Global Snowboard Equipment Market By Product Type (Split Board, Snowboard Binding, Snowboard Boots, Protective Gear, Accessories, Others), By Distribution Channel (Online Retail, Offline Channels), By End-User (Professional Snowboarders, Amateur and Leisure Snowboarders), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov 2024

- Report ID: 133916

- Number of Pages: 217

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

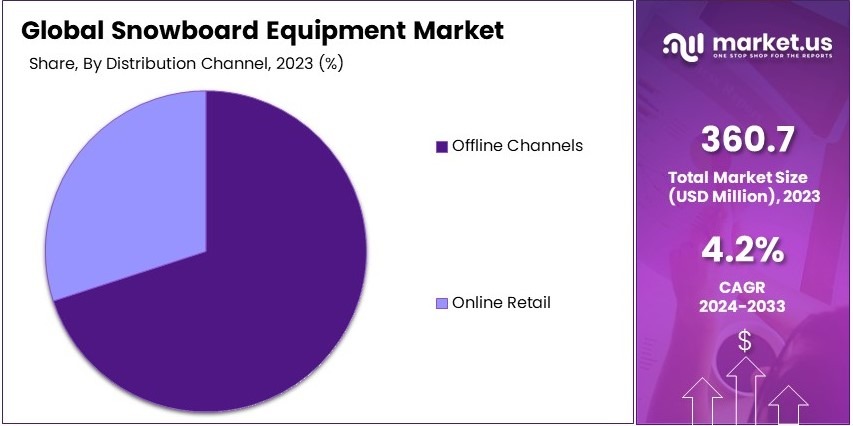

The Global Snowboard Equipment Market size is expected to be worth around USD 544.3 Million by 2033, from USD 360.7 Million in 2023, growing at a CAGR of 4.2% during the forecast period from 2024 to 2033.

Snowboard equipment refers to the gear required for snowboarding, including snowboards, bindings, boots, and outerwear such as jackets and pants. The equipment is designed to enhance performance, safety, and comfort during snowboarding activities. It also includes accessories like helmets, goggles, and gloves.

The snowboard equipment market encompasses the production, distribution, and sale of snowboarding gear. This market includes various product segments such as snowboards, bindings, boots, apparel, and accessories. It serves both recreational and professional snowboarders and is influenced by factors such as consumer demand and seasonality.

The snowboard equipment market has experienced steady growth in recent years, driven by the increasing popularity of snowboarding. According to Snowsports Industries America (SIA), the number of snowboard participants has been growing at a rate of 20% annually, outpacing other snow sports. This demand presents significant opportunities for market players.

The market’s competitiveness level remains high, as several key players vie for market share, offering innovative designs and enhanced performance features. Despite the competition, there are still opportunities for growth, especially in emerging markets where snowboarding is gaining traction. The level of market saturation is moderate, providing room for new entrants.

On a broader scale, the growth in snowboarding participants, now reaching 29.9 million in the U.S., is helping to fuel demand for equipment, benefiting manufacturers and retailers. This expansion has positive implications for the global snow sports market as a whole, creating opportunities for cross-industry partnerships and further innovations in product offerings.

Increased snowboarding participation has led to the growth of related industries, such as resort development and local sports tourism. This trend benefits local economies by attracting tourists and driving demand for rentals, lessons, and equipment sales.

Governments are also playing a role in promoting snow sports, with investments in infrastructure and regulations aimed at improving safety and accessibility. These efforts help create a favorable environment for the growth of the snowboarding market. Additionally, with rising interest, government regulations are ensuring that snowboarding remains a sustainable and safe sport for future generations.

Key Takeaways

- The Snowboard Equipment Market was valued at USD 360.7 Million in 2023, and is expected to reach USD 544.3 Million by 2033, with a CAGR of 4.2%.

- In 2023, Split Board dominates the product type segment, reflecting its popularity among backcountry riders for its versatility and performance.

- In 2023, Offline Channels lead the distribution channel segment, representing a significant preference for in-store purchases in specialized snowboarding shops.

- In 2023, Amateur/Leisure Snowboarders dominate the end-user segment, indicating broad consumer engagement with snowboarding as a recreational activity.

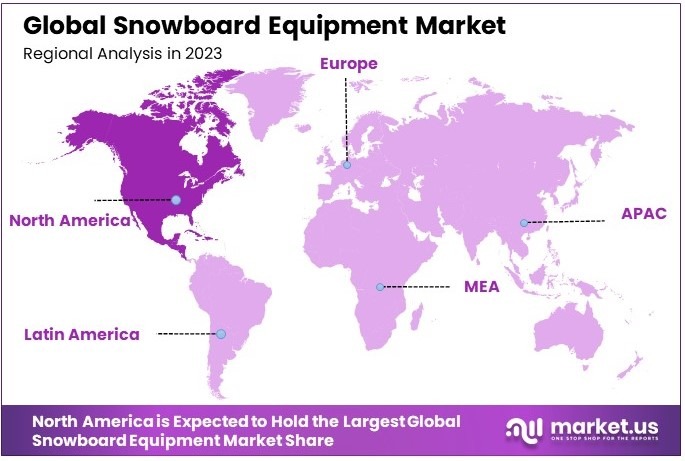

- In 2023, North America holds the dominant regional share, accounting for a large portion of the global snowboarding market due to the region’s strong winter sports culture.

Type Analysis

Split Board Dominates due to rising demand for off-piste and backcountry snowboarding.

The snowboard equipment market is segmented by product type, with the split board emerging as the dominant sub-segment. Split boards have revolutionized the backcountry snowboarding experience, making them highly popular among riders who prefer exploring off-piste terrains.

A split board allows a rider to separate the snowboard into two skis for ascending slopes and then reassemble it for downhill rides, offering more versatility and freedom. This design caters to the growing demand for backcountry snowboarding, driven by an increasing number of snowboarders looking to explore untouched, natural landscapes outside of traditional ski resorts.

Snowboard bindings are another important sub-segment in the market. Bindings are essential for connecting the snowboard to the rider’s boots, providing the necessary control and stability. The demand for snowboard bindings has remained consistent due to ongoing advancements in binding technology, with manufacturers focusing on comfort, adjustability, and performance.

Snowboard boots, while still a key component of the snowboarding setup, are another sub-segment with steady demand. Snowboard boots serve as the foundation of a rider’s equipment, providing comfort, support, and control.

Protective gear is essential for ensuring the safety of snowboarders, including helmets, wrist guards, knee pads, and padded jackets. The demand for protective gear has grown as snowboarding becomes more mainstream and safety concerns rise.

Accessories, including snowboard bags, goggles, gloves, and outerwear, make up the remaining portion of the market. Although they are necessary for the snowboarding experience, accessories tend to be purchased less frequently and generally have a lower price point. As a result, the accessories sub-segment holds a smaller share of the overall snowboard equipment market.

Distribution Channel Analysis

Offline Channels Dominate due to established retail networks and consumer preference for in-store shopping.

The distribution channels for snowboard equipment are primarily divided between offline and online retail. Offline channels, such as sporting goods stores, specialty snowboard shops, and other brick-and-mortar retailers, dominate the market. These channels benefit from a long-standing presence in the retail landscape and a strong connection with the snowboarding community.

Physical stores offer a hands-on shopping experience, where consumers can touch and feel the products, seek expert advice, and test the fit of snowboards, bindings, and boots. Many snowboarders prefer shopping in-store because of the personalized service and the ability to immediately see the quality and features of the products.

Specialty snowboard shops, in particular, cater specifically to the snowboarding community, offering a wide range of equipment and accessories. These shops often provide more specialized expertise than general sporting goods stores, making them the go-to option for dedicated snowboarders seeking the latest gear.

Online retail has gained significant traction in recent years, offering convenience and accessibility to a broader audience. With platforms such as Amazon, REI, and other specialized snowboarding websites, consumers can shop from the comfort of their homes, compare prices, and access a wider variety of products than what may be available in local stores.

Other channels, such as direct-to-consumer sales by brands, represent a smaller share of the market. Some companies, particularly well-established snowboard brands, sell their products directly through their own websites or pop-up shops. While these channels can offer exclusivity or limited edition products, they play a minor role in overall sales when compared to traditional offline retail outlets.

End-User Analysis

Amateur/Leisure Snowboarders Dominate due to the growing popularity of recreational snowboarding.

The end-user segment of the snowboard equipment market is divided between professional snowboarders and amateur/leisure snowboarders, with the latter dominating the market. The growth of snowboarding as a recreational activity has significantly expanded the consumer base, with more people taking up the sport for leisure rather than professional competition.

Factors such as increased accessibility to ski resorts, the rise of snowboarding tourism, and a growing interest in outdoor adventure sports have contributed to the broader appeal of snowboarding as a fun and challenging winter activity.

Amateur and leisure snowboarders account for the largest segment of the market, driven by the growing participation in recreational snowboarding. These riders typically engage in snowboarding for enjoyment during vacations, holidays, or weekend trips. They are often less concerned with professional-level performance and more focused on having a fun and social experience on the slopes.

Professional snowboarders, though fewer in number, still represent a vital part of the market. This group includes elite athletes who participate in high-level competitions and require top-tier snowboarding equipment tailored to their specific needs.

Key Market Segments

By Product Type

- Split Board

- Snowboard Binding

- Snowboard Boots

- Protective Gear

- Accessories

- Others

By Distribution Channel

- Online Retail

- Offline Channels

- Sporting Goods Stores

- Specialty Snowboard Shops

- Others

By End-User

- Professional Snowboarders

- Amateur/Leisure Snowboarders

Drivers

Connectivity Drives Market Growth

The increasing integration of advanced technologies into snowboard equipment is a significant factor driving the growth of the Snowboard Equipment Market. With the rise of smart devices and wireless connectivity, manufacturers are incorporating features like Bluetooth, GPS tracking devices, and app integration into snowboards and related equipment.

This not only enhances user experience but also provides consumers with valuable data, such as tracking speed, distance, and altitude. These technological improvements cater to the growing demand for more personalized, performance-driven equipment.

Additionally, advancements in manufacturing technology have allowed for lighter, more durable materials, improving both the performance and lifespan of the equipment. Such innovations contribute to the broader adoption of snowboarding, attracting both amateur and professional enthusiasts.

As the demand for higher-performance equipment increases, manufacturers continue to develop products that meet the needs of tech-savvy and performance-driven users, further fueling the market’s growth.

Restraints

Price Sensitivity Restraints Market Growth

Price sensitivity is a notable restraint on the Snowboard Equipment Market, especially for consumers who are price-conscious or new to the sport. High-quality snowboard gear, including boards, boots, bindings, and protective equipment, can be expensive, making it less accessible to a broader audience.

The high upfront cost, combined with the seasonal nature of snowboarding, may deter casual users from making significant investments in equipment. Additionally, the cost of maintenance and replacement parts adds to the overall expense.

The economic downturns and fluctuating disposable incomes also affect consumer spending on premium snowboarding equipment. This price sensitivity can lead to slower adoption rates in some regions, limiting the growth potential of the market.

Another factor that contributes to this restraint is the rise in competition from budget-friendly alternatives and second-hand markets, where consumers may prefer to purchase cheaper or used equipment rather than invest in new, high-end products. Thus, price concerns present a considerable challenge to market growth, particularly in regions where snowboarding is still an emerging sport.

Opportunity

Innovation Provides Opportunities for Growth

Innovative design and material advancements present significant opportunities for players in the Snowboard Equipment Market. The growing trend of eco-conscious consumers has led to increased demand for sustainable and environmentally friendly products.

Manufacturers are investing in the development of snowboards made from recycled materials or utilizing environmentally friendly manufacturing processes. In addition to sustainability, the increasing interest in customizing snowboarding gear offers a competitive edge for brands that can provide personalized options.

These opportunities allow brands to cater to the growing trend of consumer individuality and eco-consciousness. As consumer preferences continue to evolve, companies that stay ahead with cutting-edge designs and sustainable practices are likely to capture a larger share of the market.

Moreover, partnerships with snow resorts, schools, and tour operators to provide rental equipment or co-branded experiences further open new revenue streams, capitalizing on the expanding global snowboarding culture.

Challenges

Seasonal Factors Challenge Market Growth

Seasonal fluctuations pose a significant challenge for the Snowboard Equipment Market. Snowboarding is inherently a winter sport, and thus, demand for snowboarding equipment peaks during the colder months. This seasonal demand creates challenges for manufacturers and retailers in terms of inventory management and production cycles.

In addition, the geographic concentration of snowboarding activities in regions with suitable climates limits the market’s potential in warmer regions. As snowboarding is not a year-round activity for most consumers, this seasonality can lead to periods of low sales, resulting in a less stable revenue stream for companies.

Furthermore, unpredictable weather patterns and changing snowfall conditions can also affect the overall number of snowboarding participants in a given year, further contributing to the cyclical nature of the market. To counter these challenges, companies need to diversify their product offerings, explore off-season marketing strategies, and develop products that appeal to consumers year-round.

Growth Factors

Increasing Disposable Income is Growth Factor

An increase in disposable income is a significant growth factor for the Snowboard Equipment Market. As global economies recover and consumers experience higher levels of income, spending on leisure activities like snowboarding is on the rise.

Snowboarding is often considered a luxury sport due to the cost of equipment, travel, and resort expenses, making it more accessible to individuals with greater disposable income. The rising number of middle and upper-middle-class consumers in emerging markets, especially in countries like China, South Korea, and India, is expanding the customer base for snowboarding equipment.

These markets are seeing increasing participation in winter sports, and as disposable income grows, more consumers are willing to invest in high-quality, durable snowboarding equipment.

Additionally, increased disposable income allows consumers to upgrade their equipment or purchase multiple gear sets, contributing to higher overall sales and market growth. As wealth continues to rise in key regions, the demand for snowboarding products is expected to grow, providing new avenues for market expansion.

Emerging Trends

Eco-Friendly Equipment is Latest Trending Factor

Sustainability is becoming an increasingly important trend in the Snowboard Equipment Market. As consumers become more environmentally conscious, there is a rising demand for eco-friendly snowboarding equipment. This includes boards made from recycled materials, biodegradable protective gear, and more sustainable manufacturing processes.

The growing awareness of climate change and its effects on snow sports has also led to a push for reducing the carbon footprint of snowboarding products. Leading manufacturers are responding to this trend by incorporating green practices into their supply chains and offering products that align with eco-friendly values.

Furthermore, partnerships with environmental organizations and carbon-offset programs are becoming a key differentiator for brands, helping them appeal to consumers who prioritize sustainability. This trend towards eco-friendly equipment is not only shaping consumer purchasing decisions but is also driving innovation in product development and manufacturing.

Regional Analysis

North America Dominates with Strong Market Presence

North America leads the Snowboard Equipment Market due to its well-established winter sports culture, particularly in the U.S. and Canada. The region benefits from a large number of ski resorts and outdoor sports tourism, with snowboarding being a popular activity among consumers.

The market is also driven by high disposable incomes and a strong interest in adventure sports, which allows consumers to invest in advanced snowboarding gear. Additionally, North America’s robust retail and e-commerce networks enable easy accessibility to snowboarding equipment, while advanced technologies in product development continue to attract a tech-savvy consumer base.

North America’s dominance in the Snowboard Equipment Market is expected to remain strong. The region is likely to continue benefiting from increasing participation in snowboarding, innovations in equipment design, and expanding winter sports tourism, which will maintain its position as a market leader in the coming years.

Regional Mentions:

- Europe: Europe holds a strong market position, driven by countries like Switzerland, Austria, and France, where snowboarding is a popular winter activity. The region benefits from well-developed snowboarding infrastructure and a growing number of winter sports enthusiasts.

- Asia Pacific: Asia Pacific is experiencing a rising demand for snowboarding equipment, particularly in Japan and South Korea. Increasing investment in winter sports infrastructure and growing consumer interest in snowboarding are expected to drive market growth.

- Middle East & Africa: The Middle East & Africa regions are not traditional snowboarding hubs, but countries such as the UAE are investing in winter sports facilities, creating opportunities for growth in the snowboarding equipment market.

- Latin America: Latin America, particularly in countries like Chile and Argentina, is showing potential for snowboarding market growth, fueled by growing interest in winter sports among tourists and locals, particularly in the Andes mountains.

Key Regions and Countries covered in the report

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The Snowboard Equipment Market is highly competitive, with several prominent players driving innovation and market growth. Among the top companies, Burton Snowboards, K2 Sports, Salomon, and Rossignol hold significant shares and play pivotal roles in shaping industry trends.

Burton Snowboards is widely recognized as the leading brand in the snowboard equipment sector. Known for its comprehensive range of snowboards, boots, bindings, and apparel, Burton has established a global presence through innovation, quality, and strategic partnerships.

K2 Sports is another dominant player with a broad portfolio that includes snowboards, skis, and related accessories. The company is known for its focus on performance-driven equipment tailored to all skill levels. K2’s strong research and development capabilities allow it to maintain a competitive edge in producing durable and high-performing products.

Salomon (Amer Sports) has a well-established reputation in the action sports industry, particularly snowboarding and skiing. With its focus on technological advancement and sustainability, Salomon produces a range of high-quality snowboards, boots, and bindings designed for various levels of expertise.

Rossignol is another major player, known for its rich history and broad product range. With an emphasis on high-performance snowboards and equipment that cater to both beginners and advanced riders, Rossignol has cemented its position in the global market.

These top players continue to shape the Snowboard Equipment Market through constant product innovation, strategic marketing, and a focus on expanding their global presence. Their commitment to quality, performance, and sustainability positions them for continued success in the competitive landscape.

Top Key Players in the Market

- Burton Snowboards

- K2 Sports

- Salomon (Amer Sports)

- Rossignol

- Mervin Manufacturing (Lib Tech, Gnu, Roxy)

- Ride Snowboards

- Atomic (Amer Sports)

- Head Sports

- Jones Snowboards

- Völkl (Tecnica Group)

- Capita Snowboarding

- Never Summer Industries

- Bataleon Snowboards

- Black Diamond Equipment

- Outdoor Master

Recent Developments

- LINE Skis: On October 2024, LINE Skis, a brand recognized for its influence in freeskiing, launched its first snowboard, the Lateral. Available in sizes 148cm, 152cm, and 156cm, the snowboard is tailored for skiers who want to experience snowboarding, particularly on groomed runs, rails, and park features.

- Shaun White: On June 2024, Shaun White, a three-time Olympic gold medalist, announced the creation of The Snow League, a professional league for global snowboarding and freeskiing halfpipe competition. Set to debut in March 2025, the league will feature five events during its inaugural season, culminating in March 2026, with a total prize purse of at least $1.5 million.

- U.S. Ski & Snowboard and X Games: On June 2024, U.S. Ski & Snowboard and X Games announced a strategic partnership to launch the Winter X Games Series. This collaboration will integrate FIS World Cup events, the Toyota U.S. Grand Prix, Visa Big Air, and the Winter X Games, providing athletes with direct pathways to the X Games through event wins.

Report Scope

Report Features Description Market Value (2023) USD 360.7 Million Forecast Revenue (2033) USD 544.3 Million CAGR (2024-2033) 4.2% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Split Board, Snowboard Binding, Snowboard Boots, Protective Gear, Accessories, Others), By Distribution Channel (Online Retail, Offline Channels: Sporting Goods Stores, Specialty Snowboard Shops, Others), By End-User (Professional Snowboarders, Amateur and Leisure Snowboarders) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Burton Snowboards, K2 Sports, Salomon (Amer Sports), Rossignol, Mervin Manufacturing (Lib Tech, Gnu, Roxy), Ride Snowboards, Atomic (Amer Sports), Head Sports, Jones Snowboards, Völkl (Tecnica Group), Capita Snowboarding, Never Summer Industries, Bataleon Snowboards, Black Diamond Equipment, Outdoor Master Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Burton Snowboards

- K2 Sports

- Salomon (Amer Sports)

- Rossignol

- Mervin Manufacturing (Lib Tech, Gnu, Roxy)

- Ride Snowboards

- Atomic (Amer Sports)

- Head Sports

- Jones Snowboards

- Völkl (Tecnica Group)

- Capita Snowboarding

- Never Summer Industries

- Bataleon Snowboards

- Black Diamond Equipment

- Outdoor Master