Global Cling Film Market By Material Type (PVC, Polyethylene (PE), Polyvinylidene Chloride (PVDC), Others), By End-Use Industry (Food and Beverages, Healthcare, Consumer Goods, Industrial), By Distribution Channel (Offline, Online), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov 2024

- Report ID: 133540

- Number of Pages: 380

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

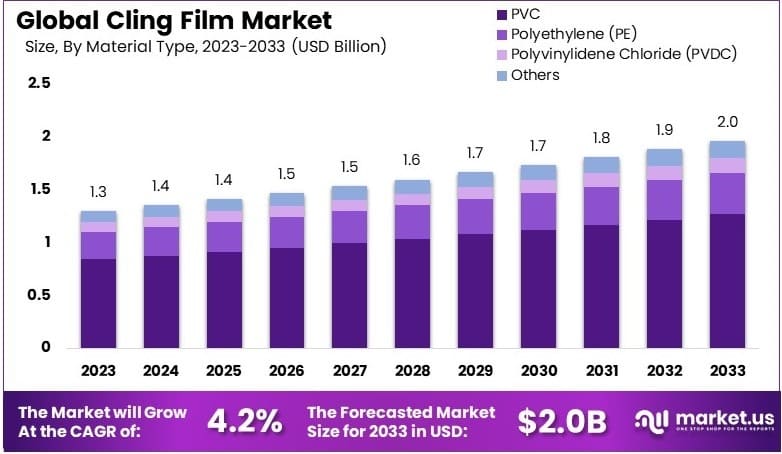

The Global Cling Film Market size is expected to be worth around USD 2.0 Billion by 2033, from USD 1.3 Billion in 2023, growing at a CAGR of 4.2% during the forecast period from 2024 to 2033.

Cling film, also known as plastic wrap, is a thin, flexible film made primarily from plastic materials like PVC or polyethylene. It is commonly used to seal and protect food, keeping it fresh for longer periods. Its stretchability and ability to adhere to surfaces make it highly versatile.

The cling film market refers to the global industry focused on the production, distribution, and sale of cling films. This market encompasses various sectors, including food packaging, industrial applications, and healthcare. It is influenced by factors such as consumer demand, technological advancements, and environmental regulations.

The cling film market is growing due to rising demand for food preservation. It is used widely in households, restaurants, and food packaging. Brands like Glad provide innovative options, such as microwave-safe films. A standard 30 cm x 300 m roll can cover 1,500 plates, showing its utility and high consumption rates.

Cling film is essential for preserving food freshness. It is lightweight, cost-effective, and adaptable. Microwave-safe variants withstand 110°C, catering to consumer needs. Its global use reflects strong market penetration. However, increasing plastic waste concerns could challenge its long-term demand, pushing the market toward biodegradable plastics.

The market shows moderate saturation but significant growth potential. Demand is driven by convenience and food safety awareness. Emerging markets present opportunities due to urbanization and rising disposable incomes. Competition is high with leading players focusing on sustainability, which could reshape the competitive landscape.

Government regulations promoting food safety and rising consumer demand for convenient packaging boost growth. Opportunities exist in biodegradable films as sustainability trends grow. Local markets benefit from affordability and ease of production, while global trends focus on innovation and eco-friendliness.

Key Takeaways

- The Cling Film Market was valued at USD 1.3 Billion in 2023 and is expected to reach USD 2.0 Billion by 2033, with a CAGR of 4.2%.

- In 2023, PVC dominated the material type segment with 64.7%, owing to its versatility and widespread industrial applications.

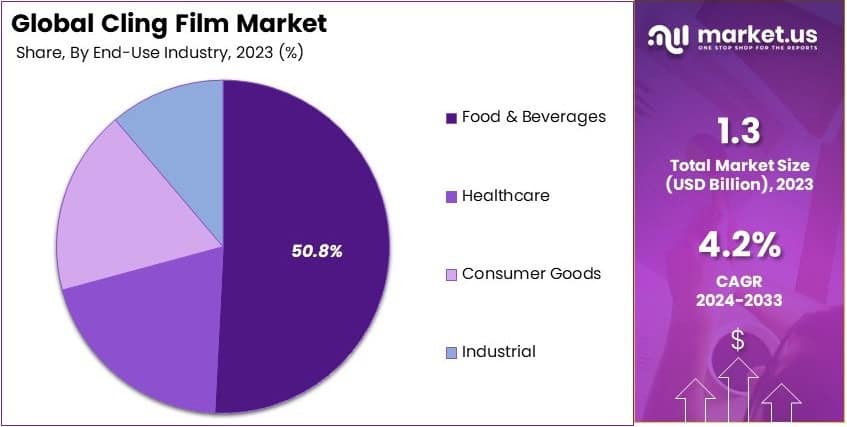

- In 2023, Food & Beverages led the end-use industry segment with 50.8%, driven by its high demand in food preservation.

- In 2023, Offline was the dominant distribution channel, benefiting from consumer preference for physical stores.

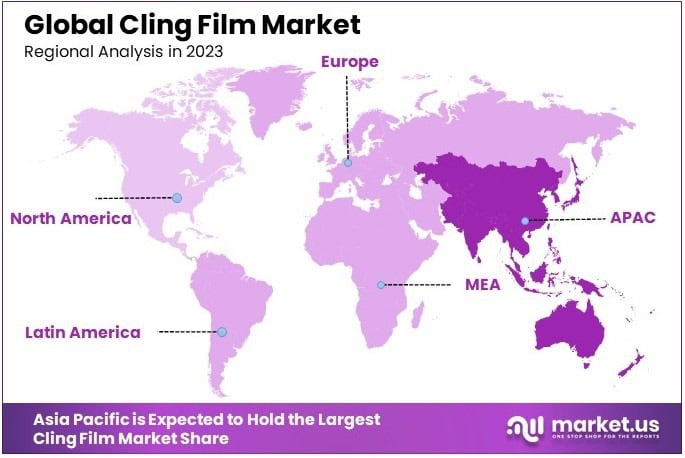

- In 2023, Asia Pacific accounted for the largest market share due to its growing industrial and consumer goods sectors.

Type Analysis

PVC dominates with 64.7% due to its cost-effectiveness and versatility.

The cling film market, categorized by material type, shows a significant dominance of Polyvinyl Chloride (PVC), which holds a 64.7% share. PVC is highly favored in the cling film industry primarily due to its cost-effectiveness and versatility in various applications.

It serves as an excellent barrier against moisture and gases, which extends the shelf life of food products, making it indispensable in the food packaging sector. Additionally, the flexibility and clarity of PVC films make them attractive for both commercial and residential use.

Polyethylene (PE) cling films are noted for their strength and stretchability, which make them suitable for securing items tightly. Although not as dominant as PVC, PE cling films are gaining traction due to their safer and more recyclable nature, addressing growing consumer and regulatory demands for sustainability.

PVDC films are recognized for their superior barrier properties compared to other plastics, particularly in terms of oxygen and aroma barrier qualities. This material is pivotal in the preservation of perishable goods, thereby playing a crucial role in the extension of product shelf life, which is essential in global supply chains.

Other materials include bio-based films and other alternative polymers that cater to niche markets. These segments are developing as the demand for eco-friendly solutions rises, providing innovative opportunities for growth in an environmentally conscious market landscape.

End-Use Industry Analysis

Food & Beverages dominate with 50.8% due to its critical role in food safety and shelf life extension.

In the segmentation by end-use industry, the Food & Beverages sector leads with a 50.8% market share, underscoring its paramount role in food safety and longevity. Cling films are extensively used in this sector to wrap fresh produce, dairy products, and ready-to-eat foods.

The ability to keep food items fresh for longer periods directly influences consumer satisfaction and reduces waste, making cling films a staple in food preservation.

In the healthcare industry, cling films are utilized for securing dressings and equipment, as well as in various sanitary applications. Their use in this sector is driven by the need for sterility and protection against contamination.

For consumer goods, cling films are employed in a myriad of ways, from packaging household items to bundling personal care products. Their protective and grouping functions facilitate the safe transport and storage of consumer goods.

In the industrial segment, cling films are essential for bundling items and securing pallets in transportation. Their strength and adaptability make them suitable for heavy-duty applications, crucial for maintaining the integrity of goods during shipping and handling.

Distribution Channel Analysis

Offline channels lead due to established trust and immediate product availability.

The distribution of cling film largely happens through offline channels, which remain predominant due to the established trust and the immediate availability of products they offer. Consumers prefer to purchase cling films from brick-and-mortar stores where they can select specific quantities and assess quality directly.

However, the online segment is rapidly growing. E-commerce platforms are becoming increasingly popular for purchasing cling films, especially among consumers valuing convenience and competitive pricing. The growth of online sales channels is supported by the broader trend of digital shopping and the expansion of logistic networks that improve product accessibility.

Key Market Segments

By Material Type

- PVC

- Polyethylene (PE)

- Polyvinylidene Chloride (PVDC)

- Others

By End-Use Industry

- Food & Beverages

- Healthcare

- Consumer Goods

- Industrial

By Distribution Channel

- Offline

- Online

Drivers

Rising Demand for Packaged Foods Drives Market Growth

The growing demand for packaged foods plays a pivotal role in the expansion of the cling film market. Busy lifestyles and the need for convenience have fueled consumer preferences for ready-to-eat meals, fresh produce, and frozen food. Cling films are vital in preserving the freshness and extending the shelf life of these products.

Additionally, industrial packaging applications are witnessing steady growth, particularly in sectors like manufacturing and logistics. Cling films are used extensively for bundling and securing products, ensuring safe transportation. This has driven their adoption in both small-scale and large-scale industrial settings.

In developing economies, retail sector growth is another driving force for the market. Supermarkets and hypermarkets increasingly rely on cling films to package fresh produce and other perishable items. The rising middle-class population and urbanization trends in regions such as Asia-Pacific contribute to this growth.

Moreover, advancements in smart packaging technologies, including IoT-enabled films, are opening new possibilities. These technologies enhance traceability and quality monitoring, making cling films indispensable in modern supply chains. Together, these factors underpin the sustained growth of the cling film market.

Restraints

Environmental Concerns Restraint Market Growth

Environmental concerns surrounding plastic waste significantly restrain the growth of the cling film market. As single-use plastics face increasing scrutiny, regulators are implementing bans and restrictions, particularly in Europe and North America. These regulations place pressure on manufacturers to develop sustainable alternatives, which often come with higher costs and longer production timelines.

The high cost of biodegradable cling films further limits their widespread adoption. While these alternatives align with environmental goals, their pricing often deters consumers and small businesses. Additionally, the lack of adequate recycling infrastructure, especially in emerging markets, exacerbates the environmental impact of traditional cling films.

Regulatory compliance challenges also hinder market expansion. Companies must adapt to a variety of standards across different regions, which can slow down production and innovation. Combined with these factors, the environmental debate surrounding plastics acts as a significant obstacle to the market’s growth trajectory.

Opportunity

Innovation in Sustainable Solutions Provides Opportunities

Innovation in biodegradable and compostable films presents substantial opportunities for cling film manufacturers. As consumers and businesses prioritize environmental sustainability, products made from renewable materials are gaining popularity. These innovations not only address regulatory concerns but also cater to a growing base of eco-conscious customers.

Expanding markets in Asia-Pacific and Latin America further contribute to growth opportunities. Rapid urbanization and an increasing middle-class population drive demand for convenience and packaged foods, creating new markets for cling films. Companies that invest in localized production facilities in these regions can gain a competitive edge.

Collaborations with e-commerce platforms also offer immense potential. Online grocery delivery services require efficient, lightweight packaging solutions, and cling films are a perfect fit. By tailoring products to meet the needs of these platforms, manufacturers can tap into a rapidly expanding market.

Finally, the integration of IoT in food packaging enables real-time monitoring of freshness and temperature. This trend aligns with the food industry’s focus on quality assurance and transparency, creating an additional avenue for growth in the cling film market.

Challenges

Competition and Material Costs Challenge Market Growth

Intense competition among key players poses significant challenges for the cling film market. With numerous established and emerging companies, differentiation becomes increasingly difficult. Manufacturers must innovate continuously to stay relevant, which often requires substantial investment.

Volatility in raw material prices, particularly petroleum-based resins, further complicates market dynamics. Sudden cost fluctuations affect profit margins, especially for small and medium-sized businesses. Scaling production of sustainable films also remains a challenge, as it involves high capital expenditure and lengthy development processes.

Consumer preferences are shifting towards reusable and eco-friendly alternatives, adding another layer of complexity. As buyers explore alternatives like beeswax wraps and reusable silicone covers, cling films face competition from non-plastic substitutes.

Growth Factors

Rising Focus on Food Preservation Is a Growth Factor

The rising focus on food preservation plays a central role in driving the growth of the cling film market. Consumers and businesses prioritize reducing food waste, especially in urban areas where fresh produce and ready meals are widely consumed. Cling films provide an effective solution by extending the shelf life of perishable items, maintaining freshness, and minimizing spoilage.

The rapid growth of quick-service restaurants and food delivery services also significantly contributes to market expansion. These sectors require lightweight, durable, and hygienic packaging to ensure food reaches consumers in optimal condition.

Urbanization itself is another important growth driver, creating a heightened demand for convenience packaging among busy consumers. As more people move to cities, the need for easy-to-use and reliable packaging materials continues to grow, bolstering the role of cling films in modern lifestyles.

Finally, government incentives promoting sustainable manufacturing practices encourage innovation in cling film production. By supporting the development of biodegradable and recyclable options, these policies not only address environmental concerns but also open new avenues for market growth.

Emerging Trends

Antimicrobial Packaging Is Latest Trending Factor

The rise of antimicrobial packaging solutions has emerged as a key trend in the cling film market. These films offer enhanced safety by reducing the risk of microbial contamination, catering to health-conscious consumers.

Edible films are another trend gaining traction, especially in high-end restaurants and niche markets. These products enhance sustainability by reducing packaging waste, aligning with global environmental goals.

Personalized packaging designs, driven by digital printing advancements, are becoming increasingly popular among businesses. Brands are using custom designs to create unique customer experiences, driving engagement and loyalty.

Lastly, technological advancements in film transparency and durability are reshaping market expectations. New materials allow for clearer and stronger films, enhancing their usability across various applications. These trends reflect the evolving needs of consumers and industries, keeping the cling film market dynamic and forward-looking.

Regional Analysis

Asia Pacific Dominates with Significant Market Share

Asia Pacific leads the Cling Film Market, accounting for a substantial portion of global sales, driven by its rapid industrial growth and increasing consumer demand for packaged foods. The region benefits from expanding manufacturing capacities, urbanization, and a rising middle-class population, which fuels demand for cost-effective and versatile packaging solutions.

Asia Pacific’s dominance is propelled by the growing food packaging industry in countries like China and India. Urbanization and changing consumer lifestyles have increased the demand for convenience foods, where cling films play a crucial role in preserving freshness. Additionally, the region’s cost advantages in production and labor make it a global hub for cling film manufacturing. Innovation in biodegradable films to meet sustainability goals has also gained traction, aligning with both consumer preferences and regulatory standards.

The robust industrial base and efficient distribution networks across the region ensure widespread product availability. Furthermore, the thriving e-commerce sector drives demand for lightweight and protective packaging solutions, enhancing cling film sales. Governments’ focus on improving food safety and reducing waste also supports the widespread adoption of cling films, especially in urban areas.

Regional Mentions:

- North America: North America drives growth in the cling film market through innovation and strong demand for sustainable materials. The food and healthcare industries play key roles, with a focus on biodegradable solutions to meet environmental goals.

- Europe: Europe emphasizes sustainability, with stringent environmental regulations driving the demand for biodegradable and recyclable cling films. The food packaging sector leads, ensuring steady market growth.

- Middle East & Africa: Urbanization and expanding retail sectors are propelling cling film adoption. Investments in packaging innovations and recycling infrastructure present growth opportunities despite challenges like limited local production.

- Latin America: Latin America experiences gradual growth, supported by the increasing popularity of packaged foods and retail development. However, economic volatility and limited manufacturing infrastructure restrict faster expansion.

Key Regions and Countries covered іn thе rероrt

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The Cling Film Market is dominated by established players leveraging advanced manufacturing techniques, sustainability initiatives, and broad distribution networks to maintain a competitive edge. Top companies like 3M, Berry Global Inc., Dow, and Anchor Packaging LLC lead the market through innovative product portfolios and global presence.

3M focuses on developing high-performance cling films that cater to industrial and food-grade applications. The company emphasizes product versatility and durability, which have become critical in meeting customer expectations across sectors.

Berry Global Inc. has a stronghold in the market due to its focus on sustainability and innovation. The company actively develops recyclable and biodegradable films, addressing environmental concerns and aligning with regulatory demands globally.

Dow leads in advanced material technologies, producing high-quality cling films that combine strength and flexibility. Its extensive research and development efforts ensure a consistent pipeline of innovative products that meet industry-specific needs.

Anchor Packaging LLC specializes in food-grade cling films, providing solutions tailored to the foodservice and retail sectors. Their focus on extending food freshness and sustainability ensures continued growth in key markets.

These companies’ ability to address evolving consumer needs, innovate in sustainability, and expand distribution networks solidifies their position as key players in the cling film market.

Top Key Players in the Market

- 3M

- Anchor Packaging LLC

- Berry Global Inc.

- CeDo Ltd.

- Dow

- Harwal Group of Companies

- Intertape Polymer Group

- Jindal Poly Films Limited

- Klöckner Pentaplast

- Mitsubishi Chemical Corporation

- MOLCO GmbH

- Multi Wrap (Pty) Ltd.

- Nan Ya Plastics Corporation

Recent Developments

- Tiger Group and HyperAMS: On June 2024, Tiger Group and HyperAMS announced a live webcast auction to be held on June 26, featuring production equipment from Zummit Plastics, a major stretch film manufacturer. The auction will showcase assets from an 85,000-square-foot facility in Phoenix, which ceased operations following Zummit Plastics’ Chapter 7 bankruptcy filing in February.

- Great Wrap: As of April 2021, Great Wrap, an Australian company, introduced compostable cling wrap made from discarded potato peels as an eco-friendly alternative to plastic wraps. The product decomposes fully in home compost within 180 days without leaving microplastics and is produced in a solar-powered facility in Melbourne.

Report Scope

Report Features Description Market Value (2023) USD 1.3 Billion Forecast Revenue (2033) USD 2.0 Billion CAGR (2024-2033) 4.2% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Material Type (PVC, Polyethylene (PE), Polyvinylidene Chloride (PVDC), Others), By End-Use Industry (Food & Beverages, Healthcare, Consumer Goods, Industrial), By Distribution Channel (Offline, Online) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape 3M, Anchor Packaging LLC, Berry Global Inc., CeDo Ltd., Dow, Harwal Group of Companies, Intertape Polymer Group, Jindal Poly Films Limited, Klöckner Pentaplast, Mitsubishi Chemical Corporation, MOLCO GmbH, Multi Wrap (Pty) Ltd., Nan Ya Plastics Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- 3M

- Anchor Packaging LLC

- Berry Global Inc.

- CeDo Ltd.

- Dow

- Harwal Group of Companies

- Intertape Polymer Group

- Jindal Poly Films Limited

- Klöckner Pentaplast

- Mitsubishi Chemical Corporation

- MOLCO GmbH

- Multi Wrap (Pty) Ltd.

- Nan Ya Plastics Corporation