Global Online Gaming Market By Type (Action, Adventure, Arcade, Sports, Others Puzzle), By Platform (Mobile Phone, PCs, Consoles, Others), By Player Count (Single player, Multi player, MMO, Others), By Age Group (18-24 YEARS, 25-34 YEARS, 35-44 YEARS, 45-54 YEARS, 55-64 YEARS), By Region And Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends And Forecast 2024-2033

- Published date: Feb. 2024

- Report ID: 113635

- Number of Pages: 209

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

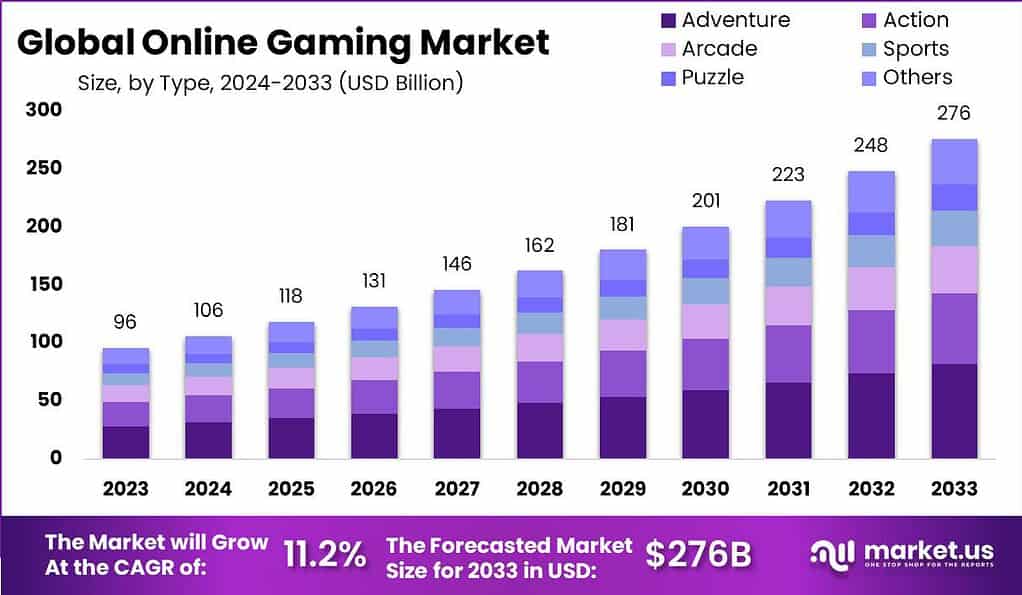

The Global Online Gaming Market size is expected to be worth around USD 276.0 Billion by 2033, from USD 96 Billion in 2023, growing at a CAGR of 11.2% during the forecast period from 2024 to 2033.

Online gaming has become an incredibly popular form of entertainment in recent years. With the rise of the internet and advancements in technology, people can now connect and play games with others from around the world. This has led to the growth of the online gaming market, which encompasses various platforms, genres, and business models.

The online gaming market has seen significant growth over recent years, driven by advances in technology and increasing internet access. Growth factors include the widespread availability of smartphones and tablets, improved internet speeds, and the rising popularity of social media and streaming platforms. These factors have made gaming more accessible and appealing to a broader audience, leading to a surge in both casual and competitive gaming.

However, the market faces challenges such as data security concerns, regulatory hurdles, and the need for continuous innovation to keep players engaged. Despite these challenges, there are ample opportunities for new entrants. Emerging technologies like virtual reality (VR) and augmented reality (AR) offer fresh avenues for innovation, while the growing trend of cloud gaming allows companies to reach a wider audience without the need for high-end hardware.

Analyst Viewpoint

The Online Gaming Market is poised for significant growth, driven by various factors. One of the primary driving factors is the increasing accessibility of high-speed internet and the proliferation of smartphones and other mobile devices. The widespread availability of internet connectivity allows players to engage in online gaming anytime and anywhere, fueling the growth of the market. Mobile gaming, in particular, has witnessed exponential growth as smartphones have become more powerful and affordable.

Another driving factor is the social aspect of online gaming. The ability to connect and interact with other players in real-time has transformed gaming into a social experience. Online gaming platforms provide opportunities for players to form communities, join clans or guilds, and collaborate or compete with others. This social element enhances player engagement and retention, driving the demand for online gaming experiences.

Furthermore, the continuous development of advanced technologies has opened up new possibilities for the Online Gaming Market. Innovations such as virtual reality (VR), augmented reality (AR), and cloud gaming have the potential to revolutionize the gaming experience. VR and AR technologies offer immersive gameplay, bringing virtual worlds to life, while cloud gaming allows players to stream games without the need for high-end hardware. These technologies provide exciting opportunities for game developers and service providers to create innovative and immersive online gaming experiences.

Additionally, the growing esports industry has contributed to the growth of the Online Gaming Market. Esports refers to competitive gaming at a professional level, with players and teams competing in tournaments for substantial prize pools. The increasing popularity of esports has led to the development of dedicated platforms, leagues, and events. This has created opportunities for game publishers, sponsors, and streaming platforms to capitalize on the esports market’s growth.

Key Takeaways

- The global Online Gaming Market is expected to reach USD 276 billion by 2033, showing a steady Compound Annual Growth Rate (CAGR) of 11.2% from USD 96 billion in 2023.

- Adventure games held a dominant market position in 2023, capturing more than 30% share, driven by story-driven games and advancements in gaming technology like AR and VR.

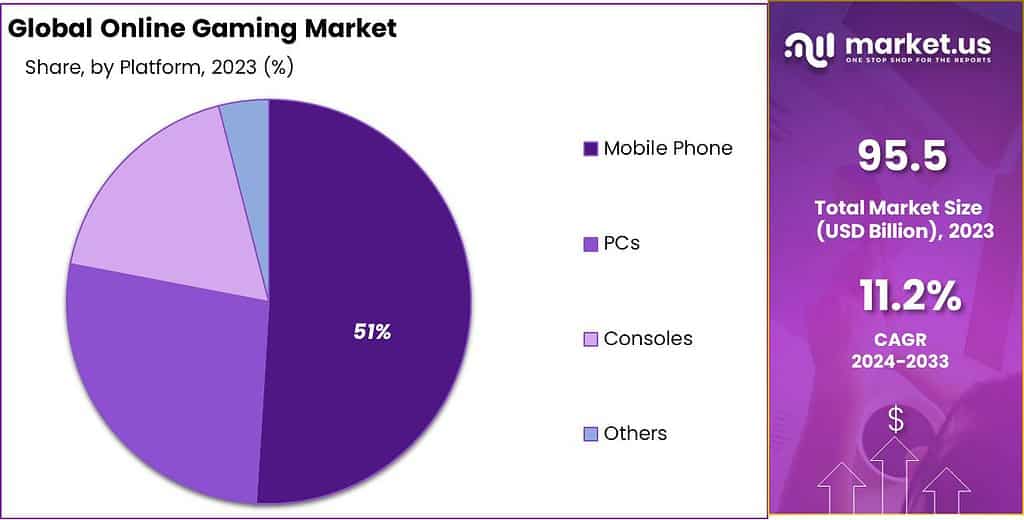

- Mobile phones dominated the market in 2023, capturing over 51% share due to widespread smartphone adoption and high-speed internet availability.

- Multiplayer and Massively Multiplayer Online (MMO) games were popular in 2023, capturing a substantial share.

- In 2023, the online gaming market witnessed the dominance of the 25-34 years age group, capturing more than a 32% share.

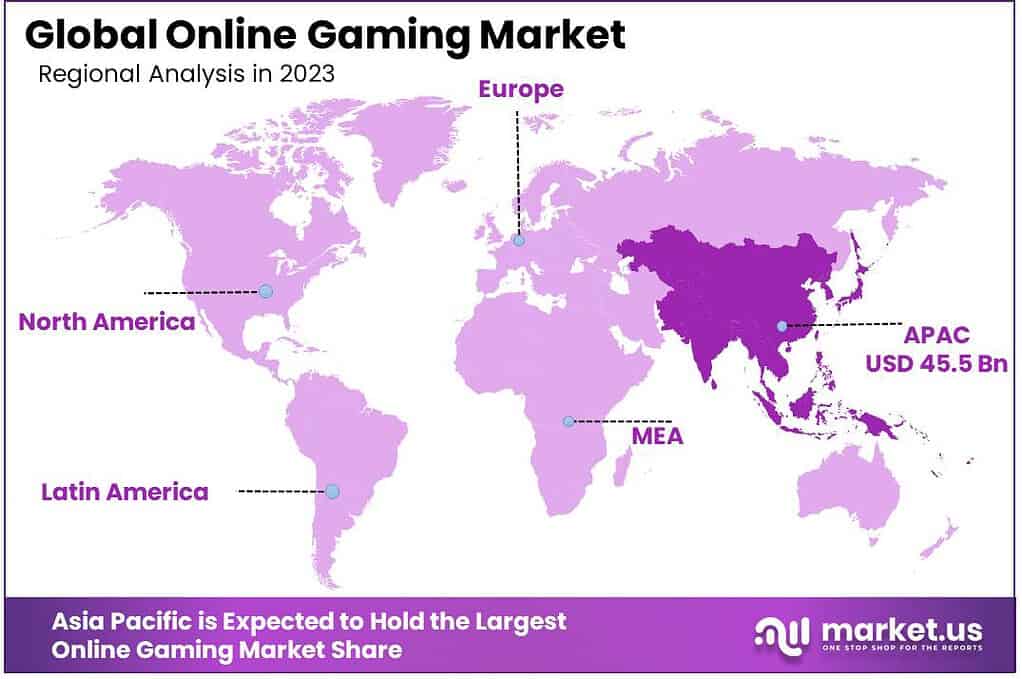

- In 2023, APAC emerged as the dominant force, capturing more than 47.67% share, driven by countries like China, Japan, and South Korea with a deep-rooted gaming culture.

Type Analysis

In 2023, the Adventure segment held a dominant market position in the online gaming market, capturing more than a 30% share. This significant market share can be attributed to several key factors. Firstly, the rise in popularity of story-driven games, which typically fall under the Adventure genre, has been substantial. These games offer immersive experiences with rich narratives and interactive environments, appealing to a broad spectrum of gamers seeking engaging, long-form content. Secondly, advancements in gaming technology, such as augmented reality (AR) and virtual reality (VR), have significantly enhanced the appeal of Adventure games, providing more lifelike and interactive experiences.

Moreover, the Adventure genre benefits from a diverse demographic appeal, attracting players across various age groups, from younger audiences to more mature gamers. This wide demographic reach is bolstered by the genre’s versatility, offering varying levels of gameplay complexity, from simple point-and-click mechanics to more intricate puzzle-solving and strategic planning. This versatility ensures a steady influx of new gamers while retaining the interest of seasoned players.

Financially, the Adventure segment has shown remarkable growth, with revenue projections indicating a consistent upward trajectory. This growth is partly fueled by the increasing availability of Adventure games on various platforms, including PC, consoles, and mobile devices, making them more accessible to a broader audience. Additionally, the segment benefits from strong support from game developers and publishers, who are investing heavily in creating high-quality Adventure titles with compelling storylines and state-of-the-art graphics.

Platform Analysis

In 2023, the Mobile phone segment held a dominant market position, capturing more than a 51% share of the Online Gaming market. This prominence can primarily be attributed to the widespread adoption of smartphones globally, combined with the increasing availability of high-speed internet services. The mobile gaming sector has been further buoyed by the development of an extensive range of games, catering to diverse demographics and preferences. This segment’s growth is supported by the proliferation of affordable smartphones in emerging economies, which has significantly expanded the consumer base.

Moreover, the convenience and accessibility of mobile gaming have been pivotal in its dominance. Unlike PCs and consoles, mobile phones offer the advantage of portability and the ease of engaging in gaming activities anytime and anywhere, which appeals to a broad spectrum of users from casual to dedicated gamers. The evolution of mobile technology, including enhanced graphics and processing capabilities, has allowed for more sophisticated and engaging games, narrowing the quality gap with traditional gaming platforms.

Financially, the mobile gaming segment benefits from a versatile revenue model. The predominance of free-to-play games with in-app purchases and advertisements has made gaming more accessible and has led to higher consumer spending in the segment. In contrast, PC and console gaming often require upfront investment in hardware and software, which can be a barrier for some users. The mobile gaming industry is also witnessing a surge in cloud-based gaming services, further democratizing access to high-quality gaming experiences without the need for high-end hardware.

Player Count Analysis

In 2023, the online gaming market witnessed a significant dominance of the Multiplayer and Massively Multiplayer Online (MMO) segment, capturing a substantial share. This segment’s popularity can be attributed to several factors. First and foremost, multiplayer games provide an immersive social experience that appeals to a wide range of players. By allowing individuals to play with or against friends and other players from around the world, these games foster a sense of community and connection.

Additionally, multiplayer games often offer competitive gameplay, which can be highly engaging and addictive. The thrill of competing against real people in real-time adds an element of excitement and unpredictability, enhancing the overall gaming experience. This aspect has contributed to the segment’s success, as players are drawn to the challenge and the opportunity to showcase their skills.

Furthermore, the rise of online streaming platforms and esports has significantly boosted the popularity of multiplayer and MMO games. Many players now stream their gameplay on platforms like Twitch, attracting large audiences and creating a vibrant gaming culture. Esports tournaments, which predominantly feature multiplayer and MMO games, have gained immense traction, with millions of viewers and lucrative prize pools.

The growth of the multiplayer and MMO segment can also be attributed to technological advancements. With the increasing availability of high-speed internet connections and the development of robust online gaming platforms, players can now engage in seamless multiplayer experiences. This accessibility has opened up opportunities for players of all levels and backgrounds to participate, further fueling the segment’s growth.

Age Group Analysis

In 2023, the online gaming market witnessed the dominance of the 25-34 years age group, capturing more than a 32% share. This segment’s strong market position can be attributed to several key factors. Firstly, individuals within this age range often have a higher level of disposable income and are more likely to invest in gaming equipment and subscriptions, enabling them to engage in online gaming on a regular basis.

Moreover, the 25-34 years age group represents a demographic that grew up during the rise of video games and witnessed the evolution of online gaming. They have likely been exposed to gaming since their childhood and have developed a passion for interactive entertainment. As they transitioned into adulthood, the accessibility and convenience of online gaming platforms became increasingly appealing, providing them with an outlet for relaxation and social interaction.

Additionally, the 25-34 years age group tends to have a stronger affinity for competitive gaming and multiplayer experiences. This segment often enjoys the thrill of engaging in intense gameplay and competing against other players, which aligns with the popularity of multiplayer and esports in the online gaming industry. The desire for social connection and the opportunity to showcase their skills in a competitive environment contribute to the strong market position of this age group.

Key Market Segments

By Type

- Action

- Adventure

- Arcade

- Sports

- Others

- Puzzle

By Platform

- Mobile Phone

- PCs

- Consoles

- Others

By Player Count

- Single player

- Multi player

- MMO

- Others

By Age Group

- 18-24 YEARS

- 25-34 YEARS

- 35-44 YEARS

- 45-54 YEARS

- 55-64 YEARS

Driver

Technological Advancements

The online gaming market is experiencing significant growth, largely driven by technological advancements. Innovations in high-speed internet, sophisticated gaming platforms, and enhanced graphic capabilities have collectively elevated the gaming experience. The integration of virtual reality (VR) and augmented reality (AR) technologies offers immersive and interactive environments, attracting a broader audience.

Cloud gaming services, reducing the need for high-end hardware, have democratized access to premium gaming experiences. Additionally, the development of mobile gaming platforms has widened the market, making online gaming accessible to a larger, more diverse population. These technological strides are instrumental in propelling the online gaming market forward, as they continually redefine user expectations and possibilities within the gaming world.

Restraint

Concerns Over Gaming Addiction and Mental Health

One of the principal restraints in the online gaming market is the growing concern over gaming addiction and its impact on mental health. Extensive gaming hours are often associated with negative health outcomes such as reduced physical activity, impaired sleep patterns, and mental health issues, including anxiety and depression.

The addictive nature of certain games, particularly those incorporating sophisticated algorithms to increase user engagement, has raised alarms among healthcare professionals and policymakers. This has led to increased scrutiny and regulatory interventions aimed at limiting gaming hours, especially among younger demographics. These concerns, if not addressed adequately by industry stakeholders, could potentially dampen market growth and lead to stricter regulations.

Opportunity

Expansion into Emerging Markets

Emerging markets present significant opportunities for the online gaming industry. Countries with growing middle-class populations and increasing internet penetration, such as India, Brazil, and Southeast Asian nations, are becoming lucrative markets for online gaming companies. These regions exhibit a rising appetite for digital entertainment, driven by a young, tech-savvy demographic.

Mobile gaming, in particular, is witnessing exponential growth in these markets due to widespread mobile phone usage. The localization of gaming content, catering to regional preferences and languages, further amplifies market potential. By tapping into these emerging markets, online gaming companies can unlock new revenue streams and diversify their user base, contributing to the global expansion of the industry.

Challenge

Ensuring Data Security and Privacy

Data security and privacy represent a significant challenge in the online gaming industry. With the increasing digitization of games and the collection of vast amounts of personal data, gaming platforms are becoming prime targets for cyber attacks. Breaches can lead to the exposure of sensitive user information, including financial data, and erode consumer trust.

The industry faces the dual task of constantly upgrading cybersecurity measures to safeguard user data while complying with evolving data protection regulations worldwide. Failure to effectively address these security concerns can result in legal ramifications and damage to the company’s reputation. Therefore, maintaining robust data security and privacy measures is imperative for the sustainable growth and credibility of the online gaming market.

Regional Analysis

In 2023, the Asia-Pacific (APAC) region emerged as a dominant force in the online gaming market, capturing more than a 47.67% share. The demand for online gaming in APAC reached US$ 45.5 billion in 2023, and there are optimistic projections for significant growth in the foreseeable future.

The APAC region’s strong market position can be attributed to several key factors. First and foremost, APAC countries such as China, Japan, and South Korea have a deep-rooted gaming culture and a large population of avid gamers. These countries have a strong history of gaming, with a robust infrastructure that supports online gaming and a thriving esports scene.

Additionally, the growing availability of high-speed internet and the widespread adoption of smartphones have contributed to the APAC region’s dominance. Mobile gaming, in particular, has witnessed significant growth, with a large portion of APAC consumers preferring gaming on their mobile devices. The region’s mobile-first approach, coupled with the development of affordable smartphones, has created a massive market for mobile gaming.

Moving to North America, the region has exhibited a significant market share, driven by factors such as the presence of major gaming companies, advanced internet infrastructure, and a strong culture of online gaming. The U.S. and Canada are prominent players, with a high rate of digital adoption and expenditure on gaming content and equipment. The market is characterized by high consumer spending on gaming and a robust competitive gaming scene, including eSports.

Key Regions and Countries Covered in this Report

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In the global online gaming industry, a comprehensive analysis of key players reveals a diverse and competitive landscape, marked by innovation and strategic market positioning. These key players contribute significantly to industry growth, technological advancements, and consumer engagement.

Tencent stands as a dominant force in the online gaming sector, especially in the APAC region. Renowned for its diverse portfolio of popular games and investments in various international gaming companies, Tencent’s influence extends globally. The company’s success can be attributed to its strategic acquisitions, robust in-game monetization models, and a deep understanding of the Asian gaming market.

Top Key Players

- Electronic Arts Inc.

- Activision Blizzard, Inc.

- Sony Interactive Entertainment Inc.

- Rovio Entertainment Corporation

- Sega, Capcom Co., Ltd.

- Tencent Holdings Ltd.

- Apple Inc.

- Nintendo Co. Ltd.

- Microsoft Corporation

- Other key players

Recent Developments

- In 2023, Tencent Holdings Ltd.: Cloud Gaming Expansion: Launched Tencent Start cloud gaming platform in China, expanding their reach into cloud-based gaming and competing with Microsoft’s xCloud.

- In 2023, Apple Inc.: Integration with AR/VR: Speculation around potential AR/VR gaming headsets from Apple could further shake up the online gaming landscape.

- In 2023, Nintendo Co. Ltd.: Innovation with Nintendo Labo and VR: Continued to explore innovative hardware and software experiences like Nintendo Labo and VR through the Nintendo Labo VR Kit.

- In 2023, Microsoft Corporation: Game Pass Growth: Xbox Game Pass subscription service saw exponential growth, solidifying Microsoft’s position as a major player in online gaming services.

Report Scope

Report Features Description Market Value (2023) US$ 96 Bn Forecast Revenue (2033) US$ 276 Bn CAGR (2024-2033) 11.2% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Action, Adventure, Arcade, Sports, Others Puzzle), By Platform (Mobile Phone, PCs, Consoles, Others), By Player Count (Single player, Multi player, MMO, Others), By Age Group (18-24 YEARS, 25-34 YEARS, 35-44 YEARS, 45-54 YEARS, 55-64 YEARS) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, and Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, and Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape Electronic Arts Inc., Activision Blizzard Inc., Sony Interactive Entertainment Inc., Rovio Entertainment Corporation, Sega, Capcom Co. Ltd., Tencent Holdings Ltd., Apple Inc., Nintendo Co. Ltd., Microsoft Corporation, Other key players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the Online Gaming MarketThe Online Gaming Market refers to the industry focused on video games that are played over the internet

How big is the Online Gaming Industry?The Global Online Gaming Market size is expected to be worth around USD 276.0 Billion by 2033, from USD 96 Billion in 2023, growing at a CAGR of 11.2% during the forecast period from 2024 to 2033.

Who are the key players in the Online Gaming market?Electronic Arts Inc., Activision Blizzard Inc., Sony Interactive Entertainment Inc., Rovio Entertainment Corporation, Sega, Capcom Co. Ltd., Tencent Holdings Ltd., Apple Inc., Nintendo Co. Ltd., Microsoft Corporation, Other key players are some of the prominent players present in the cloud computing market.

Which region has the highest market share in the cloud computing market?In 2023, the Asia-Pacific (APAC) region emerged as a dominant force in the online gaming market, capturing more than a 47.67% share.

How is virtual reality (VR) influencing the Online Gaming Market?Virtual reality is influencing the Online Gaming Market by providing immersive and interactive experiences. VR gaming allows players to feel more engaged with the virtual environment, contributing to the evolution of online gaming experiences.

What trends are shaping the future of the Online Gaming Market?Emerging trends include the integration of cloud gaming, increased focus on cross-platform play, advancements in augmented reality (AR) gaming, and the continued growth of esports as a mainstream form of entertainment.

What are the drivers in the cloud computing market?The ability of cloud computing to offer scalable and flexible resources enables businesses to easily expand or reduce their computing infrastructure based on demand. This scalability is a significant driver for organizations seeking cost-effective solutions that align with their dynamic needs.

-

-

- Electronic Arts Inc.

- Activision Blizzard, Inc.

- Sony Interactive Entertainment Inc.

- Rovio Entertainment Corporation

- Sega, Capcom Co., Ltd.

- Tencent Holdings Ltd.

- Apple Inc.

- Nintendo Co. Ltd.

- Microsoft Corporation

- Other key players