Global Automotive Plastics Market Product Type (Acrylonitrile butadiene styrene (ABS), Polypropylene (PP), Polyurethane (PU), Polyvinyl Chloride (PVC), Polyethylene (PE), Polybutylene Terephthalate (PBT), Polycarbonate (PC), Polymethyl methacrylate (PMMA), Polyamide (Nylon 6, Nylon 66), Others), Process Type (Injection Molding, Blow Molding, Thermoforming, Others), By Application (Powertrains, Electrical Components, Interior Furnishing, Exterior Furnishing, Under the hood, Chassis), Vehicle Type (Passenger Cars, Light Commercial Vehicles, Medium and Heavy Commercial Vehicles), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Feb 2025

- Report ID: 59423

- Number of Pages: 383

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

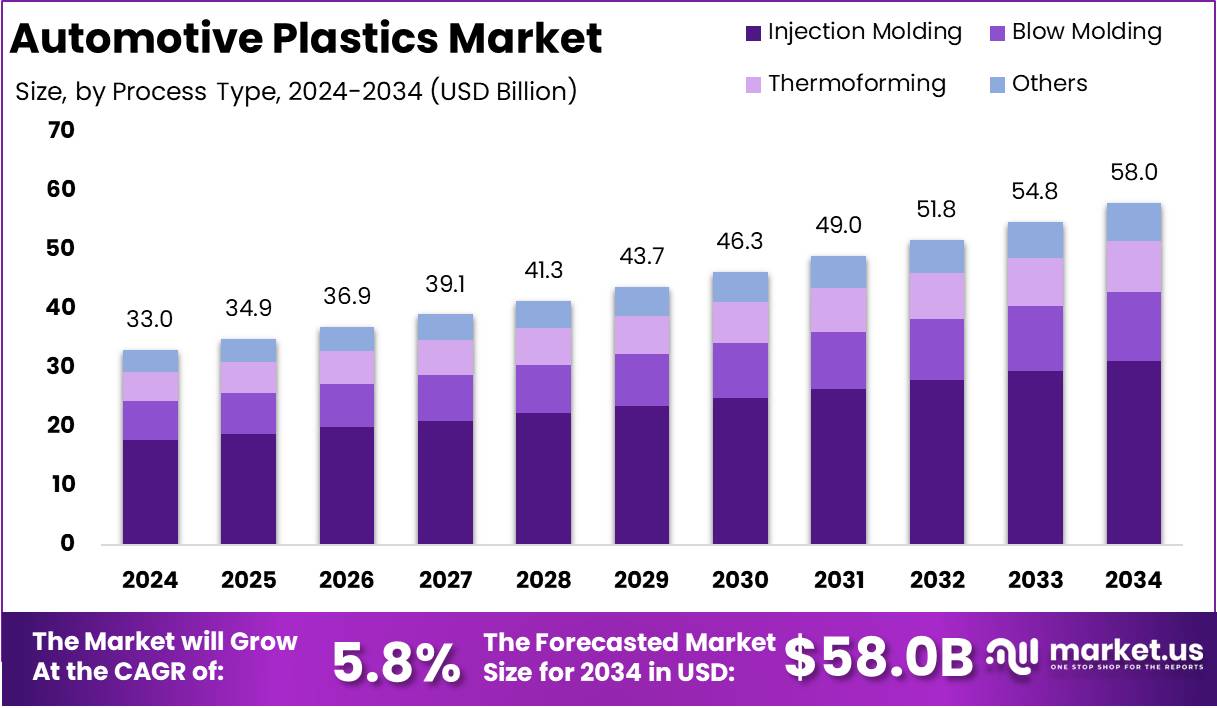

The Global Automotive Plastics Market size is expected to be worth around USD 58.0 Billion by 2034 from USD 33.0 Billion in 2024, growing at a CAGR of 5.8% during the forecast period from 2025 to 2034.

Automotive plastics refer to a diverse group of synthetic polymers utilized in various components of vehicles, ranging from interior features like dashboards and seats, to exterior body parts such as bumpers and fenders. These materials are prized for their lightweight, durability, corrosion resistance, and ease of molding into complex shapes, contributing to both vehicle performance and aesthetic appeal.

Key types of automotive plastics include thermoplastics, thermosets, and elastomers, each of which plays a distinct role in the manufacturing of automotive parts. As the automotive industry continues to prioritize fuel efficiency and sustainability, the adoption of automotive plastics is becoming an essential component of modern vehicle design.

The automotive plastics market represents the segment of the automotive industry that focuses on the manufacturing, distribution, and utilization of plastic materials in vehicle production. This market encompasses a wide range of applications including interior, exterior, under-the-hood components, and powertrain parts.

The automotive plastics market has expanded significantly in recent years, driven by technological advancements in polymer science, as well as increasing consumer and regulatory demand for fuel-efficient, lighter, and more environmentally sustainable vehicles. The market is characterized by the continuous development of high-performance plastics capable of meeting the rigorous standards of automotive engineering.

The growth of the automotive plastics market can be attributed to several factors. The primary driver has been the automotive industry’s increasing emphasis on reducing vehicle weight to enhance fuel efficiency and meet stringent emissions standards. Plastics offer a viable solution for achieving these objectives without compromising on strength or durability.

Demand for automotive plastics is largely driven by ongoing trends in automotive manufacturing, such as the shift towards electric vehicles (EVs), autonomous driving technologies, and the broader movement towards more sustainable materials. EVs, in particular, have boosted the need for lightweight components to offset the weight of batteries, thereby making plastics an integral part of electric vehicle design. .

The automotive plastics market offers significant opportunities, particularly in the development of innovative materials that support the transition towards electric and autonomous vehicles. For instance, high-performance plastics that enable the creation of lighter, more energy-efficient parts for EVs represent a growing area of opportunity. The integration of smart plastics, which can incorporate sensors and other technologies, presents another promising avenue.

According to ScienceDirect, the integration of composite materials in the automotive sector is gaining significant traction, contributing to weight reductions ranging from 15% to 40%, depending on the reinforcement types utilized.

The global application pattern of automotive polymer composites highlights that approximately 65% are deployed in the exterior and interior components of vehicles, while the remaining share is applied to structural and powertrain systems. Notably, the BMW i3 showcases the potential of carbon fiber-reinforced plastics (CFRP) with its body, which achieves a 50% reduction in weight compared to conventional steel.

In certain applications, such as replacing steel with polyacrylonitrile (PAN)-based CFRP, the vehicle weight can be reduced by as much as 60%, although this comes with a significant cost increase, up to ten times higher than traditional materials. On the other hand, substituting certain components with composite materials has the potential to reduce their weight by more than 10% while lowering overall costs by approximately 5%.

With over 70 million cars produced globally each year, the growing adoption of automotive plastics presents a considerable opportunity for manufacturers to improve fuel efficiency and sustainability while managing costs in an increasingly competitive market environment.

Key Takeaways

- The Global Automotive Plastics Market is expected to grow from USD 33.0 billion in 2024 to USD 58.0 billion by 2034, at a CAGR of 5.8% during the forecast period from 2025 to 2034.

- Polypropylene (PP) resin dominates the automotive plastics market, holding more than 33.1% of the total market share in 2024, driven by its lightweight properties, cost-effectiveness, and chemical resistance.

- Injection Molding remains the dominant processing technique, capturing over 53.9% of the market share in 2024 due to its efficiency, precision, and versatility in producing high-volume, complex components.

- The Interior Furnishing segment holds a significant share, accounting for more than 43.2% of the market in 2024, driven by rising demand for lightweight, durable, and aesthetically pleasing materials for automotive interiors.

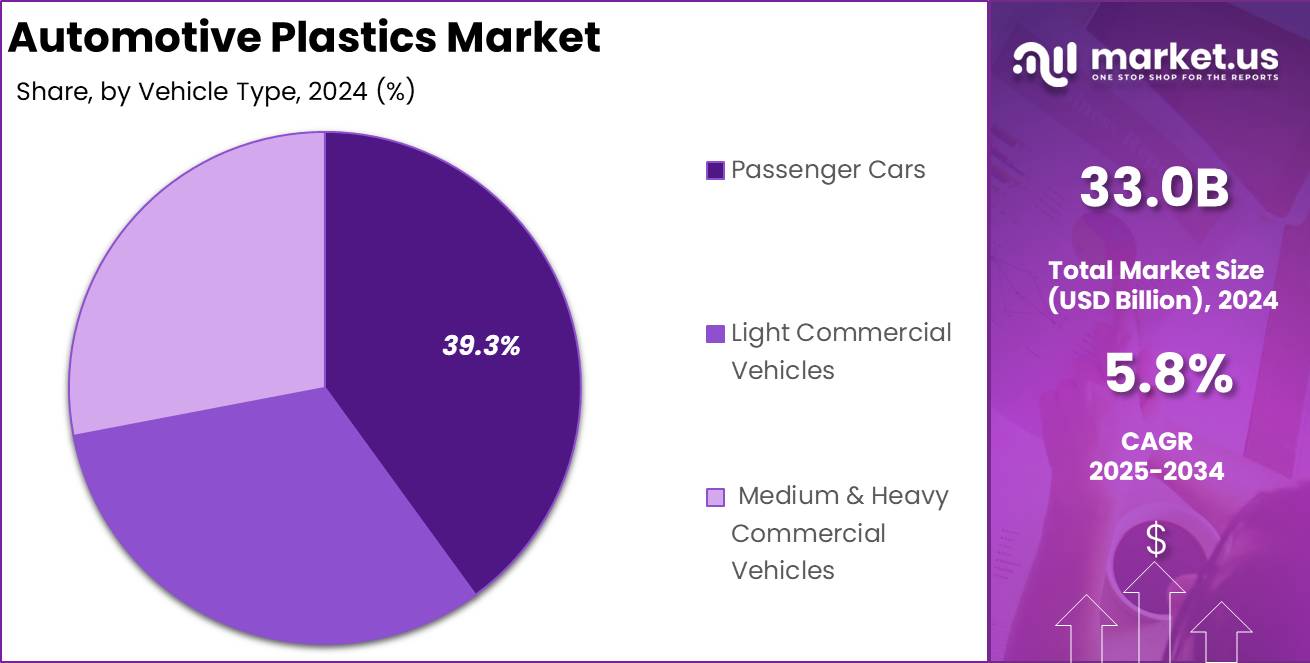

- Passenger Cars capture the largest market share at over 39.3% in 2024, reflecting ongoing demand for lightweight materials that enhance fuel efficiency, safety, and design aesthetics.

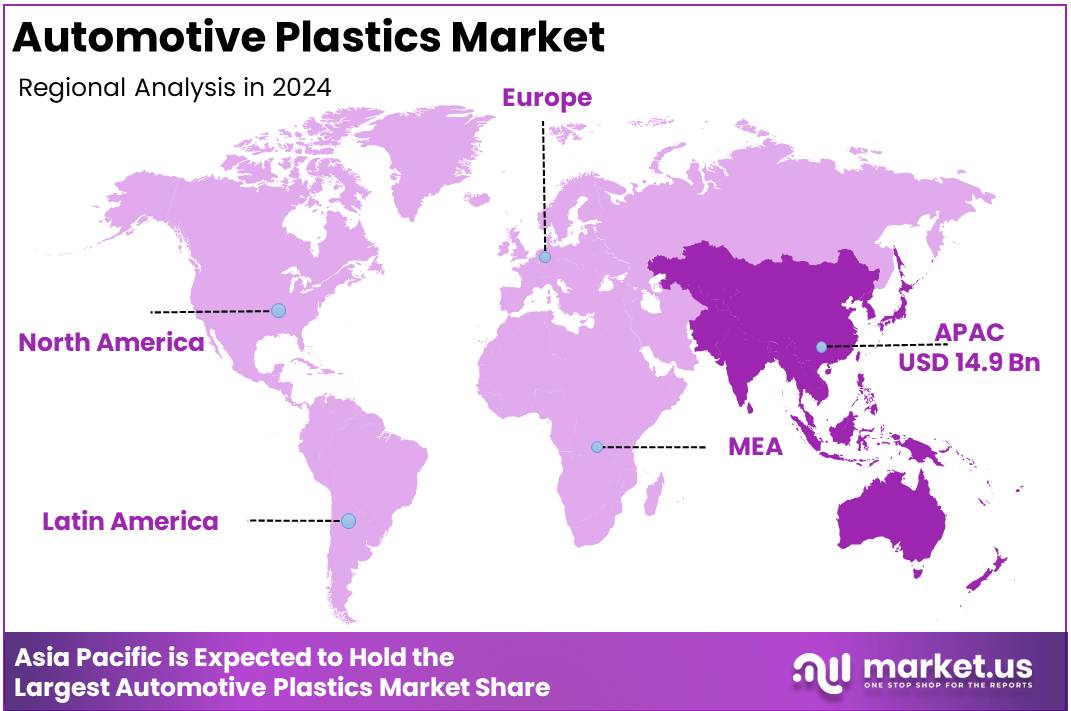

- The Asia Pacific region leads the automotive plastics market, holding the largest share of 45.2%, valued at USD 14.9 billion in 2024, driven by robust automotive production and demand in key markets such as China and Japan.

By Product Analysis

Polypropylene (PP) Dominates Automotive Plastics Market with 33.1% Market Share

In 2024, Polypropylene (PP) resin held a dominant position in the automotive plastics market, capturing more than 33.1% of the total market share. This significant share can be attributed to PP’s lightweight properties, cost-effectiveness, and its superior chemical resistance, making it a preferred choice for automotive manufacturers in the production of interior and exterior components.

ABS, a versatile thermoplastic, is widely used in automotive applications, particularly in the production of bumpers, dashboards, and interior trim. It is valued for its strength, impact resistance, and ease of processing, though it trails behind PP in terms of overall market share.

Polyurethane (PU) is increasingly used in automotive applications such as seating, insulation, and gaskets due to its durability, comfort, and sound-dampening qualities. Its flexibility in both rigid and flexible forms contributes to its rising demand.

PVC is extensively used in automotive applications, particularly in the manufacturing of door panels, dashboards, and window trims. Its excellent electrical insulation properties and resistance to environmental factors contribute to its significant role in the market.

Polyethylene (PE), known for its high impact resistance and low-cost production, finds its primary use in automotive parts like fuel tanks, shields, and bumpers. Its lightweight nature helps improve fuel efficiency in vehicles, which drives its adoption.

Polybutylene Terephthalate (PBT) is commonly used for under-the-hood applications, particularly for components requiring high resistance to heat and chemicals. Its robust mechanical properties and dimensional stability make it a popular material for automotive electronics.

Polycarbonate (PC) is prized in the automotive sector for its excellent optical properties, high impact resistance, and ability to withstand harsh environmental conditions. It is commonly used in the production of headlamp lenses, vehicle windows, and safety-related components.

Polymethyl Methacrylate (PMMA), known for its clarity and high surface hardness, is mainly used in automotive lighting and trim applications. Its resistance to UV radiation and environmental degradation further enhances its appeal in exterior components.

Polyamide, especially Nylon 6 and Nylon 66, is extensively used in the automotive industry for under-the-hood components and interior parts. Their high mechanical strength, wear resistance, and thermal stability position them as a preferred choice for many automotive manufacturers.

Other materials, including thermoplastic elastomers (TPE) and polylactic acid (PLA), hold a smaller share in the automotive plastics market but continue to grow, driven by advances in material science and sustainability concerns.

By Process Type

Injection Molding Dominates Automotive Plastics Market with 53.9% Market Share

In 2024, Injection Molding maintained a dominant position in the automotive plastics market, capturing more than 53.9% of the market share. This widespread dominance can be attributed to the process’s efficiency, precision, and versatility in producing complex, high-volume components with consistent quality.

Injection molding is particularly favored for the mass production of interior and exterior automotive parts, such as dashboards, bumpers, and door panels, where high dimensional accuracy and fast turnaround times are critical.

Blow Molding is primarily used for the production of hollow automotive components, such as fuel tanks, air ducts, and bottles. This process is valued for its ability to produce lightweight, durable parts with complex shapes and is expected to see steady growth in the market due to increasing demand for lightweight materials to improve vehicle fuel efficiency.

Thermoforming, a process where plastic sheets are heated and molded into shape, is commonly employed for making large automotive parts, including door panels, roof liners, and interior trim. Though it holds a smaller share compared to injection molding, thermoforming’s ability to produce large, intricate parts at a lower cost drives its continued use in the automotive sector.

Other processes, including rotational molding and compression molding, are used for specific automotive applications, though they hold a smaller share in comparison to the main methods of injection and blow molding. These processes are typically employed for niche products where specific material properties or shapes are required.

By Application

Interior Furnishing Dominates Automotive Plastics Market with 43.2% Market Share

In 2024, Interior Furnishing held a dominant position in the automotive plastics market, capturing more than 43.2% of the total market share. This segment’s growth is largely driven by the increasing demand for lightweight, durable, and aesthetically appealing materials for automotive interiors.

Plastics used in interior furnishings, such as dashboards, seats, door panels, and trim, offer significant advantages, including ease of manufacturing, design flexibility, and the ability to meet stringent safety and comfort standards.

The powertrain segment, which includes components like engine covers, transmission parts, and other structural components, is a critical part of the automotive plastics market. As manufacturers seek to reduce vehicle weight for better fuel efficiency and lower emissions, the demand for lightweight plastic materials in powertrain applications continues to rise.

The increasing integration of electrical systems in vehicles, such as wiring harnesses, battery casings, and connectors, has made electrical components a significant segment in automotive plastics. Plastics offer excellent insulating properties, durability, and resistance to heat, which are crucial for the performance and safety of automotive electrical systems.

Exterior furnishing applications, including bumpers, grilles, and trim, rely heavily on plastic materials due to their combination of durability, flexibility, and resistance to harsh weather conditions. Plastics in this segment also contribute to vehicle weight reduction, a key factor in improving fuel efficiency.

Under the hood applications, such as engine covers, air intake manifolds, and various seals and gaskets, benefit from plastics due to their heat resistance, chemical stability, and durability. These materials contribute to both the performance and longevity of the engine while reducing overall vehicle weight.

Plastics used in the chassis segment, such as for suspension parts or lightweight brackets, offer excellent strength-to-weight ratios and are increasingly being used to reduce the overall weight of vehicles. This segment continues to grow as automotive manufacturers strive for improved fuel economy and lower emissions through weight reduction.

By Vehicle Type

Passenger Cars Dominates Automotive Plastics Market with 39.3% Market Share

In 2024, Passenger Cars held a dominant position in the automotive plastics market, capturing more than 39.3% of the total market share. This segment’s substantial share is driven by the continued demand for lightweight materials that contribute to fuel efficiency, improved safety, and enhanced aesthetic design. Plastics in passenger vehicles are extensively used in components such as interior panels, exterior trim, bumpers, and dashboard parts, where they offer flexibility, cost-effectiveness, and high performance.

Light Commercial Vehicles (LCVs), including vans, pickups, and small trucks, account for a growing portion of the automotive plastics market. The demand for plastics in this segment is primarily driven by the need for robust, lightweight components that improve fuel efficiency and reduce maintenance costs. Plastics are commonly used in parts like cargo areas, bumpers, and interior elements.

Medium and Heavy Commercial Vehicles (M&HCVs), such as large trucks, buses, and heavy-duty transport vehicles, represent a smaller but steadily growing segment of the automotive plastics market. In these vehicles, plastics are used for applications that require durability, such as body panels, under-the-hood components, and structural parts. The continued focus on weight reduction for fuel efficiency and lower emissions is expected to contribute to the increasing adoption of plastics in this segment.

Key Market Segments

By Product Type

- Acrylonitrile butadiene styrene (ABS)

- Polypropylene (PP)

- PP LGF 20

- PP LGF 30

- PP LGF 40

- Others

- Polyurethane (PU)

- Polyvinyl Chloride (PVC)

- Rigid PVC

- Flexible PVC

- Polyethylene (PE)

- High-density Polyethylene (HDPE)

- Other PE Grades

- Polybutylene Terephthalate (PBT)

- Polycarbonate (PC)

- Polymethyl methacrylate (PMMA)

- Polyamide (Nylon 6, Nylon 66)

- Others

By Process Type

- Injection Molding

- Blow Molding

- Thermoforming

- Others

By Application

- Powertrains

- Electrical Components

- Interior Furnishing

- IMD or IML

- Others

- Exterior Furnishing

- Under the hood

- Chassis

By Vehicle Type

- Passenger Cars

- Internal Combustion Engine (ICE) Vehicles

- Electric Vehicles

- Battery Electric Vehicles (BEV)

- Plug-in Hybrid Electric Vehicles (PHEV)

- Fuel Cell Electric Vehicles (FCEV)

- Light Commercial Vehicles

- Medium & Heavy Commercial Vehicles

Driver

Growing Demand for Lightweight Materials

The increasing demand for fuel-efficient and eco-friendly vehicles is one of the primary drivers for the global automotive plastics market. Lightweight materials, such as plastics, play a pivotal role in reducing the overall weight of vehicles. This weight reduction directly correlates to improved fuel efficiency, lower emissions, and enhanced performance.

As global regulations around fuel efficiency and CO2 emissions become stricter, automakers are increasingly turning to advanced plastics as a solution to meet these regulatory standards. Plastics help lower vehicle weight by replacing heavier materials like metal in components such as bumpers, dashboards, and body panels.

Moreover, the rising adoption of electric vehicles (EVs) further strengthens this trend. EVs inherently require materials that help compensate for the added weight of batteries, and automotive plastics are ideal for this purpose. By using plastics in place of traditional materials, manufacturers can offset the additional weight and enhance the driving range of EVs.

In addition, the automotive plastics market benefits from the widespread acceptance of lightweight materials across various vehicle segments, including compact cars, mid-size sedans, and luxury vehicles. Consequently, the growing emphasis on sustainability and energy efficiency in the automotive sector is expected to continue driving the demand for automotive plastics well into the future. This shift toward lightweight plastic components is anticipated to fuel market growth and innovation, positioning automotive plastics as a key enabler of next-generation vehicles.

Restraint

Volatility in Raw Material Prices

One of the major restraints to the growth of the automotive plastics market is the volatility in the prices of raw materials. Plastics used in automotive manufacturing, such as polypropylene, polyurethane, and polycarbonate, are derived from petroleum-based sources, which are highly susceptible to fluctuations in crude oil prices.

These price variations can have a cascading effect on the cost structure of the entire automotive plastics supply chain. As oil prices rise, so does the cost of plastic production, which ultimately increases the cost of manufacturing automotive components.

The instability in raw material costs can also hinder long-term planning for automotive manufacturers, who must continuously adjust their pricing strategies and procurement processes. Furthermore, geopolitical tensions and supply chain disruptions can exacerbate these price fluctuations, further impacting the overall market.

This volatility creates an element of uncertainty that makes it difficult for stakeholders to predict future market conditions, which can lead to delayed investments in new technologies or innovations. As the automotive industry continues to prioritize cost efficiency and profitability, the volatility in raw material prices represents a significant challenge for both automakers and suppliers in the automotive plastics market. Thus, addressing this issue will be crucial for ensuring sustainable market growth in the years ahead.

Opportunity

Adoption of Bio-based Plastics

The increasing focus on sustainability in the automotive industry presents a significant opportunity for the growth of the automotive plastics market, particularly through the adoption of bio-based plastics. Bio-based plastics, made from renewable sources such as plants, algae, or waste materials, are an emerging alternative to traditional petroleum-based plastics.

These materials offer a more environmentally friendly option, contributing to reducing the carbon footprint of vehicles. As governments and consumers alike push for greener products, the demand for bio-based plastics in automotive applications is growing.

The shift toward bio-based plastics also aligns with the automotive sector’s broader strategy to reduce its environmental impact. Manufacturers are incorporating bio-based plastics in a variety of components, including interior parts like seat cushions and door panels, as well as exterior elements such as bumpers and fenders.

Bio-based plastics not only reduce the reliance on fossil fuels but also promote recycling and reuse, further enhancing the sustainability credentials of automotive manufacturers. In response to these trends, suppliers are developing new, high-performance bio-based plastics that match or exceed the durability and performance of conventional materials. This opens up a new avenue for growth in the market, as automakers look to align their product offerings with the evolving environmental and regulatory landscape.

Trends

Increasing Integration of Smart Plastics

The automotive plastics market is increasingly influenced by the trend toward smart plastics, which are materials embedded with sensors or other technologies to enhance vehicle functionality. These advanced plastics can offer a wide range of capabilities, such as real-time monitoring of vehicle performance, climate control, and even self-healing properties.

For instance, plastic components integrated with sensors can monitor temperature, humidity, and pressure, allowing for better control of the vehicle’s interior environment or alerting the driver to maintenance needs. As vehicles become more connected and autonomous, the integration of smart plastics plays a critical role in supporting the technological advancements in the automotive sector.

This trend is closely tied to the growing demand for intelligent vehicles and the expansion of the Internet of Things (IoT) within the automotive industry. Smart plastics enable automakers to develop lightweight, cost-effective solutions for housing sensors, cameras, and other electronic devices integral to modern vehicles. Additionally, these materials support the increasing use of plastics in critical areas such as the cockpit, where interaction between the vehicle and the driver is essential.

The development of smart plastics not only contributes to the vehicle’s performance but also opens the door for innovative new features, such as adaptive interiors and enhanced safety systems. As a result, the integration of smart plastics is anticipated to significantly influence the future growth of the automotive plastics market, creating a wealth of new opportunities for both manufacturers and consumers alike.

Regional Analysis

Asia Pacific Lead Automotive Plastics Market with Largest Market Share of 45.2%

The global automotive plastics market is significantly influenced by regional dynamics, with Asia Pacific leading the market in terms of both market share and growth potential. In 2024, the Asia Pacific region holds the largest share of the automotive plastics market, accounting for 45.2%, representing a market value of USD 14.9 billion. This dominance can be attributed to the region’s robust automotive manufacturing capabilities, growing demand for lightweight vehicles, and rapid technological advancements.

Countries such as China, Japan, and India are the major contributors to the market, benefiting from strong production output and a high adoption rate of advanced plastics in automotive applications.

North America, while holding a considerable share of the market, contributes less than Asia Pacific, with key drivers including the presence of major automotive manufacturers and a focus on innovation in vehicle design and safety standards.

The region’s automotive plastics market is largely driven by demand for materials that improve fuel efficiency and safety, alongside an increasing shift toward electric vehicles (EVs) that require lightweight materials for improved battery efficiency. The North American automotive plastics market is projected to continue growing, albeit at a slower pace compared to Asia Pacific.

Europe, traditionally a stronghold for automotive manufacturing, remains a significant market for automotive plastics, supported by stringent regulatory frameworks focusing on sustainability and emissions reduction.

The European market is seeing a rise in demand for recycled plastics and eco-friendly solutions, which are aligning with the region’s push toward green automotive technologies. The market in Europe is expected to grow steadily as manufacturers continue to develop and implement more sustainable materials in automotive production.

The Middle East & Africa (MEA) region, though smaller in comparison, is gradually seeing an increase in demand for automotive plastics, driven by infrastructural developments and the expanding automotive sector in countries such as the UAE and South Africa. The region’s growth is supported by the rising demand for lightweight vehicles and the increasing adoption of fuel-efficient technologies. However, market growth is constrained by limited automotive production in certain countries, impacting the overall market size.

Latin America, while showing positive growth trends, remains a relatively small player in the global automotive plastics market. The region’s automotive industry is growing, but the adoption of advanced plastics and lightweight materials is still in its nascent stages. Brazil and Mexico remain the key markets in the region, contributing significantly to the automotive plastics demand.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- United Arab Emirates

Key Players Analysis

The Global Automotive Plastics Market in 2024 will continue to be shaped by several key players, each contributing distinct strengths to the industry. Akzo Nobel N.V., BASF SE, and Covestro AG are notable for their advanced materials and coatings, providing lightweight solutions that improve fuel efficiency and overall vehicle performance.

BASF SE’s innovations in polymer chemistry will likely drive the demand for high-performance plastics in automotive applications, while Covestro AG’s focus on sustainable plastics solutions aligns well with the rising demand for eco-friendly materials in the industry. Evonik Industries AG and Adient plc bring specialized offerings in the form of high-quality interior components and functional plastics that enhance vehicle aesthetics, safety, and comfort.

Magna International, Inc. and Grupo Antolin are strong players in automotive interiors, with both companies focusing on sustainable product offerings and lightweight materials. Meanwhile, Momentive Performance Materials, Inc. and Dow, Inc. are likely to lead with advanced silicone-based materials that deliver superior heat resistance and durability.

SABIC’s position as a global leader in high-performance polymers will also continue to play a pivotal role in automotive manufacturing, particularly in lightweighting and fuel efficiency efforts. Borealis AG and Hanwha Azdel Inc. are also noteworthy for their contributions to durable, lightweight plastic solutions that enhance vehicle structure and performance.

Top Key Players in the Market

- Akzo Nobel N.V.

- BASF SE

- Covestro AG

- Evonik Industries AG

- Adient plc

- Magna International, Inc.

- Momentive Performance Materials, Inc.

- SABIC

- Dow, Inc.

- Borealis AG

- Hanwha Azdel Inc.

- Grupo Antolin

Recent Developments

- In March 2023, BASF launched a new Ultramid® Deep Gloss grade, specially designed for automotive interior parts requiring high gloss finishes. This innovative material was first utilized in the garnish of the Toyota Prius, featuring mold-in-color technology that eliminates the need for solvent-based painting. This advancement enhances production efficiency and sustainability by directly molding pre-colored resins into the desired color and finish.

- In October 2024, Celanese Corporation showcased its innovative engineered material solutions for electric vehicles (EVs) at the 2024 Battery Show in Detroit. The company emphasized its commitment to advancing EV technology with a focus on safety, efficiency, and sustainability. Celanese highlighted the importance of early-stage design collaboration with mobility customers to optimize materials, reduce costs, and mitigate risks.

- In 2025, Röchling Automotive, in collaboration with Mercedes-Benz, Bond Laminates by Envalior, and Valmet, introduced a lightweight thermoplastic composite rooftop beam for the Mercedes-Benz CLE Cabrio. This new design significantly reduces weight compared to traditional materials and enhances the vehicle’s interior appearance. Röchling was responsible for the development and production of the beam, while Envalior led the computer-aided engineering (CAE) simulation.

- In 2024, General Motors (GM) and EVgo reached a milestone by surpassing 2,000 public fast charging stations across the United States. This achievement highlights GM’s dedication to making electric vehicles more accessible to American drivers by expanding fast-charging infrastructure in collaboration with EVgo, one of the largest providers of public fast chargers.

- In 2024, the OKE Group GmbH, based in Germany, acquired Polymerica Limited Company (operating as Global Enterprises). With this acquisition, OKE Group, represented by Jackson Walker, extended its presence in North America and expanded its capabilities in Eastern Europe. Global Enterprises, with facilities in Michigan, Texas, Romania, and Mexico, manufactures automotive interior parts sold to major car manufacturers in North America and Europe.

Report Scope

Report Features Description Market Value (2024) USD 33.0 Billion Forecast Revenue (2034) USD 58.0 Billion CAGR (2025-2034) 5.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered Product Type (Acrylonitrile butadiene styrene (ABS), Polypropylene (PP), Polyurethane (PU), Polyvinyl Chloride (PVC), Polyethylene (PE), Polybutylene Terephthalate (PBT), Polycarbonate (PC), Polymethyl methacrylate (PMMA), Polyamide (Nylon 6, Nylon 66), Others), Process Type (Injection Molding, Blow Molding, Thermoforming, Others), By Application (Powertrains, Electrical Components, Interior Furnishing, Exterior Furnishing, Under the hood, Chassis), Vehicle Type (Passenger Cars, Light Commercial Vehicles, Medium and Heavy Commercial Vehicles) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Akzo Nobel N.V., BASF SE, Covestro AG, Evonik Industries AG, Adient plc, Magna International, Inc., Momentive Performance Materials, Inc., SABIC, Dow, Inc., Borealis AG, Hanwha Azdel Inc., Grupo Antolin Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Akzo Nobel N.V.

- BASF SE

- Covestro AG

- Evonik Industries AG

- Adient plc

- Magna International, Inc.

- Momentive Performance Materials, Inc.

- SABIC

- Dow, Inc.

- Borealis AG

- Hanwha Azdel Inc.

- Grupo Antolin