Global Passenger Cars Market By Propulsion Type (ICE, Electric), By Vehicle Class (Economy, Luxury), By Type (SUV, Hatchback, MUV, Sedan, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Feb 2025

- Report ID: 141072

- Number of Pages: 323

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

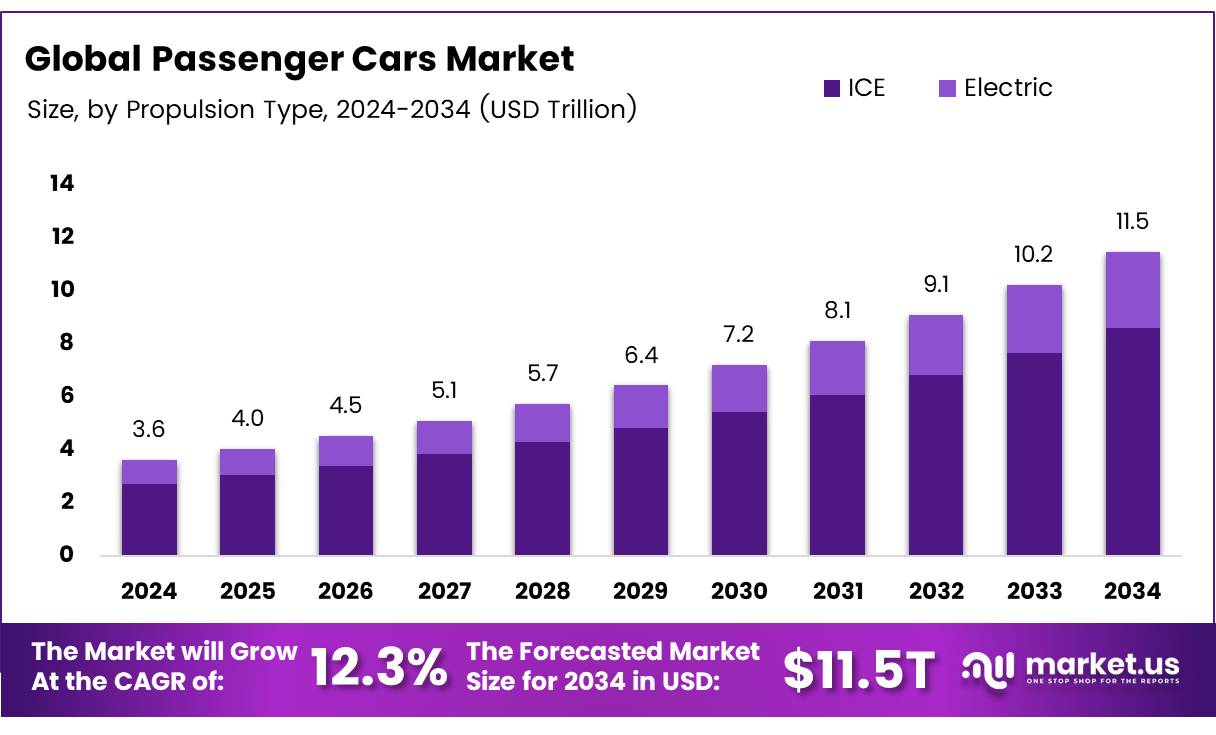

The Global Passenger Cars Market size is expected to be worth around USD 11.5 Trillion by 2034, from USD 3.6 Trillion in 2024, growing at a CAGR of 12.3% during the forecast period from 2025 to 2034.

The passenger cars market is a dynamic segment within the global automotive industry, encompassing vehicles designed primarily for the transportation of passengers. This includes a broad range of models, such as sedans, hatchbacks, SUVs, and electric vehicles (EVs).

The market is heavily influenced by factors such as consumer preferences, fuel efficiency standards, regulatory frameworks, and the growing shift toward sustainable mobility solutions.

In 2023, the global sales of passenger cars reached over 76.67 million units, including both electric and non-electric vehicles as per Roadgenius. This indicates the significant scope of the market, which spans across numerous geographies and demonstrates increasing consumer demand for both traditional and eco-friendly options.

The growth of the passenger cars market can be attributed to several driving factors, including technological advancements, increased urbanization, and evolving consumer preferences towards higher safety standards and fuel efficiency. Government incentives aimed at boosting the adoption of electric vehicles (EVs) and addressing environmental concerns have also played a pivotal role in shaping market dynamics.

According to Statistics Finland, new registrations in the country increased by 8% in December 2024, signaling an ongoing recovery and positive market sentiment. In Austria, a steady increase in passenger car registrations, with a total of 5.19 million cars as of December 2023, according to Statistics Austria, further reflects growth within the sector. The market is poised for continued expansion, particularly as governments intensify regulations around emissions and promote EV adoption.

Government investment and regulations are key contributors to the passenger cars market’s development, especially in the context of shifting towards electric mobility. Several governments globally are rolling out stricter emission standards, incentivizing consumers to transition to electric and hybrid vehicles.

For example, in Finland, where new registrations grew by 8% in December 2024, these shifts are partly attributed to favorable policies aimed at reducing carbon emissions.

Government subsidies and tax rebates for EV purchases are also accelerating demand. With the global sales of passenger cars projected to grow, manufacturers are focusing on enhancing production capabilities to meet regulatory compliance and consumer demand for more sustainable vehicles.

This regulatory pressure is expected to foster innovation and further investment in the sector, creating substantial long-term opportunities.

Key Takeaways

- The global passenger cars market is projected to reach USD 11.5 trillion by 2034, growing at a CAGR of 12.3% from 2025 to 2034.

- In 2024, Internal Combustion Engine (ICE) vehicles hold 75.3% of the passenger cars market share by propulsion type.

- The economy vehicle class captured 86.9% of the passenger cars market share in 2024, driven by demand for affordable and fuel-efficient vehicles.

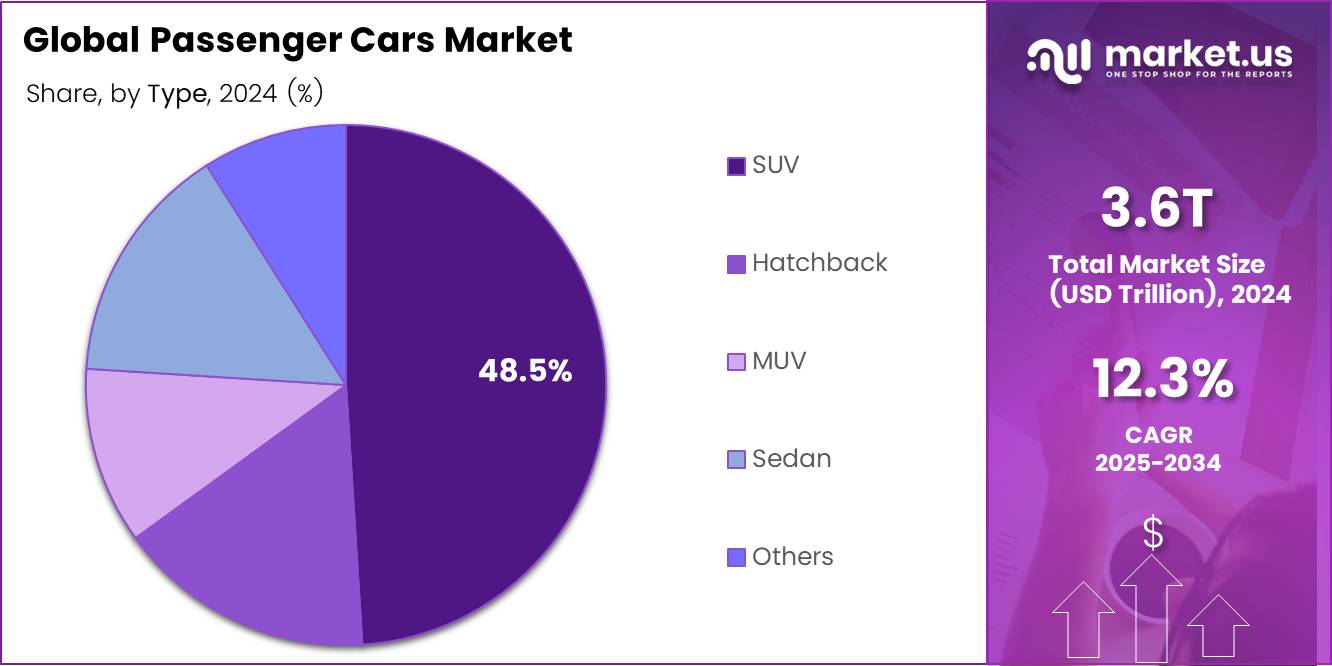

- SUVs dominate the passenger cars market with a 48.5% share in 2024, driven by consumer preference for comfort, safety, and versatility.

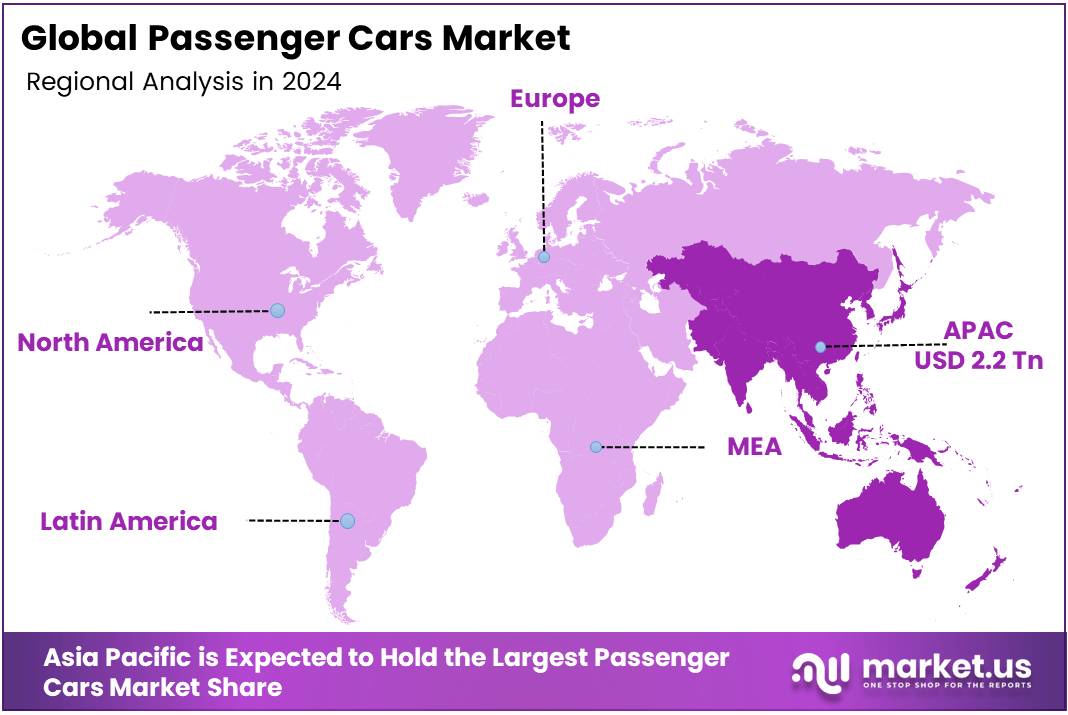

- Asia Pacific leads the passenger cars market with 62.3% of the global share, valued at USD 2.2 trillion, driven by urbanization and a growing middle class.

Propulsion Type Analysis

ICE Dominates Passenger Cars Market with 75.3% Share in By Propulsion Type Analysis Segment in 2024

In 2024, Internal Combustion Engine (ICE) vehicles maintained a dominant market position in the By Propulsion Type Analysis segment of the passenger cars market, capturing 75.3% of the total share. This significant share can be attributed to ICE vehicles’ long-standing presence, extensive infrastructure, and established consumer preference for traditional fuel sources.

The widespread availability of refueling stations, coupled with lower initial vehicle costs, continues to make ICE-powered vehicles the preferred choice for a large majority of consumers globally.

In contrast, electric vehicles (EVs) have experienced steady growth, securing a smaller portion of the market. EVs benefit from rising environmental awareness, government incentives, and advancements in battery technology, which have collectively improved range, charging speeds, and affordability.

Despite these advancements, electric vehicles held a 24.7% share in 2024, as challenges such as higher upfront costs, limited charging infrastructure, and range anxiety still act as barriers to wider adoption.

Overall, while the market for electric vehicles continues to expand, ICE vehicles remain the dominant force within the passenger cars market, driven by infrastructure, cost advantages, and entrenched consumer behavior.

Vehicle Class Analysis

Economy Segment Leads with 86.9% Market Share in 2024, Driven by Affordability and Accessibility

In 2024, the Economy segment held a dominant position in the By Vehicle Class Analysis of the Passenger Cars Market, commanding an impressive 86.9% market share. This substantial share can be attributed to the increasing demand for affordable, fuel-efficient, and practical vehicles among a broad consumer base.

As economic considerations remain a central driver for purchasing decisions, economy-class cars continue to dominate due to their lower price points, reduced operating costs, and extensive availability across various global markets. These vehicles cater to a wide demographic, including budget-conscious individuals, families, and first-time car buyers.

On the other hand, the Luxury segment holds a comparatively smaller share but remains significant in terms of market value. With consumers willing to invest in higher-quality features, advanced technology, and superior performance, the demand for luxury vehicles is projected to grow, albeit at a slower pace.

While the luxury vehicle market is expected to witness steady growth, the gap between the economy and luxury segments remains large, with the economy class continuing to benefit from broader adoption and affordability across various regions.

Type Analysis

SUV Leads Passenger Car Market with 48.5% Share in 2024

In 2024, SUVs maintained their dominant position within the By Type Analysis segment of the Passenger Cars Market, commanding a substantial 48.5% share. This market leadership can be attributed to the increasing consumer preference for larger vehicles offering enhanced comfort, advanced safety features, and versatile utility. SUVs continue to resonate with buyers due to their elevated driving position, improved off-road capabilities, and family-friendly features.

Hatchbacks followed as the second most popular segment, with a growing share due to their compact size, fuel efficiency, and affordability, which appeal to urban commuters and younger buyers. The market for Multi-Utility Vehicles (MUVs) also remains strong, although it lags behind SUVs, offering a similar blend of utility and versatility but with a slightly more niche appeal.

Sedans, once the staple of passenger cars, continue to experience a steady decline in demand, with consumers opting for SUVs and hatchbacks that offer better practicality and modern designs. The Others category, encompassing niche vehicle types, maintains a small yet stable portion of the market, driven by specialized consumer needs.

The shift toward SUVs reflects a broader trend in consumer preferences for performance, space, and technological advancements, contributing to the segment’s continued dominance.

Key Market Segments

By Propulsion Type

- ICE

- Electric

By Vehicle Class

- Economy

- Luxury

By Type

- SUV

- Hatchback

- MUV

- Sedan

- Others

Drivers

Rising Disposable Income Drives Market Expansion for Passenger Cars

The passenger car market is being significantly influenced by rising disposable income, particularly in emerging economies. As consumers experience higher income levels, their ability to afford personal vehicles increases, contributing to a surge in demand for passenger cars.

This trend is most notable in developing regions, where economic growth has enabled a larger segment of the population to purchase vehicles. Additionally, urbanization is playing a pivotal role in shaping market dynamics.

As more people migrate to cities with limited public transportation options, the need for personal vehicles has grown, further fueling market expansion. Technological advancements have also become a key driver.

Innovations such as autonomous driving technologies, advanced infotainment systems, electric powertrains, and enhanced safety features are making cars more appealing to consumers. The integration of these technologies not only improves the driving experience but also contributes to greater convenience and safety.

Furthermore, there is a marked shift in consumer preferences toward comfort and safety, which is pushing the demand for features such as heated seats, advanced climate control, automatic emergency braking, and adaptive cruise control.

These preferences reflect a growing desire for higher-quality vehicles, thereby strengthening the overall market for passenger cars. In conclusion, a combination of economic factors, technological progress, and evolving consumer demands are driving sustained growth in the global passenger car market.

Restraints

Rising Fuel Prices Affect Consumer Preferences in Passenger Car Market

The passenger car market faces significant restraints, particularly due to increasing fuel prices. As fuel prices continue to rise globally, especially in regions where consumers primarily rely on petrol or diesel-powered vehicles, there is a noticeable shift in purchasing behavior.

Higher fuel costs make larger, less fuel-efficient cars less attractive to consumers, particularly for those who prioritize long-term affordability. This shift is driving demand for smaller, more fuel-efficient models, which may limit the market share of traditional gas-powered vehicles.

Additionally, global supply chain disruptions, such as the ongoing semiconductor shortage, continue to impact the production and availability of new vehicles.

The shortage of critical components is leading to delays in manufacturing processes, which, in turn, affects the timely delivery of cars to dealerships and consumers. This disruption, combined with the rising costs of raw materials, is not only increasing vehicle prices but also making it difficult for automakers to meet the growing demand for new cars. Consequently, these factors are expected to constrain the overall growth of the passenger car market in the near term.

Growth Factors

Electric Vehicle Expansion Presents Key Growth Opportunities in the Passenger Car Market

The passenger car market is experiencing significant growth driven by several key factors, with the expansion of electric vehicles (EVs) being a primary driver.

As consumers increasingly shift towards environmentally friendly alternatives, the demand for EVs is expected to rise steadily, supported by advancements in battery technology and a growing network of charging infrastructure. These developments are making EVs more accessible and practical for a larger segment of the population.

Additionally, the push for sustainability and stricter emission regulations are accelerating the adoption of EVs across multiple markets. In parallel, the rise of autonomous driving technologies presents opportunities for manufacturers to design and develop next-generation cars with advanced safety features, driving convenience and customer satisfaction.

Another growth opportunity lies in the burgeoning car-sharing and ride-hailing services, such as Uber and Lyft, which are reshaping mobility patterns and creating demand for cars optimized for shared use.

Finally, emerging markets, particularly in regions like Asia-Pacific, Africa, and Latin America, offer untapped potential for expansion. The growing middle-class population and urbanization in these areas provide a promising environment for car manufacturers to increase their footprint and cater to rising demand for personal mobility solutions. This combination of technological innovation, evolving consumer preferences, and expanding markets will continue to shape the future of the passenger car industry.

Emerging Trends

Growing Adoption of Advanced Driver Assistance Systems (ADAS) in Passenger Cars

The passenger car market is witnessing significant trends that are reshaping the industry. One key factor is the growing integration of Advanced Driver Assistance Systems (ADAS) in vehicles.

These technologies, such as lane-keeping assistance, collision avoidance, and automated parking, are becoming more common as part of the move toward semi-autonomous driving. This development enhances safety and convenience for drivers, thus attracting more consumers. Another notable trend is the increasing demand for advanced infotainment and connectivity features.

Consumers now expect their vehicles to offer wireless connectivity, in-car entertainment, and seamless integration with mobile devices, creating a more connected and enjoyable driving experience.

Additionally, the rise of shared mobility services, like ride-hailing and car-sharing, is influencing car manufacturers to design vehicles that cater to fleet and shared usage, with an emphasis on durability and cost-effectiveness. Sustainability also plays a crucial role, as both consumers and manufacturers place higher value on eco-friendly practices.

There is a notable shift toward using recycled materials and adopting more sustainable production processes, reflecting a broader societal concern for the environment. Collectively, these trends highlight a shift toward smarter, more connected, and environmentally conscious vehicles, driving the growth of the passenger car market globally.

Regional Analysis

Asia Pacific dominates the passenger car market with 62.3% share at USD 2.2 trillion

The global passenger cars market is segmented by region, with Asia Pacific, North America, Europe, Middle East & Africa, and Latin America exhibiting distinct growth patterns.

Asia Pacific is the dominant region in the passenger cars market, accounting for 62.3% of the global share, valued at approximately USD 2.2 trillion. The region’s supremacy can be attributed to rapid urbanization, growing middle-class populations, and an increasing preference for personal vehicles.

Countries such as China, Japan, and India are major contributors to the regional market, driven by high consumer demand, strong manufacturing capabilities, and significant investments in electric vehicle (EV) infrastructure. In particular, China, as the world’s largest automotive market, plays a pivotal role, with robust sales and a major shift towards EVs further propelling market growth.

Regional Mentions:

North America holds a substantial market share of the global passenger cars market. The United States is the primary market within the region, with rising consumer disposable income and a growing demand for SUVs and electric cars. The shift towards sustainable transportation and advancements in autonomous vehicle technologies also enhance the region’s market outlook.

Europe is witnessing a notable shift towards electric vehicles due to stringent environmental regulations and increasing government incentives. The EU’s commitment to carbon neutrality and the rising popularity of eco-friendly transportation solutions have led to rapid adoption of electric passenger cars. Major markets in the region include Germany, the UK, and France, with increasing investments in EV infrastructure and manufacturing.

The Middle East & Africa and Latin America hold smaller shares, with both regions expected to see gradual growth driven by expanding economies and rising consumer purchasing power, particularly in countries like Brazil and the UAE.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The global passenger cars market in 2024 remains highly competitive, with several key players leading innovation and shaping market dynamics. Notably, companies like AUDI AG, BMW AG, Mercedes-Benz, and Volkswagen Group continue to dominate the premium segment, leveraging advanced technology, luxury offerings, and sustainable mobility solutions.

Their commitment to electrification, through platforms such as Volkswagen’s ID series and Mercedes-Benz’s EQ line, positions them favorably in an evolving regulatory and consumer landscape increasingly focused on eco-friendly solutions.

Hyundai Motor India and Kia India Pvt. Ltd. have solidified their market position through a robust portfolio of fuel-efficient and technologically advanced vehicles, catering to the growing demand for affordable yet feature-rich cars in both developed and emerging markets. The rapid expansion of electric vehicles (EVs) by Hyundai with models like the Ioniq 5 and Kia’s EV6 reflects the industry’s shift towards sustainability.

Meanwhile, Ford Motor Company, General Motors, and Honda Cars India have maintained strong market presences by focusing on diversified offerings, integrating advanced safety features, and optimizing manufacturing efficiencies. TATA Motors and Suzuki continue to capitalize on the mass-market segment, especially in developing economies, where price sensitivity remains a significant factor.

Tesla’s dominance in the electric vehicle sector is undeniable, with its continued innovations in autonomous driving and battery technology. Its global reach and leadership in EVs reinforce its market authority as consumer preferences shift towards greener alternatives.

Top Key Players in the Market

- AUDI AG.

- BMW AG

- Hyundai Motor India

- Kia India Pvt. Limited.

- Ford Motor Company

- General Motors

- Honda Cars India Limited

- Renault Group

- TATA Motors

- Suzuki

- Mercedes-Benz

- Nissan Motor Co., Ltd.

- Tesla

- Volkswagen Group

Recent Developments

- In November 2024, Bridgestone announced an investment of US$85 million aimed at enhancing its premium passenger car tire production capabilities and expanding R&D initiatives in India, strengthening its market position in the growing automotive sector.

- In January 2023, Tata Passenger Electric Mobility successfully completed the acquisition of Ford India’s Sanand plant, positioning itself for increased manufacturing capacity and further expansion in the electric vehicle market.

- In February 2025, Bosch finalized its acquisition of U.S.-based Roadside Protect, Inc., reinforcing its commitment to the development of connected mobility solutions and expanding its portfolio in roadside assistance technologies.

Report Scope

Report Features Description Market Value (2024) USD 3.6 Trillion Forecast Revenue (2034) USD 11.5 Trillion CAGR (2025-2034) 12.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Propulsion Type (ICE, Electric), By Vehicle Class (Economy, Luxury), By Type (SUV, Hatchback, MUV, Sedan, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape AUDI AG., BMW AG, Hyundai Motor India, Kia India Pvt. Limited., Ford Motor Company, General Motors, Honda Cars India Limited, Renault Group, TATA Motors, Suzuki, Mercedes-Benz, Nissan Motor Co., Ltd., Tesla, Volkswagen Group Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- AUDI AG.

- BMW AG

- Hyundai Motor India

- Kia India Pvt. Limited.

- Ford Motor Company

- General Motors

- Honda Cars India Limited

- Renault Group

- TATA Motors

- Suzuki

- Mercedes-Benz

- Nissan Motor Co., Ltd.

- Tesla

- Volkswagen Group