Personal Health Record Software Market Analysis By Deployment (Cloud-Based, Web-Based), By Component (Software & Mobile Applications, Service), By Architecture (Payer-Tethered, Provider-Tethered, Standalone), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov 2024

- Report ID: 83604

- Number of Pages: 343

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

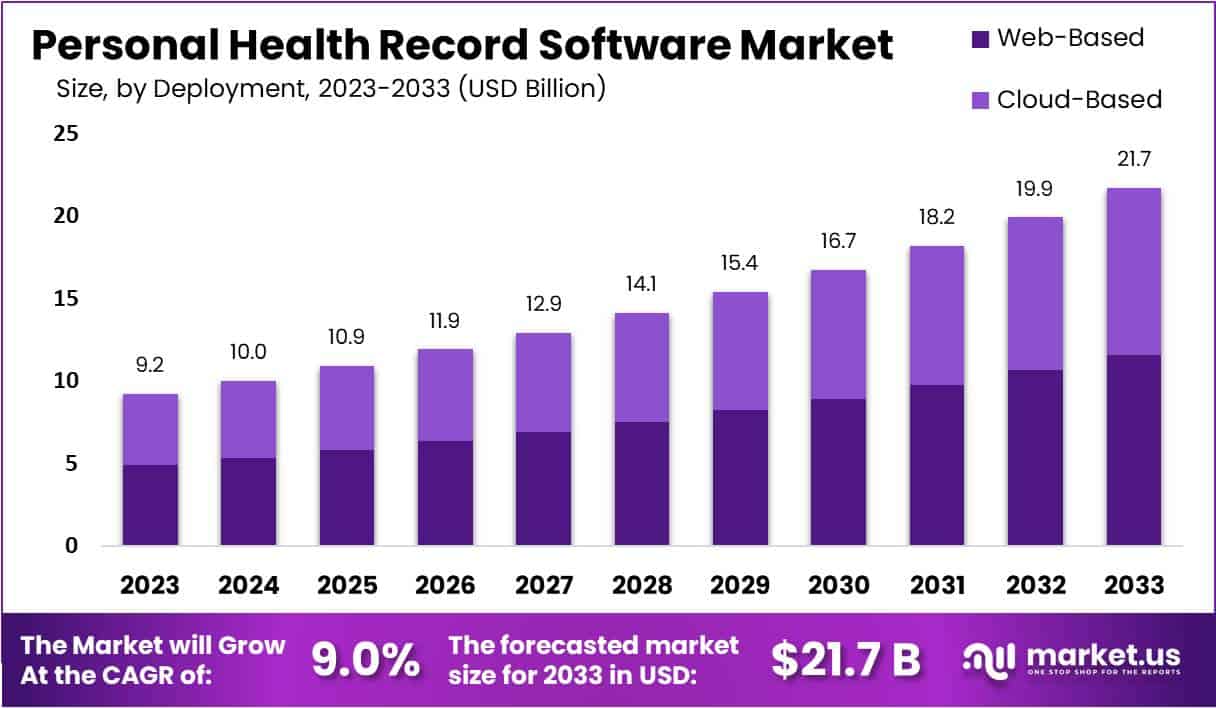

The Global Personal Health Record Software Market size is expected to be worth around US$ 9.2 Billion by 2033, from US$ 21.7 Billion in 2023, growing at a CAGR of 9% during the forecast period from 2024 to 2033.

Personal Health Record (PHR) software provides individuals with an invaluable digital tool to effectively organize and store all aspects of their health-related information electronically. PHR software’s features are tailored for comprehensive management; users can input and update medical history information such as surgeries, illnesses and chronic conditions; it allows meticulous medication tracking with detailed lists of current meds dosages schedules etc; allergies/immunization records can also be documented seamlessly for monitoring.

An appointment and health tracker helps users coordinate upcoming medical events while monitoring essential metrics, including weight, blood pressure, and glucose levels. Emergency contacts can also be stored quickly for quick access in critical situations; secure access ensures personal health information remains protected – only authorized individuals have access to it. Using such an integrated approach ensures more coordinated healthcare experience; users may choose to share their PHR with healthcare providers for additional coordination and insight into healthcare provision.

Personal Health Record (PHR) software market has seen remarkable growth over time due to a variety of key factors. First, individuals have become more aware of the significance of managing personal health information and this awareness has resulted in an increased demand for PHR software. Furthermore, digital transformation in healthcare has driven increased use of PHRs for improving patient engagement and care coordination.

Government initiatives in some regions actively support PHR use as part of healthcare strategies to optimize patient outcomes and reduce costs. As chronic diseases continue to rise, individuals seek efficient ways of organizing their health information – making PHR software increasingly relevant.

Enhancing interoperability between various healthcare systems has driven the evolution of PHR software, enabling its integration with various health IT systems. This dynamic market features vendors competing to offer user-friendly, secure, and interoperable PHR solutions that coincide with healthcare industry digitization efforts and predicted expansion of the PHR software market.

Key Takeaways

- Market Growth: Personal Health Record Software Market to reach US$ 21.7 Billion by 2033, reflecting a 9% CAGR from 2024-2033.

- Dynamic Features: Personal Health Record Software organizes health data comprehensively, including medical history, medications, and vital metrics, promoting coordinated healthcare experiences.

- Driving Factors: Increased awareness, healthcare digitization, and government initiatives propel PHR software demand, fostering a competitive landscape among user-friendly, secure solutions.

- Deployment Segment: In 2023, Cloud-Based solutions held 53.4% market share, driven by user preference for accessibility and real-time updates.

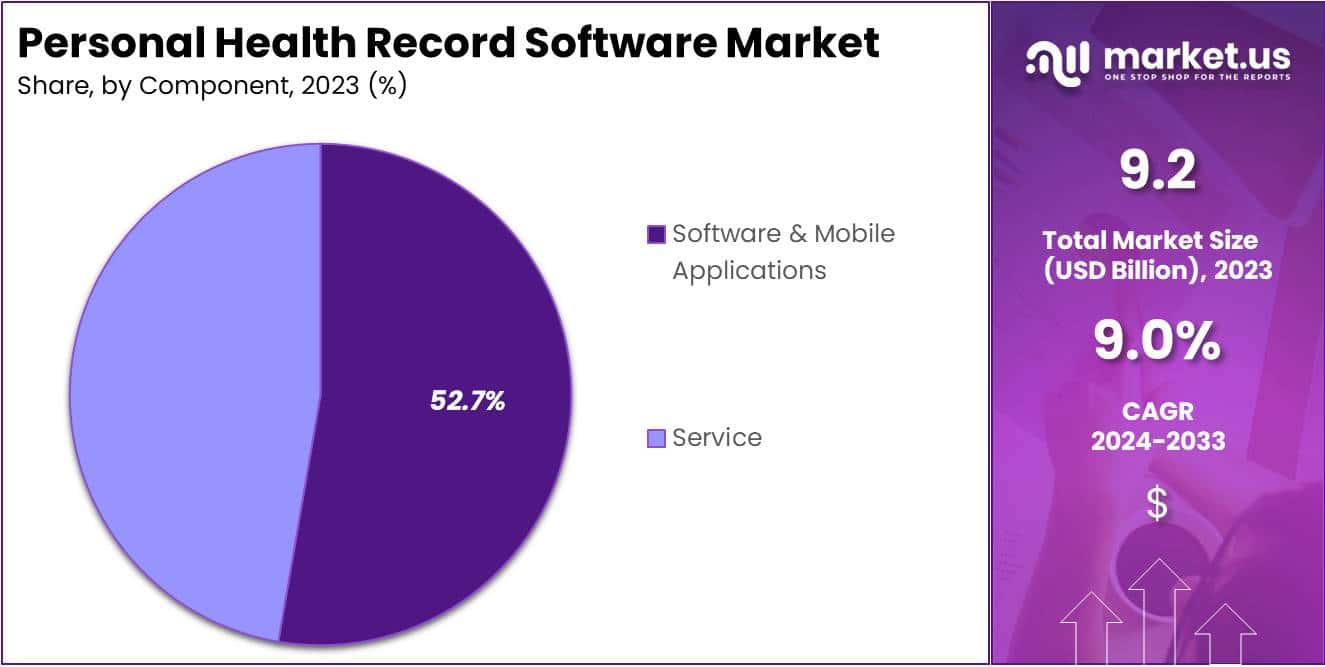

- Component Segment: Software & Mobile Applications segment led in 2023 with 52.7% market share, emphasizing user-centric design for efficient health data management.

- Architecture Segment: Standalone PHR Software claimed 40.1% market share in 2023, offering users autonomy in managing health records independently.

- Driver Insights: Key growth drivers include healthcare digitization, rising demand for patient-centric services, wearable tech integration, and government support.

- Barrier Highlights: Data privacy concerns, high implementation costs, lack of user technical know-how, and healthcare practice change resistance pose significant market obstacles.

- Opportunities: Emerging market adoption, AI and ML integration, collaborations with insurance companies, and telehealth service expansion offer growth avenues for PHR software providers.

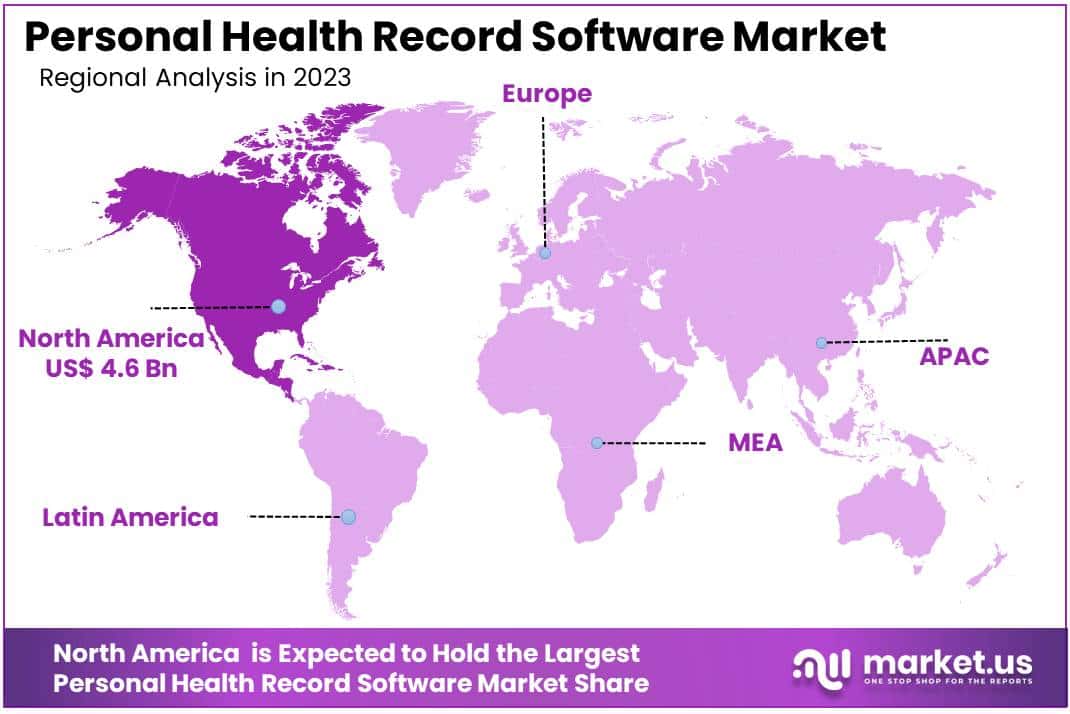

- Regional Dominance: In 2023, North America led with 50.2% market share, valued at USD 4.6 Billion, driven by advanced infrastructure, technology adoption, and supportive government policies.

Deployment Analysis

In 2023, the Personal Health Record (PHR) Software Market demonstrated its leadership within the Cloud-Based segment by holding over 53.4% market share. This widespread popularity can be attributed to users preferring cloud-based solutions due to their convenience and accessibility; users are able to quickly and effortlessly access their health records anytime, anywhere for maximum ease and efficiency.

On the other hand, Web-Based solutions played an equally significant role in market landscapes despite having a lower market share. Their user-friendly interface and ability to access health records through regular web browsers made this deployment method popular among individuals seeking an efficient way to manage their health information.

Cloud-Based deployment can be seen as a response to increasing consumer demands for seamless integration between devices and platforms. Not only does this deployment method facilitate access, but real-time updates ensure users always have access to accurate health information.

As the market evolves, it is vital for PHR software providers to adapt their solutions to meet the individual needs of users, equipping both Cloud-Based and Web-Based segments with user-friendly features for optimal use. This strategy can play a pivotal role in maintaining and expanding market share – creating a competitive landscape where user satisfaction remains at its forefront.

Component Analysis

In 2023, the Personal Health Record Software Market witnessed a notable trend, with the Software & Mobile Applications segment emerging as the frontrunner, securing a robust market position by commanding over 52.7% share. This dominance can be attributed to the increasing reliance on user-friendly digital solutions, emphasizing accessibility and convenience in managing personal health information.

Software & Mobile Applications has gained tremendous traction due to their user-centric design, which allows individuals to efficiently organize and access their health records using intuitive interfaces. This surge in adoption can be linked to mobile device use and preference for on-the-go healthcare management.

Service segment also played a pivotal role in shaping the market landscape and contributing to its overall expansion. Services, including implementation, training and support garnered considerable praise as they improved software solutions’ efficiency and effectiveness.

Software & Mobile Applications and Services coexist harmoniously in an ecosystem, providing end-users with a holistic approach to personal health management. As markets mature, stakeholders will likely observe an intricate interplay among these segments which emphasizes the necessity of comprehensive yet user-friendly solutions that seamlessly fit into individuals’ lives.

Architecture Analysis

In 2023, the Standalone segment emerged as a frontrunner in the Personal Health Record (PHR) Software Market, securing a commanding market position with a robust 40.1% share. This significant dominance can be attributed to the self-sufficiency and autonomy offered by Standalone PHR Software, allowing users to manage their health records independently.

The Provider-Tethered segment, on the other hand, exhibited a strong presence, closely following with a substantial market share. This segment appeals to users who prefer a seamless integration of their health records with healthcare providers, fostering better coordination and accessibility for both patients and healthcare professionals.

Meanwhile, the Payer-Tethered segment carved out its own niche, capturing attention in the market. With a focus on connectivity with insurance providers, Payer-Tethered PHR Software became a valuable tool for users seeking streamlined communication and transactions related to their health insurance coverage.

Looking ahead, the growth trajectory of these segments is anticipated to be dynamic, with Standalone solutions maintaining their lead due to the increasing demand for personalized and user-centric health management tools. However, the collaborative and integrated nature of Provider-Tethered and Payer-Tethered segments is likely to drive steady growth, fostering a competitive landscape in the evolving PHR Software Market.

Key Market Segments

Deployment

- Cloud-Based

- Web-Based

Component

- Software & Mobile Applications

- Service

Architecture

- Payer-Tethered

- Provider-Tethered

- Standalone

Drivers

Increase in Healthcare Digitization

Healthcare digitization is one of the key drivers of PHR software market growth. As healthcare systems around the globe adopt digital records, personal health record software becomes essential in maintaining and accessing them. This digital shift improves efficiency while decreasing paperwork. A recent HIMSS study shows significant increases in digital record adoption which indicates its market expansion potential for PHR software.

Rising Demand for Patient-Centric Healthcare Services

With an increasing focus on personalized healthcare services and more informed patients being part of care decisions, demand for PHR software has seen an upsurge. PHR software empowers patients to manage their own health data for improved healthcare outcomes – something endorsed by the American Medical Association who emphasizes its significance.

Integrating Wearable Technology

Wearable technology integration is an important driving factor of PHR software usage. Fitness trackers and smartwatches are becoming more prevalent, producing large amounts of health data which can be managed and analyzed effectively using PHR software. A report by International Data Corporation (IDC) forecasts rapid expansion in wearable device usage which should drive growth in PHR software sales markets indirectly.

Government Initiatives and Support

Government policies and initiatives play a crucial role in driving the PHR software market forward. Governments around the world have played an key role in encouraging digital health records through incentives and regulations; one such measure being the Health Information Technology for Economic and Clinical Health Act (HITECH), which offers financial incentives for adopting electronic health records – hence indirectly encouraging use of PHR software.

Restraints

Data Privacy and Security Issues

Privacy and security concerns pose major barriers for PHR software markets. Given the sensitive nature of health data, stringent security measures must be in place. Incidents of data breaches in healthcare are of particular concern among users; reports published by HIPAA Journal highlight an increase in such breaches, further underscoring how challenging it is for the PHR software market to ensure data security.

High Cost of Implementation and Maintenance

Implementation and ongoing maintenance costs can be an obstacle for healthcare providers, particularly smaller practices. These expenses cover not only purchasing the software itself but also training staff on its use and system upgrades. A study from the American Hospital Association (AHA) suggests that financial constraints pose an impediment to adopting digital technologies by these small providers.

Lack of Technical Know-How among End-Users

For effective use of PHR software to be realized, many end-users require technical expertise which many lack. This leads to underutilization of its capabilities, which limits effectiveness. Pew Research Center’s survey on digital literacy highlights varying levels of technical ability among general populations that negatively impacts adoption of digital health tools.

Resistance to Change in Healthcare Practices

Resistance to change among healthcare providers can impede adoption of PHR software. Many professionals may be used to using conventional record-keeping methods and be reluctant to switch over to digital systems. According to research by Journal of Medical Internet Research, change resistance is a common barrier in adopting healthcare technology solutions.

Opportunities

Emerging Market Adoption

Emerging markets offer incredible growth prospects for PHR software providers. As these countries improve their healthcare infrastructure, digital health solutions have seen increased adoption – such as India and China’s rapid healthcare digitization efforts which offer PHR vendors with vast customer bases to target. A report by Deloitte detailing global healthcare trends highlights this rapid digital transformation in emerging markets.

Advancements in Artificial Intelligence (AI) and Machine Learning (ML)

Integrating AI and ML technologies into PHR software presents an immense growth opportunity, as these technologies can analyze large datasets to provide personalized healthcare as well as predictive analytics insights. As evidenced by McKinsey & Company’s report which predicted significant expansion for AI healthcare applications.

Collaborations with Insurance Companies

Partnerships between PHR software vendors and insurance providers offer another growth avenue for the market. Insurance providers can leverage patient data from PHR systems for risk analysis and personalized policy offerings; furthermore, such collaborations may also improve healthcare outcomes and patient engagement – something Forbes recently highlighted by spotlighting increasing partnerships between digital health companies and insurance firms.

Expansion of Telehealth Services

Telehealth’s expansion has opened doors for PHR software development companies. With an increase in remote healthcare delivery comes a greater demand for effective health record management systems; PHR software plays an essential role in providing seamless access to health records both patients and healthcare providers in telehealth settings. According to The Global Telehealth Market Report, this trend indicates further expansion which should bode well for the market of PHR software applications.

Trends

Mobile Health (mHealth) Integration

PHR software integration with mobile health applications has become an emerging trend, particularly with smartphones being so widespread. Mobile health apps have quickly become an integral component of healthcare delivery; when combined with PHR software they provide easy access to health records.

Compliance With Healthcare Regulations

With HIPAA in the US and GDPR in Europe constantly evolving, compliance is an integral component of PHR software market trends. PHR software must adapt as regulations become stricter to remain compliant. Recent updates by Office for Civil Rights on HIPAA highlight this key component of managing health information effectively.

Implementation of Blockchain Technology for Data Security

Employing blockchain technology to enhance data security within PHR software is an emerging trend. Blockchain provides a secure and transparent means of managing health records while meeting privacy concerns. A study published by Journal of Medical Systems highlights its potential as a transformational change agent within healthcare data management.

Regional Analysis

In 2023, the global Personal Health Record (PHR) Software Market exhibited a notable regional disparity, with North America emerging as the dominant region in the market landscape. North America secured a commanding market position, capturing a substantial share of over 50.2%, and boasting a market value of USD 4.6 Billion for the year.

North America’s advanced healthcare infrastructure combined with high levels of technology adoption played a critical role in driving widespread implementation of personal health record solutions. Furthermore, favorable government initiatives and policies that encourage digitization further boosted demand for PHR software products in North America.

North America’s market dominance can be attributed to key market players and ongoing advancements in healthcare IT solutions, with industry leaders at the forefront of developing cutting-edge PHR software for meeting both healthcare providers’ and patients’ evolving needs.

Rising consumer awareness about the advantages of digital health records – such as improved access to medical information and increased patient engagement – has contributed significantly to North America’s rising adoption of Personal Health Record software.

Asia-Pacific is expected to experience explosive growth in the PHR Software Market due to rising healthcare expenditures, increased awareness of digital health solutions and efforts to modernize healthcare infrastructure. On the other hand, Europe should experience steady market share gains with its established healthcare system and emphasis on patient-centric care.

North America led the Personal Health Record Software Market in 2023 but with promising prospects of growth across other regions. As healthcare continues to evolve globally, regional differences in market trends and drivers will play a vital role in shaping its trajectory over time.

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

Personal Health Record Software Market is marked by a competitive landscape where each key player contributes distinct strengths. Epic stands out in particular due to their user-friendly interfaces and seamless integration with healthcare systems – which results in an improved experience for both healthcare providers and patients alike. Their widespread adoption across major healthcare institutions further strengthens Epic’s market dominance.

Cerner Corporation brings innovation to healthcare technology. Renowned for their focus on interoperability and data analytics, their solutions give healthcare professionals valuable insights. Their user-friendly software enhances patient engagement while meeting industry demands.

Allscripts Healthcare Solutions Inc. stands out by offering innovative PHR Software solutions with unparalleled flexibility. Their adaptable approach caters to diverse healthcare settings from large hospitals to smaller clinics while their emphasis on customization enables healthcare providers to customize solutions according to individual patient requirements, creating a responsive ecosystem.

Athenahealth Inc. offers healthcare providers an innovative cloud-based solution, emphasizing data accessibility and scalability through their PHR Software. Their commitment to simplicity and efficiency resonates with healthcare providers looking for more streamlined processes and improved patient outcomes.

Apart from these key players, the Personal Health Record Software Market sees participation by other contributors ranging from emerging startups to established entities, bringing diversity and dynamism to the market. Collaborative landscape fosters healthy competition that drives ongoing innovation of PHR Software solutions.

Market Key Players

- Epic Systems Corporation

- Cerner Corporation

- Allscripts Healthcare Solutions Inc.

- Athenahealth Inc.

- McKesson Corporation

- eClinicalWorks LLC

- Greenway Health LLC

- MEDITECH

- GE Healthcare

- CareCloud Corporation

- Amazing Charts LLC

- Other Key Players

Recent Developments

- In October 2024: Epic Systems Corporation played a significant role in setting up virtual wards through a collaboration with three NHS Foundation Trusts in England. This initiative aimed to alleviate hospital capacity issues by enabling acute care in patients’ homes, supported by Epic’s software. This effort successfully cared for 1,800 patients in its first year and freed over 4,000 bed hours, showcasing a substantial impact on improving healthcare delivery and efficiency.

- In November 2023: Athenahealth collaborated with CVS Health to launch a joint Personal Health Record (PHR) platform. This new platform integrates Athena’s Electronic Health Records (EHR) capabilities with CVS’s extensive pharmacy data, offering a more comprehensive overview of patient health.

- In June 2022: Oracle Corporation completed the acquisition of Cerner Corporation. This major transaction was valued at approximately $28.3 billion. The acquisition was finalized after a majority of Cerner’s shares were tendered, with about 69.2% of the total shares being validly tendered. This strategic move aims to redefine the future of healthcare by integrating Cerner’s robust health IT solutions into Oracle’s extensive cloud infrastructure, promising significant advancements in healthcare IT and patient care.

Report Scope

Report Features Description Market Value (2023) US$ 9.2 Billion Forecast Revenue (2033) US$ 21.7 Billion CAGR (2024-2033) 9.0% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Deployment (Cloud-Based, Web-Based), By Component (Software & Mobile Applications, Service), By Architecture (Payer-Tethered, Provider-Tethered, Standalone) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Epic Systems Corporation, Cerner Corporation, Allscripts Healthcare Solutions Inc., Athenahealth Inc., McKesson Corporation, eClinicalWorks LLC, Greenway Health LLC, MEDITECH, GE Healthcare, CareCloud Corporation, Amazing Charts LLC, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Personal Health Record Software MarketPublished date: Nov 2024add_shopping_cartBuy Now get_appDownload Sample

Personal Health Record Software MarketPublished date: Nov 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Epic Systems Corporation

- Cerner Corporation

- Allscripts Healthcare Solutions Inc.

- Athenahealth Inc.

- McKesson Corporation

- eClinicalWorks LLC

- Greenway Health LLC

- MEDITECH

- GE Healthcare

- CareCloud Corporation

- Amazing Charts LLC

- Other Key Players