Global Smart EV Charger Market Based on connector Type(Supercharger, Combined Charging System (CCS), CHAdeMO), Based on the Distribution Channel(Online Platforms, Offline Stores), Based on End-Users(Commercial, Residential), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: October 2024

- Report ID: 104789

- Number of Pages: 238

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

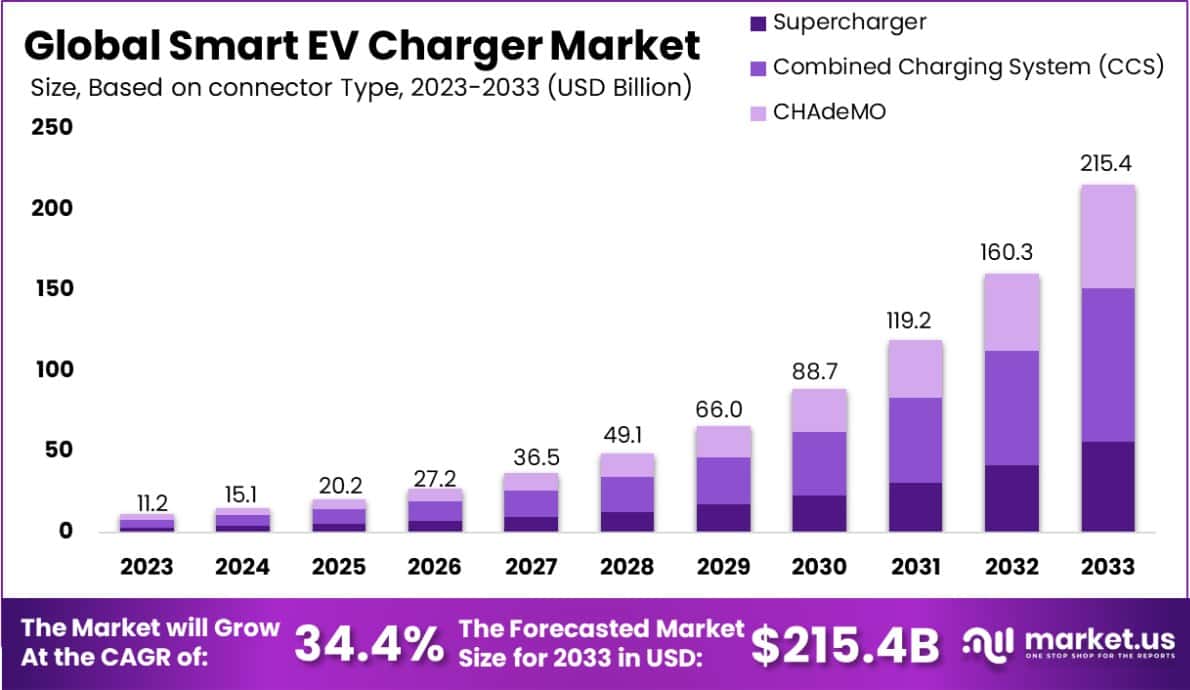

The Global Smart EV Charger Market is expected to be worth around USD 215.4 billion by 2033, up from USD 11.2 billion in 2023, growing at a CAGR of 34.4% during the forecast period from 2024 to 2033.

A Smart EV Charger is an electric vehicle charging device equipped with advanced communication technology that allows it to interact with the charging network, the vehicle, and the power grid.

This charger optimizes energy consumption by scheduling charging during off-peak hours, reducing costs and strain on the grid. It also provides remote monitoring and control capabilities, ensuring efficient energy management.

The Smart EV Charger Market comprises businesses involved in the design, manufacture, and distribution of smart electric vehicle chargers. This market is expanding rapidly due to increasing electric vehicle adoption, the need for efficient energy management systems, and supportive government policies promoting sustainable transportation solutions.

The growth of the Smart EV Charger Market is propelled by the global shift toward electric vehicles (EVs) as countries aim to reduce carbon emissions. Increasing consumer awareness and government incentives for EV adoption further stimulate demand for advanced charging infrastructure, fueling market expansion.

Demand in the Smart EV Charger Market is driven by the rising number of EVs on the road, necessitating extensive and advanced charging infrastructure. Urban areas, in particular, exhibit a high demand for these chargers due to space constraints and the higher prevalence of EVs.

Opportunities in the Smart EV Charger Market are abundant with the integration of renewable energy sources like solar and wind with charging systems. Innovations such as bi-directional charging, which allows vehicles to supply energy back to the grid, are expected to open new avenues for market growth.

The Smart EV Charger Market is poised for substantial growth, catalyzed by a confluence of regulatory support, technological advancements, and strategic investments. This sector is notably benefiting from significant governmental funding aimed at expanding the EV charging infrastructure to support the escalating adoption of electric vehicles.

For instance, Western Michigan University has received a $3.17 million grant, earmarked for electric vehicle research, enhancing the technological foundations of EV charging solutions.

Moreover, the U.S. Department of Transportation’s recent allocation of $521 million underscores a robust commitment to deploying over 9,200 electric vehicle charging ports across various regions, including tribal areas and the District of Columbia.

This initiative is split into $321 million to bolster EV infrastructure within communities and $200 million dedicated to fast-charging projects along designated Alternative Fuel Corridors.

Further energizing the market, Rhode Island has been infused with $15 million in federal funding to increase the availability of public EV charging stations, thereby improving the charging convenience for EV drivers.

The private sector is also witnessing dynamic momentum, as exemplified by Voltera’s procurement of $100 million in debt funding for expanding its EV charging solutions, a strategic move facilitated by ING Capital and Investec.

Additionally, the Department of Energy (DOE) has launched the Connected Communities 2.0 program, with a funding opportunity of up to $65 million, aimed at integrating grid-edge technology innovations.

These developments are not merely financial injections but are strategic accelerants that are expected to drive the Smart EV Charger Market towards more innovative solutions, enhanced grid reliability, and broader adoption, reflecting a market ripe with opportunities for stakeholders and investors keen on the intersection of technology and sustainable infrastructure.

Key Takeaways

- The Global Smart EV Charger Market is expected to be worth around USD 215.4 billion by 2033, up from USD 11.2 billion in 2023, growing at a CAGR of 34.4% during the forecast period from 2024 to 2033.

- In 2023, Combined Charging System (CCS) held a dominant market position in Based on connector Type segment of Smart EV Charger Market, with a 44.2% share.

- In 2023, Offline Stores held a dominant market position in Based on the Distribution Channel segment of Smart EV Charger Market, with a 73.2% share.

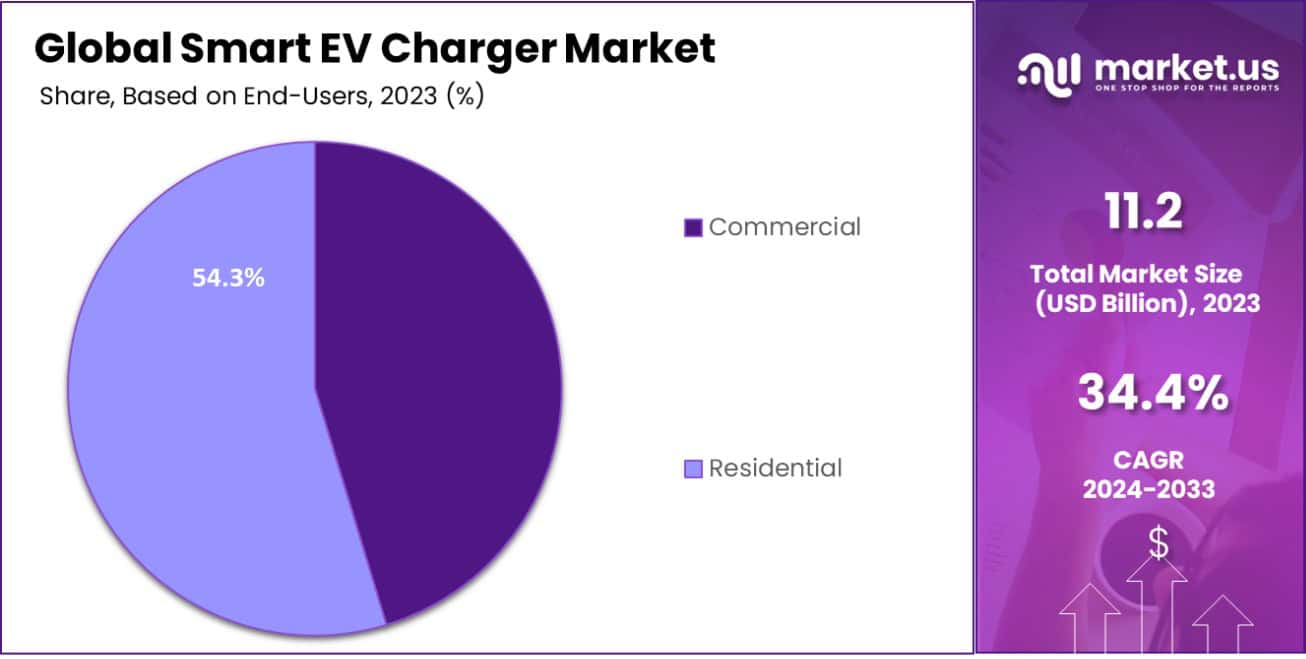

- In 2023, Residential held a dominant market position in Based on End-Users segment of Smart EV Charger Market, with a 54.3% share.

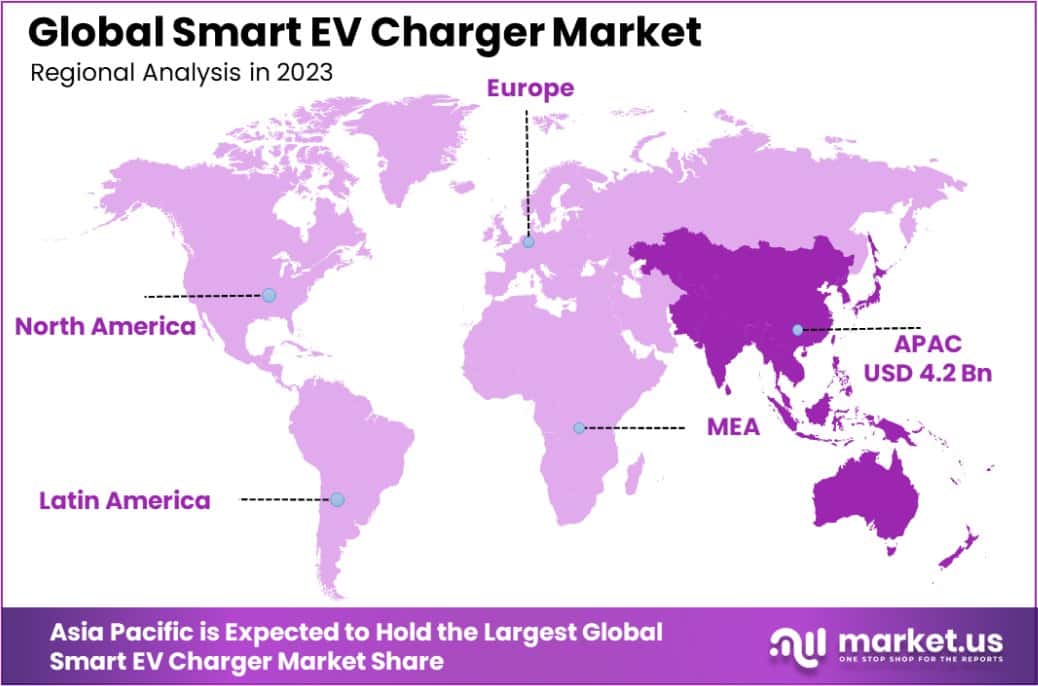

- Asia Pacific dominating a 37.5% market share in 2023 and holding USD 4.2 Billion revenue of the Smart EV Charger Market.

Based on Connector Type Analysis

In 2023, the Smart EV Charger Market witnessed notable segmentation based on connector types, where the Combined Charging System (CCS) held a dominant position with a 44.2% market share. This prominence is attributed to CCS’s widespread adoption in both Europe and North America due to its compatibility with a majority of new electric vehicles.

CCS’s design, which supports both AC and DC charging, offers a versatile solution for rapid charging needs, making it highly preferred by automotive manufacturers and infrastructure providers.

Following CCS, the Tesla Supercharger network, specifically designed for Tesla vehicles, also captured a significant portion of the market. These Superchargers are known for their high-speed charging capabilities, which significantly reduce downtime for EV drivers.

Meanwhile, the CHAdeMO connector, prevalent in Japanese manufactured vehicles, continues to maintain a stable market presence, though it has seen a gradual decline in market share due to the rising popularity of CCS in global markets.

These connectors are crucial in the ecosystem of the Smart EV Charger Market, influencing manufacturer strategies and consumer preferences. The growing investment in infrastructure development, as evidenced by substantial governmental and private funding, is set to further enhance the deployment and functionality of these charging systems, thereby supporting the broader transition towards electric mobility.

Based on the Distribution Channel Analysis

In 2023, Offline Stores held a dominant market position in the Distribution Channel segment of the Smart EV Charger Market, with a 73.2% share. This substantial market share underscores the continuing preference for purchasing smart EV chargers through traditional retail channels, where consumers can benefit from direct interaction and immediate product support.

Offline stores offer the advantage of hands-on demonstrations and personalized advice, factors crucial for consumers dealing with the complexities of smart charging technology.

Conversely, Online Platforms are steadily gaining traction, capturing a significant portion of the market as consumers increasingly seek convenience and competitive pricing. The online segment benefits from broader reach and the ability to quickly update product offerings in response to technological advancements.

However, it holds a smaller share compared to offline outlets, primarily due to consumer preference for physical verification and the technical nature of smart EV chargers, which often necessitates professional installation guidance that is more effectively communicated in person.

As the market evolves, the blend of online and offline sales channels is expected to become more integrated, with digital platforms potentially increasing their share by offering enhanced interactive experiences and virtual consultations to mimic the in-store buying experience.

Based on End-Users Analysis

In 2023, Residential held a dominant market position in the End-Users segment of the Smart EV Charger Market, with a 54.3% share. This significant presence is largely driven by the growing number of electric vehicle owners who prefer the convenience and cost-effectiveness of home charging solutions.

Residential chargers typically offer lower power output suitable for overnight charging, aligning with the daily routines of most EV users. This segment benefits from various government incentives aimed at reducing the installation costs of home chargers, further encouraging their adoption among individual homeowners.

On the other hand, the Commercial segment, which includes chargers installed in public spaces, workplaces, and commercial establishments, accounted for a substantial portion of the market. Although smaller in share compared to the residential segment, commercial chargers are essential for supporting EV drivers during travel and are critical to addressing range anxiety.

The expansion of commercial charging infrastructure is supported by increasing investments from businesses and government entities focused on building a more robust EV charging network to facilitate wider EV adoption.

As the market continues to expand, the dynamics between residential and commercial charging solutions will play a crucial role in shaping the infrastructure and accessibility of EV charging across different regions.

Key Market Segments

Based on Connector Type

- Supercharger

- Combined Charging System (CCS)

- CHAdeMO

Based on the Distribution Channel

- Online Platforms

- Offline Stores

Based on End-Users

- Commercial

- Residential

Drivers

Smart EV Charger Market Drivers

The growth of the Smart EV Charger Market is significantly driven by the escalating global adoption of electric vehicles (EVs). As environmental concerns rise and government policies increasingly favor green smart transportation, there’s a substantial push towards electrifying transport systems.

This surge in EV sales creates a robust demand for efficient and accessible charging solutions. Governments worldwide are implementing incentives and subsidies to encourage the installation of smart EV chargers, which enhance energy management and reduce electricity costs by optimizing charging times during off-peak hours.

Moreover, technological advancements in charger connectivity and integration with renewable energy sources further propel the market, making smart chargers more appealing to both private and commercial users. This convergence of policy support, technological progress, and consumer readiness is shaping a dynamic growth trajectory for the Smart EV Charger industry.

Restraint

Challenges Facing Smart EV Charger Market

A major restraint in the Smart EV Charger Market is the high initial cost of smart charging systems. These advanced chargers, equipped with features like connectivity, remote management, and integration with the smart grid, require significant investment in both hardware and installation.

For many potential users, especially in less economically developed regions, these costs pose a substantial barrier to adoption. Additionally, the lack of standardized infrastructure across different regions further complicates the deployment of universal smart charging solutions.

This standardization issue not only affects the compatibility of chargers with various electric vehicle models but also hinders the scalability of charging networks. As a result, these economic and logistical challenges could slow down the market’s growth despite the increasing demand for electric vehicles.

Opportunities

Expanding Opportunities in Smart EV Charger Market

The Smart EV Charger Market is witnessing expanding opportunities, particularly through the integration with renewable energy sources and technological innovations in charger functionality.

As the world moves towards sustainable energy solutions, the ability of smart chargers to connect with solar or wind energy systems presents a significant growth avenue.This integration not only enhances the environmental benefits of electric vehicles but also offers energy independence and cost savings to users.

Furthermore, the development of V2G (vehicle-to-grid) technology, where electric vehicles can return power to the grid, opens new prospects for energy management and grid stability.

These advancements promise not only to improve the efficiency of energy use but also to position smart chargers as a pivotal component in the broader smart grid ecosystem.

Challenges

Navigating Challenges in Smart EV Charger Market

A significant challenge facing the Smart EV Charger Market is the infrastructure gap in many regions. While urban areas are rapidly adapting to the needs of electric vehicles, rural and underserved areas lag behind due to the cost and complexity of installing advanced charging networks.

This uneven distribution creates accessibility issues and could deter potential EV buyers concerned about charging availability on longer trips. Additionally, the rapid pace of technology in EVs and chargers necessitates continuous updates and maintenance of charging stations, adding to operational challenges.

Regulatory variability across different jurisdictions also complicates the deployment and standardization of smart charging systems, requiring companies to navigate a complex landscape of local policies and electrical standards. Addressing these challenges is critical for ensuring the widespread adoption and functionality of smart EV chargers.

Growth Factors

Growth Factors Boosting Smart EV Charger Market

The Smart EV Charger Market is experiencing robust growth, driven primarily by the global surge in electric vehicle (EV) adoption. As governments worldwide implement stringent environmental regulations and offer incentives for EV purchases, the demand for convenient and efficient charging solutions is rising.

Smart EV chargers, which enable features such as remote monitoring, scheduled charging during off-peak electricity rates, and integration with smart home systems, are becoming increasingly popular. These chargers enhance the user experience by providing faster charging times and better energy management.

Additionally, technological advancements in connectivity and the increasing integration of renewable energy sources with charging infrastructure are making smart chargers more appealing and accessible. This combination of regulatory support, consumer demand, and technological innovation forms a solid foundation for continued market expansion.

Emerging Trends

Emerging Trends in Smart EV Charger Market

Emerging trends in the Smart EV Charger Market are setting the stage for transformative growth. One notable trend is the rise of ultra-fast charging technology, which significantly reduces charging time, making EVs more convenient for users with demanding schedules.

Additionally, there is a growing shift towards the integration of Internet of Things (IoT) capabilities in smart chargers, allowing for enhanced connectivity and smarter energy management. This trend facilitates real-time data exchange between the vehicle, charger, and grid, optimizing energy usage and cost-efficiency.

Bi-directional charging technology is also gaining traction, enabling EVs to function as mobile energy storage units that can supply power back to the grid or the smart home. These innovations are not only improving user convenience and grid efficiency but are also opening new business models and revenue streams in the energy sector.

Regional Analysis

The Smart EV Charger Market is witnessing differentiated growth across various regions, reflecting distinct market dynamics and policy environments. Asia-Pacific stands as the dominating region with a substantial market share of 37.5%, valued at USD 4.2 billion.

This leadership is largely driven by aggressive EV adoption rates in countries like China, Japan, and South Korea, coupled with strong governmental support for EV infrastructure.

In North America, the market is expanding rapidly due to stringent emissions regulations and a growing consumer preference for sustainable transportation options. The region is seeing a surge in investments from both public and private sectors to enhance the EV charging infrastructure.

Europe, with its robust policies supporting green transportation and high consumer awareness, is also a significant player in the global market. The region’s focus on reducing carbon footprints and the presence of major automotive manufacturers are propelling the demand for smart EV chargers.

Conversely, the Middle East & Africa and Latin America are emerging markets with growing potentials. Although currently smaller in scale compared to other regions, increasing urbanization and rising oil prices are gradually fostering a conducive environment for EV adoption and the subsequent need for smart charging solutions in these regions.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In the global Smart EV Charger Market, Tesla, Alfen, and EO Charging emerge as pivotal players, each contributing uniquely to the industry’s dynamics in 2023.

Tesla continues to be a major influencer in the market, not just through its extensive lineup of electric vehicles but also through its proprietary charging technology. The company’s Supercharger network is one of the fastest charging solutions available, designed exclusively for Tesla vehicles.

This exclusivity and widespread network not only enhance Tesla’s brand loyalty but also ensure that Tesla owners have reliable and rapid charging options virtually everywhere major markets are being penetrated.

The strategic placement of Superchargers along major highways and in urban centers significantly reduces range anxiety for Tesla users, bolstering the company’s market position.

Alfen, based in the Netherlands, distinguishes itself with a focus on integrating smart charging solutions that are compatible with multiple vehicle brands. Alfen’s chargers are known for their durability and advanced connectivity features that support grid integration and smart energy management.

The company’s commitment to innovation and sustainability in charger design caters well to the growing European market, which is rapidly advancing towards electrification.

UK-based EO Charging targets a niche segment of the market by offering customizable charging solutions primarily for fleets and businesses. EO Charging’s smart technology allows for scalable deployments, which is crucial for commercial entities looking to electrify their vehicle fleets.

Their focus on providing tailored solutions that can adapt to specific business needs positions EO Charging effectively within a competitive landscape that increasingly values versatility and customization.

Together, these companies underscore the diverse strategies and technological advancements driving the Smart EV Charger Market forward in 2023, each playing a critical role in shaping the industry’s trajectory.

Top Key Players in the Market

- Tesla

- Alfen

- EO Charging

- OVO Energy Ltd

- Bosch Automotive Service Solutions Inc.

- Robert bosch

- Enervalis

- Wallbox

- Siemens

- ABB Ltd

- Pod Point

- Silicon Labs

- Delphi Technologies

- Other Key Players

Recent Developments

- In June 2024, In a significant expansion move, Robert Bosch acquired a smaller competitor to widen its portfolio and market reach in the smart EV charger sector.

- In April 2024, Bosch launched an advanced line of smart EV chargers suitable for both residential and commercial use, featuring enhanced connectivity options and faster charging capabilities.

- In February 2024, OVO Energy introduced a new home smart EV charger that integrates seamlessly with its intelligent energy management platform, enhancing user convenience and energy efficiency.

Report Scope

Report Features Description Market Value (2023) USD 11.2 Billion Forecast Revenue (2033) USD 215.4 Billion CAGR (2024-2033) 34.4% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered Based on connector Type(Supercharger, Combined Charging System (CCS), CHAdeMO), Based on the Distribution Channel(Online Platforms, Offline Stores), Based on End-Users(Commercial, Residential) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Tesla, Alfen, EO Charging, OVO Energy Ltd, Bosch Automotive Service Solutions Inc., Robert bosch, Enervalis, Wallbox, Siemens, ABB Ltd, Pod Point, Silicon Labs, Delphi Technologies, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Smart EV Charger MarketPublished date: October 2024add_shopping_cartBuy Now get_appDownload Sample

Smart EV Charger MarketPublished date: October 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Tesla

- Alfen

- EO Charging

- OVO Energy Ltd

- Bosch Automotive Service Solutions Inc.

- Robert bosch

- Enervalis

- Wallbox

- Siemens

- ABB Ltd

- Pod Point

- Silicon Labs

- Delphi Technologies

- Other Key Players