Europe Bike Locks Market Size, Share, Growth Analysis By Type (Key Bike Locks, Password Bike Locks), By Pattern (U-locks, Chain Locks, Folding Locks, Cable Locks, Others), By Application (OEM, Aftermarket), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 80777

- Number of Pages: 267

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

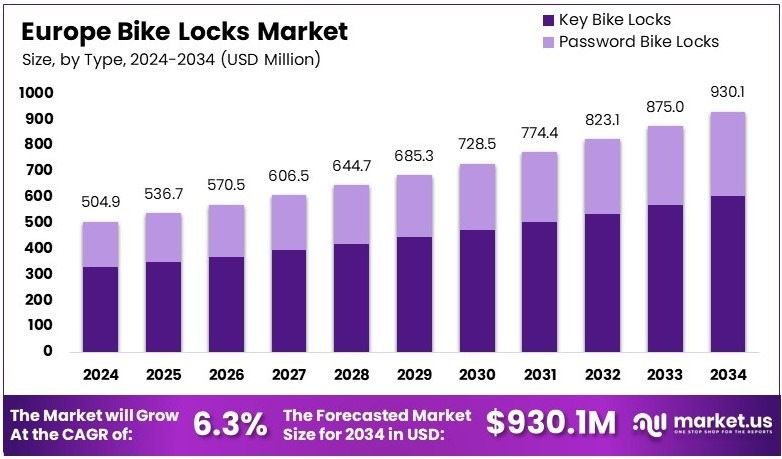

The Europe Bike Locks Market size is expected to be worth around USD 930.1 Million by 2034, from USD 504.96 Million in 2024, growing at a CAGR of 6.3% during the forecast period from 2025 to 2034.

Europe Bike Locks consist of devices designed to secure bicycles from theft. These locks vary in design and security features, including U-locks, chain locks, and cable locks, to cater to the needs of cyclists across Europe.

The Europe Bike Locks Market represents the industry that produces and sells these security devices. It includes manufacturers, distributors, and retail outlets involved in providing bike locks to consumers, focusing on enhancing security and convenience for cyclists in Europe.

The bike lock market in Europe is significantly influenced by the prevalent issue of bicycle theft across various countries. Notably, in England and Wales, the reported bicycle thefts numbered 66,960 in 2023/24, highlighting the ongoing demand for reliable security solutions in the region.

This demand acts as a primary driver for the market, pushing manufacturers to innovate and develop locks that are tougher to breach. The market’s growth is fueled by consumers seeking advanced locking mechanisms that offer enhanced security against increasing theft rates.

Moreover, the European bike lock industry faces a high level of market competitiveness. Numerous manufacturers and brands compete to capture consumer trust with features that promise the highest security. This competitive environment fosters continuous product improvement and the introduction of new technology, such as smart locks integrated with GPS tracking and alarms.

Additionally, the role of government initiatives cannot be understated in shaping market dynamics. The significant investment by the European Union, amounting to €2 billion during the 2014–2020 Multiannual Financial Framework, is aimed at bolstering walking and cycling infrastructure.

This investment not only enhances the cycling experience but also promotes broader use of bicycles, indirectly boosting the necessity for effective bike locks. As more individuals take up cycling, encouraged by improved infrastructure and government support, the demand for bike locks continues to rise, underscoring the interconnectedness of government actions and market growth in this sector.

Key Takeaways

- The Europe Bike Locks Market was valued at USD 504.96 million in 2024 and is expected to reach USD 930.1 million by 2034, with a CAGR of 6.3%.

- In 2024, Key Bike Locks led the Type segment with 64.8%, due to their reliability and widespread consumer preference.

- In 2024, U-locks dominated the Pattern segment with 42.9%, driven by their high security and resistance to cutting tools.

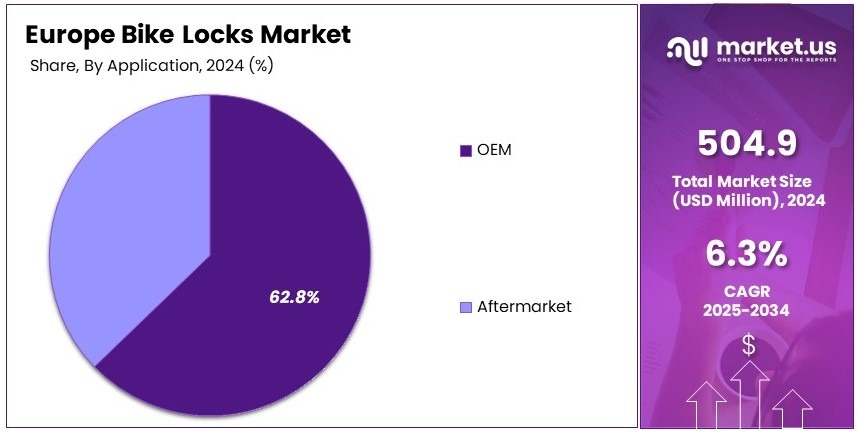

- In 2024, OEM was the leading Application segment with 62.8%, owing to rising demand from bicycle manufacturers.

- In 2024, Germany held the highest regional share at 37.1%, valued at USD 187.32 million, supported by high cycling adoption rates.

Type Analysis

Key Bike Locks dominate with 64.8% due to their widespread use and reliability in securing bicycles.

Key bike locks lead the European bike locks market, holding a significant share of 64.8%. The popularity of key locks is mainly due to their traditional and trusted design. They offer a high level of security, as the mechanism is difficult to tamper with, making them a preferred choice for cyclists who prioritize safety.

Additionally, the relatively simple and cost-effective nature of key locks contributes to their dominance. With urban cycling becoming increasingly common in cities across Europe, the demand for secure bike locks, particularly key-based locks, has surged. As cycling culture grows in popularity, especially in cities like Amsterdam and Copenhagen, consumers continue to favor key locks for their effectiveness.

Password bike locks, though growing in popularity, make up a smaller portion of the market. These locks offer convenience and keyless entry, but they are seen as slightly less secure compared to traditional key locks.

For this reason, password locks tend to be used more for lower-risk environments, such as personal bike storage or short-term use. The “others” category includes newer locking mechanisms or advanced smart locks that integrate with digital systems. While these locks are still emerging, they represent a growing trend towards innovative solutions in bike security.

Pattern Analysis

U-locks dominate with 42.9% due to their superior security and ease of use.

U-locks are the leading pattern in the European bike locks market, representing 42.9% of the market share. U-locks are known for their simplicity, effectiveness, and ability to provide a high level of security. They are widely used in urban areas where cyclists need a reliable lock to secure their bikes against theft.

U-locks are especially popular because their design makes it difficult for thieves to manipulate or cut through the lock. This security feature, combined with their relatively affordable price, makes them a popular choice for everyday cyclists in major cities like London and Berlin.

Chain locks, while also important, have a smaller share in the market. They are often favored for their flexibility, allowing cyclists to lock their bikes in different positions or to larger structures. However, chain locks tend to be bulkier and may not offer the same level of security as U-locks.

Folding locks provide a balance between security and portability, making them popular among cyclists who need a more compact solution. Cable locks, on the other hand, are less secure but often used for short-term stops or low-risk environments. The “others” category includes niche products, such as smart locks or specialty locks designed for specific types of bicycles.

Application Analysis

OEM dominates with 62.8% due to its strong presence in the manufacturing of bike locks for new bicycles.

The OEM (Original Equipment Manufacturer) segment leads the European bike locks market with a 62.8% share. This dominance is due to the widespread adoption of bike locks by manufacturers as a standard accessory included with new bicycles. Bicycle manufacturers often provide locks with their products to enhance security and add value for customers.

With cycling becoming a popular mode of transportation, especially in cities with well-established cycling infrastructure, OEM locks are crucial in offering customers a complete cycling solution. The availability of locks directly from bike manufacturers simplifies the purchasing process for consumers.

The aftermarket segment, while smaller, plays an important role in the market. Aftermarket bike locks are purchased by existing bike owners who want to replace or upgrade their locks for better security. With increasing concerns about bike theft, many cyclists are willing to invest in higher-quality locks.

This segment is expected to continue growing as cyclists prioritize safety and convenience. The “others” category within the application segment includes niche markets, such as specialty bike locks designed for specific types of bicycles or custom bike security systems.

Key Market Segments

By Type

- Key Bike Locks

- Password Bike Locks

By Pattern

- U-locks

- Chain Locks

- Folding Locks

- Cable Locks

- Others

By Application

- OEM

- Aftermarket

Driving Factors

Restraining Factors

High Costs and Effectiveness Concerns Restrain Market Growth

The Europe bike locks market faces several restraining factors that could hinder its growth. One of the main challenges is the high cost of high-security bike locks. Consumers often hesitate to invest in premium locks due to their higher price compared to basic alternatives, even though these locks offer superior protection.

Additionally, concerns over the effectiveness of basic locks against advanced theft methods create a barrier. While basic locks may provide minimal security, more sophisticated thieves use tools and techniques that can bypass them. This undermines consumer confidence in lower-priced locks, limiting their market appeal.

Limited awareness about advanced bike lock technologies also restrains growth. Many consumers are unaware of newer, more secure lock options, such as those with biometric or smart features. This lack of education prevents a wider adoption of these advanced solutions.

The availability of cheap, low-quality bike locks in the market also presents a challenge. While these inexpensive options are attractive to budget-conscious consumers, they often fail to provide adequate protection, leading to increased thefts. This issue further complicates the market, as low-quality products may erode consumer trust in bike lock security solutions.

Growth Opportunities

E-Bike Security and Smart Features Provide Growth Opportunities

The Europe bike locks market offers significant growth opportunities, particularly in the rising popularity of electric bikes (e-bikes). As more consumers opt for e-bikes, which are more expensive and vulnerable to theft, there is an increased demand for robust security solutions. E-bikes’ higher value makes them a target for theft, driving the need for advanced locks to safeguard these investments.

The growing integration of IoT and Bluetooth in bike lock systems is another key opportunity. Smart locks that use Bluetooth connectivity, allowing users to lock and unlock their bikes via smartphone apps, are gaining traction. This technology enhances both convenience and security, appealing to tech-oriented consumers.

Expansion of e-commerce platforms for lock sales presents another opportunity. As online shopping continues to grow, more consumers are turning to e-commerce platforms to purchase bike locks. This trend allows for broader access to a wide variety of lock options, including high-security and smart locks, making them more readily available to a larger audience.

Strategic partnerships with bike manufacturers for integrated security solutions also provide growth opportunities. By collaborating with bike manufacturers, bike lock companies can offer integrated security systems, which add value for consumers and increase the perceived security of bicycles.

Emerging Trends

Innovative Security Features Is Latest Trending Factor

Several trends are shaping the Europe bike locks market, with the surge in anti-theft bike lock innovations being a prominent factor. Manufacturers are continually developing new lock designs and technologies to stay ahead of thieves, including advanced locking mechanisms and tamper-proof materials. These innovations help build consumer trust in bike lock security.

Increased demand for GPS-enabled bike locks is another growing trend. Consumers are increasingly looking for locks with GPS tracking features, which allow them to track their bikes in real-time in case of theft. This added layer of security is especially appealing for expensive e-bikes and high-value bicycles.

The integration of biometric technology for enhanced security is also gaining attention. Biometric locks, which require fingerprints or facial recognition to unlock, offer a higher level of protection, ensuring only authorized users can access the bike. This technology appeals to consumers seeking top-tier security for their bicycles.

Lastly, the increasing focus on sustainability and eco-friendly materials is a trend that is influencing the bike lock market. As consumers become more environmentally conscious, bike lock manufacturers are exploring the use of sustainable materials in their products. This aligns with the broader trend towards eco-friendly consumer goods and appeals to environmentally-aware cyclists.

Regional Analysis

Germany Dominates with 37.1% Market Share

Germany holds a leading position in the Europe Bike Locks Market, commanding a 37.1% market share, valued at approximately USD 187.32 million. This dominance can be attributed to Germany’s strong cycling culture, high urbanization rate, and the increasing adoption of cycling as a sustainable mode of transportation. Additionally, Germany is home to some of the top bike lock manufacturers, which strengthens its market presence.

The high market share of Germany is driven by its large cycling population and infrastructure. As one of the largest markets for bicycles in Europe, Germany’s cities have well-developed cycling networks, which increase the demand for reliable and secure bike locks. Additionally, growing environmental awareness and the shift towards green transportation further contribute to cycling’s popularity, directly influencing the need for effective bike security solutions.

Germany’s market for bike locks is also influenced by a high rate of urbanization and an increasing number of people opting for bicycles in both urban and rural areas. The local manufacturing sector’s strength, with established brands offering high-quality, durable bike locks, ensures that Germany remains at the forefront of the market. Moreover, Germany’s commitment to sustainability and clean energy further boosts the demand for eco-friendly transportation alternatives like cycling, driving market growth.

Key Regions and Countries Covered in the Report

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Competitive Landscape

The Europe Bike Locks Market is highly competitive, with major companies providing a variety of lock solutions. Among these, ABUS, Kryptonite, OnGuard, and Master Lock stand out as the top players, driving the market forward with innovative products.

ABUS is a leading player in the bike lock market, known for its high-security locks. The company offers a wide range of bike locks, including U-locks, chain locks, and folding locks, all designed with durability and security in mind. ABUS’s reputation for producing strong, reliable products has helped it maintain a strong position in the European market. The company is particularly popular among cyclists who prioritize safety and ease of use.

Kryptonite is another dominant player in the bike lock market, well-known for its robust and tamper-resistant designs. Kryptonite locks are favored by both casual and professional cyclists for their effectiveness in preventing theft. The company continually innovates, offering a variety of lock types that cater to different security needs and price points. Its commitment to customer satisfaction and product quality has solidified its presence in Europe.

OnGuard offers a competitive range of bike locks that focus on strength and ease of use. The brand is recognized for its affordable yet secure locking solutions, making it a popular choice among a wide range of cyclists. OnGuard also produces locks with advanced features, such as anti-theft alarms, appealing to more security-conscious customers.

Master Lock is a well-established brand known for providing high-security bike locks across Europe. The company’s locks combine technology with high-quality materials, offering secure and easy-to-use solutions for cyclists. Master Lock’s broad product line and brand recognition have helped it maintain a significant market share in Europe.

Together, these companies are at the forefront of the European bike locks market, continuously innovating and offering a variety of solutions to meet the growing demand for bike security. Their strong market presence and commitment to quality make them dominant players in the industry.

Major Companies in the Market

- ABUS

- Kryptonite

- OnGuard

- Master Lock

- Hiplok

- Oxford Products

- Trelock

- Axa Security

- Litelok

- Seatylock

Recent Developments

- ABUS: In December 2024, ABUS commemorated its 100th anniversary by inaugurating a state-of-the-art factory in Rehe, Germany. The event attracted nearly 5,000 attendees, highlighting the company’s century-long commitment to security solutions. This new facility underscores ABUS’s dedication to innovation and excellence in the security industry.

- Thule Group: On November 2024, Thule Group announced an agreement to acquire Australian phone mount manufacturer Quad Lock for AU$500 million (approximately $327 million). Established in 2011, Quad Lock has expanded its product range from mountain bike mounts to include solutions for motorcycles, boats, and cars, with distribution in about 100 countries and 75% of sales direct-to-consumer.

Report Scope

Report Features Description Market Value (2024) USD 504.96 Million Forecast Revenue (2034) USD 930.1 Million CAGR (2025-2034) 6.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Key Bike Locks, Password Bike Locks), By Pattern (U-locks, Chain Locks, Folding Locks, Cable Locks, Others), By Application (OEM, Aftermarket) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape ABUS, Kryptonite, OnGuard, Master Lock, Hiplok, Oxford Products, Trelock, Axa Security, Litelok, Seatylock Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- ABUS

- Kryptonite

- OnGuard

- Master Lock

- Hiplok

- Oxford Products

- Trelock

- Axa Security

- Litelok

- Seatylock