Global Vacation Rental Market By Accommodation Type (Home, Apartments, Resort and Condominium, Others), By Booking Mode (Offline, Online), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec 2024

- Report ID: 135210

- Number of Pages: 352

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

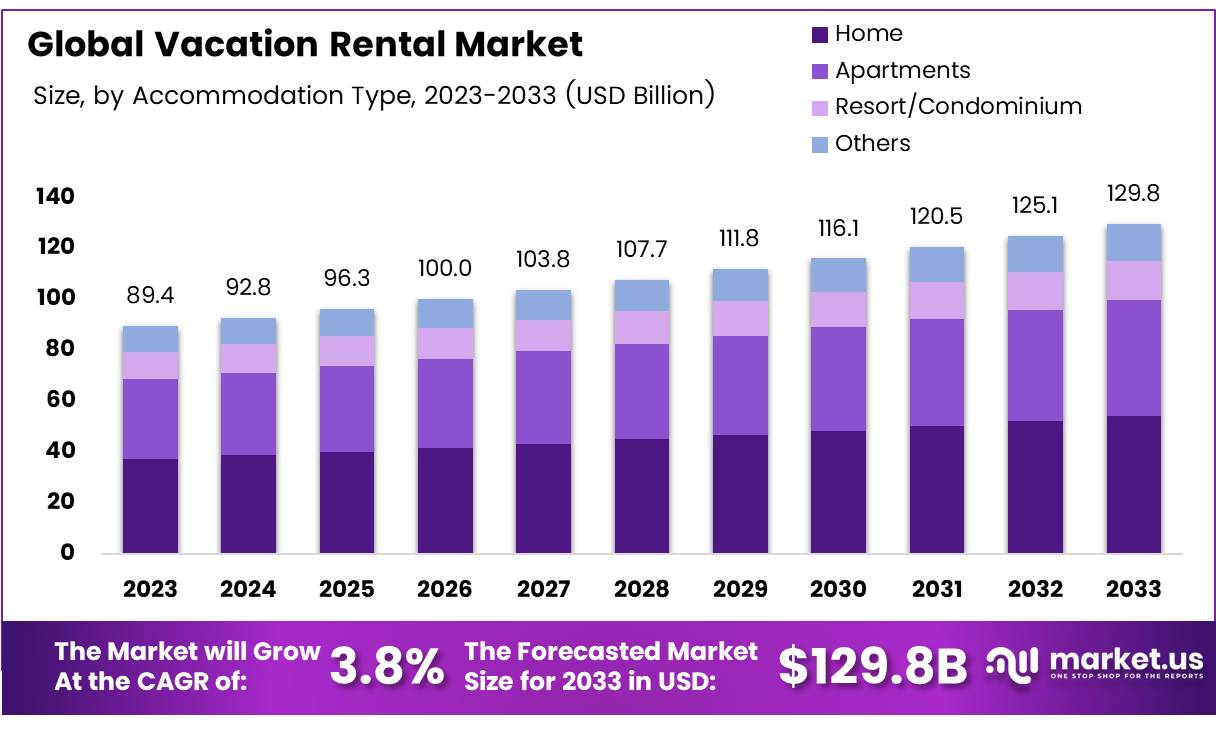

The Global Vacation Rental Market size is expected to be worth around USD 129.8 Billion by 2033, from USD 89.4 Billion in 2023, growing at a CAGR of 3.8% during the forecast period from 2024 to 2033.

Vacation rentals refer to properties that are rented out for short-term stays, typically for leisure or holiday purposes. These properties can range from private homes, apartments, smart home and villas to more unique offerings such as cabins, cottages, or even boats.

Often listed on online platforms such as Airbnb, Vrbo, or Booking.com, vacation rentals offer travelers an alternative to traditional hotel accommodations, with benefits such as more space, amenities, and local experiences. These rentals can be managed by property owners or professional management companies, and they often cater to a variety of traveler preferences, from budget to luxury.

The vacation rental market represents the broader industry that encompasses the demand, supply, and transaction of these short-term accommodations. It is a dynamic market, with growth driven by evolving travel preferences, the rise of online platforms, and an increasing desire for more personalized and private travel experiences.

The market includes a wide range of players, including property owners, managers, digital platforms, and service providers that facilitate the vacation rental process. As of 2023, the market has seen significant expansion globally, driven by more travelers opting for vacation rentals over traditional hotels.

The growth of the vacation rental market has been substantial in recent years, particularly due to shifts in travel behavior and the broader economic environment. A key factor contributing to this growth is the increase in remote working, which has led to longer stays.

According to enterprise apps today, the duration of vacations has increased by 68%, with travelers now opting for stays ranging from 21 to 30 days. This trend has created significant demand for vacation rental properties that offer more space and amenities for extended stays. The expansion of remote work has, therefore, opened up new opportunities for property owners to cater to long-term renters who seek comfortable, home-like environments for business or leisure.

In terms of opportunity, the vacation rental market is increasingly seen as an attractive sector for investment. Data from buildup bookings highlights that in the U.S., there are approximately 9 million second homes or , with 44% professionally managed. Of these, 25%-35% are rented out, indicating a large pool of untapped properties that could be converted into vacation rentals.

Additionally, the rise of platforms like Airbnb and Vrbo has made it easier for property owners to monetize their assets, attracting both individuals and investors into the market. This trend is reflected globally, as ruby home reports that around 700 million travelers used vacation rentals, with over 60 million Americans preferring this accommodation type in 2022.

Government investment and regulations are also playing a crucial role in shaping the vacation rental market. As the industry grows, governments are increasingly focusing on creating regulations to manage its impact on housing markets and communities. In many regions, policies related to zoning, taxation, and safety standards are being enforced to ensure that the vacation rental industry operates within a structured and responsible framework.

However, these regulations can also present opportunities for professional management companies to emerge, providing a compliant and structured solution to property owners. As governments recognize the economic potential of the vacation rental sector, investment in infrastructure, tourism, and digital platforms is expected to increase, fostering further market growth.

The vacation rental market’s impressive expansion is underscored by key statistics. As of 2023, there are over 2.4 million vacation rental listings and 785,000 hosts, highlighting the industry’s diversity and global reach (Airdna). In the U.S., 31.3% of vacation rentals are privately owned, with about 600,000 Americans using online platforms to rent out their properties (99firms). This growing trend towards private ownership is indicative of the evolving structure of the market, where more individuals are choosing to monetize their properties.

The financial landscape of the vacation rental market is also promising. For instance, the expected average daily rate (ADR) for U.S. vacation rentals is $326 in 2024 (Photoaid), demonstrating the luxury hotel can command compared to traditional hotels. Furthermore, the U.S. is projected to have around 62.57 million vacation rental users in 2024 (Airdna), illustrating the continued popularity of this accommodation type.

Key Takeaways

- The global vacation rental market is projected to grow from USD 89.4 billion in 2023 to USD 129.8 billion by 2033, at a CAGR of 3.8%.

- Home accommodations lead the accommodation type segment with a 48% market share in 2023, driven by demand for private and flexible lodging options.

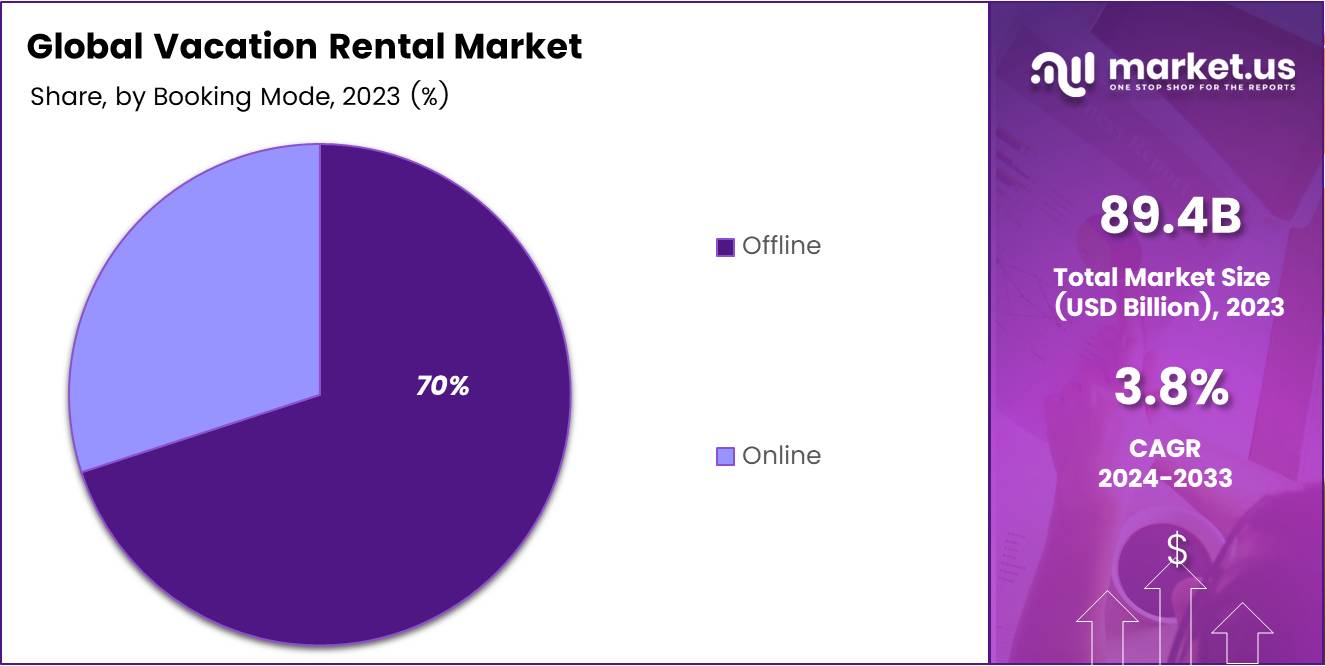

- Offline booking methods dominate the market with a 70% share in 2023, favored for their personalized service and direct communication.

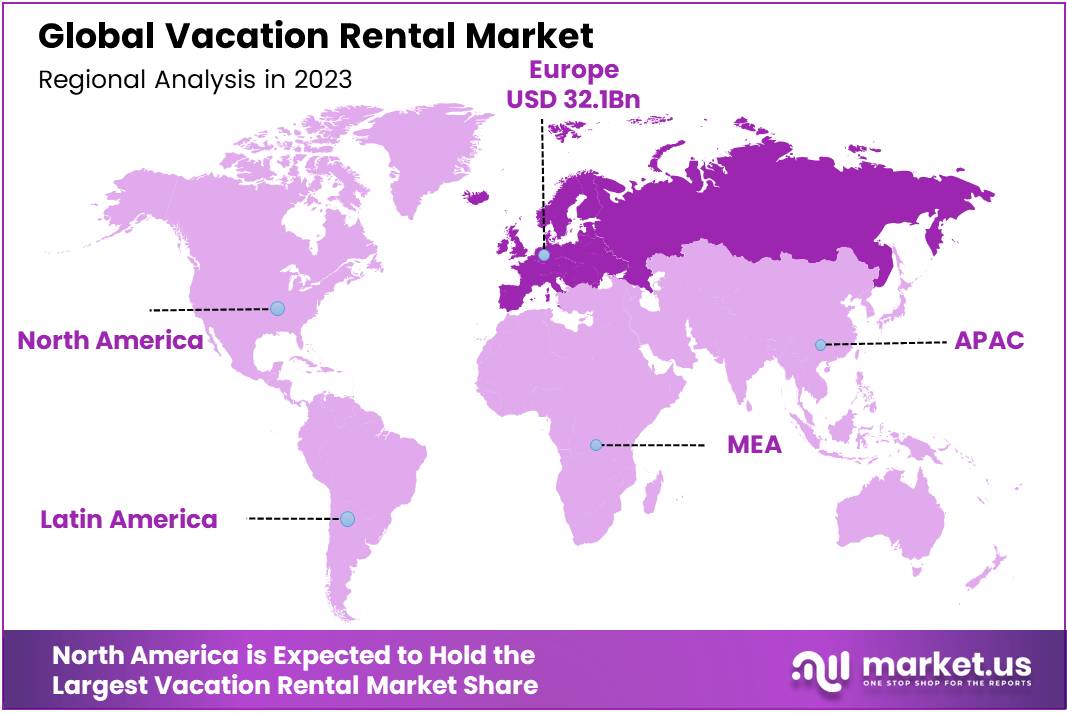

- Europe is the leading region in the vacation rental market, holding 36.2% of the market share, valued at USD 32.1 billion in 2023.

Accommodation Type Analysis

Home Accommodation Led the Vacation Rental Market in 2023 with a 48% Share Driven by Demand for Spacious and Private Lodging Options

In 2023, Home accommodation held a dominant market position in the By Accommodation Type Analysis segment of the Vacation Rental Market, commanding a 48% share. This preference for home rentals can be attributed to the growing demand for private, spacious, and flexible lodging options, offering travelers a homely experience with amenities tailored to longer stays.

Apartments followed with a substantial market share, benefiting from their appeal to urban travelers seeking convenience and proximity to key attractions. The flexibility of apartment rentals, which often provide a full range of services and amenities, has positioned them as a popular choice for both business and leisure travelers.

Resorts/Condominiums secured a smaller but significant portion of the market, appealing to tourists seeking a more luxurious experience with premium amenities such as pools, spas, and resort-like services. These properties cater primarily to vacationers looking for high-end accommodations and additional services.

The Others category, which includes unique stays such as cabins, villas, and shared accommodations, represented a growing niche in the market. As experiential travel continues to rise, demand for these alternatives is expected to increase, offering diverse lodging experiences to cater to a broad range of traveler preferences.

Booking Mode Analysis

Offline Holds 70% Share in Vacation Rental Market by Booking Mode in 2023

In 2023, Offline held a dominant market position in the By Booking Mode Analysis segment of the Vacation Rental Market, with a 70% share. This continued preference for offline bookings can be attributed to factors such as personalized service and direct communication between travelers and property owners or agents.

Many consumers value the ability to negotiate terms, ask specific questions, and receive tailored recommendations, which offline bookings facilitate. This trend is particularly strong in regions with lower digital penetration and among certain consumer demographics who prefer face-to-face interactions.

In contrast, Online bookings, while growing steadily, remain a secondary channel, accounting for 30% of the market. Despite the increasing adoption of digital platforms, offline bookings continue to be favored due to their perceived reliability and the hands-on assistance they offer.

However, the expansion of digital platforms and growing consumer reliance on convenience are expected to influence a gradual shift in market dynamics over time.

Key Market Segments

By Accommodation Type

- Home

- Apartments

- Resort/Condominium

- Others

By Booking Mode

- Offline

- Online

Drivers

Rising Value of Vacation Rentals Driven by Demand for Unique Experiences and Greater Flexibility

The vacation rental market has been driven by several key factors that have reshaped how travelers approach accommodation. Firstly, an increasing number of travelers are opting for vacation rentals instead of traditional hotels due to their desire for more privacy, space, and a home-away-from-home experience. This preference is especially noticeable among families and groups, who benefit from the added convenience of fully equipped kitchens and multiple bedrooms.

Additionally, the rise of the sharing economy, fueled by platforms like Airbnb, Vrbo, and Booking.com, has significantly broadened access to vacation rentals. These platforms make it easier for travelers to find unique properties and for hosts to reach a global audience.

Technological advancements also play a crucial role in market growth, with mobile apps, online booking systems, and virtual tours streamlining the booking process for consumers and simplifying property management for owners.

Furthermore, the growing demand for personalized travel experiences has contributed to the success of vacation rentals. Unlike standardized hotel rooms, vacation rentals allow guests to immerse themselves in local culture, offering customized experiences that cater to individual preferences.

These factors combined have created a favorable environment for the vacation rental market to expand, providing both flexibility and a sense of local authenticity that traditional accommodations cannot always match.

Restraints

Key Challenges in the Vacation Rental Market and Their Impact on Profitability and Trust

The vacation rental market faces several challenges that can limit its growth potential. One significant factor is the high property management costs. Owners must bear the expenses of regular maintenance, cleaning, and ensuring smooth customer service, which can diminish profitability.

These ongoing costs, coupled with the need to maintain property quality, can be particularly burdensome for smaller operators or those managing multiple listings. Another important restraint is safety and security concerns, which can impact both hosts and guests.

Issues such as property damage, theft, or even fraud can erode trust and lead to negative experiences. In some cases, concerns over personal safety or the safety of property may deter potential guests from booking, while hosts might face financial losses due to damage or disputes. The lack of consistent safety standards across platforms further complicates this issue, as both hosts and guests may struggle to navigate these risks.

Combined, these factors contribute to a more cautious market environment, where potential investors and hosts must carefully weigh the risks before entering or expanding in the vacation rental space. These restraints have the potential to slow market expansion, particularly in areas with high property costs or in regions with less regulation surrounding safety and insurance.

Growth Factors

Growth Opportunities in the Vacation Rental Market Driven by Emerging Markets, Sustainability, Luxury, and Technology

The vacation rental market presents several growth opportunities, especially in emerging markets like Asia-Pacific, Latin America, and parts of Africa, where rising middle-class populations and increased tourism are driving demand for short-term accommodations.

Additionally, as sustainability gains importance among travelers, there is a growing trend for eco-friendly rentals. Property owners who adopt sustainable practices and achieve green certifications can attract environmentally-conscious guests.

Another key opportunity lies in the luxury vacation rental segment, as high-net-worth individuals are increasingly opting for private, luxurious stays, which offer exclusive services and amenities. This shift provides a chance to tap into a lucrative niche market.

Furthermore, the integration of smart technology, such as voice assistants, smart thermostats, and advanced security systems, can enhance guest experiences and appeal to tech-savvy travelers. By adopting these innovations, vacation rental providers can gain a competitive edge and meet the expectations of a modern, convenience-driven market.

Emerging Trends

Key Trends Driving the Growth of the Vacation Rental Market with Clear Reasons Behind Them

The vacation rental market is evolving rapidly, driven by several key factors that reflect changing traveler preferences. One major trend is the rise of workcations, where individuals combine work with vacation in remote destinations. As remote work becomes more widespread, demand for vacation rentals that cater to this lifestyle has surged.

Properties offering reliable Wi-Fi, dedicated workspaces, and quiet environments are becoming increasingly popular. Another significant trend is the heightened focus on cleanliness and hygiene.

In the wake of the COVID-19 pandemic, travelers are now more concerned with the cleanliness of accommodations, prompting vacation rental owners to adopt stricter cleaning protocols and clearly communicate these practices to guests. Additionally, flexible booking and cancellation policies have gained prominence, as travelers seek reassurance amidst ongoing uncertainties.

Many platforms, such as Airbnb and Vrbo, have introduced these policies to encourage bookings. These changes have allowed consumers to make reservations with greater confidence, knowing they can adjust plans if necessary. Finally, the dominance of short-term rental platforms like Airbnb, Vrbo, and Booking.com continues to shape the market.

These platforms are investing heavily in new features and improving user experience, expanding their global reach, and capturing an increasing share of the vacation rental market. Together, these trends reflect the growing demand for flexibility, comfort, and safety, marking a shift in how people approach luxury travel and accommodation.

Regional Analysis

Europe remains the dominant accounting for 36.2% of the market

The global vacation rental market exhibits varied dynamics across different regions. Europe remains the dominant region, accounting for 36.2% of the market share, valued at USD 32.1 billion.

This can be attributed to the well-established tourism infrastructure, a broad customer base, and a preference for vacation rentals in key tourist destinations such as France, Spain, and Italy. The region has seen a growing shift towards longer stays, with remote work arrangements bolstering the demand for vacation rentals throughout the year.

Regional Mentions:

North America, with a particularly strong presence in the United States, continues to be a significant contributor to the vacation rental sector. The increasing preference for flexible, spacious accommodations, combined with the growth of digital booking platforms, has propelled the market’s expansion in the region. North America’s tourism sector, supported by both domestic and international travelers, remains one of the largest globally.

The Asia Pacific region is experiencing rapid growth, driven by the region’s expanding middle class and rising disposable incomes. Countries such as Japan, Australia, and Thailand have witnessed a surge in demand for vacation rentals, particularly in major cities and coastal areas. This region is expected to show substantial growth in the coming years as tourism continues to rebound.

In the Middle East and Africa, the market is growing steadily, with the UAE and South Africa emerging as key players in the vacation rental sector. The demand for luxury and high-end vacation rentals, particularly in destinations like Dubai, continues to fuel the market’s development.

Latin America, though smaller in comparison, is seeing gradual growth in demand, particularly in tourist-heavy countries like Brazil and Mexico.

Key Regions and Countries covered іn thе rероrt

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In 2023, the global vacation rental market remains highly competitive, driven by key players across various segments. Leading platforms such as Airbnb Inc., Booking Holdings Inc., and Expedia Group Inc. continue to dominate, leveraging their extensive user bases and technological infrastructure to capture significant market share. These companies have benefitted from increasing consumer demand for personalized travel experiences, facilitated by the flexibility and variety inherent in vacation rentals.

Airbnb Inc. remains a frontrunner, with its broad global presence and innovative business model that integrates short-term rentals with unique travel experiences. It capitalizes on its brand recognition, trust-building initiatives, and enhanced safety measures, which have been pivotal in attracting both hosts and guests.

Similarly, Booking Holdings Inc., with its diversified portfolio that includes Booking.com, Priceline, and Agoda, positions itself as a strong player by offering seamless booking experiences and a wide range of accommodation options, from budget to luxury.

Expedia Group Inc. has also expanded its footprint in the vacation rental space through platforms like Vrbo, strengthening its market position with competitive pricing and robust customer service.

Wyndham Destinations Inc., a major player in the timeshare segment, has diversified its offerings to include vacation rentals, capitalizing on its established loyalty programs and extensive resort network.

Additionally, emerging companies such as Oravel Stays Pvt. Ltd. (OYO), 9flats.com Pte Ltd., and MakeMyTrip Pvt. Ltd. are intensifying competition by focusing on regional markets and offering tailored solutions to meet localized consumer demands.

Top Key Players in the Market

- 9flats.com Pte Ltd.

- NOVASOL AS

- Airbnb Inc.

- Booking Holdings Inc.

- Expedia Group Inc.

- Oravel Stays Pvt. Ltd.

- TripAdvisor Inc.

- Wyndham Destinations Inc.

- Hotelplan Holding AG

- MakeMyTrip Pvt. Ltd.

Recent Developments

- In September 2024, vacation home rentals startup ELIVAAS raised $5 million in a Series A funding round to enhance its platform and expand its presence in the Indian market. The company aims to revolutionize the vacation rental experience by leveraging technology to streamline operations and improve customer service.

- In November 2023, Summer, a platform that assists customers in buying and renting out vacation homes, secured $18 million in a funding round to expand its offerings. The funds will be used to enhance the platform’s user experience and extend its reach to a broader customer base interested in vacation home ownership and rental opportunities.

- In January 2024, Overmoon raised $80 million to innovate the vacation rental market through its technology-driven platform. The company plans to use the capital to scale its operations, integrate advanced tech solutions, and provide personalized vacation home experiences for customers.

Report Scope

Report Features Description Market Value (2023) USD 89.4 Billion Forecast Revenue (2033) USD 129.8 Billion CAGR (2024-2033) 3.8% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Accommodation Type (Home, Apartments, Resort/Condominium, Others), By Booking Mode (Offline, Online) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape 9flats.com Pte Ltd., NOVASOL AS, Airbnb Inc., Booking Holdings Inc., Expedia Group Inc., Oravel Stays Pvt. Ltd., TripAdvisor Inc., Wyndham Destinations Inc., Hotelplan Holding AG, MakeMyTrip Pvt. Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- 9flats.com Pte Ltd.

- NOVASOL AS

- Airbnb Inc.

- Booking Holdings Inc.

- Expedia Group Inc.

- Oravel Stays Pvt. Ltd.

- TripAdvisor Inc.

- Wyndham Destinations Inc.

- Hotelplan Holding AG

- MakeMyTrip Pvt. Ltd.