Global Anti Counterfeiting Packaging Market Size, Share, Growth Analysis By Technology (Authentication Technology, Track and Trace Technology), By Packaging Format (Flexible Packaging, Rigid Packaging), By Application (Food and Beverages, Pharmaceuticals and Healthcare, Cosmetics and Personal Care, Electronics, Automotive Components, Consumer Goods), By End-User Industry (Manufacturers, Logistics and Supply Chain), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Jan 2025

- Report ID: 44371

- Number of Pages: 291

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

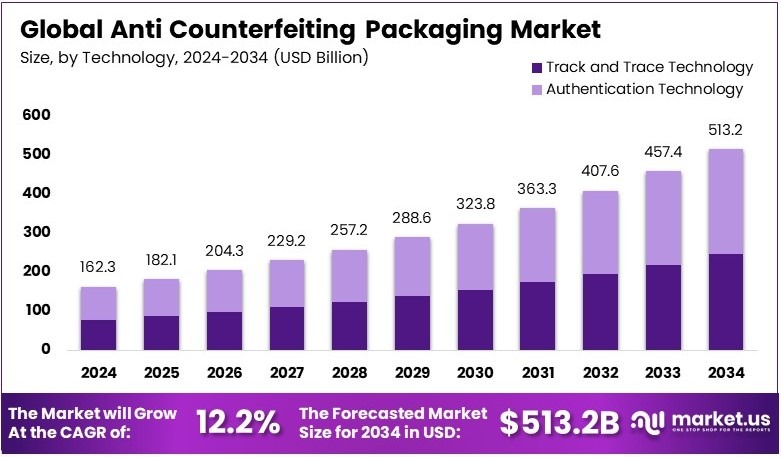

The Global Anti Counterfeiting Packaging Market size is expected to be worth around USD 512.3 Billion by 2034, from USD 162.3 Billion in 2024, growing at a CAGR of 12.2% during the forecast period from 2025 to 2034.

Anti Counterfeiting Packaging uses special techniques and materials to prevent product fraud. These packages incorporate security features like holograms, seals, or unique markers. The goal is to ensure authenticity and protect brands. They are used across industries such as pharmaceuticals and luxury goods.

The Anti Counterfeiting Packaging Market deals with products and services that offer secure packaging solutions. It involves innovation in security features and materials. Businesses in this market work with manufacturers to protect products against imitation and maintain brand integrity.

Anti-counterfeiting packaging prevents product fraud and protects brands. Counterfeit goods accounted for 2.5% of global trade in 2019, equating to USD 464 billion, according to the OECD. Industries like cosmetics and toys suffer significant losses. For example, the EU toy industry incurs losses of EUR 1 billion annually, highlighting the need for secure packaging.

The anti-counterfeiting packaging market is expanding due to rising counterfeit concerns. According to the EUIPO, clothing and footwear sectors lose nearly EUR 12 billion annually, or 5.2% of sales, to counterfeit goods. This growing issue drives demand for advanced solutions like holograms and RFID tags, creating opportunities for innovative packaging providers.

High demand for anti-counterfeiting solutions is fueled by industries protecting intellectual property (IP). A study by the EUIPO found companies with IP rights generate 23.8% more revenue per employee. This advantage increases to 41% among SMEs, showcasing the broader economic impact of effective brand protection through secure packaging.

Globally, anti-counterfeiting packaging boosts consumer trust and reduces financial losses for brands. Locally, it supports businesses in protecting their reputation. For example, secure packaging in the EU cosmetics sector, which faces EUR 3 billion in annual losses, ensures product authenticity and quality, building customer loyalty and enhancing market confidence.

Key Takeaways

- The Anti Counterfeiting Packaging Market was valued at USD 162.3 Billion in 2024, and is expected to reach USD 512.3 Billion by 2033, with a CAGR of 12.2%.

- In 2024, Track and Trace Technology dominates the technology segment with 47.7% due to its effectiveness in supply chain transparency.

- In 2024, Rigid Packaging leads the packaging format segment with 62.1% owing to its durability and protection against counterfeiting.

- In 2024, Pharmaceuticals and Healthcare dominate the application segment with 39.4% reflecting high demand for secure packaging solutions.

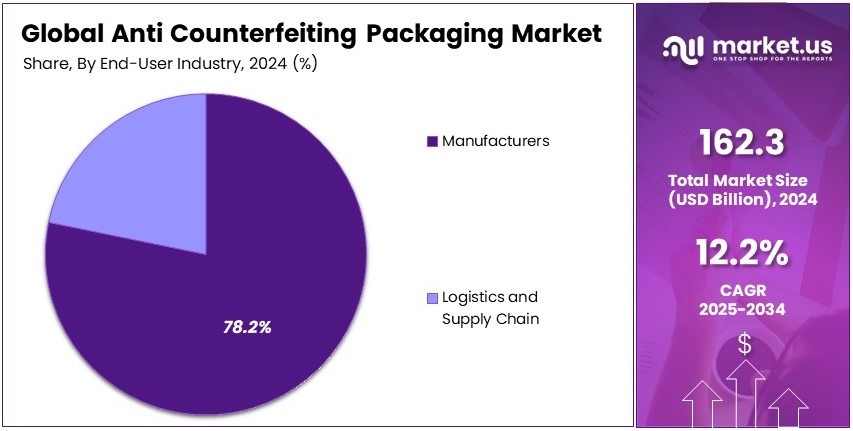

- In 2024, Manufacturers lead the end-user industry segment with 78.2% because of their stringent need for authenticity and brand protection.

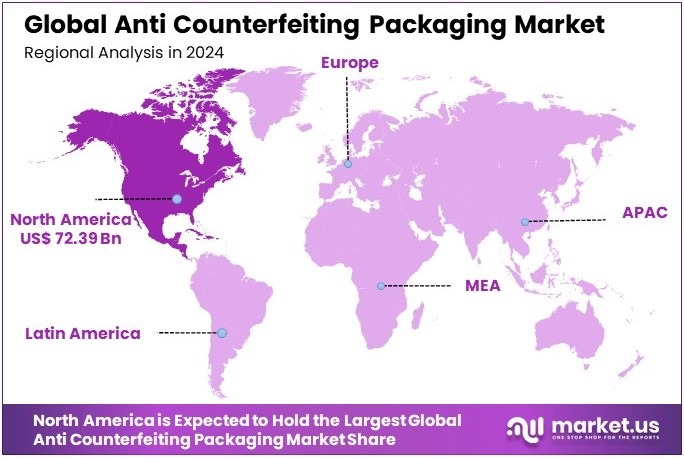

- In 2024, North America is the dominant region with 44.6% market share and a value of USD 72.39 Billion, underlining its importance in market growth.

Technology Analysis

Track and Trace Technology dominates with 53.7% due to its essential role in supply chain visibility and product verification.

Track and trace technology holds a significant position in the anti-counterfeiting packaging market, accounting for 47.7% of its share. This technology is pivotal in enhancing supply chain transparency and ensuring the authenticity of products as they move from manufacturers to consumers.

The ability to track the product’s journey and trace its origin is crucial in combating the issue of counterfeiting and theft, providing brands and consumers with confidence in the integrity of the products they purchase.

Barcode technology is a fundamental component of track and trace systems, offering a simple and cost-effective means of encoding product information that can be easily scanned and verified throughout the supply chain.

RFID (Radio Frequency Identification) offers a more advanced solution, enabling wireless tracking of products without the need for direct line-of-sight scanning, which enhances operational efficiency and security.

NFC (Near Field Communication) and QR codes also contribute significantly to this segment, providing versatile and user-friendly methods for product authentication and consumer engagement. These technologies not only prevent counterfeiting but also facilitate a deeper connection between brands and consumers through interactive packaging solutions.

Packaging Format Analysis

Rigid Packaging dominates with 62.1% due to its durability and security features.

Rigid packaging is the leading packaging format in the anti-counterfeiting packaging market, with a 62.1% share. This format is preferred for its durability and robustness, which are essential in protecting against physical tampering and environmental damage.

Rigid packaging materials, such as hard plastics and metals, are difficult to alter or mimic, providing an effective barrier against counterfeit activities.

Flexible packaging, while offering advantages such as reduced shipping costs and material usage, plays a complementary role in the anti-counterfeiting market. It is typically used for products that require lightweight and versatile packaging solutions but is less likely to incorporate complex security features compared to rigid packaging.

Application Analysis

Pharmaceuticals and Healthcare dominate with 39.4% due to the high risks associated with counterfeit medicines.

The pharmaceuticals and healthcare sector is the most critical application area for anti-counterfeiting packaging technologies, accounting for 39.4% of the market.

In this sector, the stakes are particularly high as counterfeit medicines can pose serious health risks. Effective anti-counterfeiting solutions are essential to ensure patient safety and maintain trust in healthcare products.

Food and beverages also significantly benefit from anti-counterfeiting technologies, especially for protecting brand integrity and preventing the economic losses associated with fake products.

Cosmetics and personal care, along with electronics and automotive components, are other key sectors where anti-counterfeiting packaging is vital for protecting consumers and safeguarding manufacturers’ revenues.

End-User Industry Analysis

Manufacturers dominate with 78.2% due to their need to protect brand integrity and consumer trust.

Manufacturers are the predominant end-users of anti-counterfeiting packaging technologies, holding a 78.2% share of the market. This segment’s dominance is driven by the necessity to safeguard brand integrity, maintain consumer trust, and comply with regulatory standards.

Manufacturers invest in advanced packaging solutions to ensure their products are protected from duplication and tampering throughout the supply chain.

The logistics and supply chain sector also relies on anti-counterfeiting technologies but to a lesser extent. This sector focuses on tracking and verification processes to ensure that goods move securely from manufacturers to consumers, employing technologies like RFID and barcodes to monitor the movement and authenticity of products across different points in the supply chain.

Key Market Segments

By Technology

- Authentication Technology

- Holograms

- Watermarks

- Color Shifting Ink

- Security Labels

- Track and Trace Technology

- Barcode Technology

- RFID (Radio Frequency Identification)

- NFC (Near Field Communication)

- QR Codes

By Packaging Format

- Flexible Packaging

- Rigid Packaging

By Application

- Food and Beverages

- Pharmaceuticals and Healthcare

- Cosmetics and Personal Care

- Electronics

- Automotive Components

- Consumer Goods

By End-User Industry

- Manufacturers

- Logistics and Supply Chain

Driving Factors

Rising Concern Over Brand Protection Drives Market Growth

Increasing concern over brand protection and intellectual property drives the anti-counterfeiting packaging market. As industries face rising instances of product counterfeiting, companies invest in secure packaging to protect their brands. This demand for authenticity boosts market growth. For example, a luxury cosmetics company may adopt advanced packaging features to ensure customers receive genuine products.

Growing demand for authentic and verified products from consumers further supports this trend. In addition, the expansion of e-commerce platforms necessitates secure packaging solutions to maintain trust and brand reputation. As online sales soar, manufacturers develop innovative packaging to deter counterfeiters. The rise in counterfeiting incidents motivates brands to safeguard their intellectual property.

This leads to increased investment in anti-counterfeiting measures across sectors. Stakeholders work together to refine their solutions and address these concerns while meeting consumer demands. Manufacturers focus on incorporating cutting-edge technology to stay ahead of counterfeiters. They develop features like holograms, QR codes, and other verification methods to ensure authenticity.

Restraining Factors

High Costs and Complexity Restrain Market Growth

High costs associated with advanced anti-counterfeiting technologies restrain market expansion. The complexity in implementing multi-layered security solutions often slows adoption. For example, a small manufacturer may hesitate to invest due to budget limits and technical difficulties. Limited awareness and adoption in developing regions further challenge growth.

Supply chain disruptions or economic uncertainty can also affect investment. Risk of security breaches and false positives adds to the caution among businesses. Companies must balance robust security features with affordability to widen acceptance. Complexity in integrating solutions with existing production lines requires careful planning and skilled labor.

As a result, hesitancy persists among some industry players. Awareness campaigns and simplified solutions could mitigate these restraints. By offering scalable and user-friendly technologies, providers can reach broader markets. Understanding these barriers allows stakeholders to develop targeted strategies.

Growth Opportunities

Biometric and Smart Technology Provides Opportunities

The development of biometric and biodegradable anti-counterfeit solutions presents fresh opportunities. Companies exploring smart packaging with tamper-evident features attract attention. For instance, a pharmaceutical firm might use biometric verification on packaging to assure product authenticity. Adoption of blockchain technology for secure and traceable packaging ensures transparency throughout the supply chain.

Opportunities also arise in customizable and modular designs, allowing brands to tailor solutions to their needs. These innovations address diverse industry requirements. They not only protect intellectual property but also enhance consumer trust. Manufacturers can leverage these advancements to offer unique selling points.

Incorporating smart technologies such as sensors and AI increases product value. As demand for secure, eco-friendly packaging grows, the market expands. The push for sustainable solutions aligns with global environmental goals. By focusing on these emerging trends, companies capture new market segments and open avenues for partnerships.

Emerging Trends

QR Codes and Sustainable Materials Are Latest Trending Factor

Use of QR codes and near field communication (NFC) for verification is gaining momentum. These trending technologies offer easy and effective product authentication. For example, consumers can scan a QR code with their smartphones to verify a product’s origin. Focus on sustainable and environmentally-friendly packaging also rises.

Companies adopt smart tagging and RFID technology to enhance security while reducing waste. There is increasing demand for packaging solutions that manage e-waste responsibly. The trend reflects a balance between innovation and sustainability. Manufacturers now incorporate renewable materials and biodegradable inks.

Such approaches appeal to eco-conscious consumers and regulators. The rise of smart tags and RFID enhances traceability and reduces fraud. This fusion of technology and green practices sets new industry standards. It shows how companies can meet consumer demands for safety and sustainability simultaneously.

Regional Analysis

North America Dominates with 44.6% Market Share in the Anti Counterfeiting Packaging Market

North America leads the Anti Counterfeiting Packaging Market with a 44.6% share, totaling USD 72.39 billion. This dominant market presence is driven by stringent regulations against counterfeiting and a high concentration of brand owners who demand secure packaging solutions to protect their goods and brand integrity.

The region’s advanced manufacturing capabilities and technological innovation contribute to the development of sophisticated anti-counterfeiting measures, such as RFID, holograms, and tamper-evident seals. These technologies are extensively adopted across industries including pharmaceuticals, electronics, and consumer goods, aligning with North American businesses’ focus on protecting consumer safety and brand reputation.

The forecast for North America’s influence in the Anti Counterfeiting Packaging Market remains strong. Ongoing innovations in technology and a push towards more stringent regulations are expected to drive further growth. Additionally, the increasing awareness among consumers about the dangers of counterfeit products is likely to boost demand for advanced packaging solutions, solidifying North America’s leadership position.

Regional Mentions:

- Europe: Europe plays a critical role in the Anti Counterfeiting Packaging Market, driven by rigorous regulatory environments and a high demand for secure packaging in the pharmaceutical and luxury goods sectors. The region’s commitment to safety and authenticity maintains its significant market share.

- Asia Pacific: Asia Pacific is rapidly progressing in the Anti Counterfeiting Packaging Market due to its booming pharmaceutical and consumer electronics industries. Increasing industrial activity and improvements in regulatory frameworks help propel market growth in this region.

- Middle East & Africa: The Middle East and Africa are developing markets for anti-counterfeiting technologies, focusing on enhancing product security across various sectors including pharmaceuticals and consumer goods. Growth is spurred by increasing regulations and awareness of counterfeit risks.

- Latin America: Latin America is experiencing gradual growth in the Anti Counterfeiting Packaging Market. The region is beginning to adopt more sophisticated packaging technologies to combat the prevalent issue of product counterfeiting, especially in pharmaceuticals and consumer products.

Key Regions and Countries Covered in the Report

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Landscape

In the Anti Counterfeiting Packaging Market, the top four companies are pivotal in driving innovation and providing secure packaging solutions that protect brands and consumers from counterfeit activities. These industry leaders have established strong market positions through their advanced technologies, extensive product portfolios, and global reach.

Avery Dennison stands out with its sophisticated label and packaging solutions that incorporate cutting-edge materials and security features. Their products are designed to combat counterfeiting across various industries, including pharmaceuticals, food, and luxury goods. Avery Dennison’s commitment to innovation and sustainability makes it a preferred partner for businesses seeking reliable anti-counterfeiting solutions.

3M is renowned for its science-based approach and offers a range of high-security packaging options, including tamper-evident labels and security tapes. 3M’s products are trusted by corporations worldwide for their effectiveness in providing protection against tampering and counterfeiting, ensuring product integrity from production to consumer.

CCL Industries specializes in creating decorative and functional labels that not only enhance brand aesthetics but also incorporate security technologies. Their offerings include holographic films and specialty coatings that are difficult to replicate, making them an essential choice for businesses aiming to safeguard their products.

DuPont focuses on integrating proprietary security materials and technologies into packaging designs, providing a layered defense against counterfeit threats. DuPont’s solutions are particularly valued in high-stakes markets like pharmaceuticals and electronics, where the cost of counterfeiting can be extraordinarily high.

These top companies in the Anti Counterfeiting Packaging Market leverage their research and development capabilities to continuously evolve their product offerings, meeting the growing demand for more sophisticated and reliable anti-counterfeiting solutions. Their global presence and commitment to technological advancement position them as leaders in the fight against counterfeiting, ensuring consumer trust and brand protection in diverse markets.

Major Companies in the Market

- Avery Dennison Corporation

- CCL Industries Inc.

- 3M Company

- Zebra Technologies Corporation

- E.I. Du Pont De Nemours and Company

- Sicpa Holding S.A.

- AlpVision S.A.

- Amcor

- Atlantic Zeiser

- Berry Global

- Constantia Flexibles

- Controltek

- Graphic Packaging

Recent Developments

- Digimarc Corporation: On October 2024, Digimarc Corporation introduced the Digimarc Validate mobile app, designed to combat counterfeit products in the field. This app enables field agents to authenticate products instantly using smartphones, utilizing Digimarc’s proprietary digital watermarks embedded in product packaging. The solution aims to protect customers, secure revenue, and maintain brand integrity by providing real-time authentication and reporting capabilities.

- ExxonMobil Lubricants: On June 2022, ExxonMobil Lubricants launched new packaging for its ‘Mobil Super’ lubricant range, featuring a QR-code-based anti-counterfeit feature. Consumers can scan the QR code on the bottles to verify product authenticity, enhancing protection against counterfeit products. This initiative reflects ExxonMobil’s commitment to ensuring product quality and consumer safety in the Indian market.

Report Scope

Report Features Description Market Value (2024) USD 162.3 Billion Forecast Revenue (2034) USD 513.2 Billion CAGR (2025-2034) 12.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Technology (Authentication Technology: Holograms, Watermarks, Color Shifting Ink, Security Labels; Track and Trace Technology: Barcode Technology, RFID, NFC, QR Codes), By Packaging Format (Flexible Packaging, Rigid Packaging), By Application (Food and Beverages, Pharmaceuticals and Healthcare, Cosmetics and Personal Care, Electronics, Automotive Components, Consumer Goods), By End-User Industry (Manufacturers, Logistics and Supply Chain) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Avery Dennison Corporation, CCL Industries Inc., 3M Company, Zebra Technologies Corporation, E.I. Du Pont De Nemours and Company, Sicpa Holding S.A., AlpVision S.A., Amcor, Atlantic Zeiser, Berry Global, Constantia Flexibles, Controltek, Graphic Packaging Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Anti-counterfeit Packaging MarketPublished date: Jan 2025add_shopping_cartBuy Now get_appDownload Sample

Anti-counterfeit Packaging MarketPublished date: Jan 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Avery Dennison Corporation

- CCL Industries Inc.

- 3M Company

- Zebra Technologies Corporation

- E.I. Du Pont De Nemours and Company

- Sicpa Holding S.A.

- AlpVision S.A.

- Amcor

- Atlantic Zeiser

- Berry Global

- Constantia Flexibles

- Controltek

- Graphic Packaging