Bag-in-Box Container Market By Capacity (Up to 5 liters, 5 to 10 liters, 10 to 15 liters, 15 to 20 liters, More than 20 liters), By Application (Food & Beverage (Alcoholic Beverages - Wine, Beer, Others; Non-Alcoholic Beverages - Soft Drinks, Juices & Flavored Drinks, Water, Others, Others: Tomato Products, Milk & Dairy Products, Liquid Eggs, Edible Oil, Others) Industrial Liquids (Oils, Industrial Fluids, Petroleum Products), Household Products (Household Cleaners, Liquid Detergents, Liquid Soaps & Hand wash, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: April 2025

- Report ID: 34569

- Number of Pages: 219

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

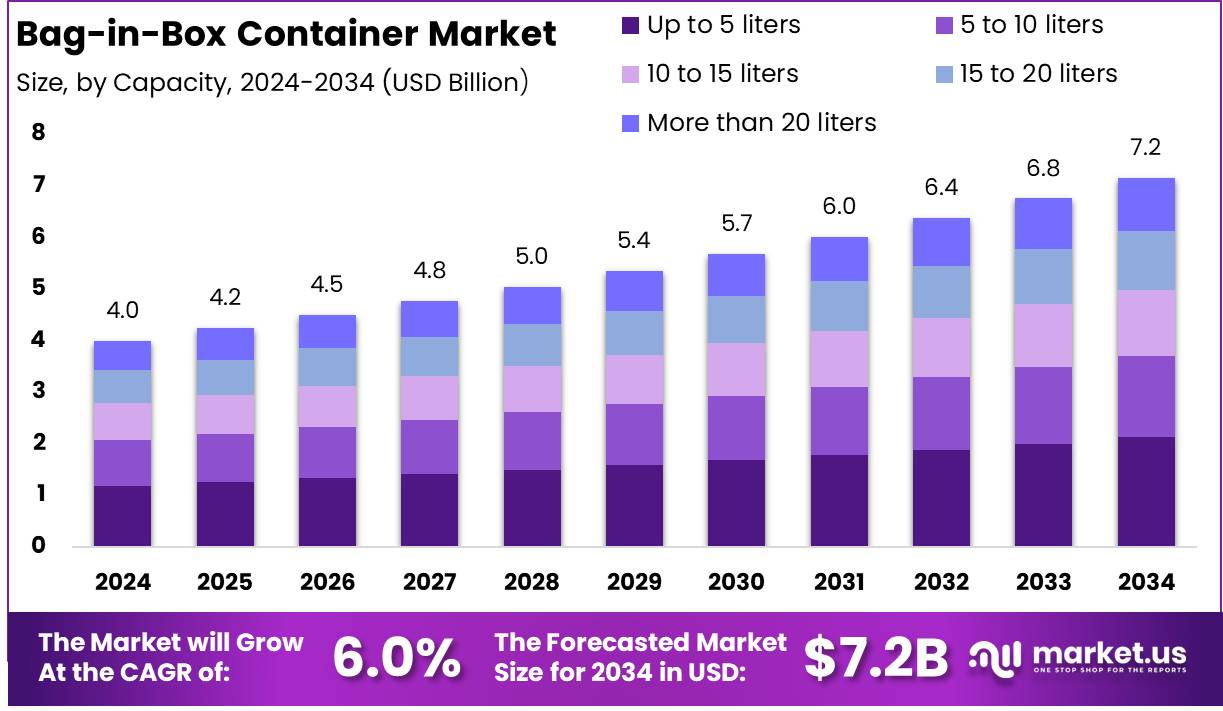

The Global Bag-in-Box Container Market size is expected to be worth around USD 7.2 Billion by 2034 from USD 4.0 Billion in 2024, growing at a CAGR of 6.0% during the forecast period from 2025 to 2034.

A Bag-in-Box (BiB) container is a type of packaging solution that integrates a flexible, multi-layered plastic bag housed within a rigid outer box, typically made of corrugated fiberboard. This structure allows the contents to be dispensed easily through a tap or valve without exposing the remaining product to air, thereby preserving quality and extending shelf life.

Bag-in-Box systems are engineered for the storage and transportation of liquids, semi-liquids, and viscous products across various industries, including food and beverage, chemicals, personal care, and pharmaceuticals. The packaging is lightweight, space-efficient, and environmentally favorable due to reduced material usage compared to traditional rigid containers.

The Bag-in-Box container market refers to the global industry focused on the production, distribution, and innovation of Bag-in-Box packaging systems. It encompasses a wide spectrum of applications, from wine and dairy packaging to industrial lubricants and cleaning agents. The market includes manufacturers of both the inner flexible bags and the outer corrugated containers, as well as providers of filling and dispensing equipment.

Driven by demand for cost-effective, sustainable, and space-saving packaging solutions, the market is experiencing notable traction across developed and emerging economies alike. The scope of this market extends from raw material suppliers to end-use industries seeking improved logistics, reduced waste, and extended product integrity.

The growth of the Bag-in-Box container market can be attributed to multiple converging factors, primarily the shift toward sustainable packaging and the increasing demand for efficient bulk packaging solutions. The format’s reduced carbon footprint, as compared to traditional packaging alternatives like rigid plastic or glass, is gaining favor amid tightening global regulations and corporate sustainability goals.

The demand for Bag-in-Box containers has witnessed substantial growth due to their logistical advantages and strong performance in minimizing product waste. Businesses are increasingly leveraging these containers for institutional and industrial use, given their ability to carry large volumes while optimizing storage and transportation efficiency. In the beverage industry, particularly, BiB containers are being favored for both commercial distribution and direct-to-consumer models due to their convenience and product preservation capabilities.

Significant opportunity exists in the innovation of materials and dispensing systems to further enhance the performance and sustainability of Bag-in-Box packaging. Market participants can benefit by developing biodegradable inner bags, lightweight outer casings, and smart dispensing mechanisms that improve user experience and environmental compliance.

According to SEALED AIR, the acquisition of Liquibox for USD 1.15 billion reinforces its strategic expansion in sustainable flexible packaging, strengthening innovation capabilities and supply chain integration in the Bag-in-Box Container segment.

According to WRAP, the global production of plastic packaging has reached 141 million tonnes annually, contributing significantly to environmental degradation. With approximately 1.8 billion tonnes of carbon emissions resulting from plastic production, use, and disposal, the pressure on sustainable alternatives intensifies. Notably, in the UK, nearly 70% of plastic waste originates from packaging, underscoring the urgency for eco-efficient packaging solutions.

Against this backdrop, the Bag-in-Box Container Market is gaining traction due to its lower environmental footprint, material efficiency, and reduced logistics emissions. As environmental regulations tighten and demand for low-impact packaging solutions accelerates, the Bag-in-Box format is positioned as a sustainable, cost-effective substitute to rigid plastics, particularly in food, beverage, and industrial liquid sectors.

According to Bain & Company, the Bag-in-Box Container Market is poised for accelerated growth, driven by heightened consumer focus on sustainability. 64% of global consumers express deep concern about environmental sustainability, a sentiment more pronounced in emerging markets like China, India, and Indonesia where 79% show high levels of concern, compared to 55% in developed regions such as the US and Europe.

This shift is notably strong among generational cohorts, with 72% of Gen Z and 68% of boomers worldwide identifying as very or extremely concerned about environmental issues. In the US, 96% of consumers acknowledge climate change, and among them, 85% of liberal voters are deeply concerned, contrasting with 39% of conservative voters. These consumer sentiments are increasingly shaping packaging preferences, positioning the Bag-in-Box Container Market as a sustainable alternative aligned with evolving global demands.

Key Takeaways

- The Global Bag-in-Box (BIB) Container Market is projected to reach approximately USD 7.2 billion by 2034, growing from USD 4.0 billion in 2024, at a compound annual growth rate (CAGR) of 6.0% during the forecast period from 2025 to 2034.

- The Up to 5 Liters segment accounted for the largest share of the market, contributing over 29.6% in 2024, underscoring strong demand for compact and convenient packaging solutions across diverse applications.

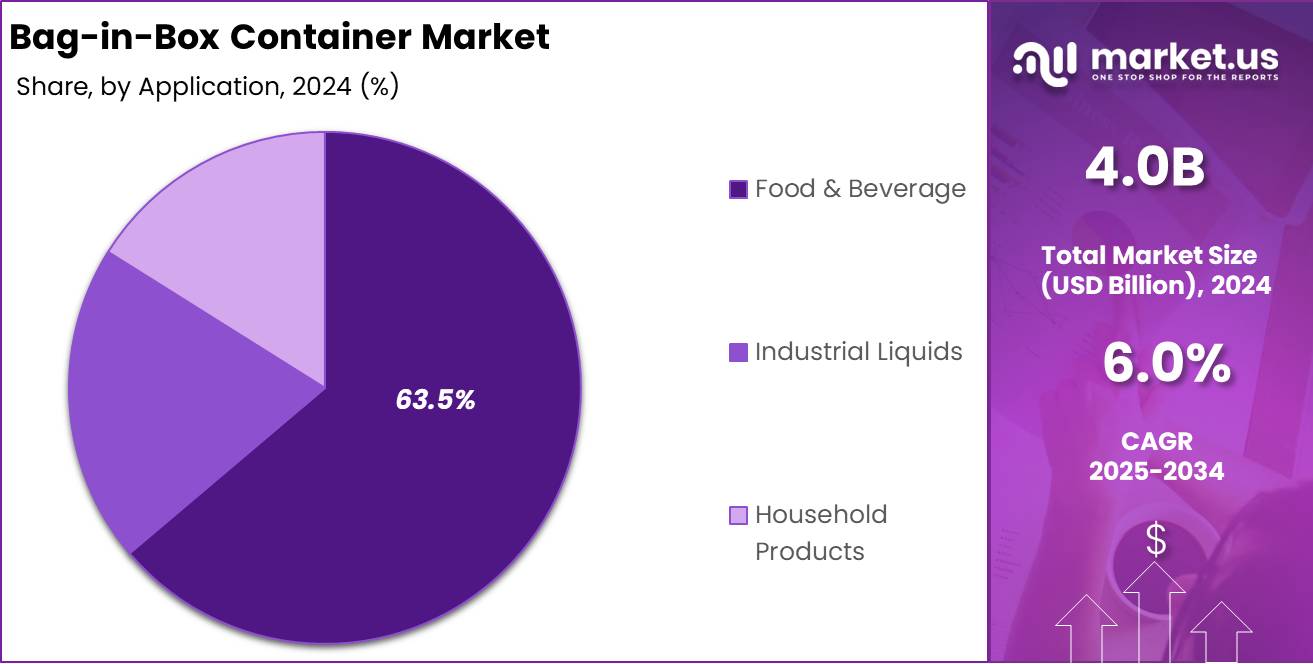

- The Food & Beverage sector remained the primary end-use industry for Bag-in-Box containers, holding a significant 63.5% share in 2024, driven by increasing adoption in wine, dairy, and juice packaging.

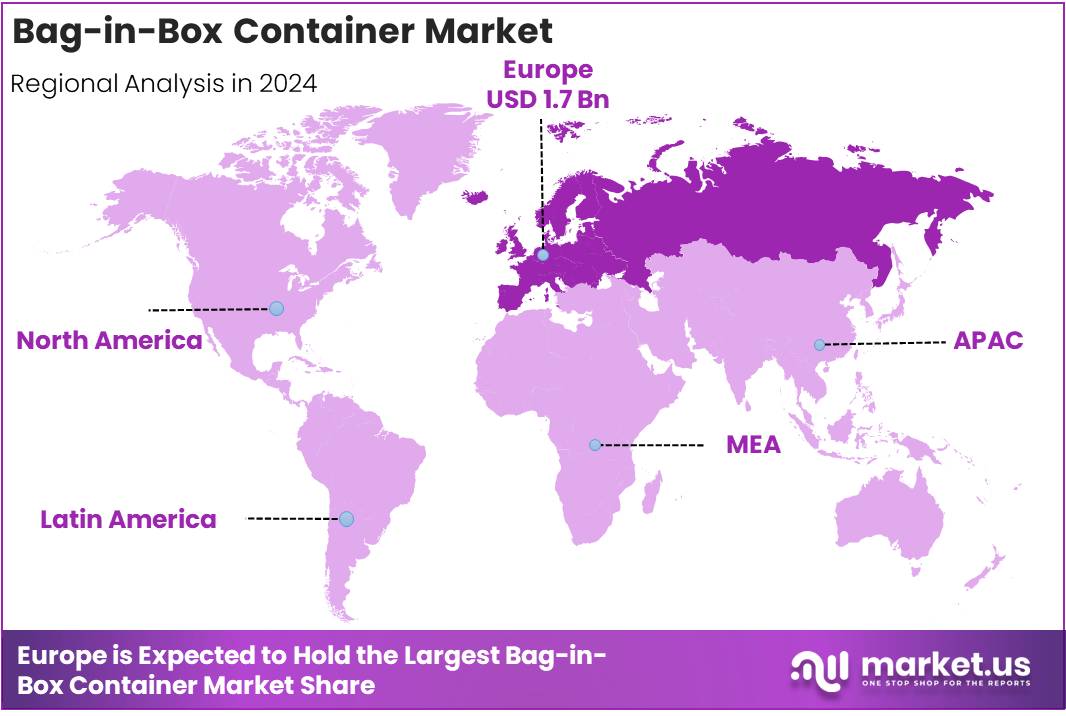

- Europe emerged as the leading regional market in 2024, capturing 43.6% of the global market share, which translated to a market value of approximately USD 1.7 billion.

By Capacity Analysis

Up to 5 Liters Dominates the Bag-in-Box Container Market with Over 29.6% Share

In 2024, Up to 5 liters secured a dominant market position in the Bag-in-Box Container Market, capturing more than 29.6% of the global revenue share. The segment’s leading status can be attributed to the rising demand for compact, easy-to-carry packaging solutions across food and beverage, household, and personal care applications.

Small-capacity containers are highly preferred for products with shorter consumption cycles, such as juices, wine, dairy items, and cleaning liquids, especially in household settings. Their convenience in storage, ease of disposal, and lower material use align with sustainability goals, further reinforcing market traction.

Moreover, small businesses and single-person households have shown a growing inclination toward low-volume, portion-controlled packaging, enhancing the adoption of up to 5-liter bag-in-box containers. As the trend of on-the-go consumption increases in urban areas, manufacturers are focusing on lightweight and user-friendly designs. These attributes contribute to logistics efficiency and waste reduction, making this capacity range a favorable choice among environmentally conscious consumers and producers alike.

In 2024, the 5 to 10 liters capacity segment emerged as a prominent contributor to the Bag-in-Box Container Market, driven by its strong adoption in medium-scale commercial and institutional environments. This capacity range offers an optimal balance between handling ease and storage efficiency, rendering it well-suited for semi-bulk applications in foodservice operations, hospitality venues, and beverage dispensing systems. It has become a preferred format for packaging items such as edible oils, syrups, and ready-to-serve beverages, owing to its cost-effectiveness and operational flexibility.

Furthermore, this segment is increasingly utilized in e-commerce liquid refill formats, where the advantages of extended shelf life and reduced spillage risks enhance its appeal. Compared to rigid containers, bag-in-box systems within this capacity bracket contribute to fewer product returns and higher customer satisfaction. Sustainability initiatives have further reinforced its adoption, as the format reduces the need for excessive secondary packaging while preserving the integrity of the contained product.

The 10 to 15 liters capacity segment has witnessed notable traction within the Bag-in-Box Container Market, particularly in industrial kitchens, commercial beverage dispensing systems, and institutional cleaning operations. This size category is valued for its ability to accommodate moderate liquid volumes without introducing significant packaging waste or increasing handling complexity. The format aligns well with bulk procurement practices, which have gained momentum as part of broader cost-efficiency measures in commercial and institutional settings.

Meanwhile, the 15 to 20 liters segment remains integral to large-volume applications across industrial, hospitality, and commercial beverage supply chains. It is widely utilized for the packaging and distribution of soft drink syrups, export-grade wines, and industrial chemicals, where the efficiency of storage and transportation is paramount. The segment benefits from the modular and stackable design of bag-in-box systems, offering a compelling alternative to traditional drums and rigid containers.

The category comprising containers of more than 20 liters is predominantly used in heavy-duty industrial contexts, institutional liquid handling, and export-oriented packaging. These high-capacity bag-in-box solutions are frequently adopted for the bulk transport of chemicals, oils, and fluid ingredients in food processing, cleaning products, and pharmaceutical manufacturing. Their environmental advantages and cost efficiency, especially when compared with drums and intermediate bulk containers (IBCs), reinforce their position as a preferred choice for large-scale liquid distribution needs.

By Application Analysis

Food & Beverage Dominates the Bag-in-Box Container Market with Over 63.5% Share

In 2024, the Food & Beverage segment held a dominant position in the Bag-in-Box Container market, capturing more than 63.5% of the global market share. This segment’s prominence is driven by the growing demand for efficient, cost-effective, and environmentally friendly packaging solutions in the food and beverage industry.

Bag-in-box containers are increasingly favored for packaging a wide range of products, including juices, syrups, edible oils, and ready-to-serve drinks. The format’s ease of handling, coupled with its ability to extend shelf life and reduce spillage, makes it ideal for both commercial and institutional use.

The rising trend of bulk purchasing, particularly in foodservice and hospitality sectors, further contributes to the market share of food and beverage products in bag-in-box containers. Additionally, sustainability concerns are pushing food and beverage producers toward packaging solutions that reduce waste and support eco-friendly initiatives, making the bag-in-box solution even more appealing.

In 2024, the Industrial Liquids segment captured a notable share of the Bag-in-Box Container market, supported by its application in the transportation and storage of industrial chemicals, oils, and other fluid-based materials. The segment’s share continues to grow as bag-in-box systems offer advantages over traditional rigid containers, including lower cost, ease of handling, and reduced product loss. The adaptability of bag-in-box containers to varying volumes, along with their ability to offer a secure and stable storage environment, makes them a preferred choice in industrial applications.

The demand for more sustainable and efficient packaging solutions in industries such as chemicals, pharmaceuticals, and agriculture further strengthens the position of industrial liquids within the Bag-in-Box Container market. By offering a flexible, cost-effective alternative to bulk containers like drums and intermediate bulk containers (IBCs), bag-in-box systems help to reduce both material costs and environmental impact.

In 2024, the Household Products segment demonstrated growth within the Bag-in-Box Container market, driven by its increasing adoption for packaging cleaning agents, detergents, and other household fluids. This segment benefits from the convenience and cost-effectiveness of bag-in-box packaging, which provides a practical and eco-friendly alternative to traditional packaging formats like plastic bottles and rigid containers. The ability of bag-in-box systems to offer a controlled dispensing mechanism makes them particularly suited for household products, where controlled portions are often required.

Key Market Segments

By Capacity

- Up to 5 liters

- 5 to 10 liters

- 10 to 15 liters

- 15 to 20 liters

- More than 20 liters

By Application

- Food & Beverage

- Alcoholic Beverages

- Wine

- Beer

- Others

- Non-Alcoholic Beverages

- Soft Drinks

- Juices & Flavored Drinks

- Water

- Others

- Others

- Tomato Products

- Milk & Dairy Products

- Liquid Eggs

- Edible Oil

- Others

- Alcoholic Beverages

- Industrial Liquids

- Oils

- Industrial Fluids

- Petroleum Products

- Household Products

- Household Cleaners

- Liquid Detergents

- Liquid Soaps & Hand wash

- Others

Driver

Rising Demand for Sustainable and Lightweight Packaging Solutions

The accelerating global emphasis on environmental sustainability is significantly driving the adoption of Bag-in-Box (BiB) containers in 2024. These containers offer a lightweight, space-efficient, and environmentally responsible packaging alternative that appeals to both manufacturers and environmentally conscious consumers. Traditional rigid packaging formats, such as glass or plastic bottles, generate higher carbon emissions due to increased material usage and logistical weight.

Bag-in-Box containers reduce transportation costs and energy consumption through their compact and collapsible design, which allows for higher volume per shipment. This contributes directly to lower greenhouse gas emissions during logistics operations. Furthermore, the use of fewer raw materials in BiB packaging supports corporate sustainability targets and compliance with evolving environmental regulations in key markets such as Europe and North America.

The transition toward circular economy models and extended producer responsibility (EPR) frameworks is also reinforcing the demand for recyclable and refillable packaging formats. Bag-in-Box containers are increasingly seen as a viable solution due to their recyclability and reduced plastic usage, with some variants offering up to 60% less plastic compared to traditional rigid alternatives.

Additionally, as industries such as food & beverage, chemicals, and household products pursue sustainable packaging options to enhance their brand image and meet consumer expectations, the BiB format is gaining prominence. In 2024, the market is witnessing strong growth particularly in the beverage sector, where Bag-in-Box containers are extensively used for wine, juices, and liquid dairy products. This environmental compatibility, coupled with operational cost efficiencies, is propelling the global Bag-in-Box container market forward and positioning it as a key segment in the future of sustainable packaging.

Restraint

Limited Suitability for Carbonated and High-Pressure Liquids

Despite their growing popularity across various liquid and semi-liquid applications, Bag-in-Box containers face inherent limitations when used for carbonated beverages or high-pressure contents, which is restricting market expansion in certain segments. The flexible inner bag, while efficient for non-carbonated liquids, is not designed to withstand the internal pressure generated by carbon dioxide in fizzy or effervescent drinks.

As a result, there is a technological constraint that prevents widespread adoption of BiB containers in the carbonated beverage market—a segment that accounts for a significant portion of global liquid packaging demand. This limitation affects the addressable market for Bag-in-Box packaging and restricts potential applications, especially in high-volume, fast-moving consumer goods sectors.

Moreover, manufacturers and brands in the carbonated beverage industry tend to prefer rigid packaging formats such as PET bottles and aluminum cans, which offer superior gas barrier properties and shelf stability. While research and development efforts are ongoing to enhance the pressure resistance and barrier capabilities of flexible BiB materials, current solutions remain cost-prohibitive or commercially unviable for mass adoption.

This constraint is particularly evident in emerging economies, where affordability and scalability are critical. Consequently, the limited application scope in high-pressure packaging markets acts as a restraint on the overall growth trajectory of the Bag-in-Box container market in 2024. Unless technological innovations enable broader functional performance, this barrier will continue to hinder full-scale market penetration.

Opportunity

Expanding Usage in E-commerce and Direct-to-Consumer (D2C) Supply Chains

The rapid growth of e-commerce and direct-to-consumer (D2C) distribution models is creating significant new opportunities for the Bag-in-Box container market in 2024. As consumers increasingly purchase liquid products online ranging from wine and plant-based beverages to cleaning solutions and oils the demand for durable, leak-proof, and tamper-evident packaging formats has intensified.

Bag-in-Box containers are uniquely positioned to meet these requirements due to their high puncture resistance, reduced breakage risk, and ability to conform to compact, transport-friendly dimensions. Unlike glass or other rigid containers, BiB formats minimize damage during transit and offer an optimal packaging solution that supports the operational efficiency of last-mile logistics.

This trend is especially pronounced in the food and beverage industry, where brands are leveraging the Bag-in-Box format to improve storage, extend shelf life, and reduce return rates from damaged goods. With the e-commerce share of retail sales reaching record highs in 2024, companies are investing in packaging innovations that can streamline fulfillment and lower shipping costs.

Bag-in-Box containers allow for greater flexibility in package sizes, which caters to varying consumer preferences in the D2C space, from individual household servings to bulk formats for institutional buyers. As consumer trust in online liquid product purchases grows, driven by better packaging performance, the role of Bag-in-Box containers in supporting this digital retail evolution becomes increasingly critical, presenting a robust growth avenue for market stakeholders.

Trends

Adoption of Aseptic Packaging Technology for Shelf-Stable Liquid Products

A key trend reshaping the Bag-in-Box container market in 2024 is the widespread adoption of aseptic packaging technology to meet the growing demand for shelf-stable, preservative-free liquid products. Aseptic BiB containers are designed to maintain product integrity without the need for refrigeration or chemical preservatives, thereby aligning with consumer preferences for healthier and more natural product formulations.

This trend is gaining strong momentum across sectors such as dairy alternatives, plant-based beverages, sauces, and pharmaceutical liquids, where maintaining sterility and extending shelf life are critical requirements. The integration of aseptic processing capabilities into BiB systems is allowing manufacturers to meet stringent hygiene standards while reducing cold chain logistics costs.

The growth of the health-conscious consumer segment and the increasing popularity of clean-label products are further fueling the demand for aseptically packaged BiB solutions. In particular, small and medium-sized food producers are adopting Bag-in-Box packaging as a cost-effective method to enter markets without the need for expensive cold storage infrastructure.

Additionally, the compatibility of BiB systems with high-volume, automated filling lines makes them well-suited for scalable production environments. As innovation in aseptic barrier materials and filling machinery continues, the Bag-in-Box container market is expected to witness robust growth, particularly in applications requiring long shelf life, minimal preservatives, and enhanced food safety standards.

Regional Analysis

Europe Leads Bag-in-Box Container Market with Largest Market Share of 43.6% in 2024

In 2024, the Bag-in-Box (BIB) Container Market demonstrated varied performance across global regions, with Europe emerging as the dominant region, capturing 43.6% of the total market share, which equated to a valuation of approximately USD 1.7 billion. This significant market presence is primarily attributed to the high adoption of sustainable and space-efficient packaging solutions across the food and beverage, industrial, and household sectors. The European market has shown strong alignment with environmental directives and circular economy policies, further fueling demand for eco-conscious packaging alternatives such as bag-in-box formats.

In North America, the market has shown steady growth, supported by increasing applications in the wine and liquid food sectors. The region has witnessed a rising preference for convenient packaging among consumers and commercial entities, fostering the adoption of BIB solutions. The availability of advanced packaging infrastructure and a well-developed retail ecosystem are facilitating the growth of the segment across the U.S. and Canada, particularly in beverage and dairy product packaging.

The Asia Pacific region is emerging as a fast-growing market for bag-in-box containers, driven by expanding manufacturing activities, growing consumption of packaged beverages, and rapid urbanization across countries such as China, India, and Japan. Increasing environmental concerns and evolving consumer preferences toward lightweight and recyclable packaging formats have also contributed to the region’s growth trajectory. Additionally, the affordability and logistical benefits of BIB packaging are gaining traction among small and medium-sized enterprises in the region.

In the Middle East & Africa, the market for BIB containers is gradually expanding, led by increasing foodservice applications and growing investment in packaging infrastructure. While the region still represents a smaller share of the global market, countries in the Gulf Cooperation Council (GCC) are increasingly embracing modern packaging technologies to align with global food safety and waste reduction standards.

Latin America is experiencing moderate growth in the bag-in-box container market, bolstered by the rising popularity of boxed wines and the gradual modernization of the retail and beverage supply chains. Brazil, in particular, is witnessing an increased demand for cost-effective and bulk packaging formats that reduce transportation costs and product spillage.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- United Arab Emirates

Key Players Analysis

The Global Bag-in-Box Container Market in 2024, several key players are exhibiting strategic positioning and operational strengths that significantly influence competitive dynamics. Smurfit Kappa continues to dominate through its integrated packaging solutions, leveraging sustainable material innovation and an extensive global footprint to meet the growing demand for eco-friendly packaging. Similarly, Amcor Ltd. is capitalizing on its advanced flexible packaging technologies and strategic acquisitions to expand its portfolio in liquid packaging applications, particularly in the food and beverage segments.

CDF Corporation and DS Smith are noted for their robust R&D capabilities and focus on custom-engineered solutions, allowing them to address specialized client requirements, particularly in industrial and pharmaceutical sectors. Liquibox, recently acquired by Sealed Air, has enhanced its global distribution network and is focusing on high-performance, low-carbon-footprint packaging, thereby reinforcing its market share in liquid transportation packaging.

Arlington Packaging (Rental) Limited and TPS Rental System Ltd are demonstrating growth through rental-based models and logistics optimization, catering especially to industrial and bulk fluid applications where flexibility and cost-efficiency are critical.

Regional players like CENTRAL PACKAGE & DISPLAY and Accurate Box Company, Inc. are strengthening their presence in North America through personalized service and design-driven innovation, while Scholle IPN maintains its leadership in aseptic packaging through continuous investment in automation and global manufacturing capabilities.

Additionally, Optopack Ltd and Zarcos America are gradually scaling operations with a strong emphasis on lightweight packaging formats and regulatory compliance, making them relevant in both emerging and mature markets. Collectively, these players are driving market evolution through sustainability, innovation, and supply chain resilience.

Top Key Players in the Market

- Smurfit Kappa

- Amcor Ltd.

- CDF Corporation

- DS Smith

- Liquibox

- Arlington Packaging (Rental) Limited

- CENTRAL PACKAGE & DISPLAY

- TPS Rental System Ltd

- Scholle IPN

- Accurate Box Company, Inc

- Optopack Ltd

- Zarcos America

Recent Developments

- In 2023, SEE completed the acquisition of Liquibox for $1.15 billion, aiming to grow its presence in sustainable flexible packaging. This move brings Liquibox’s Bag-in-Box solutions under SEE’s expanding portfolio, especially boosting its CRYOVAC® fluids and liquids division. The deal supports SEE’s shift towards smart, automated packaging systems and strengthens its global reach with added innovation capacity.

- In 2023, Smurfit Kappa launched the Vitop Uno tap on March 3, introducing a design that includes built-in tamper protection. The tap complies with the EU’s upcoming Single Use Plastics Directive and simplifies consumer use by keeping the tamper seal attached after opening. This development highlights Smurfit Kappa’s focus on user-friendly and regulation-compliant packaging.

- In 2023, Amcor expanded its AmFiber™ Performance Paper packaging into Latin America in July, targeting customers seeking recyclable options for dry food and drink items. Originally created for sweets with cold seal, it now includes heat-sealed formats for items like coffee and spices. The solution features over 80% paper content and no PVDC, supporting local recycling systems where available.

- In 2024, SIG received formal approval from the Association of Plastic Recyclers for its Terra RecShield D bag-in-box product. This beverage packaging met top recyclability standards set by the APR, helping brands reduce waste and simplify recycling processes. The certification reflects SIG’s continued push for packaging that matches both consumer expectations and environmental goals.

- In 2024, Alileo launched a compact 1.5L version of its boxed Sicilian wines in April to meet the demand for portable, high-quality wine packaging. The release includes all existing Alileo varieties and follows positive media recognition. This update supports the growing trend of premium wine in sustainable, easy-to-carry formats.

Report Scope

Report Features Description Market Value (2024) USD 3.8 Billion Forecast Revenue (2034) USD 6.8 Billion CAGR (2025-2034) 6.0% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Capacity (Up to 5 liters, 5 to 10 liters, 10 to 15 liters, 15 to 20 liters, More than 20 liters), By Application (Food & Beverage: Alcoholic Beverages – Wine, Beer, Others; Non-Alcoholic Beverages – Soft Drinks, Juices & Flavored Drinks, Water, Others; Others: Tomato Products, Milk & Dairy Products, Liquid Eggs, Edible Oil, Others; Industrial Liquids – Oils, Industrial Fluids, Petroleum Products; Household Products – Household Cleaners, Liquid Detergents, Liquid Soaps & Hand wash, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Smurfit Kappa, Amcor Ltd., CDF Corporation, DS Smith, Liquibox, Arlington Packaging (Rental) Limited, CENTRAL PACKAGE & DISPLAY, TPS Rental System Ltd, Scholle IPN, Accurate Box Company, Inc, Optopack Ltd, Zarcos America Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Bag-in-Box Container MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample

Bag-in-Box Container MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Smurfit Kappa

- Amcor Ltd.

- CDF Corporation

- DS Smith

- Liquibox

- Arlington Packaging (Rental) Limited

- CENTRAL PACKAGE & DISPLAY

- TPS Rental System Ltd

- Scholle IPN

- Accurate Box Company, Inc

- Optopack Ltd

- Zarcos America