Global RFID Tags Market Size, Share, Statistics Analysis Report By Type (Passive RFID Tags, Active RFID Tags), By Frequency (Low-Frequency (LF) RFID Tags, High-Frequency (HF) RFID Tags, Ultra-High Frequency (UHF) RFID Tags), By End-Use Industry (Transportation and Logistics, Retail, Agriculture, Healthcare, Other End-Use Industries), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec. 2024

- Report ID: 134886

- Number of Pages: 326

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- RFID Tags Statistics

- Impact of AI on RFID Tags

- North America RFID Tags Market Growth

- Type Segment Analysis

- Frequency Segment Analysis

- End Use Industry Analysis

- Key Market Segments

- Driver

- Restraint

- Opportunity

- Challenge

- Growth Factors

- Emerging Trends

- Business Benefits

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

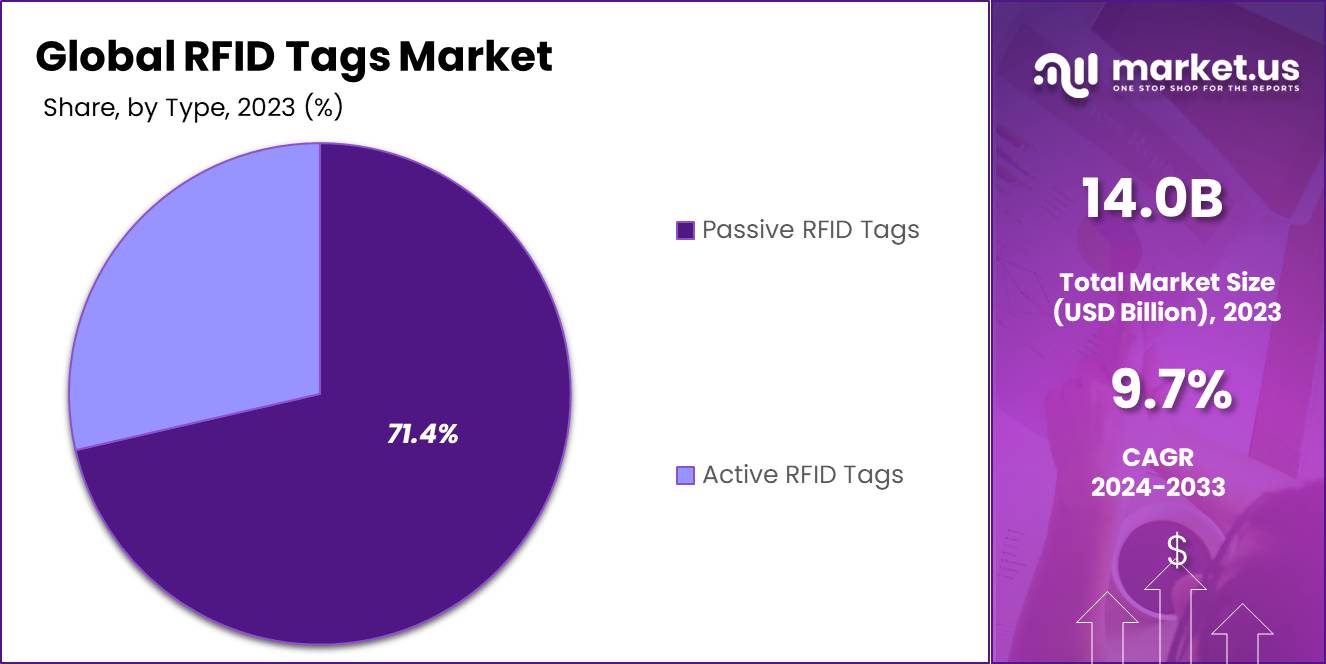

The Global RFID Tags Market size is expected to be worth around USD 35.3 Billion by 2033, from USD 14.0 Billion in 2023, growing at a CAGR of 9.7% during the forecast period from 2024 to 2033. In 2023, North America held a dominant market position, capturing more than a 34.8% share, holding USD 4.9 Billion revenue.

RFID (Radio Frequency Identification) tags are small electronic devices that consist of a small chip and an antenna. They are designed to store data that can be retrieved by RFID readers using radio waves. These tags are used in various applications such as tracking inventory, managing logistics, securing access, and automating billing systems. RFID tags can be passive, active, or semi-active, depending on whether they have their own power source.

The RFID tags market is experiencing significant growth driven by the expanding adoption of RFID technology in retail, healthcare, automotive, and logistics industries. Businesses are increasingly relying on RFID solutions to enhance supply chain efficiency, reduce labor costs, and improve data accuracy. The market is also benefitting from the integration of RFID tags in consumer products to engage customers and manage inventories more effectively.

The primary drivers of the RFID tags market include the increasing need for supply chain visibility and inventory management in retail and industrial sectors. As companies aim to minimize the human error in tracking assets, RFID technology offers a reliable solution. Additionally, the push towards automation and data-driven decision-making in industries like manufacturing and logistics further amplifies the demand for RFID systems.

Market demand for RFID tags is propelled by the growing emphasis on asset tracking and management across various sectors. Opportunities are particularly notable in healthcare for tracking medical equipment, pharmaceuticals, and patients to improve safety and operational efficiency. Retailers are leveraging RFID to enhance customer experiences by ensuring product availability and combating theft, which opens new avenues for market expansion.

For instance, In July 2024, IDT-87 UHF RFID Reader by ID Tech Solutions is tailored for outdoor industrial use, including mine gates, factory entrances, and weigh bridges. Its launch reflects the growing adoption of RFID technology in India’s industrial and logistics sectors. The company’s solutions are already trusted by major players like KEC International, banks, and the Indian Railways, highlighting its credibility. With industries increasingly seeking efficient tracking systems

According to the National Statistical Institute (INE), 22.58% of companies in Spain are now using RFID technology for product identification after production – a significant leap in recent years. This indicates that RFID adoption is still in its early stages, leaving plenty of room for growth and innovation in industries that rely on accurate tracking and identification.

RFID technology is proving transformative in logistics, with 52% of RFID tags used to improve traceability and efficiency, according to Trace ID. Companies implementing RFID have seen impressive results, including a 93% reduction in inventory management costs and a 60% decrease in losses due to better tracking. Inventory accuracy has also improved by 25.4%, making it a game-changer for businesses aiming to streamline operations.

For instance, companies like Inditex face unknown product losses of up to 0.8%, equating to an economic hit of around €100 million. By adopting RFID systems, they can significantly cut these losses, saving millions. Similarly, Grupo Éxito in Latin America reported a 93% drop in inventory costs and a 60% decline in losses, showcasing how RFID can lead to dramatic improvements in retail efficiency and profitability.

Technological advancements are continually shaping the RFID tags market. Innovations include the development of smaller, more durable, and environmentally friendly tags. Enhanced data storage capacity and integration with IoT (Internet of Things) expand the functionalities of RFID systems, making them integral to smart manufacturing and smart city projects.

Key Takeaways

- The global RFID tags market is set to grow significantly, reaching a projected USD 35.3 billion by 2033, up from USD 14.0 billion in 2023. This represents a robust CAGR of 9.7% from 2024 to 2033.

- Passive RFID Tags dominated the market in 2023, accounting for an impressive 71.4% market share. Their cost-effectiveness and versatility make them a preferred choice across industries.

- The Ultra-High Frequency (UHF) RFID Tag segment led the market in 2023, with a commanding 58.1% share. These tags are highly efficient for long-range tracking, which drives their widespread adoption.

- The Retail sector emerged as a major application area in 2023, holding over 25.3% of the market share. This growth is driven by the increasing need for inventory management and theft prevention solutions.

- North America retained its leadership position in the global RFID tags market in 2023, contributing over 34.8% to the market share. Strong technological adoption and a thriving retail sector are key growth drivers in this region.

RFID Tags Statistics

Based on data from Cybra:

- RFID technology can boost inventory accuracy to an impressive 99.99%, helping businesses minimize errors and reduce losses.

- Manufacturers and distributors who use RFID in their supply chain experience up to 80% better shipping and picking accuracy, ensuring orders are fulfilled right the first time.

- Receiving times see a significant improvement, with a 90% increase in efficiency when RFID technology is implemented.

- Warehouses and distribution centers improve inventory visibility and availability from just 2% to 20%, transforming how they track and manage stock.

- For companies that adopt RFID, inventory count accuracy jumps from 63% to 95%, reducing discrepancies and making stock management easier.

- By tagging merchandise with RFID, manufacturers can speed up inventory counts from 200 to over 12,000 items per hour, saving time and labor.

- In Spain, 52% of all RFID tags are used for logistics systems, showing how critical RFID is to streamlining operations in this sector.

Impact of AI on RFID Tags

The integration of Artificial Intelligence (AI) with Radio-Frequency Identification (RFID) technology is transforming numerous industries by enhancing the capabilities of RFID systems beyond simple tracking and tracing functions.

Here’s how AI is impacting RFID tags and their applications:

- Enhanced Data Analysis and Decision Making: AI significantly amplifies the data handling capabilities of RFID systems. By applying machine learning and other AI techniques, businesses can analyze vast arrays of RFID-generated data to identify patterns, trends, and insights that inform strategic decisions. For instance, AI can predict future behaviors and trends based on historical data from RFID systems, aiding in proactive decision-making across sectors such as inventory management, logistics, and supply chain optimization.

- Operational Efficiency and Predictive Analytics: AI enhances RFID’s efficiency by automating data processing and interpretation. This capability is crucial in environments like manufacturing and retail, where it’s used to monitor and predict equipment failures or stock needs, reducing downtime and ensuring optimal operation. Predictive analytics enabled by AI can foresee issues and automate responses, significantly streamlining operations and reducing human error.

- Improved Accuracy and Security: RFID systems are prone to data inaccuracies due to environmental factors or technical glitches. AI helps mitigate these issues by providing mechanisms to validate and correct data, enhancing the reliability and accuracy of the information captured by RFID tags. Furthermore, AI-driven systems can monitor for suspicious activities or anomalies, increasing security, particularly in sensitive environments like healthcare and high-value retail.

- Supply Chain Optimization: Combining RFID with AI leads to more sophisticated supply chain management tools. AI algorithms can analyze the real-time data collected by RFID tags to optimize logistics, improve shipping accuracy, and reduce operational costs. This integration ensures that items are in the right place at the right time, improving overall supply chain efficiency and responsiveness.

- Personalized Customer Experiences: In the retail sector, AI can leverage data from RFID tags to offer personalized shopping experiences, enhance customer service, and boost customer loyalty by providing tailored recommendations and offers based on shopping behaviors tracked via RFID.

North America RFID Tags Market Growth

In 2023, North America secured a leading position in the RFID tags market, commanding a substantial 34.8% market share with revenues reaching approximately USD 4.9 billion. This dominance is primarily attributed to the widespread adoption of RFID technology across various sectors, notably retail, healthcare, and supply chain management.

In the retail sector, RFID tags have become indispensable for inventory management, facilitating efficient stock replenishment and omnichannel fulfillment, while also playing a crucial role in theft prevention. The healthcare sector further amplifies this demand as RFID technology is extensively used for tracking patients, managing assets, and streamlining medication administration.

The robust market growth in North America is also supported by the significant presence of key market players who drive innovation and expand the application of RFID technologies. These companies are not only pioneers in the RFID space but also contribute to the regional market’s growth by continuously enhancing RFID capabilities and integrating advanced technologies for better data management and security in various industries.

The adoption of RFID technology is rapidly transforming the manufacturing and automotive sectors across Europe. A striking 94% of decision-makers in Europe (compared to 91% globally) believe this technology will play a critical role in boosting supply chain visibility within the next five years. This highlights a growing commitment to leveraging advanced tools to streamline operations and enhance transparency in an increasingly competitive market.

Moreover, the strategic use of RFID in supply chain operations enhances visibility and efficiency of goods distribution, which is critical in today’s fast-paced market environments. This technology allows for real-time tracking, which is crucial for optimizing logistical operations and responding promptly to market demands.

Type Segment Analysis

In 2023, the Passive RFID Tags segment held a dominant market position, capturing more than a 71.4% share. This substantial market share can be attributed to several factors that underscore the broad utility and economic advantages of passive RFID tags across various industries.

Firstly, passive RFID tags do not require internal power sources to operate, which significantly reduces their cost compared to active RFID tags. This cost-effectiveness makes them a viable option for large-scale deployments in industries such as retail, logistics, and supply chain management, where the volume of tags needed can be immense.

The affordability and ease of integration into existing systems encourage widespread adoption, particularly in retail environments for inventory management and in supply chains for tracking goods from production to delivery. Moreover, advancements in RFID technology have enhanced the sensitivity and data storage capabilities of passive RFID tags, broadening their application scope.

These tags are now more reliable and capable of operating in diverse environments, which has been pivotal in their increased uptake. For instance, in the healthcare sector, these tags are used for tracking medical equipment and pharmaceuticals, helping to streamline operations and improve patient care.

Furthermore, the integration of passive RFID tags with Internet of Things (IoT) systems has opened new avenues for their use, expanding their functionality in sectors like agriculture for tracking livestock and monitoring crop conditions, and in manufacturing for inventory and parts management. The growing IoT landscape continues to drive the demand for passive RFID solutions, as they provide critical data needed for intelligent decision-making and operational efficiency.

Frequency Segment Analysis

In 2023, the Ultra-High Frequency (UHF) RFID Tags segment held a dominant market position, capturing more than a 58.1% share. This significant market presence is driven by the segment’s wide application range and its technological superiority in terms of read range and speed.

UHF RFID tags operate between 860 MHz to 960 MHz, offering the longest read ranges of up to several meters and high-speed data transfer capabilities, making them ideal for tracking moving objects and managing large inventories.

These tags are particularly favored in industries where tracking over long distances and through various environmental conditions is crucial, such as in logistics, retail, and industrial settings. The efficiency of UHF tags in supply chain management is a key factor in their widespread adoption. They enable more precise tracking and management of goods from production to retail shelves, enhancing supply chain visibility and operational efficiency.

Moreover, the integration of UHF RFID tags with Internet of Things (IoT) technologies has further expanded their applications, leading to innovative uses in smart manufacturing and automated inventory systems. The ability of these tags to communicate with other devices and systems enhances their functionality, driving further integration into the digital infrastructure of various industries.

This robust positioning is also supported by continuous advancements in RFID technology, which improve tag sensitivity and data storage, thereby broadening the potential for UHF RFID applications across a growing number of sectors

End Use Industry Analysis

In 2023, the Retail segment of the RFID tags market held a dominant position, capturing more than a 25.3% share. This significant market share is primarily attributed to the essential role RFID technology plays in transforming retail operations.

RFID tags are increasingly used in retail for inventory management, enabling real-time tracking of goods which reduces out-of-stocks and overstock situations, thereby optimizing the supply chain and enhancing customer satisfaction. This technology supports retailers in improving the accuracy of inventory data, which is crucial for effective decision-making and efficient store management.

The proliferation of omnichannel retailing strategies further amplifies the need for RFID technology. Retailers are employing RFID to bridge the gap between brick-and-mortar and online shopping, creating a seamless customer experience by ensuring product availability across all channels. This integration helps in maintaining a consistent flow of goods, thus driving sales and customer loyalty.

Moreover, the retail sector benefits from RFID’s ability to enhance the shopping experience directly. For example, RFID tags can speed up the checkout process, reduce theft, and even assist in personalizing marketing efforts based on consumer purchase history and preferences. The technology’s ability to improve operational efficiencies and customer engagement is expected to continue driving its adoption in the retail industry, supporting a predicted growth to ~US$ 25.1 billion by 2030 in the RFID in retail market.

Key Market Segments

By Type

- Passive RFID Tags

- Active RFID Tags

By Frequency

- Ultra-High Frequency (UHF) RFID Tags

- Low-Frequency (LF) RFID Tags

- High-Frequency (HF) RFID Tags

By End-Use Industry

- Transportation and Logistics

- Retail

- Agriculture

- Healthcare

- Other End-Use Industries

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- UK

- Spain

- Austria

- Rest of Europe

- Asia-Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Rest of Asia-Pacific

- Latin America

- Brazil

- Middle East & Africa

- South Africa

- Saudi Arabia

- United Arab Emirates

Driver

Increased Adoption in Retail and Healthcare

The RFID market has seen significant growth, particularly driven by its increased adoption within the retail and healthcare sectors. In retail, RFID technology has revolutionized inventory management, enhancing the accuracy and efficiency of stock monitoring and replenishment.

This adoption is largely due to RFID’s ability to provide real-time data on product availability, which is crucial for maintaining the balance between supply and demand, especially in environments characterized by high volume and rapid turnover. The technology also supports omnichannel strategies, blending in-store and online shopping experiences to increase consumer satisfaction and drive sales.

In the healthcare sector, RFID’s role in improving patient safety and operational efficiency cannot be overstated. The technology aids in tracking medical equipment, managing pharmaceutical inventories, and monitoring patient care protocols. By ensuring that the right equipment and medications are available and administered correctly, RFID systems help reduce errors and enhance the quality of care. This capability is critical as healthcare providers continue to seek solutions that support more efficient and error-free operations.

Restraint

Privacy Concerns and Regulatory Challenges

Despite the advantages, the adoption of RFID technology faces significant restraints related to privacy and regulatory compliance. Privacy concerns stem from the capability of RFID systems to track individuals’ movements and record sensitive information. Consumers and civil liberties groups have expressed worries about how this data is used and stored, fearing potential misuse.

Moreover, the regulatory landscape for RFID varies significantly across regions, complicating compliance for global operations. Companies must navigate these regulations, which can differ in terms of data protection laws and standards for frequency usage, adding complexity and potentially hindering the technology’s deployment on a larger scale.

Opportunity

Integration with IoT and Advancements in Smart Technology

RFID technology’s integration with the Internet of Things (IoT) presents substantial growth opportunities. This convergence allows for the creation of smarter, more connected environments where real-time data from RFID tags enhances decision-making and operational visibility across various sectors.

For instance, in manufacturing and logistics, RFID combined with IoT leads to improved asset tracking, inventory management, and efficiency in supply chain operations. This integration supports more sophisticated systems that can predict maintenance needs, optimize routes, and manage stocks dynamically, contributing to the ongoing digital transformation in industries.

Challenge

Technological and Implementation Hurdles

Implementing RFID systems comes with its set of challenges, notably in terms of technology integration and the initial setup costs. Technical issues can arise during the deployment of RFID systems, such as interference from metal or liquids, inconsistent tag readability, and integration complexities with existing IT infrastructures.

Moreover, the cost of RFID technology, although decreasing, still represents a significant investment, particularly for small to medium-sized enterprises (SMEs). These businesses may find the cost of full-scale implementation prohibitive without clear short-term ROI, slowing down broader adoption across some industries.

Growth Factors

RFID Market Expansion Driven by Diverse Applications

The RFID market is experiencing robust growth, significantly propelled by its expanding applications across various industries. Key growth factors include the widespread adoption of RFID technology in retail for enhanced inventory management and in healthcare for asset tracking and patient care, ensuring operational efficiencies and reduced errors.

Retailers integrate RFID to gain real-time visibility into inventory levels, reduce shrinkage, and enhance the customer experience through faster checkouts and improved stock management. In healthcare, RFID’s ability to track medical equipment, pharmaceuticals, and patient information helps improve safety and compliance with regulations.

Additionally, the RFID market benefits from technological advancements and integration with the Internet of Things (IoT), which enhance data collection and analytics capabilities. These integrations are crucial in industries like manufacturing and logistics, where they improve supply chain transparency and asset utilization. The growing focus on sustainability and the need for traceability in supply chains further drive the adoption of RFID technologies, facilitating better resource management and reducing environmental impact.

Emerging Trends

Technological Innovations and Strategic Expansions

Emerging trends in the RFID market include the development of new applications such as smart packaging and personalized customer experiences in retail. Technological innovations, particularly in RFID tag miniaturization, enhanced memory, and energy efficiency, are making RFID solutions more practical and cost-effective across broader applications.

There’s a notable shift towards RFID-enabled smart labels that provide consumers with dynamic information about products, significantly impacting consumer engagement and operational practices in retail and supply chain sectors.

Companies are increasingly leveraging RFID to facilitate seamless omnichannel retail strategies, enhance customer service, and improve logistical operations. These trends are accompanied by strategic expansions and collaborations among key players aiming to broaden their market reach and enhance their technological capabilities in RFID systems.

Business Benefits

Enhanced Efficiency and Accuracy

The adoption of RFID technology offers substantial business benefits, including enhanced operational efficiency, accuracy, and cost savings. In retail, RFID reduces labor costs and errors associated with manual inventory counting and product sorting. It enables precise tracking of goods across the supply chain, from production to point of sale, reducing the likelihood of stock-outs or overstock situations. In logistics, RFID’s real-time tracking capabilities ensure that goods are efficiently managed and transported, improving delivery times and reducing lost items.

In industries such as healthcare and manufacturing, RFID provides critical data that aid in compliance, safety, and quality control processes. The technology’s ability to integrate with other enterprise systems like ERP and CRM enhances data reliability and usability, driving better decision-making and strategic planning across business operations.

Key Players Analysis

One of the leading players in the market is Zebra Technologies. It is a leader in inventory and asset management solutions with a broad RFID product portfolio. Another prominent firm operating in the market is Impinj which specializes in RAIN RFID for seamless supply chain data connectivity.

Top Key Players in the Market

- Alien Technology, LLC

- Avery Dennison Corporation

- Zebra Technologies Corporation

- HID Global Corporation

- NXP Semiconductors N.V.

- Applied Wireless, Inc.

- Impinj, Inc.

- CoreRFID Ltd.

- SATO Holdings Corporation

- RF Code, Inc.

- Other Key Players

Recent Developments

- In September 2024, Abbott Label announced that its new RFID converting plant in Nashville, TN, USA is now fully operational. This new facility represents the company’s commitment to providing cutting-edge RFID solutions and expanding its capabilities to meet evolving needs.

- In April 2024, STMicroelectronics introduced a new NFC tag chip that uses state-of-the-art blockchain-compatible elliptic curve cryptography to strengthen the level of security available to brands looking to use NFC to protect their products.

Report Scope

Report Features Description Market Value (2023) USD 14 Bn Forecast Revenue (2033) USD 35.3 Bn CAGR (2024-2033) 9.7% Largest Market North America (USD 4.9 Bn) Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Passive RFID Tags, Active RFID Tags), By Frequency (Low-Frequency (LF) RFID Tags, High-Frequency (HF) RFID Tags, Ultra-High Frequency (UHF) RFID Tags), By End-Use Industry (Transportation and Logistics, Retail, Agriculture, Healthcare, Other End-Use Industries) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Alien Technology, LLC, Avery Dennison Corporation, Zebra Technologies Corporation, HID Global Corporation, NXP Semiconductors N.V., Applied Wireless, Inc., Impinj, Inc., CoreRFID Ltd., SATO Holdings Corporation, RF Code, Inc., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Alien Technology, LLC

- Avery Dennison Corporation

- Zebra Technologies Corporation

- HID Global Corporation

- NXP Semiconductors N.V.

- Applied Wireless, Inc.

- Impinj, Inc.

- CoreRFID Ltd.

- SATO Holdings Corporation

- RF Code, Inc.

- Other Key Players