BFS (Blow-Fill-Seal) Products Market Report By Product Type (Ampoules, Vials, Bottles, Containers, Prefilled Syringes), By Material Type (Polyethylene (PE), Polypropylene (PP), Other Material Types), By End-Use Industry (Pharmaceuticals, Food & Beverages, Cosmetics & Personal Care, Chemicals & Industrial), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: May 2024

- Report ID: 12288

- Number of Pages: 276

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

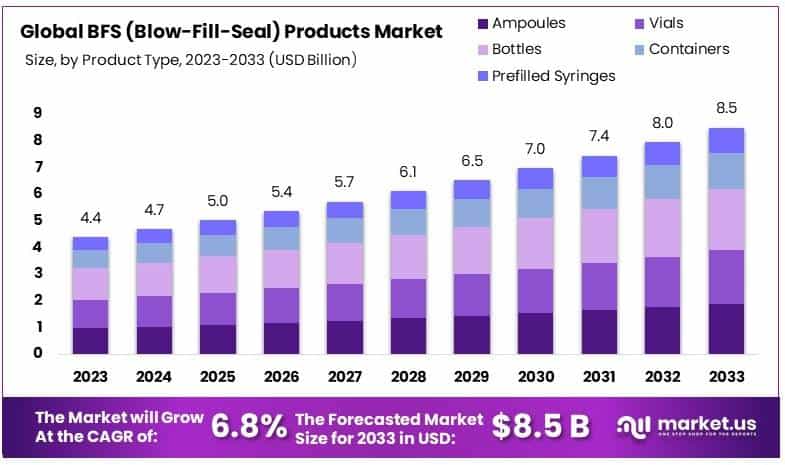

The Global BFS (Blow-Fill-Seal) Products Market size is expected to be worth around USD 8.5 billion by 2033, from USD 4.4 billion in 2023, growing at a CAGR of 6.8% during the forecast period from 2024 to 2033.

The BFS (Blow-Fill-Seal) Products Market refers to an industry centered around advanced manufacturing technology used primarily in packaging liquid and semi-liquid products. This technology integrates blowing, filling, and sealing processes into a single, automated system, enhancing efficiency and sterility.

Predominantly utilized in pharmaceuticals, the BFS method is also gaining traction in food and beverage, and cosmetics sectors. Its appeal lies in its ability to reduce contamination risks, streamline production, and lower costs.

The BFS (Blow-Fill-Seal) Products Market is positioned as a pivotal solution in addressing significant challenges in the medical and healthcare sectors. This technology’s ability to seamlessly integrate blowing, filling, and sealing in one continuous process offers substantial benefits in terms of sterility and efficiency. Given the critical nature of packaging in preventing medical errors, the relevance of BFS technology becomes evident. The World Health Organization identifies medication errors as a significant cause of injury and death, underscoring the importance of reliable packaging systems like BFS in ensuring accuracy and safety in drug administration.

Furthermore, the BFS technology’s impact extends to infection control within healthcare settings. The Centers for Disease Control and Prevention reports that healthcare-associated infections result in numerous deaths and infections annually, highlighting the need for effective sterility in medical packaging. BFS systems maintain high sterility levels, thereby playing a crucial role in reducing the risk of infections associated with medical products.

The environmental footprint of BFS technology also aligns with increasing regulatory and corporate emphasis on sustainability. The U.S. Environmental Protection Agency’s data on hospital waste underscores the pressing need for efficient and sustainable waste management solutions. BFS products, with their minimal waste generation during the manufacturing process, offer a more sustainable alternative to traditional packaging methods, reducing both general and infectious waste outputs.

In conclusion, the BFS Products Market is not just advancing from a technological standpoint but is also crucial in enhancing patient safety, controlling infections, and promoting sustainability in healthcare. This positions BFS technology as a key player in the ongoing evolution of healthcare infrastructure, promising significant growth and development in the coming years.

Key Takeaways

- Market Value: The BFS (Blow-Fill-Seal) Products Market is expected to grow from USD 4.4 billion in 2023 to approximately USD 8.5 billion by 2033, at a CAGR of 6.8%.

- Product Type Analysis: Bottles dominate with 27% due to their versatile application and consumer preference for convenient packaging, especially in pharmaceuticals and healthcare.

- Material Type Analysis: Polyethylene (PE) dominates with 47% due to its durability and compliance with regulatory standards for pharmaceutical packaging, reflecting its crucial role in maintaining sterility and product safety.

- End-Use Industry Analysis: Pharmaceuticals dominate with 42% due to critical requirements for sterility and precision in drug delivery, making BFS technology indispensable in clinical settings.

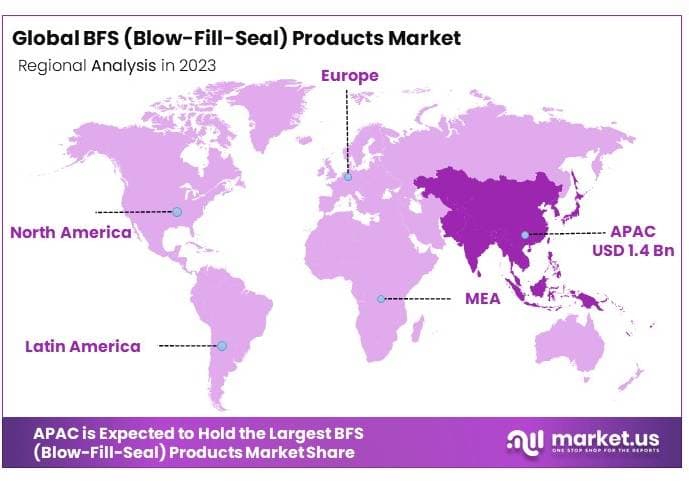

- Dominant Region: APAC dominates with 35% market share, driven by the growing pharmaceutical and healthcare sectors in countries like China and India.

- High Growth Region: North America holds about 30%, particularly driven by the U.S., showing significant growth potential in pharmaceutical and healthcare packaging.

- Analyst Viewpoint: The BFS market is moderately competitive with steady growth expected. Future trends include increased adoption of sustainable materials and further expansion into new geographic markets.

Driving Factors

Increasing Demand for Safe and Sterile Packaging Solutions Drives Market Growth

The BFS (Blow-Fill-Seal) technology significantly advances the pharmaceutical and healthcare industries by providing aseptic, contamination-free packaging solutions. This technology’s capability to maintain sterility from production to point-of-use is vital, particularly for sensitive products like parenteral drugs, which include injectables and ophthalmics.

With medication errors causing significant harm and costs—as indicated by the WHO’s report of over 1.3 million injuries annually in the U.S. due to such errors—BFS technology’s tamper-evident and sterile packaging features are increasingly crucial. These attributes help extend the shelf life of products and ensure patient safety, factors that are propelling the BFS market forward. As healthcare providers and regulatory bodies continue to prioritize patient safety and product integrity, the demand for BFS packaging solutions is expected to grow, further enhancing market expansion.

Rising Adoption of Advanced Drug Delivery Systems Drives Market Growth

The integration of BFS technology in advanced drug delivery systems, such as prefilled syringes, inhalers, and nasal sprays, is a primary driver of its market growth. These delivery systems require high precision and sterility to function effectively, making BFS an ideal packaging solution. For example, the demand for prefilled syringes is surging as they offer convenience and reduced contamination risk, which is essential for self-administration scenarios, such as diabetes management.

This growing demand is a direct catalyst for the expansion of the BFS market, as the technology meets the critical needs of modern medical treatments. Furthermore, as pharmaceutical companies continue to develop more complex biologics and personalized medicines, the need for reliable, sterile, and efficient packaging solutions like BFS is projected to increase, supporting sustained market growth.

Cost-Effective and Efficient Production Process Drives Market Growth

BFS technology enhances the economic efficiency of pharmaceutical and healthcare product manufacturing by consolidating the forming, filling, and sealing processes into a single automated operation. This integration significantly reduces labor costs, minimizes material waste, and increases production throughput, offering substantial cost savings to manufacturers.

For instance, when packaging eye drops, BFS technology reduces costs by eliminating the need for multiple components and processes required for glass vial packaging. This cost-effectiveness, combined with the high-quality output of BFS systems, makes it an increasingly attractive option for companies aiming to optimize their production lines. As cost pressures and competition within the pharmaceutical industry intensify, the adoption of efficient technologies like BFS is likely to escalate, fueling further market growth.

Restraining Factors

Limited Product Portfolio Restrains Market Growth

BFS (Blow-Fill-Seal) technology is highly effective for liquid and semi-solid products but faces significant limitations when it comes to solid dosage forms like tablets and capsules. These forms represent a large portion of the pharmaceutical market, thus the inability of BFS to package these products restricts its applicability and market reach. For instance, solid oral dosage forms are essential in various therapeutic areas, from pain management to chronic disease treatments.

The restricted capability of BFS technology to serve these broader applications constrains its market growth potential, particularly in sectors where solid dosage forms are predominant. As such, while BFS excels in specific niches, its limited product portfolio could hinder broader adoption across the entire pharmaceutical industry.

Regulatory Challenges in Certain Regions Restrains Market Growth

The growth of the BFS Products Market is also impeded by regulatory challenges in various regions. While the U.S. and Europe have well-established regulations that support the adoption of BFS technology, inconsistencies in regulatory frameworks across emerging markets pose significant barriers. These regions may lack clear guidelines or exhibit considerable variability in regulatory standards, complicating market entry for BFS products.

For manufacturers, navigating these diverse and sometimes unclear regulatory landscapes requires additional resources and can delay market penetration efforts. Consequently, these regulatory challenges can deter expansion into new markets, limiting the global growth prospects of BFS technology and hindering its potential to capitalize on worldwide market opportunities.

Product Type Analysis

Bottles dominate with 27% due to their versatile application and consumer preference for convenient packaging.

The BFS (Blow-Fill-Seal) Products Market within the product type segment sees its largest sub-segment in bottles, accounting for 27% of the market. This predominance is driven by the versatility and convenience that bottles offer in pharmaceutical, healthcare, and consumer products. Bottles are especially favored for their ease of use, safety, and effective barrier properties, which are essential for maintaining the sterility and integrity of the contents. The demand for BFS-manufactured bottles is particularly high in liquid pharmaceuticals, where sterility and dosage accuracy are paramount. These bottles are used for a wide range of products, from eye drops to injectable solutions, making them indispensable in clinical settings.

In addition to bottles, other significant sub-segments within the product type category include ampoules, vials, containers, and prefilled syringes. Ampoules and vials are critical in hospital and clinical environments for single-dose applications, often used for vaccines and injectable drugs, where sterility is a non-negotiable requirement. Containers and prefilled syringes also hold substantial market shares. Prefilled syringes, for instance, are increasingly popular due to their convenience for self-administration of prescription drugs, particularly in the management of chronic conditions like diabetes. This sub-segment’s growth is fueled by the rising demand for user-friendly and safety-enhancing pharmaceutical packaging, illustrating the diverse needs that BFS technology addresses across its product offerings.

Material Type Analysis

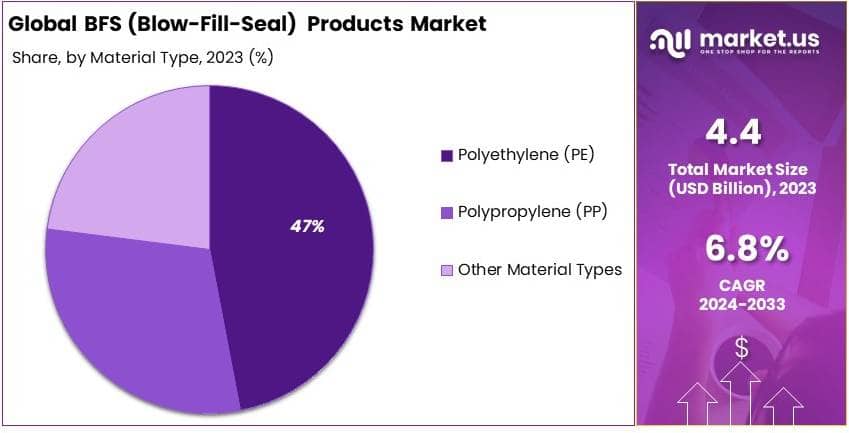

Polyethylene (PE) dominates with 47% due to its durability and compliance with regulatory standards for pharmaceutical packaging.

Within the material type segment of the BFS Products Market, Polyethylene (PE) stands out, commanding 47% of the market share. This dominance is attributed to PE’s excellent properties, such as flexibility, durability, and resistance to chemicals, which make it ideal for the stringent demands of pharmaceutical packaging. PE’s compliance with various regulatory standards worldwide ensures that it remains a preferred material for BFS applications, particularly in settings where product safety and quality are critical. Its suitability for contact with a wide range of substances and its ability to maintain the sterility of contents further enhance its appeal in the BFS market.

Other materials used in BFS technology include Polypropylene (PP) and other plastics, each serving specific needs depending on their chemical resistance, clarity, and flexibility. PP, for example, is favored for products requiring higher temperature resistance or rigidity. The segment of other materials often includes innovative composites and biodegradable plastics, catering to the growing demand for sustainable packaging solutions. These materials are gaining traction as companies seek to reduce their environmental impact while maintaining the functional benefits of traditional plastics, indicating a shift towards more sustainable practices in the BFS market.

End-Use Industry Analysis

Pharmaceuticals dominate with 42% due to critical requirements for sterility and precision in drug delivery.

The end-use industry segment of the BFS Products Market is overwhelmingly led by pharmaceuticals, which account for 42% of the market. This sector’s reliance on BFS technology is due to the critical requirements for sterility, precision, and safety in drug packaging. BFS technology’s ability to provide aseptic packaging solutions is especially valuable in this context, where even minor contamination can lead to significant health risks. The pharmaceutical industry’s stringent regulatory environment further necessitates the use of reliable and compliant packaging methods, such as those offered by BFS technology.

Besides pharmaceuticals, the BFS technology also finds significant applications in the food & beverages, cosmetics & personal care, and chemicals & industrial sectors. In food & beverages, BFS is used for the hygienic packaging of consumables, particularly where extended shelf life is necessary. In cosmetics & personal care, the technology supports the need for high-quality, contamination-free packaging for sensitive products. The chemicals and industrial sector benefits from BFS’s robust and durable packaging for aggressive or hazardous substances, highlighting the technology’s versatility across different industries. Each of these sectors contributes to the overall growth of the BFS market, but it is the pharmaceuticals sector that remains the most pivotal due to its size and the critical nature of its packaging needs.

Key Market Segments

By Product Type

- Ampoules

- Vials

- Bottles

- Containers

- Prefilled Syringes

By Material Type

- Polyethylene (PE)

- Polypropylene (PP)

- Other Material Types

By End-Use Industry

- Pharmaceuticals

- Food & Beverages

- Cosmetics & Personal Care

- Chemicals & Industrial

Growth Opportunities

Diversification into New Applications Offers Growth Opportunity

The potential for diversification of BFS (Blow-Fill-Seal) technology into new applications presents a significant growth opportunity within the market. Historically centered in the pharmaceutical and healthcare sectors, BFS is now exploring avenues in cosmetics, food and beverages, and industrial chemicals. These industries benefit immensely from BFS’s aseptic and tamper-evident packaging solutions, which ensure product integrity and extend shelf life.

For example, the cosmetics industry, with its stringent standards for sterility, could see increased adoption of BFS to maintain product purity and safety. Similarly, the food and beverage industry’s growing demand for hygienic and durable packaging solutions aligns well with BFS capabilities. By tapping into these new markets, BFS manufacturers can broaden their revenue streams and market presence, adapting their technology to meet a wider range of consumer needs and regulatory requirements.

Development of Advanced BFS Systems Offers Growth Opportunity

The ongoing development of advanced BFS systems is carving out new market opportunities by expanding the technology’s capabilities. Research and development are not only enhancing existing BFS technology but are also pushing its boundaries to accommodate a broader array of product formulations, including powders and more viscous semi-solids.

This evolution in BFS technology enables the packaging of a diverse range of new products, such as injectable drugs with complex requirements or ophthalmic solutions. For instance, recent advancements that allow BFS systems to handle suspension formulations are opening up possibilities for more sophisticated drug delivery options. Moreover, improvements in material science and machine efficiency are contributing to higher production outputs and cost reductions, making BFS a more attractive option across various industries. This progression supports market growth by broadening the applicability of BFS products and attracting interest from sectors previously untapped by this technology.

Trending Factors

Sustainability and Eco-Friendly Packaging Are Trending Factors

The growing emphasis on sustainability and eco-friendly practices in packaging is a key trend in the BFS (Blow-Fill-Seal) Products Market. BFS technology aligns perfectly with these environmental goals by significantly reducing waste and minimizing the impact on the environment. The process inherently eliminates the need for multiple packaging components, which not only reduces material use but also diminishes the risk of contamination and product loss.

For instance, when BFS is used for products like eye drops or nasal sprays, the absence of additional packaging materials leads to a direct reduction in waste and carbon footprint. This capability is increasingly valued across various industries, particularly as global regulations tighten around waste reduction and sustainability. The trend towards eco-friendly packaging solutions is expected to drive greater adoption of BFS technology, as companies seek to meet both consumer preferences and regulatory demands for greener packaging options.

Personalized Medicine and Targeted Therapies Are Trending Factors

Personalized medicine and targeted therapies represent a significant shift in the pharmaceutical industry, necessitating equally innovative packaging solutions. BFS technology’s ability to accommodate small batch sizes and customized packaging formats makes it highly suitable for these applications. As personalized and targeted treatments become more prevalent, the demand for BFS’s flexible packaging capabilities is expected to grow.

This technology can efficiently produce tailored packaging for individual patients, such as specific dosages of injectable medications or unique drug combinations, without compromising sterility or efficiency. The trend towards personalized medicine not only highlights the adaptability and precision of BFS technology but also underscores its potential to expand within the pharmaceutical sector as the demand for more customized treatment options increases.

Regional Analysis

APAC Dominates with 35% Market Share

Asia Pacific (APAC) holds a commanding 35% share of the BFS (Blow-Fill-Seal) Products Market, primarily due to its robust pharmaceutical and healthcare sectors. This region’s rapid industrialization and increasing healthcare expenditures contribute significantly to its dominance. Additionally, the growing middle class and heightened awareness of health issues drive demand for sterile and efficient packaging solutions offered by BFS technology.

The market dynamics in APAC are influenced by its large population base, which presents vast opportunities for pharmaceutical growth and, consequently, for advanced packaging technologies. The region’s focus on improving healthcare infrastructure and the push towards domestic production of medical products further amplify the adoption of BFS technology.

Regional Market Shares:

- North America: The North American market, particularly driven by the U.S., holds about 30% of the global BFS market share. The region’s stringent regulatory environment and high standard of healthcare necessitate advanced BFS technologies, supporting steady growth.

- Europe: Europe accounts for approximately 25% of the market share. This is due to its advanced pharmaceutical manufacturing capabilities and strong regulatory frameworks, which promote high-quality and innovative packaging solutions.

- Middle East & Africa: This region has a smaller, but growing, market share of around 5%. Increasing healthcare spending and infrastructure development in select countries are beginning to drive demand for BFS technologies.

- Latin America: Holding about 5% of the global market, Latin America is slowly adopting BFS technologies, particularly in response to its expanding pharmaceutical industry and rising public health awareness.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The BFS (Blow-Fill-Seal) Products Market is characterized by the presence of several influential companies that significantly impact market dynamics through innovative solutions and strategic global positioning. Unither Pharmaceuticals is a leading player known for its strong focus on single-unit dosage forms that enhance patient safety and compliance. Gerresheimer AG, with its extensive expertise in high-precision pharmaceutical packaging, contributes to the market with robust manufacturing capabilities and a global footprint.

Nephron Pharmaceuticals and Catalent, Inc. are prominent for their role in respiratory solutions and advanced drug delivery systems, respectively. These companies leverage BFS technology to offer end-to-end solutions from product development to commercialization, enhancing their market presence. Automatic Liquid Packaging Solutions, LLC, and Weiler Engineering, Inc. specialize in custom BFS solutions, catering to niche markets which require unique packaging needs.

IMA S.p.A. and Rommelag Kunststoff-Maschinen have made significant strides in integrating BFS with other manufacturing technologies, thus broadening the application range of BFS products. Brevetti Angela S.R.L. focuses on innovative approaches to BFS technology, particularly in aseptic processing.

Together, these key players drive technological advancements and competitive strategies in the BFS market, shaping industry trends and pushing the boundaries of what can be achieved with BFS technology. Their collective efforts not only enhance product offerings but also expand market reach, making BFS an indispensable technology in various industries, particularly pharmaceuticals.

Market Key Players

- Unither Pharmaceuticals

- Gerresheimer AG

- Nephron Pharmaceuticals

- Catalent, Inc.

- Automatic Liquid Packaging Solutions, LLC

- Weiler Engineering, Inc.

- IMA S.p.A.

- Rommelag Kunststoff-Maschinen

- Brevetti Angela S.R.L.

- Other Key Players

Recent Developments

- On March 13, 2024, Nikka Densok Limited and HEUFT introduced a joint solution for Blow-Fill-Seal (BFS) strips CCIT (Container Closure Integrity Testing). This collaboration aims to enhance the quality control process for BFS strips, ensuring the integrity and safety of pharmaceutical packaging.

- On February 20, 2024, Wuxi Apptec inaugurated a BFS aseptic filling line, marking a significant advancement in pharmaceutical manufacturing technology. This new line is designed to improve the aseptic filling process, contributing to the production of high-quality pharmaceutical products.

Report Scope

Report Features Description Market Value (2023) USD 4.4 Billion Forecast Revenue (2033) USD 8.5 Billion CAGR (2024-2033) 6.8% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Ampoules, Vials, Bottles, Containers, Prefilled Syringes), By Material Type (Polyethylene (PE), Polypropylene (PP), Other Material Types), By End-Use Industry (Pharmaceuticals, Food & Beverages, Cosmetics & Personal Care, Chemicals & Industrial) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Unither Pharmaceuticals, Gerresheimer AG, Nephron Pharmaceuticals, Catalent, Inc., Automatic Liquid Packaging , Solutions, LLC, Weiler Engineering, Inc., IMA S.p.A., Rommelag Kunststoff-Maschinen , Brevetti Angela S.R.L., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  BFS (Blow-Fill-Seal) Products MarketPublished date: May 2024add_shopping_cartBuy Now get_appDownload Sample

BFS (Blow-Fill-Seal) Products MarketPublished date: May 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Catalent Inc.

- Recipharm AB (publ)

- Unither Pharmaceuticals

- The Ritedose Corporation

- Unicep Packaging

- Laboratorios SALVAT

- S.A

- PrimaPharma

- Asept Pak

- Plastikon

- Birgi Mefar Group

- Pharmapack

- Unipharma LLC

- Weiler Engineering

- Merck & Co. Inc. (BioConnection)

- Curida

- UNOLAB

- Nupharm (Nueraxpharm)