Global Automotive Sun Visor Market Size, Share, Growth Analysis By Product Type (Standard Sun Visors, Electrically Operated Sun Visors, Manual Sun Visors), By Material Type (Fabric, Leather, Plastic, Polyurethane, Aluminum), By Vehicle Type (Passenger Cars, Commercial Vehicles, Electric Vehicles (EVs), Two-Wheelers), By Sales Channel (OEM (Original Equipment Manufacturer), Aftermarket), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Feb 2025

- Report ID: 140458

- Number of Pages: 364

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

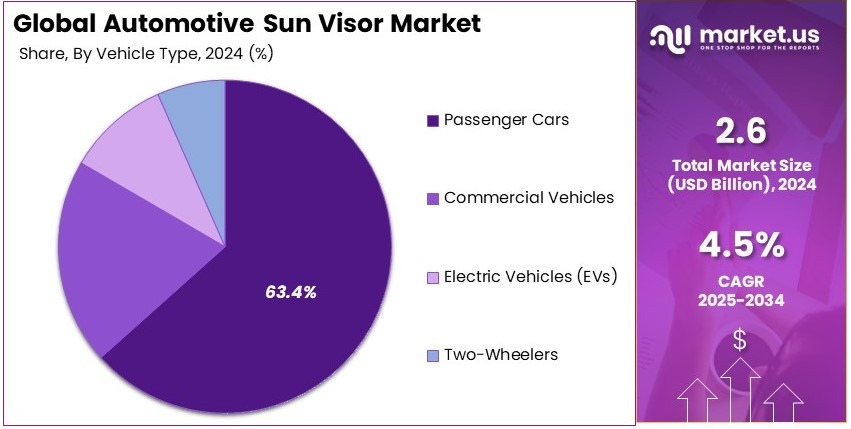

The Global Automotive Sun Visor Market size is expected to be worth around USD 4.0 Billion by 2034, from USD 2.6 Billion in 2024, growing at a CAGR of 4.5% during the forecast period from 2025 to 2034.

An automotive sun visor is a component of a vehicle located above the windshield. Its primary function is to shield drivers’ and passengers’ eyes from the sun’s glare, enhancing visibility and safety during driving.

The automotive sun visor market includes the development, manufacturing, and distribution of sun visors for vehicles. It focuses on innovations that enhance driver comfort and protection against direct sunlight.

The automotive sun visor market is experiencing significant growth, propelled by the ongoing innovation in vehicle design and consumer demand for enhanced comfort and safety features. Sun visors play a crucial role in improving driver visibility and comfort, especially in harsh lighting conditions.

Advances such as the integration of illuminated vanity mirrors, driver assistance systems, and display features within the visors are adding to their appeal and functionality. As vehicle interiors become more sophisticated, sun visors are increasingly seen as both aesthetic and functional components, leading to a greater emphasis on their design and technological integration.

Moreover, the market dynamics are heavily influenced by international trade policies and competition. For instance, the U.S. government’s recent regulations, which ban the import of vehicles equipped with connected software from specific countries starting from the model year 2027, reflect growing concerns about national security related to data collection through automotive technologies.

These regulations are reshaping the competitive landscape by restricting the entry of certain foreign technologies into the U.S. market. This policy not only impacts the availability of advanced automotive technologies but also prompts manufacturers globally to adapt their product lines and strategies to comply with these new market conditions.

Key Takeaways

- Automotive Sun Visor Market was valued at USD 2.6 Billion in 2024 and is projected to reach USD 4.0 Billion by 2034 with a CAGR of 4.5%.

- In 2024, Standard Sun Visors dominate with 45.6%, favored for their optimal design and effective glare reduction across vehicles.

- In 2024, Fabric materials lead with 35.7%, offering lightweight construction and improved comfort in visor applications.

- In 2024, Passenger Cars dominate with 63.4%, driven by high production volumes and evolving consumer preferences in urban markets.

- In 2024, OEM channels lead sales with 71.2%, reflecting strong manufacturer partnerships and efficient distribution networks.

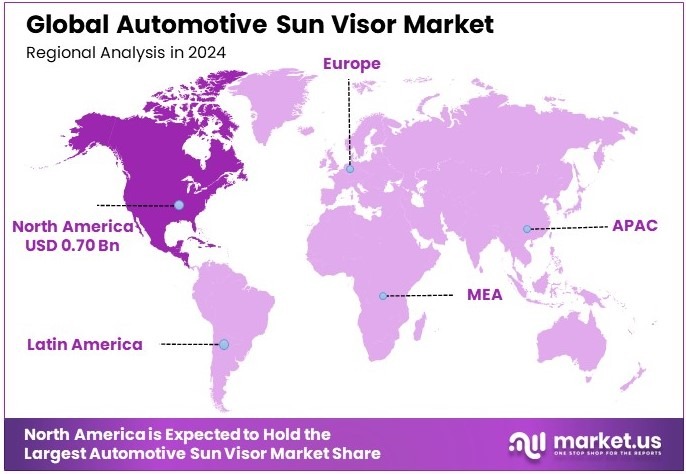

- In 2024, North America dominates with 26.8% share, contributing approximately USD 0.70 Billion in market revenues.

Product Type Analysis

Standard Sun Visors dominate with 45.6% due to their widespread use and cost-effectiveness.

Standard sun visors hold the largest market share in the automotive sun visor market, representing 45.6%. Their dominance can be attributed to their simple design, affordability, and broad adoption across various vehicle types. These sun visors are commonly used in both entry-level and mid-range vehicles due to their practicality and low production cost.

Standard sun visors are manually adjustable, which makes them easy to maintain and repair. As a result, they continue to be a popular choice for many vehicle manufacturers, especially in regions where cost efficiency is a priority.

Electrically operated sun visors are gaining traction in the market but still represent a smaller portion. They offer enhanced comfort and convenience, which is especially appealing in luxury and high-end vehicles. These sun visors can be adjusted with a button, adding an extra level of sophistication.

Manual sun visors, while less common than the standard variant, are still important in the market due to their reliability and simplicity, particularly in older or more affordable models. Despite the rise of electric and more advanced technologies, standard sun visors remain the backbone of the market due to their widespread demand and cost-effectiveness.

Material Type Analysis

Fabric dominates with 35.7% due to its durability, cost-effectiveness, and ease of production.

Fabric is the leading material used for automotive sun visors, holding 35.7% of the market share. It is preferred for its flexibility, affordability, and ease of integration with other vehicle components. The fabric used in sun visors is typically designed to withstand heat and provide a comfortable experience for users.

It is often combined with other materials, such as plastic or polyurethane, to increase strength and functionality. The ability to customize fabric sun visors with different textures and colors also contributes to their dominance in the market.

Plastic and polyurethane materials also contribute significantly to the market. Plastic is commonly used in sun visors due to its lightweight properties, ease of molding, and affordability. Polyurethane is gaining popularity because of its resilience, providing durability and resistance to heat.

Leather and aluminum are also used in certain high-end vehicles for premium sun visors, adding luxury but at a higher cost. These materials are not as common as fabric or plastic but serve specific segments, particularly in luxury vehicles.

Vehicle Type Analysis

Passenger Cars dominate with 63.4% due to their large production volumes and widespread demand.

Passenger cars lead the automotive sun visor market with 63.4% of the market share. The high volume of passenger car production, coupled with the consistent demand for vehicles in both developed and emerging markets, makes this segment the largest.

As the most common type of vehicle on the road, passenger cars require a wide range of standard features, including sun visors. The growth of the passenger car segment is supported by rising consumer demand for comfort and safety features, driving the need for reliable sun visors.

Commercial vehicles follow closely but hold a smaller market share. These vehicles, which include trucks and buses, typically require larger sun visors due to their size and driver exposure to sunlight. However, the commercial vehicle segment’s slower growth compared to passenger cars limits its overall market share.

Electric vehicles (EVs) are a rapidly growing segment, particularly in regions with high environmental awareness and government incentives. However, EVs are still emerging in the market and represent a smaller portion of the total automotive sun visor demand. Two-wheelers, such as motorcycles and scooters, make up a small share due to their limited need for sun visors, primarily focusing on riders’ visibility and protection from direct sunlight.

Sales Channel Analysis

OEM (Original Equipment Manufacturer) dominates with 71.2% due to direct supply to vehicle manufacturers.

The OEM sales channel dominates the automotive sun visor market with a significant 71.2% market share. This segment’s strength lies in its direct relationship with vehicle manufacturers. OEMs supply sun visors as part of the vehicle assembly process, ensuring that they meet the required standards and specifications for new cars.

As a result, OEM sales channels benefit from consistent demand, driven by new vehicle production. Vehicle manufacturers prefer using OEM parts due to their guaranteed quality and reliability, which ensures the performance and safety of the vehicle.

Aftermarket sales channels follow, though at a smaller share. The aftermarket sector serves customers who need replacement sun visors or want to upgrade their vehicle’s features. While aftermarket sun visors are important for vehicle maintenance and customization, they represent a smaller portion of the market compared to OEM.

These visors cater to vehicle owners who prefer to personalize their cars or replace damaged components. As vehicle production and sales continue to rise, the OEM segment is expected to maintain its dominance, while aftermarket sales will remain a secondary but important source of growth.

Key Market Segments

By Product Type

- Standard Sun Visors

- Electrically Operated Sun Visors

- Manual Sun Visors

By Material Type

- Fabric

- Leather

- Plastic

- Polyurethane

- Aluminum

By Vehicle Type

- Passenger Cars

- Commercial Vehicles

- Electric Vehicles (EVs)

- Two-Wheelers

By Sales Channel

- OEM (Original Equipment Manufacturer)

- Aftermarket

Driving Factors

Growing Demand for Vehicle Comfort and Safety Drives Market Growth

The automotive sun visor market is growing significantly, driven by the increasing demand for enhanced vehicle comfort and an improved driver experience. Consumers are seeking greater comfort and convenience in their vehicles, and sun visors are integral to providing protection from direct sunlight, reducing glare, and improving visibility.

The rising global automotive production and vehicle sales are also key drivers of this market. As more vehicles are produced and sold, the demand for sun visors grows accordingly. Additionally, the increased focus on driver and road safety within the automotive sector is contributing to the market expansion. Sun visors are essential safety features, as they help maintain visibility and reduce distractions caused by sunlight.

Technological advancements in sun visor designs are enhancing their functionality, making them more efficient and adaptable. These innovations are attracting attention from consumers and manufacturers alike, pushing the demand for more advanced and versatile sun visor systems. As vehicle safety and comfort continue to be top priorities for both consumers and automakers, the sun visor market is experiencing substantial growth.

Restraining Factors

High Costs and Integration Challenges Restrain Market Growth

Despite the growing demand for advanced sun visor systems, several factors limit the market’s growth. One of the key restraints is the high cost associated with advanced sun visor technologies, such as electrochromic visors, which offer enhanced functionality like auto-dimming or adjustable tint. These technologies add significant costs to vehicle production, which can hinder their widespread adoption.

Limited customization options for different vehicle types are another challenge. Sun visors are often designed with a one-size-fits-all approach, which may not meet the specific needs of every vehicle model, especially with the increasing variety of vehicle designs.

Additionally, there is a growing preference for alternative sun protection technologies, such as tinted windows, which are seen as a more permanent solution for glare reduction. This preference could limit the demand for traditional sun visors in some markets.

The difficulty in integrating advanced sun visors into existing vehicle designs also presents a challenge, as retrofitting vehicles with advanced visor technologies may require significant modifications to their interiors. These factors collectively present obstacles to the broader adoption of advanced sun visor systems.

Growth Opportunities

Smart, Eco-friendly and EV-Targeted Visors Provide Market Growth Opportunities

The automotive sun visor market holds numerous growth opportunities, particularly in the development of smart sun visors. Visors with embedded sensors and adaptive features that respond to environmental factors such as sunlight intensity and driving conditions are gaining popularity. These innovative visors offer enhanced functionality, making them highly appealing to both automakers and consumers.

The expansion of sun visor offerings for electric vehicles (EVs) presents another significant opportunity. As EVs continue to gain popularity, manufacturers are looking for sun visor solutions that cater to the unique design and functional needs of electric vehicles. These vehicles often prioritize energy efficiency and lightweight designs, which creates room for the development of tailored sun visor solutions.

Rising consumer demand for eco-friendly and sustainable materials in visor production is also driving growth. As environmental awareness grows, automakers are increasingly opting for materials that are recyclable, durable, and sustainably sourced, providing new avenues for innovation in the sun visor market. Moreover, improving comfort and reducing glare for autonomous vehicles is a growing focus, as these vehicles require more advanced sun protection solutions to accommodate changing driving dynamics.

Emerging Trends

Electrochromic and Integrated Designs Are Latest Trending Factors

One of the most notable trends is the introduction of electrochromic or auto-dimming sun visors. These visors automatically adjust their tint in response to sunlight intensity, improving comfort and reducing glare for the driver and passengers. This trend reflects a growing consumer preference for smart, adaptive technologies in their vehicles.

Another trend is the incorporation of integrated lighting and digital displays into sun visors. These additions provide added functionality, allowing sun visors to serve as a multi-purpose component within the vehicle’s interior, offering both practicality and aesthetic appeal.

Design trends are also focusing on creating lightweight, durable, and space-saving sun visors. As vehicles become more compact and efficient, automakers are seeking designs that maximize space while maintaining high performance and durability.

There is an increasing collaborative innovation between automotive manufacturers and technology firms to develop advanced sun visor features, further propelling the market forward with new, cutting-edge solutions. These trends are reshaping the automotive sun visor market, presenting exciting opportunities for growth and innovation.

Regional Analysis

North America Dominates with 26.8% Market Share in the Automotive Sun Visor Market

North America leads the automotive sun visor market with a 26.8% share and valuation of USD 0.70 Billion, translating to a substantial market value. This dominance is driven by high vehicle production rates, particularly in the U.S. and Canada, and a strong automotive manufacturing industry that ensures high demand for components like sun visors.

The dominance of North America in the automotive sun visor market can be attributed to several key factors. A significant reason for this high market share is the region’s robust automotive industry, with major car manufacturers such as Ford, General Motors, and Tesla producing millions of vehicles annually.

These manufacturers are major consumers of automotive parts, including sun visors, which are essential for vehicle interiors. Moreover, the rising demand for advanced, multifunctional sun visors that offer features like integrated lighting and mirror systems is boosting growth.

In addition, the increasing consumer preference for premium and comfort-focused vehicle interiors is propelling the demand for high-quality sun visors. The region’s strong focus on technological innovation in vehicle components, including sun visors, enhances consumer interest and expands market share.

Regional Mentions:

- Europe: Europe holds a significant share in the automotive sun visor market, influenced by a well-established automotive manufacturing base, particularly in Germany and France. The region’s demand for high-quality, innovative vehicle components continues to fuel growth in the sun visor market.

- Asia Pacific: Asia Pacific is witnessing rapid growth, driven by major automotive hubs like China, Japan, and India. The increasing vehicle production and demand for affordable yet functional vehicle components are key factors propelling the sun visor market in this region.

- Middle East & Africa: The Middle East and Africa are seeing steady demand for automotive sun visors, driven by growing vehicle sales in urban areas. Additionally, rising disposable incomes in regions like the UAE and Saudi Arabia are pushing demand for premium automotive products.

- Latin America: Latin America is showing moderate growth in the automotive sun visor market, driven by increasing automotive production in countries like Brazil and Mexico. As the region focuses on expanding its automotive manufacturing base, demand for vehicle components, including sun visors, is on the rise.

Key Regions and Countries Covered in the Report

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Landscape

In the Automotive Sun Visor Market, several key companies play a crucial role in driving market trends and innovation. Major players such as 3M, Johnson Controls, Lear Corporation, and Toyoda Gosei are leading the charge with their strong market presence, advanced technologies, and focus on quality and customer satisfaction.

3M is a global leader in materials science and has a significant presence in the automotive sector, including the sun visor market. The company’s ability to develop innovative products using advanced materials, such as lightweight composites and UV-resistant films, sets it apart from competitors. 3M’s extensive research and development capabilities ensure that it stays ahead in terms of product design, durability, and consumer demand.

Johnson Controls, a well-established player in the automotive components sector, is another key contributor to the sun visor market. Known for its expertise in interior systems, Johnson Controls designs and manufactures sun visors with advanced features such as integrated lighting and air filtration systems. The company’s focus on automotive interior comfort and safety positions it as a strong contender in the market.

Lear Corporation specializes in automotive seating and electrical systems, but it also has a strong presence in the sun visor market. The company’s products are highly regarded for their durability and performance. Lear’s sun visors are designed to meet the evolving needs of modern vehicles, with a focus on user convenience, safety, and lightweight materials.

Toyoda Gosei is another key player, particularly in the area of automotive interior components. The company’s sun visors are recognized for their high-quality materials and ability to integrate additional features such as touch controls and smart technology. Toyoda Gosei’s strong relationships with leading car manufacturers help it maintain a solid position in the competitive market.

These companies are essential to the automotive sun visor market, providing innovative solutions that meet the growing demand for advanced, durable, and functional products. Their ongoing commitment to innovation and market expansion will continue to shape the future of the industry.

Major Companies in the Market

- Grupo Antolin

- Magna International Inc.

- Atlas Holdings LLC

- Irvin Automotive Products, Inc.

- KASAI KOGYO CO., LTD.

- HOWA Co., Ltd.

- IAC Group

- Gentex Corporation

- GUMOTEX Co.

- Toyota Boshoku Corporation

Recent Developments

- Ford’s Patent for Multi-Functional Sun Visor (October 2023): Ford filed a patent for an innovative sun visor design that doubles as an emergency tool. The design allows the sun visor to detach from its mounting rod, revealing a pointed end capable of breaking vehicle windows in emergencies. The rod itself can also be removed from its roof mount, providing a practical solution for occupants to escape during critical situations.

- Bosch’s Virtual Visor Introduction (January 2020): Bosch unveiled its Virtual Visor, a transparent LCD screen equipped with artificial intelligence. This advanced sun visor links with a driver-monitoring camera to track the sun’s position and the driver’s line of sight, dynamically shading only the portion of the visor where sunlight could cause glare. This innovation enhances driver visibility and safety by reducing unnecessary shading.

Report Scope

Report Features Description Market Value (2024) USD 2.6 Billion Forecast Revenue (2034) USD 4.0 Billion CAGR (2025-2034) 4.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Standard Sun Visors, Electrically Operated Sun Visors, Manual Sun Visors), By Material Type (Fabric, Leather, Plastic, Polyurethane, Aluminum), By Vehicle Type (Passenger Cars, Commercial Vehicles, Electric Vehicles (EVs), Two-Wheelers), By Sales Channel (OEM (Original Equipment Manufacturer), Aftermarket) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Grupo Antolin, Magna International Inc., Atlas Holdings LLC, Irvin Automotive Products, Inc., KASAI KOGYO CO., LTD., HOWA Co., Ltd., IAC Group, Gentex Corporation, GUMOTEX Co., Toyota Boshoku Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Global Automotive Sun Visor MarketPublished date: Feb 2025add_shopping_cartBuy Now get_appDownload Sample

Global Automotive Sun Visor MarketPublished date: Feb 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Grupo Antolin

- Magna International Inc.

- Atlas Holdings LLC

- Irvin Automotive Products, Inc.

- KASAI KOGYO CO., LTD.

- HOWA Co., Ltd.

- IAC Group

- Gentex Corporation

- GUMOTEX Co.

- Toyota Boshoku Corporation