Global Furniture Rental Market By Product (Bed, Sofa and Couch, Table and Desks, Chairs and Stools, Wardrobe and Dressers, Others), By Material (Wood, Metal, Plastic, Glass, Others), By Application (Residential, Commercial), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2025

- Report ID: 137137

- Number of Pages: 283

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

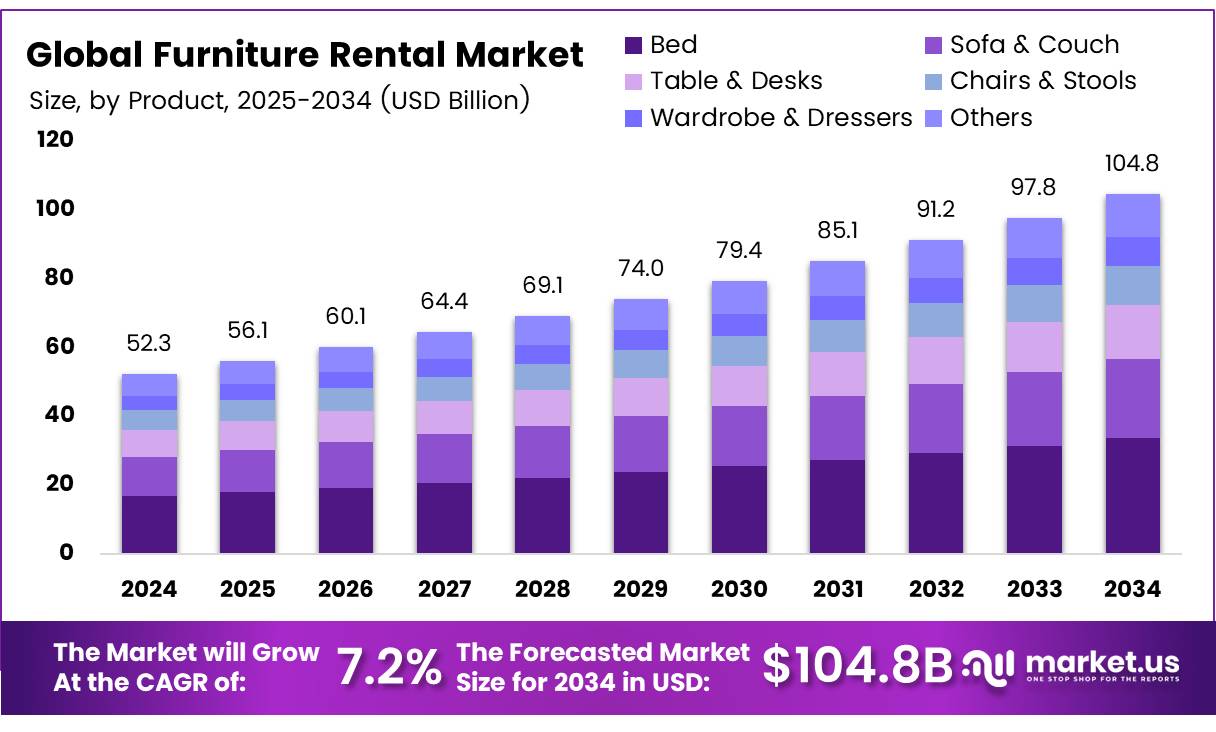

The Global Furniture Rental Market size is expected to be worth around USD 104.8 Billion by 2034, from USD 52.3 Billion in 2024, growing at a CAGR of 7.2% during the forecast period from 2025 to 2034.

Furniture rental refers to the practice of leasing furniture instead of purchasing it outright, typically for residential or commercial purposes. This model allows individuals and businesses to acquire high-quality furniture for a set period at a fraction of the cost of buying new items.

Furniture rental services provide flexibility, convenience, and cost efficiency, as customers can choose from a wide range of styles and furniture pieces to meet their needs.

This service has gained significant traction due to the growing demand for temporary solutions, such as relocating for work or short-term residential leases, where ownership is not necessary. The customer simply rents the furniture for a predefined period, after which it can either be returned, exchanged, or purchased.

The furniture rental market has evolved to cater to both individuals and businesses seeking flexible, affordable solutions for outfitting homes or office spaces. The market is characterized by services that typically include delivery, setup, maintenance, and even pick-up at the end of the rental term.

The growing demand for temporary housing, such as student housing, corporate apartments, and vacation rentals, has also contributed to the market’s expansion. Moreover, furniture rental services are increasingly seen as a sustainable and cost-effective alternative to traditional furniture purchasing, especially with the rise of eco-conscious consumers.

The furniture rental market has experienced steady growth, driven by changing consumer preferences toward flexibility and sustainability. As per Study, around 35% of consumers across different age groups report buying second-hand goods, reflecting a larger shift toward rental and reuse models.

Additionally, Steadily reports that long-term furnished rental rates can be approximately 15-20% higher than unfurnished properties, indicating a growing willingness to invest in fully furnished solutions, which often include rental furniture options.

There is considerable growth potential in the market, especially in developing regions where disposable incomes are increasing, and the trend of renting over owning is gaining popularity. According to Key vendors, over 80% of regular furniture customers would consider transitioning to renting furniture, a statistic that underscores the shifting consumer mindset towards rental services.

The government’s role in this growth is also important, particularly in terms of creating regulations that support rental services while promoting environmental sustainability.

Governments worldwide are beginning to recognize the role of circular economies and rental models in reducing waste, contributing to the push for investment in the sector. However, as this market expands, regulatory frameworks regarding rental agreements, maintenance standards, and consumer protection will need to evolve to protect both businesses and customers.

Key Takeaways

- The global Furniture Rental Market is projected to reach USD 104.8 billion by 2034, growing at a CAGR of 7.2% from 2025 to 2034.

- Beds dominated the Furniture Rental Market in 2023, accounting for 31.4% of the market share due to demand for flexible housing solutions.

- Wood-led the Furniture Rental Market by material in 2023 with a 38.9% share, driven by its durability and versatility.

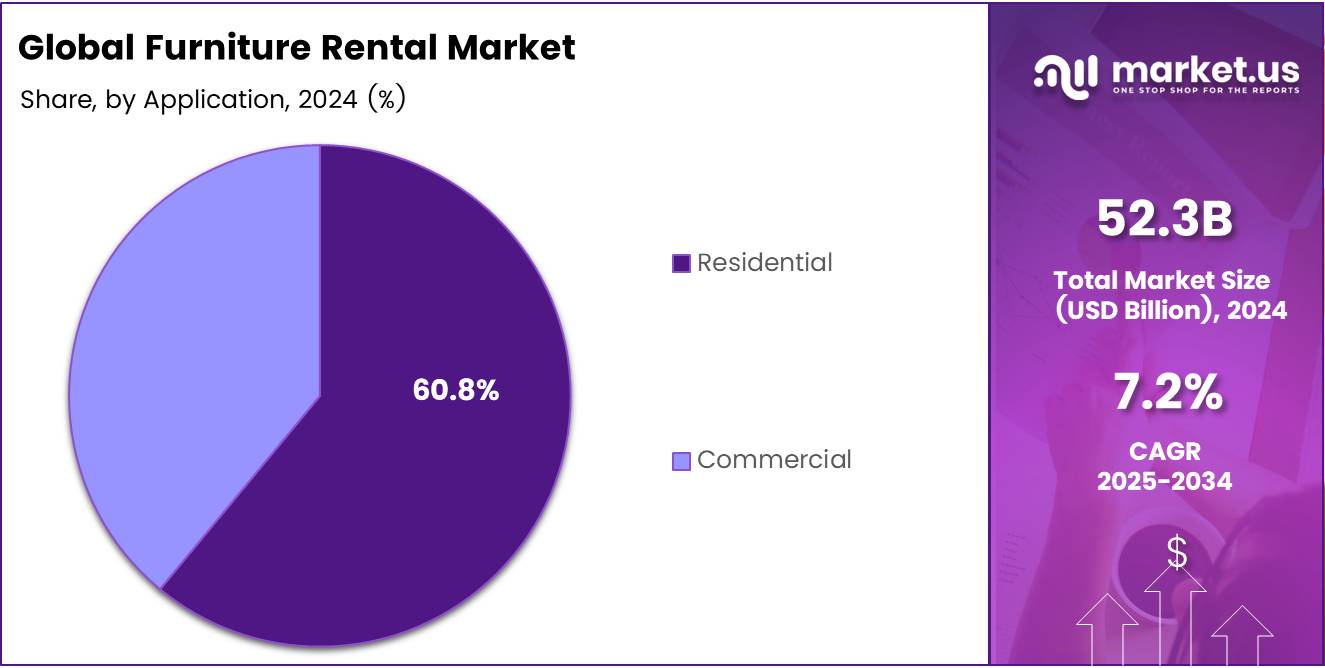

- The Residential segment held 60.8% of the Furniture Rental Market in 2023, influenced by urbanization and increased demand for flexible living.

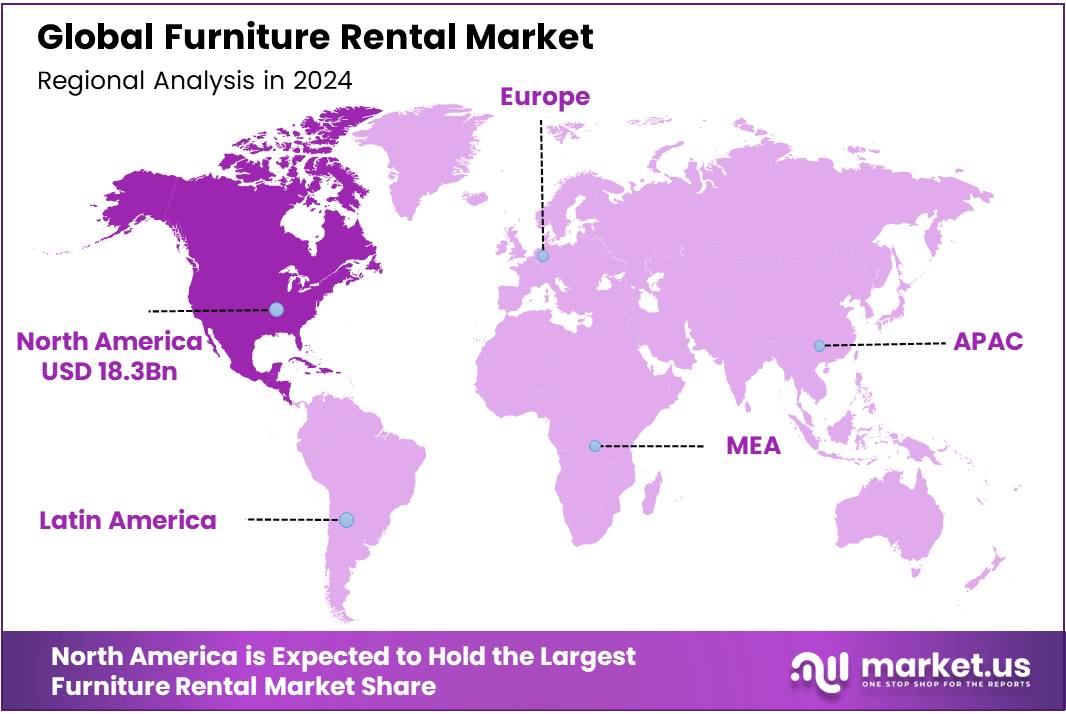

- North America held 35.3% of the Furniture Rental Market in 2023, valued at USD 18.3 billion, driven by demand for temporary housing solutions.

Product Analysis

Bed Leads Furniture Rental Market in 2023 with 31.4% Share in Product Segment

In 2023, Bed held a dominant market position in the By Product Analysis segment of the Furniture Rental Market, capturing a significant 31.4% share. This can be attributed to the growing demand for flexible living arrangements and short-term housing solutions, particularly among millennials and transient professionals.

Beds are essential items in any living space, making them a primary rental option for customers seeking convenience and cost-effective solutions.

Following beds, Sofa & Couch rentals accounted for a substantial share of the market. With an increasing number of consumers opting for comfortable yet temporary furnishings, sofas and couches have become a vital part of the rental market, holding a noteworthy percentage in the overall product mix.

Table & Desks, while slightly lower in market share, remain a critical segment for the growing remote workforce. As more people transition to hybrid or home-based working arrangements, the need for ergonomic and functional office furniture has propelled the demand for rental desks and tables.

Chairs & Stools and Wardrobe & Dressers follow closely in demand, driven by both short-term housing needs and long-term rentals for offices. Other furniture items, including accessories like lamps and rugs, make up the remaining share, although their contribution remains more limited in comparison to the primary furniture categories.

Material Analysis

Wood Leads Furniture Rental Market with 38.9% Share in 2023

In 2023, wood held a dominant market position in the By Material Analysis segment of the furniture rental market, with a 38.9% share. The preference for wood in furniture rental can be attributed to its versatility, durability, and timeless appeal.

Wood furniture is commonly chosen for both residential and commercial spaces due to its aesthetic value and ability to blend with various interior design themes. Additionally, the relatively lower maintenance requirements and long lifespan of wood furniture contribute to its continued demand in rental offerings.

Metal furniture, holding the second-largest share, accounted for a significant portion of the market, valued for its modern, industrial look and robustness. Metal furniture is commonly used in commercial rentals due to its strength and ease of maintenance.

Plastic furniture, although accounting for a smaller share, has seen growth in specific rental niches, particularly for events and short-term use. Its lightweight, cost-effective nature makes it a popular choice for temporary setups.

Glass and other materials, while less prominent in the market, contribute to the overall diversification of the furniture rental sector, providing specialized solutions for high-end or unique rental demands. The growing trend toward eco-friendly materials and sustainable production practices further influences material preferences in this market.

Application Analysis

Residential Segment Dominates Furniture Rental Market with 60.8% Share in 2023

In 2023, the Residential segment held a dominant market position in the By Application Analysis category of the Furniture Rental Market, with a significant share of 60.8%. This dominance can be attributed to increasing urbanization, the growing number of renters, and the rising demand for flexible living arrangements.

With more individuals opting for rental housing, particularly in major cities, the need for cost-effective, temporary furniture solutions has surged. Additionally, millennials and Gen Z, who prioritize mobility and are less likely to invest in permanent furniture, have contributed to the growth of this segment.

The Commercial segment, while growing steadily, accounted for the remaining share in 2023. Businesses across various industries, including hospitality, real estate, and office spaces, are increasingly turning to furniture rental services for cost-efficiency and flexibility.

This shift is particularly evident in the growing demand for rental furniture in temporary office setups, co-working spaces, and hospitality establishments, where flexibility and adaptability to changing needs are critical.

The growing trend of renting rather than owning, driven by convenience and financial considerations, is expected to fuel further growth in both segments. However, the Residential segment is likely to continue its dominance due to the substantial volume of renters in the global housing market.

Key Market Segments

By Product

- Bed

- Sofa & Couch

- Table & Desks

- Chairs & Stools

- Wardrobe & Dressers

- Others

By Material

- Wood

- Metal

- Plastic

- Glass

- Others

By Application

- Residential

- Commercial

Drivers

Urbanization, Cost Savings, and Changing Lifestyles Drive Furniture Rental Demand

The growing trend of urbanization and migration is a major driver for the furniture rental market. As more individuals move to metropolitan areas for work, studies, or career opportunities, the demand for flexible and temporary housing solutions increases. Renting furniture allows people to move into homes or apartments without the burden of buying, transporting, or assembling large pieces of furniture.

Additionally, renting is often a more cost-effective option, particularly for those with short-term housing needs, such as students, young professionals, or businesses looking to furnish temporary spaces. This affordability factor makes renting more attractive compared to the high upfront costs of purchasing new furniture. Changing consumer lifestyles are also contributing to the growth of the market.

With the increasing popularity of minimalism, sustainability, and convenience, more individuals prefer renting furniture as it aligns with their desire for less commitment and environmental consciousness. Renting provides access to quality furniture without the long-term responsibility of ownership, allowing consumers to switch out items as their needs evolve.

Furthermore, the rise in short-term residential leases, including apartments and co-living spaces, further drives the demand for flexible furniture solutions. These spaces often require temporary furniture arrangements that can be easily adjusted or upgraded. As these trends continue to gain momentum, the furniture rental market is expected to experience sustained growth, meeting the evolving needs of urban dwellers and businesses alike.

Restraints

High Costs and Limited Variety Can Hold Back Growth

The furniture rental market faces several challenges that may limit its growth potential. One key restraint is the high delivery and maintenance costs associated with renting furniture. These costs can significantly impact the overall pricing structure, making it less attractive for price-sensitive consumers.

Delivering, assembling, and maintaining rental furniture often require additional logistical efforts, which can result in higher service fees. This might discourage potential customers who are comparing the cost-effectiveness of renting versus purchasing furniture outright. Additionally, the limited variety of furniture available for rent is another factor that could impede market growth.

Unlike purchasing, where customers have access to a wide range of styles, designs, and brands, rental companies often offer a more restricted selection. This limitation can be particularly challenging for customers who have specific tastes or need furniture that matches particular aesthetic preferences.

As a result, some customers may choose to purchase furniture rather than rent, preferring the greater flexibility in selection and personalization offered by the retail market. These factors—high service costs and a limited range of choices—can create barriers for the furniture rental market to reach a broader customer base, especially when competing against traditional furniture sales channels.

Growth Factors

Growth Opportunities in the Furniture Rental Market Driven by Flexibility, Sustainability, and Innovation

The furniture rental market is poised for significant expansion, driven by several key growth opportunities. As urbanization accelerates in developing countries, new geographic regions offer substantial potential for market growth. Entering these emerging markets allows companies to cater to an increasing demand for affordable and flexible furniture solutions.

Additionally, subscription-based rental models are becoming increasingly attractive, offering residential and commercial customers flexible options that align with changing lifestyle needs. These models can foster customer loyalty by offering convenience and affordability. Sustainability initiatives also present a strong growth avenue.

With growing awareness of environmental impact, consumers are increasingly opting for eco-friendly solutions, such as furniture rental, which reduces waste and supports a circular economy. This trend aligns with shifting consumer values, particularly among younger, eco-conscious buyers.

Further, penetrating the corporate market provides an opportunity to serve businesses seeking cost-effective office furniture solutions, creating another robust revenue stream.

Finally, integrating smart furniture rentals, which incorporate IoT technology for enhanced functionality, can capture the attention of tech-savvy consumers looking for modern, connected living spaces.

By capitalizing on these opportunities, the furniture rental market is well-positioned for growth, as both consumer demand and market dynamics continue to evolve in favor of flexible, sustainable, and tech-driven solutions.

Emerging Trends

Furniture Rental Market Growth Driven by Customization, Premium Options, and Flexibility

The furniture rental market is undergoing significant transformation due to various emerging trends. One notable trend is the increased use of technology, particularly augmented reality (AR) and virtual reality (VR), which allow customers to visualize furniture in their own spaces before making a decision.

This has made online furniture rental services more interactive and user-friendly, enhancing the customer experience. Customizable rental packages are also on the rise, enabling customers to mix and match furniture styles, which provides more personalized options.

Additionally, the demand for premium and designer furniture rentals is expanding, especially among younger, affluent consumers seeking access to high-end, luxury items without the long-term commitment of purchasing them. This shift is driven by changing attitudes towards ownership and a preference for temporary, yet high-quality, goods. Flexible subscription models have also gained traction, offering rental services on a monthly or quarterly basis.

These models appeal to consumers looking for convenience and adaptability, as they can update or change their furniture based on their evolving needs or tastes. Together, these factors contribute to the growing attractiveness of the furniture rental market, providing consumers with greater flexibility, luxury, and customization options, while also supporting sustainable consumption patterns.

Regional Analysis

North America Leads Furniture Rental Market with 35.3% Share and USD 18.3 Billion Value Driven by Demand for Flexible Living Solutions

The global furniture rental market is experiencing significant growth, with regional dynamics playing a key role in shaping the industry’s landscape.

North America dominates the market, holding a substantial share of 35.3%, valued at USD 18.3 billion. This dominance is driven by a combination of factors such as the increasing demand for flexible living arrangements, especially in urban areas, and the rising popularity of temporary housing solutions among professionals, students, and relocating individuals.

The U.S., in particular, remains the central driver of this growth, supported by a well-developed real estate sector and a high rate of corporate relocations, which increases the demand for rental furniture. Additionally, the growing trend of sustainability and eco-consciousness among consumers in North America has further fueled the market’s expansion.

Regional Mentions:

Europe is another significant market, with growing adoption of furniture rental services driven by factors such as transient professional populations, student mobility, and the rising cost of home ownership. Major markets within Europe, including the U.K. and Germany, are experiencing strong growth, as rental models become increasingly popular for both residential and commercial purposes.

In the Asia Pacific region, rapid urbanization, increasing disposable incomes, and the rise of temporary housing demand are contributing to substantial market growth. Countries such as China, India, and Japan are witnessing rising interest in renting furniture as millennials and young professionals seek more affordable and flexible living solutions.

Latin America and Middle East & Africa (MEA) regions are also emerging as growing markets for furniture rental services. Increasing urban migration, the expansion of temporary expatriate populations, and a greater emphasis on flexible housing arrangements are driving the market’s development in these regions. However, their market share remains comparatively smaller than North America and Europe.

Overall, North America remains the dominating region, yet the Asia Pacific region is poised for rapid growth, with a substantial rise in demand expected over the next few years.

Key Regions and Countries covered іn thе rероrt

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The global furniture rental market has experienced notable growth in recent years, with key players driving innovation and shaping competitive dynamics. Among these, companies such as Furlenco, Rentomojo, Brook Furniture Rental, and Feather have emerged as significant contributors to the market’s expansion in 2023.

Furlenco continues to lead the Indian market with its wide array of offerings, targeting urban millennials and young professionals. The company’s flexible rental plans, coupled with a robust online platform, have positioned it as a key player in the rapidly expanding market in South Asia.

Rentomojo capitalizes on demand from consumers seeking short-term solutions, offering a diverse portfolio that includes furniture, appliances, and electronics, thus expanding its market share.

Brook Furniture Rental and Rent-A-Center remain dominant, leveraging long-established reputations and extensive distribution networks. Rent-A-Center, in particular, benefits from its large footprint and extensive customer base, providing flexible rent-to-own options that appeal to a broad demographic.

Emerging players such as Feather and Luxe Modern Rentals are further reshaping the market by offering premium, design-forward furniture options aimed at affluent renters. These companies have seen growing demand from the luxury segment, particularly among urban professionals seeking modern, high-quality living spaces on a temporary basis.

The market is also witnessing a shift toward sustainability, with companies like Fernished Inc. and The Everest embracing eco-friendly materials and circular business models, appealing to environmentally conscious consumers.

Top Key Players in the Market

- Furlenco

- The Everest

- Fashion Furniture Rental

- Feather

- Fernished Inc.

- Athoor

- Rentomojo

- Brook Furniture Rental

- Rent-A-Center

- Luxe Modern Rentals

Recent Developments

- In February 2024, Rentomojo secured $25 million in funding, led by Edelweiss, to strengthen its position in the furniture rental market and expand its offerings across India. The investment is aimed at scaling up operations and enhancing customer experience through technology-driven solutions.

- In August 2023, Royaloak Furniture announced plans to invest ₹400 crore for expansion, focusing on increasing its production capacity and enhancing its retail network across the country. The investment will also support the company’s efforts to introduce innovative designs and improve customer reach.

- In December 2024, Wooden Street raised ₹354 crore in its Series C funding round, led by Premji Invest, to further accelerate its growth in the online furniture market. The funds will be utilized to enhance its technology infrastructure, expand its product offerings, and strengthen its position in the competitive e-commerce landscape.

- In December 2023, Regency Front made a significant investment of 6 million euros to establish a new furniture production line in Europe. This move is expected to increase the company’s manufacturing capabilities and support its expansion into new international markets.

Report Scope

Report Features Description Market Value (2023) USD 52.3 Billion Forecast Revenue (2033) USD 104.8 Billion CAGR (2024-2033) 7.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Bed, Sofa and Couch, Table and Desks, Chairs and Stools, Wardrobe and Dressers, Others), By Material (Wood, Metal, Plastic, Glass, Others), By Application (Residential, Commercial) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Furlenco, The Everest, Fashion Furniture Rental, Feather, Fernished Inc., Athoor, Rentomojo, Brook Furniture Rental, Rent-A-Center, Luxe Modern Rentals Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Furlenco

- The Everest

- Fashion Furniture Rental

- Feather

- Fernished Inc.

- Athoor

- Rentomojo

- Brook Furniture Rental

- Rent-A-Center

- Luxe Modern Rentals