Global Luxury Hotel Market By Room Type(Luxury, Upper-upscale, Upscale), By Type(Business Hotels, Airport Hotels, Suite Hotels, Resorts, Others), By Category(Chain, Independent), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov 2024

- Report ID: 133060

- Number of Pages: 388

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

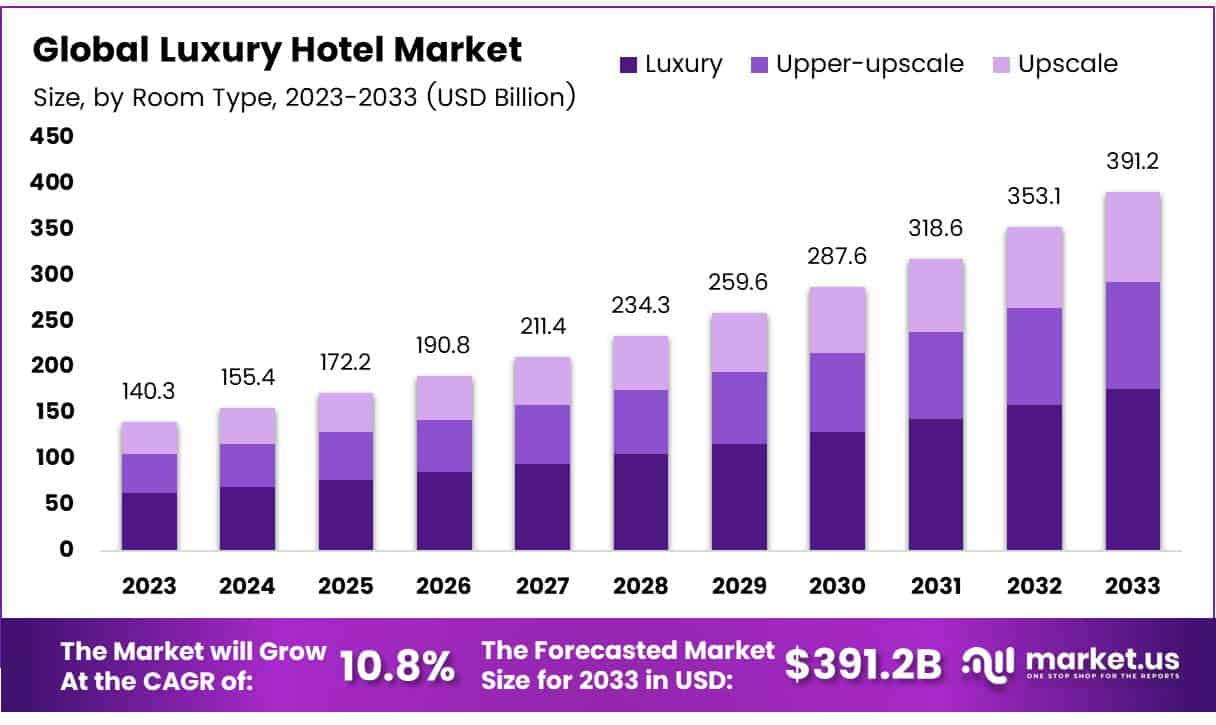

The Global Luxury Hotel Market size is expected to be worth around USD 391.2 Billion by 2033, from USD 140.3 Billion in 2023, growing at a CAGR of 10.8% during the forecast period from 2024 to 2033.

A luxury hotel represents the highest standard in hospitality, providing top-tier services, alternative accommodations, and exceptional personal care that distinctly separates it from typical hotels.

These establishments often hold a five-star rating and are located in premium areas with significant architectural appeal and lavish amenities. They target the most selective travelers, offering a service-oriented experience.

The luxury hotel market is expanding, driven by increasing global wealth, a larger group of affluent travelers, and heightened consumer interest in exclusive travel experiences.

Following the pandemic, this market has seen a rapid recovery, as luxury hotels experience higher demand with eased travel restrictions and returning consumer confidence. This recovery is fueled by wealthy individuals seeking indulgent travel experiences that offer relaxation, wellness, and personalized service.

Luxury hotels are adapting by incorporating advanced technology and sustainable practices to improve guest experiences and operational efficiency.

The adoption of smart home hardware and green practices not only attracts contemporary travelers but also supports global sustainability efforts. These innovations offer significant growth opportunities in the luxury hotel sector.

Government actions and regulations significantly influence the luxury hotel market. Many governments boost tourism through substantial investments in infrastructure like airports and roads, enhancing the accessibility and appeal of luxury hotel investments.

Regulatory frameworks, including zoning laws and environmental guidelines, ensure sustainable and ethical operations. Adhering to these regulations not only maintains legal compliance but also boosts the hotel’s reputation, attracting guests who value ethical practices.

As of February 2023, the overall U.S. hotel occupancy rate is 64.2%, indicating the hospitality sector’s recovery phase. The luxury segment is likely experiencing even stronger recovery due to the increased travel interest from affluent consumers. Projections suggest that U.S. hotels will reach 1.3 billion room nights in 2023, with luxury hotels well-positioned to capture a significant portion of these stays.

A survey by the American Hotel & Lodging Association found that 44% of affluent individuals are now more focused on travel, particularly luxury accommodations. This shift highlights substantial market potential for luxury hotels to attract this demographic by enhancing services and refining marketing strategies.

Moreover, with expected investments exceeding $12 billion in the Asia Pacific hotel market by 2024, there is a positive global growth outlook for luxury hotels, appealing to both guests and investors seeking valuable opportunities in the hospitality industry.

Key Takeaways

- The Global Luxury Hotel Market is projected to grow from USD 140.3 billion in 2023 to USD 391.2 billion by 2033, at a CAGR of 10.8%.

- In 2023, the Luxury segment led the Hotel Type Analysis of the market, holding a 35% share, driven by high demand from affluent travelers for exclusive experiences.

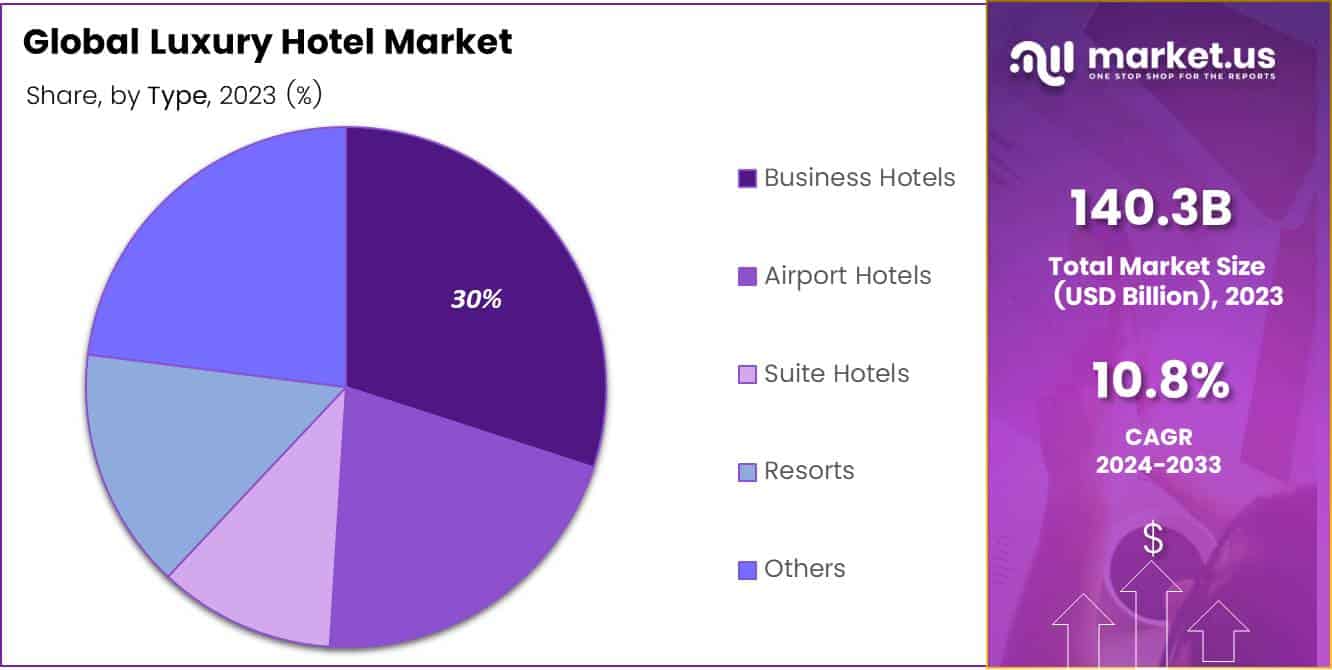

- Business Hotels dominated the Type Analysis segment with a 30% share in 2023, favored for their services tailored to the needs of business travelers.

- Chain hotels were the most prevalent in the Category Analysis segment, due to their established brand presence and extensive customer loyalty programs.

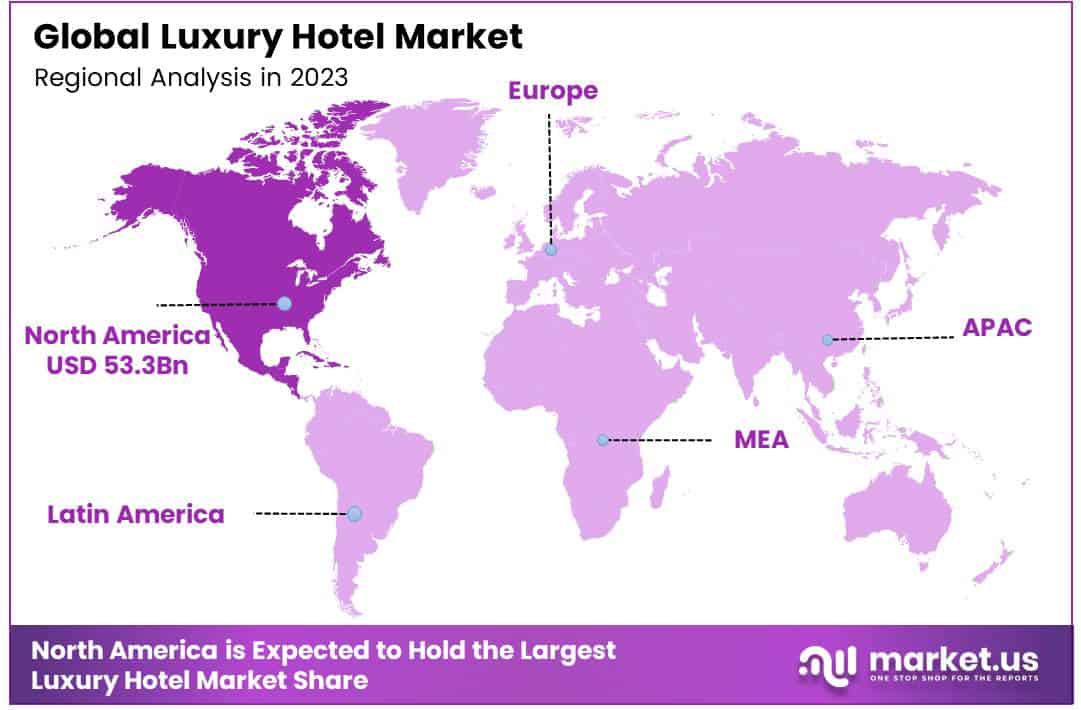

- North America is the leading region in the luxury hotel market, with a 38% share and a valuation of USD 53.3 billion, supported by a strong economy and high disposable income levels.

Hotel Type Analysis

Luxury Hotels Lead with 35% Market Share in 2023

In 2023, Luxury held a dominant market position in the By Hotel Type Analysis segment of the luxury hotel market, with a 35% share. This segment’s strong performance can be attributed to increasing demand from affluent travelers seeking exclusive experiences and premium services.

Upper-upscale hotels, which offer a slightly less opulent experience compared to luxury establishments, also captured a significant portion of the market, appealing to guests who desire high-quality accommodations without the extensive cost associated with luxury hotels.

Meanwhile, the upscale segment, known for providing full-service accommodations with numerous amenities at a more moderate price point, continued to attract a broad demographic of business and leisure travelers.

The diversified appeal across these segments underscores the dynamic nature of consumer preferences in the hospitality industry, where varying levels of luxury and service continue to meet the distinct needs and budgets of different traveler types.

As the market evolves, these segments are expected to further differentiate, catering to the nuanced demands of global tourists and reinforcing their positions within the competitive landscape of luxury accommodations.

Type Analysis

Business Hotels Lead Luxury Hotel Market with 30% Share in 2023

In 2023, Business Hotels held a dominant market position in the By Type Analysis segment of the luxury hotel market, commanding a 30% share. This segment outperformed others due to its strategic focus on providing high-quality services tailored to business travelers seeking convenience and efficiency.

Airport Hotels also carved a niche by offering transit passengers luxurious accommodations close to airport terminals, emphasizing ease of access and short-term comfort. Suite Hotels, recognized for their spacious and upscale accommodations, catered primarily to travelers looking for extended stays with a touch of luxury.

Meanwhile, Resorts attracted guests with their comprehensive offerings of relaxation and recreational activities, making them ideal for vacationers and leisure travelers.

The category labeled Others encompasses various specialized luxury accommodations, including boutique hotels and themed hotels, which appeal to niche markets looking for unique and personalized lodging experiences.

Collectively, these segments illustrate the diverse preferences and needs within the luxury hotel industry, highlighting significant opportunities for targeted growth and development across different types of luxury accommodations.

Category Analysis

Chain Leads Luxury Hotel Category with Strong Brand Presence

In 2023, Chain held a dominant market position in the By Category Analysis segment of the luxury hotel market. This predominance can be attributed to a well-established brand presence, robust operational structures, and extensive customer loyalty programs.

Chain luxury hotels, with their expansive global networks, offer uniform standards of high-end accommodations and personalized services, appealing to both business and leisure travelers seeking consistency and reliability in their stay experiences.

On the other hand, independent luxury hotels, characterized by their unique offerings and localized charm, catered to a niche clientele. These establishments focus on providing distinctive experiences, which often include bespoke amenities, exquisite local cuisine, and tailored guest services.

However, despite their appeal to those seeking authenticity and exclusivity, independent hotels held a smaller market share compared to chain hotels.

The strategic placement and marketing prowess of chain hotels have enabled them to capture a significant portion of the market. They leverage economies of scale to provide luxury at competitive prices, thereby attracting a broader audience.

Independent luxury hotels, while they excel in creating memorable and unique experiences, often face challenges in market penetration and brand visibility, which are critical in the highly competitive luxury hospitality sector.

Key Market Segments

By Room Type

- Luxury

- Upper-upscale

- Upscale

By Type

- Business Hotels

- Airport Hotels

- Suite Hotels

- Resorts

- Others

By Category

- Chain

- Independent

Drivers

Rising Incomes Fuel Luxury Hotel Demand

As disposable incomes increase worldwide, more people can afford luxury travel experiences, boosting demand for high-end accommodations. This financial uplift, coupled with advancements in global travel connectivity and a surge in tourism activities, has significantly propelled the luxury hotel market.

Tourists are seeking not only comfort but also unique experiences, leading to a rise in boutique luxury hotels that offer distinctive, personalized hospitality unlike traditional chain hotels. This shift towards unique, boutique-style accommodations reflects a broader trend in consumer preferences, emphasizing the importance of exceptional service and exclusivity in the luxury hospitality sector.

These factors combined create a dynamic environment for the growth of luxury hotels, catering to an increasingly affluent and experience-seeking global population.

Restraints

Intense Competition in Luxury Hotels

The luxury hotel market faces significant challenges, primarily due to intense competition. This market is crowded with both new entrants and established players, each striving to capture guest loyalty and outshine the rest with unique offerings and experiences.

Additionally, the rise of luxury rentals and exclusive resorts has diversified guest options, further intensifying the competitive landscape. Another major restraint is the vulnerability to pandemics and health crises, which can lead to massive disruptions in travel and hospitality services.

Events like the COVID-19 pandemic have shown how quickly and severely these sectors can be impacted, leading to steep declines in occupancy rates, revenue losses, and enforced temporary closures. These factors combined make it challenging for luxury hotels to maintain a steady growth trajectory and require innovative strategies to attract and retain high-end travelers.

Growth Factors

Growth Opportunities in the Luxury Hotel Market

Luxury hotels can significantly boost their appeal and market share by partnering with high-end brands. This strategy allows them to offer unique products and experiences that can’t be found elsewhere, making their properties more attractive to discerning travelers. Such collaborations often lead to enhanced branding and exclusive amenities that align with the luxurious expectations of their guests.

Additionally, focusing on stringent health and safety measures can provide guests with peace of mind, particularly in the post-pandemic era. This reassurance is crucial as travelers are increasingly prioritizing well-being alongside luxury. Moreover, the market holds a promising opportunity in curating authentic and personalized experiences targeted at Millennials and Generation Z.

These younger travelers are looking for unique, digitally integrated experiences that resonate with their values and lifestyles. By tapping into these trends, luxury hotels can differentiate themselves and capture a broader audience, ensuring sustained growth and relevance in a competitive market.

Emerging Trends

Bleisure Travel Drives Luxury Hotel Demand

As the boundaries between business and leisure blur, luxury hotels are increasingly tailoring their offerings to suit the needs of the bleisure traveler.

This emerging trend combines the necessities of business trips with the amenities and experiences of leisure travel. To cater to this growing segment, luxury hotels are innovating beyond traditional luxury to include themed accommodations and story-driven experiences that enrich the traveler’s stay.

Furthermore, there’s a rising demand for eco-resorts that blend luxury with sustainability, attracting guests who prioritize environmental consciousness alongside eco tourism. These trends are shaping a new future for the luxury hotel market, where personalized experiences and sustainability are becoming as crucial as opulence.

Regional Analysis

North America Dominates Global Luxury Hotel Market with 38% Share, Valued at USD 53.3 Billion

The luxury hotel market exhibits varied growth dynamics across different regions, driven by distinct economic conditions, consumer preferences, and travel trends.

In North America, the luxury hotel sector is the most dominant, commanding a 38% market share with a valuation of USD 53.3 billion. This region benefits from a robust economy, a high disposable income demographic, and a strong presence of luxury hotel chains catering to both business and leisure travelers.

Regional Mentions:

Europe, the market is characterized by its rich history and a diverse range of cultural attractions, making it a prime destination for luxury accommodations. Europe’s luxury hotels are often located in historic buildings with unique offerings, appealing to travelers seeking both luxury and an authentic experience.

In Asia Pacific, the luxury hotel market is rapidly expanding, fueled by economic growth in countries like China and India. This region is seeing an increase in both domestic luxury travel and international arrivals, with a rising middle class and growing demand for high-end hospitality experiences. Asia Pacific is known for its exceptional service standards and innovative luxury concepts, which are key differentiators in the market.

The Middle East & Africa region, although smaller in comparison, is noted for its opulent hotel offerings, particularly in the Gulf countries, where luxury hotels are integral to the tourism sector’s growth. The region’s luxury hotels often feature lavish amenities and are a hub for international business travel.

Latin America, while still developing in the luxury hotel sector, shows potential for growth with increased political stability and growing economies. The region attracts a niche market of travelers looking for luxury experiences in natural and culturally rich settings.

Key Regions and Countries covered іn thе rероrt

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In the global luxury hotel market of 2023, key players demonstrated robust strategies aimed at enhancing guest experiences and expanding their global footprints.

Marriott International, Inc., a significant contributor, emphasized digital integration and personalized services to cater to the evolving preferences of luxury travelers. Hyatt Hotels Corporation continued to excel in creating unique guest experiences by focusing on luxury wellness retreats that appeal to health-conscious consumers.

InterContinental Hotels Group plc leveraged its global presence, offering luxury accommodations that combine local cultural elements with high standards of service. Four Seasons Hotel Limited remained a benchmark for exceptional service quality, concentrating on bespoke guest experiences and expansive luxurious amenities.

Hilton Hotels & Resorts strengthened its market presence by upgrading its technology interfaces, improving customer engagement through mobile apps that offer services ranging from check-in to room customization. Kempinski Hotels S.A. maintained its reputation by emphasizing heritage and luxury, offering an authentic European elegance that attracts a niche market of luxury seekers.

Accor SA expanded its luxury segment through strategic acquisitions, enhancing its luxury portfolio with brands that offer distinctive styles and localized luxury experiences. The Indian Hotels Company Limited capitalized on the growing luxury market in Asia, focusing on high-end accommodations that highlight regional heritage and modern sophistication.

Mandarin Oriental Hotel Group and Shangri La International Hotel Management Ltd. both reinforced their positions in Asia and globally through continuous innovation in luxury services and sustainability practices, appealing to environmentally conscious consumers. Their efforts not only retained high-value guests but also attracted new patrons looking for sustainable luxury options, setting a trend for responsible luxury travel.

Top Key Players in the Market

- Marriott International, Inc.

- Hyatt Hotels Corporation

- InterContinental Hotels Group plc

- Four Seasons Hotel Limited

- Hilton Hotels & Resorts

- Kempinski Hotels S.A.

- Accor SA

- The Indian Hotels Company Limited

- Mandarin Oriental Hotel Group

- Shangri La International Hotel Management Ltd.

Recent Developments

- In November 2024, Trinity Investments successfully acquired The Standard, London in a strategic partnership with Oaktree and Partners Group. This acquisition marks a significant expansion of Trinity’s luxury hotel portfolio in one of the world’s most dynamic hospitality markets, enhancing their global presence and service offerings.

- In June 2024, Trinity Investments announced plans to invest approximately €1.5 billion in European hotels over the next three years. This ambitious strategy aims to capitalize on the growing demand for high-quality hospitality options across Europe, positioning Trinity as a leading investor in the upscale hotel sector.

- In October 2024, Hotel Engine secured a substantial $140 million investment to broaden its business travel platform beyond hotel bookings. This funding will enable the company to integrate more travel solutions and services, catering to the evolving needs of business travelers and expanding their market reach.

Report Scope

Report Features Description Market Value (2023) USD 140.3 Billion Forecast Revenue (2033) USD 391.2 Billion CAGR (2024-2033) 10.8% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Room Type(Luxury, Upper-upscale, Upscale), By Type(Business Hotels, Airport Hotels, Suite Hotels, Resorts, Others), By Category(Chain, Independent) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Marriott International, Inc., Hyatt Hotels Corporation, InterContinental Hotels Group plc, Four Seasons Hotel Limited, Hilton Hotels & Resorts, Kempinski Hotels S.A., Accor SA, The Indian Hotels Company Limited, Mandarin Oriental Hotel Group, Shangri La International Hotel Management Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Marriott International, Inc.

- Hyatt Hotels Corporation

- InterContinental Hotels Group plc

- Four Seasons Hotel Limited

- Hilton Hotels & Resorts

- Kempinski Hotels S.A.

- Accor SA

- The Indian Hotels Company Limited

- Mandarin Oriental Hotel Group

- Shangri La International Hotel Management Ltd.