Global Paper Packaging Market By Grade (Recycled Paper, Virgin Paper), By Material (Corrugated Boxes, Folding Cartons, Paper Bags and Sacks, Liquid Packaging Cartons, Others), By Application (Food and Beverages, Personal Care and Cosmetics, Healthcare, Consumer Goods, E-commerce and Retail, Industrial Packaging), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Feb 2025

- Report ID: 140566

- Number of Pages: 332

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

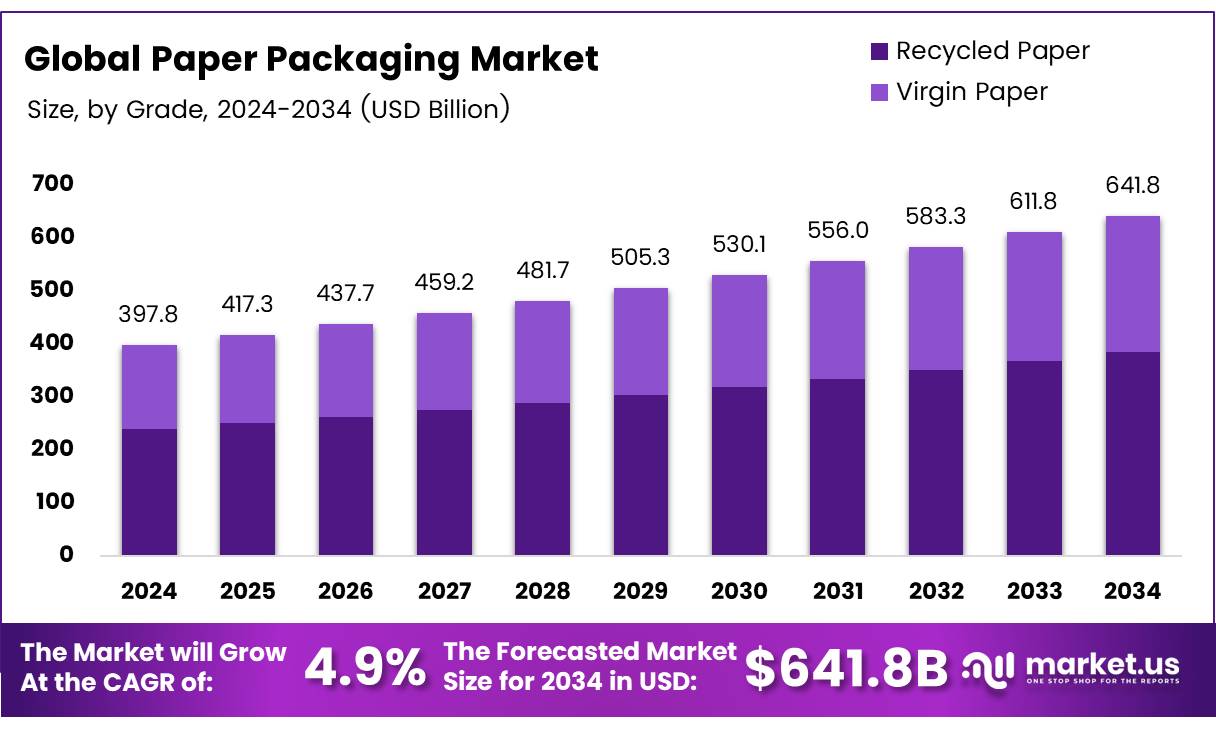

The Global Paper Packaging Market size is expected to be worth around USD 641.8 Billion by 2034, from USD 397.8 Billion in 2024, growing at a CAGR of 4.9% during the forecast period from 2025 to 2034.

The Paper Packaging Market has shown significant resilience and growth in recent years, driven by increasing consumer preference for sustainable packaging solutions. Paper packaging is increasingly recognized as a more environmentally friendly alternative to plastic, especially due to its recyclability and biodegradability.

Consumers are becoming more environmentally conscious, pushing industries to shift toward renewable materials. This change is particularly prominent in regions like Europe and North America, where environmental regulations are being enacted to curb plastic waste.

The demand for paper packaging extends across various sectors, including food and beverages, cosmetics, and e-commerce, providing a broad market scope for growth. Paper packaging materials, including cartons, boxes, and wraps, are heavily used for product safety, branding, and sustainability efforts, positioning the market for long-term expansion.

According to Visionhunters, in Europe, more than 80% of paper and board packaging materials are already recycled. This highlights a robust infrastructure for recycling and a high level of consumer and industry commitment to sustainability.

In addition, according to SAP, the paper, pulp, and packaging industries account for approximately 33-40% of global wood trade, with many mills operating self-sufficiently in terms of energy. This vertical integration helps reduce costs and supports sustainability initiatives, making paper packaging an attractive choice for businesses seeking eco-friendly solutions.

The growth of the Paper Packaging Market is largely attributed to the increasing demand for sustainable and recyclable packaging solutions. With rising awareness of environmental impact, governments worldwide are stepping up their efforts to regulate packaging waste. Policies like extended producer responsibility (EPR) are promoting the use of recyclable and biodegradable materials, which benefit the paper packaging sector.

According to Greenmatch, 76% of consumers in the UK, Europe, and the United States prefer paper-based packaging over plastic for environmental reasons. This growing consumer demand coupled with evolving regulatory pressures presents a significant opportunity for businesses in the paper packaging industry to innovate and expand.

Government investments in recycling infrastructure and initiatives to reduce carbon footprints are also contributing to the market’s growth. Many regions are introducing stricter regulations on plastic waste, pushing manufacturers toward alternatives such as paper.

These efforts are complemented by the significant investment in research and development, particularly in paper-based packaging solutions that offer comparable durability and functionality to plastic, further strengthening the market outlook.

Moreover, the growth of e-commerce and the food delivery industry is boosting demand for paper packaging, particularly in the form of corrugated boxes, wraps, and protective packaging. With these ongoing shifts in both consumer preferences and regulatory landscapes, the paper packaging market is poised for sustained growth, offering substantial opportunities for stakeholders.

Key Takeaways

- The global paper packaging market is projected to reach USD 641.8 billion by 2034, growing at a 4.9% CAGR from 2024 to 2034.

- Recycled paper holds a dominant 55.9% share in the paper packaging market due to its cost-effectiveness and environmental benefits.

- Corrugated boxes lead the market in the material segment, driven by the growing demand in e-commerce, logistics, and shipping.

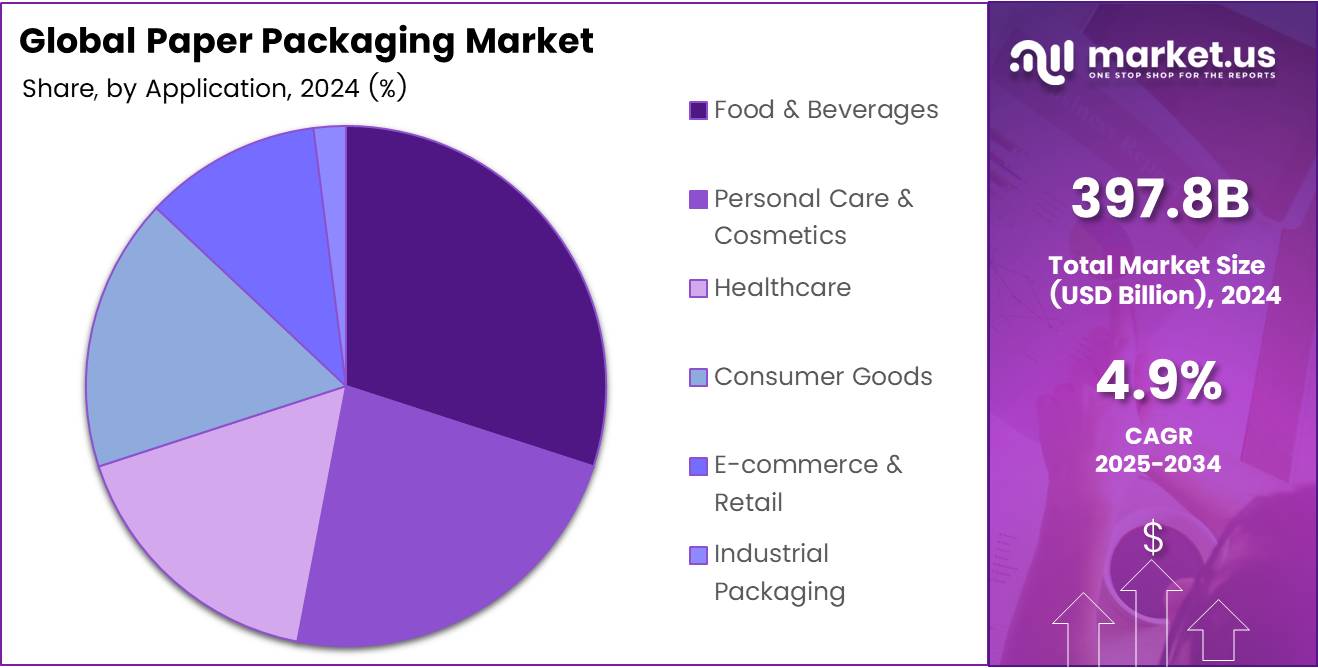

- The food & beverages sector holds the largest share in the paper packaging market, driven by the shift towards eco-friendly packaging.

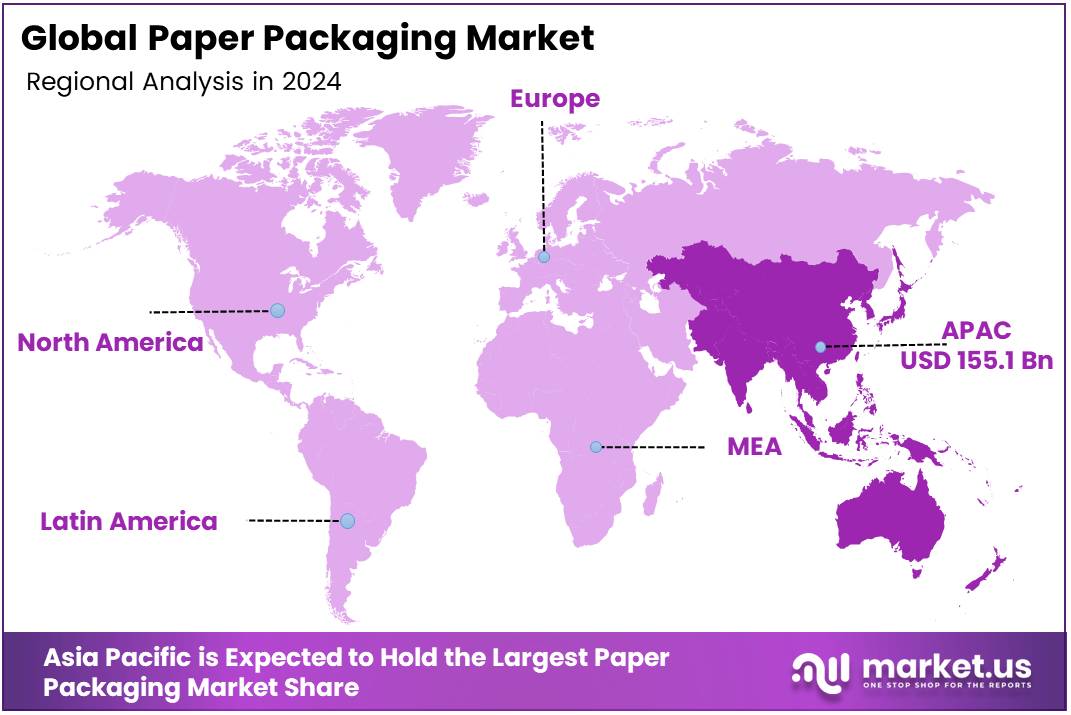

- The Asia Pacific region dominates the paper packaging market with a 39.5% share, fueled by industrialization, e-commerce growth, and sustainability trends.

Grade Analysis

Recycled Paper Leads Paper Packaging Market with 55.9% Share in 2024

In 2024, Recycled Paper held a dominant market position in the By Grade Analysis segment of the Paper Packaging Market, commanding a substantial 55.9% share. The widespread adoption of recycled paper can be attributed to its cost-effectiveness, environmental benefits, and increasing regulatory pressures on sustainability.

The growing consumer demand for eco-friendly products and businesses’ increasing commitment to reducing carbon footprints, recycled paper has become the preferred material for paper packaging, particularly in industries such as food and beverage, cosmetics, and e-commerce.

Virgin Paper maintained a significant presence in the market, contributing to the remaining share. While the preference for virgin paper has declined slightly due to environmental concerns, it continues to be favored for its superior strength, quality, and appearance.

Virgin paper is predominantly used in premium packaging applications where high-end presentation is critical. As demand for high-performance packaging materials remains strong in luxury product sectors, virgin paper is expected to retain its market relevance, though the market share for recycled paper is anticipated to grow steadily in the coming years.

Material Analysis

Corrugated Boxes Dominate Paper Packaging Market in 2024, Holding a Leading Market Share

In 2024, Corrugated Boxes held a dominant market position in the By Material Analysis segment of the Paper Packaging Market. This segment is primarily driven by the increased demand for packaging solutions in e-commerce, logistics, and shipping industries, where corrugated boxes provide durability, cost-effectiveness, and the necessary protection for a wide range of products.

Folding Cartons follow as a key material, benefiting from their widespread use in consumer goods packaging, including food, pharmaceuticals, and electronics. Paper Bags & Sacks also saw growth, fueled by rising consumer preference for eco-friendly and sustainable packaging options. Additionally, Liquid Packaging Cartons have maintained a stable presence due to their essential role in packaging beverages and liquid products.

Other packaging materials contribute to the segment as well, but their share remains relatively smaller compared to the established categories of corrugated boxes, folding cartons, and paper bags. The focus across these materials continues to emphasize sustainability and functional design, aligning with evolving market demands.

Application Analysis

Food & Beverages Lead the Paper Packaging Market in 2024

In 2024, Food & Beverages held a dominant position in the By Application Analysis segment of the Paper Packaging Market. The sector’s significant share can be attributed to the increasing shift toward sustainable and eco-friendly packaging solutions.

As consumer awareness of environmental issues rises, the demand for paper packaging in food and beverage products has grown, driven by the need for safe, recyclable, and biodegradable alternatives to plastic.

The growth of this segment is also influenced by the evolving trends in healthier eating habits, with organic and fresh food items requiring protective packaging that maintains product integrity while aligning with environmental standards. In addition, strict regulations against single-use plastics in various regions have further accelerated the adoption of paper-based packaging solutions.

Other notable segments contributing to the market include Personal Care & Cosmetics, Healthcare, and E-commerce & Retail, all of which have witnessed significant growth in paper packaging adoption.

These industries, driven by consumer preference for sustainable packaging and the convenience of recyclable options, continue to drive market expansion, reinforcing the trend toward environmentally conscious consumerism across diverse sectors.

Key Market Segments

By Grade

- Recycled Paper

- Virgin Paper

By Material

- Corrugated Boxes

- Folding Cartons

- Paper Bags & Sacks

- Liquid Packaging Cartons

- Others

By Application

- Food & Beverages

- Personal Care & Cosmetics

- Healthcare

- Consumer Goods

- E-commerce & Retail

- Industrial Packaging

Drivers

Sustainability Concerns Fuel Shift Toward Paper Packaging

The growing consumer demand for eco-friendly and sustainable products is significantly driving the transition from plastic to paper packaging. This trend is largely driven by increasing awareness about the environmental impact of plastic, especially its contribution to pollution and waste.

As consumers become more environmentally conscious, they are actively seeking brands that prioritize sustainability in their packaging choices. In response, businesses are shifting towards paper-based packaging solutions as a way to meet these expectations.

Additionally, governments across the globe are enforcing stricter environmental regulations aimed at reducing plastic usage, further incentivizing the adoption of paper packaging. These regulations are pushing businesses to align with green initiatives, making paper packaging a more viable and necessary option.

Another key driver is the rapid growth of e-commerce, which has substantially increased the demand for reliable and cost-effective packaging materials. Paper packaging has emerged as the preferred choice for online retailers due to its ability to provide safe, lightweight, and sustainable shipping solutions.

Moreover, consumer preferences continue to evolve, with more shoppers prioritizing brands that adopt sustainable practices. As a result, companies are increasingly opting for paper packaging, not only to meet regulatory standards but also to cater to a growing segment of eco-conscious consumers. The combined effect of these drivers positions the paper packaging market for continued growth in the coming years.

Restraints

High Production Costs and Durability Concerns Limit Paper Packaging Adoption

Despite its environmental benefits, the paper packaging market faces significant challenges, particularly related to production costs and durability. The manufacturing of paper packaging is generally more expensive compared to plastic or other traditional materials, primarily due to the costs involved in sourcing sustainable raw materials and the more complex production processes required to ensure eco-friendliness.

These higher costs are passed on to consumers, making paper packaging less attractive for businesses, particularly those operating in price-sensitive markets.

Furthermore, paper packaging may not offer the same level of protection as plastic or other materials, especially for products that require a higher degree of durability, such as liquids or perishable goods. Paper’s susceptibility to moisture, tearing, and crushing limits its effectiveness for packaging certain types of products, which could lead to spoilage or damage during transportation.

This durability issue creates a barrier to the widespread adoption of paper packaging, as businesses may be hesitant to switch to a material that does not meet the protective standards required for certain goods.

While advances in paper packaging technology are addressing some of these concerns, the balance between cost-effectiveness and the ability to safeguard products remains a key challenge. As such, these factors continue to restrain the paper packaging market’s growth, especially in industries where durability and cost are paramount.

Growth Factors

Expansion in Emerging Markets and Sustainable Trends Drive Paper Packaging Growth

The paper packaging market is poised for significant growth, particularly in developing regions such as Asia-Pacific and Latin America. As these economies continue to develop and urbanize, there is an increasing shift toward adopting more sustainable packaging solutions. With a rising middle class and heightened awareness about environmental issues, these regions present substantial growth opportunities for paper packaging as businesses seek eco-friendly alternatives.

Additionally, the food and beverage sector is driving demand for paper packaging, as consumers increasingly prefer sustainable options for products like takeaway containers, beverage cartons, and snack packaging.

This shift is further supported by the global phase-out of single-use plastics, creating a rising need for paper-based alternatives like straws, bags, and wrappers, which have seen growing adoption across multiple industries.

Furthermore, innovations in paper coatings and lamination technologies are opening new possibilities for paper packaging, improving its durability and functionality for more diverse product applications. These advancements are addressing earlier concerns related to moisture, strength, and product protection, making paper packaging a more viable option across various sectors, including e-commerce and electronics.

Collectively, these growth opportunities—ranging from emerging market expansion to technological innovations—position the paper packaging market for long-term growth, driven by both environmental considerations and evolving consumer preferences.

Emerging Trends

Shift to Biodegradable Packaging Boosts Paper Packaging Adoption

The paper packaging market is currently experiencing significant growth due to the increasing shift towards biodegradable and sustainable packaging options. Consumers and businesses alike are becoming more environmentally conscious, leading to a marked reduction in the use of plastic and non-recyclable materials.

This trend is driven by stricter regulations, consumer demand for eco-friendly alternatives, and a growing awareness of the environmental impact of packaging waste. As a result, companies are innovating with biodegradable paper solutions that not only maintain the protective qualities of traditional packaging but also minimize environmental harm.

Another important development is the introduction of water-resistant paper packaging, which provides a viable alternative to plastic for products requiring moisture protection. In addition, smart packaging is gaining traction, with technologies like QR codes and NFC tags being integrated into paper products to enhance consumer engagement and improve traceability.

This allows for more dynamic interactions between brands and consumers, offering real-time information on the product’s origin and lifecycle. Furthermore, multi-functional paper packaging solutions are emerging, combining the benefits of packaging and serving materials in one, such as paper cups that also act as serving containers. These innovations are helping to meet the growing demand for sustainable, functional, and versatile packaging solutions.

Regional Analysis

Asia Pacific leads the paper packaging market with 39.5% share valued at USD 155.1 billion

The Asia Pacific region dominates the global paper packaging market, accounting for 39.5% of the market share, valued at approximately USD 155.1 billion. This market leadership is driven by the region’s rapid industrialization, growing e-commerce sector, and increasing consumer preference for sustainable packaging solutions.

Countries such as China, India, and Japan are the primary contributors, with regulatory pressures and rising environmental awareness further accelerating the adoption of paper-based packaging alternatives.

Regional Mentions:

In North America, the paper packaging market is experiencing steady growth, supported by a robust manufacturing sector and the rising demand for sustainable packaging driven by both consumer and regulatory pressures. The United States is the key player, with significant growth expected due to the expansion of e-commerce and a growing focus on reducing plastic waste. The market is poised for continued expansion, driven by the implementation of circular economy practices.

Europe holds a significant share of the market, bolstered by stringent environmental regulations and a growing consumer demand for sustainable packaging options. Countries such as Germany, France, and the United Kingdom lead the region, with the food and beverage, pharmaceuticals, and consumer goods sectors showing strong demand for paper packaging. The regulatory landscape, including the European Union’s focus on reducing plastic waste, has accelerated the shift towards eco-friendly packaging materials.

In Latin America, the market is expanding as emerging economies like Brazil and Mexico show increasing demand for sustainable packaging. The market is growing moderately, driven by higher disposable incomes and a shift in consumer preferences toward eco-friendly products.

Middle East & Africa represents a smaller yet developing market for paper packaging, driven by demand from the food and beverage, retail, and pharmaceutical industries. Although infrastructure and economic challenges constrain growth, there is a gradual shift toward more sustainable packaging practices in the region.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The global paper packaging market is poised for continued growth in 2024, driven by the increasing demand for sustainable packaging solutions.

Among the key players in this market, companies like International Paper Company, Smurfit Kappa Group, and DS Smith Plc dominate with their extensive product portfolios and strong market presence. These companies are leveraging their technological expertise to meet the rising demand for eco-friendly packaging, with a focus on recyclable, biodegradable, and renewable materials.

WestRock Company and VPK Packaging Group have also emerged as significant contributors, particularly in North America and Europe. Their investments in advanced manufacturing processes and expansion of production capabilities have allowed them to maintain a competitive edge in the paper packaging space. These players are also increasingly focused on digital print technology to meet consumer demands for personalized packaging.

Sappi Limited and Amcor plc are leading the way in innovation, with a strong emphasis on sustainable and high-performance paper-based packaging solutions. Nippon Paper Industries Co., Ltd. and Mondi Group have strengthened their position through strategic acquisitions and the development of new product lines, enhancing their global market share.

Companies like Crown Holdings, Inc., Packaging Corporation of America (PCA), and Sonoco Products Company contribute to the sector’s expansion by providing end-to-end packaging solutions for a wide range of industries, from food and beverage to electronics and personal care.

Lastly, Georgia-Pacific LLC, Paragon Print and Packaging, and Södra are playing a crucial role in shaping the market through their sustainable practices and alignment with the circular economy model, promoting the use of recycled materials in their packaging solutions. As sustainability continues to be a central driver, these companies are well-positioned to capitalize on the growing demand for paper-based alternatives to plastic packaging.

Top Key Players in the Market

- International Paper Company

- Smurfit Kappa Group

- DS Smith Plc

- WestRock Company

- VPK Packaging Group

- Sappi Limited

- Amcor plc

- Nippon Paper Industries Co., Ltd.

- Mondi Group

- Crown Holdings, Inc.

- Packaging Corporation of America (PCA)

- Sonoco Products Company

- Georgia-Pacific LLC

- Paragon Print and Packaging

- Södra

Recent Developments

- In December 2024, Movopack secured $2.5 million in funding to enhance its sustainable ecommerce packaging solutions, aiming to reduce plastic waste and offer eco-friendly alternatives for the packaging industry. The funding will support the company’s efforts in scaling operations and expanding product offerings.

- In December 2024, Agrileaf raised ₹16 crore (approximately $2 million USD) in growth funding, led by Capital-A and Samarsh Capital, to accelerate its expansion in the agritech sector. The funds will be used to develop innovative solutions for sustainable agriculture and improve its technology infrastructure.

- In March 2024, sustainable packaging startup Bambrew raised ₹60 crore in funding to support the scaling of its eco-friendly packaging solutions made from bamboo and other natural materials. This investment will enable the company to meet the growing demand for biodegradable alternatives in the packaging market.

- In August 2024, Pakka Limited secured ₹244.7 crore in funding to scale up its production capabilities for sustainable packaging solutions. The company plans to use the funds to expand its operations and continue innovating in biodegradable and compostable materials.

- In October 2024, pharmaceutical packaging startup Sorich raised $1 million to enhance its packaging solutions designed for the pharmaceutical sector. The funds will aid in the development of new technologies aimed at improving product safety, shelf life, and regulatory compliance.

- In October 2024, Earthodic raised $6 million to advance its bio-based coating technology, which provides sustainable alternatives to conventional chemical coatings. The investment will support further research and product development to expand the company’s market reach in eco-friendly solutions.

Report Scope

Report Features Description Market Value (2024) USD 397.8 Billion Forecast Revenue (2034) USD 641.8 Billion CAGR (2025-2034) 4.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Grade(Recycled Paper, Virgin Paper), By Material(Corrugated Boxes, Folding Cartons, Paper Bags and Sacks, Liquid Packaging Cartons, Others), By Application(Food and Beverages, Personal Care and Cosmetics, Healthcare, Consumer Goods, E-commerce and Retail, Industrial Packaging) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape International Paper Company, Smurfit Kappa Group, DS Smith Plc, WestRock Company, VPK Packaging Group, Sappi Limited, Amcor plc, Nippon Paper Industries Co., Ltd., Mondi Group, Crown Holdings, Inc., Packaging Corporation of America (PCA), Sonoco Products Company, Georgia-Pacific LLC, Paragon Print and Packaging, Södra Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- International Paper Company

- Smurfit Kappa Group

- DS Smith Plc

- WestRock Company

- VPK Packaging Group

- Sappi Limited

- Amcor plc

- Nippon Paper Industries Co., Ltd.

- Mondi Group

- Crown Holdings, Inc.

- Packaging Corporation of America (PCA)

- Sonoco Products Company

- Georgia-Pacific LLC

- Paragon Print and Packaging

- Södra