Global Silver Catalyst Market By Product Type (High Activity Catalyst, Hybrid Catalyst, and others), By Application (EO/EG and Other), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Jan 2024

- Report ID: 51951

- Number of Pages: 384

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

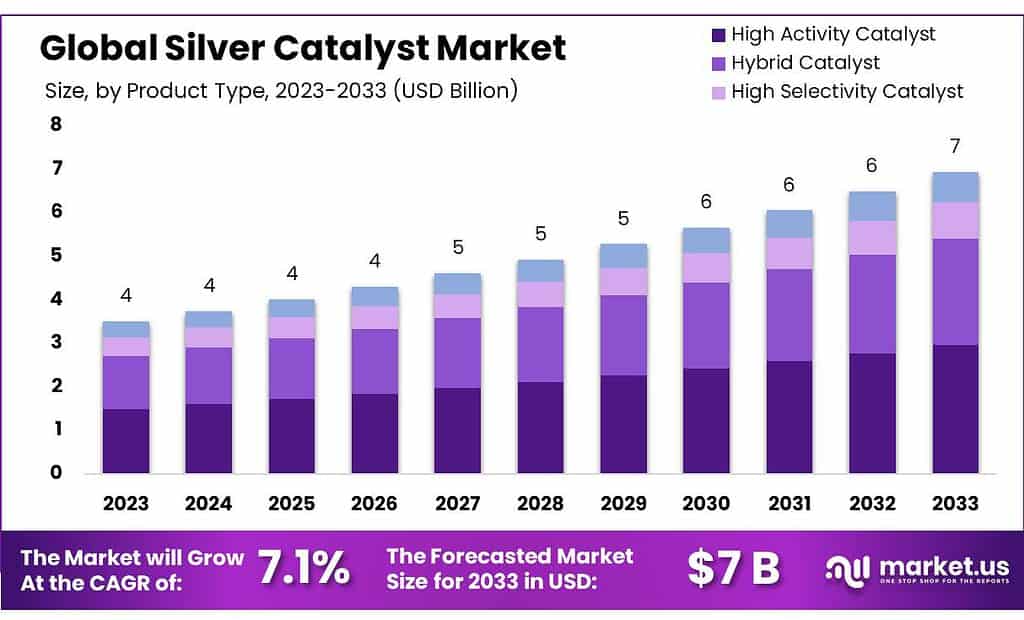

The Silver Catalyst Market size is expected to be worth around USD 7 billion by 2033, from USD 4 Bn in 2023, growing at a CAGR of 7.1% during the forecast period from 2023 to 2033.

A silver catalyst is a chemical substance or agent which is used to speed up specific reactions. Silver catalysts are generally more stable to handle and less expensive than palladium or platinum.

Thus, its applications include the development of synthetic colors and medicines, which have boosted the use of silver. Owing to increasing concerns about environmental sustainability, its protection, and strict emission controls on greenhouse gas and air pollutant emissions, the market for silver catalysts has experienced rapid growth.

Note: Actual Numbers Might Vary In Final Report

Key Takeaways

- Market Growth Projection: The Silver Catalyst Market is anticipated to expand significantly, reaching approximately USD 7 billion by 2033 from USD 4 billion in 2023, boasting a Compound Annual Growth Rate (CAGR) of 7.1%.

- Silver Catalysts and their Role: Silver catalysts play a pivotal role in accelerating specific reactions, offering stability and cost-effectiveness compared to palladium or platinum.

- Application Segmentation: In 2023, High Activity Catalysts held a dominant market share (42.4%), finding extensive use in industries requiring high performance and reliability.

- Driving Factors: Versatility, sustainability, and stringent emission controls across industries fueled the growth of the silver catalyst market.

- Market Constraints: The high cost of silver as a precious metal limited its widespread adoption, especially in industries with budget constraints.

- Opportunities for Growth: Despite challenges, expansion opportunities exist through technological advancements, sustainability emphasis, heightened health and hygiene concerns post-pandemic, and the growing demand for high-quality products.

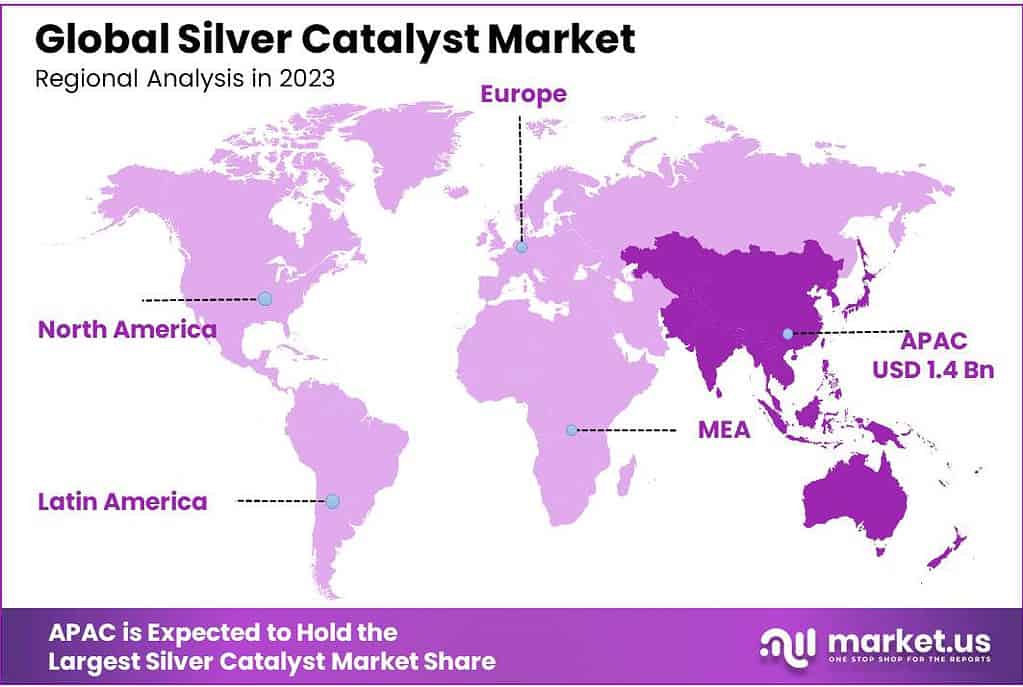

- Regional Analysis: The Asia Pacific region held the largest revenue share (39.5%) in 2023, attributed to economic conditions and access to raw materials.

- Key Players and Recent Developments: Market players engaged in mergers, acquisitions, and investments, amplifying their product range and global competitiveness. Companies like Sinopec, BASF, and Dow were among the key players contributing to market growth.

By Product Type

In 2023, High Activity Catalysts held an impressive market position, accounting for 42.4% of the market share. Their broad application and adaptation across various industries contributed significantly to this success; their efficiency and versatility made it an excellent choice for applications requiring high performance and reliability.

Ethylene Vinyl Acetate (EVA) catalysts have gained wide renown for their flexibility and durability, making them well-suited to diverse applications in various industries including packaging, footwear, and automotive sectors. Packaging companies especially value EVA catalysts’ resilience under varied environmental conditions which greatly contributes to their market presence.

Ethylene Ethyl Acrylate (EEA) quickly established itself in the market due to its compatibility with various materials and excellent adhesion properties, making it highly sought-after among adhesive, coating and sealant industries – further expanding its market share in 2023.

Ethylene Butyl Acrylate (EBA) gained attention for its remarkable weather ability and impact resistance. Industries such as construction, automotive, and packaging favored these catalysts for products requiring durability and performance in diverse environmental conditions, contributing to their notable market presence.

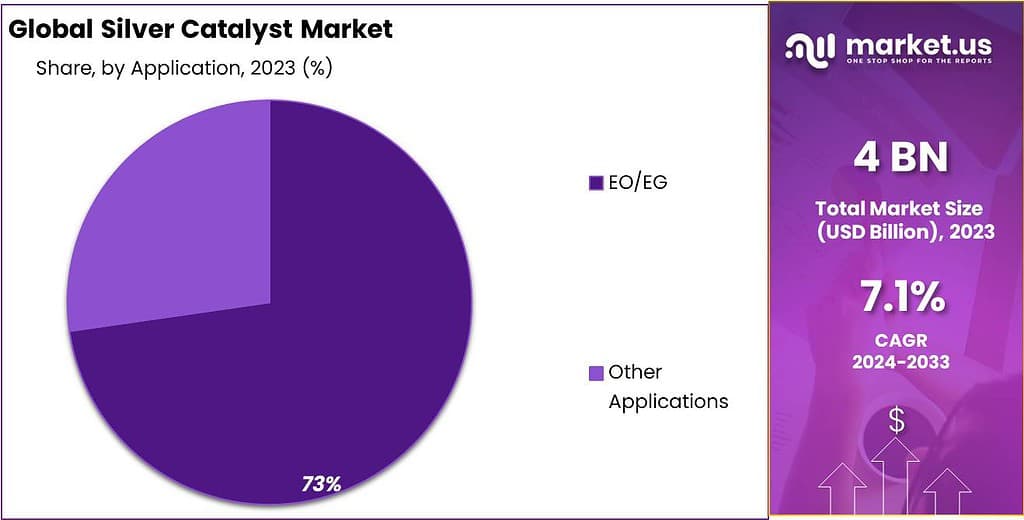

By Application

In 2023, EO/EG took the spotlight, seizing more than 72.6% of the market share in the silver catalyst market. Packaging, Silver catalysts were instrumental in revolutionizing the packaging industry. Their use in creating flexible yet durable packaging materials such as films and containers became widely adopted, increasing shelf life while offering excellent moisture and oxygen barrier properties that made them the go-to choice across a range of sectors.

Building and Construction, Silver catalysts were instrumental in shaping the construction industry. Used extensively in manufacturing materials like coatings, adhesives, and sealants containing them – contributing to greater durability, weather resistance, and overall performance of construction products – their role was unmistakably vital in improving quality and longevity for building products across this sector.

Automotive, Silver catalysts were widely utilized in the automotive industry. They played an essential role in producing automotive coatings with superior finishing, corrosion resistance, and environmental protection; furthermore, they helped increase their strength and longevity when manufactured into specific automotive components.

Textiles, Silver catalysts have long played an essential role in textile coatings and treatments, such as stain resistance treatments for fabrics. By offering functionalities like antimicrobial properties, stain resistance, and durability they help produce high-performing textiles for use across various applications such as healthcare textiles, sports apparel, and industrial textiles.

Note: Actual Numbers Might Vary In Final Report

Key Market Segments

By Product Type

- High Activity Catalyst

- Hybrid Catalyst

- High Selectivity Catalyst

- High-Performance Catalyst

By Application

- EO/EG

- Other Applications

Drivers

The silver catalyst market witnessed substantial growth in 2023, driven by a convergence of factors across various industries. Central to this surge was the catalyst’s remarkable versatility, finding extensive application in diverse sectors like packaging, automotive, construction, and textiles.

Their adaptability to different needs, whether improving product durability or providing antimicrobial properties, led to widespread adoption. Innovation and technological progress were instrumental in shaping the market landscape. Ongoing research efforts led to the development of silver catalysts with enhanced efficiency, improved performance, and cutting-edge features; these innovations ensured they met evolving industry requirements while contributing significantly to market expansion.

Moreover, there was an increasing emphasis on sustainability across industries. Silver catalysts, known for their recyclability and eco-friendly attributes in specific applications, aligned with the sustainability goals of various sectors, driving their increased usage and demand. Rising consumer demands for superior-quality products also drove growth in the silver catalyst market. Industries turned to these catalysts to increase the durability, strength, and overall performance of their products to meet this increasing consumer expectation.

Health and hygiene were central themes following the pandemic outbreak, driving the market growth. Silver catalysts’ antimicrobial properties proved popular choices among healthcare products, textiles, and packaging that prioritized hygiene as a top priority. Due to global economic expansion and industrial development, catalysts capable of improving efficiency and product quality became more and more in demand.

Furthermore, supportive regulations advocating safer materials further spurred adoption of silver catalysts across different applications. Collectively, these drivers underpinned the growth and significance of the silver catalyst market, positioning it as a fundamental element for industries striving for improved performance, sustainability, and quality in their products and processes.

Restraints

In 2023, the silver catalyst market faced numerous hurdles that hindered its progress. Primarily among them was their high cost. As a precious metal, the high expense of silver limited widespread adoption, particularly for industries operating on constrained budgets. This cost factor significantly restricted the accessibility of silver catalysts for numerous applications, hindering their broader use across industries.

Environmental concerns also emerged as a significant restraint. While silver catalysts offered eco-friendly attributes in specific applications, there were challenges surrounding their production and disposal. Managing the environmental impact of silver mining, refining processes, and the proper disposal of spent catalysts raised concerns about sustainable usage and environmental responsibility.

Technological limitations posed another obstacle to the silver catalyst market. Despite ongoing advancements, optimizing catalytic processes for maximum efficiency remained a challenge. Issues such as addressing potential side reactions or catalyst deactivation impacted their overall performance, necessitating further refinement and innovation.

Moreover, the availability of substitutes or alternative catalysts presented a hurdle. Some industries explored and adopted alternative materials offering similar functionalities at lower costs, affecting the demand for silver-based solutions. This competition from substitute materials challenged the market penetration of silver catalysts, particularly in sectors where alternative technologies proved more cost-effective.

Stringent regulatory compliance added to the challenges. Meeting rigorous standards while balancing cost-effectiveness and maintaining performance levels remained a complex task for businesses operating within regulated industries. Negotiating these regulatory hurdles without compromising on quality or affordability became a crucial aspect for market players. Market competition from other catalyst types and materials offering similar functionalities also impacted the silver catalyst market.

This competitive landscape demanded continuous innovation and differentiation to retain market relevance and overcome the challenges posed by alternative materials or technologies. Addressing these restraints demanded a delicate balance between cost considerations, technological advancements, environmental responsibility, and compliance with stringent regulations for the silver catalyst market to navigate and thrive within a highly competitive industry landscape.

Opportunities

In 2023, the silver catalyst market unveiled several promising opportunities for growth and expansion across various industries. Technological advancements stood out as a significant avenue, with ongoing innovation poised to enhance the efficiency and functionalities of silver catalysts. Further research and development efforts held the potential to create catalysts with superior performance, widening their applicability across diverse industrial sectors.

The increasing emphasis on sustainability provided a compelling opportunity for silver catalysts. Their recyclability and eco-friendly attributes in specific applications aligned well with the growing focus on sustainable manufacturing practices. Exploring and refining these aspects could amplify their role in promoting environmentally conscious solutions.

After the Pandemic, health and hygiene concerns quickly escalated, leading to increased interest for antimicrobial solutions such as silver catalysts. With their proven antimicrobial capabilities, silver catalysts found increased usage in healthcare products, textiles, and packaging to create safer and hygienic environments for healthcare use.

As consumer demand for high-quality products increased, silver catalysts saw their chance to shine. Their ability to enhance the durability, strength, and overall performance of various end products positioned them favorably to meet the increasing demand for superior quality across industries.

Challenges

In 2023, the silver catalyst market experienced several challenges which hindered its expansion and adoption across industries. Prominent among these barriers was their prohibitively expensive nature. As a precious metal, the high expense of silver posed a substantial barrier to widespread adoption, particularly for industries operating on constrained budgets.

This cost factor limited the accessibility of silver catalysts for numerous applications, hindering their broader use across industries. Environmental concerns also emerged as a significant challenge. While silver catalysts offered eco-friendly attributes in specific applications, there were challenges surrounding their production and disposal. Managing the environmental impact of silver mining, refining processes, and the proper disposal of spent catalysts raised concerns about sustainable usage and environmental responsibility.

Technological limitations posed another obstacle to the silver catalyst market. Despite ongoing advancements, optimizing catalytic processes for maximum efficiency remained a challenge. Issues such as addressing potential side reactions or catalyst deactivation impacted their overall performance, necessitating further refinement and innovation.

Moreover, the availability of substitutes or alternative catalysts presented a hurdle. Some industries explored and adopted alternative materials offering similar functionalities at lower costs, affecting the demand for silver-based solutions. This competition from substitute materials challenged the market penetration of silver catalysts, particularly in sectors where alternative technologies proved more cost-effective.

Stringent regulatory compliance added to the challenges. Meeting rigorous standards while balancing cost-effectiveness and maintaining performance levels remained a complex task for businesses operating within regulated industries. Negotiating these regulatory hurdles without compromising on quality or affordability became a crucial aspect for market players. Market competition from other catalyst types and materials offering similar functionalities also impacted the silver catalyst market.

This competitive landscape demanded continuous innovation and differentiation to retain market relevance and overcome the challenges posed by alternative materials or technologies. Addressing these restraints demanded a delicate balance between cost considerations, technological advancements, environmental responsibility, and compliance with stringent regulations for the silver catalyst market to navigate and thrive within a highly competitive industry landscape.

Regional Analysis

Asia Pacific (APAC) had the largest revenue share at over 39.5% in 2023. It accounted for 39.6% of the global market share in 2022. Owing to good economic conditions and the availability of raw material resources suited for the production of these kinds of catalysts in the Asia-Pacific region.

In North America, strict rules on air pollution and greenhouse gas emissions are what are driving the demand for silver catalysts. New high-activity improved catalytic materials, such as copper-gold alloys or Platinum Group Metals (PGMs) that are less expensive than gold, will also be a driving force in the coming years.

Because several nations have shown interest in this market and readiness to participate in the development of these kinds of catalysts as well as their manufacturing firms, the Middle East and Africa area is anticipated to experience significant growth between 2023 and 2032.

Note: Actual Numbers Might Vary In Final Report

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Key Players Analysis

A spike in acquisitions and mergers among major players has increased the number of commercially feasible goods for small-scale industries, expanding their product range. Because of this, these businesses may become more competitive on a global scale.

Additionally, rising spending brought on by global economic activities improvement will boost investor sentiment toward emerging economies over the long term. Last but not least, throughout the projected period, market growth will be fueled by high-level investments from the public and private sectors as well as rising R&D activity by the major competitors.

Johnson Matthey Fine Chemicals opened a new online catalyst store in January 2017. This store can make it easy for customers to request large quantities of catalysts and ligands of commercial grade, accelerating the development of effective and affordable procedures for agrochemicals, pharmaceuticals, and other applications.

Market Key Players

- Sinopec

- BASF

- Scientific Design

- Dow

- Haver Standard India Private Limited

- Sainergy

- K.A. Rasmussen EN

- Stanford Advanced Materials

- Hindustan Platinum

- Other Key Players

Report Scope

Report Features Description Market Value (2023) USD 4 Bn Forecast Revenue (2032) USD 7 Bn CAGR (2023-2032) 7.1% Base Year for Estimation 2022 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type(High Activity Catalyst, Hybrid Catalyst, High Selectivity Catalyst, High-Performance Catalyst), By Application(EO/EG, Other Applications) Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape Sinopec, BASF, Scientific Design, Dow, Haver Standard India Private Limited, Sainergy, K.A. Rasmussen EN, Stanford Advanced Materials, Hindustan Platinum, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What are silver catalysts?Silver catalysts are substances where silver acts as a catalyst, facilitating chemical reactions without undergoing any permanent change itself. Silver, due to its unique properties, is used in various catalytic processes across industries.

What industries use silver catalysts?Chemical Industry: Used in the production of formaldehyde, ethylene oxide, and other chemicals. Environmental Sector: Employed in the purification of air and water. Healthcare: Utilized in the production of antibacterial materials and medical devices. Electronics: Used in the production of electronics, including inks and printed circuits.

What factors drive the growth of the silver catalyst market?- Increasing demand in chemical manufacturing and environmental applications.

- Technological advancements leading to improved catalyst efficiency.

- Rising demand for electronic devices and the growing healthcare sector.

-

-

- Sinopec

- BASF

- Scientific Design

- Dow

- Haver Standard India Private Limited

- Sainergy

- K.A. Rasmussen EN

- Stanford Advanced Materials

- Hindustan Platinum

- Other Key Players