Global Car Parts Market By Product Type (Engine Parts, Transmission Parts, Brake System Parts, Electrical Components, Suspension and Braking Systems, Body and Interior Components, Fuel and Emission Components, Exhaust System, Others), By Sales Channel (OEM, Aftermarket), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec 2024

- Report ID: 134156

- Number of Pages: 257

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

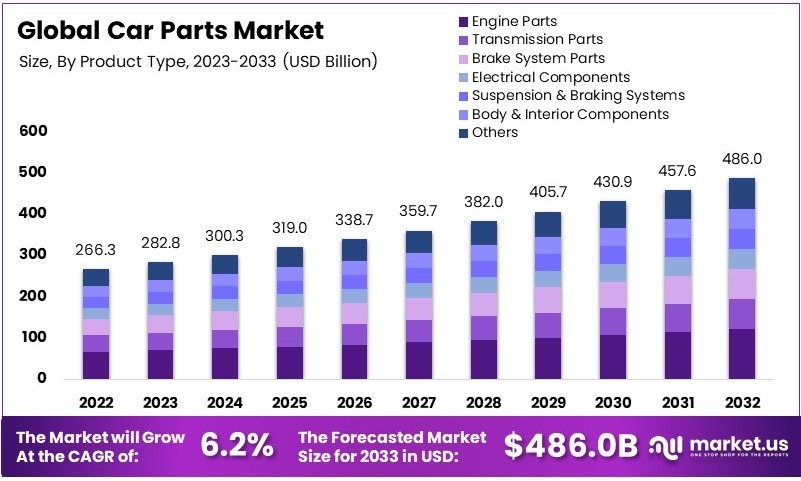

The Global Car Parts Market size is expected to be worth around USD 486.0 Billion by 2033, from USD 266.3 Billion in 2023, growing at a CAGR of 6.2% during the forecast period from 2024 to 2033.

Car parts are essential components used to assemble or repair vehicles. These include items like engines, brakes, suspension systems, and electronic parts. They ensure the functionality, safety, and performance of vehicles. Additionally, car parts are critical for maintenance and repair, keeping vehicles operational over their lifespan.

The car parts market refers to the industry involved in the production, supply, and sale of these components. It serves a wide range of customers, including manufacturers, repair shops, and individual car owners. Moreover, the market supports the global automotive industry by ensuring access to reliable parts for various vehicle types.

The car parts market is expanding steadily due to high vehicle ownership rates. 91.7% of U.S. households owned at least one vehicle in 2022, and 22.1% owned three or more, according to Forbes Advisor. Consequently, the demand for replacement and upgraded parts is rising, driven by the need for repairs and enhanced performance.

Government policies promoting electric vehicles (EVs) are shaping the market. For instance, EV-specific components like batteries and charging equipment are gaining traction. Meanwhile, intense competition encourages manufacturers to focus on affordability and innovation. As a result, advanced and efficient products are being introduced to meet evolving consumer needs.

The market faces moderate saturation in urban areas but sees opportunities in rural regions. Additionally, vehicle ownership costs averaging over $12,000 annually, as reported by AAA, drive consumers to seek cost-effective parts. Thus, the demand for durable and value-driven solutions positions the market for sustained growth.

On a broader scale, globalization strengthens supply chains, allowing manufacturers to scale operations efficiently. Locally, higher vehicle density in urban centers increases demand for essential parts like brakes and tires. Consequently, global trends and local dynamics together foster growth opportunities for innovative and adaptive businesses.

Key Takeaways

- The Car Parts Market was valued at USD 266.3 billion in 2023 and is projected to reach USD 486.0 billion by 2033, with a CAGR of 6.2%.

- In 2023, Engine Parts accounted for 24.8% of the product type segment, underscoring their essential role in vehicle performance.

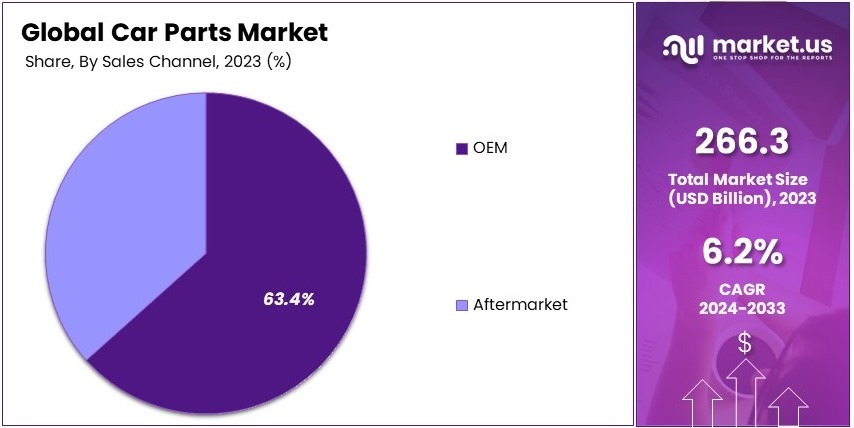

- In 2023, the OEM sales channel held 63.4% of the market, reflecting strong relationships between manufacturers and automotive companies.

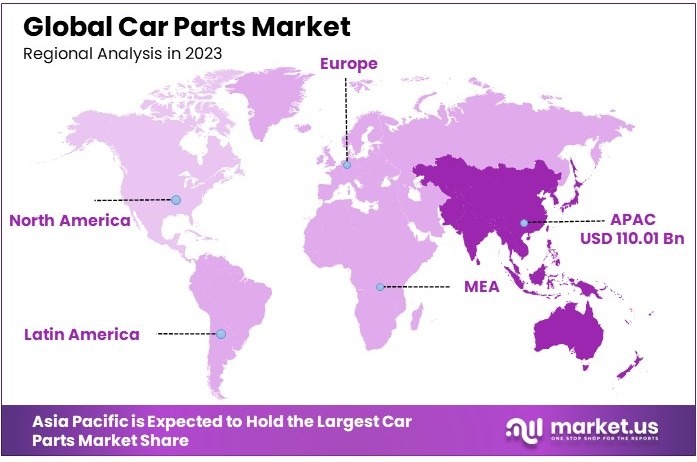

- In 2023, Asia-Pacific (APAC) led the market with a 41.3% share, equivalent to USD 110.01 billion, driven by the region’s robust automotive industry growth.

Product Type Analysis

Engine Parts dominate the Car Parts Market with 24.8% due to their critical role in vehicle performance and maintenance.

In the Car Parts Market, Engine Parts emerge as the dominant sub-segment, accounting for 24.8% of the market share. This dominance is attributed to the essential nature of these components in ensuring optimal vehicle performance and longevity. Engine parts, including pistons, crankshafts, and camshafts, are fundamental for the proper functioning of a car, driving demand across both OEM and aftermarket channels.

Transmission parts, holding an 11.3% market share, are crucial for the transmission system’s operation, affecting the vehicle’s efficiency and drive quality. Their role in enhancing fuel economy and providing smoother ride dynamics contributes significantly to the market.

Brake system parts, which account for 7.9% of the market, are vital for vehicle safety. Their development focuses on enhancing the reliability and performance of braking systems, which is critical for all vehicle types.

Electrical components make up 14.7% of the market. As vehicles incorporate more digital features, the demand for advanced electrical components, including sensors and ECUs, grows, reflecting the sector’s adaptation to modern automotive technologies.

Also at 7.9%, suspension and braking systems are essential for vehicle stability and comfort. Innovations in this area continue to improve ride quality, which is a key selling point for new models.

Comprising 12.4% of the market, body and interior components are integral to the aesthetic and functional aspects of vehicle design. This segment’s growth is propelled by consumer demand for more luxurious and comfortable interiors.

Fuel and emission components, which hold a 5.6% market share, are increasingly significant due to tightening global emission standards. Innovations in this segment focus on reducing emissions and increasing efficiency.

The Exhaust System, making up 4.6% of the market, plays a critical role in emissions control. Technological advancements are central to developing more efficient and less pollutive systems.

Other components, including a variety of miscellaneous car parts, account for 10.8% of the market. This segment includes niche parts that cater to specific aftermarket upgrades and customizations.

Sales Channel Analysis

OEM dominates the sales channel in the Car Parts Market with 63.4% due to the guarantee of part compatibility and reliability.

OEM (Original Equipment Manufacturer) parts lead the sales channel with a 63.4% market share, preferred for their guaranteed compatibility and reliability. These parts are the first choice for consumers looking for maintenance and repairs during the warranty period of their vehicles, as they ensure compliance with vehicle specifications and performance standards.

The Aftermarket sector, which constitutes 36.6% of the market, offers a variety of parts often used for replacements and upgrades beyond the original warranty. This sector allows consumers to access a broader range of options, often at lower costs, and includes parts that can enhance performance or customize the vehicle’s aesthetics.

The detailed analysis of each segment within the Car Parts Market reveals a diverse and dynamic industry driven by technological advancements, regulatory changes, and consumer preferences. Understanding these sub-segments and their contributions to the market helps in pinpointing trends, opportunities, and challenges within the automotive sector.

Key Market Segments

By Product Type

- Engine Parts

- Transmission Parts

- Brake System Parts

- Electrical Components

- Suspension and Braking Systems

- Body and Interior Components

- Fuel and Emission Components

- Exhaust System

- Others

By Sales Channel

- OEM

- Aftermarket

Drivers

Rising Demand for Fuel-Efficient Parts Drives Market Growth

The increasing emphasis on fuel efficiency and environmental sustainability significantly drives the growth of the car parts market. Consumers are actively seeking lightweight materials and advanced designs that enhance fuel economy while reducing emissions. These innovations align with stringent environmental regulations, encouraging manufacturers to produce parts that cater to eco-conscious buyers.

Furthermore, the expansion of automotive aftermarket services provides cost-effective solutions for vehicle repairs and upgrades. These services improve vehicle performance and lifespan, increasing the demand for replacement parts. The rise in electric and hybrid vehicle production further boosts the market.

Specialized components like high-capacity batteries, regenerative braking systems, and energy-efficient tires cater to this rapidly growing segment. Lastly, advancements in vehicle durability have extended their operational lifespans. This trend ensures a consistent need for high-quality replacement parts, keeping the market robust.

Restraints

Fluctuating Prices of Raw Materials Restraints Market Growth

The car parts market faces notable restraints due to fluctuating raw material prices, impacting production costs and profitability. Metals like aluminum, steel, and rare earth metals experience frequent price changes, creating unpredictability for manufacturers. This volatility disrupts supply chains and forces companies to adjust pricing, which can erode market competitiveness.

High initial investments in advanced manufacturing technologies further limit the entry of smaller players and slow the adoption of innovative production methods. These costs are especially challenging in developing regions where resources are limited.

Another critical issue is the proliferation of counterfeit car parts, which not only undermines revenue for genuine manufacturers but also endangers consumer safety. These substandard products reduce trust in established brands and complicate enforcement of quality standards.

Lastly, stringent environmental regulations on production processes add to operational complexities. Complying with these regulations often requires costly modifications to existing facilities, which can delay market expansion. These combined factors present significant barriers to growth.

Opportunity

Surge in Demand for Lightweight Components Provides Opportunities

The rising demand for lightweight components presents substantial opportunities in the car parts market. Lightweight materials such as carbon fiber and aluminum are increasingly used to improve vehicle performance and reduce emissions. These materials help manufacturers meet global sustainability goals while appealing to eco-conscious consumers.

Additionally, innovations in 3D printing offer cost-effective and customizable solutions for component production. This technology enables rapid prototyping and efficient manufacturing processes, reducing overall costs.

Subscription-based models for spare parts are also gaining popularity, providing consumers with regular access to essential components at manageable costs. These models encourage brand loyalty and increase recurring revenue for manufacturers.

Moreover, the growing demand for remanufactured and recyclable parts reflects a broader shift toward circular economies. Manufacturers focusing on sustainable and cost-effective products stand to gain significant advantages in this evolving market.

Challenges

Global Supply Chain Disruptions Challenge Market Growth

Global supply chain disruptions pose significant challenges to the car parts market, particularly in maintaining consistent production and delivery timelines. Events such as the COVID-19 pandemic and geopolitical conflicts have highlighted vulnerabilities in sourcing raw materials and components.

Manufacturers often face delays and increased costs, which impact their ability to meet market demand. Dependency on skilled labor for producing precision components further exacerbates these challenges. A shortage of trained professionals increases production costs and limits scalability, especially for advanced or custom parts.

Rapid technological changes in automotive design add another layer of complexity, requiring constant adaptation and innovation from manufacturers. This dynamic environment raises costs and risks for companies unable to keep pace.

Additionally, limited adoption of advanced car parts in developing regions due to low awareness and insufficient infrastructure hampers market penetration. Overcoming these challenges requires strategic investments in supply chain resilience and workforce development.

Growth Factors

Urbanization Leading to Increased Vehicle Usage Is a Growth Factor

Urbanization is a major growth driver for the car parts market as more people migrate to cities and rely on vehicles for transportation. This increase in vehicle ownership boosts demand for replacement parts and accessories to maintain and upgrade vehicles.

Shared mobility services, such as ride-sharing and car rental platforms, further amplify this demand. These services require frequent maintenance and replacement of components due to higher usage rates, creating opportunities for manufacturers and suppliers.

The growing popularity of in-vehicle technology upgrades is another significant factor driving market growth. Consumers are increasingly interested in enhancing their driving experience with advanced features like infotainment systems, connected devices, and enhanced safety technologies.

The expansion of e-commerce platforms for car parts also plays a pivotal role in market growth. Online sales channels provide consumers with access to a wide range of products, competitive prices, and convenient delivery options. This digital shift has also enabled small and medium-sized players to expand their reach and tap into global markets.

Emerging Trends

Integration of IoT in Car Parts Is Latest Trending Factor

The integration of IoT technology into car parts is revolutionizing the market by enhancing efficiency and functionality. IoT-enabled components, such as predictive maintenance systems and smart sensors, provide real-time monitoring and diagnostics, reducing vehicle downtime. These innovations improve vehicle performance and appeal to tech-savvy consumers.

Smart parts designed for autonomous vehicles are also gaining traction, contributing to advancements in safety and convenience. Moreover, the adoption of advanced materials like carbon fiber supports the production of durable and lightweight components.

These materials not only enhance vehicle efficiency but also align with global sustainability efforts. Customizable components are another key trend, reflecting consumers’ desire for personalized solutions.

Modular designs and tailored options allow manufacturers to cater to diverse consumer preferences, further driving market growth. These trends underscore the importance of technology and innovation in shaping the future of the car parts market.

Regional Analysis

Asia Pacific Dominates with 41.3% Market Share

Asia Pacific leads the Car Parts Market with a commanding 41.3% market share, valued at USD 110.01 billion. This dominance is driven by rapid industrialization, the rise of automotive manufacturing hubs, and increasing vehicle ownership across the region. Countries like China, India, and Japan are key contributors to this market strength.

Key factors fueling this dominance include cost-effective manufacturing, abundant raw materials, and a skilled labor force. Asia Pacific is home to several of the world’s largest car manufacturers, which creates a strong demand for locally produced car parts. Additionally, rising disposable incomes and a growing middle-class population are increasing the demand for both new vehicles and replacement parts.

The region’s focus on technological innovation further enhances market performance. Investments in smart manufacturing and electric vehicle components are reshaping the industry. Strong export capabilities enable Asia Pacific to cater to global demand, reinforcing its leadership position in the car parts market.

Regional Mentions

- North America: North America maintains a strong market share with high demand for premium car parts and advanced vehicle technologies. The region benefits from well-established automotive manufacturers and high consumer spending.

- Europe: Europe emphasizes sustainable and eco-friendly car parts, driven by stringent environmental regulations. The region also excels in high-quality engineering and innovation in luxury vehicle components.

- Middle East & Africa: The Middle East and Africa show steady growth, with increasing investments in vehicle maintenance and customization. Rising demand for affordable spare parts supports regional development.

- Latin America: Latin America is emerging as a growth market for car parts, driven by rising vehicle sales and expanding industrial capabilities. The region’s focus on low-cost manufacturing contributes to its competitive edge.

Key Regions and Countries covered in the report

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The Car Parts Market is led by prominent companies, including Bosch Group, Denso Corporation, ZF Friedrichshafen AG, and Magna International Inc. These market leaders are recognized for their advanced technology, comprehensive product portfolios, and global distribution networks.

Bosch Group is a dominant player known for its innovative automotive components and systems. Its extensive range includes braking systems, electronics, and drivetrain components, which are integral to modern vehicles. The company’s commitment to research and development positions it as a leader in advancing technologies like electric and automated vehicle systems.

Denso Corporation is a key contributor to the market, specializing in advanced automotive technologies. Denso focuses on thermal systems, powertrains, and electric vehicle components. Its strategic investments in sustainable technologies align with global trends toward eco-friendly mobility solutions.

ZF Friedrichshafen AG stands out with its expertise in driveline and chassis technology. The company is a leader in safety systems, transmission solutions, and autonomous driving technologies. ZF’s emphasis on electrification and connectivity makes it a strong player in the evolving automotive landscape.

Magna International Inc. is renowned for its diverse car parts offerings, including powertrain components, seating systems, and vehicle structures. With a global manufacturing footprint, Magna delivers innovative and lightweight solutions that cater to industry demands for efficiency and sustainability.

These top players differentiate themselves through innovation, strategic collaborations, and a strong focus on customer needs. Their leadership drives advancements in safety, electrification, and efficiency within the car parts market. As the automotive industry shifts toward electrification and automation, these companies are expected to play pivotal roles in shaping its future.

Top Key Players in the Market

- Bosch Group

- Denso Corporation

- ZF Friedrichshafen AG

- Magna International Inc.

- Continental AG

- Aisin Seiki Co. Ltd

- Faurecia

- Valeo

- Johnson Controls

- Delphi Technologies

- Hyundai Mobis

- Schaeffler Group

- Others

Recent Developments

- CarParts.com’s “Now That’s My Speed” Campaign: In June 2024, CarParts.com, Inc. launched its first major brand marketing campaign in over 25 years, titled “Now That’s My Speed.” The campaign emphasizes the company’s offering of over one million quality parts accessible via their user-friendly app, aiming to alleviate the hassle associated with automotive maintenance and repair.

- Great Wall Motors’ Manufacturing Project in Egypt: In December 2024, Great Wall Motors announced plans to establish a car and spare parts production facility within Egypt’s Suez Canal Economic Zone. This strategic move aims to meet local demand and expand exports to regional and global markets, with the Egyptian government offering special investment incentives to support the project.

- Honda Racing Corporation’s Performance Parts for Road Cars: In October 2024, Honda Racing Corporation USA announced the creation of a unit dedicated to producing authentic performance parts for Honda and Acura street, track, and off-road vehicles. This development marks HRC’s expansion into the consumer market, offering high-performance equipment and upgrades derived from their motorsports expertise to enhance the driving experience for enthusiasts.

Report Scope

Report Features Description Market Value (2023) USD 266.37 Billion Forecast Revenue (2033) USD 486.0 Billion CAGR (2024-2033) 6.2% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Engine Parts, Transmission Parts, Brake System Parts, Electrical Components, Suspension and Braking Systems, Body and Interior Components, Fuel and Emission Components, Exhaust System, Others), By Sales Channel (OEM, Aftermarket) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Bosch Group, Denso Corporation, ZF Friedrichshafen AG, Magna International Inc., Continental AG, Aisin Seiki Co. Ltd, Faurecia, Valeo, Johnson Controls, Delphi Technologies, Hyundai Mobis, Schaeffler Group, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Bosch Group

- Denso Corporation

- ZF Friedrichshafen AG

- Magna International Inc.

- Continental AG

- Aisin Seiki Co. Ltd

- Faurecia

- Valeo

- Johnson Controls

- Delphi Technologies

- Hyundai Mobis

- Schaeffler Group

- Others