Global Bicycle Motors Market By Motor Type (Hub Motor, Mid-drive Motor, Others), By Mode (Pedal Assist, Throttle, Others), By Power (Less than 350W, 350W-750W, Above 750W), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov 2024

- Report ID: 24762

- Number of Pages: 241

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

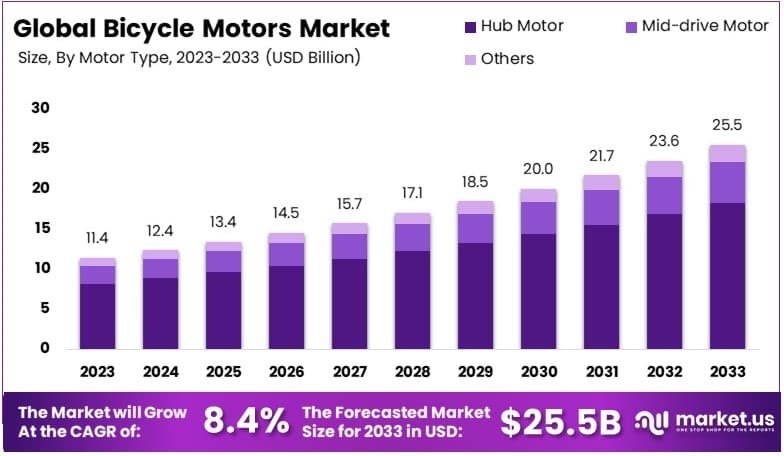

The Global Bicycle Motors Market size is expected to be worth around USD 25.5 Billion by 2033, from USD 11.4 Billion in 2023, growing at a CAGR of 8.4% during the forecast period from 2024 to 2033.

Bicycle motors are electric devices installed on bikes to assist with pedaling, making riding easier and faster. These motors vary in power, typically from 250W to 500W, and can be integrated into the front or rear wheel hub. Common in urban and commuter bikes, they offer smooth assistance on flat terrains.

The bicycle motors market involves the production and sale of motorized components for electric bicycles (e-bikes). This market serves both commuter and recreational segments, driven by demand for eco-friendly transport options. Bicycle motors are integral to the e-bike experience, supporting a shift toward sustainable and efficient travel in cities and beyond.

Hub motors, popular for their simplicity and low maintenance, are commonly used in urban settings. Delivering power outputs of 250W to 500W and torque between 40-60 Nm, these motors work best on flat terrain, although they may struggle on steep inclines. Their design makes them ideal for daily commutes and short city rides.

Growing focus on eco-friendly transport has driven substantial investments in electric mobility. According to the International Energy Agency (IEA), countries like Germany plan to deploy 7 to 10 million electric vehicles by 2030 and aim for 1 million charging stations. This broader electric mobility trend positively impacts bicycle motors, as cycling is promoted alongside other electric transport.

Bicycles remain in high demand, with over 488 bikes sold globally every minute. In 2020, France alone recorded over 500,000 electric bike sales, indicating strong growth potential. This trend shows rising interest in electric bikes as a clean and smart transport and recreational option, especially among commuters and outdoor enthusiasts.

E-mountain bikes (e-MTBs) have also gained popularity. With advancements in battery capacities from 460Wh to 1010Wh, e-MTBs now offer ranges of 22 to 50 miles depending on terrain and usage. These improvements make them suitable for both casual and extreme terrain, expanding their appeal among adventure cyclists.

Manufacturers like Giant, which produces over 6 million bikes annually, hold strong positions in the global bicycle market. This high production capacity meets the rising demand for both traditional and electric bikes, helping shape the industry landscape as electric cycling expands further.

Government initiatives have further boosted cycling. Programs like the UK’s £50 bike repair voucher scheme and Italy’s €500 bici bonus encourage more people to ride by reducing costs. These policies aim to make cycling more accessible and affordable, supporting the shift toward sustainable transportation.

Key Takeaways

- The Bicycle Motors Market was valued at USD 11.4 billion in 2023 and is expected to reach USD 25.5 billion by 2033, with a CAGR of 8.4%.

- In 2023, Hub Motors led the motor type segment with 71.6%, favored for their simplicity and low maintenance.

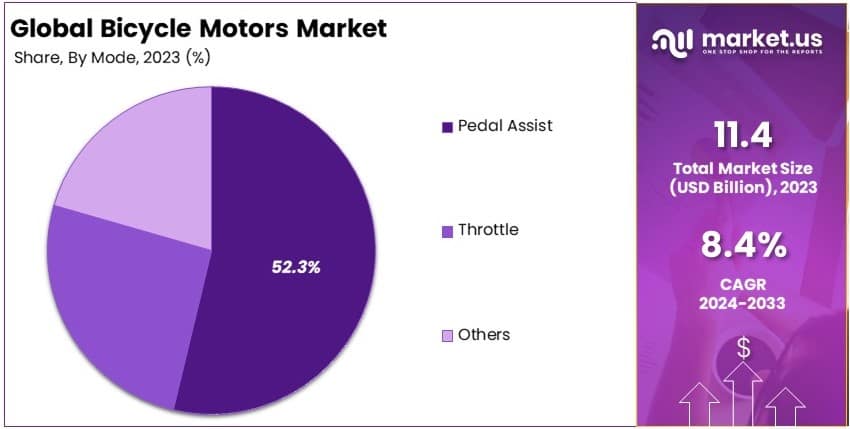

- In 2023, Pedal Assist mode dominated with 52.3%, providing a balanced and efficient cycling experience.

- In 2023, APAC led the market with 71.5%, driven by the high adoption of electric bicycles in urban areas.

Motor Type Analysis

Hub Motor dominates with 71.6% due to its ease of installation, affordability, and reliability across various bicycle designs.

Hub Motors are the most prevalent in the market, holding a significant 71.6% share. This dominance is primarily due to their ease of installation and maintenance, affordability, and compatibility with both traditional and electric scooter and motorcycle. They are integrated into the hub of the wheel and provide direct drive to it, making them ideal for urban commuters and casual riders seeking reliable and efficient motorization solutions.

Mid-drive Motors, positioned centrally on the bike, offer better balance and handling, making them suitable for mountain bikes and performance-oriented bicycles. Despite their higher cost and complex installation, their demand is increasing among enthusiasts and professional cyclists for their enhanced performance and natural riding feel.

The Others category includes specialized motors like friction drives and those integrated into the bottom bracket. These motors are less common but cater to niche markets that value customization and specific performance characteristics.

Mode Analysis

Pedal Assist dominates with 52.3% due to its energy efficiency and ability to enhance the cycling experience without overpowering the rider’s input.

Pedal Assist systems are the leading sub-segment, capturing 52.3% of the market. They work by augmenting the rider’s pedaling effort with motor power, which is particularly appealing in markets where cycling is a popular commuting and fitness activity. This mode is favored for its balance of manual and electric input, allowing longer rides with less fatigue, which is crucial for both daily commuters and recreational users.

Throttle modes offer motor power at the push of a button, providing an effortless ride without the need for pedaling. This mode is popular among those who may need or prefer not to pedal, such as older riders or those with physical limitations. Its role in the market is crucial for making cycling accessible to a broader audience.

The Others category includes less common control systems like speed sensors and torque sensors that provide a more customized motor response based on the riding conditions and the cyclist’s input. These systems are important for advancing the technology and appeal of electric bikes.

Power Analysis

350W-750W dominates due to its perfect balance between power and legal restrictions, making it suitable for both urban and rough terrains.

The 350W-750W range holds the dominant position in the market, providing sufficient power for both urban commuting and moderate off-road use. This range offers a balance of speed, torque, and compliance with most global electric bike regulations, making it the preferred choice for manufacturers and consumers alike. The versatility and legal compliance of 350W-750W motors drive their market dominance.

Motors with Less than 350W are ideal for flat terrains and lower-speed requirements, making them suitable for new riders and those in regions with strict motor power regulations. Their role in the market is to provide safe and efficient transportation for everyday use without the need for licensing in many areas.

Motors Above 750W are designed for high-performance electric bikes, catering to users who prioritize speed and power over compliance with certain regulations. These powerful motors are crucial for competitive scenarios and off-road conditions where extra power is necessary to navigate challenging environments.

Key Market Segments

By Motor Type

- Hub Motor

- Mid-drive Motor

- Others

By Mode

- Pedal Assist

- Throttle

- Others

By Power

- Less than 350W

- 350W-750W

- Above 750W

Drivers

Eco-Friendly Transportation and Urbanization Drive Market Growth

As concerns over climate change and pollution intensify, consumers and governments alike are looking for sustainable alternatives to cars and motorcycles. Electric bikes, powered by efficient motors, offer an attractive solution by providing zero-emission transport, which has significantly contributed to the market’s expansion.

Additionally, increasing urbanization and growing traffic congestion in cities have driven the demand for electric bikes. With more people living in densely populated areas, the need for convenient, fast, and environmentally friendly modes of transport is becoming more critical. E-bikes, with their ability to navigate traffic efficiently, are emerging as a preferred choice for commuters.

The rising popularity of e-bikes for health and fitness also plays a key role in market growth. Many consumers are turning to e-bikes as a way to integrate exercise into their daily routines while still benefiting from the convenience of motor assistance. This trend is particularly strong among older populations and health-conscious individuals.

Government initiatives promoting electric vehicles, including e-bikes, are another major driver. Many governments are offering incentives, subsidies, and infrastructure improvements to encourage the adoption of electric bikes, further boosting market growth.

Restraints

High Costs and Infrastructure Limit Market Growth

Despite strong demand, the Bicycle Motors Market faces several restraining factors. High initial costs are a significant barrier for many consumers. Electric bikes, particularly those equipped with advanced motors and long-lasting batteries, tend to be more expensive than traditional bicycles, limiting their appeal to cost-conscious buyers.

Limited battery life and long charging times also pose challenges. While battery technology is improving, many e-bike users still face issues related to the range and time it takes to recharge, making the product less attractive for longer commutes or frequent use.

Competition from traditional bicycles and scooters is another restraint. Many consumers still prefer conventional bikes or scooters, which are cheaper and require less maintenance, particularly in regions where electric bikes are not yet mainstream.

Additionally, the lack of charging infrastructure, especially in developing regions, slows down market growth. Without accessible charging stations, many potential customers hesitate to adopt electric bikes as their primary mode of transport.

Opportunity

Technological Advancements Provide Opportunities

The Bicycle Motors Market offers several growth opportunities, particularly in emerging markets. As urbanization spreads across regions like Asia-Pacific and Latin America, the demand for affordable and efficient mobility solutions is on the rise. Electric bikes powered by advanced motors are becoming a key player in solving transportation challenges in these areas.

Technological advancements in battery efficiency and motor design are also creating new opportunities. Innovations in lithium-ion batteries, for example, are extending the range and lifespan of e-bikes, making them more reliable and appealing to a broader audience. Similarly, improvements in motor design are enabling lighter, more powerful e-bikes, catering to consumers who prioritize performance and convenience.

The growing interest in e-bike sharing programs presents another opportunity. Many cities are exploring electric bike-sharing schemes to reduce traffic congestion and promote sustainable transport. This shift provides a significant boost to the demand for bicycle motors.

Moreover, increased demand for lightweight and foldable electric bikes is expanding the market. As more consumers look for compact, portable transportation solutions, manufacturers are developing e-bikes that are easy to carry and store, creating new market segments.

Challenges

Competition and Regulations Challenge Market Growth

The Bicycle Motors Market faces several challenges that could hinder its growth. High competition from other electric transportation modes, such as electric scooters and electric motorcycles, creates pressure on e-bike manufacturers to differentiate their products. Consumers often weigh the benefits of different electric vehicles, and the growing availability of alternatives can limit the market share of e-bikes.

Regulatory hurdles in certain regions also present a challenge. E-bikes are subject to varying regulations across countries, particularly regarding speed limits, safety standards, and motor power. Navigating these complex regulations can be difficult for manufacturers looking to expand internationally.

The market is also fragmented, with numerous small players competing for market share. This fragmentation can make it difficult for any single manufacturer to establish dominance, especially as new companies continually enter the space with innovative products.

Finally, supply chain disruptions, particularly for essential components like motors and batteries, can create bottlenecks for manufacturers. Global supply chain issues, exacerbated by events like the COVID-19 pandemic, have led to delays and increased costs, challenging the growth of the market.

Growth Factors

Electric Bikes for Deliveries and Recreation Are Growth Factors

The increased adoption of electric bikes for last-mile deliveries is a major growth factor in the Bicycle Motors Market. With the rise of e-commerce and online food delivery, many businesses are turning to e-bikes as an efficient, cost-effective solution for urban deliveries, driving demand for robust bicycle motors.

Rising consumer awareness of the benefits of e-bikes, such as reduced carbon emissions, health benefits, and lower operating costs, is also contributing to market growth. As more consumers understand these advantages, the adoption of e-bikes is expected to increase significantly.

Additionally, the growth of recreational cycling and adventure tourism is fueling demand for e-bikes with powerful motors capable of handling long rides and challenging terrains. E-bikes are becoming a popular choice for outdoor enthusiasts seeking an enhanced cycling experience.

Lastly, advancements in lightweight motor technologies are helping manufacturers develop more portable and efficient electric bikes. These innovations allow for greater flexibility in design and functionality, further supporting market growth as consumers seek both performance and convenience in their e-bikes.

Emerging Trends

Smart Features and Sustainability Are Latest Trending Factor

Many e-bike manufacturers are incorporating GPS, app-based controls, and real-time data tracking into their products, enhancing the overall user experience and attracting tech-savvy consumers. These smart features provide added convenience and security, making e-bikes more appealing in a competitive market.

Another major trend is the growing demand for high-performance motors in sports e-bikes. Consumers seeking adventure, speed, and off-road experiences are driving the development of more powerful motors that can handle rough terrains and steep inclines, opening new avenues in the e-bike segment.

The rise of connected e-bikes, which allow users to track their rides and connect with other devices, is also shaping the market. These bikes appeal to consumers who value technology integration and seamless connectivity in their transportation choices.

Lastly, the focus on sustainable and recyclable materials in manufacturing is gaining momentum. As consumers become more environmentally conscious, manufacturers are exploring the use of eco-friendly materials in e-bike production, aligning with the broader global trend toward sustainability.

Regional Analysis

Key Regions and Countries covered іn thе rероrt

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The Bicycle Motors Market is driven by key players such as Robert Bosch GmbH, Yamaha Motor Co. Ltd., and Shimano Inc. These companies lead the development of electric bicycle motors, offering powerful and energy-efficient solutions for the growing e-bike market.

Their product offerings include mid-drive and hub motors for electric bicycles, with features such as lightweight designs, high torque, and advanced battery integration. Companies like Panasonic Corporation and BAFANG focus on developing efficient motors that enhance performance while maintaining battery life.

In terms of market strategies, these players aim to partner with e-bike manufacturers and expand their presence in urban mobility solutions. Investments in R&D allow them to continuously innovate and provide high-performance motors. Pricing strategies vary, with companies offering premium, feature-rich motors as well as affordable options for entry-level e-bikes.

Geographically, these companies have a strong presence in Europe and Asia-Pacific, regions where e-bike usage is particularly high. Their global reach allows them to cater to both developed and emerging markets.

Innovation remains a key focus, with advancements in motor efficiency, lightweight materials, and integration with smart technologies like IoT and AI.

Their competitive edge lies in their ability to offer reliable, high-performance motors while continuously innovating to meet the evolving demands of the global e-bike market.

Top Key Players in the Market

- Robert Bosch GmbH

- Yamaha Motor Co.Ltd.

- Continental Aktiengesellschaft

- Panasonic Corporation

- Brose Fahrzeugteile GmbH & Co.

- Derby Cycle AG

- BAFANG

- Shimano Inc.

- Accell Group NV.

Recent Developments

- Revolt Motors: In September 2024, Revolt Motors introduced the RV1, an electric motorcycle, aimed at the commuter market. This release heightens competition with Ola Electric’s Roadster. The RV1, offering battery options for ranges of 100 km and 160 km, signifies the company’s ambition for yearly product launches over the next five years.

- DJI: In July 2024, DJI launched the Amflow PL eMTB, equipped with its Avinox e-bike motor system, weighing 19.2 kg. The motor peaks at 1,000 W in Boost mode and is compatible with 600 Wh or 800 Wh batteries, achieving up to 98 miles range. This model targets riders looking for a blend of power and efficiency across various terrains.

Report Scope

Report Features Description Market Value (2023) USD 11.4 Billion Forecast Revenue (2033) USD 25.5 Billion CAGR (2024-2033) 8.4% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Motor Type (Hub Motor, Mid-drive Motor, Others), By Mode (Pedal Assist, Throttle, Others), By Power (Less than 350W, 350W-750W, Above 750W) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Robert Bosch GmbH, Yamaha Motor Co. Ltd., Continental Aktiengesellschaft, Panasonic Corporation, Brose Fahrzeugteile GmbH & Co., Derby Cycle AG, BAFANG, Shimano Inc., Accell Group NV. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Robert Bosch GmbH

- Yamaha Motor Co.Ltd.

- Continental Aktiengesellschaft

- Panasonic Corporation

- Brose Fahrzeugteile GmbH & Co.

- Derby Cycle AG

- BAFANG

- Shimano Inc.

- Accell Group NV.