Global Chromatography Software Market Analysis By Software Type (Standalone, Integrated), By Deployment Mode (Cloud-Based, On-Premise), By End-Use Industry (Pharmaceuticals, Food & Beverage, Environmental Testing, Forensic Testing, Other End-Use Industries), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Apr 2024

- Report ID: 53235

- Number of Pages: 245

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

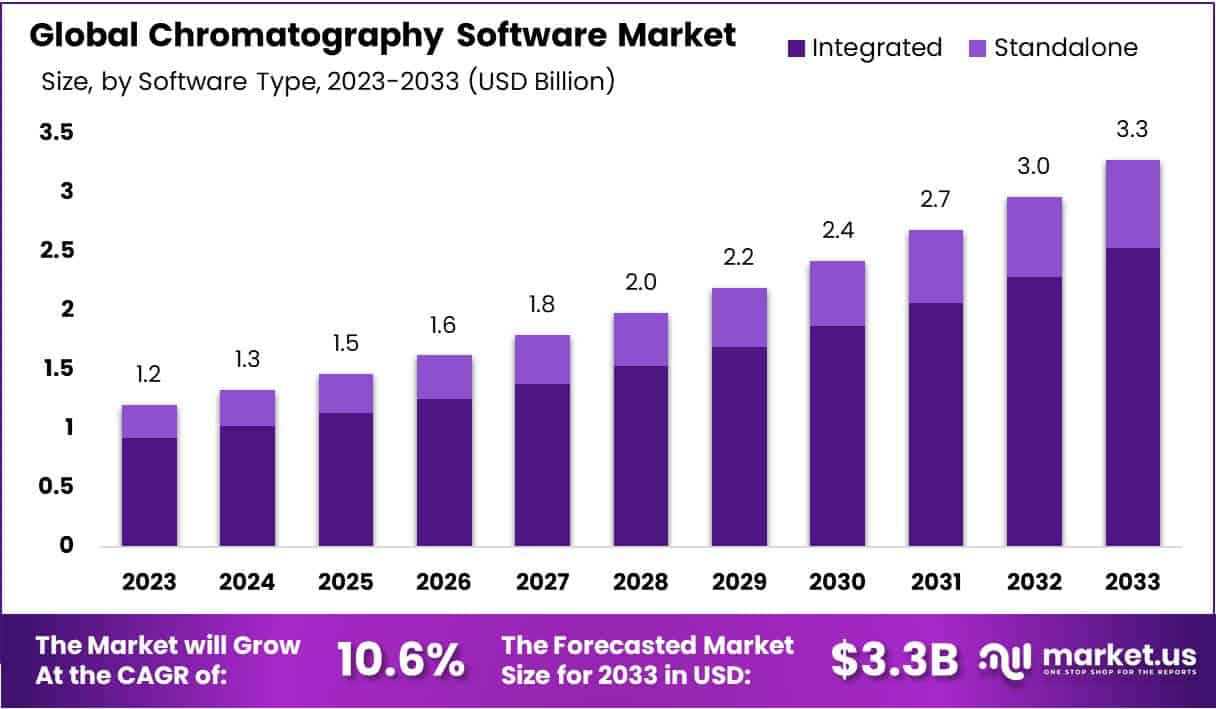

The Global Chromatography Software Market size is expected to be worth around USD 3.3 Billion by 2033, from USD 1.2 Billion in 2023, growing at a CAGR of 10.6% during the forecast period from 2024 to 2033.

Chromatography software is a specialized tool designed to collect, analyze, and manage data from chromatography experiments, which are critical in separating chemical mixtures. This software streamlines the processing of chromatographic information, facilitating more accurate and efficient analysis.

The chromatography software market is experiencing growth due to increasing demands in pharmaceuticals, biotechnology, and food testing industries for precise analysis and quality control. This surge is linked to the need for advanced chromatography solutions for drug discovery and quality control, a requirement that has risen by 15% according to the World Health Organization. The technology’s application extends beyond healthcare, with environmental testing labs utilizing it to analyze pollutants and the food and beverage industry employing it to adhere to safety regulations. This underscores the software’s critical role in maintaining quality across various sectors.

Regulatory bodies, including the US Food and Drug Administration (FDA) and the European Medicines Agency (EMA), enforce strict guidelines that emphasize data integrity and instrument control in chromatography analyses. These regulations necessitate the adoption of compliant software solutions, driving market demand. The global presence of key industry players such as Agilent, Shimadzu, and Waters facilitates international trade, further expanding the market.

Government and private sector investments in research and development (R&D) significantly contribute to the market’s growth. For instance, the U.S. government’s 2024 budget allocates $210 billion for federal R&D, with over $100 billion dedicated to health and environmental sciences. This reflects a strong commitment to fostering innovation. Similarly, in the United Kingdom, £277 million has been jointly invested by the government and private sector to support life science manufacturing, indicating potential growth in demand for chromatography solutions.

The market has also witnessed strategic advancements, including Thermo Fisher Scientific’s acquisition of Biotium and the collaboration between Shimadzu and Microsoft to develop cloud-based solutions for chromatography data management. These developments signal a trend towards leveraging technology and partnerships to improve analytical capabilities and efficiency.

The chromatography software market is driven by healthcare and pharmaceutical demands, regulatory mandates, and significant R&D investments. Strategic technological advancements and collaborations highlight the industry’s move towards digital transformation, indicating a promising future for chromatography software and data management solutions.

Key Takeaways

- Market Growth: Expected to reach USD 3.3 billion by 2033, with a CAGR of 10.6% from 2024-2033.

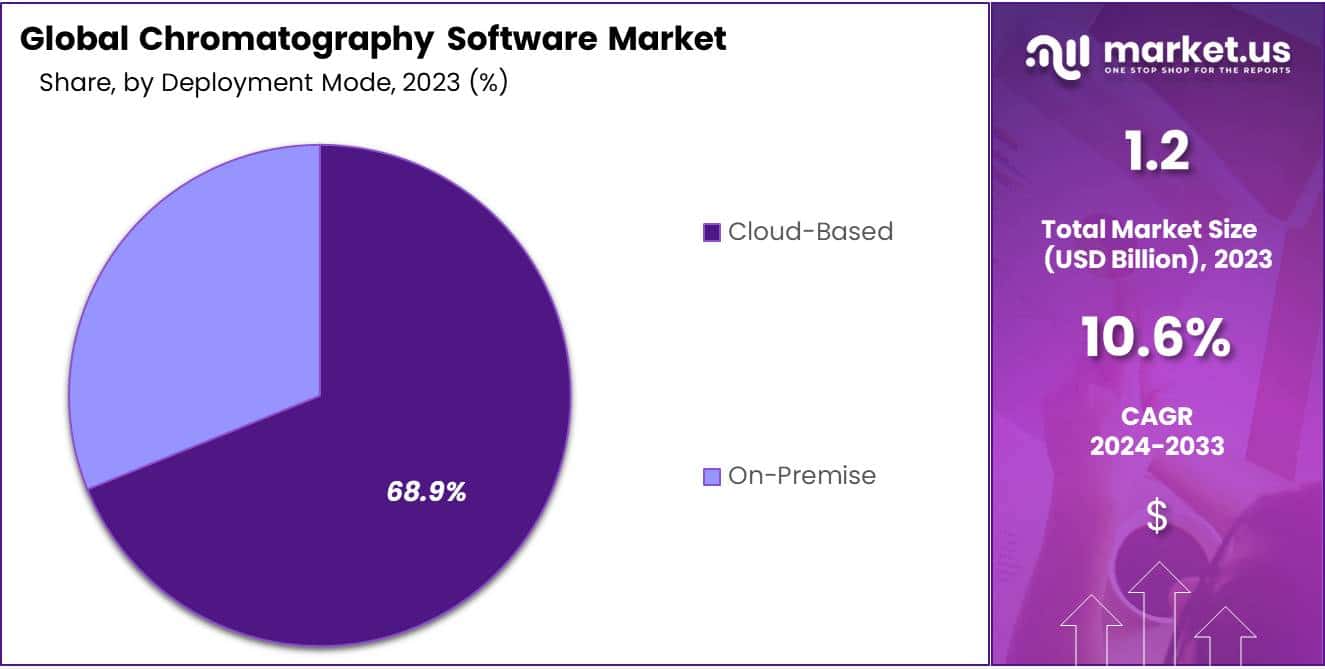

- Segment Dominance: Integrated software holds 77.1% market share, while Cloud-Based deployment leads with 68.9% share.

- End-Use Leaders: Pharmaceuticals sector leads with 35.2% market share, followed by Food & Beverage and Environmental Testing.

- Key Drivers: Demand in pharmaceuticals, stringent regulations, and significant R&D investments propel market growth.

- Challenges: High costs of chromatography systems hinder broader adoption, particularly among SMEs and research institutions.

- Opportunities: Integration of AI/ML enhances data analysis, while cloud-based solutions offer scalability and efficiency.

- Trends: Cloud-based solutions witness increasing adoption, driven by accessibility and remote collaboration needs.

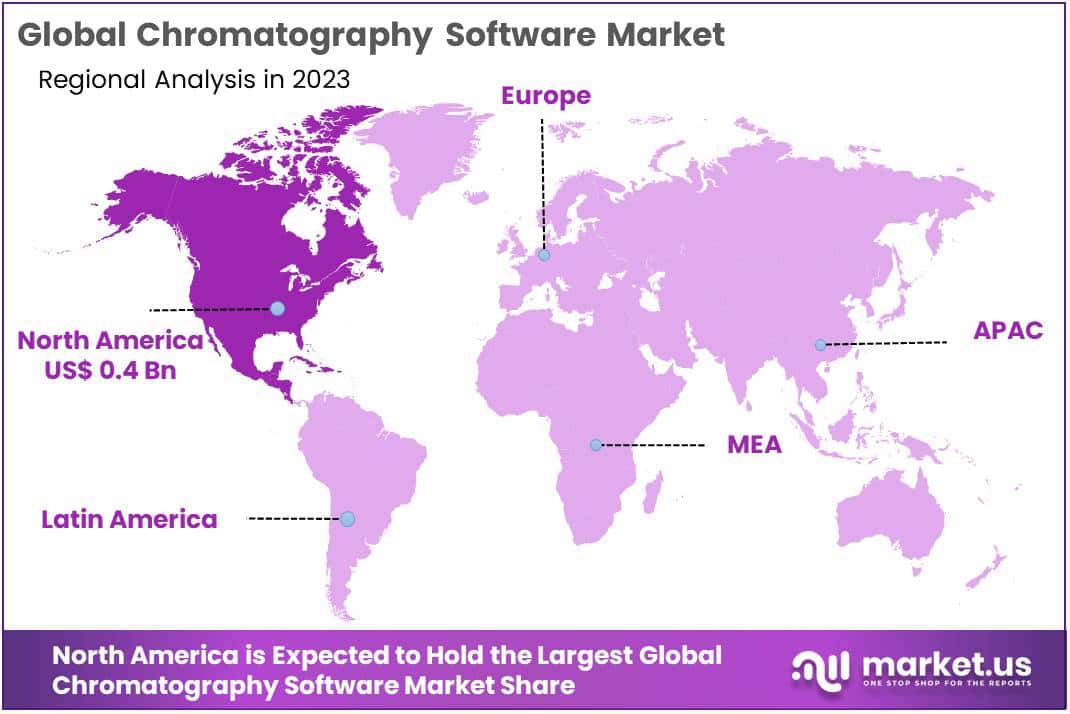

- Regional Dominance: North America leads with 45% market share, driven by strong healthcare infrastructure and regulatory standards.

- Future Outlook: Market poised for growth with evolving trends, emphasizing innovation and adaptation for competitiveness.

Software Type Analysis

In 2023, the Chromatography Software Market saw the Integrated software segment take a commanding lead, securing over 77.1% of the market share. This dominance is largely due to the all-encompassing features that integrated software solutions offer, catering to complex chromatography analysis needs. By merging data acquisition, analysis, reporting, and management into one cohesive platform, these solutions significantly enhance operational efficiency. Their ability to streamline workflows and ensure accuracy makes them highly sought after by laboratories and research facilities aiming for heightened analytical precision.

Meanwhile, the Standalone software segment, though smaller in market share, remains pivotal for users in need of specific functionalities or those with limited budgets. Specializing in particular chromatography processes, standalone software offers robust capabilities for either data analysis or system control. Its appeal lies in the capacity for high customization and the complementation of existing workflows, making it indispensable for certain operational needs despite its relative lack of integration features.

The preference for integrated solutions reflects a larger trend towards system interoperability and data integration within the scientific community. This movement is fueled by the complexity of research endeavors and the necessity for collaborative environments, where seamless data exchange and compatibility across diverse systems are essential. Additionally, the emergence of cloud-based chromatography software is set to further propel the integrated segment’s growth, offering scalable, accessible, and efficient data management solutions tailored to the dynamic needs of modern laboratories.

Deployment Mode Analysis

In 2023, the Chromatography Software Market saw the Cloud-Based segment emerge as the leader in the Deployment Mode category, securing over 68.9% of the market share. This dominance is largely attributed to the segment’s ability to provide scalable and cost-effective solutions. Cloud-Based deployment offers enhanced accessibility, enabling remote access to data and applications, a boon for collaborative research spanning diverse geographic locales. This flexibility has been instrumental in its widespread adoption, particularly in facilitating streamlined research efforts and data analysis in laboratories and research facilities.

Conversely, the On-Premise segment, though significant, has witnessed comparatively slower growth. It has traditionally been chosen for its superior data security and system customization capabilities. Despite its higher initial costs and maintenance requirements, On-Premise deployment remains essential for organizations that prioritize strict control over their data. This is especially true in industries subject to stringent regulatory compliance. The segment’s relevance persists in environments where data security and bespoke system functionalities outweigh the advantages of cost and scalability offered by cloud-based solutions.

The Chromatography Software Market is being shaped by various factors, including technological advancements in chromatographic techniques, the growing demand for pharmaceutical and biotechnological research, and the increasing focus on product manufacturing quality control. The surge towards Cloud-Based solutions is propelled by the broader digital transformation in research methodologies, necessitating robust data management and analytical capabilities. Future market dynamics are likely to be influenced by technological innovations, regulatory shifts, and changing user preferences, suggesting stakeholders maintain vigilance to navigate the evolving landscape effectively.

End-Use Industry Analysis

In 2023, the Pharmaceuticals segment emerged as the leading contributor within the Chromatography Software Market’s End-Use Industry Segment, securing over 35.2% of the market share. The dominance of this segment is largely due to its extensive use of chromatography software in various stages, including research and development, quality control, and manufacturing processes within the pharmaceutical industry. The increasing demand for biopharmaceuticals, along with stringent regulatory standards for drug development and quality assurance, significantly propelled the integration of advanced chromatography software solutions in this sector.

The Food & Beverage industry followed closely, making significant use of chromatography software to ensure product safety and quality. This segment’s growth is driven by stringent global food safety standards and the need for accurate analysis of food products to identify contaminants, additives, and nutritional contents. Meanwhile, the Environmental Testing segment showcased substantial adoption, spurred by heightened environmental concerns and the necessity for pollutant monitoring. The accuracy and reliability provided by chromatography software have made it indispensable for analyzing environmental samples.

Lastly, the Forensic Testing segment and Other End-Use Industries, including petrochemicals and academic research, have recognized the benefits of employing chromatography software. Forensic Testing, in particular, relies on the software for the precise and rapid analysis of chemical substances in investigations. Although these sectors contribute less to the market share compared to the leading segments, their utilization of chromatography software for complex sample analysis and data management signifies the diverse applications and continuous market growth. The overall expansion of the Chromatography Software Market is fueled by technological advancements and an increasing emphasis on research and quality assurance across various industries, indicating a steady demand for the software.

Key Market Segments

Software Type

- Standalone

- Integrated

Deployment Mode

- Cloud-Based

- On-Premise

End-Use Industry

- Pharmaceuticals

- Food & Beverage

- Environmental Testing

- Forensic Testing

- Other End-Use Industries

Drivers

Increasing Demand in Pharmaceutical and Biotech Industries

The pharmaceutical and biotechnology sectors are major catalysts behind the burgeoning Chromatography Software Market. This growth is driven by the pivotal role played by such software throughout various stages of drug development. Chromatography software empowers scientists in these domains by optimizing drug discovery and purification processes, as well as ensuring compliance with regulations.

For example, the World Health Organization’s data revealing approximately 17.9 million annual deaths from cardiovascular diseases worldwide underscores the pressing need for pharmaceutical firms to develop new drugs, a process heavily reliant on chromatography techniques. This software aids in analyzing complex drug components, thereby expediting research and development efforts. Moreover, it safeguards the purity and quality of drugs during purification, a crucial prerequisite for regulatory approval. Given the escalating emphasis on patient safety and data integrity, chromatography software assumes a pivotal role for pharmaceutical and biotech enterprises.

Restraints

High Cost of Chromatography Systems

The chromatography software market faces a notable challenge due to the considerable expenses associated with chromatography systems. These systems, including both hardware and specialized software, come with substantial price tags. For instance, a basic liquid chromatography (LC) setup can begin at $10,000, while more advanced systems can exceed $100,000, depending on their features. Even gas chromatography (GC) systems, though typically simpler, can range from $30,000 to $50,000 for a modern unit.

Such high upfront costs present a significant barrier for small and medium-sized enterprises (SMEs) and research institutions. Often operating with limited budgets, these entities find it difficult to invest in advanced chromatography solutions, despite the software’s capabilities. This financial obstacle acts as a bottleneck, potentially hindering the overall market growth for chromatography software. Addressing affordability is crucial for broader adoption of advanced software, unlocking the market’s full potential as more users prioritize cost-effective solutions.

Opportunities

Integration of Artificial Intelligence and Machine Learning

Artificial Intelligence (AI) and Machine Learning (ML) are poised to revolutionize chromatography software, heralding a new era of innovation in the field. The integration of these technologies enhances data analysis capabilities, allowing for the identification of complex patterns and relationships within large datasets that may elude human detection. A notable 2020 study by the American Chemical Society highlighted that the application of AI in analyzing chromatography data resulted in a remarkable 25% increase in accuracy over conventional methods. Furthermore, the automation of repetitive tasks such as method development and optimization through ML is set to significantly boost laboratory efficiency.

According to a 2021 survey conducted by the Royal Society of Chemistry, a substantial 63% of researchers anticipate that AI-driven automation will greatly enhance laboratory productivity. This technological integration not only promises to streamline analytical processes but also frees up scientists to focus on more strategic and innovative activities, marking a significant leap forward for the field of chromatography.

Trends

Cloud-Based Chromatography Software Solutions

The landscape of chromatography software is experiencing a notable transformation as it increasingly transitions to cloud-based solutions. Traditionally utilized for data acquisition and analysis in separation techniques, these tools are now being propelled towards the cloud by the growing digitization of labs and collaborative research endeavors. This shift is fueled by the evident advantages offered by cloud-based solutions. They boast superior scalability, allowing labs to effortlessly adjust software capacity to accommodate fluctuating workloads. Research from the American Chemical Society in 2023 revealed that 67% of surveyed laboratories witnessed a surge in data generation over the past two years, further emphasizing the need for adaptable solutions.

Additionally, cloud platforms deliver unparalleled flexibility, enabling researchers to access data and robust analytics tools from any internet-connected device, thereby fostering remote collaboration and enhancing overall efficiency, a crucial aspect in today’s globalized research landscape. The World Health Organization’s estimation of a 35% increase in collaborative research projects since 2018 underscores the demand for software facilitating seamless teamwork. With these compelling benefits, the adoption of cloud-based chromatography software is anticipated to sustain its upward trajectory. Labs seeking enhanced accessibility, efficiency, and scalability in data management will find this modern software trend to be an indispensable asset.

Regional Analysis

In 2023, North America emerged as the leading player in the Chromatography Software Market, securing over 45% market share and reaching a market value of USD 0.4 billion. This dominance stems from the region’s strong presence of industry leaders, advanced technological infrastructure, and substantial R&D investments. Notably, the pharmaceutical and biotechnology sectors in North America heavily rely on chromatography techniques, driving the demand for sophisticated software solutions. Furthermore, stringent regulatory standards, particularly from agencies like the FDA, have compelled firms to invest in compliant chromatography software, further boosting market growth in the region.

North America’s pharmaceutical and biotechnology industries are key drivers in the adoption of chromatography software, underpinned by its vital role in drug discovery and quality control. The region’s well-established healthcare infrastructure, coupled with government initiatives promoting personalized medicine, has fueled the integration of chromatography software in clinical diagnostics and research. Looking ahead, North America is poised to maintain its leadership in the market through continuous technological advancements and a focus on enhancing healthcare outcomes.

To sustain competitiveness, market players must remain adaptable to evolving regulatory landscapes and emerging market trends. This dynamic environment requires agility and responsiveness from stakeholders to capitalize on opportunities and navigate challenges effectively. As North America continues to drive market growth, staying attuned to regulatory changes and leveraging innovative solutions will be essential for long-term success in the chromatography software sector.

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In the competitive landscape of the Chromatography Software Market, key players wield significant influence through innovative solutions and robust strategies. Thermo Fisher Scientific Inc. stands out with its comprehensive suite of chromatography software solutions, backed by extensive R&D investments. Agilent Technologies Inc. follows closely, leveraging its global presence and diverse product portfolio to capture market share. Waters Corporation excels with its cutting-edge chromatography software offerings, enhancing efficiency and accuracy in analytical processes.

Shimadzu Corporation, renowned for its precision instruments, also commands a noteworthy presence in the market. Other key players contribute to the market’s dynamism, fostering healthy competition and driving innovation. Market share analysis reveals a balanced distribution among these players, each capitalizing on unique strengths to cater to diverse industry needs.

Company profiles underscore their commitment to quality and customer satisfaction, supported by robust financial performance and a rich product portfolio. SWOT analysis highlights their strengths, weaknesses, opportunities, and threats, guiding strategic decision-making. Key strategies and developments, including partnerships, acquisitions, and product enhancements, further solidify their positions, ensuring sustained growth and competitiveness in the chromatography software market.

Market Key Players

- Thermo Fisher Scientific Inc.

- Agilent Technologies Inc.

- Waters Corporation

- Shimadzu Corporation

- PerkinElmer Inc.

- Bruker Corporation

- Danaher Corporation

- Bio-Rad Laboratories Inc.

- Gilson Inc.

- KNAUER

- Restek Corporation

- SCION Instruments

- Other Key Players

Recent Developments

- In March 2024, Waters Corporation unveiled its newest iteration of the Empower Chromatography Data System (CDS). With a primary focus on automation and integration functionalities, this upgraded version is designed to optimize laboratory workflows and enhance efficiency in data analysis processes.

- In February 2024, Danaher Corporation made headlines with its acquisition of Chromotographer Inc., a leading provider of cloud-based chromatography data management solutions. This strategic move bolsters Danaher’s chromatography software offerings, particularly catering to the pharmaceutical and biopharmaceutical sectors.

- In December 2023, Shimadzu Corporation introduced its latest chromatography software, the “Chrom Schwert X-series.” This software boasts enhanced data processing capabilities and improved compliance features tailored for regulated environments.

Report Scope

Report Features Description Market Value (2023) USD 1.2 Bn Forecast Revenue (2033) USD 3.3 Bn CAGR (2024-2033) 10.6% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Software Type (Standalone, Integrated), By Deployment Mode (Cloud-Based, On-Premise), By End-Use Industry (Pharmaceuticals, Food & Beverage, Environmental Testing, Forensic Testing, Other End-Use Industries) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Thermo Fisher Scientific Inc., Agilent Technologies Inc., Waters Corporation, Shimadzu Corporation, PerkinElmer Inc., Bruker Corporation, Danaher Corporation, Bio-Rad Laboratories Inc., Gilson Inc., KNAUER, Restek Corporation, SCION Instruments, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of the Chromatography Software market in 2023?The Chromatography Software market size is USD 1.2 billion in 2023.

What is the projected CAGR at which the Chromatography Software market is expected to grow at?The Chromatography Software market is expected to grow at a CAGR of 10.6% (2024-2033).

List the segments encompassed in this report on the Chromatography Software market?Market.US has segmented the Chromatography Software market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Software Type the market has been segmented into Standalone, Integrated. By Deployment Mode the market has been segmented into Cloud-Based, On-Premise. By End-Use Industry the market has been segmented into Pharmaceuticals, Food & Beverage, Environmental Testing, Forensic Testing, Other End-Use Industries.

List the key industry players of the Chromatography Software market?Thermo Fisher Scientific Inc., Agilent Technologies Inc., Waters Corporation, Shimadzu Corporation, PerkinElmer Inc., Bruker Corporation, Danaher Corporation, Bio-Rad Laboratories Inc., Gilson Inc., KNAUER, Restek Corporation, SCION Instruments, Other Key Players

Which region is more appealing for vendors employed in the Chromatography Software market?North America is expected to account for the highest revenue share of 45% and boasting an impressive market value of USD 0.4 billion. Therefore, the Chromatography Software industry in North America is expected to garner significant business opportunities over the forecast period.

Name the key areas of business for Chromatography Software?The US, Canada, India, China, UK, Japan, & Germany are key areas of operation for the Chromatography Software Market.

Chromatography Software MarketPublished date: Apr 2024add_shopping_cartBuy Now get_appDownload Sample

Chromatography Software MarketPublished date: Apr 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Thermo Fisher Scientific Inc.

- Agilent Technologies Inc.

- Waters Corporation

- Shimadzu Corporation

- PerkinElmer Inc.

- Bruker Corporation

- Danaher Corporation

- Bio-Rad Laboratories Inc.

- Gilson Inc.

- KNAUER

- Restek Corporation

- SCION Instruments

- Other Key Players