Global Polyethylene Market Size, Share, And Growth Analysis Report By Type (High-Density Polyethylene (HDPE), Low-Density Polyethylene (LDPE), Linear Low-Density Polyethylene (LLDPE)), By Source (Virgin, Recycled), By Processing Method (Extrusion Molding, Injection Molding, Blow Molding, Rotational Molding, Calendering, Others), By End-Use (Packaging, Automotive, Building and Construction, Consumer Goods, Healthcare, Electrical and Electronics, Agriculture, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: April 2025

- Report ID: 112744

- Number of Pages: 308

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

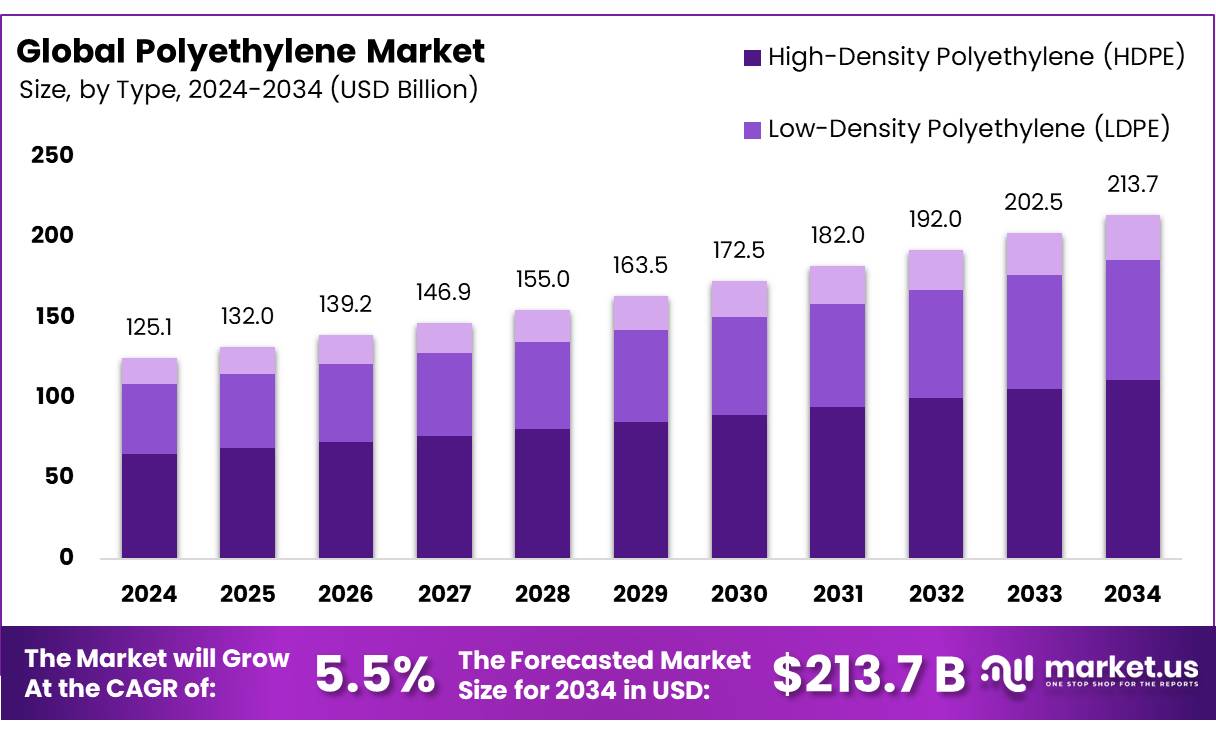

The Global Polyethylene Market size is expected to be worth around USD 213.7 billion by 2034, from USD 125.1 billion in 2024, growing at a CAGR of 5.5% during the forecast period from 2025 to 2034.

Polyethylene (Polythene) is one of the world’s most popular plastics. It is an enormously versatile polymer which is suited to a wide range of applications from heavy-duty damp proof membranes for new buildings to light, flexible bags and films. Two major types of PE are in use in the films and flexible packaging sector – LDPE (Low Density) used generally for trays and heavier duty films such as long-life bags and sacks, poly tunnels, protective sheeting, food bags etc and HDPE (High Density) which is used for most thin gauge carrier bags, fresh produce bags and some bottles and caps.

Polyethylene (PE) is a polymer obtained from the polymerization of ethylene. It represents the most produced plastic polymer in the world, followed by PP and PVC, accounting for 34% of the total plastics market. The melting point for high-density polyethylene is typically in the range of T = 120–130 °C, and for low-density polyethylene, about T = 105–115 °C. Polyethylene polymers have excellent chemical resistance.

The material is a flexible, translucent or waxy polymer that offers excellent weatherproofing and maintains toughness at low temperatures, down to -60°C. It is easy to process using most manufacturing methods, cost-effective, and exhibits good chemical resistance. Its physical properties include a tensile strength ranging from 0.20 to 0.40 N/mm², exceptional notched impact strength with no break (Kj/m²), a thermal coefficient of expansion between 100 and 220 x 10⁶, a maximum continuous use temperature of 65°C, and a density of 0.944 to 0.965 g/cm³.

Polyethylene growth opportunities lie in sustainable innovations, including bio-based polyethylene derived from sugarcane or corn. Recycling technologies are also advancing, addressing plastic pollution concerns. The construction sector presents potential for polyethylene in geomembranes and insulation. As industries prioritize eco-friendly solutions, the market is poised for transformation, balancing economic growth with environmental responsibility.

Key Takeaways

- The Global Polyethylene Market is projected to grow from USD 125.1 billion in 2024 to USD 213.7 billion by 2034, at a CAGR of 5.5%.

- High-Density Polyethylene (HDPE) dominates with a 52.4% market share, driven by its use in packaging, construction, and consumer goods.

- Extrusion molding leads processing methods with a 38.4% share, favored for producing pipes, films, and sheets.

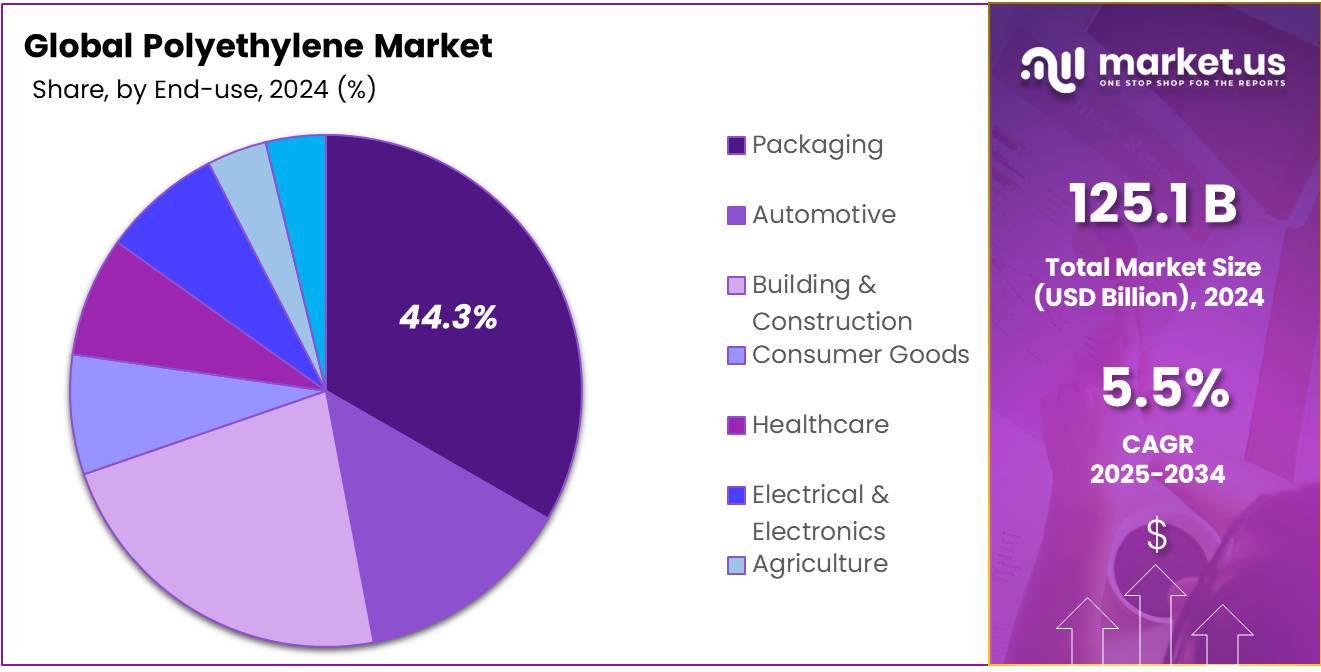

- The Packaging Industry holds a 44.3% share of polyethylene demand, valued for its versatility and cost-effectiveness.

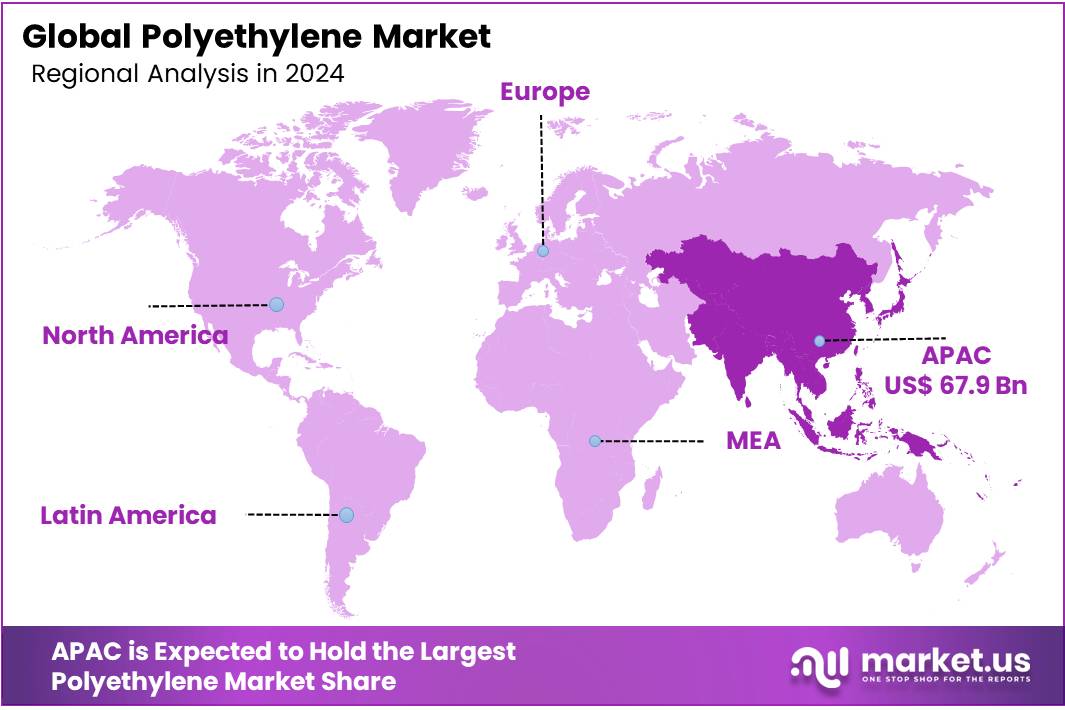

- The Asia-Pacific region commands a 54.3% market share, worth USD 67.9 billion in 2024, fueled by industrialization and urbanization.

Analyst Viewpoint

The global polyethylene market, a vital cog in the plastics industry, presents a mixed bag of investment opportunities and risks, shaped by consumer shifts, technological advancements, and tightening regulations. Investors can tap into growth areas like bio-based polyethylene, spurred by consumer demand for sustainable options as global consumers now prefer eco-friendly packaging.

Technological innovations, such as metallocene catalysts improving LLDPE performance, offer avenues for high-margin products, particularly in Asia-Pacific, which holds 54% of the market share. Volatile crude oil prices, a key feedstock, can erode margins with oil price fluctuations. Plastic waste reduction targets push for recycling and could raise compliance costs.

Policies like the EU’s single-use plastic ban drive innovation. Emerging markets in Africa and Latin America, with less stringent rules, offer growth but face infrastructure gaps. Investors must weigh these dynamics, balancing the allure of high-growth segments against the headwinds of regulation and raw material volatility.

By Type

HDPE Dominates Polyethylene Market with 52.4% Share in 2024

In 2024, High-Density Polyethylene (HDPE) held a dominant market position, capturing more than a 52.4% share of the overall polyethylene market. This strong performance was driven by its widespread use in packaging, construction, and consumer goods due to its durability, chemical resistance, and recyclability. The demand for HDPE continued to grow as industries favored it for bottles, pipes, and industrial containers.

HDPE is expected to maintain its leading position, supported by increasing applications in sustainable packaging and infrastructure development. The segment’s growth is further fueled by rising environmental concerns, pushing manufacturers to adopt recyclable materials. With its versatility and cost-effectiveness, HDPE remains the preferred choice over other polyethylene types, reinforcing its dominance in the market.

By Source

Virgin Polyethylene Commands 83.3% Market Share in 2024, Reinforcing Industry Dominance

In 2024, virgin polyethylene held a dominant market position, capturing more than an 83.3% share of the total polyethylene supply. Its widespread preference comes from superior quality, consistency, and performance in high-demand applications like food packaging, medical products, and automotive components.

Manufacturers continue to favor virgin polyethylene due to its reliability in meeting strict industry standards, especially where recycled materials still face limitations in purity and strength. Virgin polyethylene is expected to maintain its stronghold, as industries with stringent safety and durability requirements, such as healthcare and electronics, keep driving demand.

Sustainability trends push for more recycled alternatives, but virgin material remains irreplaceable for critical applications. With no major disruptions in supply chains or material innovation, virgin polyethylene will likely stay the primary choice for bulk production in the near term.

By Processing Method

Extrusion Molding Leads Polyethylene Processing with 38.4% Market Share in 2024

In 2024, extrusion molding held a dominant market position, capturing more than a 38.4% share of the polyethylene processing methods. This segment’s strong performance was driven by its efficiency in producing pipes, films, and sheets, which are widely used in packaging, construction, and agriculture.

The method’s ability to handle large-scale production while maintaining cost-effectiveness made it the preferred choice for manufacturers. Extrusion molding is expected to retain its leading role, supported by rising demand for plastic films in food packaging and irrigation pipes in agriculture.

The process’s adaptability to different polyethylene grades ensures its continued dominance, with no major shifts anticipated in the near term. As industries prioritize high-volume, consistent-quality production, extrusion molding will likely remain the top processing method in the polyethylene market.

By End-Use

Packaging Sector Drives Polyethylene Demand with 44.3% Market Share in 2024

In 2024, the packaging industry dominated polyethylene end-use demand, holding more than a 44.3% share. This strong position comes from polyethylene’s versatility in making everything from food wraps and shopping bags to rigid containers and industrial packaging.

Its lightweight, durability, and cost-effectiveness keep it as the top choice for manufacturers and retailers alike. Packaging is expected to remain the leading application for polyethylene, driven by steady demand from food & beverage, e-commerce, and consumer goods sectors.

Sustainability concerns push for alternative materials, but polyethylene’s performance and affordability ensure it stays essential for protective and flexible packaging solutions. With no major substitutes matching its balance of properties, polyethylene will likely keep its stronghold in packaging for years to come.

Key Market Segments

By Type

- High-Density Polyethylene (HDPE)

- Low-Density Polyethylene (LDPE)

- Linear Low-Density Polyethylene (LLDPE)

By Source

- Virgin

- Recycled

By Processing Method

- Extrusion Molding

- Injection Molding

- Blow Molding

- Rotational Molding

- Calendering

- Others

By End-Use

- Packaging

- Automotive

- Building and Construction

- Consumer Goods

- Healthcare

- Electrical and Electronics

- Agriculture

- Others

Drivers

Rising Domestic Demand Fuels Polyethylene Growth in India

One of the major driving forces behind the growth of polyethylene in India is the significant increase in domestic demand, particularly in sectors such as packaging, agriculture, and infrastructure. This surge is evident in the substantial rise in the country’s polyethylene production capacity over recent years.

According to the Department of Chemicals and Petrochemicals, the installed capacity for Low-Density Polyethylene (LDPE) in India expanded from 160,000 metric tonnes in 2018-19 to 610,000 metric tonnes. This growth is not merely a reflection of industrial expansion but also a response to the everyday needs of the Indian population.

Polyethylene is integral to the production of various daily-use items, including packaging materials, agricultural films, and pipes. The increasing demand for these products underscores the material’s significance in enhancing the quality of life and supporting the country’s development.

Restraints

Import Dependence Challenges India’s Polyethylene Sector

India’s polyethylene industry faces a significant challenge due to its heavy reliance on imports. Despite efforts to boost domestic production, the gap between demand and supply has been widening. According to the Department of Chemicals and Petrochemicals, the installed capacity for polymers increased from 10,115 thousand metric tonnes (TMT) to 12,894 TMT.

Production during the same period saw only a marginal rise from 10,040 TMT to 11,487 TMT. This disparity led to an increase in imports from 4,479 TMT to 4,789 TMT, while exports declined from 1,934 TMT to 1,173 TMT. The growing import dependence is further highlighted by projections from the Standing Committee on Chemicals and Fertilizers, which observed that the gap between India’s demand and its capacity to produce major petrochemicals is expected to increase from 1,124 kilo tonnes per annum (KTPA) in 2018-19 to 7,112 KTPA by 2025, marking a 533% increase.

This reliance on imports not only affects the trade balance but also exposes the industry to global market volatilities and supply chain disruptions. To address this, the Indian government has implemented initiatives like the Petroleum, Chemicals and Petrochemical Investment Regions (PCPIR) policy, aiming to promote investment and infrastructure development in the chemical sector.

Opportunity

Government Initiatives Driving Polyethylene Growth in India

One of the major factors contributing to the growth of polyethylene in India is the government’s proactive initiatives aimed at bolstering the petrochemical sector. Recognizing the strategic importance of petrochemicals in the nation’s industrial landscape, the Indian government has implemented policies and programs to enhance domestic production and reduce dependency on imports.

A significant initiative in this direction is the establishment of Petroleum, Chemicals and Petrochemical Investment Regions (PCPIRs). These are specifically delineated investment regions to attract both domestic and foreign investments in the petrochemical sector.

The PCPIR policy aims to provide world-class infrastructure, a conducive policy environment, and a regulatory framework to facilitate the growth of the sector. The Department of Chemicals and Petrochemicals (DCPC) has been instrumental in formulating and implementing policies that support the growth of the petrochemical industry.

Trends

India’s Push Towards Self-Reliance in Polyethylene Production

India is making significant strides in enhancing its domestic polyethylene production, aiming to reduce dependency on imports and strengthen its position in the global petrochemical industry. According to the Department of Chemicals and Petrochemicals, the production of polymers, which includes polyethylene, increased from 9.27 million tonnes in 2017-18 to 12.55 million tonnes in 2023-24, reflecting a compound annual growth rate (CAGR) of 5.16%.

This growth is supported by government initiatives such as the Petroleum, Chemicals and Petrochemical Investment Regions (PCPIRs) policy, which aims to attract investments and develop infrastructure for the petrochemical sector. The government’s focus on skill development and research in the petrochemical sector is evident through institutions like the Central Institute of Petrochemicals Engineering & Technology (CIPET), which provides technical education and training, ensuring a skilled workforce for the industry.

Regional Analysis

Asia-Pacific Leads Global Polyethylene Market with 54.3% Share

The Asia-Pacific (APAC) region has solidified its position as the dominant force in the global polyethylene market, commanding a substantial 54.3% share, equivalent to approximately USD 67.9 billion in 2024. This dominance is driven by rapid industrialization, urbanization, and the expansion of key end-use sectors such as packaging, construction, automotive, and electronics.

China stands at the forefront of this growth, leveraging its extensive manufacturing capabilities and infrastructure development initiatives. The country’s ambitious projects, including the Belt and Road Initiative, have significantly increased the demand for polyethylene in construction and related activities.

India, another major contributor, is experiencing a robust increase in polyethylene consumption, driven by the growth of its packaging industry and the implementation of industrial automation to boost production. The country’s packaging consumption has doubled over the last decade, reflecting a shift towards packaged food items and a growing middle-class population.

The APAC region’s dominance is underpinned by its ability to adapt to changing market dynamics, invest in infrastructure, and meet the growing demands of diverse industries. With continued economic development and strategic initiatives, APAC is poised to maintain its leading position in the global polyethylene market.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

- LyondellBasell Industries Holdings B.V. is a global leader in polyethylene production, offering a wide portfolio of high-density (HDPE), low-density (LDPE), and linear low-density (LLDPE) polyethylene. The company operates facilities across North America, Europe, and Asia.

- Covestro AG, though primarily recognized for polyurethanes and polycarbonates, plays a growing role in the polyethylene value chain through innovation in sustainable materials. The company emphasized bio-based and recycled content in polyethylene-based solutions. Covestro’s contribution is largely integrated through advanced film materials for packaging and mobility.

- Dow is a global chemical leader and a top producer of polyethylene resins, offering a broad range of performance-enhanced HDPE, LDPE, and LLDPE. Dow emphasized decarbonization and launched several recyclable polyethylene innovations targeting the flexible packaging sector. Operating in over 31 countries, the company leverages its scale and technical know-how to meet high-volume demand.

Top Key Players in the Market

- LyondellBasell Industries Holdings B.V.

- Covestro AG

- SABIC

- Dow

- Exxon Mobil Corporation

- LG Chem

- SCG Chemicals Co., Ltd.

- Evonik Industries AG

- PTT Global Chemical Public Company Limited

- INEOS

- Braskem

- Formosa Plastics

- Mitsubishi Chemical Corporation

- NOVA Chemicals Corporate

- Sinopec

- TotalEnergies

- Chevron Phillips Chemical Company LLC

- Westlake Chemical

- DSM

Recent Developments

- In 2024, it focused on circular polymers and advanced recycling to meet sustainability targets. With strong R&D and innovation, LyondellBasell maintains a dominant position in packaging, automotive, and industrial applications through its proprietary Hostalen, Lupolen, and Metocene polyethylene technologies.

- In 2024, the company emphasized bio-based and recycled content in polyethylene-based solutions. Covestro’s contribution is largely integrated through advanced film materials for packaging and mobility. Its strategic partnerships in the circular economy and materials science expertise are strengthening its competitive edge in specialty polyethylene applications, particularly in Europe.

Report Scope

Report Features Description Market Value (2024) USD 125.1 Billion Forecast Revenue (2034) USD 213.7 Billion CAGR (2025-2034) 5.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (High-Density Polyethylene (HDPE), Low-Density Polyethylene (LDPE), Linear Low-Density Polyethylene (LLDPE)), By Source (Virgin, Recycled), By Processing Method (Extrusion Molding, Injection Molding, Blow Molding, Rotational Molding, Calendering, Others), By End-Use (Packaging, Automotive, Building and Construction, Consumer Goods, Healthcare, Electrical and Electronics, Agriculture, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape LyondellBasell Industries Holdings B.V., Covestro AG, SABIC, Dow, Exxon Mobil Corporation, LG Chem, SCG Chemicals Co., Ltd., Evonik Industries AG, PTT Global Chemical Public Company Limited, INEOS, Braskem, Formosa Plastics, Mitsubishi Chemical Corporation, NOVA Chemicals Corporate, Sinopec, TotalEnergies, Chevron Phillips Chemical Company LLC, Westlake Chemical, DSM Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)

-

-

- LyondellBasell Industries Holdings B.V.

- Covestro AG

- SABIC

- Dow

- Exxon Mobil Corporation

- LG Chem

- SCG Chemicals Co., Ltd.

- Evonik Industries AG

- PTT Global Chemical Public Company Limited

- INEOS

- Braskem

- Formosa Plastics

- Mitsubishi Chemical Corporation

- NOVA Chemicals Corporate

- Sinopec

- TotalEnergies

- Chevron Phillips Chemical Company LLC

- Westlake Chemical

- DSM