Global In-Car Infotainment Market By Product (Audio Unit, Display Unit, Head-up Display, Navigation Unit and Communication Unit), By Installation Type (OE fitted and Aftermarket), By Application (Passenger Cars and Commercial Vehicles), By Component (Hardware and Software), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2023-2032

- Published date: Dec 2024

- Report ID: 32774

- Number of Pages: 360

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

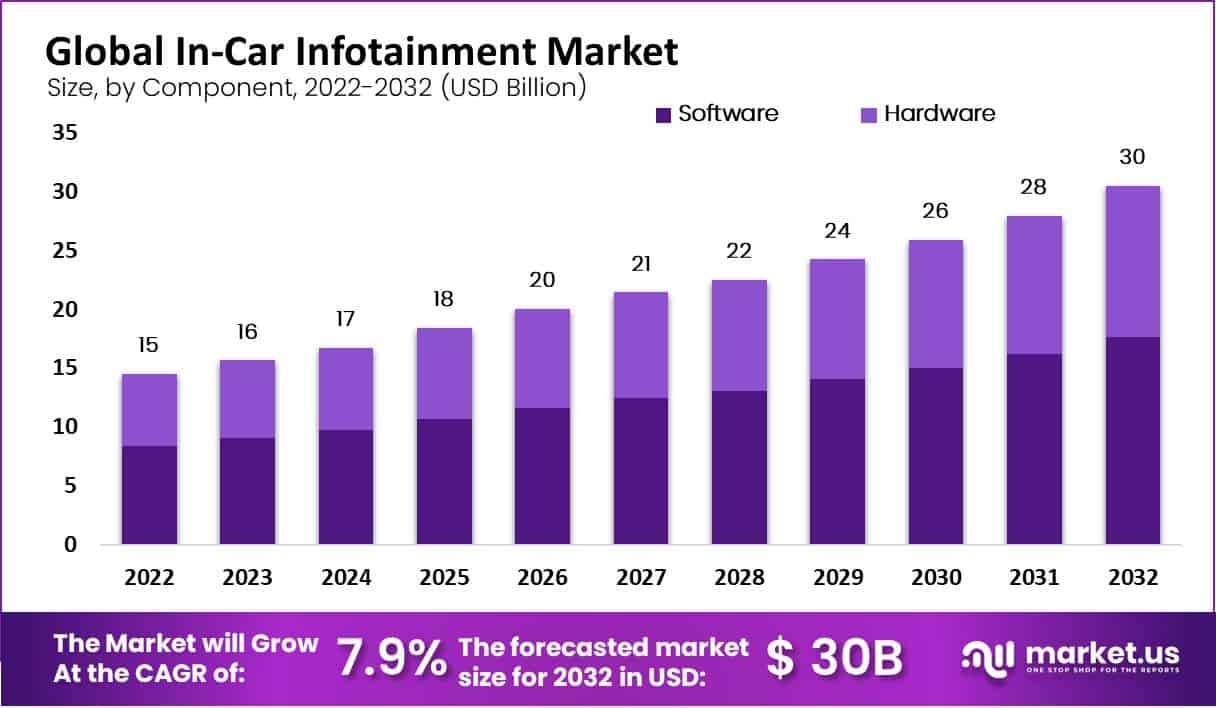

The Global In-Car Infotainment Market size is expected to be worth around USD 30.0 Billion by 2032, From USD 16.0 Billion by 2023, growing at a CAGR of 7.9% during the forecast period from 2023 to 2032.

The In-Car Infotainment Market encompasses integrated multimedia and information systems designed for vehicles, offering entertainment (music, video) and information services (navigation, diagnostics). These systems combine hardware (touchscreens, audio systems) and software (apps, operating systems) to enhance the in-vehicle experience, serving both OEMs and aftermarket suppliers.

The market is growing due to advancements in connectivity technology like 5G, the rise of electric and autonomous vehicles, and increasing consumer demand for connected experiences. Automakers are integrating infotainment systems as standard features, responding to the consumer expectation for seamless, smartphone-like functionality in vehicles.

Demand is driven by a consumer preference for personalized, connected automotive experiences, especially among younger demographics. Automakers are incorporating infotainment features across all vehicle segments, influenced by regulatory standards that require advanced safety and connectivity.

Demand is driven by a consumer preference for personalized, connected automotive experiences, especially among younger demographics. Automakers are incorporating infotainment features across all vehicle segments, influenced by regulatory standards that require advanced safety and connectivity.Significant opportunities exist in software innovation, particularly integrating AI and cloud-based services. The shift towards electric and autonomous vehicles also creates demand for infotainment as a central hub for vehicle management. Emerging markets in Asia-Pacific and Latin America offer further growth potential due to increasing vehicle sales and consumer tech adoption.

In the evolving landscape of the In-Car Infotainment Market, strategic collaborations are pivotal for technology advancement and market expansion. A notable development in December 2023 was Volkswagen’s strategic partnership with XPENG, marked by a 4.99% stake acquisition in the latter. This alliance is set to catalyze the joint development of two mid-size electric vehicles tailored for the Chinese market.

Leveraging Volkswagen’s robust vehicle development expertise alongside XPENG’s innovative smart EV technologies, this collaboration is poised to significantly enhance digital and automated driving experiences. The synergy is expected to reduce the production timeline by over 30%, with the inaugural models projected to debut in 2026. This partnership not only underscores the strategic shifts within the market but also highlights the increasing focus on digital integration and smart technology enhancement in vehicle infotainment systems.

In the dynamic In-Car Infotainment Market, Stellantis is positioning itself as a leader through strategic investments and innovations. The company recently announced a significant €5.6 billion initiative in South America, aimed at enhancing various aspects of vehicle development, including advanced infotainment systems.

This investment underscores a strategic focus on integrating cutting-edge technologies to elevate the user experience and maintain competitiveness in the rapidly evolving automotive sector. By prioritizing technological enhancements in infotainment, Stellantis is not only responding to increasing consumer demands for more connected and interactive vehicles but also shaping future trends in the global automotive industry.

The In-Car Infotainment Market is experiencing a transformative shift, significantly propelled by governmental investments. A prime example is the Canadian government’s allocation of $131.6 million to Honda Canada, an initiative focused on retooling manufacturing capabilities for hybrid-electric vehicles. This commitment is further augmented by an equivalent financial match from the Province of Ontario, elevating the total investment to $263.2 million.

Key Takeaways

- The In-Car Infotainment Market is projected to grow from USD 16.0 billion in 2023 to USD 30.0 billion by 2032, at a CAGR of 7.9%, driven by advancements in connectivity and the rise of electric and autonomous vehicles.

- Analyst Viewpoint Summary, Growing consumer demand for connected, personalized automotive experiences and regulatory standards for advanced safety and connectivity are key growth drivers for the In-Car Infotainment Market.

- The Head-up Display segment leads the market with over 31% share, driven by the demand for safety-enhancing features and AR integrations.

- The Software segment dominates with over 58% of the market share, highlighting the critical role of AI integration and connected services in infotainment systems.

- The Commercial Vehicle segment holds over 67% of the market, reflecting the rising adoption of infotainment for fleet management, driver communication, and navigation.

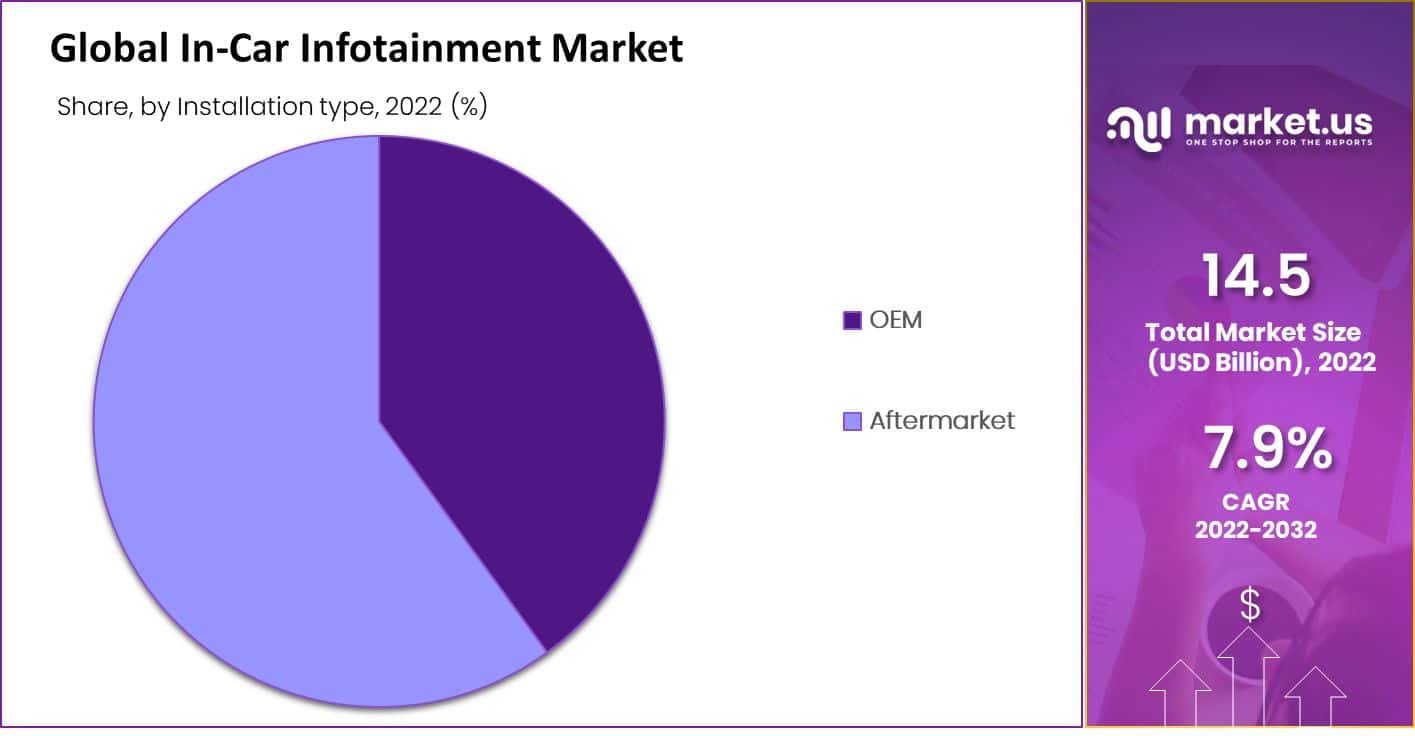

- The Aftermarket segment captured over 60% of the market share due to growing consumer interest in upgrading existing vehicles with advanced connectivity and multimedia features.

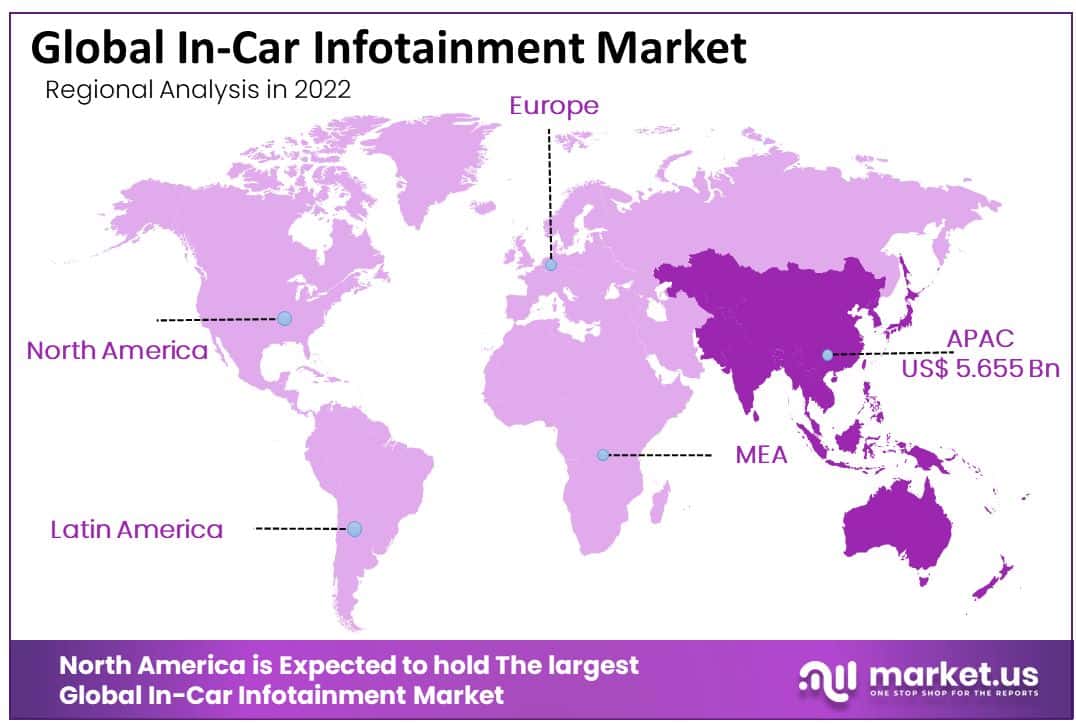

- Asia Pacific leads with a 39% market share, driven by rapid technological adoption and high demand for luxury vehicles with advanced infotainment systems.

- High development costs and technical complexity limit new entrants, creating financial and technological barriers for smaller players in the infotainment market.

By Product Analysis

Head-up Display segment dominated the in-car infotainment market, accounting for over 31% of the market share

In 2022, Head-up Display (HUD) held a dominant market position, capturing more than a 31% share of the global in-car infotainment market. The dominance of HUD is attributed to increasing consumer demand for advanced vehicle technology that enhances driver safety and comfort.

Automakers are integrating HUD systems to provide real-time data such as navigation, speed, and traffic information directly within the driver’s line of sight, minimizing distractions and improving overall driving experiences. This segment is expected to see robust growth due to technological advancements like augmented reality (AR) overlays and the rising adoption of electric and autonomous vehicles, which prioritize safety and driver assistance features.

Meanwhile, the Audio Unit segment also contributed significantly to market revenues, driven by the growing consumer preference for premium sound systems. Luxury and mid-range car manufacturers are increasingly offering high-quality, multi-speaker systems and branded audio collaborations, enhancing the in-car entertainment experience.

This trend aligns with the growing popularity of streaming services and digital media consumption, which has led to a surge in demand for advanced audio solutions that deliver immersive and personalized sound experiences.

The Navigation Systems segment witnessed moderate growth, supported by the increasing integration of GPS technology and real-time traffic updates. These systems are becoming essential features as consumers look for more convenience and efficiency in daily commutes and long-distance travel.

Lastly, the Connectivity Solutions segment is emerging as a crucial driver for the in-car infotainment market. With the proliferation of 5G technology and the growing need for seamless integration between vehicles and external devices, automakers are focusing on developing advanced connectivity solutions that support voice commands, internet browsing, and real-time vehicle diagnostics.

By Component Analysis

Software segment dominated the in-car infotainment market, accounting for over 58% of the market share

In 2022, the software segment within the In-Car Infotainment Market secured a commanding market position, capturing more than a 58% share. This predominance can be attributed to the increasing demand for connected vehicle services and advanced driver-assistance systems (ADAS) that rely heavily on sophisticated software solutions. The market is segmented into hardware and software components, where the software aspect not only dominates but also drives innovation in the industry.

Key advancements in this sector include the integration of artificial intelligence (AI) for voice recognition, real-time traffic updates, and personalized user experiences, further bolstering the software segment’s substantial market share. Additionally, collaborations between automotive manufacturers and software developers have been crucial in developing integrated systems that enhance the driver and passenger experience, thereby supporting sustained growth in this market segment.

By Application Analysis

Commercial vehicle segment dominated the in-car infotainment market, accounting for over 67% of the market share

In 2022, the commercial vehicle segment within the In-Car Infotainment Market held a dominant market position, capturing more than a 67% share. This substantial market share is driven by the increasing adoption of advanced infotainment systems in commercial fleets for enhanced driver communication, navigation, and entertainment options.

Commercial vehicles, including trucks and buses, are increasingly equipped with systems that offer real-time tracking, route optimization, and telematics functionalities, which not only improve operational efficiencies but also contribute to driver safety.

The rise in regulatory mandates for vehicle safety and the growing focus on connected vehicle technologies have further propelled the demand in this segment. As fleet operators seek to optimize operations and enhance the in-cabin experience, the integration of high-end infotainment systems is expected to continue driving growth in this market segment.

By Installation Type Analysis

Aftermarket segment dominated the in-car infotainment market, accounting for over 60% of the market share

In 2022, the aftermarket segment of the In-Car Infotainment Market held a dominant market position, capturing more than a 60% share. This significant market presence is largely due to the rising consumer demand for upgraded infotainment systems in existing vehicles. Vehicle owners are increasingly seeking advanced connectivity and multimedia features, which are often lacking in older or base model cars.

As a result, the aftermarket provides diverse and technologically advanced options that can be retrofitted in a wide range of vehicle makes and models. This segment benefits from the continuous innovations in smartphone integration technologies, such as Apple CarPlay and Android Auto, along with improved navigation and voice-assisted functionalities that enhance user experiences.

Additionally, the affordability of aftermarket solutions compared to factory-installed systems continues to drive their popularity among cost-conscious consumers looking to enhance their in-car experience without purchasing a new vehicle.

Key Market Segments

Based on Product

- Audio Unit

- Display Unit

- Head-up Display

- Navigation Unit

- Communication Unit

Based on component

- Hardware

- Software

Based Application

- Passenger cars

- Commercial Vehicle

Based on the Installation type

- OEM

- Aftermarket

Driver

Increased Consumer Expectations

The In-Car Infotainment Market as modern consumers demand advanced, seamless, and integrated digital experiences. With a rising preference for enhanced connectivity, entertainment, and convenience, car buyers increasingly prioritize infotainment systems when choosing vehicles.

These expectations are not merely about entertainment; consumers now look for sophisticated features such as real-time navigation, voice assistance, internet connectivity, and integration with smartphones and smart home systems.

This shift is amplified by the proliferation of smart devices and the growing ecosystem of IoT (Internet of Things), which has conditioned consumers to expect similar levels of interactivity and personalization in their vehicles.

The market is thus witnessing rapid integration of technologies like AI-powered interfaces, augmented reality displays, and advanced driver assistance systems (ADAS) that work in tandem with infotainment platforms.

Restraint

High Development Costs and Complexity

The development and integration of advanced in-car infotainment systems require substantial investment and technical expertise, presenting a significant barrier to market growth. The high costs associated with developing sophisticated hardware, software, and connectivity solutions often deter smaller players and increase the financial burden on established manufacturers.

For instance, the costs of developing high-quality displays, integrating voice recognition, and ensuring seamless connectivity with smartphones and other devices can exceed millions of dollars, impacting the overall return on investment (ROI).

This financial strain is further intensified by the complexity of developing systems that meet the increasingly sophisticated demands of consumers who expect seamless, intuitive, and integrated experiences similar to their personal smart devices. Manufacturers must balance these expectations with regulatory compliance requirements for safety and cybersecurity, which add layers of complexity and cost.

Moreover, the need for continuous software updates and compatibility with emerging technologies such as 5G and autonomous driving capabilities increases both the technical and financial investment. As a result, only a few major players with sufficient capital and technical resources can keep up, creating a fragmented market landscape.

This scenario also leads to longer development cycles, delaying product launches and limiting the pace of market growth. The interaction between these factors high costs, technical complexity, and consumer expectations creates a compounding effect that restricts new entrants and innovation, ultimately restraining the overall growth of the in-car infotainment market.

Opportunity

Growing Urbanization Fuels Demand

As urbanization accelerates globally, with projections indicating that over 68% of the world’s population will reside in urban areas by 2050, the demand for advanced in-car infotainment systems is poised for significant growth. In 2024, this trend is expected to create substantial opportunities in the global in-car infotainment market as cities evolve into smart ecosystems, necessitating seamless integration between vehicles and urban infrastructure.

Urban consumers increasingly expect their vehicles to offer sophisticated connectivity features that mirror their digital lifestyles. These expectations include seamless integration with smart city elements like traffic management systems, navigation through real-time updates, and access to entertainment and productivity features.

To address this, automotive companies are investing heavily in 5G technology and Internet of Things (IoT) integrations, which enable vehicles to communicate efficiently with external environments and enhance overall user experience. For instance, smart infotainment systems equipped with augmented reality (AR) navigation and over-the-air (OTA) software updates are anticipated to become more prevalent.

Trends

Expansion of Over-the-Air (OTA) Updates

The global In-Car Infotainment Market in 2024 is witnessing a significant transformation driven by the expansion of Over-the-Air (OTA) updates. Automotive manufacturers are increasingly integrating OTA capabilities into their infotainment systems, enabling real-time software enhancements, bug fixes, and feature additions without the need for a service visit. This trend is not only enhancing user convenience but also positioning infotainment systems as a central platform for personalized user experiences.

OTA updates are expanding beyond traditional navigation and entertainment functionalities, encompassing safety features and vehicle performance optimizations. This evolution reflects the automotive industry’s response to growing consumer demand for seamless digital experiences akin to smartphone technology. Leading market players, such as Tesla, Ford, and BMW, are setting benchmarks in this domain, pushing the boundaries of what infotainment systems can offer.

The expansion of OTA updates is also creating new revenue streams for automakers through subscription-based services and partnerships with technology firms. It is expected that in 2024, these updates will enable further integration with third-party applications, providing users with tailored content, real-time traffic updates, and other personalized services. The emphasis on OTA capabilities underscores the strategic shift towards software-defined vehicles, where the focus is on delivering continuous improvements and feature updates, extending the lifecycle and relevance of in-car systems.

Regional Analysis

Asia Pacific dominates the market with a 39% market share

Asia Pacific leads the in-car infotainment market with a commanding 39% share, translating to a market value of USD 5.655 billion. This dominance is attributed to rapid technological advancements and increased adoption of luxury vehicles equipped with advanced infotainment systems. The region benefits from strong automotive production in countries such as China, Japan, and South Korea, coupled with high consumer demand for vehicle connectivity features.

North America follows, characterized by high consumer expectations for connectivity and entertainment features within vehicles, which drives the integration of sophisticated infotainment systems. The U.S. market, in particular, shows robust growth due to the presence of major automobile manufacturers and tech companies pushing the envelope in infotainment technology, emphasizing seamless mobile and voice control integration.

Europe remains a significant player with a focus on luxury and performance vehicles that are typically equipped with advanced infotainment systems. The European market is propelled by stringent regulations regarding driver safety and fuel efficiency, encouraging manufacturers to adopt systems that offer better navigation and fuel monitoring.

Middle East & Africa shows growth potential with an increasing demand for luxury vehicles that are typically equipped with the latest in-car infotainment systems. The market here is driven by the affluent consumer base in Gulf Cooperation Council (GCC) countries who demand cutting-edge technology and connectivity features in their vehicles.

Latin America is gradually catching up, with growth influenced by increasing vehicle sales and a rising middle class that is beginning to demand more sophisticated vehicle features, including advanced infotainment systems. Although this region has a smaller market share compared to others, it shows promise due to economic improvements and a growing automotive sector.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In the evolving landscape of the global in-car infotainment systems market, several key players are poised to redefine the automotive experience through innovative solutions and strategic alliances. As of 2024, Volkswagen AG remains at the forefront, integrating cutting-edge connectivity features that enhance user interaction and safety.

Their systems are distinguished by seamless smartphone integration and intuitive interfaces, leveraging their robust manufacturing capabilities to deploy these technologies widely across their vehicle models.

Harman International, a subsidiary of Samsung Electronics, continues to lead with its advanced audio systems and connected car solutions, focusing on personalization and the integration of voice commands to bolster driver engagement and comfort. Their collaboration with major OEMs and direct consumer feedback loops significantly drive their product innovations.

Ford Motor Company has also made notable advancements in their SYNC platform, incorporating AI-driven functionalities that provide real-time traffic updates, predictive maintenance alerts, and enhanced navigational features, which are increasingly becoming standard expectations among consumers.

ALPS ALPINE CO., LTD and Continental AG are key contributors, primarily through their focus on high-resolution displays and user-friendly interfaces. These features are not only elevating the aesthetic appeal of dashboards but also improving the ease of use, which is critical for safety and customer satisfaction.

Pioneer Corporation and PANASONIC CORPORATION continue to excel in multimedia integration and connectivity, pushing the boundaries with modular infotainment systems that support various digital formats and connectivity protocols, ensuring compatibility with numerous devices and services.

Meanwhile, AUDI AG and BMW AG are leveraging their luxury market positions to introduce bespoke infotainment features that emphasize immersive audio-visual experiences, including augmented reality components, which are setting new standards for in-car entertainment.

Top Key Players in the Market

- Volkswagen AG

- Harman International

- Ford Motor Company

- ALPS ALPINE CO., LTD

- AUDI AG

- BMW AG

- Continental AG

- PANASONIC CORPORATION

- PIONEER CORPORATION

- SAMSUNG ELECTRONICS CO

- VISTRON CORPORATION

- Other companies

Recent Developments

- In 2023 Volkswagen acquired a 4.99% stake in XPENG to jointly develop two mid-size EVs for China. The partnership will leverage XPENG’s smart EV tech and aims to launch the models by 2026, accelerating production timelines by 30%.

- In 2024 Stellantis, Announced a €5.6 billion investment in South America, focusing on vehicle developments, particularly enhancing infotainment systems in new models.

- In 2023 LG Electronics, Strengthened its in-car infotainment market position by partnering with Renault for the Mégane E-TECH Electric. The system uses Google Android Automotive, offering over-the-air updates and remote status checks, supporting the trend of software-centric vehicles.

Report Scope

Report Features Description Market Value (2023) US$ 16.0 Bn Forecast Revenue (2032) US$ 30 Bn CAGR (2023-2032) 7.9% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product (Audio Unit, Display Unit, Head-up Display, Navigation Unit and Communication Unit), By Installation Type (OE fitted and Aftermarket), By Application (Passenger Cars and Commercial Vehicles), By Component (Hardware and Software) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Volkswagen AG 2023, Ford Motor Company, ALPS ALPINE CO., LTD, AUDI AG, BMW AG, Continental AG, PANASONIC CORPORATION, PIONEER CORPORATION, SAMSUNG ELECTRONICS CO., VISTRON, CORPORATION, Other companies. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Volkswagen AG

- Harman International

- Ford Motor Company

- ALPS ALPINE CO., LTD

- AUDI AG

- BMW AG

- Continental AG

- PANASONIC CORPORATION

- PIONEER CORPORATION

- SAMSUNG ELECTRONICS CO

- VISTRON CORPORATION

- Other companies