Global Hybrid Electric Vehicle Market By Propulsion Type (Plug-in Hybrids, Full Hybrids, Mild Hybrids, Others), By Configuration Type (Parallel HEV, Series HEV, Combination HEV), By Vehicle Type (Passenger Cars, Commercial Vehicles, Two-Wheelers, Others), By Power Source (Stored Electricity, On Board Electric Generator), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Jan 2025

- Report ID: 136879

- Number of Pages: 373

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

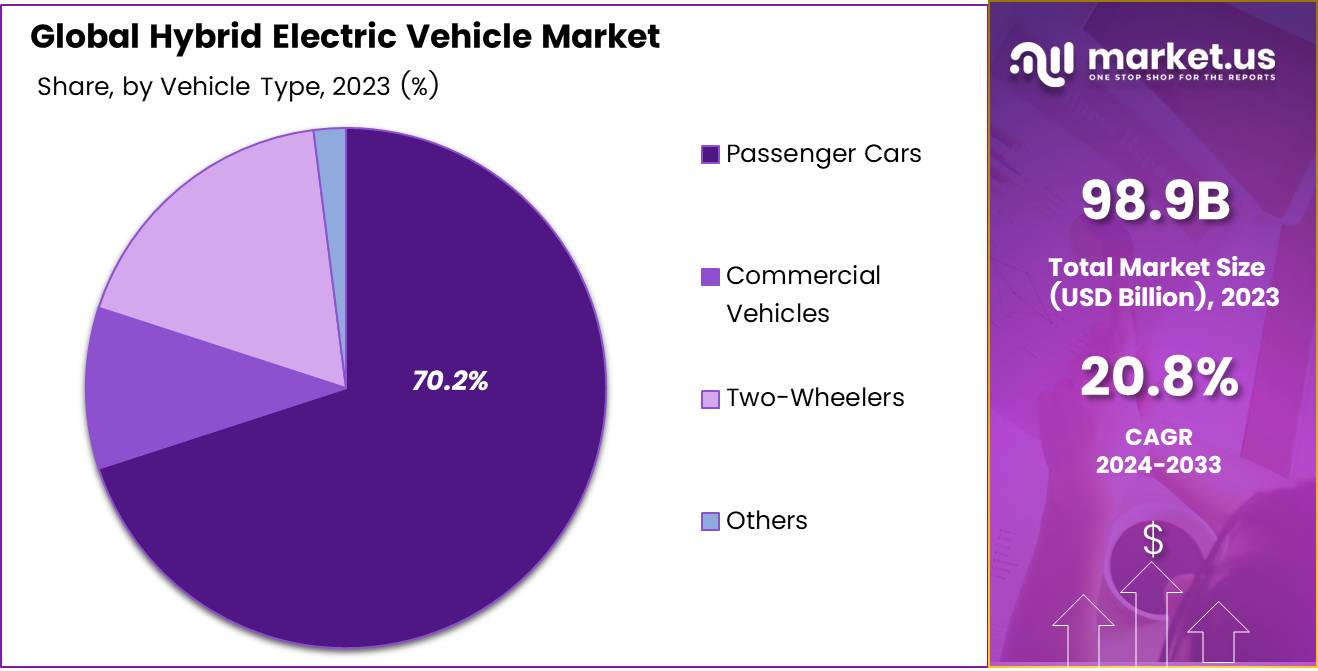

The Global Hybrid Electric Vehicle Market size is expected to be worth around USD 654.4 Billion by 2033, from USD 98.9 Billion in 2023, growing at a CAGR of 20.8% during the forecast period from 2024 to 2033.

Hybrid Electric Vehicles (HEVs) integrate an internal combustion engine with one or more electric motors, utilizing both gasoline and electricity as power sources. This dual system allows HEVs to consume less fuel and emit fewer greenhouse gases compared to conventional vehicles.

The technology behind HEVs includes regenerative braking, electric motor drive/assist, and automatic start/shutoff, making them highly efficient in urban traffic environments where frequent stops are common.

The Hybrid Electric Vehicle Market encompasses the production, distribution, and sale of HEVs. As consumer awareness of environmental issues grows and oil prices fluctuate, the demand for fuel-efficient, lower-emission vehicles has surged, positioning HEVs as a compelling intermediary technology before the complete transition to fully electric vehicles

The growth of the Hybrid Electric Vehicle market can be attributed to several factors, including increasing regulatory pressures to reduce carbon emissions, technological advancements, and evolving consumer preferences.

According to Study, about 4.2 million new plug-in hybrid electric vehicles were sold worldwide in 2023, highlighting the rising demand. Furthermore, it is projected that global production of hybrid electric vehicles will grow to around 5.4 million units by 2025. This growth signifies a robust expansion phase for the industry, fueled by both consumer interest and technological innovation.

Governments worldwide are playing a pivotal role in accelerating the adoption of HEVs through investments and stringent regulations aimed at decreasing vehicular emissions. Policies such as tax incentives for buyers and subsidies for manufacturers are lowering the entry barriers and costs associated with HEVs.

According to Energy, sales of hybrid electric vehicles increased by 53% compared to 2022, underscoring a swift market expansion driven by heightened consumer demand and supportive government policies.

Moreover, with the availability of electric vehicle models rising, as noted by Virta, the market saw a total of 590 electric car models available to consumers in 2023, a 15% increase from the previous year. This diversification in model availability is expected to further boost consumer interest and sales, with predictions suggesting that up to 1,000 models will be available by 2028.

These statistics not only demonstrate current growth but also forecast a continued upward trajectory in the HEV sector, presenting lucrative opportunities for stakeholders across the automotive industry.

Key Takeaways

- The global Hybrid Electric Vehicle (HEV) market is projected to grow from USD 98.9 billion in 2023 to USD 654.4 billion by 2033, at a CAGR of 20.8%.

- Plug-in Hybrids held a 30.5% market share in 2023 due to their balance of range and emissions, appealing to consumer preferences.

- Parallel HEV dominated the configuration segment in 2023 for its dual capability of driving the vehicle and charging the battery, enhancing fuel efficiency and reducing emissions.

- Passenger cars captured an 85.9% share of the HEV market in 2023, showing high consumer preference over other vehicle types.

- Stored Electricity was the leading power source in 2023, commanding a 70.5% market share.

- The Asia Pacific region led the HEV market in 2023, with a 41.5% share, driven by strong adoption in China and Japan and favorable policies.

Propulsion Analysis

Plug-in Hybrids Take the Lead with 30.5% Market Share Due to Their Balance of Electric Range and Fuel Backup

In 2023, Plug-in Hybrids held a dominant market position in the By Propulsion Analysis segment of the Hybrid Electric Vehicle Market, with a 30.5% share. This propulsion category outperformed others due to its superior balance between range and emissions, meeting consumer preferences for extended electric-only drive capabilities coupled with the reassurance of a gasoline backup.

Full Hybrids followed, integrating both gasoline and electric motors to optimize fuel efficiency, though they did not require external charging. Their market penetration, while substantial, remained lower than that of Plug-in Hybrids, reflecting consumer trends towards vehicles that offer greater electric range.

Mild Hybrids presented an economical alternative, utilizing a smaller battery system to aid the internal combustion engine rather than powering the vehicle solely. This segment attracted cost-conscious consumers looking to reduce fuel consumption without the higher upfront costs associated with more robust hybrid systems.

The Others category, encompassing alternative hybrid technologies, captured a smaller segment of the market. This group includes systems that do not fit neatly into the conventional categories of hybrid vehicles, often incorporating innovative technologies that are still gaining traction in mainstream markets.

Overall, the propulsion technology landscape within the Hybrid Electric Vehicle Market is shaped significantly by consumer demand for efficiency and lower emissions, with Plug-in Hybrids leading the charge in 2023.3

Configuration Type Analysis

Parallel HEVs Lead the Charge in Hybrid Market Innovations

In 2023, Parallel HEV held a dominant market position in the By Configuration Type Analysis segment of the Hybrid Electric Vehicle Market.

This configuration type has consistently garnered significant market share due to its efficient design, which allows the engine to directly drive the vehicle while simultaneously charging the battery. This dual capability not only enhances fuel efficiency but also reduces emissions, factors which are critical in consumers’ growing preference for environmentally friendly vehicles.

Conversely, the Series HEV configuration, wherein the engine solely generates electrical power for the motor, has seen moderate adoption. The primary advantage here is the potential for optimizing engine operations and energy usage, which is particularly advantageous in urban settings with frequent stops and starts.

The Combination HEV, which integrates features of both parallel and series configurations, offers versatility through its adaptable energy management system. However, its market penetration is less extensive compared to Parallel HEVs, primarily due to higher complexities and costs associated with its sophisticated design.

Overall, the market dynamics within the Hybrid Electric Vehicle sector are significantly influenced by technological advancements and consumer demand for efficiency and lower environmental impact. The continued dominance of Parallel HEVs can be attributed to their balance of performance, cost, and environmental benefits.

Vehicle Type Analysis

Dominant Position of Passenger Cars in the Hybrid Electric Vehicle Market

In 2023, Passenger Cars held a dominant market position in the By Vehicle Type Analysis segment of the Hybrid Electric Vehicle Market, with an 85.9% share. This substantial market share underscores the significant preference for passenger hybrid vehicles over other types, such as commercial vehicles, two-wheelers, and other categories.

The preference can be attributed to increasing consumer awareness regarding the environmental benefits of hybrid technology combined with government incentives aimed at reducing carbon emissions. Consequently, the sales of passenger hybrid cars have escalated, reflecting a robust consumer shift towards more sustainable and fuel-efficient transportation options.

Commercial Vehicles accounted for a smaller segment of the market. The adoption rate in this category is tempered by higher initial investment costs and a slower turnaround on return on investment. However, it is anticipated that as technology advances and becomes more cost-effective, the penetration of hybrid technology in commercial vehicles will increase.

The Two-Wheelers and Others categories remain relatively underdeveloped within the hybrid electric vehicle market. These segments face challenges such as limited range and lower consumer demand compared to passenger vehicles. Nonetheless, ongoing technological improvements and potential regulatory incentives could stimulate future growth in these sectors.

Power Source Analysis

Stored Electricity Leads with 70.5% Share in Hybrid Electric Vehicle Market Power Sources

In 2023, Stored Electricity held a dominant market position in the By Power Source Analysis segment of the Hybrid Electric Vehicle Market, commanding a 70.5% share.

This significant market presence can be attributed to advancements in battery technology and consumer preferences for more environmentally friendly vehicles. The widespread adoption of stored electricity as a power source is driven by its efficiency and reliability in providing sustained energy for hybrid vehicles.

Conversely, the On Board Electric Generator segment, although smaller, plays a crucial role in extending the range of hybrid vehicles by generating additional power on demand. This technology remains essential for long-distance travel and situations where electric charging infrastructure is insufficient.

As hybrid technologies evolve, the integration of on board generators with advanced battery systems is anticipated to enhance vehicle performance and appeal.

The synergy between stored electricity and on board generators is pivotal in meeting diverse consumer demands and regulatory standards, positioning the hybrid electric vehicle market for continued growth and innovation.

Key Market Segments

By Propulsion Type

- Plug-in Hybrids

- Full Hybrids

- Mild Hybrids

- Others

By Configuration Type

- Parallel HEV

- Series HEV

- Combination HEV

By Vehicle Type

- Passenger Cars

- Commercial Vehicles

- Two-Wheelers

- Others

By Power Source

- Stored Electricity

- On Board Electric Generator

Drivers

Enhanced Fuel Efficiency Appeals to Cost-Conscious Consumers

The market for hybrid electric vehicles (HEVs) is primarily driven by their superior fuel efficiency, which significantly reduces operating costs for users compared to traditional internal combustion engine vehicles. This attribute is particularly appealing in an era of increasing environmental awareness and rising fuel prices.

Furthermore, the declining costs of lithium-ion batteries contribute to making HEVs more accessible to a broader range of consumers and manufacturers alike. As battery technology advances, the economic feasibility of HEVs continues to improve.

Additionally, the expansion of charging infrastructure, both public and private, alleviates one of the primary concerns potential buyers have about hybrid vehicles: range anxiety. With more charging options available, the practicality of owning an HEV increases, thereby boosting market adoption.

Technological innovations in HEVs, such as enhanced energy management systems, regenerative braking, and the use of lighter materials, also play a crucial role.

These advancements not only improve the overall vehicle performance but also make them more attractive to consumers looking for efficient, high-performance vehicles. Each of these factors collectively propels the hybrid electric vehicle market forward, reflecting a shift towards more sustainable and cost-effective personal transportation solutions.

Restraints

High Initial Costs Can Deter Buyers

In the hybrid electric vehicle (HEV) market, several restraints are impacting growth and consumer adoption. Primarily, the high initial purchase price of HEVs stands as a significant barrier.

These vehicles often command a premium over their conventional counterparts due to the sophisticated technology and costly components required for their dual-powered systems. This initial cost can be prohibitive for budget-conscious consumers, making it difficult for them to justify the investment despite potential long-term savings on fuel.

Additionally, HEVs present a limitation in their electric-only driving range. While they do provide improved fuel efficiency by combining an internal combustion engine with an electric motor, their range on electric power alone does not compare favorably with fully electric vehicles.

This limitation can deter consumers who are interested in longer-range electric driving capabilities, thus posing a challenge to the broader acceptance and penetration of hybrid vehicles in the market. These factors collectively contribute to the restrained growth prospects within the hybrid electric vehicle sector.

Growth Factors

Expanding into Emerging Markets Unlocks Valuable Opportunities for Hybrid Electric Vehicles Due to Increasing Urbanization and Fuel

The hybrid electric vehicle (HEV) market is poised for significant expansion, particularly in emerging economies where urbanization and a rising middle class are intensifying demand for fuel-efficient transportation solutions. These regions present a fertile ground for the adoption of HEVs, thanks to growing environmental awareness and the escalating cost of fossil fuels.

Furthermore, strategic partnerships between automakers and technology companies are pivotal in catalyzing this growth. Such collaborations are enhancing the development of advanced battery technologies and integrated energy management systems, which are crucial for the operational efficiency and appeal of HEVs.

Additionally, the surge in shared mobility platforms offers a lucrative opportunity for HEVs, as these vehicles are ideally suited to the service model due to their lower operational costs and reduced environmental impact.

The progression of plug-in hybrid electric vehicles (PHEVs), which combine electric and gasoline propulsion, further broadens the market’s scope by offering consumers more versatile and economically viable vehicle options.

Collectively, these factors are driving the global expansion of the hybrid electric vehicle market, underscoring its potential as a leader in sustainable automotive solutions.

Emerging Trends

Enhanced Battery Technologies Boost HEV Market Growth

The hybrid electric vehicle (HEV) market is witnessing significant growth, driven by several key trends. Foremost among these is the advancement in battery technology. The development of high-capacity, low-cost batteries with longer lifespans is crucial, enhancing vehicle performance and range.

Concurrently, the integration of autonomous driving features in HEVs is expanding, enhancing safety and consumer convenience by allowing cars to handle some driving tasks.

Furthermore, the automotive industry’s shift towards sustainable manufacturing practices marks a critical trend. Automakers are increasingly using recycled materials and adopting production techniques that lower carbon footprints, reflecting a commitment to environmental sustainability.

Another notable trend is the improvement in energy recovery systems, such as regenerative braking, which now capture more energy during braking, significantly boosting the overall efficiency and appeal of hybrid vehicles. These trends collectively contribute to the robust expansion of the HEV market, indicating a promising future driven by innovation and sustainability.

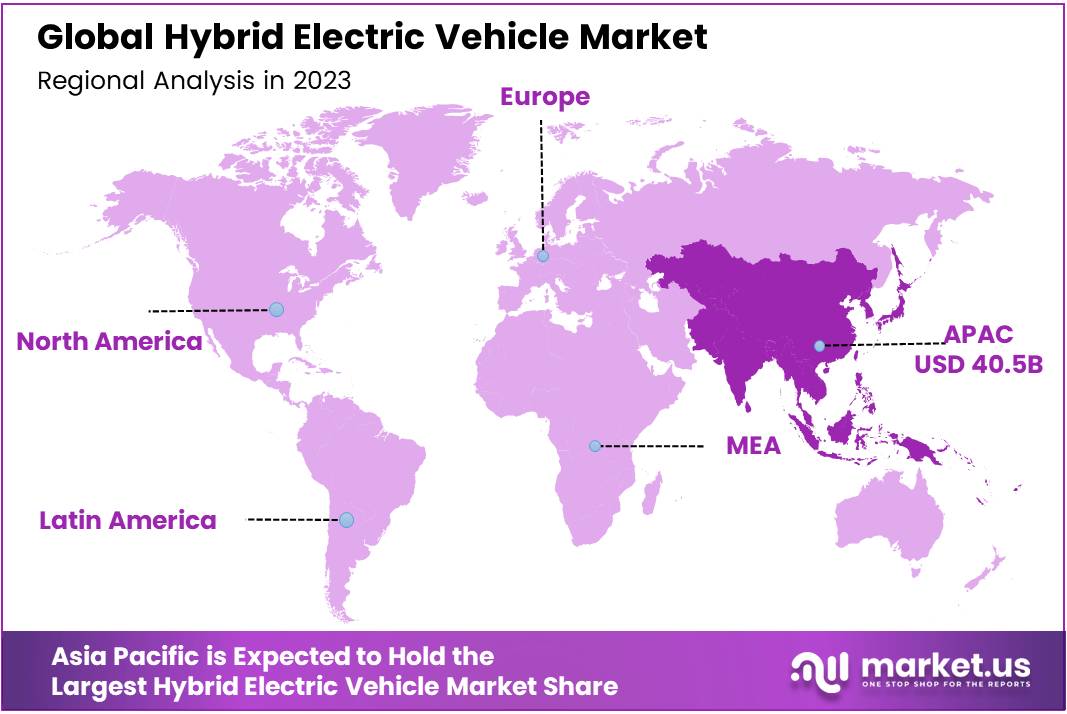

Regional Analysis

Asia Pacific Leads Hybrid Electric Vehicle Market with 41.5% Share, Valued at USD 40.5 Billion

Asia Pacific is the leading region in the HEV market, holding a 41.5% share and valued at USD 40.5 billion. This dominance is driven by high adoption rates in China and Japan, supported by favorable government policies and technological advancements that encourage the uptake of HEVs.

Regional Mentions:

The hybrid electric vehicle (HEV) market displays distinct growth trajectories across various global regions, shaped by economic incentives, regulatory landscapes, and consumer inclinations.

In North America, growth is propelled by stringent environmental regulations and heightened consumer awareness about sustainability. The United States, in particular, shows robust investment in HEV technology and infrastructure enhancements such as increased availability of charging stations.

Europe’s market advancement is influenced by strict carbon emission reduction targets and substantial government incentives, with countries like Germany, France, and the UK at the forefront. The region’s commitment to a substantial reduction in greenhouse gas emissions by 2030 significantly fosters the HEV sector’s development.

Middle East & Africa and Latin America, though smaller in comparison, are experiencing incremental growth. Initiatives towards economic diversification and rising environmental consciousness are gradually promoting HEV adoption in these regions.

Overall, the expansion of the HEV market reflects a global trend towards more sustainable transportation solutions, with Asia Pacific at the forefront due to strong policy support, advanced market maturity, and consumer readiness to embrace new technologies.

Key Regions and Countries covered іn thе rероrt

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In the global Hybrid Electric Vehicle (HEV) market in 2023, several key companies have been pivotal in shaping industry dynamics, prominently influencing development and competitive landscapes.

ZF and BorgWarner have emerged as influential in advancing hybrid transmission systems, which are critical for the efficacy and performance of HEVs. Their focus on innovation in electric drivetrains positions them advantageously as industry leaders in this technology segment.

Delphi and Continental have been significant in the integration of electronics and propulsion technologies, enhancing vehicle efficiency and connectivity. Their efforts in developing sophisticated energy management systems have been critical for optimizing fuel consumption and emissions reductions in hybrid vehicles.

Automotive manufacturers such as Hyundai, Daimler, Volvo, Ford, Toyota, Honda, and Nissan are at the forefront of incorporating these advanced technologies into their vehicle offerings.

These companies have strengthened their market positions through broad and diverse HEV models catering to varying consumer preferences. Particularly, Toyota and Honda continue to be market leaders due to their early investments in hybrid technology and widespread global penetration.

Schaeffler’s contributions to modular hybrid solutions have supported OEMs in customizing vehicles to specific market demands, further enriching the competitive matrix of the industry.

The market’s trajectory is supported by increasing regulatory pressures for lower emissions, rising fuel prices, and growing consumer awareness of environmental impacts. These companies, through their innovations and strategic market approaches, are not only enhancing their competitive edge but are also significantly driving the growth and sustainability of the global HEV market.

Top Key Players in the Market

- ZF

- Delphi

- Hyundai

- Daimler

- BorgWarner

- Continenta

- Continental

- Volvo

- Schaeffler

- Ford

- Toyota

- Honda

- Nissan

Recent Developments

- In September 2024, Jaguar Land Rover (JLR) invested £500 million to establish an electric vehicle (EV) factory in Merseyside, aiming to lead innovations in the automotive industry.

- In March 2024, Stellantis announced a €5.6 billion investment in South America, representing the largest capital infusion into the region’s automotive sector.

- In June 2024, EV Connect was acquired by Schneider Electric, a move designed to accelerate the electric vehicle revolution by enhancing charging infrastructure and technology.

Report Scope

Report Features Description Market Value (2023) USD 98.9 Billion Forecast Revenue (2033) USD 654.4 Billion CAGR (2024-2033) 20.8% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Propulsion Type (Plug-in Hybrids, Full Hybrids, Mild Hybrids, Others), By Configuration Type (Parallel HEV, Series HEV, Combination HEV), By Vehicle Type (Passenger Cars, Commercial Vehicles, Two-Wheelers, Others), By Power Source (Stored Electricity, On Board Electric Generator) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape ZF, Delphi, Hyundai, Daimler, BorgWarner, Continenta, Continental, Volvo, Schaeffler, Ford, Toyota, Honda, Nissan Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Hybrid Electric Vehicle MarketPublished date: Jan 2025add_shopping_cartBuy Now get_appDownload Sample

Hybrid Electric Vehicle MarketPublished date: Jan 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- ZF

- Delphi

- Hyundai

- Daimler

- BorgWarner

- Continenta

- Continental

- Volvo

- Schaeffler

- Ford

- Toyota

- Honda

- Nissan