Global Luxury Electric Vehicles Market By Propulsion Type (Fuel Cell Electric Vehicle, Battery Electric Vehicle, Plug-In Hybrid Electric Vehicle), By Type (Cars, Buses, Vans, Trucks), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov 2024

- Report ID: 133898

- Number of Pages: 377

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

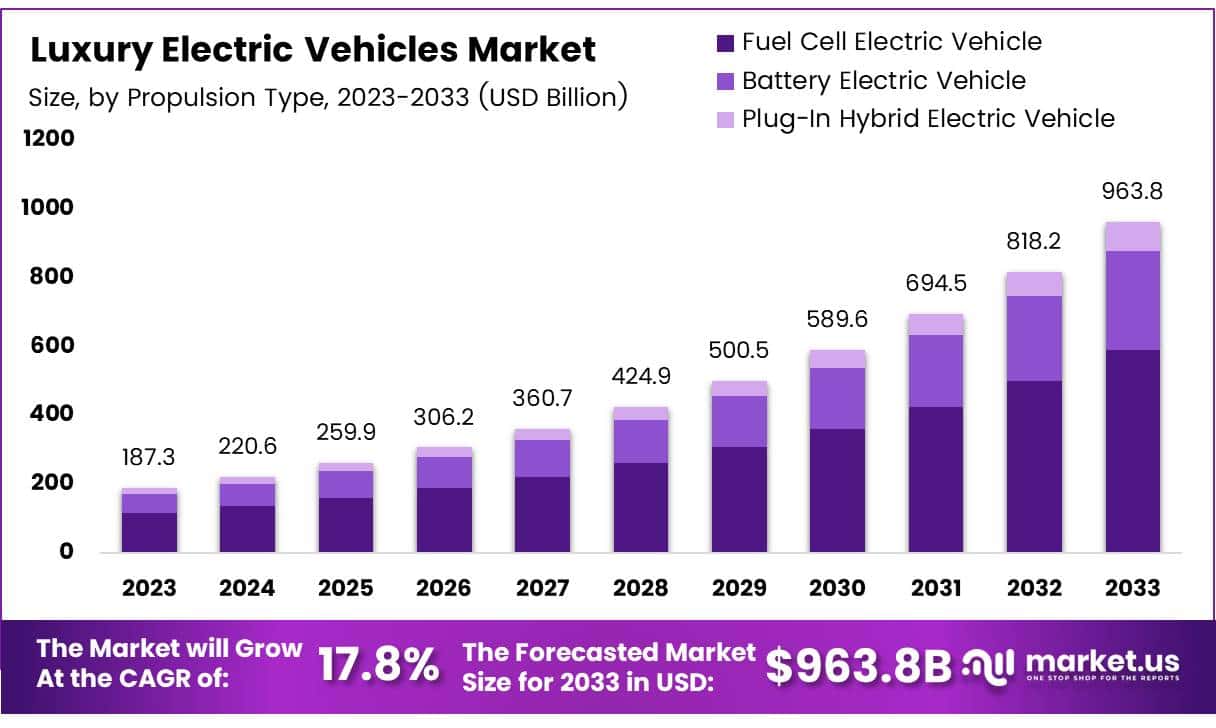

The Global Luxury Electric Vehicles Market size is expected to be worth around USD 963.8 Billion by 2033, from USD 187.3 Billion in 2023, growing at a CAGR of 17.8% during the forecast period from 2024 to 2033.

Luxury Electric Vehicles (EVs) are high-end, premium electric cars that offer cutting-edge technology, superior performance, and a refined driving experience while utilizing electric powertrains. These vehicles cater to consumers seeking not only sustainability and environmental benefits but also the luxury and advanced features associated with traditional luxury car brands.

The Luxury Electric Vehicle market refers to the segment within the broader electric vehicle (EV) industry focused on high-end, premium electric cars. This market encompasses a range of vehicles, including sedans, SUVs, and sports cars, designed with high performance, superior technology, and sustainable mobility in mind.

The market is experiencing rapid growth, driven by rising consumer demand for eco-friendly alternatives to traditional luxury vehicles, combined with the expansion of EV infrastructure and advancements in battery technology.

The luxury electric vehicle market is witnessing significant growth, driven by increasing consumer demand for cleaner, greener alternatives in the high-end automotive segment.

According to the International Energy Agency (IEA), global EV sales surpassed 10 million units in 2022, marking a 60% increase from the previous year. This surge in EV adoption is indicative of a broader trend towards electrification across all vehicle segments, including luxury models. In 2023, EV sales increased by an additional 33%, highlighting the ongoing acceleration of this trend.

The opportunity for luxury electric vehicles extends beyond just consumers. Automakers are increasingly recognizing the importance of a sustainable, electric-powered future, which has resulted in an uptick in investments into R&D, infrastructure, and manufacturing.

Government incentives and regulatory frameworks are pivotal factors in the growth of the luxury electric vehicle market. The adoption of EVs is heavily influenced by favorable policies, tax incentives, and infrastructure development initiatives provided by governments worldwide.

In 2023, the U.S. government under the Inflation Reduction Act increased incentives for EV adoption, offering up to $7,500 tax credits for consumers purchasing electric vehicles, including luxury models. This move is expected to further stimulate consumer interest in EVs, driving up demand in the luxury segment as well.

In Europe, government support for electric vehicles is equally strong. The European Union (EU) has not only imposed stringent emissions standards to push automakers toward electrification but also invested heavily in the development of EV infrastructure. In 2024, the EU announced an additional €1 billion in funding for EV charging infrastructure and research on EV batteries, with the goal to reduce reliance on non-EU battery suppliers.

The global luxury electric vehicle market shows significant regional growth. In 2023, China led with 60% of global EV sales, followed by Europe at 25% and the U.S. at 10%, according to the IEA. In the U.S., EV sales rose to 7.6% of total vehicle sales in 2023, up from 5.9% in 2022 (Coxautoinc). This trend indicates increasing demand for luxury EVs as major automakers expand their electric offerings in key markets.

Key Takeaways

- The global luxury electric vehicle market is projected to reach USD 963.8 billion by 2033, growing at a CAGR of 17.8%.

- Fuel Cell Electric Vehicles (FCEVs) dominated the market in 2023, holding a 65.3% share by propulsion type.

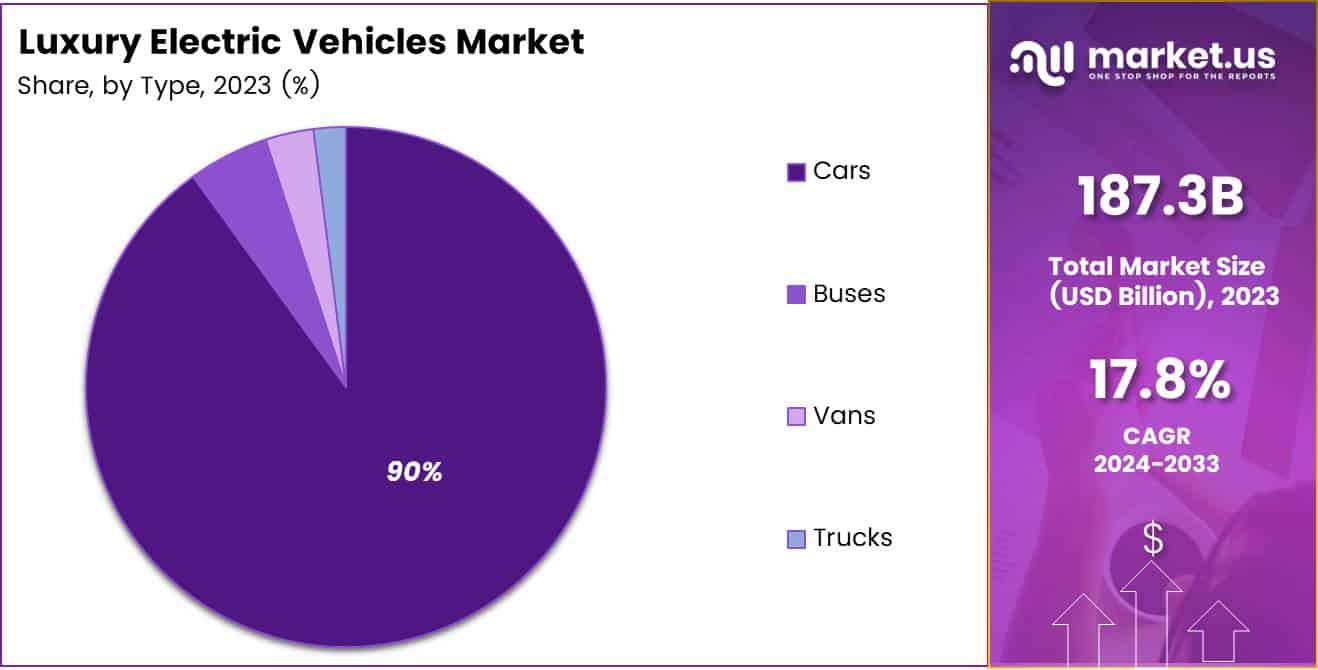

- Cars represented 90.1% of the luxury electric vehicle market in 2023, driven by consumer demand for luxury and sustainability.

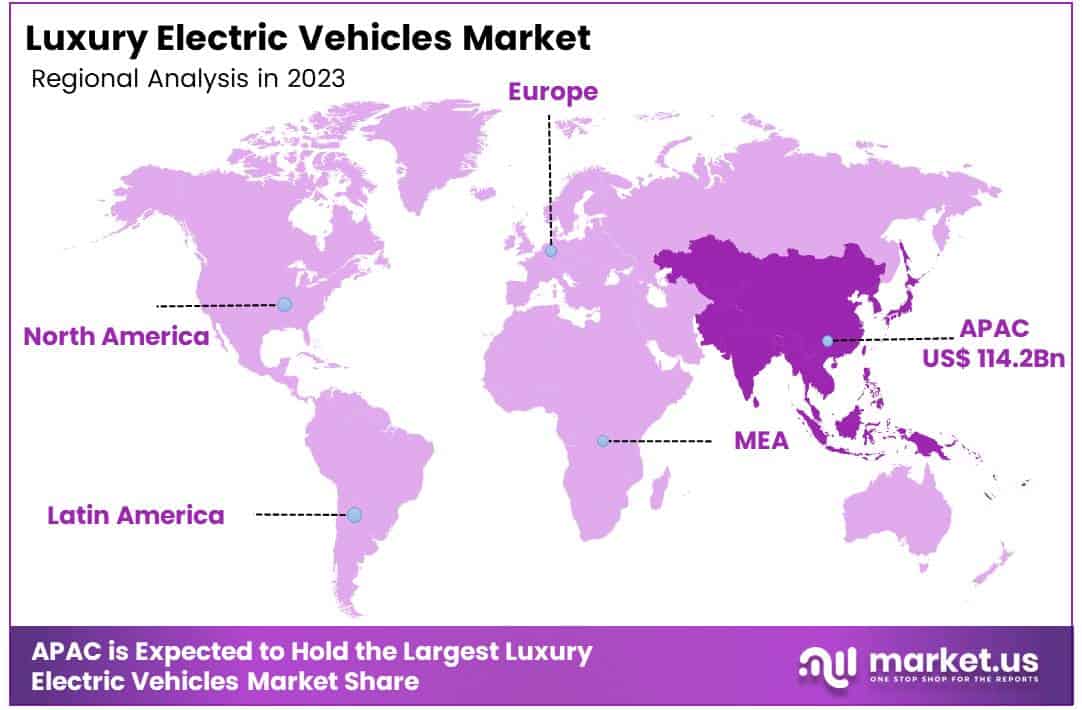

- Asia Pacific leads the global luxury EV market, holding 61% of the market share, valued at approximately USD 114.25 billion.

Propulsion Type

Fuel Cell Electric Vehicles Dominate Luxury EV Market with 65.3% Share in 2023

In 2023, Fuel Cell Electric Vehicles (FCEVs) held a dominant market position in the By Propulsion Type segment of the Luxury Electric Vehicles Market, with a 65.3% share. FCEVs are gaining traction in the luxury segment due to their long-range capabilities, fast refueling times, and minimal environmental impact.

These vehicles, powered by hydrogen fuel cells, offer a unique advantage in terms of quick refueling compared to battery electric vehicles (BEVs), making them particularly appealing to consumers who prioritize convenience alongside sustainability.

Battery Electric Vehicles (BEVs) also hold a significant share in the luxury EV market, driven by advancements in battery technology, expanding charging infrastructure, and growing consumer interest in eco-friendly alternatives. While BEVs are not as dominant as FCEVs in this particular segment, their performance, efficiency, and lower maintenance needs continue to attract luxury vehicle buyers.

Meanwhile, Plug-In Hybrid Electric Vehicles (PHEVs), which combine both electric and traditional combustion engine power, represent a smaller portion of the luxury EV market. Although their share is comparatively low, PHEVs provide an attractive option for consumers who are seeking a balance between electric driving and the flexibility of gasoline-powered range extension.

Type Analysis

Cars Lead the Luxury Electric Vehicle Market with a 90.1% Share in 2023

In 2023, Cars held a dominant market position in the By Type Analysis segment of the Luxury Electric Vehicles Market, with a 90.1% share. This substantial market share can be attributed to the growing consumer preference for personal mobility solutions that offer both luxury and sustainability.

The increasing adoption of electric vehicles (EVs) in the luxury car segment, driven by advancements in battery technology, extended range capabilities, and eco-friendly incentives, has significantly contributed to the category’s growth. Additionally, the proliferation of premium models from renowned automakers has reinforced the segment’s leadership position.

Buses accounted for a modest share of the market, driven by government and institutional initiatives aimed at reducing carbon emissions in urban transport systems. With growing investments in electric public transportation, this segment is expected to expand steadily over the forecast period.

Vans and trucks, while also part of the luxury EV market, currently represent smaller segments. These vehicles cater primarily to niche commercial applications, including logistics and fleet operations, where businesses are gradually transitioning to electric solutions. However, their adoption is relatively slower compared to passenger cars, due to higher initial costs and infrastructure constraints.

Key Market Segments

By Propulsion Type

- Fuel Cell Electric Vehicle

- Battery Electric Vehicle

- Plug-In Hybrid Electric Vehicle

By Type

- Cars

- Buses

- Vans

- Trucks

Drivers

Growing Demand for Eco-Friendly Luxury Vehicles

The luxury electric vehicle (EV) market is experiencing significant growth, driven by several key factors. Increasing environmental concerns, particularly the rising awareness of climate change and the need to reduce carbon emissions, have led more consumers to consider eco-friendly alternatives to traditional combustion engine vehicles.

Furthermore, government policies are actively supporting the transition to electric mobility. Various incentives, such as tax rebates, exemptions from registration fees, and stricter emission regulations, are encouraging both consumers and manufacturers to shift toward electric options. These initiatives are expected to continue to play a critical role in the widespread adoption of luxury EVs.

Additionally, technological advancements are enhancing the appeal of electric luxury cars. Improvements in battery technology, which offer longer driving ranges and shorter charging times, have addressed some of the key limitations traditionally associated with electric vehicles.

As these technologies evolve, luxury EVs are becoming more practical and convenient, thereby attracting a broader base of high-end consumers. These factors—environmental concerns, supportive government policies, and rapid technological progress—are collectively propelling the growth of the luxury electric vehicle market, signaling a promising future for the industry.

Restraints

High Purchase Cost and Charging Infrastructure Challenges

The luxury electric vehicle (EV) market faces several key restraints that could limit its growth potential. One of the primary barriers is the high purchase cost, which is significantly influenced by the expensive battery technology that powers these vehicles.

While the performance and features of luxury EVs are generally superior, their price remains out of reach for a large portion of the consumer base, particularly when compared to traditional internal combustion engine vehicles. This high upfront cost can deter potential buyers, even though long-term savings in fuel and maintenance may make the vehicles more cost-effective over time.

Another challenge is the limited charging infrastructure, especially in regions where fast-charging stations are not widespread or easily accessible. While major cities and developed markets have seen significant advancements in EV charging networks, many rural and remote areas still face limited access to high-speed charging stations.

This lack of infrastructure can create range anxiety among consumers, reducing the attractiveness of luxury EVs for those concerned about long-distance travel or the inconvenience of slow charging.

Until these issues are addressed by reducing vehicle prices through advancements in battery technology and expanding charging infrastructure the growth of the luxury EV market could be constrained, preventing it from reaching its full potential.”

Growth Factors

Growth Opportunities for Luxury Electric Vehicles

The luxury electric vehicle (EV) market is poised for significant growth, driven by several key factors. One of the most promising opportunities lies in the expansion into emerging markets.

As urbanization accelerates and disposable incomes rise in regions like Asia-Pacific, Latin America, and parts of Africa, the demand for high-end electric vehicles is expected to increase. Consumers in these areas are becoming more environmentally conscious while seeking premium, innovative products, making luxury EVs an attractive option.

Additionally, advancements in battery technology are opening new possibilities for the market. Improvements in battery life, energy density, and faster charging capabilities are addressing some of the key limitations of EVs, making them more practical for everyday use and enhancing their appeal to affluent buyers.

Another important opportunity is the potential for partnerships with charging infrastructure providers. By collaborating with companies that build and operate EV charging stations, luxury EV manufacturers can improve convenience for their customers, making EV ownership more seamless and reducing range anxiety.

These partnerships are likely to accelerate the adoption of electric vehicles among high-end consumers, who value both performance and convenience. Collectively, these factors indicate a positive outlook for the luxury EV market, with substantial growth potential in both established and emerging markets.

Emerging Trends

Key Trends Shaping the Luxury Electric Vehicle Market

The luxury electric vehicle (EV) market is currently undergoing a transformation, driven by several key trends. One of the most prominent factors is the increasing popularity of high-performance electric vehicles. These cars offer superior speed, acceleration, and driving experience, rivaling traditional luxury sports cars, which has attracted consumers looking for both performance and sustainability.

In parallel, the trend toward minimalist interior designs is gaining traction, with many luxury EVs featuring sleek, futuristic cabins that prioritize large touchscreen displays, creating a more tech-driven, user-friendly environment. This emphasis on digital interfaces not only enhances the aesthetic appeal of these vehicles but also aligns with consumer demand for connected, intelligent designs.

Additionally, there is a notable shift toward sustainable materials in the construction of luxury EVs. Manufacturers are increasingly integrating eco-friendly materials such as vegan leather, recycled plastics, and sustainable woods into vehicle interiors and exteriors. This move aligns with the growing consumer preference for products that are not only luxurious but also environmentally responsible.

These trends reflect a broader shift in consumer values toward performance, innovation, and sustainability, helping to shape the future of the luxury EV market. With increasing consumer interest in environmentally conscious luxury, these factors are expected to drive significant growth in the segment in the coming years.

Regional Analysis

Asia Pacific Dominating Region in Luxury Electric Vehicles Market with 61% Market Share

The global luxury electric vehicles (EV) market is witnessing significant growth, with notable regional dynamics shaping its trajectory. Asia Pacific is the dominant region, accounting for 61% of the market share, valued at approximately USD 114.25 billion. This dominance can be attributed to the rapid adoption of electric mobility in key markets such as China, Japan, and South Korea.

China, in particular, remains the world’s largest market for EVs, driven by aggressive government policies, incentives, and the increasing penetration of domestic EV manufacturers like BYD and NIO.

Regional Mentions:

In North America, the luxury EV market is expanding rapidly, fueled by high consumer demand and the push for sustainable mobility. The United States is the largest market in the region, with brands like Tesla, Lucid Motors, and Rivian gaining significant traction. This growth is further supported by federal and state-level incentives, a shift towards stricter emission standards, and the rising popularity of electric vehicles as a status symbol among affluent consumers.

Europe also plays a crucial role in the luxury EV market, with strong contributions from major automotive hubs like Germany, the UK, and France. The region benefits from stringent environmental policies, substantial government incentives, and the electrification strategies of legacy automakers such as BMW, Mercedes-Benz, and Audi. These factors have led to an increased adoption of electric luxury vehicles, positioning Europe as a key player in the global market.

The Middle East & Africa and Latin America regions, while still in the early stages of luxury EV adoption, are projected to see gradual growth. As infrastructure improves and government policies begin to support electric mobility, these regions will contribute to the broader market expansion in the coming years. However, their share remains relatively small compared to Asia Pacific, North America, and Europe.

Key Regions and Countries covered іn thе rероrt

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In 2023, the global luxury electric vehicle (EV) market remains highly competitive, with several key players driving innovation, sustainability, and market growth.

Tesla, Inc. continues to lead the market, maintaining its strong brand presence and market share due to its advanced battery technology, extensive supercharging network, and high-performance vehicles. Tesla’s Model S, Model X, and the upcoming Cybertruck are pivotal in maintaining its dominant position in the luxury EV segment.

BYD Auto Co., Ltd. has emerged as a formidable competitor, particularly in the Chinese market. The company’s focus on vertical integration, from battery production to vehicle assembly, has allowed it to achieve cost efficiencies while maintaining high-quality standards. BYD’s luxury EVs, such as the Tang EV and the Yuan Plus, are expanding its presence beyond China into Europe and other global markets.

Volkswagen AG has been aggressively expanding its luxury EV portfolio with the ID. series, including the ID.4 and ID. Buzz. The company is focused on transforming its flagship brands like Audi and Porsche into leaders in the premium EV segment. Audi’s e-tron models and Porsche’s Taycan continue to gain traction in the luxury space, supported by Volkswagen’s robust global production and charging infrastructure.

BMW AG, Hyundai Motor Company, and AB Volvo also continue to strengthen their positions with innovative EV offerings. BMW’s i4 and iX models, Hyundai’s Ioniq 5, and Volvo’s electric XC40 are gaining popularity among affluent consumers seeking high-performance, sustainable vehicles.

Other notable players, including Ford, Toyota, Kia, and Audi, are expanding their luxury EV lines, offering a wide range of options that combine performance, design, and sustainability to meet growing consumer demand. The competition is expected to intensify as these companies ramp up their investments in EV technology and expand their market reach in the coming years.

Top Key Players in the Market

- Tesla, Inc.

- BYD Auto Co., Ltd.

- Volkswagen AG

- BMW AG

- Hyundai Motor Company

- AB Volvo

- Ford Motor Company

- Toyota Motor Corporation

- Kia Corporation

- Audi AG

Recent Developments

- In September 2024, Jaguar Land Rover (JLR) announced a £500 million investment to create an “EV Factory of the Future” in Merseyside, aiming to strengthen its electric vehicle production capabilities.

- In November 2024, Mahindra revealed plans to invest Rs 4,500 crore to support the growth of two new electric vehicle brands, expanding its footprint in the EV market.

- In July 2023, Mercedes-Benz committed $45 billion in a strategic push to dominate the luxury electric vehicle segment, focusing on high-end EV production and innovation.

- In April 2023, Jaguar Land Rover (JLR) disclosed a £15 billion investment plan over the next five years, accelerating its transition to an electric-first, modern luxury automotive future.

Report Scope

Report Features Description Market Value (2023) USD 187.3 Billion Forecast Revenue (2033) USD 963.8 Billion CAGR (2024-2033) 17.8% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Propulsion Type (Fuel Cell Electric Vehicle, Battery Electric Vehicle, Plug-In Hybrid Electric Vehicle), By Type (Cars, Buses, Vans, Trucks) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Tesla, Inc., BYD Auto Co., Ltd., Volkswagen AG, BMW AG, Hyundai Motor Company, AB Volvo, Ford Motor Company, Toyota Motor Corporation, Kia Corporation, Audi AG Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Luxury Electric Vehicles MarketPublished date: Nov 2024add_shopping_cartBuy Now get_appDownload Sample

Luxury Electric Vehicles MarketPublished date: Nov 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Tesla, Inc.

- BYD Auto Co., Ltd.

- Volkswagen AG

- BMW AG

- Hyundai Motor Company

- AB Volvo

- Ford Motor Company

- Toyota Motor Corporation

- Kia Corporation

- Audi AG