Global Automotive Collision Repair Market Size, Share, Growth Analysis By Product (Consumables, Paints & Coatings, Spare Parts), By Service Channel (OE, DIFM, DIY), By Vehicle Type (Heavy-Duty Vehicle, Light-Duty Vehicle), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 14863

- Number of Pages: 369

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

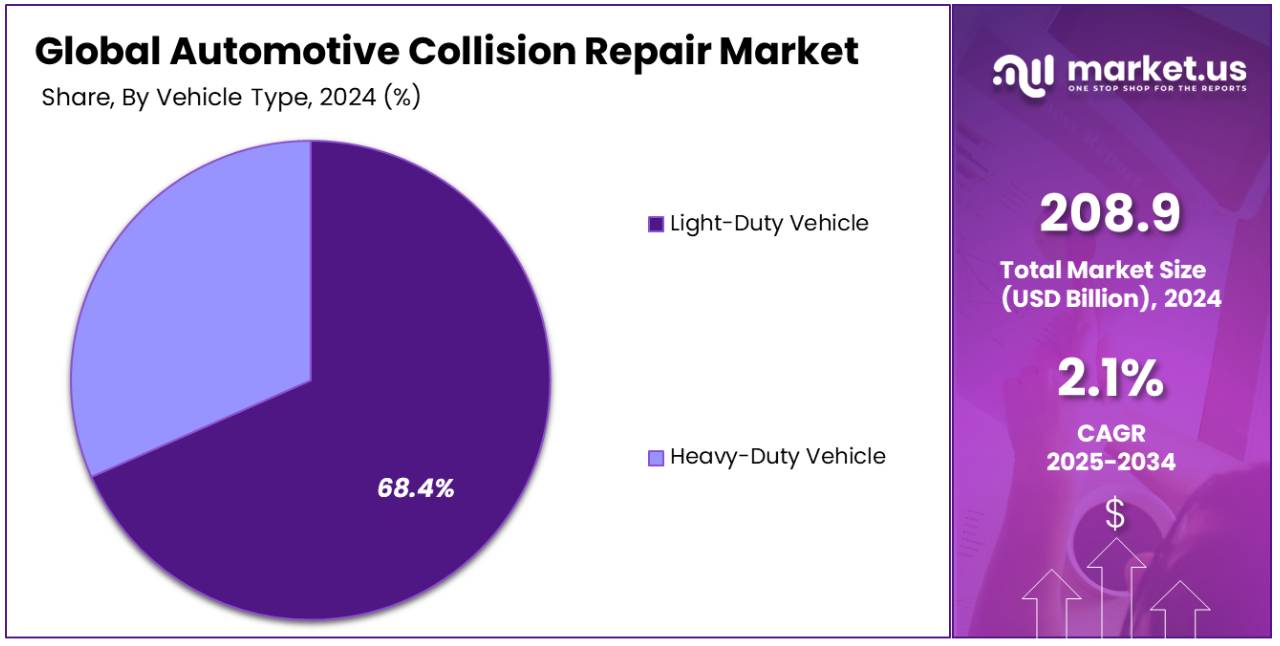

The Global Automotive Collision Repair Market size is expected to be worth around USD 257.2 Billion by 2034, from USD 208.9 Billion in 2024, growing at a CAGR of 2.1% during the forecast period from 2025 to 2034.

Automotive collision repair involves restoring vehicles damaged in accidents. It includes bodywork, painting, and structural repairs. Skilled technicians assess damage and apply modern repair techniques. The process ensures safety, functionality, and appearance restoration. Quality collision repair supports vehicle longevity and resale value while meeting industry standards and customer expectations consistently.

The automotive collision repair market encompasses the trade of repair services and associated products. It involves a network of service centers, parts suppliers, and insurance companies. Market trends in this sector are shaped by several factors, including the age of the vehicle, safety regulations, and technological advancements. The market’s growth is bolstered by an increase in vehicle ownership and a corresponding rise in the demand for accident repairs across various regions.

The automotive collision repair market is increasingly relevant due to rising vehicle ownership and the subsequent congestion in urban areas. In 2022, the U.S. recorded 278,870,463 registered vehicles, with trucks making up 170,239,357 of these. This high vehicle density is a key driver for the collision repair industry, as more vehicles on the road typically lead to more accidents.

Furthermore, the demand for collision repair services is underscored by the significant hours spent in traffic congestion, which increases the likelihood of vehicular accidents. For example, drivers in New York City and London each spent an average of 101 hours in traffic in 2023, ranking them among the most congested cities globally. This heavy traffic contributes directly to the volume of collision repair needs.

Moreover, the financial impact of these accidents is substantial, influencing the collision repair market. The Insurance Information Institute noted that in 2022, the average auto liability claim for bodily injury was $26,501, and for property damage, it was $6,551. These high costs highlight the crucial role of effective and efficient collision repair services to manage expenses stemming from road incidents.

In this context, the collision repair market not only provides essential services but also plays a significant role in managing the socio-economic impacts of increased vehicle use in densely populated areas. As vehicle numbers and urban congestion continue to rise, so too does the importance of this industry in maintaining automotive and road safety and functionality.

Key Takeaways

- Automotive Collision Repair Market was valued at USD 208.9 Billion in 2024 and is projected to reach USD 257.2 Billion by 2034, with a CAGR of 2.1%.

- In 2024, Spare Parts led the product segment with 64.3%, driven by increased replacement demand.

- In 2024, Original Equipment (OE) held 55.4% in the service channel segment, benefiting from high-quality manufacturer parts.

- In 2024, Light-Duty Vehicles accounted for 68.4%, reflecting the dominance of passenger vehicles in repair services.

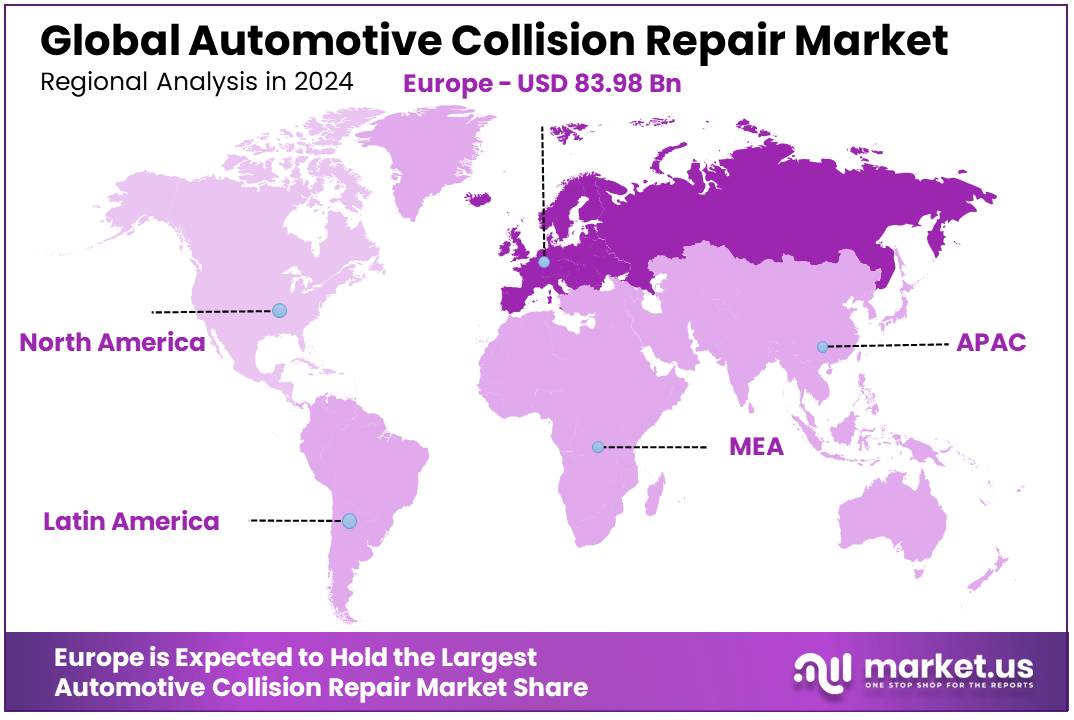

- In 2024, Europe held 40.2% of the market, valued at USD 83.98 Billion, supported by stringent vehicle safety regulations.

Type Analysis

Spare Parts dominate with 64.3% due to their critical role in vehicle repair and maintenance.

The Automotive Collision Repair Market is significantly driven by the demand for Spare Parts, which accounted for 64.3% of the market in 2024. This sub-segment’s dominance is attributed to the continuous need for replacement parts in post-collision repairs, which are essential for restoring vehicle functionality and safety. Spare Parts range from minor components like mirrors and lights to major elements such as engines and transmissions, highlighting their extensive impact on the repair process.

In contrast, other product sub-segments like Consumables and Paints & Coatings also play pivotal roles but are less dominant. Consumables, including items such as adhesives and sealants, are crucial for the durability of repairs but less significant in terms of market share.

Paints & Coatings are essential for restoring a vehicle’s aesthetic and protective finish, yet they do not command a majority market share. Both sub-segments contribute to the market’s growth by ensuring comprehensive repair solutions that extend beyond mere functionality to include vehicle appearance and longevity.

Service Channel Analysis

Original Equipment (OE) leads with 55.4% owing to manufacturer guarantees and assured compatibility.

The dominance of the OE (Original Equipment) sub-segment in the Automotive Collision Repair Market, holding a 55.4% share in 2024, stems from its assurance of quality and compatibility with existing vehicle systems. OE parts are preferred for their ability to preserve vehicle warranties and match the exact specifications of the vehicle, which is crucial for maintaining performance and safety standards post-collision.

Meanwhile, the DIFM (Do It For Me) and DIY (Do It Yourself) service channels also contribute to the market landscape. DIFM offers professional services, ensuring expert handling and installation of parts, which is vital for complex repairs. DIY, though smaller in market share, appeals to a niche segment of consumers interested in personal involvement in the repair process, catering to those seeking cost-effective solutions and personal satisfaction from hands-on work.

Vehicle Type Analysis

Light-Duty Vehicles lead with 68.4% due to their prevalence in consumer markets and frequent usage.

Light-Duty Vehicles are the predominant sub-segment in the Automotive Collision Repair Market, with a market share of 68.4% in 2024. This sub-segment’s significant share is due to the high volume of light-duty vehicles in operation, including passenger cars and small trucks, which are commonly involved in road accidents. The frequency of collisions involving these vehicles escalates the demand for collision repair services.

On the other hand, the Heavy-Duty Vehicle sub-segment, though essential, commands a smaller share of the market. These vehicles include large trucks and buses, which are less numerous but require more substantial and costly repairs when involved in collisions. The repair of heavy-duty vehicles is a critical service that ensures the safety and operational efficiency of larger transport vehicles which are crucial for commercial and industrial activities.

Key Market Segments

By Product

- Consumables

- Paints & Coatings

- Spare Parts

By Service Channel

- OE

- DIFM

- DIY

By Vehicle Type

- Heavy-Duty Vehicle

- Light-Duty Vehicle

Driving Factors

Urbanization and Insurance Uptake Drives Market Growth

The automotive collision repair market is expanding due to increasing vehicle ownership, especially in densely populated urban areas. As more people rely on personal vehicles for daily travel, road traffic congestion rises. This leads to a higher frequency of minor and major accidents, directly increasing demand for collision repair services.

Alongside this, more vehicle owners now have insurance coverage that includes accidental damage. With rising insurance claims, repair shops are seeing steady business from both individuals and insurance companies. This trend is particularly strong in regions with mandatory vehicle insurance policies.

Advancements in repair tools and paint systems also support market growth. Modern paint booths, for instance, allow faster drying and better color matching, which improves customer satisfaction and throughput.

Another driver is the growing complexity of vehicle structures. Today’s cars come equipped with sensors, cameras, and lightweight materials that require specialized repair processes. For example, a minor bumper replacement may now involve recalibrating multiple safety systems.

Restraining Factors

High-Tech Repairs and Workforce Gaps Restraints Market Growth

Several challenges are holding back the full potential of the automotive collision repair market. One key issue is the high cost of fixing vehicles with advanced driver-assistance systems (ADAS). These components, such as radar sensors and lane-keeping cameras, are expensive and often require recalibration after a collision. This adds time and cost to repairs.

Additionally, there is a growing shortage of skilled technicians who are trained to work on modern vehicles. With rapid changes in automotive technology, many repair shops struggle to find or train workers who can handle complex electronic systems and high-strength materials.

Insurance reimbursement also varies widely by region. Inconsistent claim approval processes and delayed payments from insurers can reduce profitability for repair businesses. This is especially difficult for smaller repair shops with limited financial flexibility.

Lastly, counterfeit and low-quality replacement parts pose a threat to service quality. These parts may not meet safety standards, leading to poor performance and potential legal risks for repair providers.

Growth Opportunities

Tech-Driven Services and Sustainability Provide Opportunities

New opportunities are emerging in the collision repair market through digital tools, sustainability efforts, and EV servicing. One major area is the expansion of certified repair centers for electric and hybrid vehicles. As EV sales grow, there is rising demand for specialized workshops that can safely handle battery systems and lightweight materials.

Digital tools are also reshaping how damage is assessed. Remote inspection apps and AI-powered estimation software allow technicians to evaluate damages using photos or video. This speeds up the claims process and improves customer convenience.

Sustainability is another promising avenue. Repair centers are increasingly adopting eco-friendly paints and recyclable materials. These solutions reduce environmental impact and align with regulations on volatile organic compounds (VOCs) used in conventional products.

Meanwhile, robotics and automation are making repair workshops more efficient. Robots can assist in tasks like welding, sanding, or paint application, improving accuracy and reducing labor costs.

These trends present strong opportunities for repair providers to modernize their operations. By investing in new technologies and eco-conscious practices, businesses can meet changing customer expectations while standing out in a competitive, insurance-driven market landscape.

Emerging Trends

Smart Tech and Mobile Services Are Latest Trending Factor

The collision repair market is embracing several high-impact trends that improve speed, precision, and service reach. One major trend is the use of augmented reality (AR) for technician training and repair support. AR headsets can guide mechanics step-by-step during complex repairs, reducing errors and training time.

OEM-certified repair networks are also growing. Automakers are partnering with select repair centers to ensure consistent quality using genuine parts and approved procedures. This builds customer trust and meets the needs of high-end and tech-heavy vehicles.

Telematics systems are becoming vital in post-accident support. These in-vehicle systems can detect a collision, send data to insurers, and recommend nearby certified repair shops. This makes the repair process faster and more connected.

Mobile repair services are also gaining popularity. These services offer on-site repairs for minor dents, scratches, or bumper issues. For urban customers or fleet operators, this provides convenience and reduces downtime.

Regional Analysis

Europe Dominates with 40.2% Market Share

Europe leads the Automotive Collision Repair Market with a 40.2% share, valued at USD 83.98 billion. This commanding market presence is driven by high vehicle density and stringent regulations concerning vehicle maintenance and safety.

Key factors boosting Europe’s market share include advanced automotive repair technologies, a robust network of repair facilities, and stringent EU regulations that mandate regular vehicle inspections and repairs. High standards for vehicle safety and consumer awareness about vehicle maintenance also contribute significantly to the market’s size.

Looking ahead, Europe’s influence in the global Automotive Collision Repair Market is expected to continue growing. Technological advancements in repair methods, along with increasing vehicle sales and the rising complexity of automotive electronics, suggest a steady demand for collision repair services. Europe’s market may expand further as newer, more repair-intensive vehicles become mainstream.

Regional Mentions:

- North America: North America holds a significant portion of the Automotive Collision Repair Market, driven by high vehicle ownership and the prevalence of road accidents. The region’s focus on insurance coverage for repairs and technological adoption in repair services underscores its robust market performance.

- Asia Pacific: Asia Pacific is rapidly growing in the Automotive Collision Repair Market, fueled by increasing vehicle ownership and expanding automotive industries in China, India, and Southeast Asia. The region’s growth is also supported by improving road safety standards and rising consumer awareness about vehicle maintenance.

- Middle East & Africa: The Middle East and Africa are developing in the Automotive Collision Repair Market, with improvements in road infrastructure and an increase in automotive sales. The region’s market is being gradually driven by urbanization and economic diversification.

- Latin America: Latin America is witnessing growth in the Automotive Collision Repair Market. Economic recovery and increasing motorization rates are leading to more vehicles on the road, which in turn drives the demand for collision repair services.

Key Regions and Countries Covered in the Report

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Landscape

The automotive collision repair market is led by companies with strong product portfolios, global networks, and advanced technology. The top four players in this market are 3M, Denso Corporation, Robert Bosch GmbH, and Magna International Inc. These companies support the market with high-quality parts, tools, and repair systems.

3M is a major player due to its wide range of collision repair products. These include abrasives, adhesives, fillers, and paint preparation systems. The company is known for innovation and reliable performance. 3M also provides training and support to repair shops, which adds value to its offering.

Denso Corporation supplies key components used in collision repairs, such as sensors, electronics, and thermal systems. The company works closely with automakers, ensuring high compatibility and performance. Denso’s focus on safety and quality supports its strong position in the market.

Robert Bosch GmbH offers a broad range of parts and diagnostic tools used in the repair process. The company is trusted for its high standards in engineering and testing. Bosch also provides advanced systems for electronic and mechanical repairs, helping shops work faster and more accurately.

Magna International Inc. is one of the largest automotive suppliers, offering structural parts and exterior components. Its products are widely used in vehicle body repair. The company invests in lightweight materials and modern design, supporting faster and safer repairs.

These leading companies drive the automotive collision repair market by offering reliable, advanced, and easy-to-use solutions. Their partnerships with OEMs and investment in innovation ensure high-quality repair outcomes. As vehicle technologies become more complex, these players continue to provide the tools and parts needed to meet changing repair needs efficiently and safely.

Major Companies in the Market

- Automotive Technology Products LLC

- 3M

- Continental AG

- Denso Corporation

- Federal-Mogul LLC

- Faurecia

- Honeywell International Inc.

- Johnson Controls Inc.

- International Automotive Components Group

- Magna International Inc.

- Martinrea International Inc.

- Mann+Hummel Group

- Mitsuba Corporation

- Takata Corporation

- Robert Bosch GmbH

Recent Developments

- Valvoline and Breeze AutoCare: On January 2025, Valvoline announced a definitive agreement to acquire Breeze AutoCare, adding nearly 200 stores to its network. The acquisition, valued at approximately $625 million in cash, is part of Valvoline’s strategy to accelerate its growth and expand its service offerings in the automotive maintenance sector.

- Quality Collision Group and LaMettry’s Collision: On November 2024, Quality Collision Group, backed by Susquehanna Capital Partners, acquired LaMettry’s Collision, an 11-store operation in the Minneapolis area. This acquisition marked the largest transaction in the collision repair industry for 2024, expanding Quality Collision Group’s footprint and operational capacity.

Report Scope

Report Features Description Market Value (2024) USD 208.9 Billion Forecast Revenue (2034) USD 257.2 Billion CAGR (2025-2034) 2.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Consumables, Paints & Coatings, Spare Parts), By Service Channel (OE, DIFM, DIY), By Vehicle Type (Heavy-Duty Vehicle, Light-Duty Vehicle) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Automotive Technology Products LLC, 3M, Continental AG, Denso Corporation, Federal-Mogul LLC, Faurecia, Honeywell International Inc., Johnson Controls Inc., International Automotive Components Group, Magna International Inc., Martinrea International Inc., Mann+Hummel Group, Mitsuba Corporation, Takata Corporation, Robert Bosch GmbH Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Automotive Collision Repair MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

Automotive Collision Repair MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- The 3M Company

- Automotive Technology Products LLC

- Continental AG

- Denso Corporation

- Faurecia

- Federal-Mogul LLC

- Honeywell International, Inc.

- International Automotive Components Group

- Johnson Controls, Inc.

- Magna International Inc.

- Other Key Players