Global Adhesives and Sealants Market By Product (Silicone, Acrylic, Epoxy, Polyurethanes, and Other Products), By Application (Construction, Packaging, Consumers, Automotive, and Other Applications), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: April 2024

- Report ID: 22060

- Number of Pages: 257

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

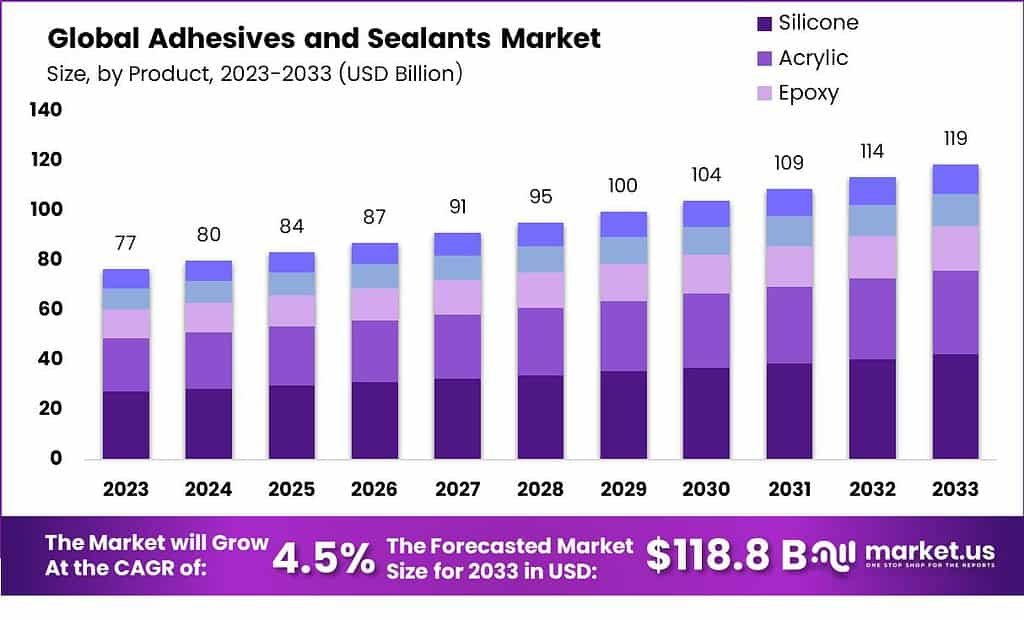

The Global Adhesives and Sealants Market is anticipated to be USD 119 billion by 2033. It is estimated to record a steady CAGR of 4.5% in the Forecast period 2023 to 2033. It is likely to total USD 77 billion in 2023.

Adhesives and sealants play a crucial role in various industries, providing essential bonding and sealing solutions. These substances are integral to the manufacturing and construction processes, contributing to the durability and longevity of products

The global adhesives and sealants market is experiencing significant growth, driven by the expanding automotive, construction, and electronics sectors. Key players in the industry are constantly innovating to meet the evolving demands of consumers. Understanding the market trends and key players is essential for stakeholders looking to navigate this dynamic landscape.

Adhesives and sealants find extensive use in various industries. In the automotive sector, they contribute to the light weighting of vehicles, enhancing fuel efficiency. In construction, these substances ensure the structural integrity of buildings. The electronics industry relies on adhesives and sealants for component assembly and protection against environmental factors.

The global adhesives and sealants market is experiencing remarkable expansion, driven by expanding automotive, construction, and electronics sectors. Industry players are continuously innovating their offerings in response to consumers’ evolving needs.

Key Takeaways

- Market Size Projection: Adhesives and Sealants Market to reach USD 119 billion by 2032, growing at a steady 4.5% CAGR, with USD 77 billion expected in 2023.

- Dominant Product Type: In 2023, silicone led with over 35.6% market share. Acrylic, epoxy, polyurethanes, and specialized products also played vital roles.

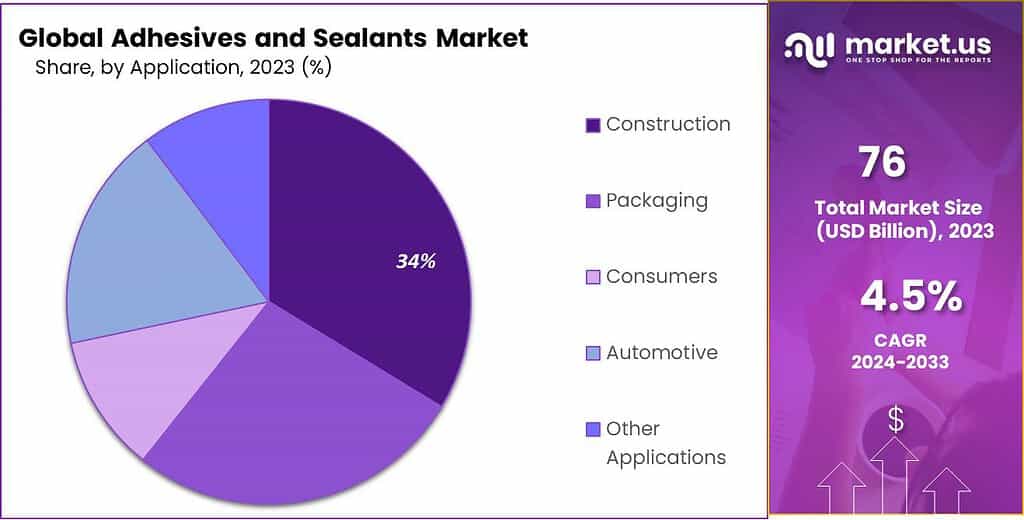

- Leading Application: Construction sector commands 35.7% market share. Packaging, automotive, consumers, and other applications contribute significantly to market dynamics.

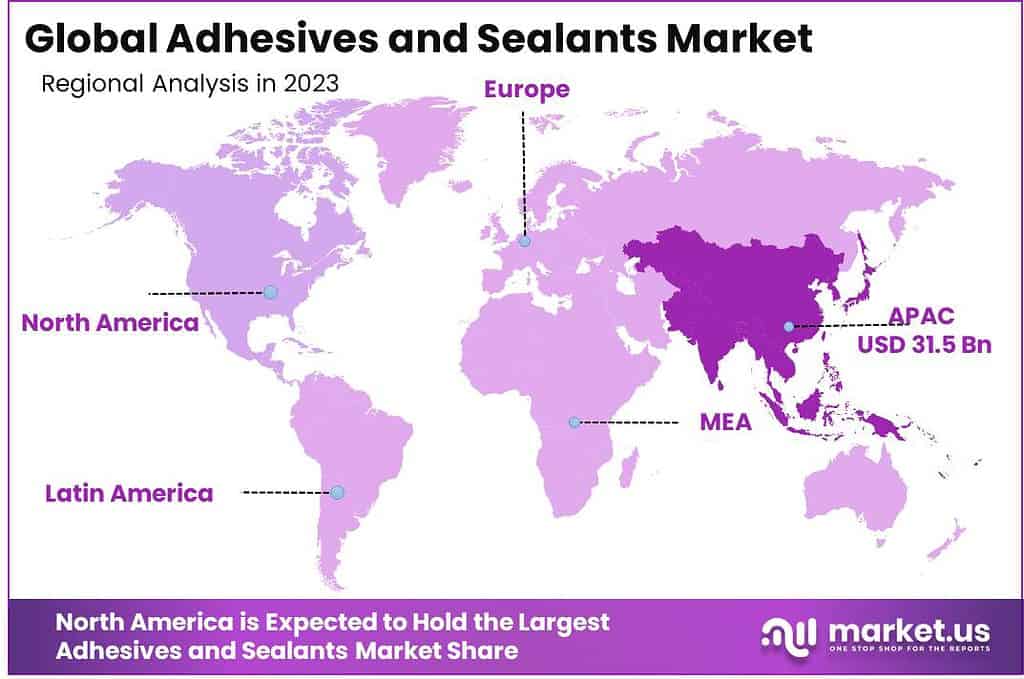

- Regional Analysis: Asia Pacific led in 2023 with a 41.2% market share, driven by industrial development in China and India.

Product Type Analysis

In 2023, the adhesives and sealants market witnessed remarkable segmentation by product type, with silicone emerging as the frontrunner, firmly establishing its dominance by capturing a substantial market share of over 35.6%. This ascendancy can be attributed to the superior properties exhibited by silicone-based adhesives and sealants, such as excellent resistance to extreme temperatures, weathering, and chemicals, making them indispensable in various industries. The versatility of silicone products in applications ranging from construction to automotive and electronics further bolstered its market position.

Moving forward, the acrylic segment also made significant strides, garnering a noteworthy share of the market. Acrylic-based adhesives and sealants have gained traction due to their quick curing times and strong bonding capabilities, which align with the demand for efficient and durable solutions in industries like packaging and assembly.

Epoxy-based adhesives and sealants retained their presence in the market, holding a substantial share. Their reputation for high strength and exceptional adhesion properties ensures their continued utilization in demanding applications within the aerospace, marine, and automotive sectors.

Polyurethanes, known for their flexibility, durability, and moisture resistance, secured a notable market share as well. Industries such as construction and automotive rely on polyurethane-based products for their ability to provide long-lasting and resilient bonds in challenging environments.

Lastly, the category of “Other Products” exhibited promising growth, encompassing a range of niche adhesives and sealants tailored to specific industrial needs. As market dynamics continue to evolve, this segment may witness further diversification and innovation.

In conclusion, the adhesives and sealants market in 2023 showcased a diverse landscape of product types, each offering unique advantages to cater to the needs of various industries. While silicone led the way with its exceptional properties, acrylic, epoxy, polyurethane, and other specialized products also played pivotal roles, reflecting the dynamic nature of this ever-evolving industry.

Application Analysis

In 2023, the adhesives and sealants market displayed a distinctive segmentation by application, with the construction segment emerging as the undisputed leader, commanding a significant market share of over 35.7%. This leading position could be explained by the constant demand for sealants and adhesives in the construction field and are used in a variety of uses, such as sealing, bonding, and insulation. The constant expansion of the construction industry that is fueled by infrastructure development and urbanization is a major factor in the growth of this sector.

Following closely, the packaging segment also demonstrated substantial market presence. Adhesives and sealants play a critical role in the packaging industry, ensuring the integrity and security of various products during transit and storage. Their use in the production of food packaging, pharmaceuticals, and consumer goods packaging contributed significantly to their market share.

Meanwhile, the consumers segment, which encompasses a wide array of consumer-oriented applications, showcased notable growth. Adhesives and sealants find utility in everyday products like furniture, textiles, and electronics, enhancing product durability and functionality.

Note: Actual Numbers Might Vary In Final Report

The automotive segment maintained a firm foothold in the market, securing a considerable share. Adhesives and sealants are integral in the automotive industry for bonding and sealing applications, contributing to vehicle safety and reducing weight, thus aligning with the industry’s focus on efficiency and sustainability.

Lastly, the category of “Other Applications” emerged as an area of interest and innovation, encompassing specialized uses across diverse industries. These applications often involve unique adhesive and sealant requirements tailored to specific needs.

Driving Factors

- Construction Boom: The global construction industry continues to expand, driven by urbanization and infrastructure development. Adhesives and sealants are essential for bonding, sealing, and insulating materials in construction, making this sector a significant driver of market growth.

- Automotive Light-weighting: As the automotive industry focuses on reducing vehicle weight to improve fuel efficiency and sustainability, adhesives and sealants play a crucial role in replacing traditional fasteners. This trend is driving a rise in demand in the automative industry.

- Growth in the Packaging industry: explosion of e-commerce as well as the increased consumer demand for goods packaged has caused a boom in the manufacturing of packaging.

Restraining Factors

- Raw Material Price Volatility: The adhesives and sealants industry relies on various raw materials, and price fluctuations can impact production costs. Volatile material prices pose a challenge for market players.

- Environmental Regulations: Stringent environmental regulations are pushing the industry toward more sustainable and eco-friendly formulations. Adapting to these regulations can be costly and challenging for some manufacturers.

Growth Opportunities

- Green and Sustainable Products: The market can capitalize on the increasing demand for eco-friendly adhesives and sealants. Developing and marketing green products aligns with consumer preferences and regulatory requirements.

- Technological Advancements: Investment in research and development to create innovative formulations with improved performance characteristics offers growth opportunities. High-performance adhesives and sealants for specialized applications can open new markets.

Latest Trends

- Bio-Based Formulations: There is a growing trend toward bio-based adhesives and sealants derived from renewable sources. These products are gaining traction due to their sustainability and reduced environmental impact.

- Smart Adhesives: The integration of smart technologies into adhesives is on the rise. These adhesives can sense and respond to environmental changes, finding applications in healthcare, electronics, and other industries.

- Digitalization and E-commerce: The industry is embracing digital tools for marketing, sales, and customer engagement. E-commerce platforms are becoming essential for product distribution and customer convenience.

- Customization and Specialization: Tailoring adhesives and sealants for specific industries and applications is a notable trend. Customized solutions offer enhanced performance and efficiency for end-users.

Key Market Segments

By Product

By Application

- Construction

- Packaging

- Consumers

- Automotive

- Other Applications

Geopolitical and Recession Impact Analysis

Analyzing the geopolitical and recession impacts on the adhesives and sealants market requires a comprehensive assessment of the interconnected factors that influence this industry. Geopolitical considerations, such as trade policies, tariffs, and global alliances, have a direct bearing on the market’s dynamics.

In recent years, geopolitical tensions and trade disputes have introduced uncertainties. These disruptions can affect the supply chain, leading to fluctuations in raw material prices and availability. Companies operating in the adhesives and sealants sector often source materials globally, making them vulnerable to geopolitical shifts. Navigating these challenges necessitates a flexible supply chain strategy and close monitoring of international relations.

Moreover, economic recessions can significantly impact the market. During economic downturns, construction activity, a major consumer of adhesives and sealants, tends to decline, affecting market demand. Additionally, reduced consumer spending can impact industries like automotive and packaging, indirectly affecting the market.

However, it’s worth noting that adhesives and sealants also exhibit resilience during economic downturns. Companies often seek cost-effective solutions to replace traditional mechanical fasteners, which can lead to increased adoption of adhesives and sealants. Furthermore, the trend toward light-weighting in automotive and aerospace industries remains a growth driver, even during economic challenges.

To thrive in this environment, companies in the adhesives and sealants market should maintain a diverse customer base across industries and regions, closely monitor geopolitical developments, and invest in research and development to provide innovative and cost-effective solutions. While geopolitical and recessionary impacts are real concerns, the market’s ability to adapt and innovate can help mitigate these challenges and, in some cases, even lead to new opportunities.

Regional Analysis

In 2023, the world market for sealants and adhesives showed an impressive segmentation based on geographic regions with regions in the Asia Pacific region emerging as the most prominent, taking a lead in the market with a market share of 41.2% of the total market share. The demand for Adhesives and sealants in APAC was valued at USD 31.5 billion in 2023 and is anticipated to grow significantly in the forecast period.

The dominance can be attributed to the region’s booming industrial development, particularly in emerging economies like China and India which are where the construction automobile, electronics, and construction industries are flourishing. The growing demand for sealants and adhesives in these areas, triggered by infrastructure expansion and increasing consumer spending, has pushed Asia Pacific Asia Pacific region to the leading edge of market.

In the meantime, Europe and North America continued to have a significant presence on the market and Europe taking a large part in the overall market. Europe’s focus on sustainability and stringent environmental laws have prompted the use of environmentally friendly sealants and adhesives that are aligned with the preferences of consumers and increasing market share.

North America also retained a considerable market share, primarily due to the region’s strong presence in industries such as aerospace and automotive, where adhesives and sealants play a pivotal role in lightweighting and enhancing performance.

Latin America showcased steady growth potential, driven by expanding construction and automotive sectors, while the Middle East and Africa exhibited emerging opportunities, notably in the construction and oil and gas industries.

Key Regions and Countries Covered in this Report

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Player Analysis

Analyzing key players in the adhesives and sealants market involves a thorough examination of the industry’s major participants, their market share, strategies, and contributions to the market’s growth and innovation.

Top Key Players

- 3M Company

- Ashland Inc.

- Avery Denison Corporation

- H B Fuller

- Henkel AG

- Sika AG

- Pidilite Industries

- Huntsman

- Wacker Chemie AG

- RPM International Inc.

Recent Developments

- In September 2022, Henkel AG & Co. KGaA made a significant move by expanding its production facility located in Brandon, South Dakota. This expansion was primarily aimed at the manufacturing of thermal interface material adhesives. These specialized adhesives hold pivotal importance in both the electronics and automotive industries due to their ability to efficiently dissipate heat, ensuring optimal performance and reliability of electronic components and automotive systems. Notably, these thermal interface material adhesives are marketed under the well-known brands Loctite and Bergquist, reinforcing Henkel’s commitment to providing high-quality adhesive solutions to meet the specific needs of these industries.

- In January 2022, Bostik, a subsidiary of Arkema and a leading player in the adhesive solutions sector, entered into a strategic agreement with DGE Group, a specialty chemicals distributor. This partnership aimed to enhance the distribution of Bostik’s products across Europe, the Middle East, and Africa. One of the notable highlights of this agreement was the inclusion of Born2Bond engineering adhesives, meticulously designed for a wide range of applications, including automotive, electronics, and luxury packaging.

Report Scope

Report Features Description Market Value (2023) US$ 77 Bn Forecast Revenue (2033) US$ 119 Bn CAGR (2023-2033) 4.5% Base Year for Estimation 2023 Historic Period 2020-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product (Silicone, Acrylic, Epoxy, Polyurethanes, and Other Products), By Application (Construction, Packaging, Consumers, Automotive, and Other Applications) Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape 3M Company, Ashland Inc., Avery Denison Corporation, H B Fuller, Henkel AG, Sika AG, Pidilite Industries, Huntsman, Wacker Chemie AG, RPM International Inc. Customization Scope Customization for segments and region/country level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What are adhesives and sealants?Adhesives are substances used to bind two or more surfaces together, while sealants are used to prevent the passage of fluids through joints or openings in materials. Both play crucial roles in various industries, including construction, automotive, and manufacturing.

How big is Adhesives and Sealants Industry?The Global Adhesives and Sealants Market is anticipated to be USD 119 billion by 2032. It is estimated to record a steady CAGR of 4.5% in the Forecast period 2023 to 2033. It is likely to total USD 77 billion in 2023.

What are the primary applications of adhesives and sealants?Adhesives are commonly used in industries such as automotive, construction, packaging, and electronics. Sealants find applications in areas requiring protection against water, dust, or chemicals, such as in building and construction, automotive assembly, and aerospace.

What factors drive the growth of the adhesives and sealants market?The market growth is driven by factors such as increasing demand from end-use industries like construction and automotive, advancements in technology, and the trend towards lightweight and durable materials.

What are the challenges faced by the adhesives and sealants industry?Challenges include fluctuating raw material prices, environmental concerns related to certain adhesive formulations, and the need for constant innovation to meet evolving industry standards.

What are the future trends in the adhesives and sealants market?Future trends include the adoption of smart adhesives, increased use of bio-based materials, and the development of high-performance adhesives for specific applications such as electronics and medical devices.

Adhesives and Sealants MarketPublished date: April 2024add_shopping_cartBuy Now get_appDownload Sample

Adhesives and Sealants MarketPublished date: April 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- 3M Company

- Ashland Inc.

- Avery Denison Corporation

- H B Fuller

- Henkel AG

- Sika AG

- Pidilite Industries

- Huntsman

- Wacker Chemie AG

- RPM International Inc.