Global Home Fitness Equipment Market By Product Type (Treadmills, Cardiovascular Training Equipment, Stationary Cycles, Power Racks, Other Product Types), By Distribution Channel (Online Platforms, Offline Stores), By End-User (Households, Gym in Apartments, Apartments), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov 2024

- Report ID: 64783

- Number of Pages: 303

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

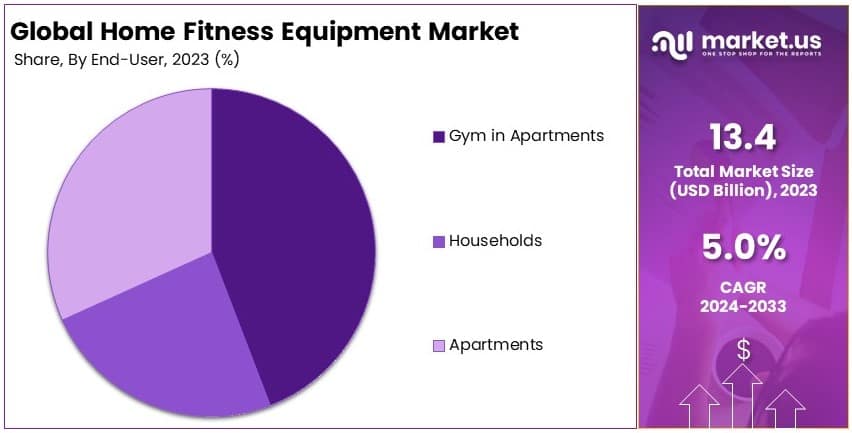

The Global Home Fitness Equipment Market size is expected to be worth around USD 21.8 Billion by 2033, from USD 13.4 Billion in 2023, growing at a CAGR of 5.0% during the forecast period from 2024 to 2033.

Home fitness equipment includes devices and machines used for exercise at home, such as treadmills, dumbbells, and stationary bikes. These products enable people to maintain fitness routines without going to the gym, offering convenience and flexibility for various workout preferences.

The home fitness equipment market involves the production and sale of fitness devices for personal use. This market serves consumers interested in staying active at home. It includes a range of equipment, from basic weights to advanced workout machines, meeting diverse fitness needs and lifestyles.

The World Health Organization aims to reduce physical inactivity by 15% by 2030, creating a supportive environment for the industry. Moreover, a study published by the American Medical Association (AMA) found that 150-300 minutes of moderate activity per week could reduce all-cause mortality by up to 30%.

The home fitness equipment market is expanding as more consumers prioritize health and wellness, especially following the recent rise in at-home workouts. According to the Centers for Disease Control and Prevention (CDC), only 24.2% of U.S. adults meet recommended physical activity guidelines, with men more likely than women to achieve these standards (30.5% vs. 16.5%).

This gap underscores the potential for home fitness equipment to bridge accessibility and convenience for physical activity. Rising awareness of health risks linked to inactivity, such as cardiovascular disease and diabetes, also drives demand for fitness equipment that supports consistent exercise at home.

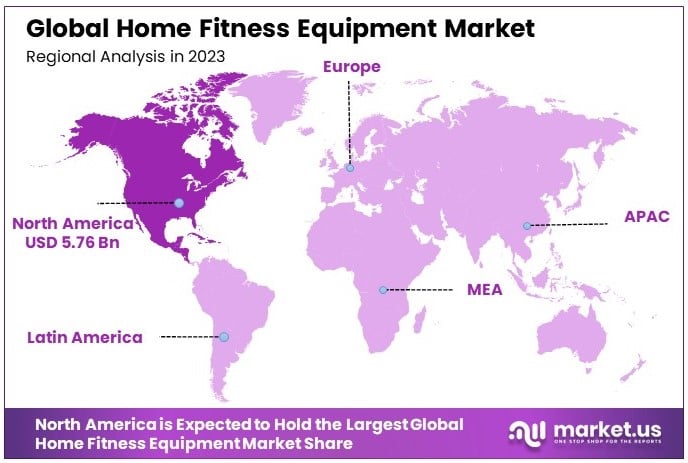

Market competitiveness is strong, with brands offering products that cater to varied needs, from cardio machines to resistance equipment. While saturation levels are high in North America and Europe, emerging markets present new opportunities as disposable incomes rise and health awareness grows.

Key Takeaways

- The Home Fitness Equipment Market was valued at USD 13.4 Billion in 2023 and is projected to reach USD 21.8 Billion by 2033, with a CAGR of 5.0%.

- In 2023, Cardiovascular Training Equipment leads the product segment with 35.2%, driven by home workout trends.

- In 2023, Online Platforms dominate distribution with 54%, reflecting the shift towards e-commerce for fitness.

- In 2023, Gym in Apartments holds the dominant end-user position, indicating the convenience of in-building fitness options.

- In 2023, North America dominates with 43.0% market share, influenced by health and wellness trends.

Product Type Analysis

Cardiovascular Training Equipment dominates with 35.2% due to its comprehensive health benefits.

Cardiovascular Training Equipment holds the largest market share at 35.2%. This dominance is primarily due to the wide-ranging health benefits these machines offer, such as improved heart health, increased metabolism, and enhanced mood.

Equipment like ellipticals, rowing machines, and stair climbers are included in this category and are favored for their ability to provide a full-body workout that is both effective and efficient.

These machines are particularly popular in home settings because they are versatile and occupy relatively little space compared to other comprehensive gym equipment. Their user-friendly design appeals to individuals across various fitness levels, making them a top choice for families.

Treadmills and Stationary Cycles also hold significant portions of the market. Treadmills are a preferred choice for people who focus on running and walking exercises, providing an all-weather option for cardiovascular training at home.

Stationary cycles are favored for low-impact workouts that reduce the risk of injury and are suitable for rehabilitating and elderly users. Power Racks are essential for strength training enthusiasts looking to build muscle and increase strength through weightlifting routines.

Distribution Channel Analysis

Online Platforms dominate with 54% due to the convenience and variety they offer.

Online Platforms lead the market with a 54% share, driven by the convenience and broad selection they provide. Consumers prefer online shopping for fitness equipment because it allows them to easily compare prices, read customer reviews, and choose from a wider range of products than typically available in physical stores.

The rise of e-commerce has made it simpler for consumers to access high-quality fitness equipment from manufacturers around the world. Online platforms often offer competitive pricing and doorstep delivery, which adds to the appeal, especially for bulky items like home fitness equipment.

Offline Stores remain important, particularly for customers who prefer to test equipment before purchasing. These stores provide a hands-on experience and immediate product familiarity, which can be crucial for high-investment purchases. Personal interaction with sales staff can also influence purchasing decisions, offering consumers expert advice on choosing the right equipment for their needs.

End-User Analysis

Gym in Apartments dominates, catering to the growing demand for accessible fitness solutions in residential complexes.

The ‘Gym in Apartments’ segment dominates, reflecting the increasing trend of residential complexes offering communal fitness centers as a value-added amenity to attract tenants. This arrangement benefits residents who prefer the convenience of not having to travel far for fitness facilities and provides a social environment for exercising that can motivate regular use.

These gyms are typically equipped with a variety of equipment to cater to different fitness preferences and are maintained by the apartment management, ensuring they are always in good condition. The convenience and variety offered make them an attractive option for residents, and they often become a key selling point for the property.

Households as end-users represent a significant portion of the market, driven by individuals or families investing in their health and wellness from the comfort of their homes. Apartments without dedicated gym spaces also contribute to demand, as residents look to create personal workout areas in smaller living spaces.

Key Market Segments

By Product Type

- Treadmills

- Cardiovascular Training Equipment

- Stationary Cycles

- Power Racks

- Other Product Types

By Distribution Channel

- Online Platforms

- Offline Stores

By End-User

- Households

- Gym in Apartments

- Apartments

Drivers

Increasing Health and Fitness Awareness Drives Market Growth

Rising health and fitness awareness drives the Home Fitness Equipment Markets. Consumers are becoming more conscious of maintaining a healthy lifestyle, leading to increased demand for home workout equipment.

The growth of at-home workouts further boosts this market. As people continue to prefer exercising at home, equipment like treadmills, resistance bands, and dumbbells see a surge in demand.

The rising demand for smart fitness devices also supports market growth. These devices, integrated with advanced fitness tracking features, appeal to tech-savvy users seeking more personalized fitness routines.

Busy lifestyles encourage home-based fitness solutions. Consumers find it more convenient to work out at home rather than visiting gyms, which drives the adoption of home fitness equipment.

Restraints

High Cost of Advanced Equipment Restraints Market Growth

High costs of advanced home fitness equipment act as a major restraint. Premium products such as smart treadmills and digital bikes can be expensive, limiting accessibility for some consumers.

Limited space in homes also hinders growth. Many consumers, especially in urban areas, may not have sufficient space to accommodate large fitness equipment.

Low awareness of home fitness benefits in certain regions further restricts market expansion. In some areas, consumers may lack knowledge of the equipment’s benefits or availability.

Preference for outdoor activities is another restraint. Consumers who enjoy jogging, cycling, or outdoor sports may not prioritize purchasing home fitness equipment, reducing potential market growth.

Opportunity

Expansion in Emerging Markets Provides Opportunities

Emerging markets offer significant growth opportunities for the Home Fitness Equipment Markets. Rising urbanization and increasing middle-class income drive demand for fitness products in regions like Asia-Pacific and Latin America.

The development of multi-functional equipment also presents opportunities. Products that offer several workout options in a single device appeal to consumers seeking versatile fitness solutions.

Integration with digital fitness platforms creates additional growth avenues. Equipment that syncs with fitness apps provides users with real-time data and workout plans, enhancing engagement.

The rising demand for subscription-based fitness services supports growth. Home fitness companies are launching subscription models for virtual classes, adding value to their equipment offerings.

Challenges

Intense Market Competition Challenges Market Growth

Intense market competition challenges the Home Fitness Equipment Markets. Numerous brands compete on pricing, quality, and innovation, making it tough for companies to maintain profit margins.

Supply chain disruptions further impact growth. Delays in the delivery of components and finished products can affect availability and sales, hindering market stability.

Economic uncertainty impacts consumer spending on non-essential products like fitness equipment. During financial downturns, households may delay or forgo purchases, affecting sales.

Rapid technological changes require frequent upgrades. Manufacturers must continually innovate to meet evolving consumer expectations, increasing operational costs and complicating product development.

Growth Factors

Government Campaigns Promoting Active Lifestyles Are Growth Factors

Government campaigns promoting active lifestyles drive the Home Fitness Equipment Markets. Initiatives encouraging daily physical activity increase awareness and demand for home fitness solutions.

Rising disposable income in urban areas supports growth. Higher income levels enable consumers to invest in advanced fitness equipment, boosting market expansion.

Growth in online sales channels further fuels the market. E-commerce platforms make it easier for consumers to explore and purchase fitness equipment, increasing accessibility and convenience.

The increase in fitness influencers promoting home workouts adds to market growth. Influencers encourage followers to adopt home fitness routines, increasing interest in equipment purchases.

Emerging Trends

Adoption of AI-enabled Fitness Devices Is Latest Trending Factor

The adoption of AI-enabled fitness devices is a major trend in the Home Fitness Equipment Markets. These devices offer personalized coaching and feedback, enhancing user experience.

The growing preference for compact and portable equipment also drives trends. Consumers seek easy-to-store products like foldable treadmills and compact weight sets that save space.

Increased use of virtual trainers further supports market trends. Consumers increasingly rely on virtual trainers for guided workouts, driving demand for compatible equipment.

The focus on sustainable and eco-friendly equipment aligns with consumer interest in green products. Equipment made from recycled materials or energy-efficient technologies is gaining popularity.

Regional Analysis

North America Dominates with 43.0% Market Share

North America leads the Home Fitness Equipment Markets with a 43.0% share, totaling USD 5.76 billion. This dominance is driven by high health awareness, increased adoption of at-home workouts, and strong consumer purchasing power. The U.S. is the largest market, followed by Canada, which shows rising interest in home-based fitness solutions.

The region benefits from advanced fitness technology, a strong e-commerce network, and high demand for smart and connected fitness devices. Additionally, the shift towards remote working and rising investments in personal well-being drive market growth. Frequent product innovations and digital fitness integration also enhance the market dynamics in North America.

The market is expected to grow further as consumers continue to prioritize convenient fitness solutions. Expanding online fitness programs, coupled with rising demand for multi-functional and compact equipment, will support sustained market leadership.

Regional Mentions:

- Europe: Europe sees steady growth, driven by increasing health awareness, government wellness campaigns, and demand for eco-friendly fitness products. The region’s focus on personal wellness supports home fitness adoption.

- Asia Pacific: Asia Pacific shows rapid growth, fueled by urbanization, rising disposable income, and increasing adoption of digital fitness platforms in countries like China, India, and Japan.

- Middle East & Africa: The region experiences moderate growth, supported by growing health consciousness and expanding retail channels. Demand for affordable home fitness solutions is rising.

- Latin America: Latin America shows potential, driven by increased health awareness and growing digital infrastructure. Key markets include Brazil and Mexico, where fitness influencers drive interest in home workouts.

Key Regions and Countries covered іn thе rероrt

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The home fitness equipment market is driven by increasing health awareness and growing demand for convenient home workouts. The top four companies in this sector are Johnson Health Tech Co. Ltd., Icon Health & Fitness, Inc., Fitness World AS, and Amer Sports Corporation. These companies maintain strong positions through innovation, diverse product portfolios, and global distribution networks.

Icon Health & Fitness, Inc., which owns brands like NordicTrack and ProForm, leads the market with high-tech equipment, focusing on treadmills, bikes, and connected fitness solutions. Its investment in digital fitness, including apps and virtual training, boosts its competitive edge.

Fitness World AS offers a wide range of affordable home fitness equipment, appealing to budget-conscious consumers. Its focus on versatility and functionality in products like multi-gyms and compact equipment supports its growth in the market.

Amer Sports Corporation markets popular brands like Precor and Wilson, offering premium fitness machines tailored for serious athletes and home users. Its emphasis on quality and brand strength enhances its global presence in the home fitness segment.

These companies maintain their leadership positions through constant innovation, strategic acquisitions, and a strong focus on user-friendly home fitness solutions, making them key players in the home fitness equipment market.

Top Key Players in the Market

- Johnson Health Tech Co. Ltd.

- Icon Health & Fitness, Inc.

- Fitness World AS

- Amer Sports Corporation

- Core Health & Fitness, LLC

- Nordic Track

- ProForm

- Hoist Fitness Systems

- Nautilus, Inc.

- Other Key Players

Recent Developments

- Sunny Health & Fitness: In May 2024, Sunny Health & Fitness launched its Smart Stepper line, featuring advanced connectivity with the SunnyFit app. These steppers allow users to track health metrics, access workouts, and participate in challenges, designed for diverse fitness levels and compact home settings.

- Echelon: In October 2024, Echelon expanded its product range with a new at-home strength machine, offering interactive components to boost user engagement and enhance strength training.

- REP Fitness: On August 1, 2024, REP Fitness announced its entry into the European market with a direct-to-consumer model, planning to establish distribution centers to deliver strength and conditioning equipment efficiently.

- NordicTrack and ProForm: In September 2024, NordicTrack and ProForm introduced a new smart equipment lineup under iFIT, featuring an AI Coach and updated iFIT operating system across treadmills, bikes, ellipticals, and a rower, aimed at personalizing the workout experience.

- Peloton: In May 2024, Peloton reported a 17% revenue increase for Q3 2024, totaling $1.2 billion. This growth was driven by rising connected fitness subscriptions and robust sales of new equipment models, further expanding its product line and global reach.

Report Scope

Report Features Description Market Value (2023) USD 13.4 Billion Forecast Revenue (2033) USD 21.8 Billion CAGR (2024-2033) 5.0% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Treadmills, Cardiovascular Training Equipment, Stationary Cycles, Power Racks, Other Product Types), By Distribution Channel (Online Platforms, Offline Stores), By End-User (Households, Gym in Apartments, Apartments) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Johnson Health Tech Co. Ltd., Icon Health & Fitness, Inc., Fitness World AS, Amer Sports Corporation, Core Health & Fitness, LLC, Nordic Track, ProForm, Hoist Fitness Systems, Nautilus, Inc., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Home Fitness Equipment MarketPublished date: Nov 2024add_shopping_cartBuy Now get_appDownload Sample

Home Fitness Equipment MarketPublished date: Nov 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Johnson Health Tech Co. Ltd.

- Icon Health & Fitness, Inc.

- Fitness World AS

- Amer Sports Corporation

- Core Health & Fitness, LLC

- Nordic Track

- ProForm

- Hoist Fitness Systems

- Nautilus, Inc.

- Other Key Players