Global Patient Registry Software Market By Type of Registry (Disease Registry, Health Service Registry, and Product Registry), By Software Type (Standalone, and Integrated), By Deployment Mode (On-Premise and Web/Cloud-Based), By Database Type (Commercial and Public), By Functionality (Population Health Management, Product Outcome Evaluation, Health Information Exchange, Medical Research & Clinical Studies, Patient Care Management, and Point-Of-Care), By End-User (Government, Pharma & Medical Device Companies, Hospitals & Medical Practices, Research Organization, and Private Payers) By Region, and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 27786

- Number of Pages: 358

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Type of Registry Analysis

- Software Type Analysis

- Deployment Mode Analysis

- Database Type Analysis

- Functionality Analysis

- End-User Analysis

- Key Segments Analysis

- Market Dynamics

- Market Restraints

- Market Opportunities

- Impact of macroeconomic factors / Geopolitical factors

- Latest Trends

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

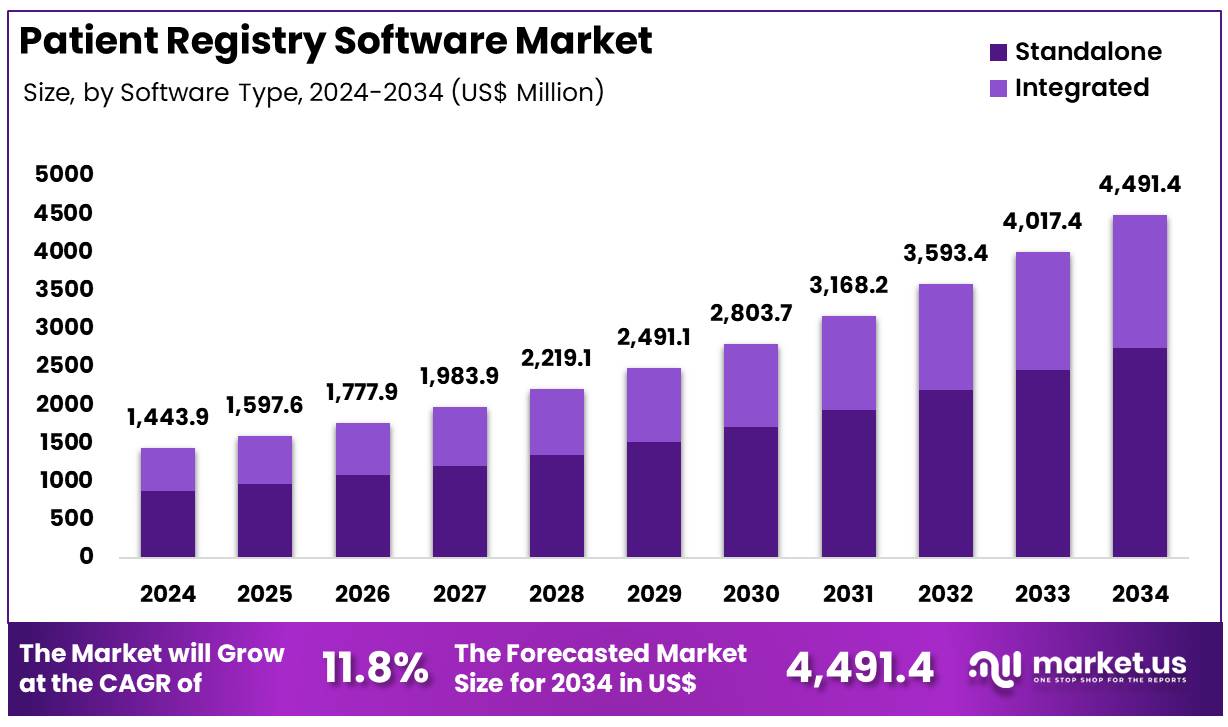

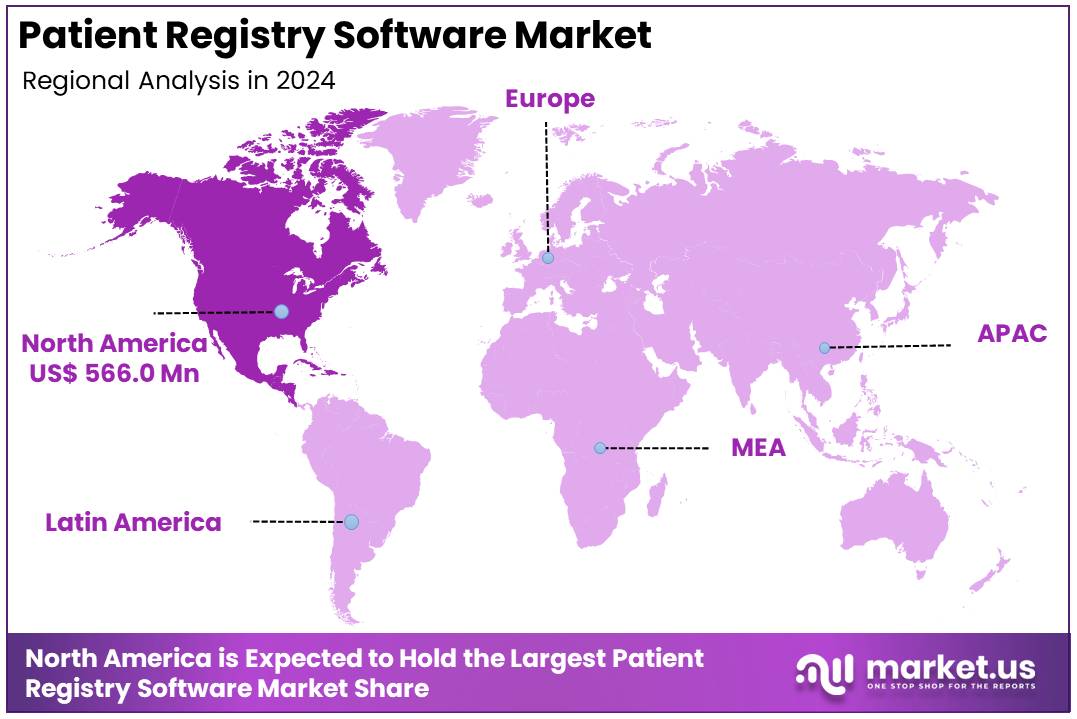

Global Patient Registry Software Market was valued at US$ 1443.9 Million in 2024 and is expected to grow at a CAGR of 11.8% from 2024 to 2034. In 2024, North America led the market, achieving over 39.2% share with a revenue of US$ 566.0 Million.

Global Patient Registry Software Market, Global Analysis, 2020-2024 (US$ Million)

Global 2020 2021 2022 2023 2024 CAGR Revenue 1,018.0 1,108.7 1,200.2 1,312.7 1,443.9 11.8% A patient registry is a tool to collect, organize, and analyze clinical, patient-oriented data from a variety of sources. It is a singular, unifying system that compiles data of all those who have been afflicted with a medical condition, both physical and mental. In essence, it is a database from which clinical data can be extracted.

Such a tool is utilized to monitor the quality of medical care, to store medical knowledge, and ultimately, to refine the process of patient care. Patient registries contain highly relevant data about patients, which helps provide new insights into their medical conditions. This is immensely useful in comprehending the process of disease progression and developing innovative and effective treatments.

Patient registries have traditionally been maintained on paper, which has proven to be unnecessary and tedious in the age of digital technology. With the help of software dedicated to maintaining the patient registry, data transfer, extraction, and analysis have become much more convenient. Further, such software allows for interoperability, which has proven to be cost and time-effective.

A patient registry software is an electronic patient registry and is operated online. Such electronic patient registries can be maintained with tools such as spreadsheet programs or database programs. The complexity of the system utilized is highly dependent on the scale of the research and the severity of the medical condition.

Key Takeaways

- The global patient registry software market was valued at USD 1,443.9 million in 2024 and is anticipated to register substantial growth of USD 4,491.4 million by 2034, with 11.8% CAGR.

- In 2024, the disease registry segment took the lead in the global market, securing 62.9% of the total revenue share.

- The standalone segment took the lead in the global market, securing 61.3% of the total revenue share.

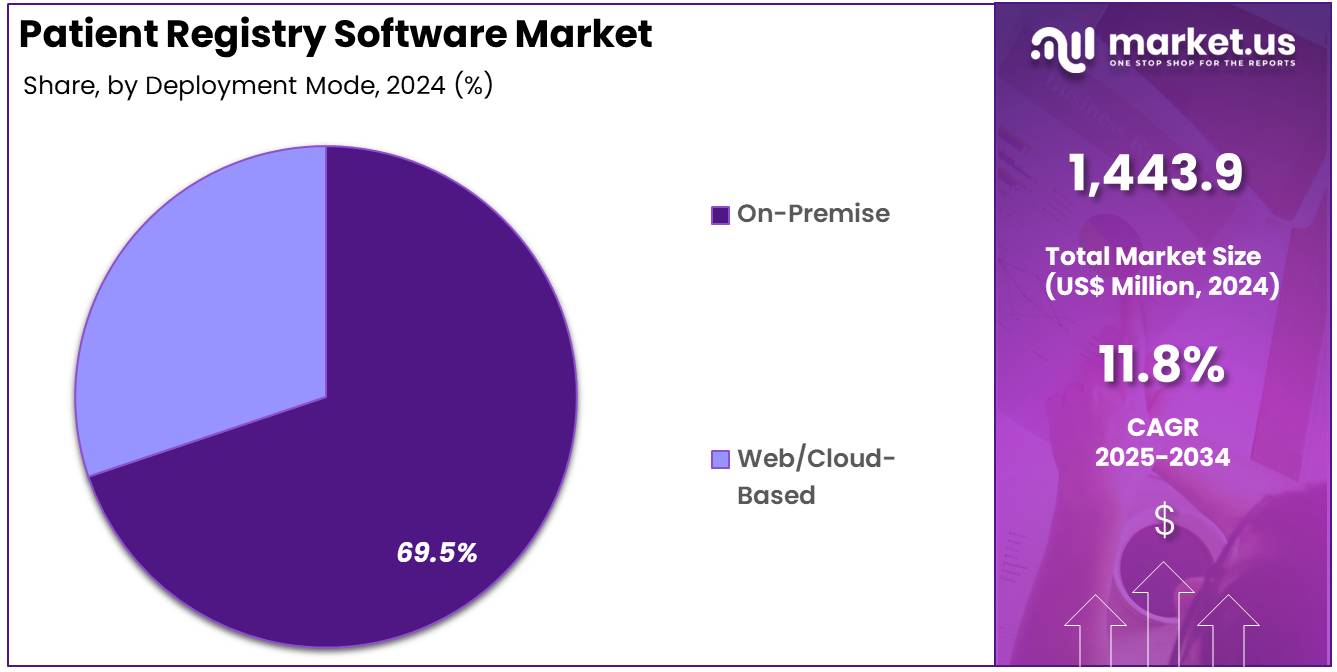

- The on-premise segment took the lead in the global market, securing 69.5% of the total revenue share.

- The commercial segment took the lead in the global market, securing 63.5% of the total revenue share.

- North America maintained its leading position in the global market with a share of over 39.2% of the total revenue.

Type of Registry Analysis

Based on type of registry the market is fragmented into disease registry, health service registry, and product registry. Amongst these, disease registry segment dominated the global patient registry software market capturing a significant market share of 62.9% in 2024. The disease registry segment has dominated the global patient registry software market due to its critical role in managing and analyzing patient data related to specific diseases.

Disease registries collect comprehensive data on patients with particular conditions, such as cancer, diabetes, cardiovascular diseases, and rare diseases, enabling healthcare providers, researchers, and public health agencies to track the progression of diseases, monitor treatment outcomes, and improve patient care.

This segment’s dominance is largely driven by the increasing need for data-driven healthcare solutions and personalized medicine. Disease registries enable the collection of large datasets, which can be used for epidemiological studies, clinical trials, and identifying trends in disease progression, treatment responses, and patient outcomes. With the growing emphasis on evidence-based practices, healthcare systems are increasingly adopting patient registry software to streamline the management of chronic diseases and optimize treatment protocols.

Global Patient Registry Software Market, Type of Registry Analysis, 2020-2024 (US$ Million)

Type of Registry 2020 2021 2022 2023 2024 Disease Registry 630.9 690.2 750.5 823.5 908.1 Health Service Registry 111.1 121.8 132.7 146.8 163.8 Product Registry 276.0 296.7 317 342.4 372.0 Software Type Analysis

The market is fragmented by software type into standalone, and integrated. Standalone dominated the global patient registry software market capturing a significant market share of 61.3% in 2024. The standalone segment has dominated the global patient registry software market due to its simplicity, ease of use, and cost-effectiveness.

Standalone registry software solutions are designed to operate independently, without the need for complex integrations with other healthcare systems, making them particularly attractive to smaller healthcare providers or those with limited IT infrastructure. These solutions are focused on specific needs, such as tracking patient data for particular diseases or conditions, and are often easier to implement and maintain than more complex, integrated systems.

Standalone patient registry software offers significant advantages, including faster deployment, lower upfront costs, and simplified data management, as healthcare organizations can focus solely on the registry’s core functions without the complexity of integrating with other electronic health records (EHR) or health information systems.

As a result, standalone solutions are particularly popular among small to medium-sized healthcare providers and organizations that require specialized registry management without the need for large-scale infrastructure investments.

Global Patient Registry Software Market, Software Type Analysis, 2020-2024 (US$ Million)

Software Type 2020 2021 2022 2023 2024 Standalone 637.5 691.1 743.8 808.9 884.5 Integrated 380.4 417.6 456.5 503.8 559.4 Deployment Mode Analysis

The market is fragmented by deployment mode into on-premise and web/cloud-based. On-Premise dominated the global patient registry software market capturing a significant market share of 69.5% in 2024. On-premise solutions have dominated the global patient registry software market primarily due to their greater control over data security and customization.

Organizations using on-premise systems can store and manage patient data within their own infrastructure, ensuring that sensitive health information remains within their direct control. This level of security is particularly crucial in healthcare, where regulatory compliance (such as HIPAA in the U.S.) is a top priority. Many hospitals and healthcare institutions also prefer on-premise solutions for reasons related to data sovereignty, as they can ensure compliance with local data storage laws.

Additionally, on-premise software allows for extensive customization to meet the specific needs of an organization, which is often critical in healthcare environments with diverse workflows and requirements. Healthcare providers can tailor the system to integrate with existing electronic health records (EHR) or other internal systems.

Global Patient Registry Software Market, Deployment Mode Analysis, 2020-2024 (US$ Million)

Deployment Mode 2020 2021 2022 2023 2024 On-Premise 707.4 770.5 833.6 911.9 1,003.00 Web/Cloud-Based 310.6 338.2 366.6 400.8 441.0 Database Type Analysis

The market is fragmented by database type into commercial and public. Commercial dominated the global patient registry software market capturing a significant market share of 63.5% in 2024. Commercial solutions have dominated the global patient registry software market due to their ability to offer comprehensive, scalable, and specialized features that cater to a wide range of healthcare providers. These solutions are typically developed by established vendors with extensive experience in the healthcare industry, which allows them to provide robust and feature-rich platforms designed to meet the complex needs of different healthcare organizations.

One of the key reasons for the dominance of commercial solutions is their ability to integrate seamlessly with existing health IT systems, such as electronic health records (EHR) and laboratory information systems (LIS). This interoperability ensures a smooth flow of data across various platforms, reducing administrative burdens and improving the overall efficiency of patient data management.

Additionally, commercial patient registry software often offers advanced analytics capabilities, which are crucial for healthcare providers looking to derive actionable insights from patient data. These insights can aid in patient care management, clinical research, and population health management.

Global Patient Registry Software Market, Database Type Analysis, 2020-2024 (US$ Million)

Database Type 2020 2021 2022 2023 2024 On-Premise 638.6 698.2 758.6 831.5 916.70 Web/Cloud-Based 379.4 410.5 441.7 481.2 527.3 Functionality Analysis

The market is fragmented by functionality into population health management, product outcome evaluation, health information exchange, medical research & clinical studies, patient care management, and point-of-care. Population health management dominated the global patient registry software market capturing a significant market share of 28.7% in 2024. Population health management (PHM) has dominated the global patient registry software market due to its focus on improving health outcomes for large groups of patients through data-driven insights and coordinated care.

PHM emphasizes the use of patient registries to track and manage populations with specific health conditions, monitor health trends, and ensure timely interventions. As healthcare systems increasingly shift towards value-based care models, PHM tools have become essential for healthcare providers aiming to reduce costs while improving patient outcomes.

Patient registry software used for PHM integrates clinical data from various sources, such as electronic health records (EHRs), lab results, and patient-reported data, into centralized databases. This provides healthcare providers with a comprehensive view of patient health, enabling them to identify at-risk individuals, monitor chronic diseases, and ensure preventive care is delivered effectively.

Global Patient Registry Software Market, Functionality Analysis, 2020-2024 (US$ Million)

Functionality 2020 2021 2022 2023 2024 Population Health Management 291.8 318.8 345.4 377.6 414.50 Product Outcome Evaluation 80.6 87.3 94.0 102.5 112.5 Health Information Exchange 123.4 133.2 143.1 154.5 167.6 Medical Research & Clinical Studies 212.1 234.0 256.6 285 318.7 Patient Care Management 169.0 180.7 192.5 207.0 223.8 Point-Of-Care 141.0 154.7 168.6 186.1 206.8 End-User Analysis

The market is fragmented by end-user into government, pharma & medical device companies, hospitals & medical practices, research organization, and private payers. Government dominated the global patient registry software market capturing a significant market share of 31.9% in 2024. Government entities have dominated the global patient registry software market due to their significant role in healthcare regulation, funding, and public health initiatives.

Governments, particularly in developed countries, are key stakeholders in the development and implementation of patient registries to monitor population health, track disease outbreaks, and ensure public health safety. These registries often focus on chronic disease management, cancer registries, vaccination records, and other public health initiatives aimed at improving national health outcomes.

One of the main reasons for government dominance is the increasing emphasis on regulatory compliance, particularly with standards like HIPAA (Health Insurance Portability and Accountability Act) in the U.S. and GDPR in Europe. Governments often fund and mandate the use of patient registry software to ensure data is collected consistently, securely, and in a manner that supports both clinical and public health initiatives.

Global Patient Registry Software Market, End-User Analysis, 2020-2024 (US$ Million)

End-User 2020 2021 2022 2023 2024 Government 317.3 347.7 378.5 416.6 461.2 Pharma & Medical Device Companies 167.6 184.3 201.7 223.2 248.4 Hospitals & Medical Practices 266 288.6 311.3 339.4 372.4 Research Organization 157.1 169.9 182.6 197.9 215.6 Private Payers 110.1 118.2 126.1 135.6 146.3

Key Segments Analysis

By Type of Registry

- Disease Registry

- Cardiovascular

- Cancer

- Diabetes

- Rare disease

- Other Types of Disease Registry

- Health Service Registry

- Product Registry

- Medical Device

- Drug

By Software Type

- Standalone

- Integrated

By Deployment Mode

- On-Premise

- Web/Cloud-Based

By Database Type

- Commercial

- Public

By Functionality

- Population Health Management

- Product Outcome Evaluation

- Health Information Exchange

- Medical Research & Clinical Studies

- Patient Care Management

- Point-Of-Care

By End-User

- Government

- Pharma & Medical Device Companies

- Hospitals & Medical Practices

- Research Organization

- Private Payers

Market Dynamics

Rise in Government Initiatives

The rise in government initiatives is significantly driving the growth of the global patient registry software market. Governments worldwide are increasingly investing in digital health infrastructure to improve healthcare delivery, streamline data management, and promote public health initiatives. One of the key drivers of this trend is the push for better population health management through enhanced data collection and analysis, which is made possible by patient registry software.

Governments are mandating and funding the establishment of patient registries for various chronic diseases, cancers, and rare conditions. These initiatives are aimed at tracking disease progression, improving the quality of care, and ensuring timely interventions. For example, government-funded registries can help monitor national health trends, identify at-risk populations, and allocate healthcare resources more efficiently.

In addition, governments are offering incentives to healthcare organizations to adopt electronic health records (EHRs) and other health IT solutions, which are closely integrated with patient registry systems. This supports the broader shift toward value-based care, where healthcare providers are rewarded for improving patient outcomes rather than the volume of services provided.

Market Restraints

Data Security Concerns

EHR and patient registry software include the entirety of clinical data stored electronically. Such database contains Protected Health Information (PHI) and is sensitive and invaluable thus, can be misused. A patient registry software may contain up to 18 protected health identifiers, which may be misused for extortion, identity theft, and fraud. One of the main concerns regarding patient registry software is data security.

Major threats against patient registry software are phishing attacks, Malware & Ransomware Attacks, Encryption Blind Spots and Cloud Threats. Risk for data security can be alleviated by educating medical professionals on cybersecurity, fortifying database systems, encrypting sensitive data and updating security systems.

- According to a report by Office of Information Security, 578 healthcare organizations were severely affected by data breach in the year 2021. These data breaches impacted over 41 million individuals. Over 20% of breaches resulted in compromised credentials. Further, phishing and misconfiguration accounted for 17% and 15% of total data breaches in 2021.

Market Opportunities

Increase in Accountable Care Organizations

The increase in accountable care organizations (ACOs) is creating significant growth opportunities for the global patient registry software market. ACOs are healthcare groups that voluntarily come together to provide coordinated care to a population of patients, aiming to reduce healthcare costs while improving quality outcomes. This shift to value-based care, where providers are financially incentivized to focus on patient outcomes rather than volume, is driving the demand for sophisticated data management tools, such as patient registry software.

Patient registries allow ACOs to centralize patient data from multiple sources—such as hospitals, physicians, and outpatient clinics—into a comprehensive system that provides a 360-degree view of each patient’s health status. This integrated data is essential for ACOs to track patient outcomes, manage chronic conditions, and implement preventive care strategies. By using patient registries, ACOs can identify high-risk patients, monitor care gaps, and ensure that patients receive timely interventions, all of which are essential for meeting ACO performance benchmarks.

Impact of macroeconomic factors / Geopolitical factors

The global patient registry software market is significantly influenced by macroeconomic and geopolitical factors. Macroeconomic conditions, such as economic growth, healthcare spending, and inflation, directly affect the demand for patient registry software.

In times of economic growth, governments and healthcare organizations are more likely to invest in advanced technologies like patient registries to improve patient outcomes and operational efficiency. However, during economic downturns, budget constraints may limit such investments, especially in emerging markets.

Geopolitical factors also play a crucial role. Trade policies, regulatory frameworks, and international relations can impact the market. For instance, geopolitical tensions or changes in healthcare regulations in key markets like the U.S., EU, or China could affect software developers’ ability to access certain markets or comply with specific standards.

Additionally, cross-border data privacy laws and international partnerships can either encourage or inhibit the global reach of patient registry solutions. The increasing trend toward data localization in certain regions, such as the EU’s GDPR, could also create barriers for global companies.

Latest Trends

The global patient registry software market is experiencing several key trends that are shaping its future. One major trend is the integration with Electronic Health Records (EHRs), which enables seamless data exchange and improves the accuracy and efficiency of patient tracking. Additionally, there is a growing focus on real-time data analytics to support decision-making, enhance patient care, and optimize operational workflows.

Cloud-based solutions are gaining popularity due to their cost-effectiveness, scalability, and ease of access, allowing healthcare providers to manage and analyze patient data remotely. Another significant trend is the rising emphasis on personalized medicine, where patient registries are being used to track specific conditions and treatment responses to tailor care to individual patients. The increasing adoption of artificial intelligence (AI) and machine learning (ML) within these platforms is also noteworthy, helping to uncover hidden patterns in data and predict outcomes.

Furthermore, the demand for compliance with regulations such as GDPR and HIPAA is driving the development of software that ensures data privacy and security. Lastly, the expansion of global health initiatives, including efforts to manage chronic diseases and improve public health infrastructure, is pushing for the adoption of patient registry software across emerging markets. These trends collectively reflect a shift toward more data-driven, efficient, and personalized healthcare systems.

Regional Analysis

The patient registry software market in North America is expanding at a significant rate. The market growth is propelled by growing emphasis on healthcare data management. The healthcare industry in North America is increasingly focusing on efficient data management and analysis to improve patient care, track outcomes, and reduce costs. Patient registry software plays a crucial role in centralizing and managing patient data, making it a valuable tool for healthcare providers and organizations.

Additionally, the establishment of Health Information Exchanges (HIEs) in various U.S. states and Canadian provinces facilitates the sharing of patient information across different healthcare providers and systems. Patient registry software is integral to HIEs for maintaining a comprehensive patient record that can be accessed by authorized providers. This assists in the expansion of the regional market size.

- According to a data published in 2022, “How A Clinical Data Registry Can Work With Your EHR,“ proposes that data stored within a data registry serves the purpose of assisting healthcare professionals in determining the optimal treatment approach for patients who share a common disease or medical condition.

Global Patient Registry Software Market, Regional Analysis, 2020-2024 (US$ Million)

Region 2020 2021 2022 2023 2024 North America 407.9 442.3 476.3 517.8 566.0 Europe 274.4 290.6 306.2 324.9 345.8 Asia Pacific 202.8 229.3 257.1 292.2 334.6

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The competitive landscape of the global patient registry software market is characterized by a mix of established players and emerging companies vying for market share. Leading players like IQVIA, Optum, and Cerner Corporation dominate the market, offering comprehensive solutions that integrate with electronic health records (EHRs) and enable advanced data analytics. These companies leverage their strong reputations, extensive client bases, and broad geographic reach to maintain a competitive edge.

Newer entrants, including niche players such as Health Catalyst and SIMPLYHEALTH, are gaining traction by offering specialized, cloud-based solutions tailored to specific healthcare needs, such as rare disease management or personalized medicine. The competitive dynamics are also influenced by technology innovations, with companies investing heavily in artificial intelligence (AI), machine learning (ML), and big data analytics to enhance their software capabilities.

IQVIA Inc. is a global leader in advanced analytics, technology solutions, and contract research services for the healthcare industry. The company offers data-driven insights that help pharmaceutical, biotechnology, and healthcare organizations optimize their operations and improve patient outcomes. McKesson Corporation is a leading global healthcare services and information technology company, providing pharmaceutical distribution, medical supplies, and healthcare IT solutions.

As one of the largest pharmaceutical distributors in the world, McKesson serves healthcare providers, payers, and patients across various sectors. The company’s healthcare IT solutions, including patient registry software, help healthcare organizations streamline operations, improve patient care, and comply with regulations.

Top Key Players

- IQVIA Inc.

- McKesson Corporation

- ImageTrend, Inc.

- Dacima Software Inc.

- ArborMetrix Inc.

- Evado Clinical

- Global Vision Technologies Inc.

- FIGmd, Inc.

- Phytel

- Liaison Technologies

- Optum

Recent Developments

- In January 2023, IQVIA Inc. & GO2 Foundation for Lung Cancer did a partnership to develop an expanded & improved Global Lung Cancer Registry to advance lung cancer research globally. The Registry, built on the IQVIA Connection platform, serves as a secure and centralized data repository designed to collect data from lung cancer patients worldwide. This initiative aims to provide researchers with a wealth of valuable data, enabling them to identify and analyze trends related to lung cancer.

- In April 2020, IQVIA introductions broad, open COVID-19 registry platform to advance research, collaboration, and understanding. The IQVIA CARE Project is a voluntary registry open to individuals worldwide. Its primary objective is to advance the collective understanding of COVID-19 by facilitating the sharing of information related to various aspects of the disease, including treatment outcomes, disease prevalence, and symptom progression.

- In February 2023, McKesson received approval from The Centers for Medicare & Medicaid Services (CMS) to participate in the Merit-based Incentive Payment System (MIPS) as a Qualified Clinical Data Registry (QCDR).

Report Scope

Report Features Description Market Value (2024) US$ 1443.9 Million Forecast Revenue (2034) US$ 4491.4 Million CAGR (2025-2034) 11.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type of Registry (Disease Registry, Health Service Registry, and Product Registry), By Software Type (Standalone, and Integrated), By Deployment Mode (On-Premise and Web/Cloud-Based), By Database Type (Commercial and Public), By Functionality (Population Health Management, Product Outcome Evaluation, Health Information Exchange, Medical Research & Clinical Studies, Patient Care Management, and Point-Of-Care), By End-User (Government, Pharma & Medical Device Companies, Hospitals & Medical Practices, Research Organization, and Private Payers) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape IQVIA Inc., McKesson Corporation, ImageTrend, Inc., Dacima Software Inc., ArborMetrix Inc., Evado Clinical, Global Vision Technologies Inc., FIGmd, Inc., Phytel, Liaison Technologies and Optum Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Patient Registry Software MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

Patient Registry Software MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- IQVIA Inc.

- McKesson Corporation

- ImageTrend, Inc.

- Dacima Software Inc.

- ArborMetrix Inc.

- Evado Clinical

- Global Vision Technologies Inc.

- FIGmd, Inc.

- Phytel

- Liaison Technologies

- Optum