Global Connected Vehicles Market By Communication (Vehicle to Vehicle (V2V), Vehicle to Pedestrian(V2P), Vehicle to Device(V2D), Vehicle to Infrastructure(V2I)), By End-User(Aftermarket, Original Equipment Manufacturer), By Connectivity(DSRC, Cellular, Satellite, Wi-Fi), By Vehicle Type(Passenger Cars, Commercial Vehicles), By Propulsion(ICE Vehicle, Electric Vehicle (EV)), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: October 2024

- Report ID: 56944

- Number of Pages: 226

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

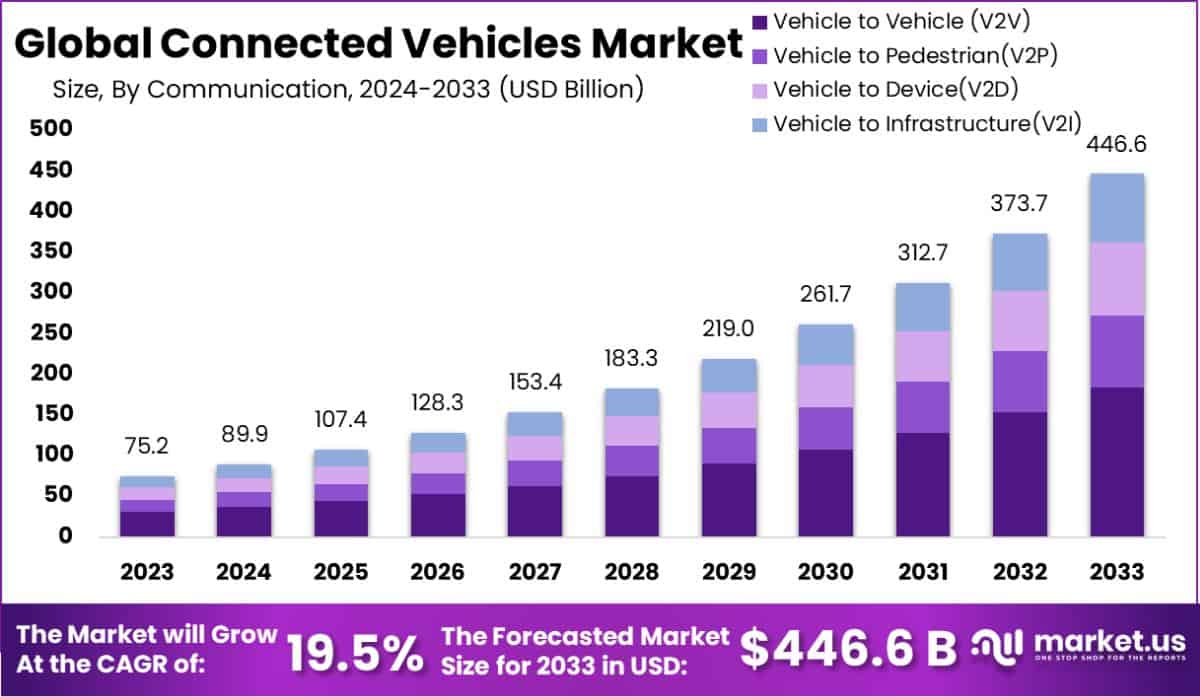

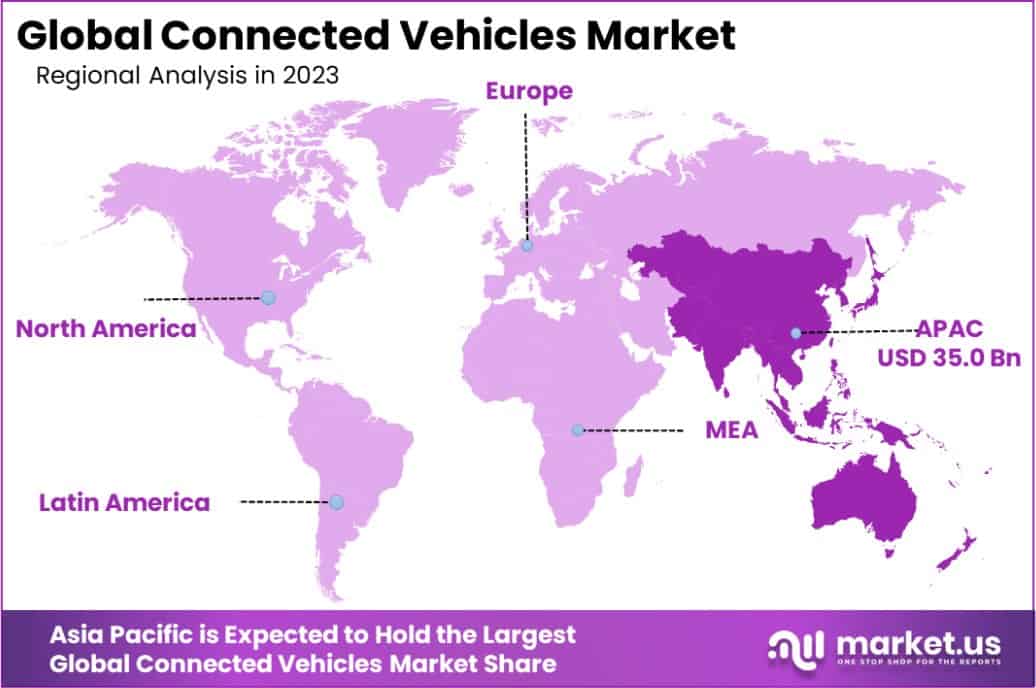

The Global Connected Vehicles Market size is expected to be worth around USD 446.6 Billion by 2033, from USD 75.2 Billion in 2023, growing at a CAGR of 19.5% during the forecast period from 2024 to 2033. Asia Pacific dominated a 46.6% market share in 2023 and held USD 35.0 Billion in revenue from the Connected Vehicles Market.

Connected vehicles are automobiles equipped with internet access and a wireless local area network. This technology allows vehicles to communicate with each other and with roadside infrastructure, enhancing safety and efficiency on the roads by sharing information about driving conditions, traffic, and accidents.

The Connected Vehicles Market encompasses the sale and development of vehicles equipped with connectivity technologies. This market is driven by factors such as increasing demand for real-time traffic and incident alerts, the push for higher fuel efficiency, and the integration of smartphones with vehicles.

The proliferation of IoT in automotive manufacturing is significantly boosting the Connected Vehicles Market. Enhanced safety features and predictive maintenance powered by IoT connectivity are major factors driving this market’s expansion.

Consumer expectations for safety, convenience, and efficient driving experiences are spurring demand for connected vehicles. The integration of advanced telematics and real-time data analytics is critical in meeting these consumer demands.

The advent of 5G technology presents immense opportunities for the Connected Vehicles Market. With faster connectivity and reduced latency, 5G enables more efficient vehicle-to-everything communications, paving the way for advances in autonomous driving technologies and enhanced road safety.

The Connected Vehicles Market is undergoing a transformative shift, bolstered by substantial investments and policy support that underscore its burgeoning significance. In 2023, the U.S. Department of Transportation ignited further industry evolution by allocating $40 million towards Vehicle-to-Everything (V2X) technologies, primarily aimed at fortifying road safety and enhancing mobility.

This strategic infusion of funds highlights a commitment to integrating cutting-edge connectivity technologies that promise to redefine vehicular communication standards and safety protocols on a global scale.

Furthermore, the UK’s Centre for Connected and Autonomous Vehicles has earmarked £18.5 million (approximately $23 million) for early 2024, designated for local enterprises specializing in connected and automated mobility. This initiative not only fosters innovation within the domestic market but also positions the UK as a pivotal player in the global connected vehicles arena, stimulating advancements in technology and operational efficiencies.

Additionally, the sector is set to benefit from an impressive £197 million investment (around $250 million) from private entities including industry giants like Microsoft and Virgin. This funding is targeted towards the development of AI technologies for autonomous vehicles, signaling robust investor confidence and a strategic focus on technological integration that could spur revolutionary changes in autonomous driving solutions.

These combined efforts and financial commitments are not merely enhancing existing capabilities but are also paving the way for new opportunities and advancements in the Connected Vehicles Market. This strategic backing substantially fuels innovation, drives market competition, and underscores the significant potential for growth and transformation in the realm of connected automotive solutions.

Key Takeaways

- The Global Connected Vehicles Market size is expected to be worth around USD 446.6 Billion by 2033, from USD 75.2 Billion in 2023, growing at a CAGR of 19.5% during the forecast period from 2024 to 2033.

- In 2023, Vehicle to Vehicle (V2V) held a dominant market position in the By Communication of Connected Vehicles Market, with a 41.1% share.

- In 2023, Original Equipment Manufacturers held a dominant market position in the end-user segment of the Connected Vehicles Market, with an 81.2% share.

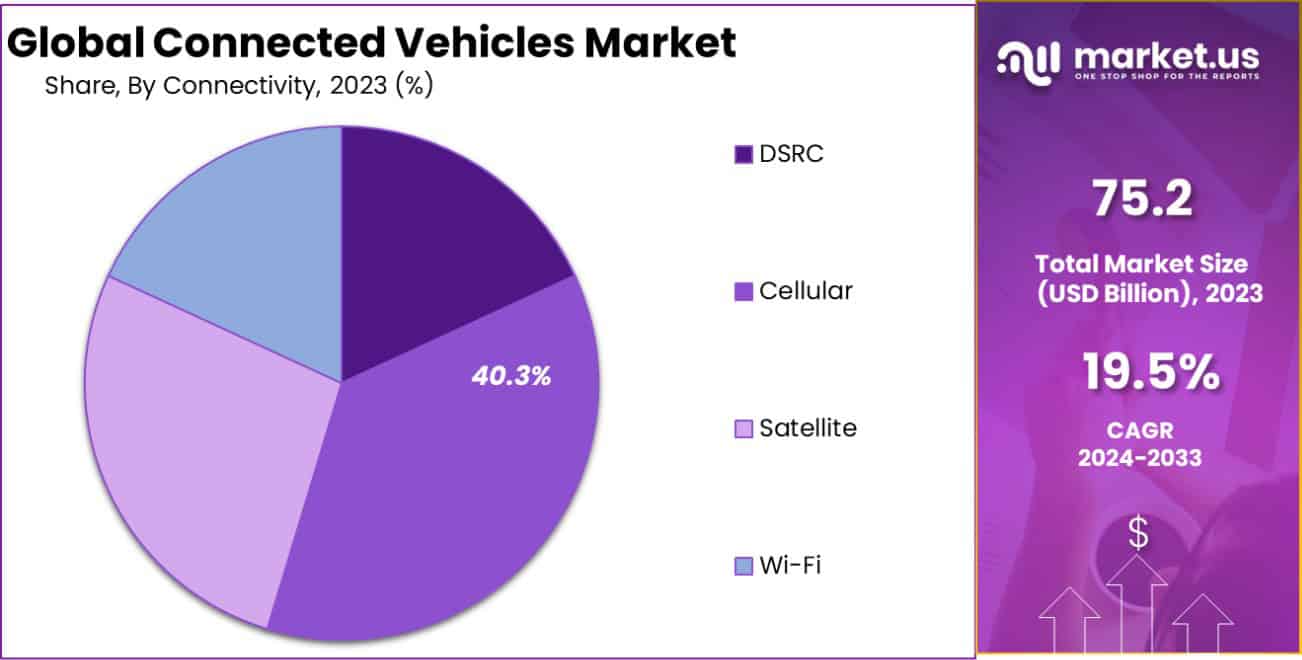

- In 2023, Cellular held a dominant market position in the By Connectivity segment of Connected Vehicles Market, with a 40.3% share.

- In 2023, Passenger Cars held a dominant market position in the Vehicle Type segment of the Connected Vehicles Market, with a 75.2% share.

- In 2023, ICE Vehicle held a dominant market position in the By Propulsion segment of the Connected Vehicles Market, with a 77.2% share.

- Asia Pacific dominated a 46.6% market share in 2023 and held USD 35.0 Billion in revenue from the Connected Vehicles Market.

By Communication Analysis

In 2023, Vehicle to Vehicle (V2V) held a dominant market position in the By Communication segment of the Connected Vehicles Market, with a 41.1% share. This segment leads due to its critical role in enhancing real-time communication between vehicles, which significantly improves road safety and traffic management. V2V technology enables vehicles to broadcast and receive omnidirectional messages, creating a highly responsive and self-organizing traffic system.

Following closely, Vehicle Infrastructure (V2I) communication accounted for a substantial market share, facilitating seamless interactions between vehicles and road infrastructures such as traffic lights and signs, which is vital for optimizing driving decisions and enhancing road safety.

Vehicle-to-Pedestrian (V2P) communications also play a crucial role, especially in urban settings, by improving the safety of pedestrians through advanced alert systems that notify drivers about pedestrian movements. Lastly, Vehicle to Device (V2D) interactions, although holding a smaller share, are pivotal in integrating personal devices with vehicle systems, thereby enhancing the user experience through customized infotainment and vehicle management solutions.

These segments collectively underpin the broader Connected Vehicles Market, each contributing uniquely to the ecosystem’s evolution toward greater connectivity and automation in transportation.

By End-User Analysis

In 2023, the Original Equipment Manufacturer (OEM) segment held a dominant market position in the By End-User segment of the Connected Vehicles Market, with an 81.2% share. This significant dominance is attributed to the increasing integration of advanced connectivity technologies directly by vehicle manufacturers.

OEMs are heavily investing in embedded solutions that offer enhanced security and seamless updates, which are pivotal in driving consumer preference toward factory-installed connected technologies. This trend is further supported by collaborations between automobile manufacturers and technology providers to innovate and refine these integrated systems, ensuring that connectivity features remain a core competitive differentiator in new vehicles.

Conversely, the Aftermarket segment, while smaller in market share, plays a crucial role in enabling older vehicles to benefit from connected technologies. Aftermarket solutions provide an accessible option for vehicle owners to upgrade their existing vehicles with advanced connectivity features, thereby expanding the reach of connected vehicle technologies across various vehicle ages and types.

Despite its smaller size, the aftermarket segment is expected to see growth driven by increasing consumer awareness and the declining cost of connectivity technology.

By Connectivity Analysis

In 2023, Cellular connectivity held a dominant market position in the By Connectivity segment of the Connected Vehicles Market, with a 40.3% share. This leading status is driven by the widespread deployment of 4G LTE networks and the advent of 5G, which offer high-speed, reliable connections that are critical for real-time vehicle communications.

Cellular connectivity supports a range of applications from basic data transmission to complex Vehicle-to-Everything (V2X) communications, positioning it as a cornerstone for future advancements in autonomous driving technologies.

Meanwhile, Dedicated Short Range Communications (DSRC) follows, providing direct communication pathways that are vital for safety-critical communications, particularly in dense urban environments where immediate vehicle response is essential.

Satellite connectivity, though smaller in share, is crucial for ensuring coverage in remote areas where terrestrial network connectivity is limited, thereby enhancing navigation and tracking capabilities. Lastly, Wi-Fi holds a key role, especially in localized settings such as parking lots and urban hotspots, where it supports infotainment downloads and software updates.

Collectively, these connectivity options form an integral part of the Connected Vehicles Market, each serving specific functions that enhance vehicle performance, safety, and user experience.

By Vehicle Type Analysis

In 2023, Passenger Cars held a dominant market position in the by-vehicle type segment of the Connected Vehicles Market, with a 75.2% share. This substantial market share reflects the increasing consumer demand for enhanced safety features, comfort, and connectivity in personal vehicles.

As connectivity becomes a standard expectation rather than a luxury, manufacturers are embedding advanced telematics and infotainment systems that offer real-time traffic updates, autonomous driving capabilities, and smartphone integration. This surge is supported by the proliferation of high-speed mobile networks and the decreasing cost of technology, making connected features more accessible to a broader audience.

On the other hand, Commercial Vehicles also benefit from connected technologies, particularly for fleet management and operational efficiency. Although they hold a smaller portion of the market, connected solutions in commercial vehicles enable real-time tracking, optimized route management, and improved logistics planning. This segment is crucial for enhancing the efficiency of smart transportation and delivery services, contributing to reduced operational costs and improved service delivery in commercial sectors.

Together, these segments underscore the pervasive impact of connectivity across different vehicle types, each adapting to the specific needs of their respective markets and driving forward the overall growth of the Connected Vehicles Market.

By Propulsion Analysis

In 2023, ICE (Internal Combustion Engine) Vehicles held a dominant market position in the By Propulsion segment of the Connected Vehicles Market, with a 77.2% share. Despite the growing shift towards sustainable transportation, ICE vehicles continue to lead due to their extensive infrastructure and consumer familiarity.

This segment’s dominance is reinforced by ongoing innovations in vehicle connectivity and efficiency that enhance the traditional ICE vehicle’s appeal, integrating advanced driver-assistance systems (ADAS) and connected services for safety and entertainment.

Conversely, Electric Vehicles (EVs) are rapidly gaining market share, driven by global efforts to reduce carbon emissions and the increasing availability of charging infrastructure. EVs are inherently more compatible with connected technologies due to their digital-first design, which integrates more seamlessly with advanced technologies for monitoring and managing vehicle performance, energy use, and maintenance. This synergy between electric propulsion and connectivity is expected to accelerate the adoption of EVs in the coming years.

Both segments are crucial to the Connected Vehicles Market. While ICE vehicles currently dominate, the shift towards EVs represents a significant trend that is likely to reshape the landscape of automotive propulsion in alignment with advancements in-vehicle connectivity and environmental regulations.

Key Market Segments

By Communication

- Vehicle to Vehicle (V2V)

- Vehicle to Pedestrian(V2P)

- Vehicle to Device(V2D)

- Vehicle to Infrastructure(V2I)

By End-User

- Aftermarket

- Original Equipment Manufacturer

By Connectivity

- DSRC

- Cellular

- Satellite

- Wi-Fi

By Vehicle Type

- Passenger Cars

- Commercial Vehicles

By Propulsion

- ICE Vehicle

- Electric Vehicle (EV)

Drivers

Key Drivers of Connected Vehicle Growth

The Connected Vehicles Market is primarily driven by the escalating demand for enhanced road safety and more efficient traffic management. As vehicles become more integrated with high-speed internet and advanced connectivity features, they offer significant improvements in safety through real-time communication systems that alert drivers to potential hazards and optimize traffic flow.

This market is also propelled by consumer expectations for greater vehicle functionality, encompassing seamless mobile integration, real-time navigation, and autonomous driving features. Additionally, regulatory support for vehicle safety standards and environmental concerns encourages the adoption of connected technologies that contribute to fuel efficiency and reduced emissions.

These factors collectively fuel the rapid expansion of the Connected Vehicles Market, aligning with advancements in technology and shifts in consumer preferences towards smarter, safer driving experiences.

Restraint

Challenges Limiting Connected Vehicle Adoption

A significant restraint in the Connected Vehicles Market is the concern over cybersecurity and data privacy. As vehicles become more connected, they are increasingly vulnerable to cyber-attacks that can threaten passenger safety and data integrity.

Consumers’ worries about the potential for hacking or unauthorized data access can dampen enthusiasm for connected vehicle technologies. Furthermore, the high cost of implementing advanced connectivity and autonomous technologies can also limit market growth, particularly in developing regions where price sensitivity is higher.

These factors create barriers to widespread adoption, as they require robust security solutions and potentially lower-cost innovations to make connected vehicles more accessible and trustworthy for a broader audience. This restraint is a crucial challenge for industry stakeholders to address to ensure the continued growth of the market.

Opportunities

Expanding Horizons in Connected Vehicles

The Connected Vehicles Market presents substantial opportunities, particularly through the integration of 5G technology and autonomous driving advancements. The rollout of 5G networks promises ultra-fast connectivity and lower latency, enhancing vehicle-to-everything communications.

This can lead to more reliable autonomous driving systems and improved safety protocols, potentially increasing consumer trust and adoption rates. Additionally, the push for smart cities around the world provides a fertile ground for expanding connected vehicle technologies, which are pivotal in improving traffic management and reducing environmental impacts.

There is also a growing trend towards Mobility-as-a-Service (MaaS), where connected vehicles play a key role in offering efficient, personalized transport solutions. These opportunities not only encourage technological innovation but also open new business models and revenue streams in the automotive and transportation sectors.

Challenges

Navigating Challenges in Connected Vehicles

The Connected Vehicles Market faces several challenges that could hinder its growth. One of the main obstacles is the complexity and cost of infrastructure development necessary to support widespread vehicle connectivity.

Building and maintaining an extensive network of connected systems requires significant investment, which can be a deterrent for many regions. Additionally, there are regulatory and standardization issues to contend with. As technology rapidly evolves, creating consistent standards that ensure compatibility and safety across different systems and borders poses a considerable challenge.

There is also the issue of consumer resistance due to concerns over privacy and the reliability of new technologies. Overcoming these challenges will require coordinated efforts between technology developers, automobile manufacturers, and regulatory bodies to develop robust, secure, and user-friendly connected vehicle solutions.

Growth Factors

Driving Growth in Connected Vehicles

The Connected Vehicles Market is driven by several compelling growth factors. The increasing emphasis on vehicle safety and the need for efficient traffic management systems are major drivers, as connected vehicles offer significant improvements in these areas through real-time data communication and advanced navigation systems.

Consumer demand for convenience features such as remote diagnostics, automatic software updates, and enhanced infotainment systems also fuels this market’s expansion. Additionally, governmental regulations pushing for higher safety standards and lower emissions are prompting vehicle manufacturers to invest in connected technologies.

The advent of 5G technology, which facilitates faster and more reliable vehicle-to-everything communications, further accelerates the adoption of connected vehicles. These factors collectively catalyze the growth of the market, promising innovative developments in the automotive sector.

Emerging Trends

Trends Shaping Connected Vehicle Future

Emerging trends in the Connected Vehicles Market are setting the stage for significant transformations in how we think about transportation. Integration of artificial intelligence (AI) is a key trend, as AI enhances vehicle autonomy and enables more personalized user experiences through predictive maintenance and advanced driver assistance systems.

The proliferation of electric vehicles (EVs) is another trend, where connectivity is used to optimize battery management and integrate vehicles into the smart grid. Furthermore, the concept of vehicle-to-grid (V2G) communications is gaining traction, allowing vehicles to not only consume energy but also contribute back to the grid, opening new avenues for energy management.

Additionally, the rise of Mobility-as-a-Service (MaaS) relies heavily on connected technologies to provide seamless travel solutions across different modes of transport. These trends underscore the dynamic evolution of the Connected Vehicles Market, promising enhanced efficiency and user-centric solutions.

Regional Analysis

In the Connected Vehicles Market, regional dynamics play a pivotal role in shaping the landscape. Asia Pacific emerges as the dominating region, holding a substantial 46.6% market share, valued at USD 35.0 billion.

This prominence is driven by significant investments in automotive technology by major economies such as China, Japan, and South Korea, coupled with a high rate of adoption of advanced transportation solutions. The region benefits from strong governmental support for smart city initiatives and a robust smart manufacturing base for electronics and automotive components.

North America also plays a crucial role, with its market characterized by high levels of technological adoption and stringent regulatory standards for vehicle safety and emissions, fostering a conducive environment for growth in connected vehicle technologies.

Europe follows closely, with a focus on innovation and sustainability, particularly in the German and French markets, which are spearheading efforts in automotive connectivity and autonomous driving technologies.

Meanwhile, the Middle East & Africa, and Latin America are experiencing gradual growth. These regions are increasingly recognizing the benefits of connected vehicles in terms of traffic management and environmental impact, though they face challenges such as infrastructure development and regulatory environments that are still evolving. Collectively, these regional markets contribute to a diverse and expanding global Connected Vehicles Market landscape.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In the global Connected Vehicles Market, key players such as Robert Bosch GmbH, Harman International Industries, Inc., and Airbiquity Inc. are pivotal in driving the sector’s innovation and expansion in 2023.

Robert Bosch GmbH stands out with its extensive expertise in automotive parts and smart systems, making it a cornerstone in the connected vehicles landscape. Bosch’s investment in IoT and AI technologies has enabled it to offer sophisticated vehicle connectivity solutions that enhance driver safety and vehicle efficiency.

The company’s continuous innovation in sensor technology and software solutions helps OEMs integrate complex systems that advance autonomous driving capabilities and connected services, ensuring Bosch remains at the forefront of the market’s evolution.

Harman International Industries, Inc., a subsidiary of Samsung Electronics, leverages its strength in infotainment and audio solutions to enrich the in-vehicle experience. Harman’s connected car systems not only provide entertainment but also ensure that drivers receive real-time information and alerts, thereby improving safety and driving experience.

Their commitment to developing advanced connectivity solutions is evident through their collaborations with leading automakers, aiming to transform the car into a sophisticated mobile device.

Airbiquity Inc. specializes in vehicle telematics services, offering robust platforms for wireless vehicle-to-everything communication. Their technology facilitates the efficient transmission of data between vehicles and infrastructure, which is crucial for the functionality of autonomous vehicles.

Airbiquity’s focus on scalable and secure software platforms enables automakers to deploy updates and services seamlessly, enhancing vehicle intelligence and user satisfaction.

These companies, through their distinct capabilities and strategic initiatives, significantly contribute to shaping a dynamic and competitive Connected Vehicles Market, ensuring ongoing advancements and broader adoption of connected vehicle technologies.

Top Key Players in the Market

- Robert Bosch GmbH

- Harman International Industries, Inc.

- Airbiquity Inc.

- DENSO Corporation

- Visteon Corporation

- Continental AG

- Intellias

- Qualcomm Technologies Inc.

- CloudMade

- Ford Motor Company

- Intellias Ltd.

- BMW Group

- Samsung Electronics

- Aptiv PLC

- Veoneer Inc.

- Garrett Motion Inc.

- Magna International Inc.

- AT&T Inc.

- Other Key Players

Recent Developments

- In July 2023, Visteon Corporation launched a state-of-the-art infotainment system that integrates seamlessly with multiple digital services for enhanced user experiences.

- In May 2023, Continental AG secured a significant funding round of $50 million to further develop its autonomous driving technologies and connected vehicle solutions.

- In March 2023, DENSO introduced a new connected vehicle platform aimed at improving safety through advanced diagnostics and real-time data analytics.

Report Scope

Report Features Description Market Value (2023) USD 75.2 Billion Forecast Revenue (2033) USD 446.6 Billion CAGR (2024-2033) 19.5% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Communication (Vehicle to Vehicle (V2V), Vehicle to Pedestrian(V2P), Vehicle to Device(V2D), Vehicle to Infrastructure(V2I)), By End-User(Aftermarket, Original Equipment Manufacturer), By Connectivity(DSRC, Cellular, Satellite, Wi-Fi), By Vehicle Type(Passenger Cars, Commercial Vehicles), By Propulsion(ICE Vehicle, Electric Vehicle (EV)) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Robert Bosch GmbH, Harman International Industries, Inc., Airbiquity Inc., DENSO Corporation, Visteon Corporation, Continental AG, Intellias, Qualcomm Technologies Inc., CloudMade, Ford Motor Company, Intellias Ltd., BMW Group, Samsung Electronics, Aptiv PLC, Veoneer Inc., Garrett Motion Inc., Magna International Inc., AT&T Inc., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Connected Vehicles MarketPublished date: October 2024add_shopping_cartBuy Now get_appDownload Sample

Connected Vehicles MarketPublished date: October 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Robert Bosch GmbH

- Harman International Industries, Inc.

- Airbiquity Inc.

- DENSO Corporation

- Visteon Corporation

- Continental AG

- Intellias

- Qualcomm Technologies Inc.

- CloudMade

- Ford Motor Company

- Intellias Ltd.

- BMW Group

- Samsung Electronics

- Aptiv PLC

- Veoneer Inc.

- Garrett Motion Inc.

- Magna International Inc.

- AT&T Inc.

- Other Key Players