Global Automotive Engine Market By Placement Type(In-line Engine, V-type Engine, W Engine), By Fuel Type(Gasoline, Diesel, Other Fuel Types), By Vehicle Type(Passenger Vehicles, Light Commercial Vehicles (LCV), Heavy Commercial Vehicles (HCV)), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: October 2024

- Report ID: 39912

- Number of Pages: 275

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

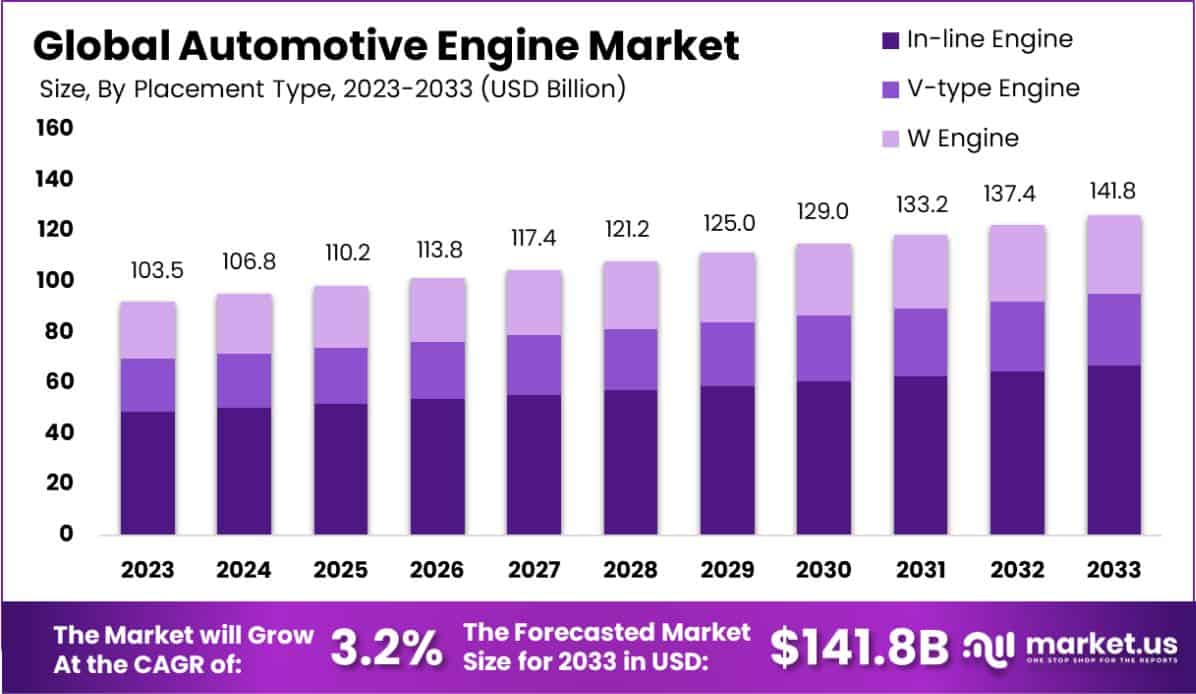

The Global Automotive Engine Market size is expected to be worth around USD 141.8 Billion by 2033, from USD 103.5 Billion in 2023, growing at a CAGR of 3.2% during the forecast period from 2024 to 2033. North America dominated a 35.3% market share in 2023 and held USD 36.5 Billion in revenue from the Automotive Engine Market.

An automotive engine is a power unit that propels vehicles by converting fuel energy into mechanical energy. It typically operates through internal combustion processes, using either gasoline, diesel, or alternative fuels to drive the vehicle’s movement. The combustion of fuel within a confined space generates power, triggering the movement of pistons connected to a crankshaft.

The automotive engine market involves producing, distributing, and selling engines for various vehicle types, encompassing passenger cars, trucks, and buses. It is driven by factors such as technological advancements, regulatory norms related to emissions, and the increasing demand for fuel-efficient vehicles. The market’s dynamics are influenced by the automotive industry’s trends, including shifts towards electric vehicles (EVs) and hybrid technologies.

The growth of the automotive engine market can be attributed to stringent environmental regulations that mandate lower emissions and higher fuel efficiency. Manufacturers are innovating with advanced engine technologies that meet these standards while enhancing performance.

Increased demand in the automotive engine market is propelled by rising vehicle sales in emerging economies due to growing urbanization and economic development. This uptick in vehicle ownership creates a robust demand for efficient and reliable engines.

Emerging opportunities within the automotive engine market include the integration of hybrid and electric powertrains. This shift is driven by a global push towards sustainability, presenting engine manufacturers with prospects to innovate and expand into new, greener technologies.

The automotive engine market is navigating a transformative era, marked by significant technological and regulatory shifts. This sector, foundational to global transportation, is increasingly influenced by the push towards lower emissions and enhanced fuel efficiency.

Strategic investments by governments and private entities are pivotal in shaping the market’s trajectory. Notably, the UK government’s commitment through the Advanced Propulsion Centre, with an £85.8 million funding package, underscores a robust move towards zero-emission vehicle technologies.

This initiative includes a significant £59.9 million allocation under the Collaborative Research and Development program, complemented by a £29.6 million grant from the Department for Business and Trade. Furthermore, the Technology Developer Accelerator Programme’s allocation of over £2.3 million to 14 companies catalyzes innovation in automotive projects.

Across the Atlantic, the U.S. Department of Treasury’s injection of approximately $51 billion into General Motors via the Automotive Industry Financing Program during the financial crisis highlights a strategic intervention aimed at stabilizing and subsequently stimulating the automotive sector.

These investments not only bolster technological advancements but also stimulate market growth by facilitating the development of next-generation automotive engines. The strategic influx of funds is critical in driving forward the market’s adaptation to emergent technologies and regulatory demands, positioning it for sustained growth and innovation in the evolving global economic landscape.

Key Takeaways

- The Global Automotive Engine Market size is expected to be worth around USD 141.8 Billion by 2033, from USD 103.5 Billion in 2023, growing at a CAGR of 3.2% during the forecast period from 2024 to 2033.

- In 2023, In-line Engine held a dominant market position in the Placement Type segment of the Automotive Engine Market, with a 47.2% share.

- In 2023, Gasoline held a dominant market position in the Fuel Type segment of the Automotive Engine Market, with a 38% share.

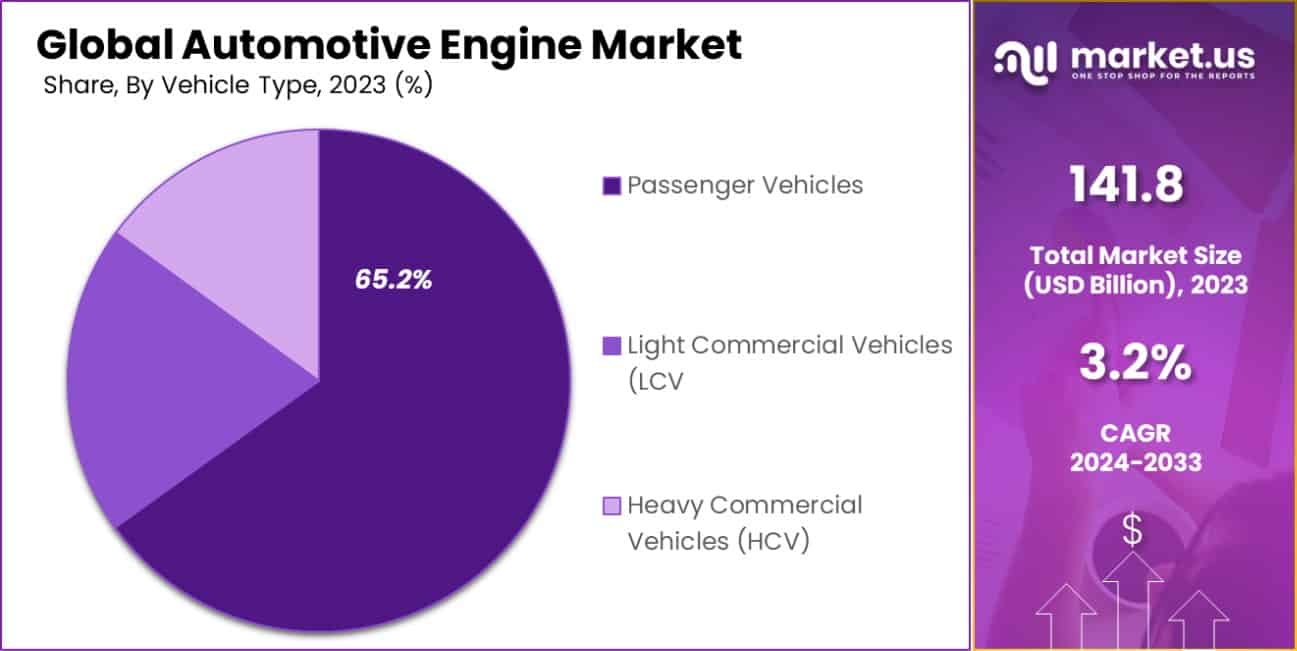

- In 2023, Passenger Vehicles held a dominant market position in the by-vehicle type segment of the Automotive Engine Market, with a 65.2% share.

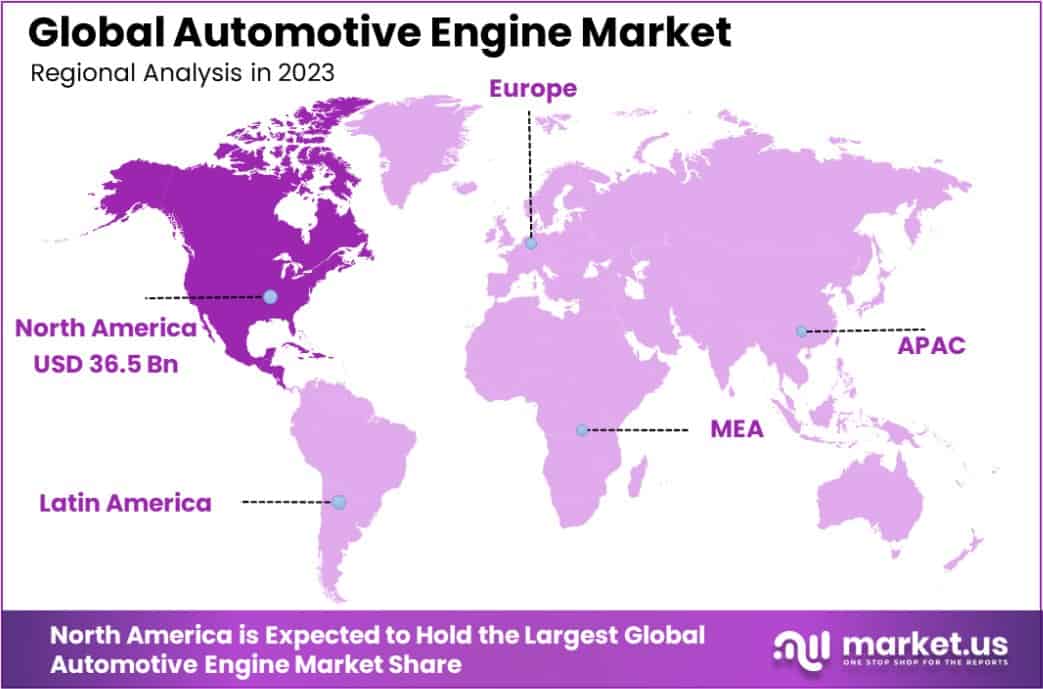

- North America dominated a 35.3% market share in 2023 and held USD 36.5 Billion in revenue from the Automotive Engine Market.

By Placement Type Analysis

In 2023, the by-placement type segment of the Automotive Engine Market saw the In-line Engine taking a leading position, capturing a 47.2% share. This engine type’s popularity stems from its streamlined design and efficiency, which are highly valued in consumer and commercial vehicles.

Following the In-line Engine, the V-type Engine also held a significant portion of the market, appreciated for its power output and compact design, making it ideal for performance-oriented vehicles. The W Engine, though less common, is recognized for its high-performance capabilities in luxury and high-end sports cars, serving a niche yet valuable market segment.

The dominance of the In-line Engine is attributed to its widespread application across various vehicle segments, from economy to premium models, due to its balance of performance and cost-effectiveness.

Manufacturers favor this engine for its simpler construction and lower manufacturing costs, which align well with the industry’s push toward more economically efficient automotive solutions.

As automakers continue to innovate and seek efficient yet powerful solutions, the In-line Engine’s versatility and adaptability are expected to sustain its market prevalence. Meanwhile, the demand for V-type and W Engines will continue to be driven by specific performance requirements and consumer preferences for more dynamic and luxurious driving experiences.

By Fuel Type Analysis

In 2023, Gasoline engines maintained a dominant market position in the By Fuel Type segment of the Automotive Engine Market, securing a 38% share. This dominance can be attributed to the widespread availability of gasoline and its established infrastructure globally, which ensures continued preference among consumers and manufacturers.

Diesel engines, known for their efficiency and durability, captured a significant market segment, favored particularly in commercial vehicles and in regions with high diesel fuel availability. Other Fuel Types, which include hybrids and electric engines, are gradually gaining market share, reflecting the industry’s shift towards sustainable and alternative fuel technologies.

The prevalence of gasoline engines is driven by their lower initial cost compared to diesel and alternative fuel engines, as well as consumer familiarity and acceptance. However, the market is witnessing a gradual shift as environmental regulations become stricter and technology in electric and hybrid engines advances.

This shift indicates a potential decrease in gasoline’s market share in the coming years, as Other Fuel Types offer more environmentally friendly alternatives and are supported by government incentives. Diesel engines will continue to hold relevance in heavy-duty applications where their robustness and higher torque output are indispensable.

By Vehicle Type Analysis

In 2023, Passenger Vehicles held a dominant market position in the by-vehicle type segment of the Automotive Engine Market, commanding a 65.2% share. This segment’s strength is primarily driven by the high demand for personal transportation solutions globally, coupled with a broad spectrum of offerings ranging from entry-level to premium vehicles.

Following Passenger Vehicles, Light Commercial Vehicles (LCVs) accounted for a notable portion of the market. LCVs are increasingly preferred for their versatility and economic efficiency in urban logistics and small businesses.

Heavy Commercial Vehicles (HCVs), though smaller in market share, are essential in sectors like construction, mining, and large-scale logistics, relying on the robustness and high performance of their engines.

The market dominance of Passenger Vehicles is supported by ongoing innovations in engine technologies, which aim to enhance fuel efficiency and reduce emissions while maintaining performance. This trend is crucial in light of growing environmental concerns and stringent emission regulations.

As urbanization continues to rise, and economies expand, the demand for both LCVs and HCVs is expected to grow. These vehicles support commercial activities and infrastructure development, essential for economic growth, further diversifying the Automotive Engine Market’s landscape.

Key Market Segments

By Placement Type

- In-line Engine

- V-type Engine

- W Engine

By Fuel Type

- Gasoline

- Diesel

- Other Fuel Types

By Vehicle Type

- Passenger Vehicles

- Light Commercial Vehicles (LCV

- Heavy Commercial Vehicles (HCV)

Drivers

Key Drivers of Engine Market Growth

The growth of the automotive engine market is primarily driven by increasing vehicle production and the rising demand for fuel-efficient vehicles. As consumers become more environmentally conscious, there is a significant shift towards hybrid and electric engines, which are seen as more sustainable alternatives.

Additionally, technological advancements in engine design and materials have enabled manufacturers to develop engines that are not only more powerful but also lighter and more efficient.

Governments around the world are implementing stricter emissions regulations, compelling automakers to innovate and adapt, further fueling the demand for advanced automotive engines.

This regulatory push, combined with consumer preferences and technological innovations, is propelling the automotive engine market forward.

Restraint

Challenges Hindering Engine Market Growth

The automotive engine market faces significant challenges, primarily due to the strict emission regulations imposed worldwide. These regulations compel manufacturers to invest heavily in research and development to produce engines that meet these stringent standards, increasing the overall cost of production.

Additionally, the growing popularity of electric vehicles (EVs) poses a threat to traditional internal combustion engines (ICEs), as consumers and governments alike push for cleaner, more sustainable alternatives. This shift is reducing the demand for traditional engines, impacting market growth.

Furthermore, fluctuations in raw material prices also pose a challenge, affecting the stability of supply chains and increasing production costs, which can deter market growth in the automotive engine sector.

Opportunities

Expanding Opportunities in the Engine Market

The automotive engine market is witnessing expanding opportunities, particularly through the integration of hybrid technologies and the development of more fuel-efficient engines. As global environmental concerns rise, there is a clear shift towards vehicles that offer reduced emissions and better fuel economy.

This trend is opening doors for innovations in hybrid and downsized engines that provide the performance consumers expect while meeting eco-friendly standards. Additionally, emerging markets are experiencing rapid growth in vehicle sales, presenting a substantial opportunity for engine manufacturers to capitalize on new consumer bases.

The ongoing advancements in technology, such as turbocharging and direct fuel injection, also offer significant potential for growth by enhancing engine efficiency and performance, making this an exciting time for developments within the automotive engine sector.

Challenges

Key Challenges Facing Engine Market

The automotive engine market is navigating several challenges that could impact its growth. The shift towards electric vehicles (EVs) is one of the most significant hurdles, as it reduces the demand for traditional combustion engines. This transition is supported by government incentives and stricter emissions regulations aimed at combating climate change.

Additionally, the rising costs of raw materials and components are increasing production expenses for engine manufacturers, squeezing their profit margins. Supply chain disruptions, often caused by global trade tensions or pandemics, further complicate production schedules and inventory management.

These factors, combined with the rapid pace of technological change, require companies in the engine market to adapt quickly or risk falling behind in an increasingly competitive and evolving landscape.

Growth Factors

Driving Forces in the Engine Market

The automotive engine market is set for growth, driven by several key factors. Increasing global vehicle sales, particularly in emerging economies, fuel demand for new and efficient engines. Technological advancements are also crucial, as they allow for the development of engines that are not only more powerful but also more fuel-efficient and environmentally friendly.

This is particularly important as more consumers and governments demand lower emissions and better fuel economy. The rise of hybrid and alternative fuel vehicles also contributes to market growth, as these technologies require sophisticated engine designs.

Additionally, manufacturers are focusing on meeting stringent global emissions standards, driving innovation in engine technologies. Together, these factors are propelling the automotive engine market towards significant growth and transformation.

Emerging Trends

New Trends Shaping Engine Market

Emerging trends in the automotive engine market are set to transform the industry. A notable trend is the increasing adoption of electric and hybrid engines as alternatives to traditional combustion engines, driven by global efforts to reduce carbon emissions.

Additionally, there’s a growing emphasis on engine downsizing without sacrificing performance, achieved through technologies like turbocharging and advanced fuel injection systems. The integration of artificial intelligence and machine learning is also becoming prevalent, enhancing engine diagnostics, performance, and fuel efficiency.

Furthermore, the use of lightweight and high-strength materials in engine construction is helping to improve fuel economy and reduce vehicle emissions. These trends are not only shaping current market dynamics but are also paving the way for future developments in automotive engine technologies.

Regional Analysis

The global automotive engine market demonstrates significant regional disparities, driven by diverse economic conditions, technological adoption rates, and regulatory landscapes.

In North America, the market is robust, commanding a dominant 35.3% share valued at USD 36.5 billion, propelled by stringent emissions standards and high consumer demand for vehicles with advanced engine technologies, including hybrids and high-efficiency internal combustion engines.

Europe closely follows, with a strong emphasis on reducing carbon footprints, leading to increased investments in electric and hybrid engines, as well as innovations in diesel technology. The Asia Pacific region, however, is the fastest-growing market, driven by rising vehicle production and sales in countries like China and India, coupled with growing environmental awareness and tightening emissions regulations.

Conversely, the Middle East & Africa and Latin America markets are smaller but gradually expanding, as economic stability improves and demand for passenger vehicles increases, although they still face challenges such as lower technological adoption and fluctuating economic conditions.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In 2023, the global automotive engine market will be significantly influenced by key players such as AB Volvo, Cummins Inc., and Fiat Automobiles S.p.A. Each company brings distinct strengths and strategic approaches to the market, shaping industry dynamics and competitive landscapes.

AB Volvo has consistently focused on innovation in sustainable engine technologies, particularly in the realm of electric and hybrid engines. This aligns with global shifts toward environmental sustainability and positions Volvo strongly in regions with stringent emissions regulations. Their commitment to reducing the carbon footprint of their vehicle fleet by 2025 underpins their strategic initiatives and product developments.

Cummins Inc. is renowned for its expertise in diesel and natural gas engines, and in 2023, it has continued to excel by diversifying its offerings to include more environmentally friendly options, such as electrified power systems. Cummins’ investment in advanced technologies for fuel efficiency and reduced emissions continues to cater to the growing demand for sustainable industrial and commercial transportation solutions.

Fiat Automobiles S.p.A, part of the larger Stellantis group, leverages its vast market reach to adapt to changing consumer preferences and regulatory landscapes, particularly in Europe and Latin America. Fiat’s strategy includes enhancing its engine efficiency and integrating hybrid technologies into its popular models, aiming to maintain a competitive edge in a rapidly evolving market.

Overall, these companies exemplify the industry’s shift towards sustainability, with each leveraging its core competencies to adapt to the technological and environmental demands of the automotive sector. Their efforts are pivotal in driving the global automotive engine market towards a more sustainable future, highlighting the critical role of innovation and strategic adaptation in maintaining market leadership.

Top Key Players in the Market

- AB Volvo

- Cummins Inc.

- Fiat Automobiles S.p.A

- Volkswagen AG

- Ford Motor Co.

- Mitsubishi Heavy Industries, Ltd.

- General Motors

- Honda Motor Co., Ltd.

- Mercedes-Benz

- Renault Group

- Toyota Motor Corporation

- Honda Motor Co., Ltd

- Hyundai Motor Company

- Scania AB

- Toyota Motor Corp.

- Other Key Players

Recent Developments

- In September 2023, Mitsubishi Heavy Industries, Ltd. Invested $500 million in research for developing ultra-efficient jet engines, targeting a 30% reduction in fuel use.

- In August 2023, Ford Motor Co. Acquired a startup specializing in hybrid technology, aiming to integrate advanced hybrid systems into its 2025 lineup.

- In July 2023, Volkswagen AG Launched a new line of eco-friendly engines, enhancing fuel efficiency by 20% compared to previous models.

Report Scope

Report Features Description Market Value (2023) USD 103.5 Billion Forecast Revenue (2033) USD 141.8 Billion CAGR (2024-2033) 3.2% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Placement Type(In-line Engine, V-type Engine, W Engine), By Fuel Type(Gasoline, Diesel, Other Fuel Types), By Vehicle Type(Passenger Vehicles, Light Commercial Vehicles (LCV), Heavy Commercial Vehicles (HCV)) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape AB Volvo, Cummins Inc., Fiat Automobiles S.p.A, Volkswagen AG, Ford Motor Co., Mitsubishi Heavy Industries, Ltd., General Motors, Honda Motor Co., Ltd., Mercedes-Benz, Renault Group, Toyota Motor Corporation, Honda Motor Co., Ltd, Hyundai Motor Company, Scania AB, Toyota Motor Corp., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Automotive Engine MarketPublished date: October 2024add_shopping_cartBuy Now get_appDownload Sample

Automotive Engine MarketPublished date: October 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- AB Volvo

- Cummins Inc.

- Fiat Automobiles S.p.A

- Volkswagen AG

- Ford Motor Co.

- Mitsubishi Heavy Industries, Ltd.

- General Motors

- Honda Motor Co., Ltd.

- Mercedes-Benz

- Renault Group

- Toyota Motor Corporation

- Honda Motor Co., Ltd

- Hyundai Motor Company

- Scania AB

- Toyota Motor Corp.

- Other Key Players