Global Jewellery Box Packaging Market Size, Share, Growth Analysis By Product Type (Rigid Boxes, Folding Cartons, Magnetic Closure Boxes, Drawer Boxes, Hinged Boxes, Others), By Jewelry Type (Necklaces, Rings, Earrings, Bracelets, Watches, Others), By End-User (Retail Stores, Jewelry Manufacturers, E-commerce, Gift Shops, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 144395

- Number of Pages: 222

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

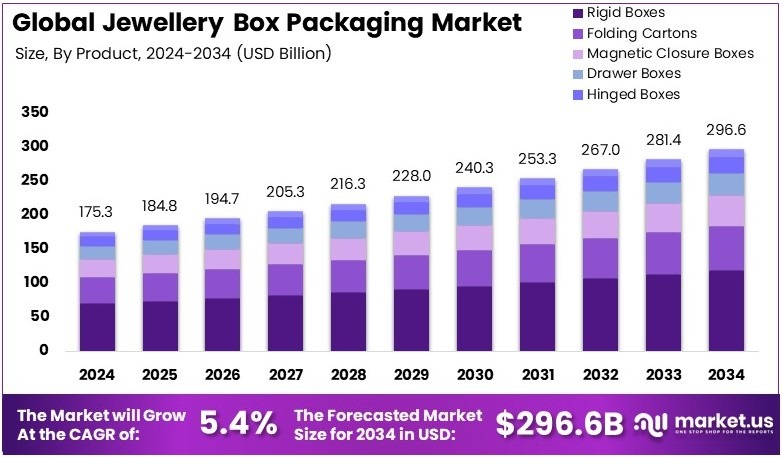

The Global Jewellery Box Packaging Market size is expected to be worth around USD 296.6 Billion by 2034, from USD 175.3 Billion in 2024, growing at a CAGR of 5.4% during the forecast period from 2025 to 2034.

Jewellery box packaging refers to the small, elegant containers used to protect and display jewellery. These boxes are made from materials like cardboard, wood, or plastic. They are designed to keep items safe, enhance presentation, and offer a luxury feel. Many are custom-designed for branding or gifting.

The jewellery box packaging market includes companies that design, produce, and sell packaging for jewellery items. Growth is supported by rising jewellery sales, gifting trends, and demand for premium packaging. The market also includes sustainable materials and customized packaging to suit branding needs in retail and e-commerce.

The jewellery box packaging segment serves luxury goods markets like fine jewellery, watches, and designer accessories. As global e-commerce grows, packaging demand is rising. In 2023, online retail sales reached $5.9 trillion and are projected to cross $8 trillion by 2027. This trend boosts the need for premium, durable packaging.

The jewellery box packaging market is evolving with new designs, materials, and branding needs. Luxury brands want boxes that reflect elegance and protect high-value items. At the same time, packaging must also be sustainable. These factors are creating more opportunities for innovation and growth across this niche market.

In addition, global players are making big moves. In June 2024, Smurfit Kappa acquired WestRock, forming Smurfit WestRock. The new entity earned $34 billion in 2023. This merger strengthens capabilities in paper-based packaging, giving luxury brands more options for eco-friendly and customized solutions.

On the flip side, competition is increasing. Many suppliers now offer similar styles and materials. To stand out, packaging firms focus on custom shapes, recyclable components, and luxury textures. Without such features, it’s harder to compete. Therefore, creative design and material sourcing are becoming business essentials.

At a global level, regulations are reshaping production. The EU’s PPWR aims for a 5% cut in packaging by 2030. This encourages recyclable materials and waste reduction. Moreover, export limits on metals can impact supply chains and costs, making packaging production more complex and region-dependent.

Locally, cities with high luxury sales—like Paris or New York—are seeing faster shifts to eco-friendly boxes. These regions influence trends across the packaging sector. Meanwhile, smaller boutique brands are also adopting stylish and sustainable packaging to attract conscious consumers. This shows how change is happening at every scale.

Key Takeaways

- The Jewellery Box Packaging Market was valued at USD 175.3 billion in 2024 and is expected to reach USD 296.6 billion by 2034, with a CAGR of 5.4%.

- In 2024, Rigid Boxes dominate the product type segment with 38.4%, preferred for their durability and premium appeal.

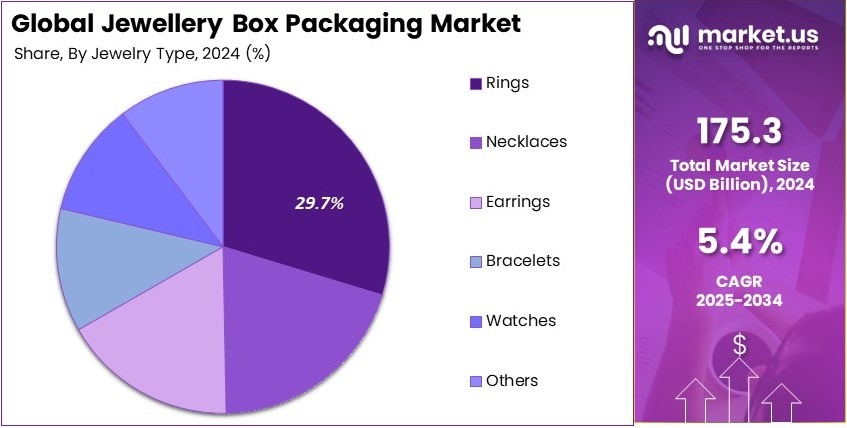

- In 2024, Rings lead the jewelry type segment with 29.7%, as they are the most commonly gifted and purchased items.

- In 2024, Retail Stores hold the largest share in the end-user segment with 44.2%, benefiting from high foot traffic in jewelry shops.

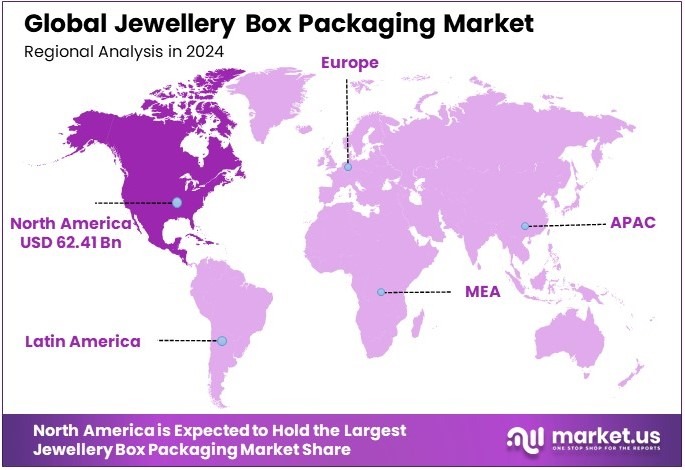

- In 2024, North America leads the market with 35.6% and a value of USD 62.41 billion, driven by luxury brand demand.

Product Type Analysis

Rigid Boxes dominate with 38.4% due to their strong structure, premium appearance, and wide use in luxury packaging.

In the Jewellery Box Packaging Market, product type plays a major role in value perception and brand image. Rigid boxes lead this segment because they offer high durability and a luxury feel. They are widely used by premium jewelry brands to protect valuable items and create an elegant unboxing experience.

Many high-end stores use custom rigid boxes with velvet or satin interiors to enhance the presentation. This adds perceived value to the jewelry and encourages repeat purchases. Consumers shopping for engagement rings or expensive watches often expect this type of packaging. As such, rigid boxes have become a standard in luxury and mid-range jewelry categories.

Folding cartons follow behind in share. They are popular among budget and lightweight items, especially for fashion or artificial jewelry. Magnetic closure boxes are rising in demand due to their sleek look and secure seal, often used in gifting.

Drawer boxes appeal to modern buyers who prefer convenience and reusable packaging. Hinged boxes, though less flexible in design, still have a strong presence in traditional segments. The “Others” category includes eco-friendly boxes and pouch-style formats, which are gaining attention in niche markets that focus on sustainability and minimalist packaging.

Jewelry Type Analysis

Rings dominate with 29.7% due to their high sales volume, regular gifting, and symbolic value in events like weddings and engagements.

Jewelry box packaging for rings holds the largest market share due to the high frequency of purchase and gifting occasions. Rings are among the most commonly bought jewelry items, both for personal use and special events. As a result, the demand for small, elegant, and sturdy ring boxes is consistently strong.

Retailers often use luxurious packaging to reflect the importance of the item inside. Many ring boxes come with cushions or clips to secure the piece, especially for diamond or engagement rings. In global markets like the U.S. and India, where weddings and personal milestones drive frequent ring purchases, packaging becomes a key part of branding.

Necklaces follow closely, requiring larger and longer boxes with soft interiors to prevent tangling. Earrings are typically packaged in compact boxes with inserts to keep the pair secure. Bracelets need boxes that support the shape and reduce friction during transport, making quality packaging important for protection.

Watch packaging often uses large, protective boxes with cushion support and branding. The “Others” category includes brooches, anklets, or nose pins. These need specific packaging styles, but the lower sales volume keeps this group’s share smaller.

End-User Analysis

Retail Stores dominate with 44.2% due to direct customer interaction and the need to offer visually appealing packaging at the point of sale.

Retail stores lead the end-user segment of the Jewellery Box Packaging Market because packaging influences buying decisions. In-store purchases often rely on instant impressions. Shiny boxes, elegant finishes, and luxurious textures attract attention and help justify premium pricing.

Packaging is especially important for impulse buyers or for gifting purposes. Jewelry retailers use this as a tool to enhance brand experience and customer satisfaction. In high-traffic markets such as malls or tourist locations, attractive packaging increases foot traffic and encourages social sharing, which indirectly supports marketing.

Jewelry manufacturers follow with significant demand for bulk, customizable packaging. They often order large quantities and need consistent quality for product shipments. E-commerce sellers depend on durable, protective packaging to ensure safe delivery and unboxing satisfaction. Many use branded boxes with soft interiors and compact designs for delivery purposes.

Gift shops cater to seasonal trends, offering decorative and thematic boxes that appeal to event-driven buyers. The “Others” segment includes wholesalers and promotional product firms, which need flexible packaging options based on their wide product range and target customer preferences.

Key Market Segments

By Product Type

- Rigid Boxes

- Folding Cartons

- Magnetic Closure Boxes

- Drawer Boxes

- Hinged Boxes

- Others

By Jewelry Type

- Necklaces

- Rings

- Earrings

- Bracelets

- Watches

- Others

By End-User

- Retail Stores

- Jewelry Manufacturers

- E-commerce

- Gift Shops

- Others

Driving Factors

Luxury Appeal and E-Commerce Drive Market Growth

The jewellery box packaging market is growing as consumers seek more luxury and personalization. Shoppers today want more than just protection for their jewellery—they also want beautiful packaging that reflects the brand’s identity. Premium brands use rigid boxes, velvet linings, and metallic finishes to make the experience feel special. These boxes not only protect valuable items but also elevate the customer’s unboxing moment.

E-commerce and direct-to-consumer (DTC) jewellery brands are also driving innovation. Online stores compete by offering memorable packaging that adds value and builds trust. Brands often include custom inserts, personalized notes, or branded interiors to make their deliveries feel high-end and unique.

Sustainability is another key driver. Many consumers now prefer packaging made from recycled or eco-friendly materials. Boxes made from biodegradable paper, soy-based inks, and reusable fabrics are in demand. This shift supports both luxury and environmental values.

The growth of custom gifting and high-end jewellery segments is also boosting demand. Whether for weddings, anniversaries, or special milestones, elegant packaging is now seen as part of the gift itself.

Restraining Factors

Cost Challenges and Material Issues Restrain Market Growth

While the jewellery box packaging market is growing, several challenges limit its full potential. One major issue is the high cost of producing premium and custom-designed boxes. Quality materials like velvet, leather, and metal accents add to production expenses. These costs often lead to higher prices, which may not be ideal for budget-conscious or mass-market brands.

Sourcing sustainable materials is another obstacle. Brands want to offer eco-friendly packaging, but finding recyclable or biodegradable options that also look elegant is difficult. Many green materials lack the same visual appeal or durability as traditional luxury materials.

Fluctuations in raw material prices also impact production. Changes in the cost of paperboard, metals, and fabrics can make planning and budgeting more complicated for packaging manufacturers. This affects profit margins and slows innovation.

Minimalist and soft pouch packaging alternatives add further pressure. These options are more affordable and space-saving, making them attractive for fast-moving consumer brands. As some customers prefer simpler designs, the demand for rigid, ornate boxes may see slower growth in certain segments.

Growth Opportunities

Smart Features and Sustainable Luxury Provide Opportunities

There are exciting growth opportunities in the jewellery box packaging market. One major area is smart packaging with anti-counterfeit features. RFID-enabled boxes help brands track inventory and prove authenticity. This is especially important for high-value pieces and helps fight fake products in the luxury segment.

Sustainable luxury is another strong trend. Consumers want eco-conscious products that still feel premium. Brands are now using biodegradable materials and vegan leather for their packaging. These choices help companies meet both environmental goals and luxury standards, creating a positive brand image.

Multi-functional packaging is also gaining popularity. Jewellery boxes that double as storage or display pieces offer more long-term value. Buyers appreciate items they can keep and use beyond the initial purchase. This trend supports repeat purchases and brand loyalty.

Jewellery subscription services are growing, and they need durable, attractive packaging to protect items during delivery. Stylish yet strong boxes help create a premium customer experience and keep products safe.

Emerging Trends

Modern Designs and Custom Printing Are Latest Trending Factor

New design trends are transforming the jewellery box packaging market. One popular trend is the use of magnetic closures and built-in LED lights. These features create a more engaging and elegant unboxing experience. LED lights highlight the jewellery’s shine and are often used in premium displays and gift boxes.

Another trend is the use of 3D printing for custom and on-demand packaging. This allows brands to create personalized boxes with unique shapes, textures, or names engraved on them. It also supports limited-edition designs and reduces production waste.

Transparent and acrylic jewellery boxes are also becoming more popular. These modern, clear boxes offer a sleek and minimalist way to showcase jewellery while still keeping it secure. They are often used for rings, watches, and display counters in retail settings.

Digital printing is also trending in this space. Brands now use high-quality digital techniques to print logos, messages, and patterns directly onto boxes. This adds a personalized touch and enhances brand recognition.

Regional Analysis

North America Dominates with 35.6% Market Share

North America leads the Jewellery Box Packaging Market with a 35.6% share, totaling USD 62.41 billion. This dominant position is driven by high jewelry consumption, luxury brand presence, and strong demand for premium packaging. The region is home to major jewelry retailers and designers who emphasize brand identity and unboxing experience through quality packaging.

Key factors behind this lead include a large base of high-income consumers, gifting culture, and strong retail networks. Jewelry purchases during events like Valentine’s Day, Christmas, and weddings significantly boost packaging needs. Top brands like Tiffany & Co. and Cartier invest heavily in personalized, elegant box packaging to enhance customer experience and brand value. Retail stores across the U.S. and Canada also rely on attractive packaging to stand out in competitive markets.

The regional market benefits from advanced printing, packaging, and supply chain systems. Consumers also prefer eco-friendly and reusable packaging, prompting innovation in sustainable designs. North America’s preference for visual appeal, secure inserts, and customization keeps pushing demand for rigid boxes, drawer-style boxes, and magnetic closures.

Regional Mentions:

- Europe: Europe shows steady growth in the jewellery box packaging market, driven by high-end fashion brands and sustainable packaging policies. Countries like Italy and France focus on artisanal designs and recyclable luxury packaging for both retail and gift sectors.

- Asia Pacific: Asia Pacific is expanding rapidly, supported by growing middle-class income and demand for wedding and festival jewelry. India and China lead with high gold jewelry sales, fueling mass and custom jewelry box production in various formats.

- Middle East & Africa: The Middle East and Africa show rising interest in premium packaging, especially in countries like UAE and Saudi Arabia. High-value gold and diamond purchases support demand for luxury and custom-designed packaging in retail and gifting channels.

- Latin America: Latin America is gradually growing, driven by the retail and artisan jewelry segments. Countries like Brazil and Mexico are seeing increased demand for creative and colorful packaging styles, especially in tourist and craft-based jewelry markets.

Key Regions and Countries Covered in the Report

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Landscape

The jewellery box packaging market is growing with rising demand for luxury presentation and secure storage. The top four companies—Westpack A/S, International Packaging Corporation, Stuller, Inc., and Gunther Mele Limited—are leading the market with high-quality products, design innovation, and strong client relationships.

These companies offer a wide range of packaging solutions including ring boxes, necklace cases, and luxury pouches. They serve both large jewellery brands and small boutique stores. Their packaging not only protects jewellery but also adds value to the customer experience.

Design innovation is a key strength. These players focus on stylish and elegant packaging, often offering customization. This helps jewellery brands stand out and build brand identity. Materials like velvet, leatherette, and eco-friendly paperboard are commonly used to match customer preferences.

These top companies also focus on sustainable practices. Many now offer recyclable and biodegradable packaging. This aligns with the growing demand for eco-friendly luxury packaging and strengthens their brand image.

Speed and flexibility in service are also important. These key players provide short lead times and handle both bulk and small orders efficiently. Their global supply capabilities help serve clients across regions.

In summary, the leading companies in the jewellery box packaging market stand out through stylish designs, premium materials, and strong service quality. Their focus on customization and sustainability gives them an edge in a competitive and growing market.

Major Companies in the Market

- Westpack A/S

- International Packaging Corporation

- Stuller, Inc.

- Gunther Mele Limited

- Asch Grossbardt Inc.

- Potters Ltd.

- Elite Packaging

- Thomas Sabo GmbH & Co. KG

- Finer Packaging Group

- Jewel Box Co.

- Boxpac

- Swiftpak Ltd.

- GBE Packaging Supplies

Recent Developments

- WOLF: On March 2025, WOLF released the Ballet Musical Jewelry Box to celebrate its 190th anniversary. The jewelry box features a walnut wood veneer exterior, an embroidered Swan Lake theatre design interior, and two interchangeable ballet dancers that perform when activated.

- KIMITAKE: On May 2024, KIMITAKE introduced rebranded jewelry packaging inspired by Japanese cultural heritage. The design features traditional elements such as the Kyoto Nishijin-Ori Drawstring Bag with the ‘Sakuragawa’ pattern, a Paulownia Box, and Kyo-Yuzen Dyeing techniques, reflecting the brand’s commitment to preserving traditional artistry.

Report Scope

Report Features Description Market Value (2024) USD 175.3 Billion Forecast Revenue (2034) USD 296.6 Billion CAGR (2025-2034) 5.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Rigid Boxes, Folding Cartons, Magnetic Closure Boxes, Drawer Boxes, Hinged Boxes, Others), By Jewelry Type (Necklaces, Rings, Earrings, Bracelets, Watches, Others), By End-User (Retail Stores, Jewelry Manufacturers, E-commerce, Gift Shops, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Westpack A/S, International Packaging Corporation, Stuller, Inc., Gunther Mele Limited, Asch Grossbardt Inc., Potters Ltd., Elite Packaging, Thomas Sabo GmbH & Co. KG, Finer Packaging Group, Jewel Box Co., Boxpac, Swiftpak Ltd., GBE Packaging Supplies Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Jewellery Box Packaging MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

Jewellery Box Packaging MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Westpack A/S

- International Packaging Corporation

- Stuller, Inc.

- Gunther Mele Limited

- Asch Grossbardt Inc.

- Potters Ltd.

- Elite Packaging

- Thomas Sabo GmbH & Co. KG

- Finer Packaging Group

- Jewel Box Co.

- Boxpac

- Swiftpak Ltd.

- GBE Packaging Supplies