Global Fresh Food Packaging Market By Packaging Material (Plastic (Polyethylene (PE), Polypropylene (PP), Polyethylene Terephthalate (PET), Polyvinyl Chloride (PVC), Others), Paper and Paperboard (Metal, Aluminum, Steel, Glass, Others), By Packaging Type (Rigid Packaging (Boxes, Cans, Jars, Others), Flexible Packaging (Bags, Pouches, Wraps, Others), By Pack Type (Converted Roll Stock, Gusseted Bags, Flexible Paper, Corrugated Box, Others), By Application (Fruits and Vegetables , Meat, Poultry, and Seafood, Dairy Products, Bakery or Confectionery Products, Others), By Distribution Channel (Direct Sales, Indirect Sales, Supermarkets/Hyper Markets, Specialty Stores, Online Stores, Others), By Region And Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends And Forecast 2025-2034

- Published date: March 2025

- Report ID: 13123

- Number of Pages: 262

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

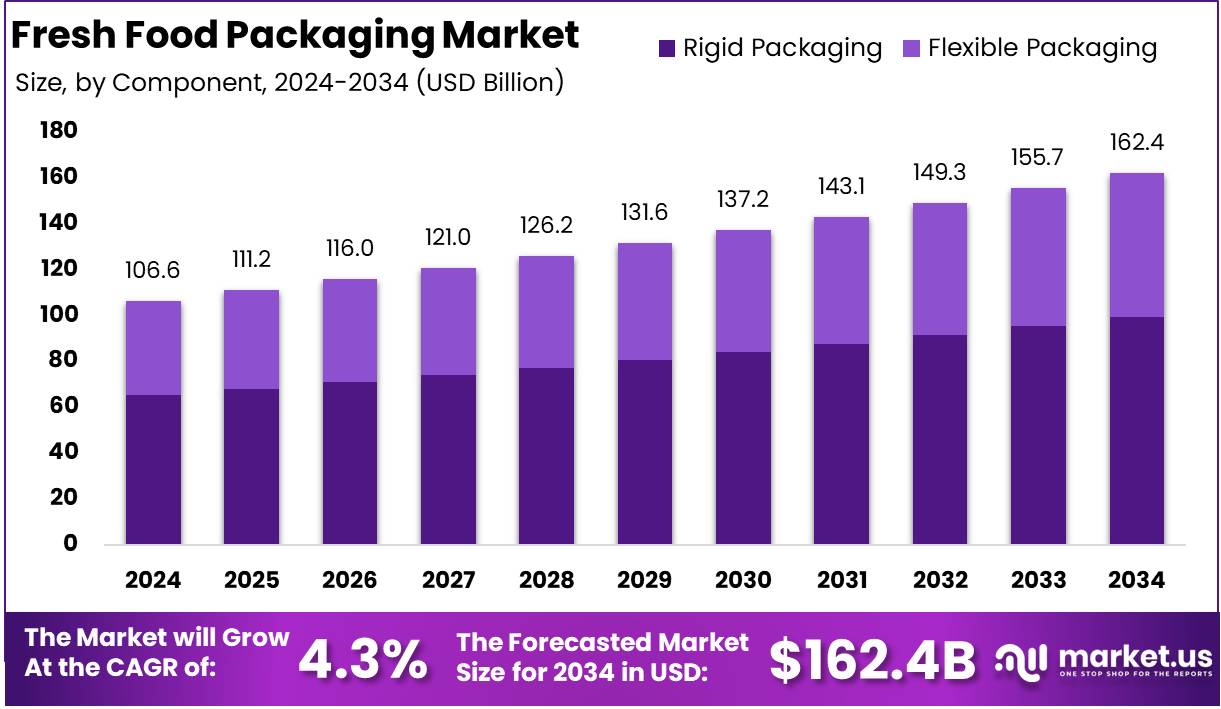

The Global Fresh Food Packaging Market size is expected to be worth around USD 162.4 Billion by 2034 from USD 106.6 Billion in 2024, growing at a CAGR of 4.3% during the forecast period from 2025 to 2034.

Fresh food packaging refers to the specialized materials and technologies used to store, protect, and extend the shelf life of perishable food products, such as fruits, vegetables, dairy, meat, seafood, and bakery items. The primary objective of fresh food packaging is to maintain product quality by preventing contamination, reducing spoilage, and ensuring optimal freshness during storage and transportation.

Advanced packaging solutions, including modified atmosphere packaging (MAP), vacuum sealing, and biodegradable materials, play a critical role in preserving nutritional value while minimizing food waste.

The fresh food packaging market encompasses the global industry involved in the production, innovation, and distribution of packaging materials specifically designed for perishable food products. It includes various packaging formats such as rigid and flexible plastic, paperboard, metal, glass, and sustainable alternatives.

The market is driven by advancements in food preservation technologies, rising consumer demand for sustainable packaging, and stringent regulatory policies aimed at reducing single-use plastics. Industry players, including packaging manufacturers, food producers, and retailers, continuously invest in research and development to enhance the functionality and eco-friendliness of fresh food packaging solutions.

The fresh food packaging market is expanding due to multiple converging factors. Increasing global food consumption, driven by population growth and urbanization, is fueling demand for efficient packaging solutions that extend shelf life and reduce food wastage. The shift toward sustainable packaging, supported by government regulations and corporate sustainability commitments, is accelerating the adoption of biodegradable, compostable, and recyclable materials.

The demand for fresh food packaging is on an upward trajectory, propelled by evolving consumer preferences and industry trends. The growing need for convenience, especially in the ready-to-eat and on-the-go food segments, is increasing reliance on advanced packaging solutions. Supermarkets, grocery stores, and e-commerce platforms are witnessing a surge in fresh food sales, necessitating robust and efficient packaging materials that ensure hygiene and durability.

The fresh food packaging market presents significant opportunities for innovation and investment. The rising demand for sustainable and eco-friendly packaging materials opens avenues for companies to develop alternatives to traditional plastic packaging, such as plant-based films, edible coatings, and recyclable biopolymers.

Technological advancements in smart packaging, including freshness indicators and blockchain-enabled traceability, offer a competitive edge for manufacturers looking to enhance consumer trust and food safety compliance.

According to Trvst, the Fresh Food Packaging Market is poised for significant growth, driven by the urgent need to reduce food waste, which results in $1 trillion in economic losses globally, with 1.3 billion tonnes of food discarded annually. The economic impact is staggering, with $750 billion lost every year due to wasted food (excluding seafood and fish).

The Food and Agriculture Organization (FAO) reports that 29 million tonnes of milk and over 20% of the 263 million tonnes of global meat production are wasted. Additionally, 22% of oilseeds and pulses are lost annually. The U.S. leads food waste, discarding 40 million tons annually, underscoring the critical role of innovative packaging solutions in extending shelf life, enhancing sustainability, and reducing losses across the supply chain.

The Fresh Food Packaging Market is facing increasing pressure to adopt sustainable solutions as packaging waste continues to rise globally. 141 million tonnes of plastic packaging waste are generated annually, with 40% attributed to packaging. According to Business Waste, the EU produces 84 million tonnes of packaging waste, with residents generating 7kg per person.

Paper and cardboard dominate EU packaging waste 34 million tonnes, followed by plastic 16.1 million tonnes and glass 15.6 million tonnes, with 84.2% of total packaging waste being recycled. In the U.S., 2 million tonnes of municipal solid waste comes from packaging, contributing 63% to total MSW. These figures underscore the urgent need for sustainable innovations in fresh food packaging.

Key Takeaways

- The global fresh food packaging market is projected to reach USD 162.4 billion by 2034, growing at a CAGR of 4.3% from USD 106.6 billion in 2024.

- Plastic remains the dominant packaging material, capturing 43.3% of the market share in 2024.

- Rigid packaging leads the market, accounting for 61.2% of the total market share in 2024.

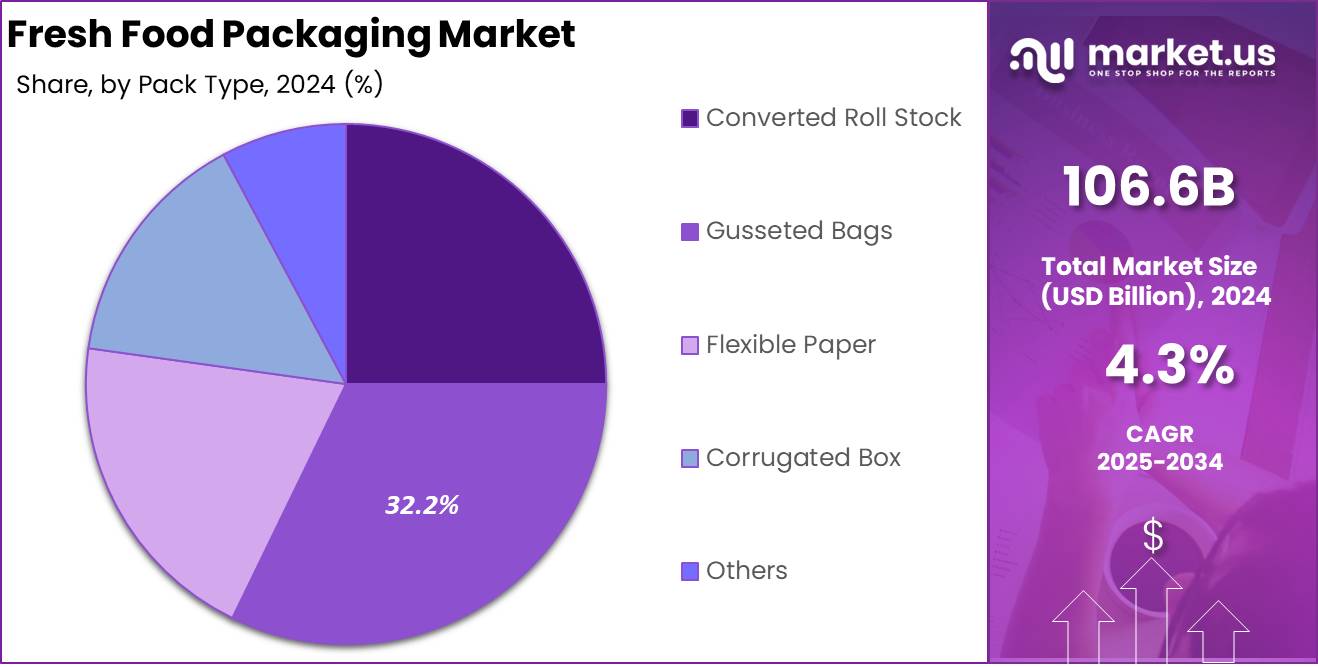

- Gusseted bags dominate with a 32.2% market share in 2024.

- Fruits & vegetables remain the primary application segment, securing 41.2% of the market share in 2024.

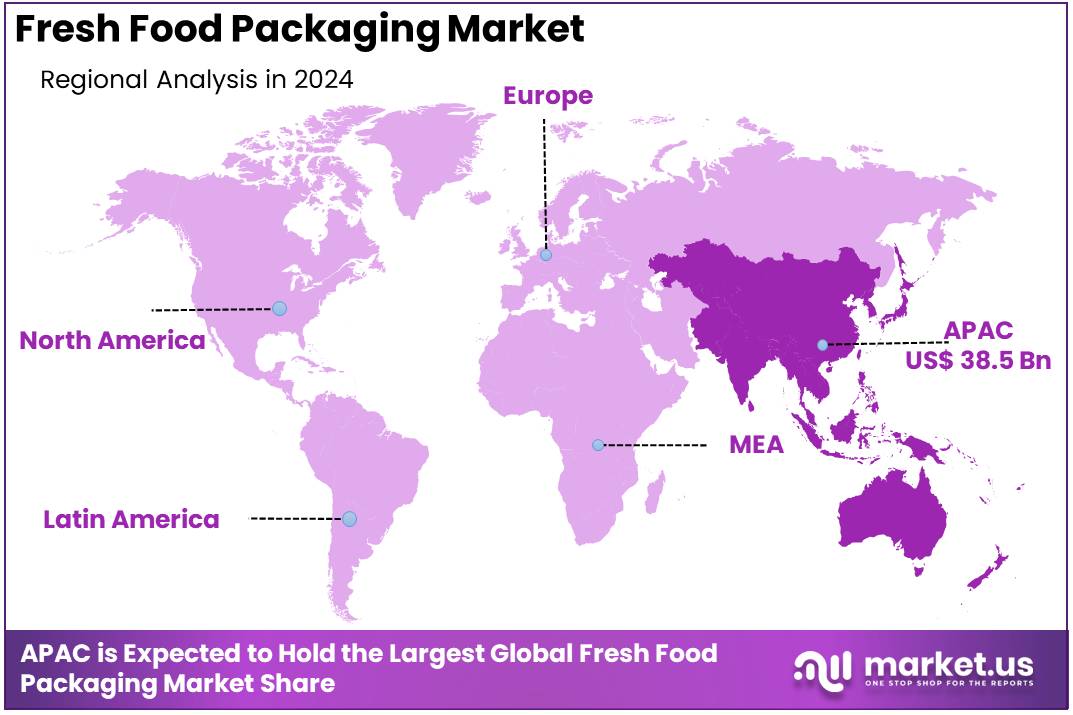

- The Asia Pacific region holds the largest market share at 36.2%, with a market valuation of USD 38.5 billion in 2024.

By Packaging Material Analysis

Plastic Dominates Fresh Food Packaging Market with a 43.3% Share in 2024

In 2024, plastic remained the dominant packaging material in the fresh food packaging market, capturing 43.3% of the total market share. The segment’s growth can be attributed to its lightweight nature, cost-effectiveness, and superior barrier properties, which enhance food preservation and extend shelf life.

Additionally, advancements in biodegradable and recyclable plastic packaging have driven further adoption, addressing sustainability concerns while maintaining functionalit

The paper & paperboard segment has gained significant momentum due to the rising demand for eco-friendly and compostable packaging alternatives. Growing environmental concerns, coupled with regulatory restrictions on plastic usage, have accelerated the shift toward paper-based materials.

Metal packaging continues to play a crucial role in preserving fresh food products, offering high durability, recyclability, and protective properties. Tinplate and tin-free steel are widely used in canned food applications, including meat, seafood, and vegetables. Ongoing innovations in lightweight metal packaging and advanced sealing technologies are further enhancing product longevity and safety.

Aluminum packaging has gained popularity as a lightweight, recyclable, and highly effective barrier material. It is widely used in packaging for fresh meat, dairy, and bakery products, ensuring freshness while protecting against external factors.

Technological advancements in coating applications are further improving aluminum’s resistance to corrosion, making it a preferred choice for food manufacturers seeking sustainable and high-performance packaging solutions.

Steel packaging continues to be a reliable choice for canned fruits, vegetables, and ready-to-eat meals, owing to its high strength and protective qualities. While alternative materials are increasingly being explored, steel remains widely used in long-term food preservation applications, where durability and contamination resistance are key considerations.

Glass packaging continues to be a preferred option in the premium and organic food segments, valued for its non-reactive nature, recyclability, and transparency. It enhances product appeal while ensuring flavor integrity and extended shelf life. However, challenges related to higher costs and fragility have limited its broader adoption, keeping its presence concentrated in niche markets.

The others segment includes bioplastics, composite materials, and edible packaging solutions, which are gaining traction as sustainable alternatives to traditional packaging materials.

Innovations in biodegradable films and plant-based packaging technologies are driving interest among manufacturers and consumers seeking eco-friendly and functional packaging solutions. This category is expected to evolve steadily, supported by ongoing research and technological advancements.

By Packaging Type Analysis

Rigid Packaging Leads Fresh Food Packaging Market with a 61.2% Share in 2024

In 2024, rigid packaging remained the dominant packaging type in the fresh food packaging market, capturing 61.2% of the total market share. The segment’s growth is driven by its durability, strong protective properties, and ability to extend shelf life.

Key packaging formats, including boxes, cans, and jars, are widely used for dairy products, ready-to-eat meals, and beverages. The rising demand for food safety and contamination-resistant packaging solutions has further strengthened the segment’s market position.

Flexible packaging is gaining significant traction in the fresh food packaging market, driven by its lightweight design, cost efficiency, and adaptability. This segment includes bags, pouches, and wraps, commonly used for meat, seafood, bakery, and fresh produce packaging.

Increasing consumer demand for convenient and resealable packaging options, along with advancements in biodegradable and recyclable flexible materials, is fueling segment growth.

By Pack Type Analysis

Gusseted Bags Dominate Fresh Food Packaging Market with a 32.2% Share in 2024

In 2024, gusseted bags emerged as the leading pack type in the fresh food packaging market, capturing 32.2% of the total market share. Their expandable design, durability, and ability to hold large volumes make them a preferred choice for fresh produce, bakery items, and meat products. The growing demand for cost-effective, space-efficient, and resealable packaging solutions has further strengthened the segment’s position in the market.

Converted roll stock continues to gain traction in the fresh food packaging market, driven by its versatility, lightweight structure, and cost efficiency. Widely used for form-fill-seal applications, this packaging format is ideal for snack foods, dairy products, and frozen foods. Increasing adoption of custom-printed and recyclable roll stock materials is further fueling growth in this segment.

The flexible paper segment is witnessing steady growth, supported by rising demand for eco-friendly and compostable packaging solutions. It is commonly used for bakery products, sandwiches, and fresh produce due to its breathability and recyclability. Advancements in coated and laminated paper materials are enhancing moisture resistance and food safety, driving greater adoption across the market.

Corrugated boxes play a crucial role in the fresh food packaging market, widely used for transport and bulk storage of fresh food products. Their high strength, recyclability, and superior protective properties make them a preferred choice for fruits, vegetables, dairy, and meat shipments. Growing emphasis on sustainable and lightweight corrugated solutions is contributing to the segment’s steady expansion.

The others segment includes clamshells, trays, wraps, and edible packaging, all gaining attention due to increasing innovations in biodegradable and compostable materials. As manufacturers seek alternative packaging solutions aligned with sustainability goals, this category is expected to see continued advancements and market expansion.

By Application Analysis

Fruits & Vegetables Dominate Fresh Food Packaging Market with a 41.2% Share in 2024

In 2024, fruits & vegetables emerged as the leading application segment in the fresh food packaging market, capturing 41.2% of the total market share. The segment’s dominance is driven by the high demand for protective and breathable packaging solutions that extend shelf life and maintain freshness.

Packaging formats such as corrugated boxes, gusseted bags, and flexible films are widely used to prevent spoilage, enhance transportation efficiency, and meet sustainability requirements.

In 2024, fruits & vegetables emerged as the leading application segment in the fresh food packaging market, driven by the high demand for protective and breathable packaging solutions that extend shelf life and maintain freshness.

Packaging formats such as corrugated boxes, gusseted bags, and flexible films are widely used to prevent spoilage, enhance transportation efficiency, and meet sustainability requirements.

Meat, poultry, and seafood continue to witness significant demand in the fresh food packaging market, supported by the rising adoption of vacuum-sealed and modified atmosphere packaging (MAP).

These solutions help prevent contamination, enhance product longevity, and ensure food safety. Innovations in biodegradable and recyclable meat packaging materials are further driving segment growth.

The dairy products segment is growing steadily, driven by increasing consumption of milk, cheese, yogurt, and butter. The demand for rigid plastic containers, cartons, and flexible pouches continues to rise due to their protective and temperature-resistant properties. Growing consumer preference for single-serve and resealable dairy packaging is also fueling segment expansion.

Bakery & confectionery products are gaining traction in the fresh food packaging market, supported by the rising consumption of packaged baked goods and sweets. Paper-based and flexible packaging solutions such as wrappers, pouches, and clamshells are widely used to preserve freshness, prevent moisture exposure, and enhance product appeal. The demand for custom-printed and eco-friendly bakery packaging is also contributing to segment growth.

The others segment includes prepared meals, frozen foods, and specialty food items, where increasing demand for convenient, on-the-go packaging solutions is driving adoption. Advancements in biodegradable and smart packaging technologies are further expanding this segment, catering to evolving consumer preferences for sustainable and functional packaging alternatives.

By Distribution Channel Analysis

Indirect Sales Dominate Fresh Food Packaging Market with a 61.2% Share in 2024

In 2024, indirect sales emerged as the leading distribution channel in the fresh food packaging market, capturing 61.2% of the total market share. The dominance of this segment is driven by the wide distribution network of supermarkets, hypermarkets, and specialty stores, which offer a diverse range of fresh food packaging solutions. The convenience of bulk purchasing, competitive pricing, and accessibility has further strengthened the segment’s position in the market.

Direct sales continue to expand in the fresh food packaging market, primarily through manufacturer-to-business transactions. Food producers and retailers prefer direct procurement of customized packaging solutions to meet specific branding, sustainability, and efficiency needs. The growing focus on eco-friendly and innovative packaging materials is further propelling the adoption of this distribution channel.

Supermarkets and hypermarkets play a vital role in the distribution of packaged fresh food products, offering diverse packaging solutions to cater to consumer demands for convenience, quality, and sustainability. The rising trend of on-the-go food consumption and pre-packaged fresh items is fueling growth in this segment, as retailers seek innovative and efficient packaging solutions.

Specialty stores focus on premium and organic fresh food packaging solutions, emphasizing sustainable, high-quality, and innovative materials.

These stores attract health-conscious and environmentally aware consumers, driving demand for compostable, biodegradable, and custom-branded packaging options. The increasing preference for artisanal and locally sourced food products is further supporting growth in this segment.

Online stores are gaining traction in the fresh food packaging market, supported by the growing e-commerce sector and increasing demand for home delivery services.

Digital platforms provide easy access to a variety of fresh food packaging options, including customized, sustainable, and innovative materials. The rise in direct-to-consumer food brands and meal kit services is further accelerating the adoption of e-commerce-based packaging distribution.

The others segment includes wholesale suppliers, farmers’ markets, and alternative distribution networks, catering to specific customer needs. This segment is witnessing gradual adoption of innovative and sustainable packaging solutions, as businesses and consumers seek eco-friendly and cost-effective alternatives.

Key Market Segments

By Packaging Material

- Plastic

- Polyethylene (PE)

- Polypropylene (PP)

- Polyethylene Terephthalate (PET)

- Polyvinyl Chloride (PVC)

- Others

- Paper & Paperboard

- Metal

- Aluminum

- Steel

- Glass

- Others

By Packaging Type

- Rigid Packaging

- Boxes

- Cans

- Jars

- Others

- Flexible Packaging

- Bags

- Pouches

- Wraps

- Others

By Pack Type

- Converted Roll Stock

- Gusseted Bags

- Flexible Paper

- Corrugated Box

- Others

By Application

- Fruits & Vegetables

- Meat, Poultry, and Seafood

- Dairy Products

- Bakery & Confectionery Products

- Others

By Distribution Channel

- Direct Sales

- Indirect Sales

- Supermarkets/Hyper Markets

- Specialty Stores

- Online Stores

- Others

Driver

Growing Demand for Convenience Foods

The global fresh food packaging market is experiencing significant growth, primarily driven by the escalating consumer demand for convenience foods. This shift in consumer behavior is attributed to increasingly busy lifestyles, urbanization, and a preference for ready-to-eat or easy-to-prepare meals.

Products such as salad bags, chopped vegetable packs, and single-serve portions exemplify this trend, offering consumers time-saving solutions without compromising on freshness or nutritional value.

The convenience factor not only caters to individual consumers but also aligns with the needs of working professionals and families seeking quick meal options. This surge in demand necessitates innovative packaging solutions that preserve the quality and extend the shelf life of fresh food items, thereby propelling the growth of the fresh food packaging market.

In response to this trend, packaging manufacturers are developing materials and designs that maintain product integrity while offering user-friendly features. For instance, resealable bags, portion-controlled packaging, and microwave-safe containers are gaining popularity.

These advancements not only enhance consumer convenience but also address concerns related to food safety and waste reduction. As a result, the fresh food packaging market is witnessing increased investments in research and development to create sustainable and efficient packaging solutions that meet the evolving demands of convenience-oriented consumers.

Restraint

Environmental Concerns and Regulatory Pressures

Despite the growth prospects, the fresh food packaging market faces significant restraints due to environmental concerns and stringent regulatory pressures. The widespread use of plastic packaging has led to increased pollution and waste management challenges, prompting governments and environmental agencies to implement stricter regulations. For example, certain regions have introduced bans or limitations on single-use plastics, compelling manufacturers to seek alternative materials.

These regulatory measures aim to reduce the environmental footprint of packaging but pose challenges for the industry in terms of compliance and cost implications. The need to balance functionality, cost-effectiveness, and environmental sustainability presents a complex hurdle for market players.

In response, companies are exploring eco-friendly packaging options, such as biodegradable materials and recyclable packaging designs. However, transitioning to these alternatives often involves higher production costs and potential changes in packaging performance.

Additionally, consumer acceptance of new packaging materials plays a crucial role in the successful adoption of sustainable solutions. Therefore, while environmental regulations drive innovation towards greener packaging, they also impose constraints that require strategic adaptation by manufacturers to maintain market competitiveness.

Opportunity

Advancements in Sustainable Packaging Solutions

The growing emphasis on sustainability presents a significant opportunity for the fresh food packaging market. Consumers are increasingly seeking products that align with environmentally friendly practices, prompting manufacturers to innovate in sustainable packaging solutions.

Advancements in materials science have led to the development of biodegradable and compostable packaging options derived from renewable resources.

These innovations not only reduce the reliance on traditional plastics but also cater to the eco-conscious consumer base. Implementing sustainable packaging solutions can enhance brand reputation and open new market segments, thereby driving growth in the fresh food packaging industry.

Moreover, regulatory frameworks supporting sustainability initiatives further bolster this opportunity. Governments and international bodies are encouraging the adoption of eco-friendly packaging through incentives and favorable policies. Companies that proactively integrate sustainable practices into their operations are likely to benefit from these supportive measures.

Additionally, sustainable packaging solutions can lead to cost savings in the long term by reducing material usage and improving supply chain efficiencies. Therefore, embracing sustainability not only addresses environmental concerns but also offers economic advantages, positioning companies for success in a competitive market landscape.

Trends

Integration of Smart Packaging Technologies

A notable trend in the fresh food packaging market is the integration of smart packaging technologies. These innovations involve embedding sensors and indicators within packaging to monitor and communicate the condition of the food product. For instance, time-temperature indicators can provide real-time information about the freshness of perishable items, enhancing food safety and reducing waste.

Such technologies offer consumers greater transparency and confidence in the quality of the products they purchase. For manufacturers and retailers, smart packaging facilitates better inventory management and logistics planning, contributing to operational efficiencies. The adoption of these technologies is expected to grow, driven by advancements in the Internet of Things (IoT) and increasing consumer demand for information-rich products.

Furthermore, smart packaging aligns with the broader trend of digitalization in the food industry. By enabling traceability and data collection throughout the supply chain, these technologies support compliance with food safety regulations and quality standards.

They also provide valuable insights into consumer behavior and preferences, informing product development and marketing strategies. As the cost of smart packaging components decreases and their functionality improves, more companies are likely to adopt these solutions, thereby enhancing the overall value proposition of fresh food packaging. This trend signifies a shift towards more intelligent and responsive packaging systems that cater to the evolving needs of both consumers and businesses.

Regional Analysis

Asia Pacific Leads Fresh Food Packaging Market with Largest Market Share of 36.2% in 2024

The Asia Pacific region dominates the global fresh food packaging market, accounting for the largest market share of 36.2% in 2024, with a market valuation of USD 38.5 billion. The strong market presence in this region is driven by rapid urbanization, increasing disposable income, and growing consumer demand for packaged and convenience food.

China, India, and Japan are key contributors, with rising investments in sustainable packaging solutions and stringent regulations promoting eco-friendly alternatives. The expanding e-commerce sector and evolving retail infrastructure further fuel market growth.

North America represents a significant segment of the fresh food packaging market, supported by increasing demand for sustainable and biodegradable packaging solutions. The U.S. and Canada lead the region’s growth, driven by stringent regulatory frameworks promoting recyclable materials.

Rising consumer preference for organic and fresh food products also strengthens the market, as companies invest in innovative packaging to extend shelf life and reduce food waste.

Europe holds a strong position in the market, with countries such as Germany, France, and the U.K. at the forefront of sustainable packaging innovations. The region’s stringent environmental regulations and the European Union’s commitment to a circular economy drive the adoption of compostable and reusable packaging materials. The demand for advanced barrier technology in packaging, aimed at reducing food spoilage, further propels market expansion.

The Middle East & Africa market is experiencing steady growth, primarily fueled by rising disposable incomes, urbanization, and an expanding retail sector. Countries like the UAE and Saudi Arabia are witnessing an increasing demand for high-quality packaging solutions to meet the growing consumption of fresh produce and meat products.

Additionally, government initiatives to reduce plastic waste are fostering a transition toward biodegradable packaging solutions.

Latin America is also emerging as a key market, with Brazil, Mexico, and Argentina driving demand for innovative food packaging solutions. The region’s increasing focus on improving food supply chains and reducing post-harvest losses supports the adoption of durable and efficient packaging materials.

Government initiatives promoting sustainable packaging and the expansion of organized retail sectors contribute to overall market growth in this region.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- United Arab Emirates

Key Players Analysis

The Global Fresh Food Packaging Market in 2024 is shaped by key players employing innovative packaging solutions to enhance food preservation, reduce environmental impact, and meet evolving consumer demands. Amcor plc, a leading flexible and rigid packaging provider, continues to drive market growth through its sustainable and recyclable packaging solutions.

Similarly, Sealed Air Corporation, known for its Cryovac® brand, focuses on high-barrier packaging that extends shelf life and reduces food waste. Mondi plc is at the forefront of fiber-based and flexible packaging, emphasizing circular economy initiatives. Sonoco Products Company leverages its expertise in paperboard and rigid plastic containers to enhance food safety and convenience.

Bemis Company, Inc., now part of Amcor, strengthens its flexible packaging offerings, integrating advanced film technologies for fresh produce, dairy, and meat. DS Smith plc plays a significant role in corrugated packaging solutions, aligning with sustainability trends.

Huhtamaki Oyj continues to innovate in molded fiber and paperboard solutions, catering to eco-conscious consumers. Smurfit Kappa Group plc, a leader in paper-based packaging, focuses on sustainable alternatives to plastic. Winpak Ltd. specializes in high-performance barrier films, ensuring extended product freshness.

Tetra Pak, a pioneer in carton packaging, maintains its dominance in liquid food packaging through aseptic technology. UFlex Limited expands its global footprint with flexible packaging solutions, emphasizing recyclability.

WestRock Company strengthens its paper and corrugated solutions, while Silgan Holdings Inc. enhances its metal and plastic packaging portfolio. Constantia Flexibles Group GmbH continues to innovate in flexible packaging, prioritizing lightweight and high-barrier materials. These players collectively drive market evolution through sustainability, technology, and consumer-centric innovations.

Top Key Players in the Market

- Amcor plc

- Sealed Air Corporation

- Mondi plc

- Sonoco Products Company

- Bemis Company, Inc.

- DS Smith plc

- Huhtamaki Oyj

- Smurfit Kappa Group plc

- Winpak Ltd.

- Tetra Pak

- UFlex Limited

- WestRock Company

- Silgan Holdings Inc.

- Constantia Flexibles Group GmbH

Recent Developments

- In September 12, 2023 – Smurfit Kappa and WestRock have officially signed a definitive transaction agreement to merge and create Smurfit WestRock, a global packaging leader. This follows the announcement of their possible combination on September 7, 2023. The newly formed company aims to drive innovation and sustainability in the packaging industry.

- In December 13, 2024 – Tetra Pak has been honored with the ‘Resource Efficiency’ Award at the Sustainable Packaging News Awards 2024. The recognition highlights the company’s pioneering efforts in developing a paper-based barrier material that enhances sustainability in packaging solutions.

- In 2024, Amcor has announced the acquisition of Berry Global Group, Inc. in an $8.4 billion all-stock transaction. The newly combined entity, named Amcor plc, will be headquartered in Zurich, Switzerland, with a major operational presence in Evansville, Indiana. This merger strengthens its position as a global packaging giant.

- In December 09, 2024 – Novolex® and Pactiv Evergreen Inc. (NASDAQ: PTVE) have reached a definitive agreement to merge, forming a leading manufacturer in food, beverage, and specialty packaging. The combination unites complementary businesses to create one of the most diverse substrate offerings, supported by an extensive manufacturing and distribution network.

- In February 24, 2025 – Lakeview Farms, backed by CapVest Partners LLP, has successfully completed its merger with noosa Holdings, Inc. The merged company will operate as Novus Foods, signaling its ambition to become a leading player in the refrigerated grocery segment.

- In 2025, Macfarlane Group PLC has acquired The Pitreavie Group Limited (“Pitreavie”) for a total cash consideration of up to £18.0 million, including a £4.0 million earn-out over two years. This acquisition strengthens Macfarlane’s protective packaging business as part of its ongoing strategic expansion.

Report Scope

Report Features Description Market Value (2024) USD 106.6 Billion Forecast Revenue (2034) USD 162.4 Billion CAGR (2025-2034) 4.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Packaging Material (Plastic (Polyethylene (PE), Polypropylene (PP), Polyethylene Terephthalate (PET), Polyvinyl Chloride (PVC), Others), Paper and Paperboard (Metal, Aluminum, Steel, Glass, Others), By Packaging Type (Rigid Packaging (Boxes, Cans, Jars, Others), Flexible Packaging (Bags, Pouches, Wraps, Others), By Pack Type (Converted Roll Stock, Gusseted Bags, Flexible Paper, Corrugated Box, Others), By Application (Fruits and Vegetables , Meat, Poultry, and Seafood, Dairy Products, Bakery or Confectionery Products, Others), By Distribution Channel (Direct Sales, Indirect Sales, Supermarkets/Hyper Markets, Specialty Stores, Online Stores, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Amcor plc, Sealed Air Corporation, Mondi plc, Sonoco Products Company, Bemis Company, Inc., DS Smith plc, Huhtamaki Oyj, Smurfit Kappa Group plc, Winpak Ltd., Tetra Pak, UFlex Limited, WestRock Company, Silgan Holdings Inc., Constantia Flexibles Group GmbH Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Fresh Food Packaging MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

Fresh Food Packaging MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Amcor plc

- Sealed Air Corporation

- Mondi plc

- Sonoco Products Company

- Bemis Company, Inc.

- DS Smith plc

- Huhtamaki Oyj

- Smurfit Kappa Group plc

- Winpak Ltd.

- Tetra Pak

- UFlex Limited

- WestRock Company

- Silgan Holdings Inc.

- Constantia Flexibles Group GmbH