Global Hang Gliding Equipment Market By Type (Powered, Non-Powered), By Product Type (Gliders, Harnesses, Helmets, Others), By End User (Recreational, Professional), By Distribution Channel (Online, Offline), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 14665

- Number of Pages: 214

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

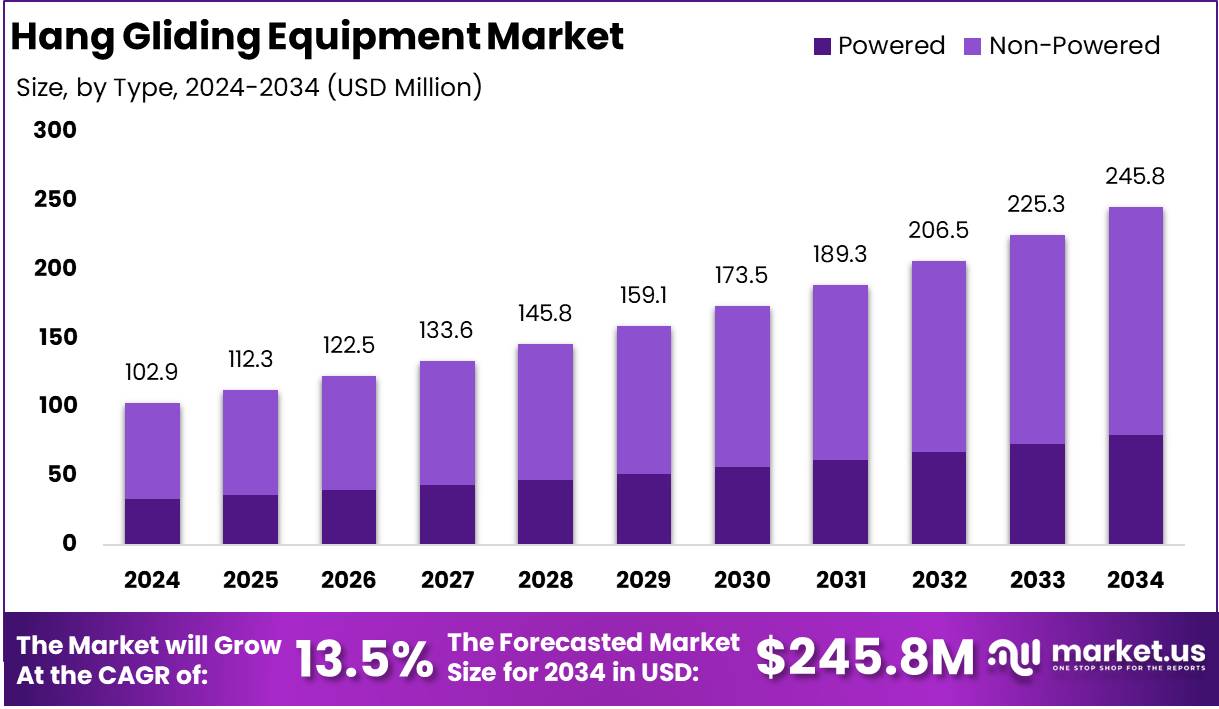

The Global Hang Gliding Equipment Market size is expected to be worth around USD 245.8 Million by 2034 from USD 102.9 Million in 2024, growing at a CAGR of 9.1% during the forecast period from 2025 to 2034.

Hang gliding equipment refers to the specialized gear and accessories essential for engaging in the sport of hang gliding. This includes the hang glider itself a lightweight, non-motorized aircraft constructed from an aluminum or composite frame with a fabric wing along with harnesses, helmets, variometers, and safety accessories.

Designed for aerodynamic efficiency and pilot control, these components collectively ensure stability, maneuverability, and safety during flight. Advanced materials, such as carbon fiber and high-performance fabrics, continue to enhance durability and performance, catering to both recreational and competitive pilots.

The hang gliding equipment market encompasses the global production, distribution, and sale of essential gear used in the sport of hang gliding. This market includes manufacturers of high-performance gliders, safety gear, navigation instruments, and related accessories, serving both hobbyists and professional gliders.

Driven by technological advancements, increased participation in adventure sports, and growing interest in eco-friendly recreational activities, the market is characterized by product innovation and evolving safety standards.

The market’s growth is primarily fueled by rising interest in extreme sports and adventure tourism, supported by increasing disposable income and lifestyle shifts toward outdoor recreational activities. Advancements in aerodynamics, lightweight materials, and safety technologies are driving product enhancements, making the sport more accessible and appealing.

Demand for hang gliding equipment is driven by a combination of factors, including a strong consumer base in adventure tourism, increasing participation in recreational aviation sports, and a growing emphasis on safety and performance.

Enthusiasts and professional athletes seek advanced, durable, and lightweight equipment, prompting manufacturers to focus on continuous product improvement. Regional demand variations exist, with higher traction in areas featuring favorable topography for the sport, such as mountainous and coastal regions.

The market presents significant opportunities through product innovation, particularly in lightweight materials and enhanced safety mechanisms. Integration of digital navigation and performance tracking systems is opening new avenues for premium offerings.

According to Peekpro, the Hang Gliding Equipment Market is gaining traction, with 25,000 Americans actively participating. As part of the $200 million global extreme sports industry, which attracts over 490 million participants, the demand for high-quality gear continues to grow. Safety remains a critical factor, with stringent equipment checks and pre-flight inspections contributing to a low fatality rate of just 3.5 deaths per year.

Industry players focus on advanced safety measures, trained instructors, and liability insurance to drive consumer confidence. As extreme sports expand globally, the market presents opportunities for innovation in lightweight materials, aerodynamic designs, and digital flight analytics.

The hang gliding equipment market continues to evolve, driven by innovation and a dedicated user base. Around 25,000 people take at least one flight annually, sustaining demand for gliders, harnesses, and safety gear. However, safety remains a challenge, with a mortality rate of 1 in 560 flights.

According to Health Research Funding, fatal accidents peaked at 40 deaths in 1974, underscoring past risks. Manufacturers are improving aerodynamics, lightweight materials, and safety mechanisms to reduce accidents. Stricter regulations and advancements in design are expected to enhance safety, fostering steady market growth in the coming years.

Key Takeaways

- The global hang gliding equipment market is projected to grow from USD 102.9 million in 2024 to USD 245.8 million by 2034, at a CAGR of 9.1%.

- Non-Powered Hang Gliding Equipment leads the market in 2024, accounting for 67.5% of the share.

- Gliders dominate the product type segment with a 53.2% market share in 2024, driven by their essential role in the sport.

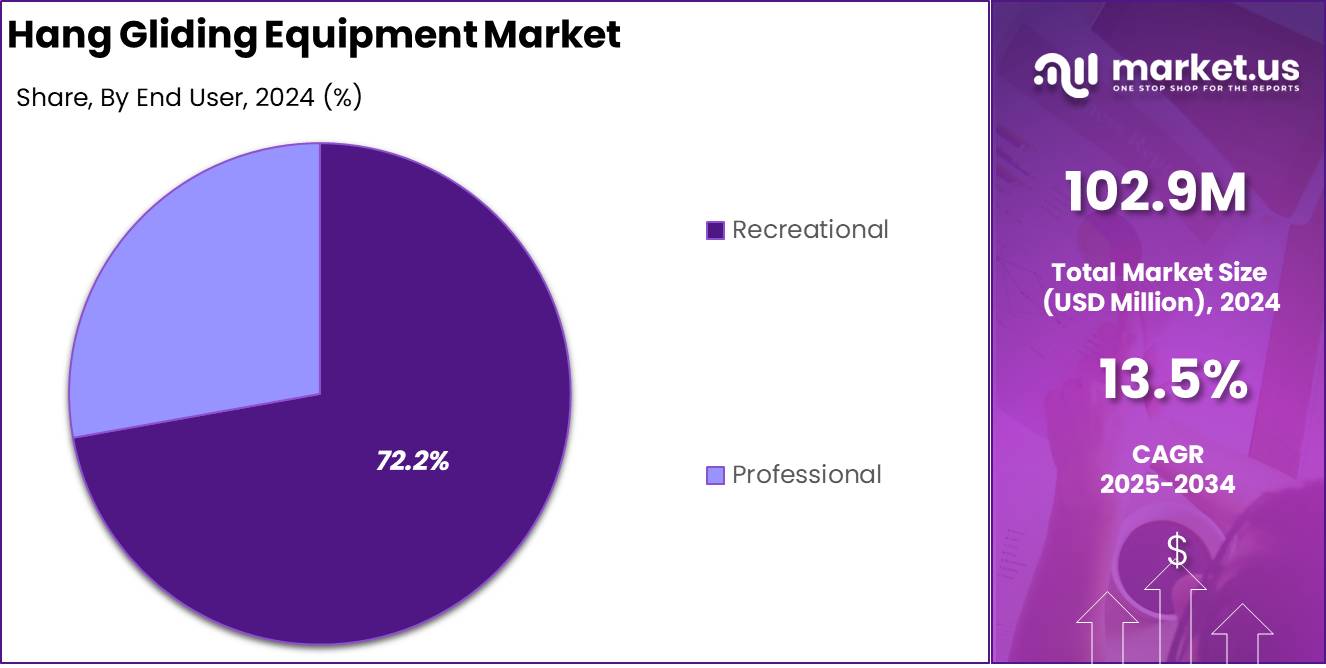

- Recreational Hang Gliding Equipment holds the largest market share at 72.2% in 2024, indicating strong consumer demand.

- Offline Distribution Channels dominate in 2024, capturing 63.3% of the market share, reflecting consumer preference for in-person purchases.

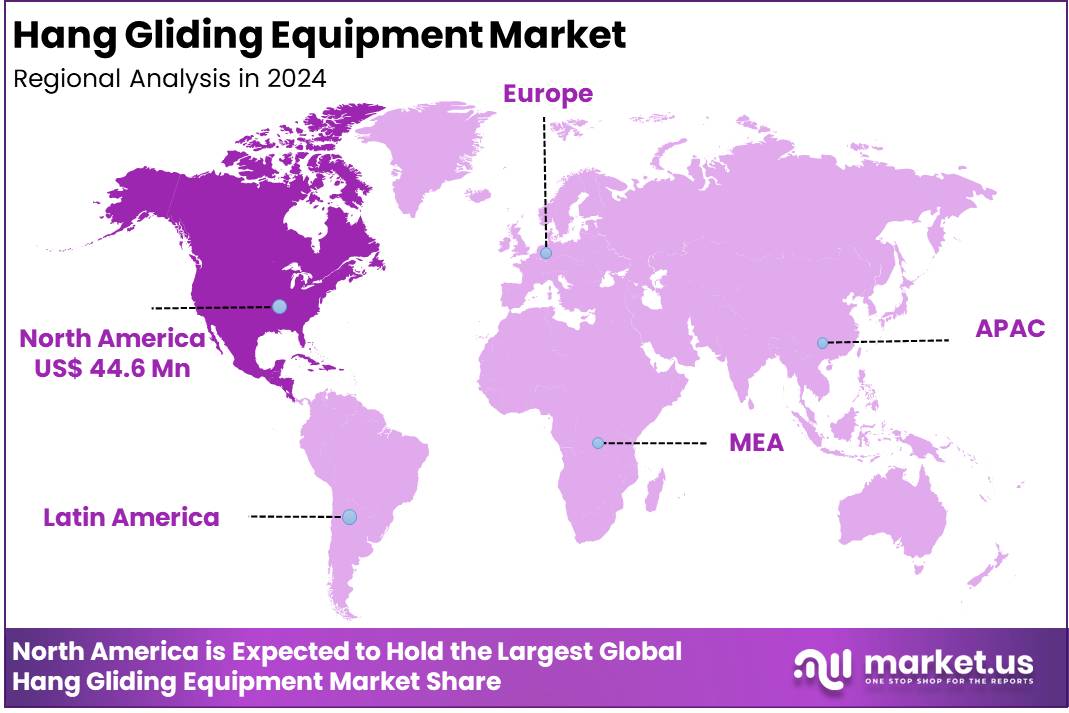

- North America leads the market with a 43.4% share in 2024, valued at approximately USD 44.6 million.

By Type Analysis

Non-Powered Hang Gliding Equipment Dominates the Market with a 67.5% Share in 2024

In 2024, Non-Powered Hang Gliding Equipment emerged as the dominant segment by type, capturing 67.5% of the market share. The segment’s growth is driven by the increasing preference for traditional hang gliding experiences, lower maintenance costs, and adherence to regulatory guidelines that favor non-powered flight activities.

Enthusiasts and professionals continue to favor non-powered hang gliders due to their affordability, simplicity, and suitability for various terrains, ensuring their sustained market leadership.

The Powered Hang Gliding Equipment segment is gaining traction due to advancements in lightweight motor technology and the increasing demand for longer flight durations and enhanced control. Powered hang gliders offer the advantage of independent takeoff capabilities, making them an attractive choice for adventure enthusiasts and commercial applications.

While the segment remains smaller compared to its non-powered counterpart, ongoing innovations and rising consumer interest are expected to drive steady growth.

By Product Type Analysis

Gliders Dominate the Hang Gliding Equipment Market with a 53.2% Share in 2024

In 2024, Gliders emerged as the dominant segment by product type, capturing 53.2% of the market share. The segment’s leadership is driven by the essential role of gliders in the sport, as they form the core equipment required for flight. Increasing participation in recreational and competitive hang gliding, coupled with advancements in lightweight and durable materials, has further fueled demand.

The growing preference for customized and high-performance gliders is also contributing to the segment’s sustained market dominance.

The Harnesses segment continues to experience stable growth, driven by the increasing emphasis on safety and comfort in hang gliding. Technological advancements, such as ergonomic designs and impact-resistant materials, are enhancing product adoption among both beginners and experienced gliders.

As safety regulations become more stringent, the demand for high-quality harnesses is expected to rise further.

The Helmets segment is witnessing a rise in demand, supported by increasing awareness about head protection during flights. Regulatory requirements and the growing adoption of certified helmets among enthusiasts are contributing to market expansion. Manufacturers are focusing on lightweight and aerodynamically optimized designs to improve user comfort without compromising on safety.

The Others category, which includes flight suits, variometers, and communication devices, is growing steadily. These accessories play a critical role in enhancing flight performance, safety, and overall experience. The rising demand for smart wearables and advanced navigation tools in the hang gliding community is expected to drive further growth in this segment.

By End User Analysis

Recreational Segment Dominates the Hang Gliding Equipment Market with a 72.2% Share in 2024

In 2024, Recreational Hang Gliding Equipment emerged as the dominant segment by end user, capturing 72.2% of the market share. The segment’s growth is driven by the increasing popularity of adventure sports, rising participation in leisure activities, and the accessibility of hang gliding training programs.

Affordable equipment options and improved safety features have further encouraged enthusiasts to engage in the sport, strengthening the dominance of the recreational segment.

The Professional Hang Gliding Equipment segment is witnessing steady growth, fueled by its use in competitive sports, aerial photography, and commercial applications.

Advances in high-performance gliders and safety gear are attracting professional pilots and sports organizations. While the segment remains smaller compared to recreational users, ongoing investments in professional training and international competitions are expected to drive further growth.

By Distribution Channel Analysis

Offline Channel Dominates the Hang Gliding Equipment Market with a 63.3% Share in 2024

In 2024, Offline Distribution Channels emerged as the dominant segment by distribution channel, capturing 63.3% of the market share. The dominance of this segment is driven by the preference for physical stores, specialty sports retailers, and authorized dealers where customers can assess product quality, receive expert guidance, and ensure proper fitting.

Additionally, offline channels offer hands-on demonstrations and after-sales services, reinforcing their strong market presence.

The Online Distribution Channel is experiencing steady growth, driven by the rising popularity of e-commerce platforms and direct-to-consumer sales.

Competitive pricing, convenience, and a wider range of product options are attracting more consumers to purchase hang gliding equipment online. As digital adoption continues to rise, the online segment is expected to gain further momentum in the coming years.

Key Market Segments

By Type

- Powered

- Non-Powered

By Product Type

- Gliders

- Harnesses

- Helmets

- Others

By End User

- Recreational

- Professional

By Distribution Channel

- Online

- Offline

Driver

Rising Popularity of Adventure Tourism

The growing demand for adventure tourism is a significant factor driving the expansion of the hang gliding equipment market. More travelers are seeking thrilling outdoor experiences that provide an escape from routine activities.

Hang gliding, which offers an unmatched aerial perspective and an adrenaline rush, has gained popularity among both seasoned adventure enthusiasts and newcomers. As tourism industries worldwide promote adventure-based activities, destinations known for aerial sports have witnessed an increase in participation rates, thereby fueling the demand for high-quality hang gliding equipment.

Travel agencies and tour operators are also investing in adventure tourism packages, incorporating hang gliding experiences to cater to the growing consumer interest. This shift is influencing equipment manufacturers to innovate and meet the rising demand for lightweight, durable, and performance-enhancing gear.

In addition, the accessibility of adventure tourism in emerging markets is boosting the adoption of hang gliding. Governments and private organizations are investing in infrastructure development to attract adventure tourists, leading to more designated hang gliding zones, training centers, and safety programs.

The rising social media influence, where adventure travelers share their hang gliding experiences, is further accelerating interest in the sport. These factors collectively contribute to the steady growth of the hang gliding equipment industry, making adventure tourism a key market driver.

Restraint

Safety Concerns and Regulatory Challenges Limiting Market Growth

One of the major challenges restricting the growth of the hang gliding equipment market is the safety risks associated with the sport. Hang gliding, being an extreme activity, involves potential hazards such as strong winds, unpredictable weather conditions, and the need for precise maneuvering. These risks often discourage participation, particularly among beginners, thereby limiting the expansion of the market.

Additionally, safety incidents reported over the years have heightened concerns, prompting stricter safety guidelines and regulations. The requirement for thorough training and certification has made entry into the sport more complex, impacting the rate of new participants.

Government regulations surrounding aerial sports vary across regions, leading to inconsistencies in accessibility and compliance requirements. Many countries impose strict licensing and operational guidelines, which can limit the growth of hang gliding schools and commercial operators.

Furthermore, insurance companies often perceive hang gliding as a high-risk activity, leading to costly insurance premiums for both individuals and businesses involved in the industry. The combination of safety concerns and regulatory barriers acts as a significant restraint, preventing the hang gliding equipment market from reaching its full potential.

Manufacturers must address these challenges by introducing advanced safety features in equipment and collaborating with authorities to establish standardized regulations that ensure both safety and ease of participation.

Opportunity

Technological Advancements Enhancing Performance and Safety

Technological advancements are creating significant opportunities for the hang gliding equipment market by improving both safety and performance. Innovations in material science have led to the development of lighter and more aerodynamic gliders, enhancing stability and maneuverability.

Carbon fiber and advanced composite materials are replacing traditional aluminum structures, making gliders more efficient while reducing pilot fatigue. These advancements attract both professional and recreational users, contributing to increased adoption rates of hang gliding equipment.

In addition to structural improvements, the integration of digital technologies has enhanced safety measures. GPS-based navigation systems, real-time weather tracking, and smart flight instruments allow pilots to make data-driven decisions, reducing risks associated with unexpected weather changes or difficult landing conditions.

Furthermore, manufacturers are introducing harness systems with enhanced impact protection, automatic deployment parachutes, and ergonomic designs that increase comfort and control.

These innovations are making the sport more accessible to beginners, who previously found hang gliding intimidating due to safety concerns. With continued investment in research and development, the industry is expected to see further breakthroughs that improve user experience and increase participation, solidifying technology as a key opportunity for market growth.

Trends

Eco-Tourism and Sustainable Practices Shaping Market Demand

The increasing focus on eco-tourism and sustainable travel is emerging as a significant trend influencing the hang gliding equipment market. As travelers become more conscious of their environmental impact, demand for low-carbon outdoor activities has risen.

Hang gliding, which does not rely on fuel-powered engines or produce emissions, aligns with the growing preference for sustainable adventure sports. Many eco-tourism destinations are now incorporating hang gliding into their offerings, attracting environmentally conscious tourists and boosting demand for equipment.

Manufacturers are responding to this trend by developing gear made from eco-friendly materials. Sustainable production methods, such as the use of recycled composites and biodegradable packaging, are gaining traction among leading brands. Additionally, businesses in the adventure tourism sector are promoting responsible flying practices, including designated flight zones to minimize disruptions to wildlife and natural habitats.

The alignment of hang gliding with sustainability initiatives is not only driving its popularity but also positioning it as a preferred activity for future adventure tourism markets. As awareness of environmental issues continues to grow, the demand for sustainable and responsible outdoor activities is expected to further propel the hang gliding equipment market.

Regional Analysis

North America Leads the Hang Gliding Equipment Market with the Largest Market Share of 43.4%

The North America hang gliding equipment market dominates the global landscape, holding a substantial 43.4% market share in 2024, valued at approximately USD 44.6 million. This dominance can be attributed to the region’s well-established adventure tourism sector, high disposable income, and strong participation in aerial sports.

The United States, as a key contributor, showcases a growing trend toward recreational outdoor activities, supported by a well-developed infrastructure for hang gliding training and competitions. Additionally, the presence of dedicated gliding zones and favorable weather conditions further bolster the market’s growth. Canada also plays a significant role, with increasing consumer interest in extreme sports contributing to market expansion.

In Europe, the market for hang gliding equipment is witnessing steady growth due to the increasing popularity of aerial sports across countries such as Germany, France, and the United Kingdom. The region benefits from a rich aviation history, a strong regulatory framework promoting adventure sports safety, and a well-established network of gliding clubs.

The rising number of adventure tourism enthusiasts and favorable topography with numerous hang gliding sites contribute to the market’s growth. The region’s demand for technologically advanced and lightweight hang gliders further supports product innovation.

The Asia Pacific region is experiencing rapid expansion in the hang gliding equipment market, driven by growing adventure tourism industries in countries like China, Australia, and India. The increasing middle-class population and rising disposable incomes are key factors boosting the adoption of aerial sports.

Australia, in particular, is a major hub for hang gliding, offering extensive coastal and mountainous regions suitable for the sport. The growing influence of international hang gliding competitions and expanding infrastructure for adventure sports further enhance market demand.

The Middle East & Africa region is gradually emerging as a niche market for hang gliding equipment, with increasing interest in adventure sports tourism in countries such as the United Arab Emirates and South Africa.

The presence of desert landscapes and mountainous terrains provides suitable environments for gliding enthusiasts. However, the market’s growth is somewhat restrained due to the limited number of professional training centers and regulations surrounding aerial sports.

Latin America holds a moderate share of the hang gliding equipment market, with Brazil and Argentina being key contributors. The region’s vast natural landscapes and growing adventure tourism industry present opportunities for market expansion.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- United Arab Emirates

Key Players Analysis

The Global Hang Gliding Equipment Market in 2024 is characterized by the presence of several key players, each contributing to market expansion through innovation, product differentiation, and strategic collaborations. Aeros Company continues to strengthen its market position through technologically advanced hang gliders with enhanced aerodynamics and lightweight materials.

Similarly, Airborne Windsports Pty Ltd remains a significant player with its focus on high-performance hang gliders designed for both recreational and competitive use. Albatross Flying Systems Pvt. Ltd. is leveraging its expertise in aviation technology to introduce cost-effective solutions, appealing to the growing adventure tourism segment.

Apco Aviation maintains a competitive edge by integrating high-quality fabrics and safety features into its hang gliding equipment, ensuring better durability and flight stability. Finsterwalder GmbH and Flight Design are investing in research and development to optimize glider performance, emphasizing weight reduction and enhanced maneuverability.

ICARO 2000, known for its precision engineering, is targeting professional gliders with advanced material compositions, boosting efficiency. Kortel Design and La Mouelle are differentiating through ergonomic harness designs and accessories, enhancing pilot comfort and safety.

Moyes Delta Gliders remains a dominant force in the competitive hang gliding segment, continually innovating in terms of speed and handling capabilities. North Wing and Stilescom focus on entry-level and intermediate hang gliders, addressing a broader consumer base.

Wills Wings Inc., a longstanding industry player, continues to lead in product reliability, aerodynamics, and pilot-friendly designs, reinforcing its strong market presence. Together, these companies drive market growth through innovation and evolving consumer preferences.

Top Key Players in the Market

- Aeros Company

- Airborne Windsports Pty Ltd

- Albatross Flying Systems Pvt. Ltd.

- Apco Aviation

- Finsterwalder GmbH

- Flight Design

- ICARO 2000

- Kortel Design

- La Mouelle

- Moyes Delta Gliders

- North Wing

- Stilescom

- Wills Wings Inc.

Recent Developments

- In 2024, Diamondback Energy, Inc. (NASDAQ: FANG) finalized its merger with Endeavor Energy Resources, L.P., marking a major step in its growth. Chairman and CEO Travis Stice emphasized that this merger strengthens Diamondback, positioning it as a key player in North American oil production. With prime assets in the Permian Basin, the company remains focused on maximizing value and generating strong cash flow.

- In 2023, North Wing successfully completed flight tests and enhancements for the Discovery 207 wing, an affordable upgrade for the ATF Soaring Trike. This ultralight trike, known for its durability and performance, now offers a nearly silent 21kW, 28HP electric propulsion system, delivering zero emissions and improved glide efficiency. ATF owners can upgrade their trikes with the ATF Retrofit Kit, embracing a cleaner, more efficient flight experience.

Report Scope

Report Features Description Market Value (2024) USD 102.9 Million Forecast Revenue (2034) USD 245.8 Million CAGR (2025-2034) 9.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered Aeros Company, Airborne Windsports Pty Ltd, Albatross Flying Systems Pvt. Ltd., Apco Aviation, Finsterwalder GmbH, Flight Design, ICARO 2000, Kortel Design, La Mouelle, Moyes Delta Gliders, North Wing, Stilescom, Wills Wings Inc. Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape By Type (Powered, Non-Powered), By Product Type (Gliders, Harnesses, Helmets, Others), By End User (Recreational, Professional), By Distribution Channel (Online, Offline) Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Hang Gliding Equipment MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

Hang Gliding Equipment MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Aeros Company

- Airborne Windsports Pty Ltd

- Albatross Flying Systems Pvt. Ltd.

- Apco Aviation

- Finsterwalder GmbH

- Flight Design

- ICARO 2000

- Kortel Design

- La Mouelle

- Moyes Delta Gliders

- North Wing

- Stilescom

- Wills Wings Inc.