Global E-Commerce Logistics Market Size, Share, Statistics Analysis Report By Type (Forward Logistics, Reverse Logistics), By Service (Transportation, Warehousing, Others), By Business Model (3PL, 4PL, Others), By Operation (Domestic, International), By Industry Vertical (Retail, Consumer Electronics, Fashion and Apparel, Food and Grocery, Health and Beauty, Pharmaceuticals and Healthcare, Others), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec 2024

- Report ID: 134772

- Number of Pages: 252

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

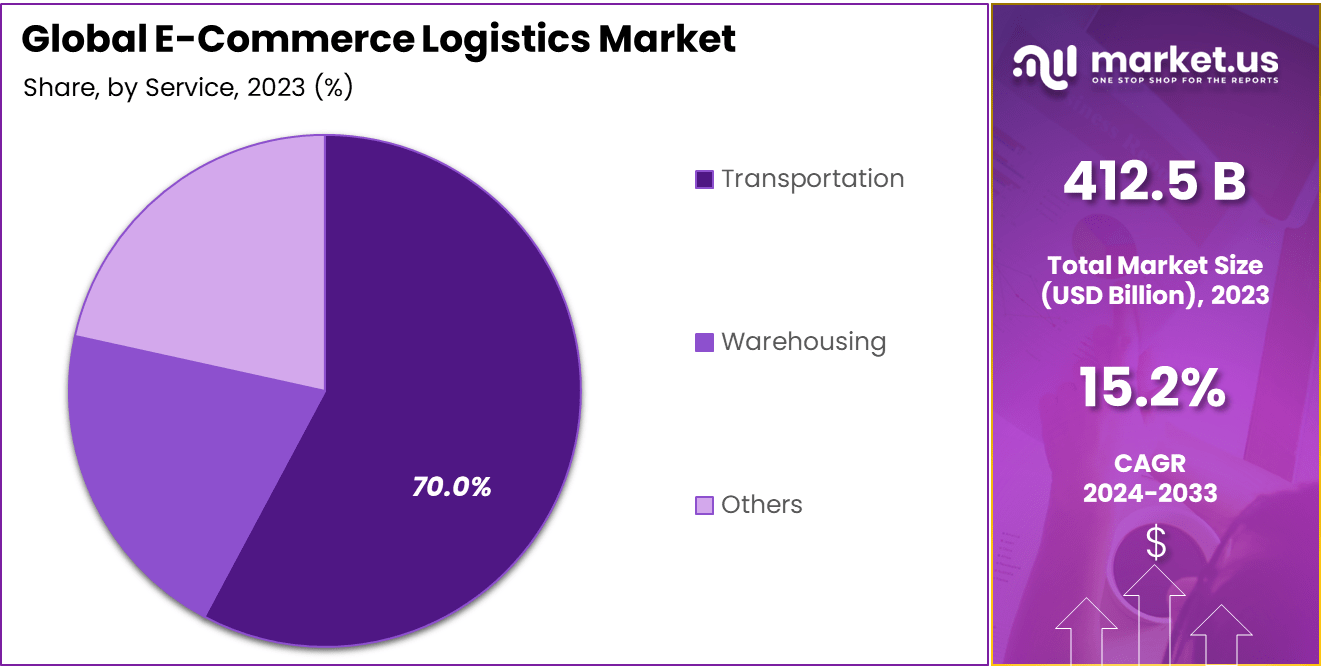

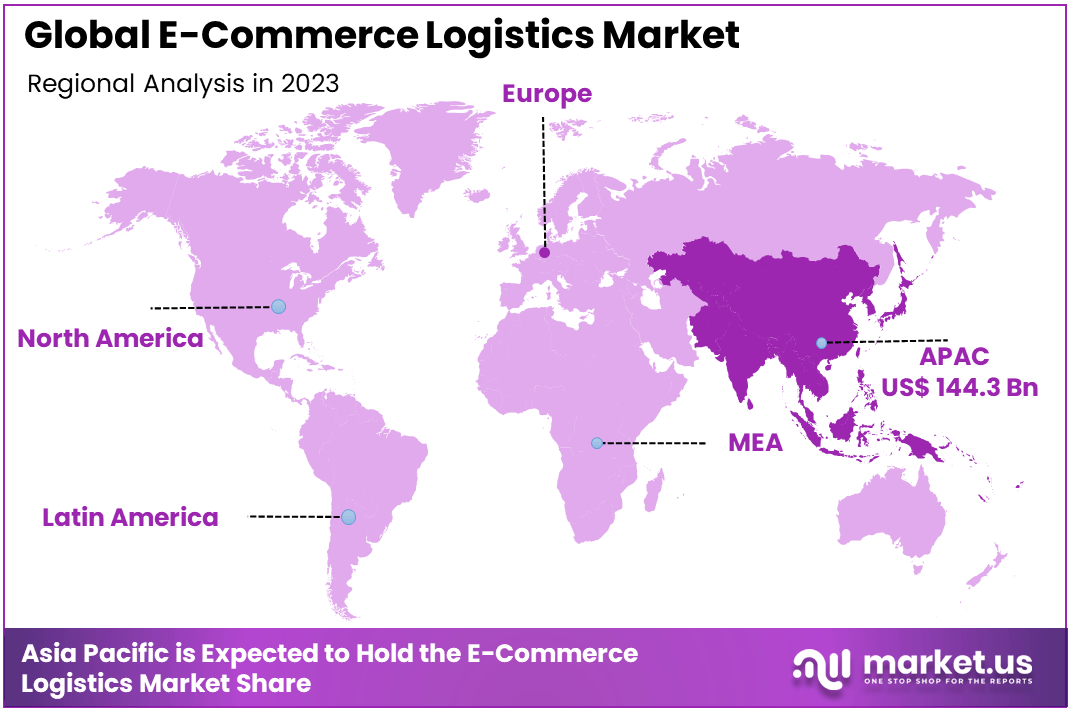

The Global E-Commerce Logistics Market is expected to be worth around USD 1698.0 Billion By 2033, up from USD 412.5 billion in 2023. It will grow at a CAGR of 15.2% during the forecast period from 2024 to 2033. In 2023, Asia Pacific held a dominant market position, capturing more than a 35% share and holding USD 144.3 billion in revenue.

E-commerce logistics refers to the processes involved in the transportation, warehousing, packaging, and delivery of goods ordered online. It is critical in fulfilling customer orders, ensuring timely deliveries, and maintaining inventory management. As online shopping grows, e-commerce logistics ensures that goods are stored in fulfillment centers, picked, packed, and shipped to customers most efficiently.

The logistics process also includes handling returns and exchanges, which are significant components of the online shopping experience. Given the nature of e-commerce, logistics operations are highly dynamic, relying on various transportation methods, real-time tracking systems, and automated technologies to meet consumer demands.

The global e-commerce logistics market has witnessed tremendous growth, driven by the increasing popularity of online shopping, advancements in technology, and evolving consumer expectations. E-commerce logistics encompasses everything from last-mile delivery solutions to the management of large distribution centers, making it a highly complex and competitive industry.

The market is expected to continue expanding as more consumers turn to online shopping, with businesses seeking efficient and cost-effective ways to manage their supply chains. The growing demand for fast, flexible, and reliable delivery options has prompted logistics providers to develop innovative solutions, such as same-day delivery and drone delivery, to meet customer expectations.

The primary drivers behind the e-commerce logistics market include the surge in online shopping, the need for fast and efficient delivery, and the expansion of e-commerce companies globally. The rise of e-commerce giants like Amazon, Alibaba, and Walmart has set new standards for delivery speed and service quality, pushing logistics providers to adapt.

Additionally, advancements in technology, such as real-time tracking, automation in warehouses, and artificial intelligence for route optimization, have significantly improved efficiency and reduced operational costs. With a growing preference for same-day and next-day deliveries, logistics companies are increasingly investing in innovative solutions to meet consumer expectations.

The demand for e-commerce logistics services has skyrocketed due to the rapid growth of the e-commerce industry. More consumers are shopping online, and this trend is not only limited to urban areas but is also expanding to rural regions. The rising demand for faster and more reliable delivery options, along with the increase in international shipments, is putting pressure on logistics providers to scale their operations.

This demand is also pushing companies to enhance their digital capabilities, making it easier for consumers to track their orders and get real-time updates. The surge in online shopping during the pandemic further fueled this demand, and experts predict this growth will continue for years to come.

One of the significant opportunities within the e-commerce logistics market lies in the adoption of automation and robotics in warehouses. Automated systems can streamline picking, packing, and sorting, which not only reduces labor costs but also speeds up the overall process. Furthermore, the rise of cross-border e-commerce is creating a huge opportunity for logistics companies to expand their services internationally.

As more consumers shop from global retailers, the need for reliable and efficient cross-border logistics will increase. Additionally, sustainable logistics solutions, such as electric delivery vehicles and carbon-neutral shipping methods, present an opportunity for companies to appeal to environmentally conscious consumers.

Shipping costs are a major component of e-commerce logistics, accounting for nearly 90% of total order fulfillment expenses. Within this, last-mile delivery has become increasingly significant, representing over 50% of total shipping costs as of 2023. The logistics landscape is evolving, with companies adopting advanced technologies such as robotics and artificial intelligence to enhance efficiency and reduce costs.

In terms of operational dynamics, the domestic e-commerce logistics segment is expected to dominate with a market share of approximately 62.1% by 2033. The transportation sector within e-commerce logistics is also projected to hold a substantial share at around 58.8%, driven by the rising demand for efficient and timely delivery services.

Overall, the e-commerce logistics market is not only growing in size but also in complexity, necessitating innovations in last-mile delivery solutions and enhanced supply chain visibility to meet consumer expectations for faster and more reliable service.

Key Takeaways

- Market Growth: The global E-commerce logistics market is projected to grow from USD 412.5 billion in 2023 to USD 1698.0 billion by 2033, reflecting a strong CAGR of 15.2%.

- Dominant Logistics Type: In 2023, the Forward Logistics segment held a dominant share, accounting for 69% of the market. This is largely driven by the increasing demand for efficient order fulfillment and product delivery from manufacturers to customers.

- Service Breakdown: Transportation services were the most significant contributor in 2023, capturing 70% of the market share. This emphasizes the central role transportation plays in e-commerce logistics, especially with the rise in demand for fast, flexible, and reliable delivery options.

- Business Model Preference: The 3PL (Third-Party Logistics) business model accounted for 76% of the market share in 2023, reflecting the growing reliance of e-commerce companies on outsourcing logistics services to specialized providers for cost efficiency and scalability.

- Operational Focus: Domestic operations accounted for 75% of the market share, highlighting that a significant portion of e-commerce logistics focuses on local and regional deliveries as e-commerce continues to boom within countries.

- Leading Industry Vertical: The Fashion and Apparel sector remains the largest vertical in e-commerce logistics, capturing 39% of the market share in 2023. This is driven by the high volume of fashion-related online purchases that require fast and accurate delivery services.

- Regional Dominance: Asia-Pacific led the market with 35% of the global market share in 2023, fueled by the region’s growing e-commerce market, particularly in countries like China and India, and robust logistics infrastructure development.

By Type

In 2023, the Forward Logistics segment held a dominant market position, capturing more than 69% of the market share. This significant market share can be attributed to the increasing demand for fast and efficient delivery of goods from e-commerce retailers to end customers.

Forward logistics is the process of moving products from the manufacturer to the consumer, and its importance has only grown as e-commerce sales continue to surge. As more customers expect rapid, cost-effective shipping options, forward logistics is central to fulfilling this demand, making it a critical part of e-commerce supply chains.

The growth of Forward Logistics is driven by the rising expectations for quick and reliable deliveries, especially in the wake of the pandemic. Consumers now expect shorter delivery times, with many willing to pay a premium for expedited shipping.

E-commerce companies have responded by optimizing their logistics operations, utilizing technology such as route optimization, real-time tracking, and automated warehouses to reduce lead times and improve customer satisfaction. Furthermore, the increased adoption of last-mile delivery solutions, such as local distribution centers and third-party delivery providers, has also helped to strengthen forward logistics services.

In contrast, Reverse Logistics, which involves the return of goods from the consumer back to the retailer or manufacturer, is comparatively less prevalent but is growing steadily. While reverse logistics plays a vital role, especially in industries like fashion and electronics where returns are more common, it does not yet command the same market share as forward logistics. The return process is more complex, requiring specialized handling, transportation, and restocking procedures, which adds to the cost and logistical complexity.

By Service

In 2023, the Transportation segment held a dominant market position, capturing more than 70% of the share in the E-Commerce Logistics Market. This dominance is primarily due to the critical role transportation plays in ensuring that products reach consumers in a timely and efficient manner. As e-commerce continues to grow, transportation is the backbone of logistics operations, facilitating the movement of goods from warehouses to distribution centers and ultimately to the end consumer. With the rise of online shopping, transportation networks have had to expand and become more efficient, resulting in this segment’s strong market position.

The need for fast and reliable transportation is being driven by changing consumer expectations. Customers now demand quicker deliveries, often expecting products to arrive within 24 to 48 hours. To meet this demand, retailers are investing heavily in their transportation networks. This includes expanding last-mile delivery capabilities, optimizing delivery routes, and leveraging technology for real-time tracking. Transportation providers are increasingly using advanced analytics and AI-driven tools to optimize delivery schedules, reduce fuel consumption, and minimize operational costs, all of which contribute to the growth of this segment.

Additionally, last-mile delivery is one of the fastest-growing areas within transportation. The shift towards e-commerce has significantly increased the volume of deliveries to residential areas, making last-mile logistics an essential component of e-commerce success. Companies are focusing on innovative solutions like drones, autonomous vehicles, and delivery lockers to address the challenges of last-mile delivery, particularly in urban environments. These innovations are improving efficiency, reducing delivery times, and lowering costs, further boosting the demand for transportation services in the e-commerce logistics market.

By Business Model

In 2023, the 3PL (Third-Party Logistics) segment held a dominant market position, capturing more than 76% of the share in the E-Commerce Logistics Market. This significant market share reflects the increasing reliance of businesses on third-party providers to handle complex logistics functions, particularly as e-commerce grows and customer expectations evolve.

3PLs offer a broad range of services including transportation, warehousing, inventory management, and order fulfillment, which allows e-commerce companies to focus on their core competencies while leaving logistics operations to specialized partners.

The dominance of the 3PL segment is also driven by the scalability and flexibility it offers to e-commerce businesses. As demand fluctuates based on seasons or promotional events, 3PL providers can quickly adjust their services to meet changing needs without requiring companies to invest heavily in their infrastructure.

This makes 3PL an attractive option for companies that want to avoid the capital expenditures associated with owning warehouses, fleets, or other logistics assets. Additionally, 3PL providers are increasingly adopting advanced technologies such as artificial intelligence (AI) and machine learning (ML) to improve route optimization, predict demand, and enhance inventory management, which further boosts their appeal.

Another reason for the continued dominance of the 3PL segment is its ability to provide end-to-end solutions that integrate seamlessly with e-commerce platforms. By outsourcing logistics to 3PL providers, businesses can leverage their expertise and network to deliver products more efficiently and at lower costs. This helps improve operational efficiency, reduce delivery times, and enhance customer satisfaction—critical factors in a highly competitive e-commerce environment.

By Operation

In 2023, the Domestic segment held a dominant market position, capturing more than 75% of the share in the E-Commerce Logistics Market. This strong market share can be attributed to the increasing trend of local online shopping and the significant growth in regional e-commerce platforms.

Domestic logistics operations are simpler and more cost-effective compared to international logistics, as they do not involve complex customs processes, tariffs, or long-distance transportation challenges, making them highly appealing for both businesses and customers.

The growth of the domestic segment is driven by the rising demand for faster, more reliable delivery options within local markets. With consumers expecting quicker delivery times, often within 1-2 days, e-commerce businesses are prioritizing domestic supply chains to meet these expectations. Additionally, many companies are setting up local fulfillment centers and partnering with regional logistics providers to ensure faster and more efficient order processing and last-mile delivery.

As more consumers opt for shopping within their local regions, especially post-pandemic, businesses are focusing on optimizing domestic supply chains to enhance customer satisfaction and reduce delivery costs. The Domestic segment continues to benefit from robust infrastructure, technology advancements, and an increasing preference for local products, further consolidating its dominant position in the market.

By Industry Vertical

In 2023, the Fashion and Apparel segment held a dominant market position in the E-Commerce Logistics Market, capturing more than 39% of the share. This dominance can be attributed to the rapid expansion of online fashion retail, driven by changing consumer preferences for convenience, a broad range of styles, and competitive pricing. Fashion and apparel have long been among the top categories for e-commerce due to the ease with which products can be marketed and sold online, making it a significant driver of logistics demand.

The growing adoption of online shopping platforms, coupled with the popularity of fast fashion, has propelled the need for efficient and reliable logistics systems in the fashion and apparel sector. Consumers now expect faster delivery times, often driven by the need to receive seasonal trends or last-minute purchases.

As a result, fashion retailers are increasingly investing in optimized domestic and international logistics solutions, such as efficient warehouse management and last-mile delivery networks, to meet these expectations.

Moreover, the rise of mobile shopping, social media influencers, and fashion-forward online platforms has intensified the competition, with e-commerce businesses needing to offer a seamless experience, from browsing to delivery.

The Fashion and Apparel segment benefits from a highly dynamic consumer base that demands flexibility, speed, and a diverse range of product offerings. As a result, this vertical continues to be a key contributor to the growth of e-commerce logistics, driving the need for advanced technological solutions to streamline supply chains.

Key Market Segments

By Type

- Forward Logistics

- Reverse Logistics

By Service

- Transportation

- Warehousing

- Others

By Business Model

- 3PL

- 4PL

- Others

By Operation

- Domestic

- International

By Industry Vertical

- Retail

- Consumer Electronics

- Fashion and Apparel

- Food and Grocery

- Health and Beauty

- Pharmaceuticals and Healthcare

- Others

Driving Factors

Increasing Consumer Demand for Faster Deliveries

One of the primary drivers of the E-Commerce Logistics Market is the growing consumer demand for faster and more reliable delivery services. In the current digital era, the convenience of online shopping has created new consumer expectations.

Today, consumers not only expect a vast array of products to be available at their fingertips but also anticipate fast and efficient delivery services. With the rise of companies like Amazon offering same-day or next-day deliveries, customers have become accustomed to this level of convenience.

This demand for quick delivery times has significantly influenced the e-commerce logistics industry. Logistics companies and retailers are under increasing pressure to streamline their operations to meet customer expectations.

Fast, reliable delivery is now considered a key competitive differentiator. As such, businesses in the logistics space are investing heavily in innovative technologies to enhance their delivery speeds, such as robotics, automation in warehouses, and advanced tracking systems.

Additionally, with the rise of “last-mile delivery” services, logistics providers are focusing on enhancing their transportation solutions to ensure efficient final-mile fulfillment. The last mile, which refers to the final step of delivery from the distribution center to the customer, is often the most expensive and time-consuming part of the supply chain. As a result, logistics companies are experimenting with new technologies like drones, autonomous vehicles, and optimized routing algorithms to cut down delivery time and cost.

Restraining Factors

High Operational Costs in E-Commerce Logistics

Despite the rapid growth of the e-commerce logistics sector, one significant restraint hindering its expansion is the high operational costs involved in logistics management. Logistics providers face significant challenges in managing costs related to transportation, warehousing, and supply chain management. The cost of managing these complex systems, especially with the rising demand for faster delivery, can become burdensome for companies operating on thin margins.

The transportation costs associated with delivering goods to end customers, especially in urban areas, can be significant. The rise in fuel prices, along with the need for advanced fleet management systems, contributes to the soaring operational costs.

Furthermore, last-mile delivery remains a costly and challenging segment of the supply chain, as this stage involves intricate logistics, including high labor costs and infrastructure requirements. To make matters worse, the unpredictability of customer demand and delivery volumes can lead to inefficiencies in transportation, resulting in unused capacity or inefficient routes.

Warehousing costs also add to the financial burden on logistics providers. With the rise of e-commerce, demand for warehouse space has surged, leading to increased rental and storage costs. Moreover, the shift towards omnichannel logistics, where e-commerce retailers operate both online and offline, means that retailers must manage complex inventory systems, increasing both overheads and inventory carrying costs.

Growth Opportunities

Technological Innovations to Optimize Logistics Operations

A major opportunity in the E-Commerce Logistics Market lies in the adoption of technological innovations that help streamline logistics operations, improve efficiency, and reduce costs. With the growing need for faster deliveries, logistics companies are increasingly turning to cutting-edge technologies such as artificial intelligence (AI), machine learning, and blockchain to optimize their operations.

AI and machine learning algorithms are being used to enhance route optimization, predict delivery times, and improve inventory management. For instance, AI-driven predictive analytics can help companies forecast demand trends, allowing them to adjust inventory and staffing levels accordingly. Additionally, machine learning models can analyze data from past deliveries to optimize future routes, reducing delivery times and fuel costs.

Another emerging technology is robotics and automation. In warehouses, robots can handle tasks such as sorting, packing, and labeling, increasing operational efficiency and reducing labor costs. Automation also extends to delivery fleets. Companies are experimenting with autonomous vehicles and drones for last-mile delivery, which can drastically reduce human labor costs while improving delivery speed and accuracy. For example, drones can be used to deliver small parcels in rural or hard-to-reach areas, bypassing traffic congestion.

Challenging Factors

Managing Last-Mile Delivery Complexity

The complexity of last-mile delivery remains one of the most significant challenges faced by e-commerce logistics companies. Last-mile delivery refers to the final step in the delivery process, where products are transported from a distribution center to the customer’s doorstep. While last-mile delivery is crucial for ensuring customer satisfaction, it is also the most challenging and costly segment of the supply chain.

One of the primary challenges is the cost associated with last-mile delivery. Studies show that last-mile delivery can account for up to 53% of the total delivery cost. This is due to factors like the need for multiple stops, urban congestion, high fuel consumption, and the necessity for human drivers.

In densely populated cities, traffic congestion can further slow down delivery times, making it difficult to meet consumer expectations for fast, on-demand delivery. Additionally, the need for flexible delivery windows and multiple options for customers (e.g., same-day or next-day delivery) increases the complexity and cost of last-mile delivery operations.

Another significant challenge is managing the return process. In e-commerce, return rates are high, particularly for items like clothing and electronics. This can create inefficiencies in reverse logistics and lead to further operational costs. Additionally, returns can create challenges for inventory management, as returned products need to be restocked, refurbished, or disposed of, which adds complexity and cost to logistics operations.

Growth Factors

The growth of the e-commerce logistics market is driven by several key factors, particularly the rapid expansion of online shopping and the increasing need for faster delivery services. With consumers demanding quick, reliable, and cost-effective shipping options, e-commerce businesses are increasingly relying on robust logistics solutions to meet customer expectations.

The proliferation of smartphones and internet connectivity has also made shopping more accessible, fueling the demand for logistics services to support this growing digital marketplace. Additionally, the rise of omnichannel retailing, where customers can shop across various platforms, has further driven the need for efficient logistics operations to handle both online and offline orders seamlessly.

Emerging Trends

One of the major emerging trends is the adoption of automation and robotics in warehouses. Companies are investing in technologies like robotic sorting systems, drones, and automated guided vehicles (AGVs) to streamline warehouse operations, reduce human error, and increase speed.

Another significant trend is the rise of last-mile delivery innovation, with businesses exploring options such as electric vehicles, drones, and crowdsourced delivery networks to speed up deliveries, especially in urban areas. Furthermore, companies are increasingly focusing on sustainability in their logistics operations by implementing green supply chain practices and reducing carbon emissions.

Business Benefits

For businesses, efficient logistics are critical for maintaining customer satisfaction and reducing operational costs. By implementing advanced logistics solutions, companies can achieve faster delivery times, lower shipping costs, and reduce inventory holding costs.

Additionally, the integration of real-time tracking and advanced analytics allows businesses to optimize routes, forecast demand more accurately, and offer more personalized services to customers. These improvements enhance operational efficiency and customer loyalty, driving profitability in the highly competitive e-commerce sector.

Regional Analysis

In 2023, Asia Pacific held a dominant market position in the E-commerce Logistics sector, capturing more than a 35% share, with a revenue of USD 144.3 Billion. The region’s strong performance can be attributed to the rapid growth of e-commerce, especially in emerging markets like China and India. Asia Pacific’s vast consumer base, coupled with a growing middle class, has led to an increase in demand for online shopping, driving the need for more efficient and scalable logistics solutions.

The region’s extensive digital infrastructure and advancements in mobile technology have played a pivotal role in supporting the booming e-commerce industry. Leading e-commerce giants such as Alibaba, JD.com, and Rakuten are based in the Asia Pacific, further driving demand for logistics services. Additionally, a growing number of small and medium-sized enterprises (SMEs) are embracing online platforms, increasing the need for logistics support across the region.

Furthermore, the high adoption of technologies like artificial intelligence, automation, and robotics in warehousing and transportation is boosting logistics efficiency in Asia Pacific. China, in particular, has invested heavily in smart logistics, such as drone delivery and autonomous vehicles, creating opportunities for logistics companies to innovate and expand their service offerings.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Player Analysis

Aramex International, a key player in the global E-commerce logistics market, has been expanding its presence through strategic acquisitions and partnerships. In 2023, the company acquired Mena Express, a logistics firm specializing in last-mile delivery solutions. This acquisition aligns with Aramex’s commitment to improving its service offerings and expanding its footprint in the Middle East and North Africa (MENA) region.

C.H. Robinson, a leading logistics provider, has made significant strides in e-commerce logistics by leveraging its robust global network and advanced technology solutions. In 2023, C.H. Robinson expanded its portfolio by launching Navisphere Vision, an AI-powered platform aimed at providing real-time visibility into logistics operations. The platform is designed to help e-commerce businesses track shipments, optimize inventory, and make better decisions based on data-driven insights.

CEVA Logistics, a global leader in supply chain management and logistics, has been actively enhancing its position in the e-commerce logistics space. In 2023, CEVA launched a new e-commerce fulfillment center in Europe to cater to the growing demand for order fulfillment services from online retailers. The facility is designed to streamline the process of picking, packing, and shipping e-commerce orders while reducing costs and improving delivery times.

Top Key Players in the Market

- Aramex International

- C.H. Robinson

- CEVA Logistics

- Clipper Logistics Plc.

- DB Schenker

- DHL

- DSV Global

- FedEx

- Gati Limited

- Kenco Group, Inc.

- Kuehne + Nagel

- Maersk

- Nippon Express

- UPS

- XPO Logistics Plc.

- Others

Recent Developments

- In April 2023: Amazon announced the expansion of its delivery network to enhance its e-commerce logistics operations. The company introduced new fulfillment centers and last-mile delivery stations across key regions, including the United States, Europe, and Asia Pacific.

- In June 2023: DHL launched its new “Green Logistics” initiative, focusing on reducing the carbon footprint of its global supply chain operations. The company committed to electrifying 60% of its global fleet by 2030 and introducing more sustainable packaging solutions for e-commerce businesses.

Report Scope

Report Features Description Market Value (2023) USD 412.5 Bn Forecast Revenue (2033) USD 1698.0 Bn CAGR (2024-2033) 15.2% Largest Market Asia Pacific Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Forward Logistics, Reverse Logistics), By Service (Transportation, Warehousing, Others), By Business Model (3PL, 4PL, Others), By Operation (Domestic, International), By Industry Vertical (Retail, Consumer Electronics, Fashion and Apparel, Food and Grocery, Health and Beauty, Pharmaceuticals and Healthcare, Others) Regional Analysis North America (US, Canada), Europe (Germany, UK, Spain, Austria, Rest of Europe), Asia-Pacific (China, Japan, South Korea, India, Australia, Thailand, Rest of Asia-Pacific), Latin America (Brazil), Middle East & Africa(South Africa, Saudi Arabia, United Arab Emirates) Competitive Landscape Aramex International, C.H. Robinson, CEVA Logistics, Clipper Logistics Plc., DB Schenker, DHL, DSV Global, FedEx, Gati Limited, Kenco Group, Inc., Kuehne + Nagel, Maersk, Nippon Express, UPS, XPO Logistics Plc., Others Customization Scope We will provide customization for segments and at the region/country level. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  E-Commerce Logistics MarketPublished date: Dec 2024add_shopping_cartBuy Now get_appDownload Sample

E-Commerce Logistics MarketPublished date: Dec 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Aramex International

- C.H. Robinson

- CEVA Logistics

- Clipper Logistics Plc.

- DB Schenker

- DHL

- DSV Global

- FedEx

- Gati Limited

- Kenco Group, Inc.

- Kuehne + Nagel

- Maersk

- Nippon Express

- UPS

- XPO Logistics Plc.

- Others