Global Keyless Entry and Start Market Size, Share, Growth Analysis By Product (PIC-Based, ARM-Based), By Application (Passenger Car, Commercial Vehicles), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 100122

- Number of Pages: 281

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

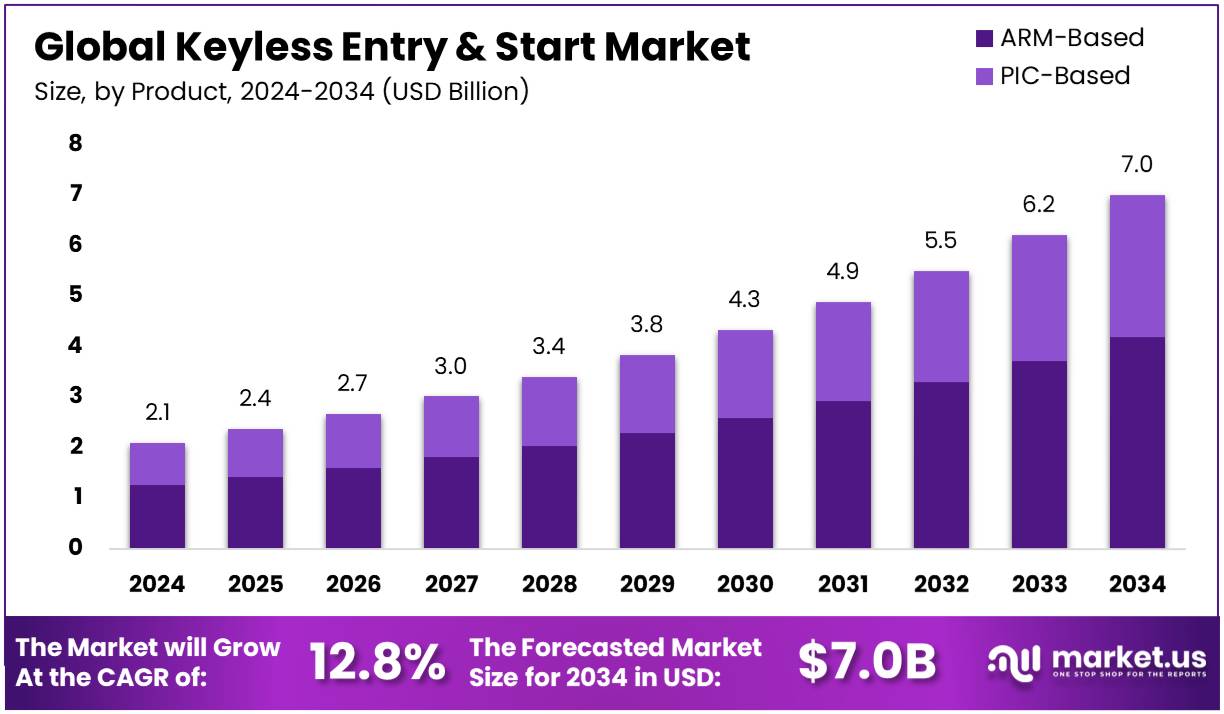

The Global Keyless Entry and Start Market size is expected to be worth around USD 7.0 Billion by 2034, from USD 2.1 Billion in 2024, growing at a CAGR of 12.8% during the forecast period from 2025 to 2034.

Keyless entry and start systems allow vehicles to unlock and start without traditional keys. They use electronic signals from a fob or smartphone. This technology improves convenience and security. The systems are integrated with vehicle electronics and enhance user experience. They are becoming standard in modern car designs, increasingly popular.

The keyless entry and start market encompasses the sale of advanced vehicle access systems and includes manufacturers, suppliers, and technology providers. This market’s growth is primarily driven by consumer demand for convenience and security. Innovations in technology and the integration of these systems into new vehicle models support market expansion. Additionally, competitive pricing and regulatory standards play crucial roles in shaping market trends within the automotive industry.

The keyless entry and start market is expanding rapidly, driven by consumer demand for advanced vehicle technology. A study by Autotrader found that 48% of car buyers value in-vehicle technology above brand or body style. This trend underscores the growing importance of technological features in consumer vehicle purchasing decisions.

However, security remains a concern, as evidenced by findings from the General German Automobile Club (ADAC), which revealed that 99% of keyless cars, including popular models like the BMW 7 Series and Ford Focus, could be compromised through relay attacks. This vulnerability highlights a critical area for improvement within the market.

Moreover, collaborations between automotive manufacturers and tech companies are set to enhance the keyless entry system’s capabilities and security. For instance, BMW is integrating Huawei’s technology to launch its first electric cars with the HiCar system in China by 2026. This partnership aims to improve smart connectivity and in-vehicle app experiences, marking a significant step towards more integrated and advanced automotive technologies.

In this context, the keyless entry and start market is poised for growth, with technological advancements and enhanced security measures becoming pivotal. As automakers and tech companies continue to innovate, the market is expected to evolve, offering more secure and user-friendly options to consumers, thereby driving further expansion.

Key Takeaways

- Keyless Entry and Start Market was valued at USD 2.1 Billion in 2024 and is projected to reach USD 7.0 Billion by 2034, growing at a 12.8% CAGR.

- In 2024, ARM-Based Systems dominated the product segment, widely adopted in luxury vehicles for advanced security features.

- In 2024, PIC-Based Systems remained a cost-effective alternative for entry-level vehicles.

- In 2024, Passenger Cars held the leading market share, driven by increasing demand for advanced vehicle access solutions.

- In 2024, North America led the market with 36.5%, valued at USD 0.77 Billion, supported by rising adoption of smart vehicle technologies.

Product Analysis

ARM-Based dominates with a significant market share due to its advanced features and reliability in high-end vehicles.

The Keyless Entry and Start Market is heavily influenced by ARM-Based products, which hold a substantial market share due to their sophisticated technology and reliability. ARM-Based systems are preferred for their enhanced security features and faster processing capabilities, which are crucial in luxury and technologically advanced vehicles. This sub-segment’s dominance is supported by consumer demand for higher security standards and seamless user experience in vehicle access and ignition.

Conversely, PIC-Based products, although less dominant, serve an essential role by providing cost-effective solutions for entry-level vehicles. These systems cater to manufacturers and consumers who prioritize affordability without requiring high-end specifications, ensuring that keyless entry technology remains accessible across a broader market spectrum.

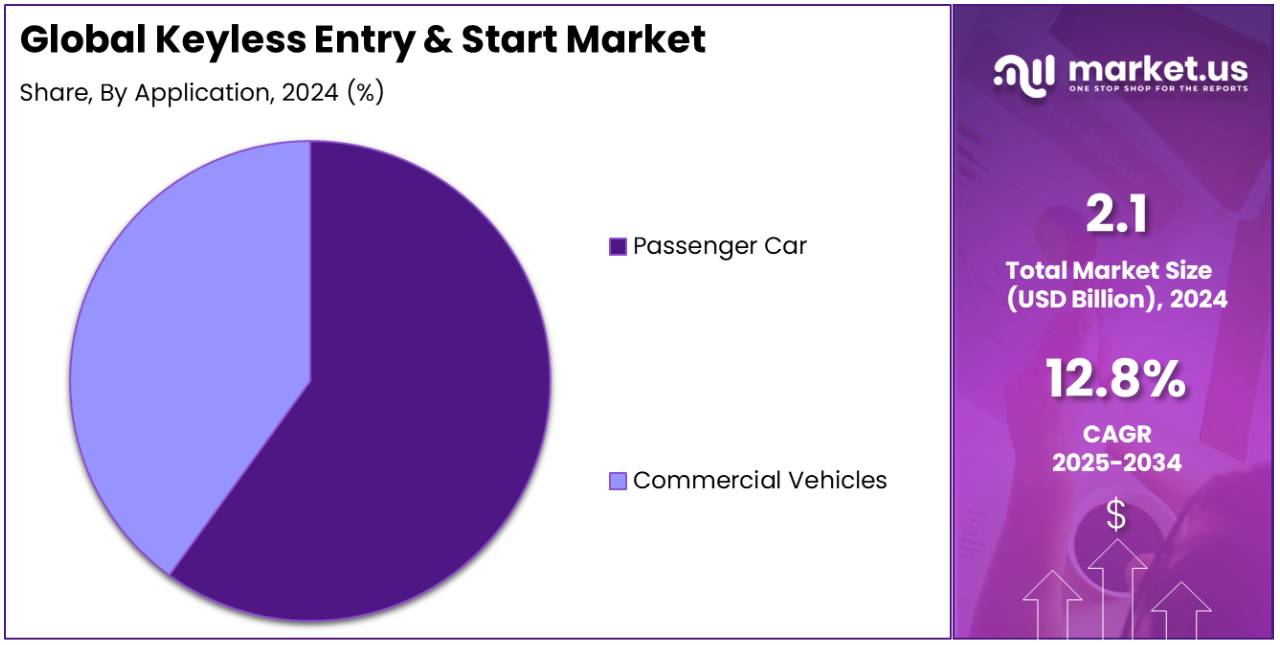

Application Analysis

Passenger Cars lead with the largest market share due to widespread adoption and consumer preference for convenience features.

Passenger Cars are the primary application sub-segment in the Keyless Entry and Start Market, reflecting their dominant market share. The widespread adoption of keyless entry systems in passenger cars is driven by the increasing consumer demand for convenience and advanced security features. This preference is particularly pronounced in urban areas, where the ease of access and start functionalities significantly enhances the daily usability of vehicles.

Commercial Vehicles, while also incorporating keyless systems, focus more on security and fleet management capabilities. Though they hold a smaller portion of the market, commercial vehicles are crucial for integrating advanced keyless technologies that cater to business needs, such as improved fleet security and management efficiency, which in turn supports the overall growth of the keyless entry and start systems market.

Key Market Segments

By Product

- PIC-Based

- ARM-Based

By Application

- Passenger Car

- Commercial Vehicles

Driving Factors

Smart Features and Vehicle Premiumization Drives Market Growth

The keyless entry and start market is witnessing significant growth due to the rising demand for convenience, comfort, and advanced security in modern vehicles. As drivers increasingly expect hassle-free access and start functions, automakers are integrating keyless systems into a broader range of vehicle models. This feature, once exclusive to luxury vehicles, is now becoming standard in mid-size cars, thanks to growing global production and shifting consumer expectations.

OEMs are also actively pushing toward smart mobility by enhancing vehicle connectivity. Keyless systems fit seamlessly into this vision by supporting app-based control, remote access, and integration with infotainment and navigation systems. These technologies are aligned with the broader trend of connected cars, where digital convenience and automation improve the driving experience.

Additionally, rising concerns over vehicle theft have prompted the use of more secure keyless solutions. Advanced encryption and rolling-code systems are now part of modern keyless entry units, adding layers of protection and reducing unauthorized access risks.

Restraining Factors

Cyber Risks and Retrofit Limitations Restrain Market Growth

Despite growing popularity, several challenges are slowing the adoption of keyless entry and start systems. One of the primary concerns is the vulnerability to cyber threats, such as relay attacks and signal hijacking. Criminals can intercept or replicate key fob signals, enabling unauthorized vehicle access. This creates ongoing security concerns for both automakers and consumers.

Another key restraint is cost. Keyless systems are significantly more expensive than traditional mechanical locks and ignition systems. For budget vehicle segments or cost-sensitive markets, this added expense can be a barrier to inclusion, especially for base models.

Retrofitting keyless solutions into older vehicles also presents difficulties. Many legacy vehicles lack the electrical architecture needed to support smart access systems. As a result, installation becomes complex, costly, or impractical, limiting the market to newer models.

Additionally, keyless systems are reliant on battery-powered key fobs. Users frequently report issues such as weak signals, dead batteries, or the need for frequent replacements. This adds a layer of maintenance and reduces perceived reliability.

Growth Opportunities

Biometric Access and Digital Keys Provide Opportunities

The market for keyless entry and start systems is expanding into new opportunity areas driven by innovation and changing mobility trends. One major growth area is the development of biometric-based access solutions, such as fingerprint or facial recognition. These systems enhance both security and personalization by allowing only verified users to start the vehicle, and are being tested in high-end and concept cars.

Smartphone-based digital keys are also gaining traction. These solutions enable car access and ignition via mobile apps, removing the need for physical keys altogether. Users can lock, unlock, and start their vehicles using Bluetooth or NFC, with some platforms allowing remote sharing of digital keys for temporary access. This is especially beneficial in car-sharing services and corporate fleet management.

Keyless technology is also being integrated into two-wheelers and commercial vehicles. With rising urban traffic and growing demand for secure, contactless solutions, two-wheeler manufacturers are beginning to offer smart access features. Similarly, logistics operators are adopting keyless systems to reduce key loss and streamline fleet operations.

Emerging Trends

Ultra-Wideband and Digital Innovations Are Latest Trending Factor

Several emerging trends are reshaping the keyless entry and start market, with a strong focus on security, personalization, and seamless user experience. One of the most notable developments is the adoption of ultra-wideband (UWB) technology. UWB enables precise distance measurement between the vehicle and the key fob, significantly improving signal security and reducing the risk of relay attacks.

Gesture-controlled and proximity-based unlocking systems are also gaining popularity. These systems allow users to unlock their vehicles simply by approaching or making a specific hand movement. This hands-free convenience adds to the premium feel of modern vehicles, particularly in urban settings where fast and contactless interaction is valued.

Another trend is the integration of personalized driver profiles into keyless access systems. When a specific user accesses the vehicle, settings such as seat position, climate control, and infotainment preferences are automatically adjusted. This feature enhances comfort and adds a layer of customization to the driving experience.

Furthermore, blockchain-based digital key platforms are emerging as secure solutions for access management. These decentralized systems ensure tamper-proof sharing and tracking of digital keys, supporting secure access in shared and rental vehicle scenarios.

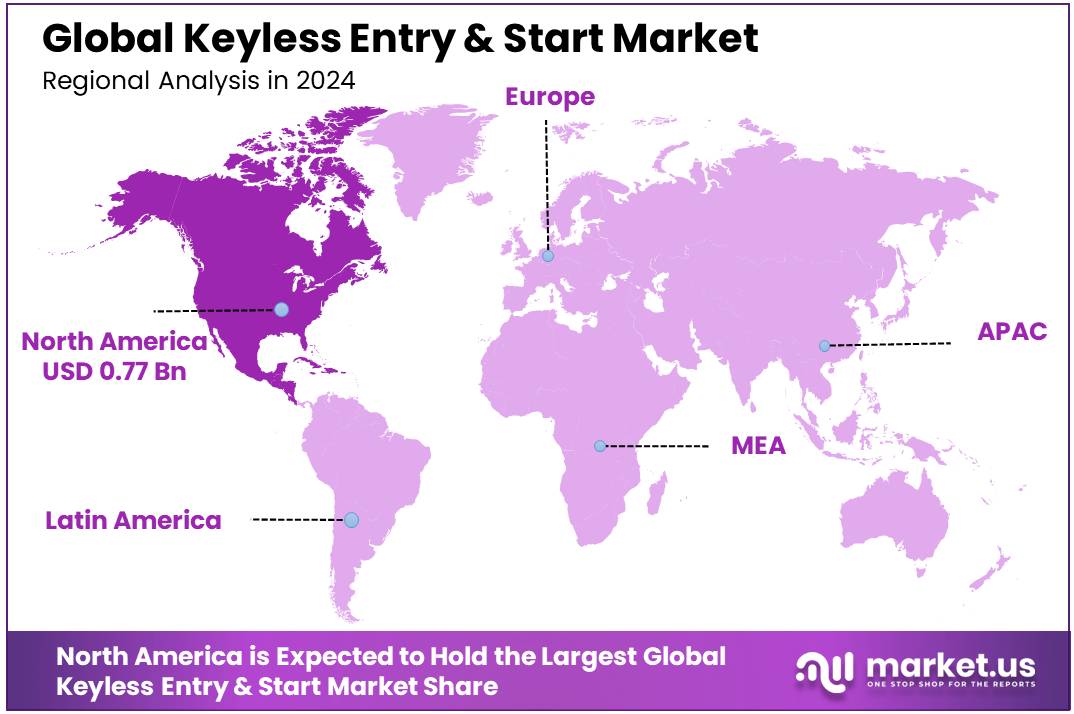

Regional Analysis

North America Dominates with 36.5% Market Share

North America leads the Keyless Entry and Start Market with a 36.5% share, totaling USD 0.77 billion. This market dominance is driven by the region’s high adoption of advanced automotive technologies and consumer preference for convenience and security features in vehicles.

Key factors contributing to North America’s high market share include widespread technological integration within the automotive industry, strong consumer purchasing power, and a significant shift towards more connected and autonomous vehicles. The region’s robust automotive market and rapid adoption of new technologies like mobile-connected keyless entry systems also play a crucial role.

The future influence of North America in the global Keyless Entry and Start Market is projected to remain strong. With ongoing innovations in automotive technology and increasing demand for high-tech vehicle features, North America is likely to continue driving the market forward. The trend towards electric and smart vehicles, which frequently incorporate advanced entry systems, suggests further growth potential for this segment in the region.

Regional Mentions:

- Europe: Europe holds a significant position in the Keyless Entry and Start Market, with a focus on enhancing vehicle security and user convenience. The region’s adoption of stringent vehicle safety and anti-theft regulations supports the growth of this market.

- Asia Pacific: Asia Pacific is experiencing rapid growth in the Keyless Entry and Start Market, driven by the expanding automotive industry and rising consumer demand for technology-enhanced vehicles, particularly in China, Japan, and South Korea.

- Middle East & Africa: The Middle East and Africa are gradually expanding their market share in the Keyless Entry and Start sector, influenced by increasing luxury vehicle sales and advancements in vehicle security technologies.

- Latin America: Latin America is developing its Keyless Entry and Start Market amid growing awareness of vehicle security and technological adoption in major economies like Brazil and Mexico, catering to a rising middle-class consumer base.

Key Regions and Countries Covered in the Report

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Landscape

The keyless entry and start market is growing fast due to rising demand for convenience, safety, and advanced vehicle technologies. The top four players in this market are Continental AG, DENSO Corporation, Robert Bosch GmbH, and Valeo. These companies lead with smart systems, innovation, and strong OEM partnerships.

Continental AG is a major provider of intelligent access control systems. It offers keyless technologies that improve security and user convenience. The company integrates its systems with other vehicle electronics, creating a seamless driving experience.

DENSO Corporation supplies advanced keyless start systems to leading automakers. Its products are known for reliability and efficient performance. DENSO invests in research to enhance security features and reduce energy use, supporting both safety and sustainability.

Robert Bosch GmbH offers a wide range of keyless solutions, including passive entry systems and smart key modules. The company focuses on digital innovation, cybersecurity, and seamless integration with car electronics. Bosch is also investing in smartphone-based vehicle access systems.

Valeo is a strong player in smart vehicle access. Its keyless systems offer hands-free entry and remote start. The company works closely with automakers to develop customized solutions. Valeo also focuses on driver comfort and enhanced anti-theft protection.

These key players are driving the market through innovation, strong R&D, and partnerships with car manufacturers. They focus on user-friendly designs, system security, and integration with connected car technologies. Their strong presence across global markets and ongoing investment in digital access solutions position them as leaders in the growing keyless entry and start market.

Major Companies in the Market

- Alps Electric Co. Ltd.

- Continental AG

- DENSO Corporation

- Hella KGaA Hueck & Co.

- Microchip Technology Inc.

- Mitsubishi Electric Corporation

- NXP Semiconductors

- Robert Bosch GmbH

- Tokai Rika

- Valeo

- ZF Friedrichshafen AG

- Other Key Players

Recent Developments

- Syntiant and Knowles’ Consumer MEMS Microphone Division: On September 2024, Syntiant announced its plan to acquire the Consumer Micro-Electro-Mechanical Systems (MEMS) Microphone division of Knowles Corporation for $150 million in cash and stock. The acquired business generated revenues of $256 million in FY 2023 and $136 million in the first half of 2024.

- Emerson and NI: On April 2023, Emerson entered into a definitive agreement to acquire NI (National Instruments) for $60 per share in cash, valuing the transaction at $8.2 billion. NI specializes in software-connected automated test and measurement systems, which are instrumental in accelerating product development cycles.

Report Scope

Report Features Description Market Value (2024) USD 2.1 Billion Forecast Revenue (2034) USD 7.0 Billion CAGR (2025-2034) 12.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (PIC-Based, ARM-Based), By Application (Passenger Car, Commercial Vehicles) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Alps Electric Co. Ltd., Continental AG, DENSO Corporation, Hella KGaA Hueck & Co., Microchip Technology Inc., Mitsubishi Electric Corporation, NXP Semiconductors, Robert Bosch GmbH, Tokai Rika, Valeo, ZF Friedrichshafen AG, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Keyless Entry and Start MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

Keyless Entry and Start MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Alps Electric Co. Ltd.

- Continental AG

- DENSO Corporation

- Hella KGaA Hueck & Co.

- Microchip Technology Inc.

- Mitsubishi Electric Corporation

- NXP Semiconductors

- Rebert Bosch GmbH

- Tokai Rika

- Valeo

- ZF Friedrichshafen AG

- Other Key Players