional outdoor environments, there is an increased demand for high-quality outdoor furniture. This trend is particularly noticeable in regions where favorable weather conditions encourage year-round outdoor living, such as North America and Europe.

Homeowners are increasingly investing in patios, balconies, gardens, and other outdoor areas, transforming them into extensions of their living spaces. This demand is spurred by a growing desire to spend more time in nature, entertain outdoors, or simply relax in an open-air environment.

In response, manufacturers are focusing on creating furniture that is both aesthetically pleasing and highly functional. With the rising interest in creating a seamless transition between indoor and outdoor living areas, outdoor furniture has evolved to mirror the design trends of indoor pieces. Materials have also improved, with a focus on durability and weather resistance, making outdoor furniture not just attractive but also long-lasting.

The shift towards more sustainable living has also pushed for the development of eco-friendly outdoor furniture, further driving the demand for innovative solutions. As more consumers seek to personalize their outdoor spaces, the market for premium, customized outdoor furniture continues to grow, contributing to the overall expansion of the outdoor furniture sector.

Restraint

High Cost of Premium Outdoor Furniture

While the demand for outdoor furniture is rising, one of the significant restraints on market growth is the high cost associated with premium outdoor furniture. Consumers increasingly desire high-quality materials such as teak, wrought iron, and synthetic rattan, which, while durable and aesthetically appealing, come at a premium price.

Additionally, advanced features like ergonomic design, weather-resistant finishes, and customizations add to the overall cost of outdoor furniture. These higher price points may deter price-sensitive consumers, limiting market penetration in lower-income segments and emerging markets.

Moreover, the initial investment required for outdoor furniture can be substantial, especially when outfitting larger outdoor spaces. As a result, many consumers opt for more affordable alternatives made from less durable materials or choose to invest in their indoor furniture instead. This price sensitivity affects demand, particularly in regions with less disposable income.

Furthermore, the cost of raw materials and shipping has been volatile, adding to production costs, which can ultimately lead to higher retail prices. Despite the increasing demand for luxury outdoor furniture, this cost barrier remains a significant restraint on the broader market’s growth, limiting accessibility for a significant portion of potential customers.

Opportunity

Eco-Friendly and Sustainable Outdoor Furniture

One of the most significant opportunities in the global outdoor furniture market lies in the growing demand for eco-friendly and sustainable furniture options. As environmental awareness continues to rise, consumers are increasingly seeking products that align with their values, favoring materials that are either recyclable, biodegradable, or sourced responsibly.

This shift is encouraging manufacturers to innovate and design furniture made from sustainable materials such as reclaimed wood, recycled plastics, and organic textiles. Brands that focus on sustainability can capitalize on this trend, differentiating themselves in a crowded market by offering products that are not only stylish but also environmentally responsible.

The opportunity is particularly strong in markets where consumers are becoming more conscious of their environmental impact. For example, in Europe and North America, the demand for sustainable outdoor furniture is growing rapidly, as more people prioritize reducing their carbon footprint. Companies that can offer durable, eco-friendly products at competitive prices have a clear market advantage.

Additionally, the circular economy, which focuses on reusing and recycling materials, is providing new pathways for innovation in outdoor furniture design. As more consumers opt for sustainable alternatives, businesses that embrace these principles will not only meet growing demand but also contribute to the long-term health of the industry and the planet, making sustainability a key opportunity for growth in the outdoor furniture market.

Trends

Integration of Technology in Outdoor Furniture

A significant trend shaping the future of the outdoor furniture market is the integration of technology into outdoor furniture designs. With the rise of smart homes and connected devices, consumers are increasingly looking for furniture that offers more than just aesthetic value.

Outdoor furniture is now being equipped with features such as built-in speakers, charging ports, LED lighting, and even heating and cooling systems. These innovations allow outdoor spaces to become more functional, comfortable, and tech-savvy, catering to the evolving needs of modern consumers.

The incorporation of technology into outdoor furniture reflects broader lifestyle changes, where convenience and connectivity are key. For example, smart outdoor furniture can create an enhanced experience for consumers by integrating with home automation systems, allowing users to control lighting, music, and climate from their smartphones. Additionally, innovations like solar-powered outdoor lighting or furniture with integrated wireless charging pads cater to the increasing demand for energy efficiency and sustainability.

These technological advancements are not only attracting tech-savvy consumers but are also making outdoor spaces more versatile, driving the market forward. As technology continues to evolve, the integration of smart features into outdoor furniture is expected to become a dominant trend, contributing significantly to the growth of the outdoor furniture market in the coming years.

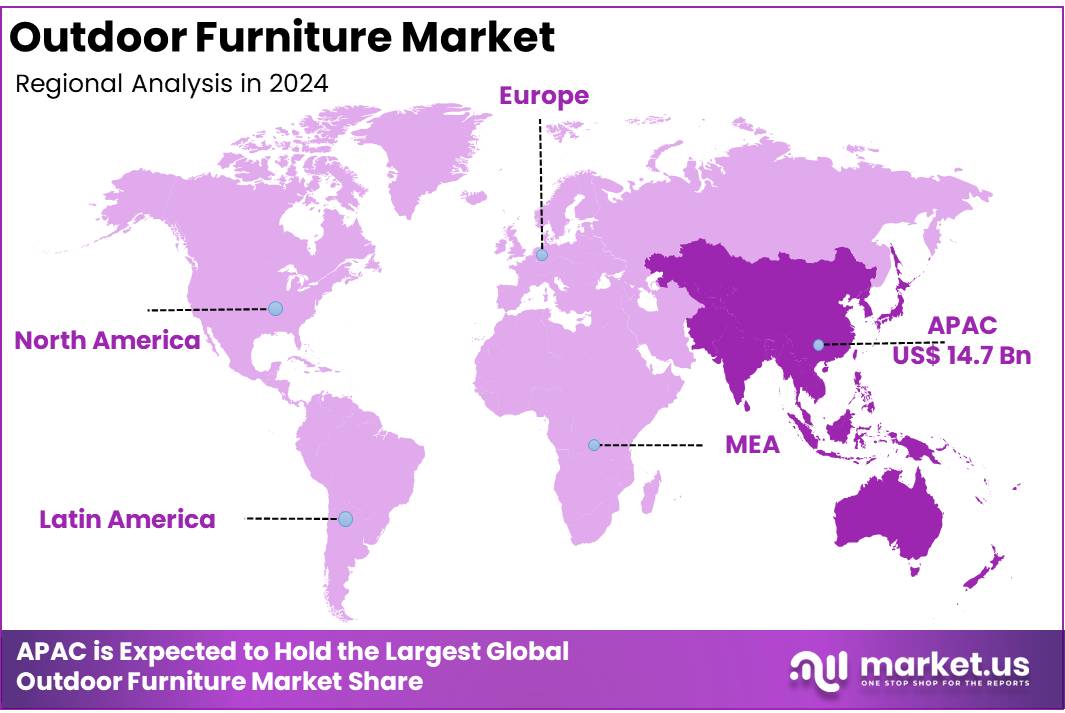

Regional Analysis

Asia Pacific Dominates the Outdoor Furniture Market with 43.6% Market Share in 2024

The global outdoor furniture market is experiencing dynamic growth, with significant regional variations in demand and market share. In 2024, Asia Pacific dominates the market, accounting for 43.6% of the total market share, valued at approximately USD 14.7 billion. The region’s large share can be attributed to the rapidly expanding middle class, increasing disposable income, and growing interest in outdoor leisure activities.

North America holds the second-largest market share in the outdoor furniture industry. The U.S. leads this market, driven by high demand for premium and eco-friendly outdoor furniture products. The North American market is characterized by an established outdoor living culture, particularly in suburban areas, and a growing preference for multifunctional and durable furniture options.

Europe follows as another key player in the outdoor furniture market. The region benefits from a strong tradition of outdoor living, with countries such as Germany, France, and Italy showing steady demand. Factors such as increasing consumer interest in home and garden décor, along with a growing awareness of sustainability, are driving market growth in Europe.

The Middle East & Africa (MEA) region represents a smaller, but steadily growing portion of the market. The region’s demand for outdoor furniture is influenced by its climate and rising interest in luxury outdoor living spaces, especially in high-income countries such as the UAE and Saudi Arabia. The market here is primarily driven by affluent consumers seeking high-end, durable products.

Latin America, while smaller compared to other regions, also shows promise with growing demand for outdoor furniture driven by urban expansion and rising living standards, particularly in Brazil and Mexico.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- United Arab Emirates

Key Players Analysis

In 2024, key players in the global outdoor furniture market continue to shape the landscape with innovative designs, sustainable materials, and diverse product offerings. Adams Manufacturing, known for its high-quality resin furniture, leads in providing weather-resistant and maintenance-free products, capitalizing on consumer demand for durability and convenience.

Similarly, Agio International Company Limited and Article blend traditional craftsmanship with contemporary style, positioning themselves as top choices for upscale outdoor living solutions. Leading furniture giant Ashley Furniture Industries Inc. has expanded its reach by combining comfort and style, offering both modern and classic outdoor collections.

In the premium sector, Brown Jordan and Dedon GmbH stand out with their luxury outdoor furniture, emphasizing artistry and exclusivity. Brands like Fermob USA and Gloster Furniture are also garnering attention for their eco-friendly products and cutting-edge designs.

IKEA and Inter IKEA Group are shifting market dynamics by making outdoor furniture more accessible, functional, and sustainable, catering to a broader audience with affordable yet stylish offerings. Polywood LLC and Keter Group are driving the eco-conscious trend, producing furniture made from recycled materials, addressing both aesthetic appeal and environmental concerns.

Companies such as Kingsley Bate and Lloyd Flanders, Inc. emphasize superior craftsmanship, offering high-end, handcrafted outdoor pieces. Meanwhile, brands like SunWest and TUUCI cater to niche markets with customizable and highly durable umbrellas and shading solutions. The competition remains fierce as players continue to innovate, meet evolving consumer preferences, and commit to sustainability, ensuring the global outdoor furniture market’s strong growth trajectory.

Top Key Players in the Market

- Adams Manufacturing

- Agio International Company Limited

- Article

- Ashley Furniture Industries Inc.

- Aura Global Outdoor Furniture

- Barbeques Galore

- Brown Jordan

- Burrow Inc.

- Century Outdoor Furniture LLC.

- Dedon GmbH

- Ebel Inc.

- Fermob USA, Inc.

- Gloster Furniture

- Grandin Road

- Homecrest Outdoor Living LLC

- IKEA, Inc.

- Inter IKEA Group

- Keter Group

- Kimball International Inc.

- Kingsley Bate

- Lloyd Flanders, Inc.

- Polywood LLC

- Sifas USA

- Sunset West

- Terra Outdoor Living

- TUUCI

- Woodard Furniture

Recent Developments

- In 2024, Herman Miller introduced a new bamboo-based material for its Eames Lounge Chair and Ottoman. This eco-friendly innovation underscores the company’s dedication to sustainability, a priority since its founder, D.J. De Pree, emphasized environmental responsibility in 1953. The bamboo upholstery, known for its durability, scratch resistance, and colorfastness, enhances the chair’s luxury appeal while remaining in line with the brand’s commitment to using innovative materials.

- In 2024, RH (NYSE: RH) launched its latest catalog, the 2024 Outdoor Sourcebook, featuring a collection of over 40 new outdoor furniture designs. Crafted from premium materials like teak and aluminum, this range showcases high-end outdoor living solutions from top designers. Available through RH’s website and immersive showrooms across North America and Europe, the catalog offers a curated selection for those seeking elegant outdoor furnishings.

- In 2024, Wayfair Inc. (NYSE: W) reported positive results for its third quarter, despite ongoing challenges in the market. The company demonstrated strong resilience and continued growth, capturing additional market share while maintaining control over costs. With a focus on improving profitability, Wayfair aims to deliver sustainable long-term growth by balancing operational efficiencies and strategic investments.

- In 2024, Twin Star Home expanded its outdoor furniture portfolio by acquiring Grand Basket, a company specializing in hand-woven wicker furniture. This acquisition enhances Twin Star’s presence in the outdoor living space and complements its previous acquisitions, strengthening its e-commerce-driven platform across North America. Twin Star’s move reflects its ongoing strategy to grow its outdoor offerings and leadership in the home furnishings market.

Report Scope

Report Features Description Market Value (2024) USD 33.8 billion Forecast Revenue (2034) USD 57.2 billion CAGR (2025-2034) 5.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Seating Sets, Loungers, Dining Sets, Chairs, Table, Others), By Material Type (Wood, Plastic, Metal, Textile, Others), By End Use (Commercial, Residential), By Distribution Channels (Home Centers, Flagship Stores, Specialty Stores, Online, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Adams Manufacturing, Agio International Company Limited, Article, Ashley Furniture Industries Inc. , Aura Global Outdoor Furniture, Barbeques Galore, Brown Jordan, Burrow Inc., Century Outdoor Furniture LLC., Dedon GmbH, Ebel Inc., Fermob USA, Inc., Gloster Furniture, Grandin Road, Homecrest Outdoor Living LLC, IKEA, Inc., Inter IKEA Group, Keter Group, Kimball International Inc., Kingsley Bate, Lloyd Flanders, Inc., Polywood LLC, Sifas USA, Sunset West, Terra Outdoor Living, TUUCI, Woodard Furniture Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Adams Manufacturing

- Agio International Company Limited

- Article

- Ashley Furniture Industries Inc.

- Aura Global Outdoor Furniture

- Barbeques Galore

- Brown Jordan

- Burrow Inc.

- Century Outdoor Furniture LLC.

- Dedon GmbH

- Ebel Inc.

- Fermob USA, Inc.

- Gloster Furniture

- Grandin Road

- Homecrest Outdoor Living LLC

- IKEA, Inc.

- Inter IKEA Group

- Keter Group

- Kimball International Inc.

- Kingsley Bate

- Lloyd Flanders, Inc.

- Polywood LLC

- Sifas USA

- Sunset West

- Terra Outdoor Living

- TUUCI

- Woodard Furniture