Styrenic Polymers Market By Products(Polystyrene (PS), Acrylonitrile Butadiene Styrene (ABS), Styrene Acrylonitrile (SAN), Styrene Butadiene Block Copolymers (SBC), Styrene Methyl Methacrylate (SMMA), Others), By End-Use(Packaging, Automotive & Transportation, Building & construction, Consumer Goods, Medical, Sports & Leisure, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Feb 2024

- Report ID: 115457

- Number of Pages: 280

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

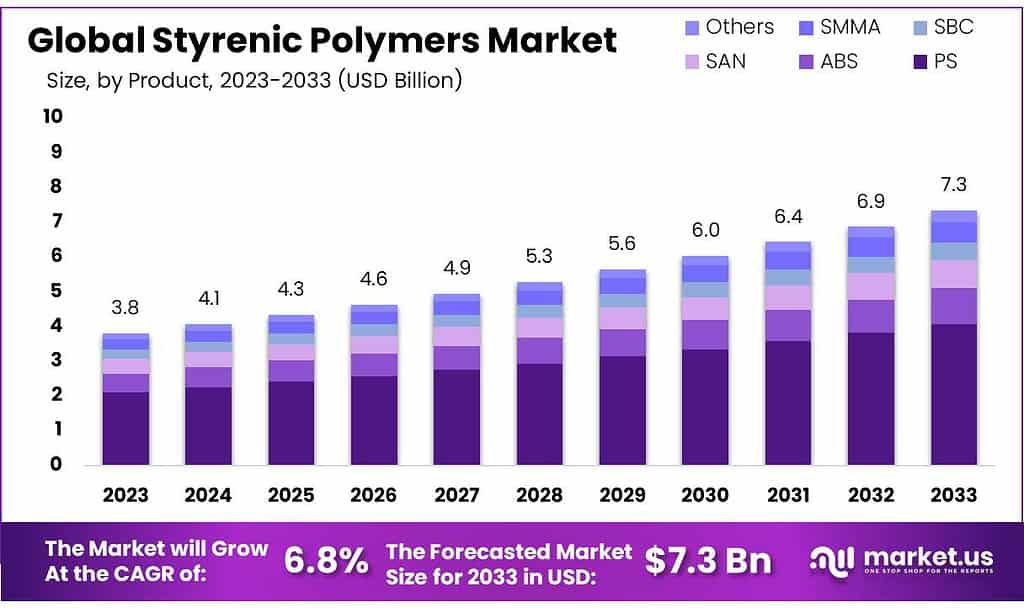

The Styrenic Polymers Market size is expected to be worth around USD 7.3 billion by 2033, from USD 3.8 Bn in 2023, growing at a CAGR of 6.8% during the forecast period from 2023 to 2033.

The styrenic polymers market is a significant sector within the chemical industry, focused on the production, distribution, and sale of styrenic polymers. Derived from monomer styrene, a liquid hydrocarbon, styrenic polymers are a class of plastics known for their manufacturing ease, versatility, and cost-effectiveness.

Common types within this category include polystyrene (PS), acrylonitrile butadiene styrene (ABS), styrene acrylonitrile (SAN), and styrene butadiene rubber (SBR), among others. These polymers are favored for their distinctive properties such as clarity, impact resistance, and rigidity, which make them indispensable across a range of applications. The key industries leveraging these materials include packaging, construction, consumer electronics, automotive, and medical devices, all of which demand the specific benefits that styrenic polymers provide.

In the global market landscape, the European Union stands out with its significant trading figures for chemicals, which prominently include styrenic polymers. In 2021, the EU reported substantial chemical trade, importing chemicals valued at €272 billion and exporting €458 billion.

This robust trade activity underscores the critical role of styrenic polymers, which are extensively utilized across various industries due to their versatile applications. Such economic data points to a vibrant market scenario where both imports and exports play pivotal roles, driven by constant demand in the various end-use sectors.

Moreover, production data from major markets such as the United States, Germany, and China further highlights the scale of styrenic polymer manufacturing. For example, the U.S. consistently produced over 2 million tons of polystyrene annually in recent years. Such high-volume production not only reflects the strong market demand but also places styrenic polymers as key materials in the global chemical industry market.

However, the market for styrenic polymers is not without its challenges, particularly in terms of price volatility. Prices for products like general-purpose polystyrene (GPPS) and high-impact polystyrene (HIPS) have experienced fluctuations ranging from $1,000 to $1,500 per metric ton.

These price changes are primarily influenced by the costs of raw materials and market demand fluctuations, showcasing the dynamic and often unpredictable nature of the polymer market. This volatility reflects broader economic factors and industry-specific trends that stakeholders must navigate.

Key Takeaways

- The market is expected to grow from USD 3.8 billion in 2023 to USD 7.3 billion by 2033, at a 6.8% CAGR.

- Polystyrene (PS) dominated in 2023 with a 55.6% market share.

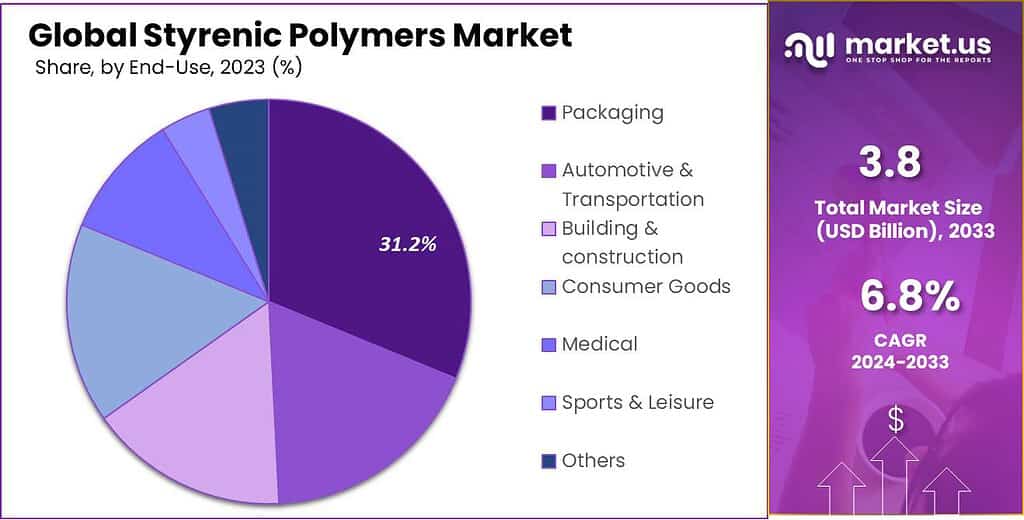

- Packaging industry leads with a 73.3% share due to versatility and cost-effectiveness.

- EU chemical imports in 2021 were €272 billion, and exports €458 billion.

- The U.S. produced over 2 million tons of polystyrene annually.

- Prices for GPPS and HIPS ranged from $1,000 to $1,500 per metric ton.

- Environmental regulations increase production costs by 10-20%.

By Products

In 2023, Polystyrene (PS) held a dominant market position, capturing more than a 55.6% share. Polystyrene, known for its versatility and affordability, remains a preferred choice across various applications such as packaging, consumer goods, and construction materials. Its widespread adoption can be attributed to its lightweight nature, excellent insulation properties, and ease of processing, making it a go-to option for manufacturers looking for cost-effective solutions.

Following closely behind, Acrylonitrile Butadiene Styrene (ABS) accounted for a significant portion of the market share. ABS polymers are valued for their high impact resistance, strength, and dimensional stability, making them ideal for applications in automotive components, electronics, and household appliances. The demand for ABS is driven by its ability to withstand harsh environmental conditions and maintain structural integrity, ensuring long-term durability.

Styrene Acrylonitrile (SAN) also secured a notable market share, owing to its exceptional clarity, chemical resistance, and heat resistance properties. SAN finds extensive usage in industries such as food packaging, medical devices, and consumer electronics, where transparency and durability are paramount. Its compatibility with various processing techniques further enhances its appeal to manufacturers seeking high-performance materials for their products.

Styrene Butadiene Block Copolymers (SBC) emerged as another significant segment in the styrenic polymers market. SBCs offer a unique combination of elasticity, toughness, and adhesion, making them indispensable in applications such as adhesives, sealants, and footwear. Their ability to provide enhanced performance characteristics while maintaining cost efficiency drives their adoption across diverse industries.

By End-Use

In 2023, Packaging held a dominant market position, capturing more than a 73.3% share. The packaging industry remains the largest consumer of styrene polymers due to their versatility, cost-effectiveness, and ability to meet various packaging requirements. Styrenic polymers, such as polystyrene (PS) and acrylonitrile butadiene styrene (ABS), are widely used in packaging applications for food and beverage, cosmetics, pharmaceuticals, and consumer goods.

Their properties, including lightweight, impact resistance, and thermal insulation, make them ideal for protecting products during storage and transportation. Following closely, the Automotive & Transportation sector emerged as a significant consumer of styrene polymers. ABS, ABS blends, and styrene-butadiene block copolymers (SBC) find extensive use in automotive interiors, exterior components, and under-the-hood applications.

These polymers offer advantages such as high strength-to-weight ratio, impact resistance, and dimensional stability, contributing to enhanced safety, fuel efficiency, and aesthetics in vehicles.

The Building & Construction industry also commands a notable share of the styrenic polymers market. Polystyrene (PS) and styrene acrylonitrile (SAN) are commonly used in construction applications such as insulation, roofing materials, piping, and decorative fixtures.

Their properties, including thermal insulation, moisture resistance, and durability, make them suitable for both residential and commercial construction projects, contributing to energy efficiency and structural integrity. Consumer Goods represent another significant end-use segment for styrenic polymers.

ABS, SAN, and styrene methyl methacrylate (SMMA) are utilized in the production of household appliances, electronic devices, toys, and consumer electronics. These polymers offer aesthetic appeal, impact resistance, and design flexibility, meeting the diverse demands of consumers for durable and visually appealing products.

Market Key Segmentation

By Products

- Polystyrene (PS)

- Acrylonitrile Butadiene Styrene (ABS)

- Styrene Acrylonitrile (SAN)

- Styrene Butadiene Block Copolymers (SBC)

- Styrene Methyl Methacrylate (SMMA)

- Others

By End-Use

- Packaging

- Automotive & Transportation

- Building & construction

- Consumer Goods

- Medical

- Sports & Leisure

- Others

Drivers

Expanding Applications and Rising Demand in the Styrenic Polymers Market

Styrenic polymers are favored due to their versatility, finding applications across industries such as packaging, automotive, construction, consumer goods, and healthcare. The demand for lightweight materials, driven by factors like fuel efficiency and sustainability, is boosting the adoption of styrenic polymers in industries like automotive and transportation.

Urbanization and infrastructure projects are spurring demand for construction materials, with styrenic polymers like polystyrene (PS) and styrene acrylonitrile (SAN) being utilized for insulation, piping, roofing, and other construction applications.

Ongoing advancements in polymer chemistry and processing technologies are facilitating the development of new styrenic polymer grades with improved properties and functionalities, thus expanding their application scope and stimulating market growth.

Rising disposable incomes, evolving lifestyles, and changing consumer preferences are driving the consumption of consumer goods, where styrenic polymers, known for their aesthetic appeal and durability, are extensively used in electronics, appliances, and household products manufacturing.

There’s a growing emphasis on sustainability and recycling, prompting industries to adopt eco-friendly materials like recyclable styrenic polymers, which also contribute to lightweighting initiatives and circular economy principles.

Restraints

Impact of Environmental Regulations on the Plastic Industry

Compliance with environmental regulations can significantly increase production costs for the plastics industry, with estimates suggesting a rise of 10-20% depending on the region and the specifics of the regulation. These increased costs are associated with the need to invest in cleaner production technologies, enhanced waste management systems, and the development of new, compliant materials.

Currently, less than 30% of all plastic waste is collected for recycling globally, and styrenic polymers, due to their complex chemical nature, often have lower recycling rates compared to other plastics. This contributes to ongoing environmental concerns and heightens regulatory pressures.

In the European Union, regulations aimed at reducing plastic waste are projected to impact over 25% of the existing plastic market, pushing the industry towards adopting more sustainable alternatives or significantly improving recycling technologies.

Companies are responding to these challenges by investing heavily in research and development (R&D). Some large players are allocating up to 5-7% of their annual revenue to develop new, sustainable polymer solutions. This substantial investment in R&D underscores the industry’s commitment to overcoming regulatory and environmental challenges.

Moreover, market dynamics are shifting due to consumer demand for sustainable products. Market research indicates a growing preference among consumers for environmentally friendly materials, with surveys showing that up to 50% of consumers in major markets favor such products.

This shift in consumer preferences is influencing market demand patterns and necessitating changes in the production and development of traditional styrenic polymers.

Opportunities

Expanding Applications in Automotive and Construction

The growing emphasis on sustainability presents an opportunity for styrenic polymer manufacturers to develop and market eco-friendly alternatives. Innovations in recycling technologies offer the chance to unlock new market opportunities and strengthen the industry’s sustainability credentials.

Advances in polymer chemistry provide opportunities to enhance the performance characteristics of styrenic polymers, opening up new application areas. Emerging economies offer significant growth opportunities for the styrenic polymers market, especially in sectors like automotive, packaging, construction, and consumer goods.

Offering customized solutions and specialty grades tailored to specific industry needs can create opportunities for differentiation and premium pricing. Providing value-added services such as technical support and supply chain optimization can enhance customer satisfaction and loyalty.

Trends

Shift Towards Sustainable Production

One major trend in the styrenic polymers market is the significant shift towards sustainable production methods, driven by increasing environmental concerns and stringent regulations. This trend is notably evident in sectors such as packaging, automotive, electronics, and construction, where styrenic polymers are extensively used. Governments and regulatory bodies are actively promoting this shift through various initiatives aimed at reducing the environmental footprint of industrial materials.

As the demand for environmentally friendly products increases, companies are investing in the development of bio-based styrenic polymers and recycling technologies. These efforts are supported by legislative measures in regions such as Europe and North America, where regulations mandate the reduction of single-use plastics and encourage the use of recyclable and renewable materials.

Technological advancements further support this growth by enhancing the material properties of styrenic polymers, making them more suitable for a wide range of applications while being environmentally benign.

Innovations in styrenic polymer formulations are enabling the production of materials that are not only more durable and versatile but also recyclable and less harmful to the environment. These innovations are critical for meeting both consumer expectations and regulatory requirements, representing a significant growth opportunity within the market.

Several government-funded programs are providing incentives for companies to develop sustainable materials. For instance, initiatives in the EU and the US offer grants and tax benefits for research and development in green materials, including new generations of styrenic polymers.

These factors together are shaping a major trend in the styrenic polymers market, steering it towards more sustainable and environmentally friendly practices. This not only helps in complying with global sustainability goals but also opens up new market opportunities for innovative products in various industrial applications.

Regional Analysis

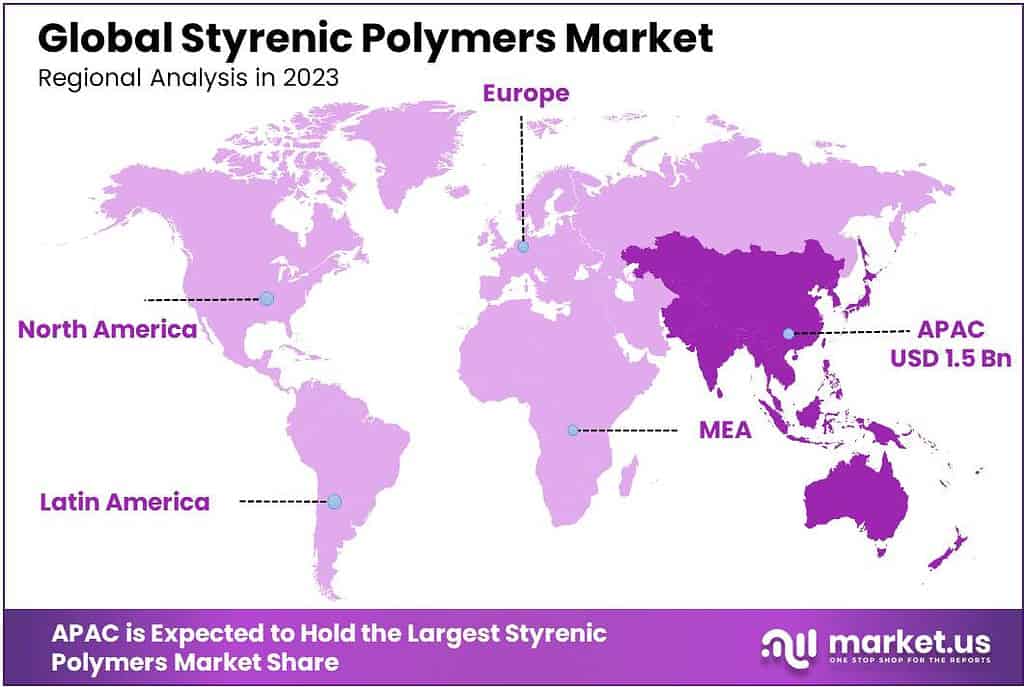

Asia Pacific (APAC) had the largest revenue share at over 39.3% in 2023. The region’s supremacy is attributed to robust regulatory support for renewable energy initiatives, particularly in the US and Canada. Government incentives and policies encouraging the adoption of renewable energy sources have made Power Purchase Agreements (PPAs) an appealing option for both producers and consumers.

Data from the American Clean Power Association (ACP) revealed a record-high activity in clean power PPAs, with US commercial and industrial (C&I) companies signing nearly 20 GW in 2022. The mature and technologically advanced renewable energy sector in North America has facilitated large-scale projects, reinforcing the growth of the Styrenic Polymers market. Corporations are increasingly turning to PPAs to secure cost-effective, long-term renewable energy supplies, driven by societal demand for green energy.

In contrast, Europe experienced the fastest growth rate in the Styrenic Polymers market, boasting a remarkable 36.6% Compound Annual Growth Rate (CAGR) during the forecasted period. Projections indicate that Europe is poised to surpass North America in market share in the coming years. Stringent environmental regulations and ambitious renewable energy targets set by the European Union have accelerated the adoption of renewable energy sources, making PPAs an attractive avenue for securing sustainable, long-term energy supplies.

Recent reports highlight 2023 as a record-breaking year for the European Power Purchase Agreement (PPA) market, witnessing contracted renewable power volumes exceeding 16.2 GW. Forecasts anticipate the European PPA market to exceed 20 GW in 2024. The increasing corporate commitment to sustainability in Europe is a driving force behind the surge in demand for renewable PPAs, aligning with companies’ goals to reduce their carbon footprint and ensure a sustainable energy future.

Key Regions and Countries Covered in this Report:

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- India

- Japan

- South Korea

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Key Players Analysis

The Styrenic Polymers market is characterized by the presence of key players contributing to its growth and innovation. BASF SE, a global chemical giant, stands out as a major player offering a diverse portfolio of styrenic polymers for various industries. INEOS Styrolution, a leading global supplier, is known for its contributions to sectors such as automotive and electronics.

SABIC, a global chemical leader, plays a pivotal role in providing styrenic polymer solutions for applications in packaging, automotive, and construction. TotalEnergies, with a focus on energy and petrochemicals, actively participates in the development of innovative and sustainable styrenic polymer solutions.

Other significant contributors include Trinseo, LG Chem, Versalis S.p.A. (Eni), Chevron Phillips Chemical Company LLC, Asahi Kasei Corporation, and Toray Industries, Inc. These key players collectively shape the dynamics of the Styrenic Polymers market, driving advancements and meeting the evolving needs of diverse industries worldwide.

Market Key Players

- INEOS Styrolution

- TotalEnergies

- SABIC

- Dow, Inc.

- BASF SE

- Trinseo

- LG Chem

- Chi Mei Corporation

- Covestro

- Versalis

- Styron LLC

- Asahi Kasei Corporation

- Kumho Petrochemical Co., Ltd.

Recent Developments

In 2023, TotalEnergies had invested over USD 5 billion in low-carbon energy projects, reinforcing its position as a leader in the energy transition

In 2023 INEOS Styrolution This plant, set to utilize cutting-edge depolymerization technology, is part of their commitment to incorporating 30% recycled content in their polystyrene products by 2025

Report Scope

Report Features Description Market Value (2023) US$ 3.8 Bn Forecast Revenue (2033) US$ 7.3 Bn CAGR (2024-2033) 6.8% Base Year for Estimation 2023 Historic Period 2020-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Products(Polystyrene (PS), Acrylonitrile Butadiene Styrene (ABS), Styrene Acrylonitrile (SAN), Styrene Butadiene Block Copolymers (SBC), Styrene Methyl Methacrylate (SMMA), Others), By End-Use(Packaging, Automotive & Transportation, Building & construction, Consumer Goods, Medical, Sports & Leisure, Others) Regional Analysis North America: The US and Canada; Europe: Germany, France, The UK, Italy, Spain, Russia & CIS, and the Rest of Europe; APAC: China, India, Japan, South Korea, ASEAN, and the Rest of APAC; Latin America: Brazil, Mexico, and Rest of Latin America; Middle East & Africa: GCC, South Africa, and Rest of Middle East & Africa. Competitive Landscape INEOS Styrolution, TotalEnergies, SABIC, Dow, Inc., BASF SE, Trinseo, LG Chem, Chi Mei Corporation, Covestro, Versalis, Styron LLC, Asahi Kasei Corporation, Kumho Petrochemical Co., Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the Size of Styrenic Polymers Market?Styrenic Polymers Market size is expected to be worth around USD 7.3 billion by 2033, from USD 3.8 Bn in 2023

What CAGR is projected for the Styrenic Polymers Market?The Styrenic Polymers Market is expected to grow at 6.8% CAGR (2023-2032).

Name the major industry players in the Styrenic Polymers Market?INEOS Styrolution, TotalEnergies, SABIC, Dow, Inc., BASF SE, Trinseo, LG Chem, Chi Mei Corporation, Covestro, Versalis, Styron LLC, Asahi Kasei Corporation, Kumho Petrochemical Co., Ltd.

-

-

- INEOS Styrolution

- TotalEnergies

- SABIC

- Dow, Inc.

- BASF SE

- Trinseo

- LG Chem

- Chi Mei Corporation

- Covestro

- Versalis

- Styron LLC

- Asahi Kasei Corporation

- Kumho Petrochemical Co., Ltd.