Global Bus Infotainment System Market By Type (Hardware, Software), By Application (Passenger Car, Commercial Vehicle ), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov 2024

- Report ID: 49674

- Number of Pages: 288

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

The Global Bus Infotainment System Market size is expected to be worth around USD 1,113.3 Million by 2033, from USD 483.4 Million in 2023, growing at a CAGR of 8.7% during the forecast period from 2024 to 2033.

A Bus Infotainment System refers to a sophisticated on-board entertainment and information solution designed for passenger buses. These systems provide a mix of audio, video, and interactive content, such as music, movies, live TV, internet access, and GPS-based navigation information.

The Bus Infotainment System Market encompasses the global industry focused on the development, production, and deployment of infotainment technologies specifically tailored for buses. This market includes hardware components such as screens, speakers, control units, and software platforms that enable content delivery and user interaction.

It serves multiple sectors including public transportation, charter services, and luxury coach segments. As urbanization and the demand for connected mobility solutions grow, the market plays a crucial role in elevating the standards of passenger travel.

Several factors drive the growth of the Bus Infotainment System Market. The increasing demand for enhanced passenger comfort and the rising adoption of smart transportation solutions in urban areas are key contributors. Technological advancements such as 5G connectivity and cloud-based content management systems have enabled real-time updates and high-quality media streaming.

Additionally, governments and transport authorities are emphasizing digitalization to improve public transport systems, creating a favorable environment for market expansion.

The demand for bus infotainment systems is growing as passengers increasingly expect a seamless and enjoyable travel experience. Commuters, particularly in long-distance and luxury travel segments, prioritize access to entertainment and information.

Moreover, the integration of infotainment systems in public buses is becoming more common as transportation operators seek to differentiate their services and improve customer satisfaction. This demand is further amplified by the rise of smart city initiatives and the shift towards connected and automated public transport systems.

The Bus Infotainment System Market presents significant opportunities for innovation and growth. Emerging markets in Asia-Pacific, Latin America, and Africa, where public transportation systems are undergoing modernization, offer untapped potential.

Furthermore, the integration of advanced technologies like artificial intelligence (AI) for personalized content recommendations and voice recognition systems can enhance user engagement. Additionally, partnerships between technology providers and transportation operators can lead to customized solutions that cater to specific regional and demographic needs, driving further market expansion.

According to CNBC, Chinese electric vehicle (EV) startup Xpeng’s shares surged 13% following the announcement of a $744 million deal to acquire Didi’s smart electric car development business. This strategic move, coupled with Volkswagen’s planned $700 million investment for a 4.99% stake in Xpeng, underscores the intensifying competition in the EV market.

Despite reporting a second-quarter net loss of 2.8 billion yuan ($384.5 million), Xpeng’s aggressive expansion and strategic partnerships highlight the dynamic nature of the industry. These developments are poised to influence the Bus Infotainment System market, as advancements in EV technology and strategic collaborations drive innovation and growth.

According to Global Times, Volkswagen completed the acquisition of shares amounting to 4.99% of the total issued and outstanding share capital in XPeng, following the announcement of the partnership in July 2023. Another Chinese EV maker, Nio, in December last year signed a pact for an investment of $2.2 billion with Abu Dhabi-based CYVN Holding.

Additionally, Dutch automaker Stellantis NV announced in October 2023 an investment of 1.5 billion euros to acquire approximately 20% of China’s EV start-up Leapmotor, underlining the advantage and competitiveness of China’s EV manufacturing.

Key Takeaways

- The Global Bus Infotainment System Market is projected to expand from USD 483.4 million in 2023 to USD 1,113.3 million by 2033, growing at a compound annual growth rate (CAGR) of 8.7% over the forecast period from 2024 to 2033.

- Hardware devices, capturing over 58% of the market share, remain the dominant force in bus infotainment systems due to ongoing demand for advanced in-bus entertainment and connectivity.

- Software systems, holding a 42% share, are integral to evolving infotainment solutions, bolstered by the demand for interactive and real-time content management.

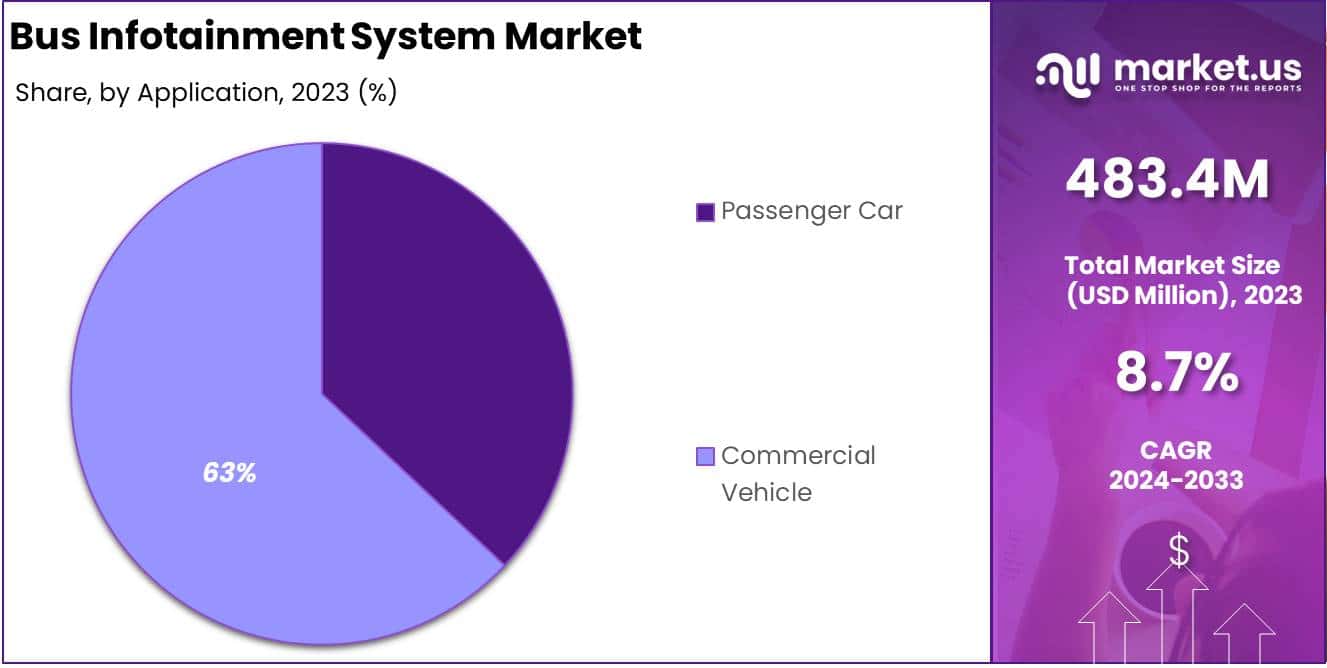

- The commercial vehicle segment leads the application of bus infotainment systems, commanding a 63% market share, reflecting widespread integration in public and charter buses.

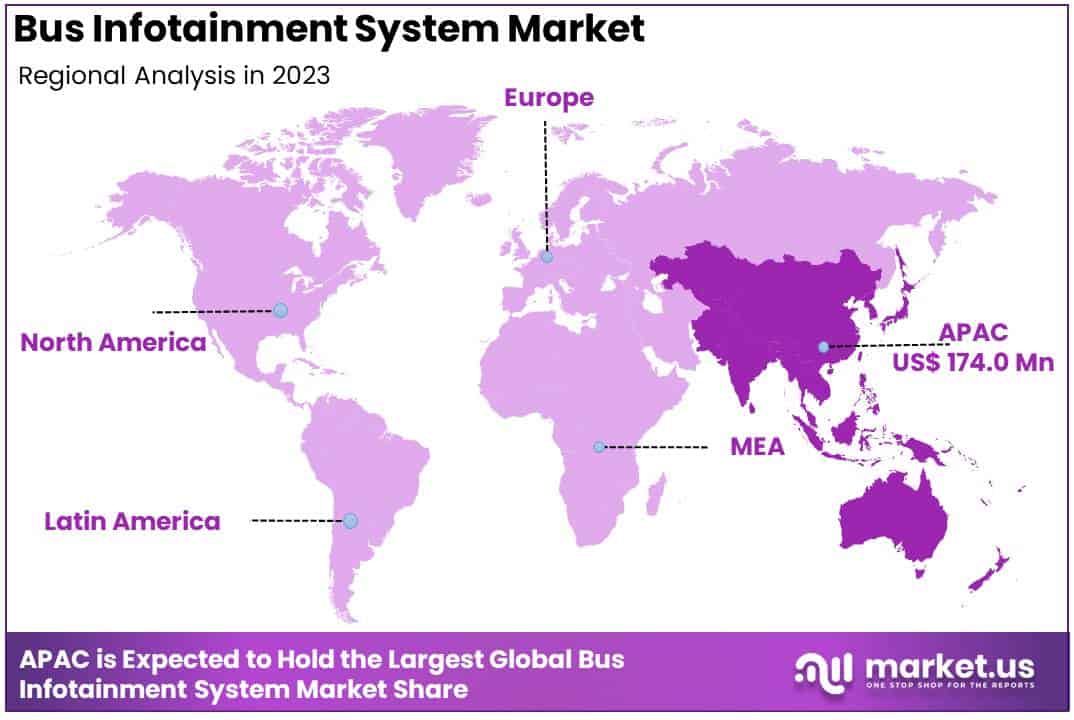

- The Asia-Pacific region holds the largest market share at 36%, demonstrating significant growth driven by urbanization and tech adoption in public transit systems.

By Type Analysis

Hardware Devices Dominate Bus Infotainment System Market with 58% Share

In 2023, hardware devices held a dominant position in the bus infotainment system market, capturing more than 58% of the market share. This segment includes essential components such as displays, audio systems, and connectivity modules that provide passengers with entertainment and information during transit.

The increasing demand for advanced hardware solutions is driven by the need for enhanced passenger experiences and the integration of cutting-edge technologies in modern buses.

In 2023, software systems accounted for 42% of the bus infotainment system market. This segment encompasses applications and platforms that manage content delivery, user interfaces, and system functionalities.

The growth in this area is fueled by the rising demand for customizable and interactive infotainment experiences, as well as the integration of features like real-time updates, navigation assistance, and passenger information systems. As the industry evolves, software systems are expected to play an increasingly vital role in delivering seamless and engaging passenger experiences.

By Application Analysis

Commercial Vehicles Lead Bus Infotainment System Market with 63% Share

In 2023, the commercial vehicle segment dominated the bus infotainment system market, capturing over 63% of the market share. This dominance is attributed to the widespread adoption of infotainment systems in buses, coaches, and other public transport vehicles, aiming to enhance passenger experience and provide real-time information.

The integration of advanced infotainment solutions in commercial vehicles is driven by the need to offer entertainment, navigation assistance, and connectivity features to passengers during transit.

In 2023, passenger cars represented 37% of the bus infotainment system market. While this segment is smaller compared to commercial vehicles, there is a growing trend of incorporating infotainment systems in passenger cars to improve driver and passenger experience.

Features such as multimedia entertainment, navigation, and connectivity are increasingly being integrated into passenger cars, contributing to the segment’s growth. However, the adoption rate remains lower than in commercial vehicles, primarily due to cost considerations and varying consumer preferences.

Key Market Segments

By Type

- Hardware

- Software

By Application

- Passenger Car

- Commercial Vehicle

Driver

Integration of Advanced Connectivity Features

The global bus infotainment system market is experiencing significant growth, primarily driven by the integration of advanced connectivity features. Modern passengers demand seamless access to information and entertainment during transit, mirroring the connectivity they enjoy in other aspects of their lives.

To meet these expectations, bus manufacturers and operators are equipping vehicles with sophisticated infotainment systems that offer real-time updates, internet access, and multimedia content.

These systems enhance the passenger experience by providing services such as live news, weather updates, route information, and entertainment options, thereby increasing customer satisfaction and loyalty.

The adoption of such technologies not only improves the travel experience but also positions public transportation as a competitive alternative to private vehicles, potentially boosting ridership.

Furthermore, the integration of connectivity features facilitates operational efficiencies for bus operators. Real-time data collection and communication enable better fleet management, predictive maintenance, and optimized routing, leading to cost savings and improved service reliability.

The ability to monitor vehicle performance and passenger metrics allows operators to make informed decisions, enhancing overall operational effectiveness.

As urbanization continues and smart city initiatives expand, the demand for connected public transportation solutions is expected to rise, further propelling the growth of the bus infotainment system market.

This trend underscores the importance of technological advancement in meeting evolving passenger expectations and operational requirements, solidifying the role of connectivity as a key driver in the market’s expansion.

Restraint

High Implementation Costs

Despite the clear benefits of advanced bus infotainment systems, high implementation costs pose a significant restraint to market growth. The development, installation, and maintenance of sophisticated infotainment solutions require substantial financial investment. For many bus operators, especially those in emerging markets or smaller enterprises, these costs can be prohibitive.

The expenses associated with hardware procurement, software development, system integration, and ongoing technical support add to the financial burden. Additionally, the need for regular updates and potential system upgrades to keep pace with technological advancements further escalates costs. This financial challenge can deter operators from adopting new systems, thereby limiting the market’s expansion.

Moreover, the return on investment (ROI) for bus infotainment systems may not be immediately apparent, particularly in regions where passenger willingness to pay for enhanced services is low. Operators may struggle to justify the upfront expenditure without clear evidence of increased revenue or ridership.

This financial uncertainty can lead to hesitation in adopting new technologies, slowing the overall growth of the market. To overcome this restraint, stakeholders may need to explore cost-effective solutions, such as scalable systems that allow for incremental upgrades, or partnerships that share the financial burden. Addressing the cost barrier is crucial for broader adoption and sustained growth in the bus infotainment system market.

Opportunity

Expansion in Emerging Markets

Emerging markets present a significant opportunity for the growth of the bus infotainment system industry. Rapid urbanization and increasing investments in public transportation infrastructure in countries across Asia, Africa, and Latin America are creating a fertile ground for the adoption of advanced infotainment solutions. As these regions develop, there is a growing demand for modern, efficient, and comfortable public transit options.

Implementing infotainment systems can enhance the passenger experience, making public transportation more attractive and competitive. This, in turn, can lead to increased ridership and revenue for transit operators. The relatively untapped nature of these markets offers a substantial growth potential for companies willing to invest and adapt their products to meet local needs and preferences.

Additionally, the proliferation of mobile devices and improved internet connectivity in emerging markets support the integration of infotainment systems. Passengers increasingly expect access to information and entertainment on the go, mirroring trends seen in developed nations.

By capitalizing on this opportunity, bus operators can differentiate their services and build brand loyalty. Furthermore, governments in these regions are often supportive of technological advancements that improve public transportation, providing a favorable regulatory environment.

Strategic partnerships with local stakeholders and customization of offerings to align with regional preferences can further enhance market penetration. Overall, the expansion into emerging markets represents a promising avenue for growth in the bus infotainment system sector.

Trends

Integration of Artificial Intelligence and Machine Learning

The integration of artificial intelligence (AI) and machine learning (ML) into bus infotainment systems is an emerging trend that is reshaping the market landscape. AI and ML technologies enable infotainment systems to offer personalized content and services to passengers, enhancing user engagement and satisfaction.

By analyzing passenger preferences and behavior patterns, these systems can curate customized entertainment options, provide tailored information, and even suggest routes or destinations.

This level of personalization not only improves the passenger experience but also opens new avenues for targeted advertising, creating additional revenue streams for operators. The ability to deliver relevant content in real-time aligns with the growing consumer expectation for individualized services, thereby increasing the appeal of public transportation.

Moreover, AI and ML contribute to operational efficiencies by enabling predictive maintenance and optimizing fleet management. By continuously monitoring system performance and analyzing data, these technologies can predict potential failures and schedule maintenance proactively, reducing downtime and maintenance costs. They also assist in optimizing routes based on real-time traffic data, improving punctuality and fuel efficiency.

The adoption of AI and ML in bus infotainment systems reflects a broader trend towards smart transportation solutions, where technology is leveraged to enhance both user experience and operational effectiveness. As these technologies become more accessible and cost-effective, their integration into infotainment systems is expected to accelerate, driving further innovation and growth in the market.

Regional Analysis

Asia-Pacific Leads Bus Infotainment System Market with Largest Market Share of 36%

In 2023, the Asia-Pacific region solidified its position as the leader in the global bus infotainment system market, capturing a substantial 36% share and generating revenues of USD 174.0 million. This dominance is driven by rapid urbanization, expanding public transportation networks, and a growing middle-class population in countries such as China, India, and Japan.

The increasing demand for enhanced passenger experiences and technological advancements in infotainment systems further bolster this growth.

North America follows, accounting for approximately 28% of the market share. The region’s growth is propelled by high consumer expectations for advanced in-vehicle entertainment and information systems, coupled with stringent safety regulations that encourage the adoption of integrated infotainment solutions.

The presence of major automotive manufacturers and technology companies also contributes to the market’s expansion in this region.

Europe holds a significant portion of the market, with a 22% share. The region benefits from a strong automotive industry, increased investments in smart transportation, and a focus on enhancing passenger comfort and safety. Countries like Germany, France, and the United Kingdom are at the forefront of integrating advanced infotainment systems into public transportation.

Latin America and the Middle East & Africa, though currently representing smaller market shares of 8% and 6% respectively, are emerging as potential growth areas. Improving economic conditions, urbanization, and infrastructure development initiatives in countries such as Brazil, South Africa, and the UAE are driving the gradual integration of infotainment solutions into public transportation systems.

As these regions continue to invest in upgrading their transportation infrastructure, the adoption of bus infotainment systems is expected to rise, enhancing the overall commuter experience.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- United Arab Emirates

Key Players Analysis

The global bus infotainment system market in 2024 is shaped by a mix of established players and emerging innovators, each bringing unique strengths to the landscape.

Key players such as ACTIA Group and Robert Bosch GmbH leverage their extensive experience in automotive electronics to provide robust and reliable infotainment systems, which are crucial for seamless passenger engagement and connectivity.

ACTIA Group’s emphasis on innovation in connected solutions aligns well with the growing demand for integrated infotainment in the public transportation sector.

Axinom GmbH and Azimut Emotion Bus Solutions are known for their sophisticated media and connectivity solutions, catering to the increasing consumer expectation for high-quality, personalized content. These companies are likely to benefit from the rising trend of digitalization within public transportation, especially with Axinom’s focus on digital platform architecture and Azimut’s expertise in passenger information systems.

Continental AG and ZF Friedrichshafen AG, two major players in the automotive sector, are expected to further diversify the market with advanced infotainment solutions powered by AI and IoT technologies.

These companies are well-positioned to cater to the demand for integrated vehicle-to-everything (V2X) communication, enhancing safety and operational efficiency in public transit.

Luminator Technology Group and Micro Star International Co. Ltd. provide specialized solutions that align well with emerging smart city initiatives, where advanced infotainment systems play a vital role in the seamless movement of people.

Furthermore, the growing involvement of companies like Integrabus and other niche players in this sector underscores a competitive and innovation-driven market.

Together, these players are expected to advance the market with technology-focused, customer-centric solutions that reflect evolving consumer expectations for connected, efficient, and enjoyable bus transit experiences.

Top Key Players in the Market

- ACTIA Group

- Axinom GmbH

- Azimut Emotion Bus Solutions.

- Continental AG

- Integrabus

- LUMINATOR

- Micro Star Intl Co Ltd.

- Robert Bosch GmbH

- ZF Friedrichshafen AG

- ACITA Group

- Luminator Technology Group

- Other Key Players

Recent Developments

- June 26, 2023 – XPENG announced its partnership with ACCESS to integrate the Twine™ for Car (Twine4Car) in-vehicle infotainment system into its EV lineup. Starting with the XPENG P7 sedan, this system will offer apps and streaming services, with European deliveries beginning in summer 2023. Current XPENG owners will also gain access through an over-the-air (OTA) update.

- December 2023 Nio secured a $2.2 billion investment from CYVN Holding, based in Abu Dhabi, boosting its financial position in the competitive EV market. Similarly, Stellantis NV committed €1.5 billion in October 2023 to acquire a 20% stake in Leapmotor, showcasing global confidence in China’s EV innovation.

- July 10, 2024 CAAM reported a 6.1% year-over-year rise in China’s vehicle sales for the first half of 2024, reaching 14.047 million units. Notably, New Energy Vehicles (NEVs) surged 32%, achieving a 35.2% market share.

- February 28, 2024 Karma Automotive acquired the tech assets and IP of Airbiquity, a leading automotive software firm. This move enhances Karma’s tech capabilities, aligning with its ultra-luxury EV strategy.

Report Scope

Report Features Description Market Value (2023) USD 483.4 Million Forecast Revenue (2033) USD 1,113.3 Million CAGR (2024-2033) 8.7% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Hardware, Software), By Application (Passenger Car, Commercial Vehicle) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape ACTIA Group, Axinom GmbH, Azimut Emotion Bus Solutions., Continental AG, Integrabus, LUMINATOR, Micro Star Intl Co Ltd., Robert Bosch GmbH, ZF Friedrichshafen AG, ACITA Group, Luminator Technology Group, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Bus Infotainment System MarketPublished date: Nov 2024add_shopping_cartBuy Now get_appDownload Sample

Bus Infotainment System MarketPublished date: Nov 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- ACTIA Group

- Axinom GmbH

- Azimut Emotion Bus Solutions.

- Continental AG

- Integrabus

- LUMINATOR

- Micro Star Intl Co Ltd.

- Robert Bosch GmbH

- ZF Friedrichshafen AG

- ACITA Group

- Luminator Technology Group

- Other Key Players