Global Cosmetics and Personal Care Packaging Equipment Market By Product (Filling, Labelling, Cleaning, Form-Fill-Seal, Cartoning, Wrapping, Palletizing), By Application (Skin Care, Hair Care, Decorative Cosmetics, Bath and Shower, Perfumes, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec 2024

- Report ID: 134409

- Number of Pages: 278

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

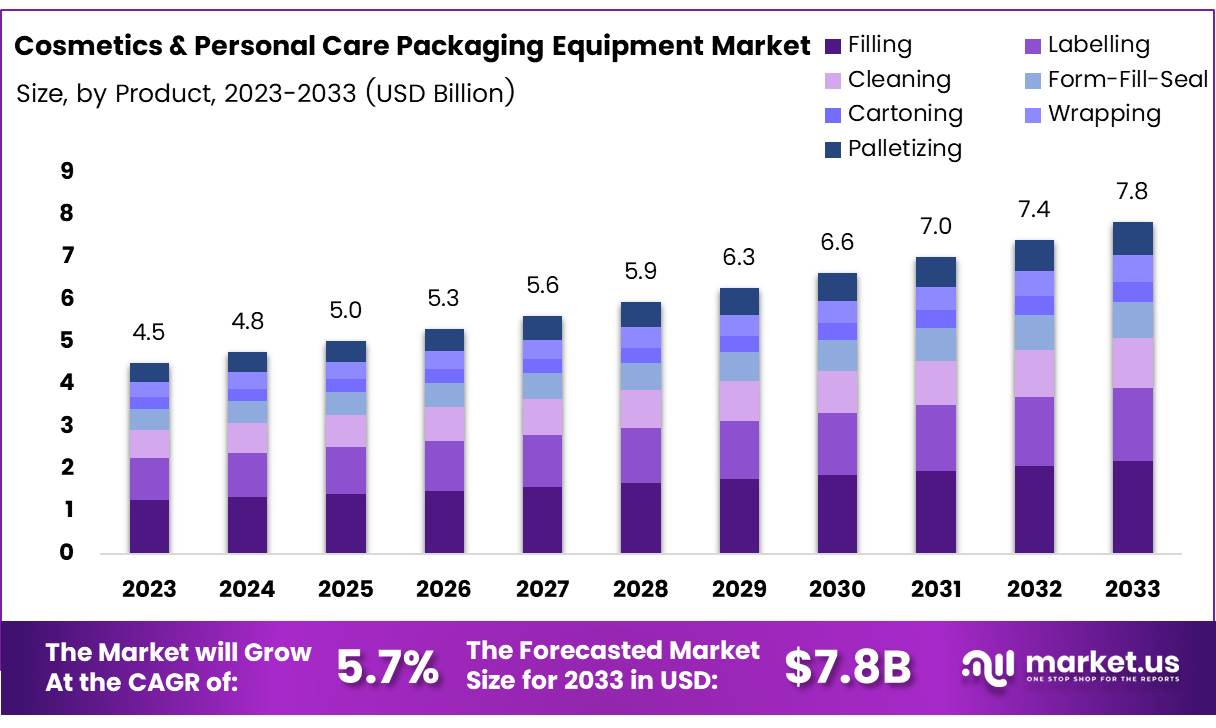

The Global Cosmetics and Personal Care Packaging Equipment Market size is expected to be worth around USD 7.8 Billion by 2033, from USD 4.5 Billion in 2023, growing at a CAGR of 5.7% during the forecast period from 2024 to 2033.

Cosmetics and personal care packaging equipment refers to the machinery used in the packaging processes for products such as skincare, haircare, fragrance, and makeup items. This equipment plays a crucial role in filling, capping, labeling, and sealing products in a variety of packaging formats, including bottles, jars, tubes, and pouches.

The cosmetics and personal care packaging equipment market is experiencing robust growth, driven by several key factors. First, the rising demand for beauty and personal care products across emerging markets, particularly in Asia-Pacific and Latin America, has resulted in an increased need for packaging solutions that can efficiently handle larger volumes of production. This demand is compounded by the evolving consumer preferences for sustainability and innovation in packaging.

According to Survey, more than 75% of U.S. consumers placed importance on sustainably packaged cosmetic products in 2023, signaling a clear shift towards eco-friendly packaging solutions.

As a result, manufacturers are investing heavily in packaging equipment that incorporates recyclable, biodegradable, and lightweight materials, as well as energy-efficient processes to align with consumer expectations for sustainability.

Moreover, the demand for customized packaging, including unique shapes, sizes, and personalized designs, is on the rise, presenting significant opportunities for packaging equipment manufacturers. The emergence of e-commerce as a dominant sales channel for cosmetics and personal care products has also increased the need for packaging that ensures product protection during shipping while maintaining visual appeal.

Government investment and regulatory frameworks have a significant influence on the cosmetics and personal care packaging equipment market. Regulations around product safety, environmental impact, and waste management are becoming stricter, pushing manufacturers to adopt more sustainable packaging practices.

In Europe, for example, the European Union’s packaging and packaging waste directive has accelerated the demand for recyclable and reusable packaging materials, which, in turn, is influencing packaging machinery design and development.

In addition to regulatory impacts, government investments in industrial automation and sustainability are shaping the market. For example, several European countries are offering incentives and subsidies for manufacturers that incorporate sustainable practices and technologies in their production processes.

The packaging machinery industry reached €9.2 billion in turnover in 2023, with exports contributing €7.2 billion. Italy’s sector saw a 10.5% increase in foreign turnover, rising to €7.2 billion. This growth reflects the global demand for advanced packaging solutions, particularly in cosmetics and personal care.

Key Takeaways

- The global Cosmetics and Personal Care Packaging Equipment Market is projected to reach USD 7.8 billion by 2033, growing at a CAGR of 5.7%.

- Filling equipment led the market in 2023, holding a 39.1% share due to its efficiency and technological advancements in packaging.

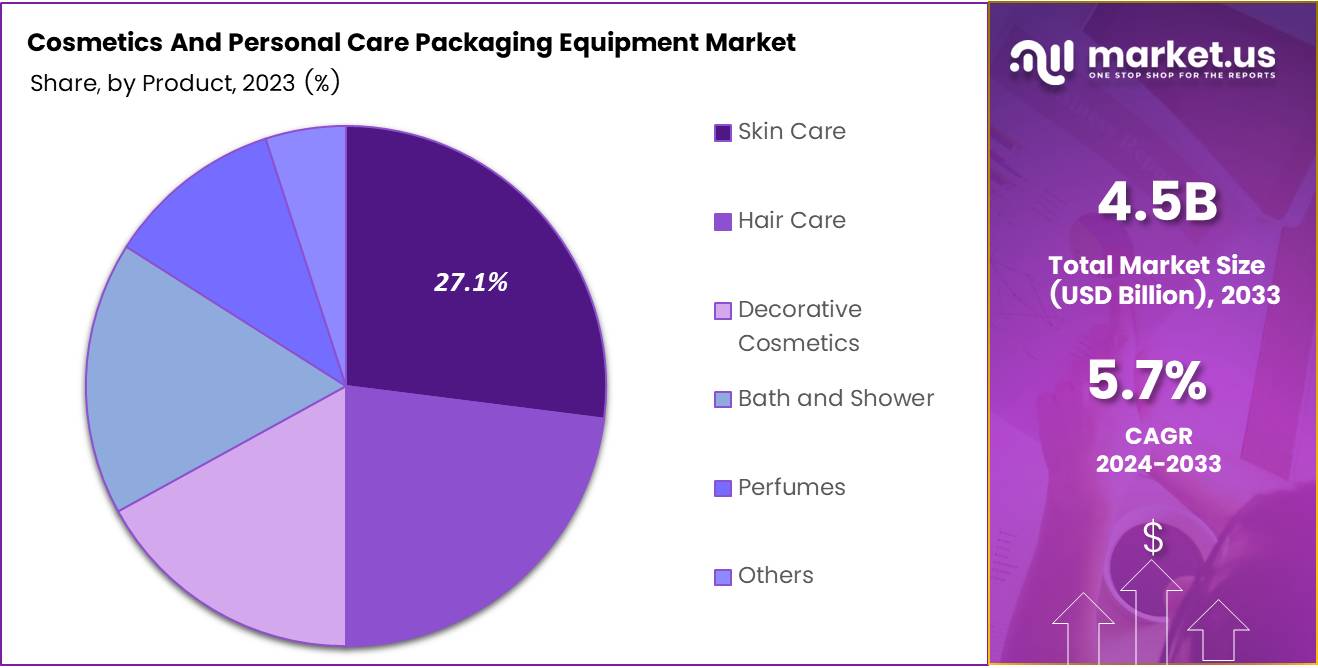

- Skin Care applications dominated the market with a 27.1% share in 2023, driven by increasing consumer demand and packaging innovations.

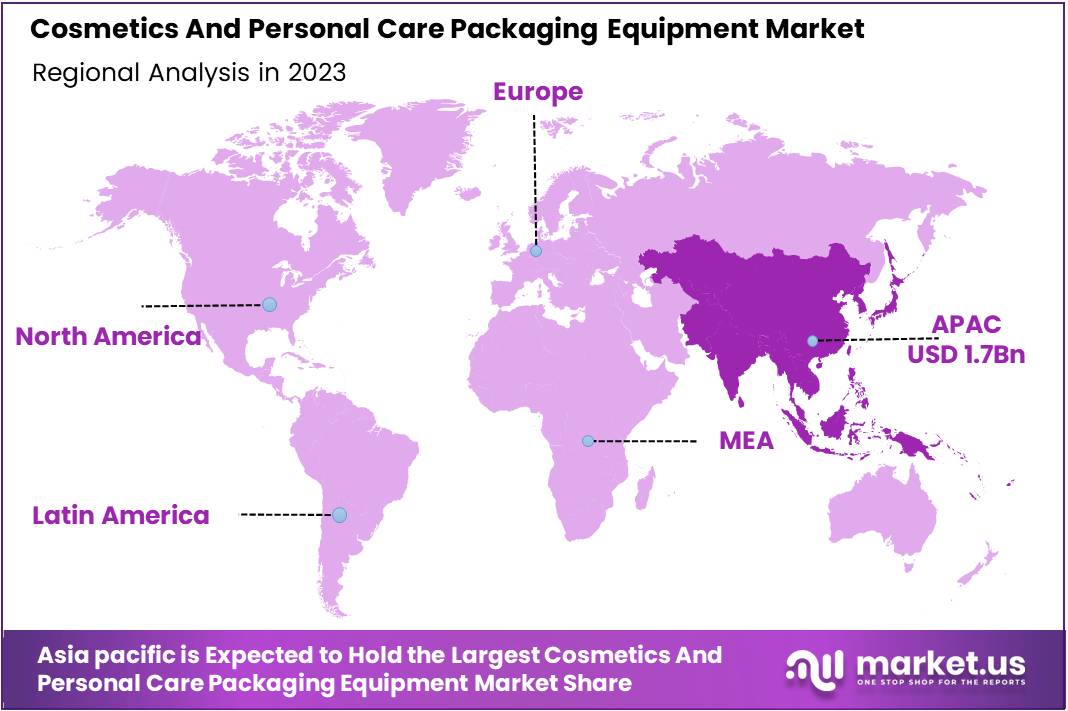

- Asia Pacific is the leading region in the market, accounting for 38.2% of the total share, valued at USD 1.7 billion in 2023.

Product Analysis

In 2023, Filling Led the Cosmetics and Personal Care Packaging Equipment Market with a 39.1% Share in the By Product Analysis Segment

In 2023, Filling held a dominant market position in the By Product Analysis segment of the Cosmetics and Personal Care Packaging Equipment Market, with a 39.1% share. This sector’s prominence can be attributed to the increasing demand for automated and precise packaging processes, essential for maintaining product integrity in the cosmetics industry. The efficiency of filling machinery, coupled with advancements in technology, has enabled companies to meet high-volume production needs while ensuring accuracy and hygiene.

The Labelling segment followed closely, driven by consumer preference for clear, informative packaging, contributing significantly to brand differentiation. The Cleaning segment also experienced growth, supported by stringent hygiene standards and the need for thorough sanitation between production runs.

The Form-Fill-Seal segment saw robust demand, particularly in high-speed production environments, as it combines multiple functions into a single, streamlined process. Cartoning, Wrapping, and Palletizing segments also held considerable shares, with packaging automation playing a pivotal role in reducing labor costs and improving efficiency.

Overall, the continuous innovation in packaging technologies and the growing emphasis on sustainable and cost-effective solutions are expected to drive steady growth across all segments, with filling equipment maintaining its lead in market share.

Application Analysis

In 2023, Skin Care Led the Cosmetics and Personal Care Packaging Equipment Market with 27.1% Share

In 2023, Skin Care held a dominant market position in the By Application Analysis segment of the Cosmetics and Personal Care Packaging Equipment Market, with a 27.1% share. The increasing demand for skin care products, driven by a growing consumer awareness of health and beauty, has propelled this segment’s market leadership. Packaging innovation in skin care, including sustainable materials and airless packaging solutions, is expected to further support growth.

Hair Care follows closely, with a notable market share, as consumers continue to prioritize hair health and aesthetics. Hair care packaging has evolved to include eco-friendly alternatives and user-friendly designs, aligning with the broader sustainability trend. Decorative Cosmetics, while maintaining a significant presence, sees steady growth fueled by innovation in product formulations and packaging aesthetics.

Bath and Shower products also contribute to the market, with packaging innovation focusing on convenience and hygiene. Perfumes, on the other hand, experience moderate growth, driven by the demand for premium and luxury fragrances, as well as personalized packaging options. The Others segment, encompassing a variety of niche products, also shows promising potential in response to changing consumer preferences.

Overall, these application categories highlight dynamic shifts in consumer behavior and packaging innovation within the Cosmetics and Personal Care industry.

Key Market Segments

By Product

- Filling

- Labelling

- Cleaning

- Form-Fill-Seal

- Cartoning

- Wrapping

- Palletizing

By Application

- Skin Care

- Hair Care

- Decorative Cosmetics

- Bath and Shower

- Perfumes

- Others

Drivers

Key Drivers of the Cosmetics and Personal Care Packaging Equipment Market

The growth of the cosmetics and personal care packaging equipment market is primarily driven by several key factors. First, the increasing demand for sustainable packaging materials is reshaping the industry. Consumers are more conscious about the environmental impact of their purchases, leading brands to shift towards eco-friendly, recyclable, and biodegradable packaging. This has resulted in significant innovations in packaging equipment to meet these new requirements.

Additionally, the global cosmetics industry is experiencing rapid growth, supported by rising disposable incomes, changing beauty standards, and an increasing number of beauty-conscious consumers worldwide. This surge in demand is further fueling the need for packaging equipment to ensure products are efficiently and attractively packaged.

Furthermore, advancements in automation technology have played a critical role in enhancing production efficiency. Automated packaging systems are now widely adopted across the industry, offering significant benefits such as reduced labor costs, improved speed, and greater precision in packaging.

These innovations are driving market expansion by allowing manufacturers to meet increasing production demands while improving cost-efficiency. As consumer preferences evolve and technological innovations continue to advance, these drivers are expected to sustain the growth of the cosmetics and personal care packaging equipment market.

Restraints

High Capital Investment and Complexity of Packaging Designs as Market Restraints

One of the main challenges in the cosmetics and personal care packaging equipment market is the high capital investment required for advanced machinery. The cost of acquiring cutting-edge equipment can be prohibitive, particularly for small and medium-sized enterprises (SMEs) that may have limited financial resources.

These businesses may find it difficult to justify the upfront investment, even though such equipment can increase long-term productivity and reduce operational costs. Furthermore, the growing demand for unique, customized packaging designs also presents a restraint.

As cosmetic and personal care brands strive for differentiation, they often require packaging solutions that are more intricate and complex. This increases the demand for specialized machinery, which can be costly and slower compared to standard packaging lines. The need for customization may result in lower production speeds and higher operational complexity, impacting overall efficiency.

As a result, the added costs and challenges associated with implementing these advanced and customized solutions could deter companies from investing in new packaging equipment, particularly in a market where price competition is strong. These factors combined could hinder the widespread adoption of advanced packaging technologies, especially for smaller players aiming to maintain competitive pricing while meeting the rising demand for premium and customized packaging solutions.

Growth Factors

Growth Opportunities in Cosmetics and Personal Care Packaging Equipment

The cosmetics and personal care packaging equipment market is witnessing several key growth opportunities driven by emerging technologies and shifting consumer preferences. Smart packaging solutions, which incorporate features such as anti-counterfeit technology and digital labeling, are gaining traction as consumers and brands seek enhanced product security and personalized experiences.

These innovations allow for better traceability, authenticity verification, and consumer engagement, creating a valuable growth avenue for packaging equipment manufacturers. In parallel, the increasing demand for sustainable packaging is driving the shift toward eco-friendly materials.

Innovations such as plant-based plastics, biodegradable films, and compostable packaging are reshaping the market, offering packaging equipment suppliers the chance to meet environmental demands and regulatory standards. As sustainability becomes a central focus for brands, adapting to these trends is vital for market competitiveness.

Additionally, the rise of 3D printing technology in packaging production is opening new doors for customized, short-run packaging solutions. By enabling rapid prototyping and cost-effective small-scale production, 3D printing allows brands to experiment with unique designs and packaging formats, offering flexibility and creativity that was previously difficult to achieve. These evolving trends present significant opportunities for growth and innovation within the packaging equipment industry, as suppliers respond to the changing needs of the cosmetics and personal care market.

Emerging Trends

Key Trends in Cosmetics and Personal Care Packaging Equipment

In the cosmetics and personal care packaging equipment market, several key trends are shaping the industry. First, luxury packaging is gaining significant traction, with high-end cosmetic brands increasingly investing in premium materials and intricate designs. These premium packaging solutions, which often feature elegant finishes and unique craftsmanship, aim to enhance the overall consumer experience and reinforce brand prestige. Another major trend is the integration of automation and robotics into packaging lines.

Automation, powered by AI-driven systems, is revolutionizing the sector by increasing production efficiency, reducing human error, and ensuring more precise packaging processes. This shift is particularly beneficial in meeting the high demand for fast, consistent production without compromising on quality.

Additionally, the use of smart labels is on the rise. These interactive labels, which can be scanned by consumers using smartphones or mobile apps, provide access to detailed product information, such as ingredients, origin, and usage tips, offering a more engaging and personalized experience.

These labels also allow brands to improve consumer interaction and build trust by providing transparency. Together, these trends reflect the growing emphasis on enhancing the consumer journey, optimizing operational efficiency, and leveraging innovative technologies in the cosmetics and personal care packaging market.

Regional Analysis

Asia Pacific Leads the Growth in the Cosmetics and Personal Care Packaging Equipment Market, Accounting for 38.2% Share

The Cosmetics and Personal Care Packaging Equipment Market is experiencing substantial growth across various regions, driven by increasing demand for packaged products, technological advancements, and evolving consumer preferences. Among the key regions, Asia Pacific dominates the market, accounting for 38.2% of the total market share, valued at USD 1.7 billion in 2023.

The region’s dominance is largely attributed to the presence of major manufacturing hubs in countries such as China, India, Japan, and South Korea, as well as the growing beauty and personal care industry. The rising middle-class population, increased disposable incomes, and greater interest in premium, sustainable, and innovative packaging solutions further fuel the growth in Asia Pacific.

Regional Mentions:

In North America, the market is driven by strong consumer spending, particularly in the U.S., and a rising demand for eco-friendly packaging. Technological innovations, including airless packaging and refillable containers, are gaining popularity in this region. Moreover, the growing focus on sustainability and regulatory initiatives promoting environmentally responsible packaging practices are expected to contribute to market expansion.

Europe follows closely, with strong demand for luxury and high-end personal care products. Countries such as Germany, France, and the UK are the key contributors, and the shift towards organic and natural products continues to influence the packaging segment. Stringent environmental regulations and consumer awareness regarding eco-friendly practices support the market growth in this region.

In Middle East & Africa and Latin America, while the markets are still in the emerging stage, they are witnessing steady growth driven by an increasing demand for personal care products. There is a growing inclination toward innovative packaging solutions, particularly in the premium segment, but overall market growth remains more gradual compared to other regions.

Key Regions and Countries covered іn thе rероrt

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The global Cosmetics and Personal Care Packaging Equipment market in 2023 is characterized by a competitive landscape featuring several key players who have significantly influenced market dynamics through innovation, strategic acquisitions, and regional expansion.

Wimco Engineering has positioned itself as a leader in the market with a strong portfolio of customized packaging solutions tailored to the cosmetics and personal care sectors. Their expertise in automation and precision technology contributes to the increasing demand for high-quality, efficient packaging systems.

Syntegon Technology GmbH continues to be a prominent player, with a focus on sustainable and efficient packaging technologies. Their solutions cater to the growing demand for eco-friendly and resource-efficient packaging, an area gaining traction within the cosmetics industry due to rising sustainability trends.

Marchesini Group S.P.A., known for its innovative and high-performance equipment, has strengthened its position by developing scalable and modular systems that accommodate diverse packaging needs within the personal care sector. Its ability to integrate cutting-edge technology enhances production efficiency, a key factor for large-scale manufacturers.

AMET Packaging, Inc. (after acquiring APACKS) has broadened its offering of advanced packaging machinery, providing innovative systems that cater to both small-scale and large-scale production environments. This acquisition enhances its competitive advantage by diversifying its capabilities in automated filling and capping solutions.

Bosch Packaging Technology and OPTIMA Packaging Group focus on advancing automation and digitalization in packaging systems, improving efficiency, and reducing labor costs. Their emphasis on machine flexibility and customization ensures they meet the ever-evolving needs of cosmetics packaging.

Top Key Players in the Market

- Wimco Engineering

- Syntegon Technology GmbH

- Marchesini Group S.P.A.

- AMET Packaging, Inc. (acquired APACKS)

- Bosch Packaging Technology

- Prosys Innovative Packaging Equipment

- E-PAK Machinery

- OPTIMA Packaging Group

- Accutek Packaging Equipment Companies

- Ronchi Mario

- Filamatic

Recent Developments

- In October 2024, ClayCo Cosmetics secured $2 million in funding from Unilever Ventures to accelerate its expansion and further develop its innovative cosmetics products, with a focus on sustainability and clean beauty.

- In April 2024, Sparxell, a company specializing in sustainable pigments, raised $3.2 million to advance the commercialization of its eco-friendly, high-performance colorants for the cosmetic and consumer goods industries.

- In December 2024, Proven, a personalized skincare brand, raised $12.2 million in its latest funding round to expand its product offerings, enhance AI-driven skin analysis, and accelerate growth in the global skincare market.

Report Scope

Report Features Description Market Value (2023) USD 4.5 Billion Forecast Revenue (2033) USD 7.8 Billion CAGR (2024-2033) 5.7% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Filling, Labelling, Cleaning, Form-Fill-Seal, Cartoning, Wrapping, Palletizing), By Application (Skin Care, Hair Care, Decorative Cosmetics, Bath and Shower, Perfumes, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Wimco Engineering, Syntegon Technology GmbH, Marchesini Group S.P.A., AMET Packaging, Inc. (acquired APACKS), Bosch Packaging Technology, Prosys Innovative Packaging Equipment, E-PAK Machinery, OPTIMA Packaging Group, Accutek Packaging Equipment Companies, Ronchi Mario, Filamatic Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Cosmetics and Personal Care Packaging Equipment MarketPublished date: Dec 2024add_shopping_cartBuy Now get_appDownload Sample

Cosmetics and Personal Care Packaging Equipment MarketPublished date: Dec 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Wimco Engineering

- Syntegon Technology GmbH

- Marchesini Group S.P.A.

- AMET Packaging, Inc. (acquired APACKS)

- Bosch Packaging Technology

- Prosys Innovative Packaging Equipment

- E-PAK Machinery

- OPTIMA Packaging Group

- Accutek Packaging Equipment Companies

- Ronchi Mario

- Filamatic