Global Car Accessories Market By Product Type (Exterior Accessories, Interior Accessories, Performance Accessories, Electronics and Electrical Accessories, Car Care Accessories), By Vehicle Type (Passenger Cars, Commercial Vehicles, Electric Vehicles (EVs), Two-wheelers), By Price Range, By Sales Channel, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec 2024

- Report ID: 134155

- Number of Pages: 214

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

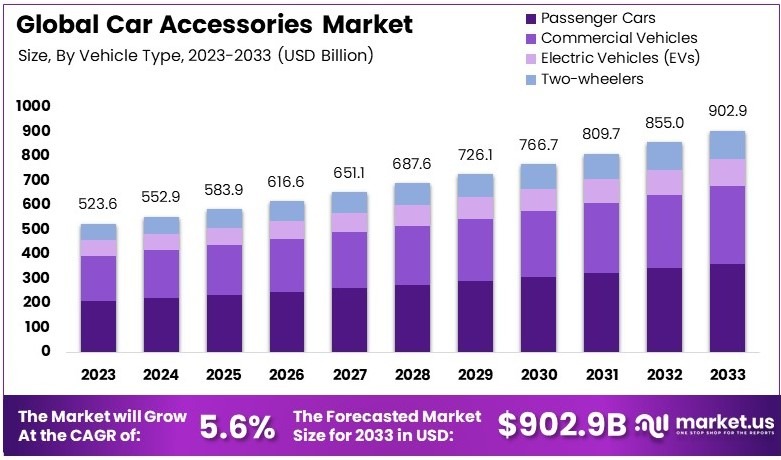

The Global Car Accessories Market size is expected to be worth around USD 902.9 Billion by 2033, from USD 523.6 Billion in 2023, growing at a CAGR of 5.6% during the forecast period from 2024 to 2033.

Car accessories are products designed to enhance a vehicle’s functionality, appearance, or comfort. These include items like seat covers, steering wheel grips, car mats, and exterior modifications. Notably, such accessories allow vehicle owners to customize their cars based on personal preferences and specific needs, improving overall convenience and driving experience.

The car accessories market refers to the industry involved in manufacturing and distributing these products. It covers a wide array of items ranging from functional upgrades to aesthetic enhancements. Consequently, this market caters to diverse consumer demands, including those seeking practical solutions and those focused on personalization and style.

The car accessories market is experiencing steady growth, supported by high vehicle ownership rates. 91.7% of U.S. households owned at least one vehicle in 2022, and 22.1% owned three or more, according to Forbes Advisor. Consequently, rising consumer interest in customization and functionality is driving consistent demand for accessories. Additionally, technological advancements have made products more innovative and user-friendly, enhancing customer satisfaction.

On the regulatory side, government incentives for electric vehicles (EVs) are shaping accessory trends. For instance, EV-specific products like charging station accessories are seeing greater demand. However, intense market competition pushes manufacturers toward innovation. As a result, businesses are focusing on cost-efficient and diversified solutions to capture a broader consumer base.

The car care products market is also experiencing robust growth, fueled by increased awareness of vehicle maintenance. With ownership costs exceeding $12,000 annually, according to AAA, consumers are prioritizing products that extend vehicle lifespan and reduce long-term expenses. Moreover, eco-friendly car care options are gaining traction, reflecting growing consumer preference for sustainable solutions.

Broader trends emphasize durability and performance, while local factors like heavy urban traffic boost demand for cleaning and protective products. Similarly, companies are developing advanced formulations tailored to specific consumer needs. This alignment with market demands is driving steady expansion and enabling businesses to differentiate competitively.

Key Takeaways

- The Car Accessories Market was valued at USD 523.6 Billion in 2023 and is expected to reach USD 902.9 Billion by 2033, with a CAGR of 5.6%.

- In 2023, Exterior Accessories dominated the product type segment due to their significant impact on vehicle aesthetics and functionality.

- In 2023, Passenger Cars led the market by vehicle type, reflecting the high ownership rates of personal vehicles.

- In 2023, the Premium price range held a significant market share, driven by consumer demand for high-quality products.

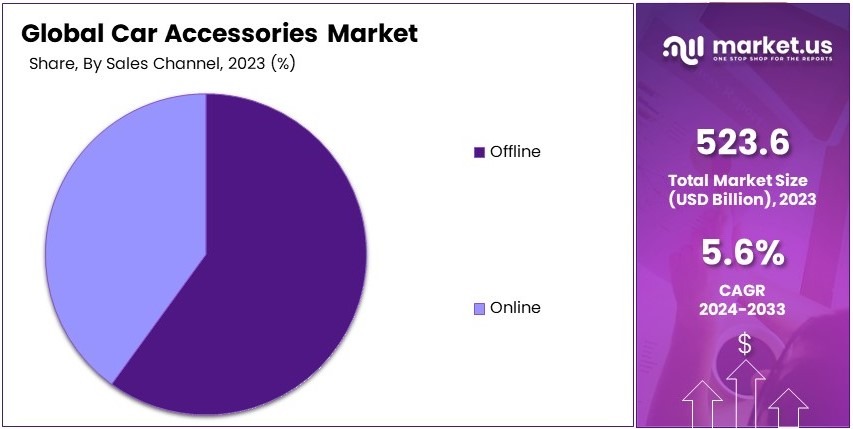

- In 2023, the Offline sales channel dominated, as customers preferred in-person purchases for car accessories.

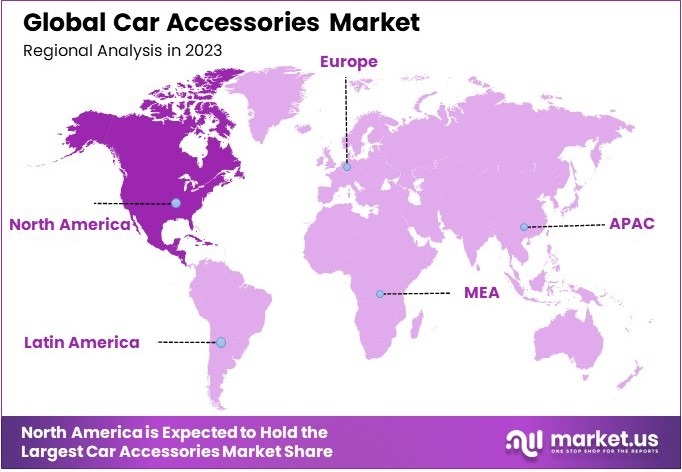

- In 2023, North America was the dominant region, attributed to high vehicle ownership and customization trends.

Type Analysis

Exterior Accessories dominate the Car Accessories Market due to their essential role in vehicle aesthetics and functionality.

The Car Accessories Market is broadly segmented into various product types, with Exterior Accessories standing out as the dominant sub-segment. These accessories, including items such as custom rims, spoilers, and body kits, are favored for their ability to enhance both the aesthetics and functionality of vehicles. Their popularity is driven by consumer demands for personalization, which not only improves the vehicle’s appearance but also potentially increases its resale value.

Interior Accessories enhance the comfort and aesthetic appeal of a car’s interior. Items such as custom seat covers, dashboard trims, and ambient lighting make up this segment. Though not as dominant as exterior accessories, they are essential for manufacturers focusing on luxury cars and comfort within the automotive space.

Performance Accessories include upgrades like engine modifications and exhaust systems. These accessories are crucial for improving a vehicle’s performance and efficiency, targeting car enthusiasts and owners interested in enhancing their vehicle’s power output.

This segment covers advanced infotainment systems and GPS trackers, reflecting the growing consumer preference for technological integration. These accessories are increasingly becoming standard features in new car models, driven by expectations for connectivity and enhanced navigational systems.

Car Care Products, such as cleaning kits and protective covers, play a supportive role in vehicle maintenance. They help extend the life and aesthetics of a vehicle, ensuring a consistent demand within the car accessories market.

Vehicle Type Analysis

Passenger Cars lead the market, driven by high ownership rates and extensive customization options.

Passenger cars are the primary segment in the Car Accessories Market, supported by widespread vehicle ownership and a diverse range of customization options. This segment benefits from continuous innovations in car manufacturing and the increasing trend of vehicle personalization among owners.

Commercial vehicles hold a significant market segment, with accessories like GPS systems and cargo management tools enhancing operational efficiency and functionality in commercial uses.

The Electric Vehicles segment is expanding rapidly, with accessories like specialized charging cables and battery enhancements gaining prominence as the adoption of EVs grows.

For two-wheelers, including motorcycles and scooters, accessories such as custom saddles and handle grips are vital, enhancing functionality and improving the rider experience.

Price Range Analysis

Premium accessories dominate the market as consumers are increasingly investing in high-quality, durable products.

Premium accessories lead the price range segment, appealing to consumers looking for high-quality, durable products that enhance performance and vehicle aesthetics. This preference is particularly strong among car owners who view their vehicle as a long-term investment.

Mid-range accessories provide a balance of quality and cost, appealing to a broad consumer base looking for good performance at a reasonable price.

Economy accessories cater to budget-conscious consumers needing basic enhancements or replacements at a low cost, maintaining inclusivity within the market.

Sales Channel Analysis

Offline sales channels continue to dominate due to consumer preference for physically inspecting products before purchase.

Offline sales lead in the Car Accessories Market, with consumers preferring to inspect products in person, a trend especially prevalent in markets focused on quality and compatibility assurance.

However, online sales are growing, driven by the convenience of browsing, comparisons, and home delivery services. This growth is supported by increasing consumer trust in e-commerce platforms.

Each segment and sub-segment contributes uniquely to the dynamics of the Car Accessories Market, reflecting the diversity of consumer preferences and the extensive range of available products. This detailed analysis underscores the complex and multifaceted nature of the market.

Key Market Segments

By Product Type

- Exterior Accessories

- Interior Accessories

- Performance Accessories

- Electronics and Electrical Accessories

- Car Care Accessories

By Vehicle Type

- Passenger Cars

- Commercial Vehicles

- Electric Vehicles (EVs)

- Two-wheelers

By Price Range

- Premium

- Mid-range

- Economy

By Sales Channel

- Online

- Offline

Drivers

Increasing Demand for Advanced Safety Features Drives Market Growth

The rising demand for advanced safety features is a key driver of the car accessories market. Consumers are prioritizing safety enhancements such as rearview cameras, parking sensors, and blind-spot monitoring systems. These features not only enhance driving safety but also align with increasing road safety regulations worldwide.

Additionally, the expansion of in-car infotainment systems, including touchscreen infotainment and advanced audio solutions, is gaining traction. Consumers now expect vehicles to double as entertainment hubs, further pushing demand for aftermarket upgrades.

Moreover, the growth of aftermarket services offers a cost-effective solution for vehicle owners to enhance functionality, enabling wider adoption of accessories. Finally, the increase in vehicle ownership in emerging economies contributes significantly to market expansion. As disposable incomes rise, more consumers are investing in both new vehicles and add-ons, creating a robust demand for a wide range of car accessories.

Restraints

High Costs of Advanced Accessories Restraints Market Growth

High costs of advanced accessories remain a significant challenge for market growth. Advanced systems like smart infotainment setups, ADAS technologies, and premium sound systems often come at a steep price, limiting their affordability for average consumers.

Compatibility issues further complicate the scenario, as not all accessories work seamlessly with every vehicle model. This results in additional costs for customization and fitting. Additionally, counterfeit products flooding the market undercut the sales of genuine products, harming the reputation of premium brands.

Regulatory constraints also act as a barrier, as governments impose strict laws on modifications that may impact vehicle safety or emissions compliance. These combined restraints slow the adoption of advanced car accessories across key consumer segments.

Opportunity

Integration of AR in Navigation Provides Opportunities

The integration of augmented reality (AR) in navigation systems presents significant opportunities for the car accessories market. AR technology enhances the driving experience by overlaying real-time directions onto windshields, improving safety and convenience.

The development of accessories for autonomous vehicles further expands growth potential. Products such as sensors, LIDAR systems, and advanced cameras cater to the unique needs of self-driving cars.

Additionally, subscription-based models for accessories are gaining popularity, enabling consumers to upgrade and access premium features without heavy upfront investments. The rising demand for eco-friendly car products, including biodegradable materials and energy-efficient systems, aligns with global sustainability goals, offering another lucrative avenue for market players.

Challenges

Rapid Technological Obsolescence Challenges Market Growth

Rapid technological obsolescence poses a critical challenge to the car accessories market. With frequent innovations, products like infotainment systems and smart security devices quickly become outdated, reducing their long-term value.

Dependency on raw material supply chains also creates vulnerabilities, particularly during disruptions like global crises. Limited awareness in rural areas further restricts market penetration, as consumers are often unaware of available options or lack access to reliable retailers.

Lastly, rising costs of skilled labor for installing advanced accessories create barriers for smaller players, hindering their ability to compete effectively.

Growth Factors

Rising Vehicle Customization Culture Is Growth Factor

The growing culture of vehicle customization significantly drives market growth. Consumers increasingly seek accessories that reflect their personal style, such as custom interiors, unique lighting systems, and high-end audio setups.

Preference for luxury accessories, including leather upholstery and advanced climate control systems, is also on the rise, particularly among premium car owners. The surge in technological integration, including IoT-enabled devices and app-controlled features, further enhances demand.

Additionally, urbanization is driving vehicle sales, particularly in emerging markets, creating a larger consumer base for aftermarket accessories. Together, these factors ensure robust growth and innovation in the car accessories market.

Emerging Trends

Adoption of EV-Specific Accessories Is Latest Trending Factor

The adoption of EV-specific accessories is an emerging trend driving the car accessories market. Accessories such as specialized charging cables, energy-efficient tires, and battery management systems cater to the unique needs of electric vehicles.

Wireless charging solutions are also gaining popularity, offering convenience to modern EV owners. Furthermore, modular and portable accessories, such as compact storage organizers and detachable seat covers, appeal to consumers seeking flexibility.

The rising trend of voice-controlled devices, such as smart assistants integrated with in-car systems, reflects consumer preferences for seamless, hands-free operations. These innovations are shaping the future of car accessories, making vehicles smarter and more user-friendly.

Regional Analysis

North America Dominates with Major Market Share

North America leads the Car Accessories Market, capturing a majority of the global market share. This dominance is attributed to strong consumer demand for advanced car accessories, high disposable income levels, and a preference for premium products. The region’s well-developed automotive industry and widespread adoption of new technologies further solidify its leading position.

Key factors driving this market share include the presence of major automotive manufacturers and accessory providers. Companies in the U.S. and Canada invest heavily in research and development, ensuring innovative and high-quality offerings. The growing trend of vehicle personalization and a strong aftermarket industry also contribute significantly to North America’s market leadership.

The region’s advanced infrastructure and robust retail networks enable efficient distribution and accessibility of car accessories. Additionally, favorable economic conditions and government incentives for vehicle modernization foster sustained growth. North America’s preference for high-tech and sustainable accessories aligns with global trends, further reinforcing its market position.

Regional Mentions

- Europe: Europe holds a significant position, emphasizing eco-friendly car accessories and stringent regulatory compliance. Its focus on sustainable innovation drives steady market growth.

- Asia Pacific: Asia Pacific is the fastest-growing region, fueled by rising car ownership, rapid urbanization, and increasing disposable incomes in countries like China and India.

- Middle East & Africa: The Middle East and Africa show promising growth, with rising demand for luxury car accessories and investments in vehicle customization.

- Latin America: Latin America is emerging as a key market, driven by increasing vehicle sales and the adoption of affordable, functional car accessories.

Key Regions and Countries covered in the report

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The Car Accessories Market is dominated by a mix of established global companies and specialized players, with significant contributions from Bosch Automotive, Continental AG, Magna International Inc., and Delphi Technologies (BorgWarner). These key players lead the industry through innovation, extensive product portfolios, and strong distribution networks.

Bosch Automotive is a market leader known for its advanced automotive solutions. The company excels in manufacturing high-quality accessories, including wiper systems, lighting, and electronic components. Its focus on research and development drives consistent innovation in safety and performance-enhancing products.

Continental AG is another major contributor, leveraging its expertise in mobility technologies and automotive solutions. The company specializes in smart and sustainable accessories such as advanced driver assistance systems (ADAS) and connectivity devices. Continental’s emphasis on digital solutions aligns with the growing demand for high-tech car accessories.

Magna International Inc. stands out for its comprehensive range of vehicle components, including exterior and interior accessories. The company’s global manufacturing presence and innovative approach make it a key player in addressing diverse customer needs. Magna’s focus on lightweight and energy-efficient products complements industry trends toward sustainability.

Delphi Technologies, now part of BorgWarner, is a significant player in electronic and performance-oriented car accessories. The company’s expertise in propulsion systems and electronic components ensures its relevance in the evolving automotive market, particularly in electric and hybrid vehicles.

These top players differentiate themselves through cutting-edge innovation, strategic partnerships, and strong customer-focused strategies. Their contributions drive advancements in safety, sustainability, and technology within the car accessories market. As the industry evolves, these companies are likely to maintain their leadership by adapting to consumer preferences and regulatory requirements.

Top Key Players in the Market

- Bosch Automotive

- Continental AG

- Magna International Inc.

- Delphi Technologies (BorgWarner)

- 3M

- Valeo SA

- Yokohama Rubber Co., Ltd.

- AutoZone Inc.

- Advance Auto Parts, Inc.

- Sears Holdings Corporation (Sears Auto Center)

Recent Developments

- Creckk’s Mobile Application Launch: In August 2024, Creckk, an Ahmedabad-based company, launched a mobile application aimed at revolutionizing car accessories shopping in India. The app offers over 5,000 products across 67 categories, including interior and exterior accessories, lighting, care products, and essential parts, with free doorstep delivery and installation services.

- Kia’s Sustainable Car Accessory Initiative: In October 2024, Kia Corporation introduced a limited-edition trunk liner for the EV3, made from plastic reclaimed from the Great Pacific Garbage Patch through its partnership with The Ocean Cleanup. Comprising 40% recycled ocean plastic, the trunk liner is designed to be as durable and functional as conventional counterparts and features a QR code providing information about its development and Kia’s environmental initiatives.

- AutoNation’s eCommerce Platform Launch: In October 2023, AutoNation, Inc. launched AutoNationParts.com, an eCommerce platform offering customers the ability to purchase high-quality automotive parts and accessories online. The website provides genuine manufacturer parts from over 25 brands, with competitive pricing and direct home delivery.

Report Scope

Report Features Description Market Value (2023) USD 523.6 Billion Forecast Revenue (2033) USD 902.9 Billion CAGR (2024-2033) 5.6% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Exterior Accessories, Interior Accessories, Performance Accessories, Electronics and Electrical Accessories, Car Care Accessories), By Vehicle Type (Passenger Cars, Commercial Vehicles, Electric Vehicles (EVs), Two-wheelers), By Price Range (Premium, Mid-range, Economy), By Sales Channel (Online, Offline) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Bosch Automotive, Continental AG, Magna International Inc., Delphi Technologies (BorgWarner), 3M, Valeo SA, Yokohama Rubber Co., Ltd., AutoZone Inc., Advance Auto Parts, Inc., Sears Holdings Corporation (Sears Auto Center) Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Bosch Automotive

- Continental AG

- Magna International Inc.

- Delphi Technologies (BorgWarner)

- 3M

- Valeo SA

- Yokohama Rubber Co., Ltd.

- AutoZone Inc.

- Advance Auto Parts, Inc.

- Sears Holdings Corporation (Sears Auto Center)